Can MLPs Go Global?

We’re into earnings season for public companies including Master Limited Partnerships (MLPs). Quarterly report cards on performance should provide useful information on the nascent recovery in the U.S. energy sector.

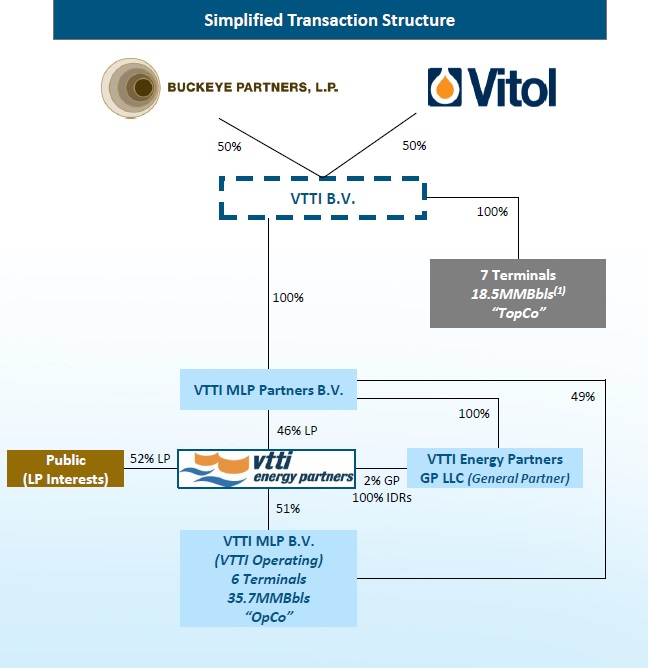

When they reported 3Q16 earnings Buckeye Partners (BPL) caught our attention with their investment in VTTI BV, a global owner of storage and terminalling assets headquartered in the Netherlands. VTTI BV is owned by Vitol, a privately held energy company. Beneath VTTI BV is a publicly traded MLP, VTTI Energy Partners, LP (VTTI). BPL and VTTI/Vitol are in similar businesses, albeit BPL is in the U.S. while VTTI/Vitol are worldwide.

BPL has bought 50% of the General Partner of VTTI for $1.1BN, an investment whose returns are virtually all going to come outside the U.S.. It’s quite a thought provoking move. The MLP structure is a consequence of the U.S. tax code. MLPs generally don’t pay tax on their income because their investors do. There are substantial tax disincentives for non-U.S. investors and U.S. tax-exempt investors to invest directly in MLPs. It’s not impossible but in most cases prohibitively costly. Because MLPs aren’t taxed, they have a cost of equity capital advantage over an otherwise identical business structured as a C-corp.

(Diagram from Buckeye’s presentation on the deal)

But this advantage ought not to extend beyond the U.S. The profits earned by a refined product terminal located in, say, New York aren’t taxed at source because the investors are U.S. taxable and report their proportional share of the income on their tax return via a K-1. But why would the Dutch, or South Africans similarly extend this advantage to physical assets in their country owned by VTTI, a U.S. listed MLP? And in fact they don’t, which ought to eliminate the MLP cost of equity advantage and restrict the MLP structure to holding U.S. assets.

VTTI is a partnership but chooses to be taxed as a corporation. And it does pay tax, at an average rate of 24% over the past four years according to their 2015 10K. The Netherlands, Malaysia, U.S. and Belgium all receive tax from VTTI, reflecting their far-flung footprint. So we have a tax-paying entity with a GP entitled to Incentive Distribution Rights (IDRs), a low growth investment that trades at a 7.3% yield based on their most recently declared quarterly distribution of $0.3281.

Most MLP GPs are earning 50% of the marginal dollar of Distributable Cash Flow (DCF) earned by the MLPs they control. VTTI isn’t yet there. IDRs come with DCF thresholds, similar in concept to the marginal tax rates that kick in as your income rises. VTTI’s GP is at the top of the 15% IDR share. Beyond $0.328125 per unit they get 25% and above $0.39375 they get 50%. Vitol, and now BPL, will increasingly participate in per unit DCF growth. Vitol retains storage assets at the parent level which they can sell (“drop down”) to VTTI as well as $600MM of new projects under consideration. So there’s some visibility around how they might grow DCF.

The question is, why is this structure working with non-U.S. assets whose income is already being taxed before it reaches the equity owners? For the answer, look to Williams Companies (WMB). In August, we noted that WMB had recognized they had two types of investor: income-seeking MLP investors who hold Williams Partners (WPZ), and growth seeking investors who hold WMB. So when WMB cut its dividend in order to invest in WPZ, both sets of investors found something to like. WPZ investors liked the support this gave to their distribution, while WMB investors cheered the redirection of their dividends into a high yielding security. Both securities rose. WPZ is “YieldCo”, generating steady income. WMB is “GrowthCo”, with better growth prospects. In Williams Satisfies Two Masters we explained our thinking.

The VTTI structure works because VTTI investors are most focused on income, and won’t drive the yield on VTTI down much for the promise of faster growth. So that growth is partly redirected via the GP IDRs to VTTI BV, and now to BPL as well.

It’ll be interesting to watch, because on the earnings call BPL didn’t identify operating synergies as being that important to them. They are financial investors in a sector they know pretty well. They now own a GP. The MLP model is showing its applicability globally, not through a tax advantage but via its ability to separate cashflows and meet the specific needs of different investor segments, lowering its cost of equity.

We are invested in BPL and WMB.