Can MLPs Go Global?

We’re into earnings season for public companies including Master Limited Partnerships (MLPs). Quarterly report cards on performance should provide useful information on the nascent recovery in the U.S. energy sector.

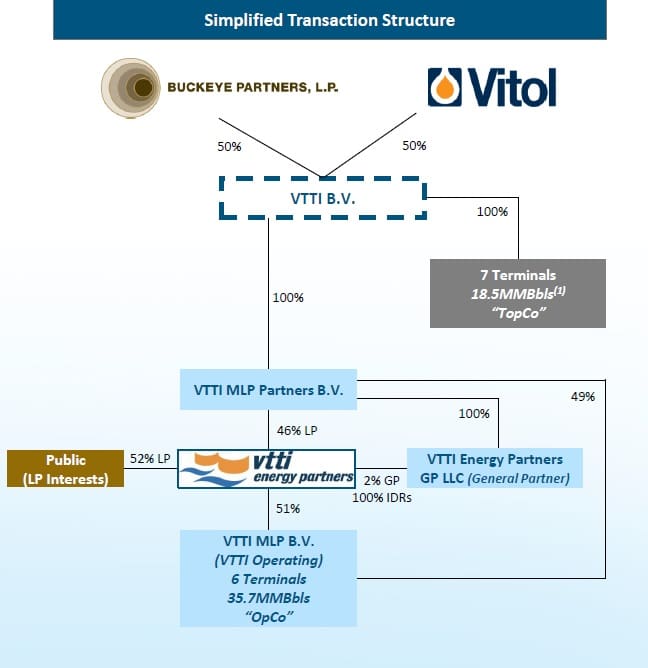

When they reported 3Q16 earnings Buckeye Partners (BPL) caught our attention with their investment in VTTI BV, a global owner of storage and terminalling assets headquartered in the Netherlands. VTTI BV is owned by Vitol, a privately held energy company. Beneath VTTI BV is a publicly traded MLP, VTTI Energy Partners, LP (VTTI). BPL and VTTI/Vitol are in similar businesses, albeit BPL is in the U.S. while VTTI/Vitol are worldwide.

BPL has bought 50% of the General Partner of VTTI for $1.1BN, an investment whose returns are virtually all going to come outside the U.S.. It’s quite a thought provoking move. The MLP structure is a consequence of the U.S. tax code. MLPs generally don’t pay tax on their income because their investors do. There are substantial tax disincentives for non-U.S. investors and U.S. tax-exempt investors to invest directly in MLPs. It’s not impossible but in most cases prohibitively costly. Because MLPs aren’t taxed, they have a cost of equity capital advantage over an otherwise identical business structured as a C-corp.

(Diagram from Buckeye’s presentation on the deal)

But this advantage ought not to extend beyond the U.S. The profits earned by a refined product terminal located in, say, New York aren’t taxed at source because the investors are U.S. taxable and report their proportional share of the income on their tax return via a K-1. But why would the Dutch, or South Africans similarly extend this advantage to physical assets in their country owned by VTTI, a U.S. listed MLP? And in fact they don’t, which ought to eliminate the MLP cost of equity advantage and restrict the MLP structure to holding U.S. assets.

VTTI is a partnership but chooses to be taxed as a corporation. And it does pay tax, at an average rate of 24% over the past four years according to their 2015 10K. The Netherlands, Malaysia, U.S. and Belgium all receive tax from VTTI, reflecting their far-flung footprint. So we have a tax-paying entity with a GP entitled to Incentive Distribution Rights (IDRs), a low growth investment that trades at a 7.3% yield based on their most recently declared quarterly distribution of $0.3281.

Most MLP GPs are earning 50% of the marginal dollar of Distributable Cash Flow (DCF) earned by the MLPs they control. VTTI isn’t yet there. IDRs come with DCF thresholds, similar in concept to the marginal tax rates that kick in as your income rises. VTTI’s GP is at the top of the 15% IDR share. Beyond $0.328125 per unit they get 25% and above $0.39375 they get 50%. Vitol, and now BPL, will increasingly participate in per unit DCF growth. Vitol retains storage assets at the parent level which they can sell (“drop down”) to VTTI as well as $600MM of new projects under consideration. So there’s some visibility around how they might grow DCF.

The question is, why is this structure working with non-U.S. assets whose income is already being taxed before it reaches the equity owners? For the answer, look to Williams Companies (WMB). In August, we noted that WMB had recognized they had two types of investor: income-seeking MLP investors who hold Williams Partners (WPZ), and growth seeking investors who hold WMB. So when WMB cut its dividend in order to invest in WPZ, both sets of investors found something to like. WPZ investors liked the support this gave to their distribution, while WMB investors cheered the redirection of their dividends into a high yielding security. Both securities rose. WPZ is “YieldCo”, generating steady income. WMB is “GrowthCo”, with better growth prospects. In Williams Satisfies Two Masters we explained our thinking.

The VTTI structure works because VTTI investors are most focused on income, and won’t drive the yield on VTTI down much for the promise of faster growth. So that growth is partly redirected via the GP IDRs to VTTI BV, and now to BPL as well.

It’ll be interesting to watch, because on the earnings call BPL didn’t identify operating synergies as being that important to them. They are financial investors in a sector they know pretty well. They now own a GP. The MLP model is showing its applicability globally, not through a tax advantage but via its ability to separate cashflows and meet the specific needs of different investor segments, lowering its cost of equity.

We are invested in BPL and WMB.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!