Coping With Heat

/

This is the time of year when liberal news outlets warn of irreversible climate change. We spent a couple of days in Naples, FL which was, unusually, cooler than New Jersey. The daily afternoon thunderstorms that accompany hurricane season moderate the heat. When I first moved to New York from London in 1982 I remember being amazed at how on very hot days the tarmac on the streets felt soft underfoot.

PJM Interconnect, which operates the grid for mid-Atlantic states and as far west as Illinois, issued an order for Maximum Generation. New Jersey electricity prices are rising by 17%, which PJM blames in part on declining supply. Only self-flagellating Democrat energy policies could engineer such an outcome. State policy is to move to 100% renewable power by 2035.

Coal plants are being closed but solar and wind are inadequate – especially since offshore wind projects have been canceled. The policy is a virtue-signaling goal that is expensive, irrelevant and risks leaving the state short of power at peak times like these. Let’s hope there’s enough available to avoid power losses during the summer.

This blog shares with Energy Secretary Chris Wright a belief that climate change is real. Left wing policy prescriptions have failed to make much impact, because they favor intermittent energy instead of pushing for worldwide displacement of coal with gas.

Emissions growth in the developing world is far too much to be offset by even the most draconian energy policies promoted by rich world liberals. In the UK, industry has complained about the prohibitive cost of electricity as the country has shifted to windpower.

Britain has been reducing its emissions at the cost of jobs. The government recently announced plans to cut prices for industrial users, which means they’ll be subsidized by taxpayers. Once again, renewables are not cheap.

Data centers are the main source of demand growth in the US, and they are also being blamed for the jump in New Jersey electricity prices. But at a global level, increased air conditioning is more impactful than AI.

India’s Centre for Science and the Environment claims that, “A single heatwave – even one lasting just a few days – causes tens of thousands of excess deaths in India,” Global warming and rising living standards are driving energy demand up. Coal provides 75% of India’s electricity. For all non-OECD countries, it’s 45%. The US is 16% and the EU is 13%. The number of air-conditioning units in India is expected to grow from 110 million today to almost half a billion* within the next decade. That’s where emissions are going up.

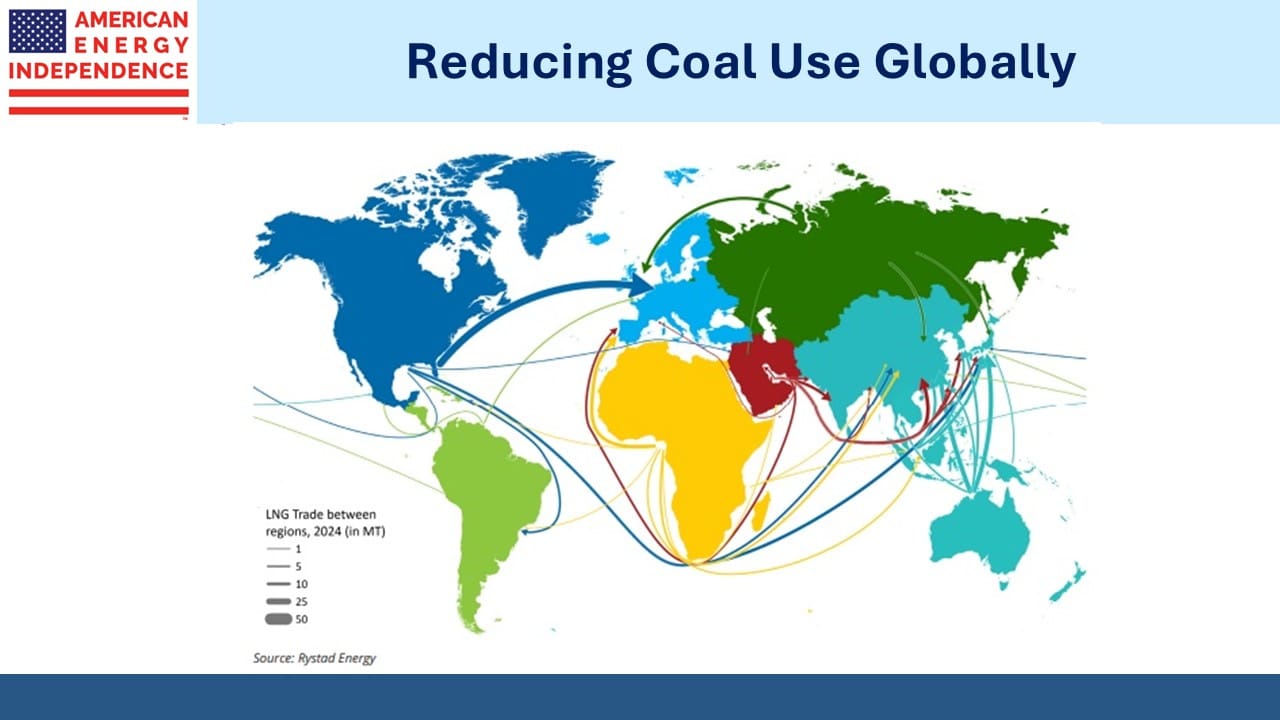

India imported 26.1 Million Tons (MTs) of LNG last year, equal to around 3.5 Billion Cubic Feet per Day (BCF/D). This was up from 21.9 MTs in 2023. The US provided almost a fifth of this. We were their second biggest supplier, behind Qatar which is a much shorter trip.

India plans to double its imports of LNG by 2030. They’ve signed contracts with ADNOC and TotalEnergies, two companies that have in turn contracted to buy LNG from NextDecade’s Rio Grande terminal in Texas once it’s completed.

Since gas generates around half the emissions of coal when used to produce electricity, investments in growing our LNG export capability are helping keep Indians cool in the summer and reducing their emissions.

The last few days illustrate how hard it is to trade any market, including energy, based on developments in the Middle East. But on balance, even when oil prices drop sharply and erase prior gains, the net effect is to highlight the security in America’s supply of oil and gas both for our domestic market and overseas buyers. Qatar easily fended off Iran’s missiles, whose delivery was in any case well telegraphed.

But America’s LNG shipments do not leave ports at risk of attack. We don’t have to ask arriving tankers to wait miles away to avoid creating a concentrated target at the shipping terminal. They don’t have to pass through a narrow strait of water that might be closed during a war.

Because LNG contracts are often ten years or more, buyers need to consider a range of possibilities.

Venture Global (VG) was a brief beneficiary of the fears around shipping access through the Strait of Hormuz. This is because they have the most uncommitted capacity of any LNG exporter, so would have been able to profit from a short term spike in global LNG prices.

This is what they did in 2022 when Russia invaded Ukraine, earning an estimated $3.5BN along with the ire of customers who believed those deliveries should have gone to them under existing contracts. VG’s slide on Monday mirrored oil, as markets priced in reduced tensions in the region.

Other positive LNG news came from Cheniere. They announced Final Investment Decision on Trains 8 and 9 at Corpus Christi, and plan to spend $25BN on accretive growth projects, buybacks and debt repurchases through 2032, by which time they expect to reach $25 per share of Distributable Cash Flow. They also raised their dividend by 11%, although at 0.94% it won’t draw income-seeking investors.

We were also happy to see that TD Cowen raised NextDecade to a Buy, which boosted the stock yesterday. We continue to think it’s attractively priced.

We have two have funds that seek to profit from this environment:

*An earlier version of this blog post incorrectly stated India had 110,000 a/c units rising to 500.000 by 2035. Sorry.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!