Facebook’s Arrogant Culture

Facebook’s (FB) business model should be well understood as extracting value from the enormous amount of data users provide about themselves. Relationships and “Likes” disclose much about an individual’s affinities. Moreover, when a FB user clicks on an ad or even just hovers her cursor over it, FB knows. This knowledge is exceptionally valuable to advertisers, since a great deal of advertising has historically relied on reaching a group you think could be interested without knowing who reacted. The oft-quoted saying that companies know half their advertising budget is wasted, just not which half, shows there’s plenty of room for improvement.

It’s a powerful proposition, and relies on users sharing all kinds of personal details in exchange for freely sharing holiday photos, or which restaurant they’re currently at “enjoying adult beverages.” But as the latest furor over Cambridge Analytica shows, FB doesn’t protect all this data as well as they might, or at least not as well as regulators might like. In some ways it betrays an arrogant culture – since users provide the data about themselves for free, they must not value it very highly. Nonetheless, FB is now Villain #1. Congressional hearings will surely follow, and perhaps even some constraints on the commercialization of free user data into a lucrative advertising platform.

We had our own experience of FB’s culture as a small advertiser. Last year we launched the American Energy Independence Index, along with an ETF that seeks to track its performance. We were intrigued at what we heard about FB’s precise marketing, which appeared to provide us with the opportunity for targeted ads at FB users whose profile suggested they’d be interested. You’d only pay for users who clicked on the ad. Furthermore, FB’s software would refine our targeted audience based on analyzing the results. So we tried it out.

Advertising of securities including ETFs is highly regulated. Such ads on FB are rare, so we knew we were on relatively new territory. But there is clear evidence that investing is moving farther online, with robo-advisers now offering algorithm-based advice to the next generation of investors. Any ad had to be fully compliant with all the applicable regulations, and unfortunately FB doesn’t allow you to design a mock-up of your ad for internal review. So the FB page was briefly posted and taken down a couple of times as we ensured it was compliant. Product endorsements are also forbidden, so out of an abundance of caution we sought no FB “friends”, to avoid any unwanted “Likes”.

The result was, we looked nothing like a typical FB user. No friends, no interaction with other users, and a page that had been posted for a couple of seconds at a time.

FB is on the lookout for Russians. Or more accurately, internet trolls and other “bots” with nefarious objectives such as influencing our election. Naturally, FB has designed software to screen for suspicious activity, and we met the algorithm’s criteria. Our account was suspended. But the ad, which was compliant with the regulations even if FB was suspicious of the user, continued.

Our corporate credit card was duly billed for activity even while our account was suspended.

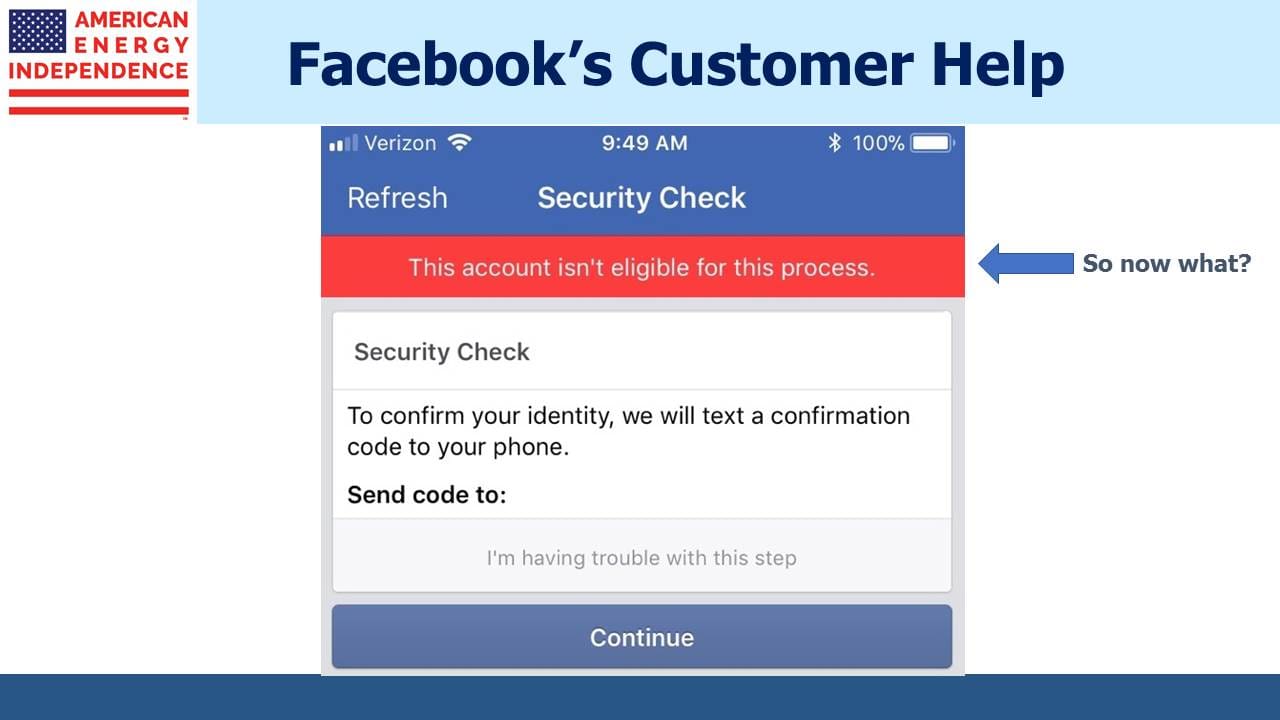

And here’s the point. You cannot contact Facebook. There is no number for a customer to call if there’s a problem. Nowhere at all. There’s nobody to e-mail. You can submit an enquiry on a website, and you’ll receive an automated response. We do investment research, which is largely online, so we are not exactly neophytes at finding information on the web. And it became abundantly clear that FB’s advertising business model is designed to avoid the expense of human interaction. I even reached out to someone who works in their Advertising department. We’d played golf last Summer and he’d left me impressed with how their deep knowledge of users could benefit their advertising customers. Surely, a golf acquaintance could help. He responded with a URL that led to another automated response.

This is why FB is an arrogant company. They don’t believe it’s necessary to provide humans to talk to their customers. This is the same culture that lost control of data provided to Cambridge Analytica. They really don’t care. Perhaps that’s why Procter and Gamble concluded that much digital advertising was a waste.

Finally, we cancelled our corporate credit card claiming unauthorized use. The ads stopped. FB never asked why.

The Shale Revolution, which is leading us to American Energy Independence, is increasingly a technology-reliant business with engineers seated in front of computer terminals remotely guiding a drill bit to within inches of its target. Happily, the energy business still finds value in humans to run things.

We are not invested, and have never been invested, in FB

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!