Shale Leads Growth in Proved Reserves

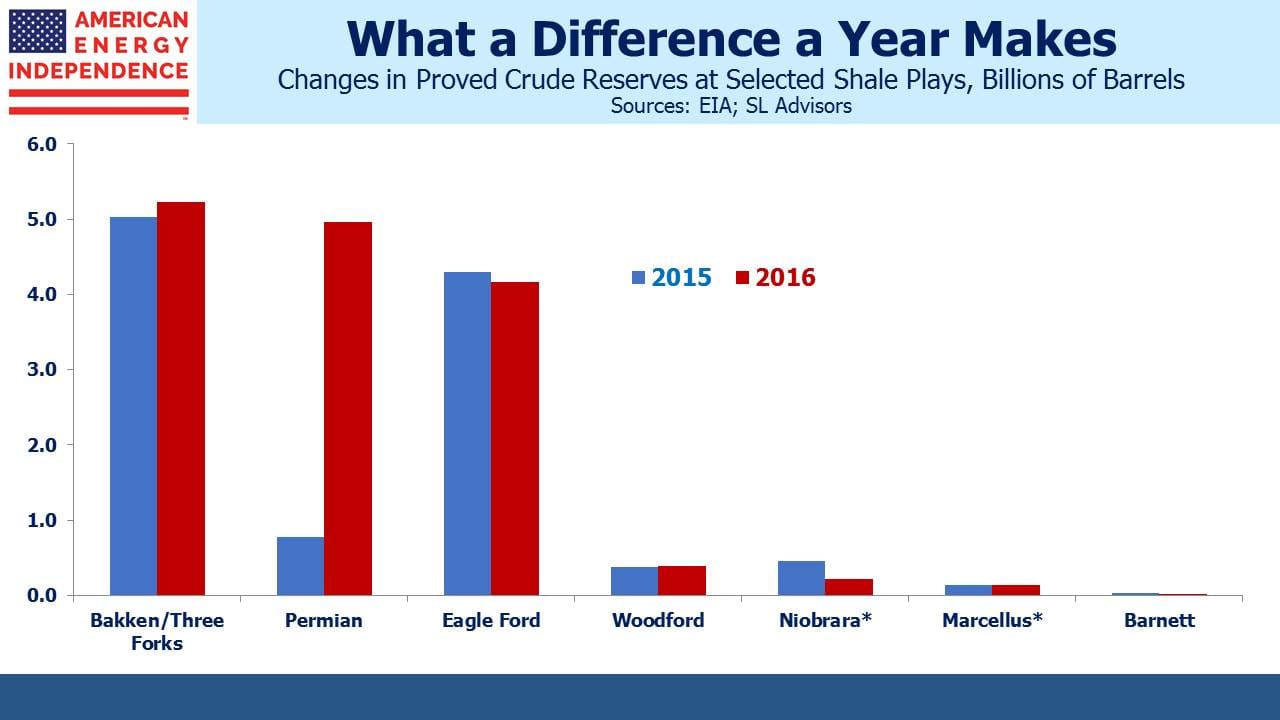

On Thursday the U.S. Energy Information Administration (EIA) released updated figures on proved reserves as of 2016. In order to count as proved, companies must be reasonably certain that the reserves are recoverable under existing operating and economic conditions. Improvements in technology have increased the amount of recoverable reserves from some shale formations.

The dramatic increase in Permian reserves is driving increased production. As we noted (see Rising Oil Output Is Different This Time), Permian output is set to reach 3 Million Barrels per Day (MMB/D) in March. It’s increasingly looking as if pipeline demand is approaching capacity. JPMorgan recently said they expect pipeline bottlenecks to develop in 2H18 and into 2019, before additional capacity currently under construction is added. But they expect that by 2020 tightness will occur again. Permian production is expected to reach 3.5 MMB/D by the end of this year, and continue rising to 4.1 MMB/D through 2019 and 4.9MMB/D by 2020.

New takeaway capacity will be required by then. In recent years, midstream infrastructure businesses have rarely missed an expansion opportunity even if it led to stretched balance sheets. NuStar (NS) was the most recent firm to acknowledge such over-reach. The collapse of their GP/MLP structure and distribution cut announced ten days ago were caused in part by the failure of their early 2017 Navigator acquisition to ramp up cashflows quickly enough. The industry’s history of providing new capacity too readily has diverted cashflows from distributions to growth and debt repayment, frustrating traditional investors. They’ll be hoping that recent financial discipline sweeping across energy producers similarly afflicts pipeline operators, resulting in higher returns on future projects.

Overall U.S. proved reserves of crude oil and lease condensate were virtually unchanged in 2016 versus 2015 at 35.2 Billion Barrels. Gains in the Lower 48 states were offset by declines in Alaska and offshore. Proved reserves of natural gas rose 5% to 324 Trillion Cubic Feet, as total additions were 150% of production. The U.S. continues to enjoy a substantial cost advantage in natural gas production, with exports of Liquified Natural Gas (LNG) set to reach 10 Billion Cubic Feet per Day (BCF/D) by late 2019, 3% of global consumption.

Commodity prices affect proved reserves as they have to be commercially recoverable. The 2016 oil and gas prices used for these calculations were 15% and 6% lower than in 2015. When the 2017 figures are published they’ll be based on oil and gas prices 20-21% higher. U.S. reserves are likely to keep growing.

The American Energy Independence Index (AEITR) finished the week +2.7%.

Please click here for important legal disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!