New Energy Policies Are Here

/

It’s now less than a week until Donald Trump takes over in the White House. The past couple of months have caused many to wonder why there’s such a long gap between the election and the inauguration. It’s a holdover from the eighteenth century when the time was required to allow messengers to travel to the capital with election results but is clearly no longer required. Joe Biden should have had the good grace to keep a low profile during this interregnum, but instead chose to issue executive orders promoting liberal policies on offshore drilling and immigration.

Biden will soon be gone, and attention is turning to the energy-related executive orders Trump is planning for his first days in office. He’s widely expected to lift the LNG permit pause, which will improve certainty for negotiations on long-term supply agreements.

Chris Wright, Trump’s nominee to head the Energy Department, will bring an articulate voice explaining why US LNG exports are good for everyone involved. Bettering Human Lives, a report published by Wright’s firm Liberty Energy, recounts the history of hydrocarbons and offers insight into how energy policy is likely to be pursued. It’s well worth reading.

Trump’s opposition to windpower represents a shift from his first time in office when his administration was supportive. Communities are increasingly objecting to the visual intrusion of huge wind turbines. It’s reasonable to ask why supporters of weather-dependent energy in the US don’t first demand reduced coal use by developing countries. Getting emerging Asia to displace coal with LNG is one of the most effective ways to reduce CO2 levels.

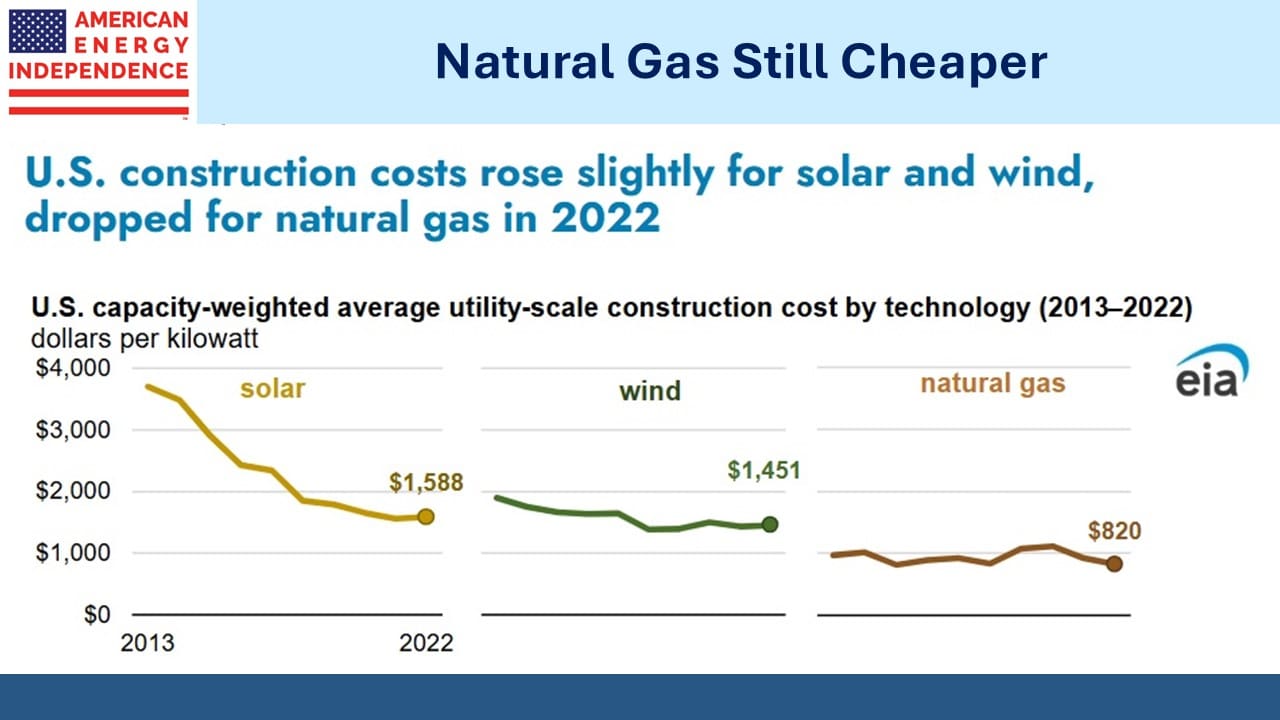

The Energy Information Administration (EIA) published data late last year showing that construction costs for solar and wind have stopped falling, while those for natural gas continue to. This is why clean energy stocks have performed so poorly and why electricity tends to be expensive where renewables provide a high share.

The data is through 2022 so missing the recent demand for electricity from data centers which is driving investment in natural gas power generation. Large providers of such equipment such as Siemens Energy report increasing backlogs, so it wouldn’t be surprising to see the cost of natgas power edge up somewhat when the EIA updates their information.

The other day I was chatting with an investor, and while he’s fully bought in to the primacy of natural gas he wondered whether nuclear power might at some point displace it.

Nuclear energy seems such an obvious solution to the world’s need to deliver reliable carbon-free power. Vocal opponents such as the Sierra Club promote a completely unrealistic view of how the world can generate electricity. I often note that the US navy operates almost a hundred nuclear reactors in aircraft carriers and submarines. There’s no record of any problem with any of these. Perhaps we should just let the US navy run all our civilian nuclear reactors.

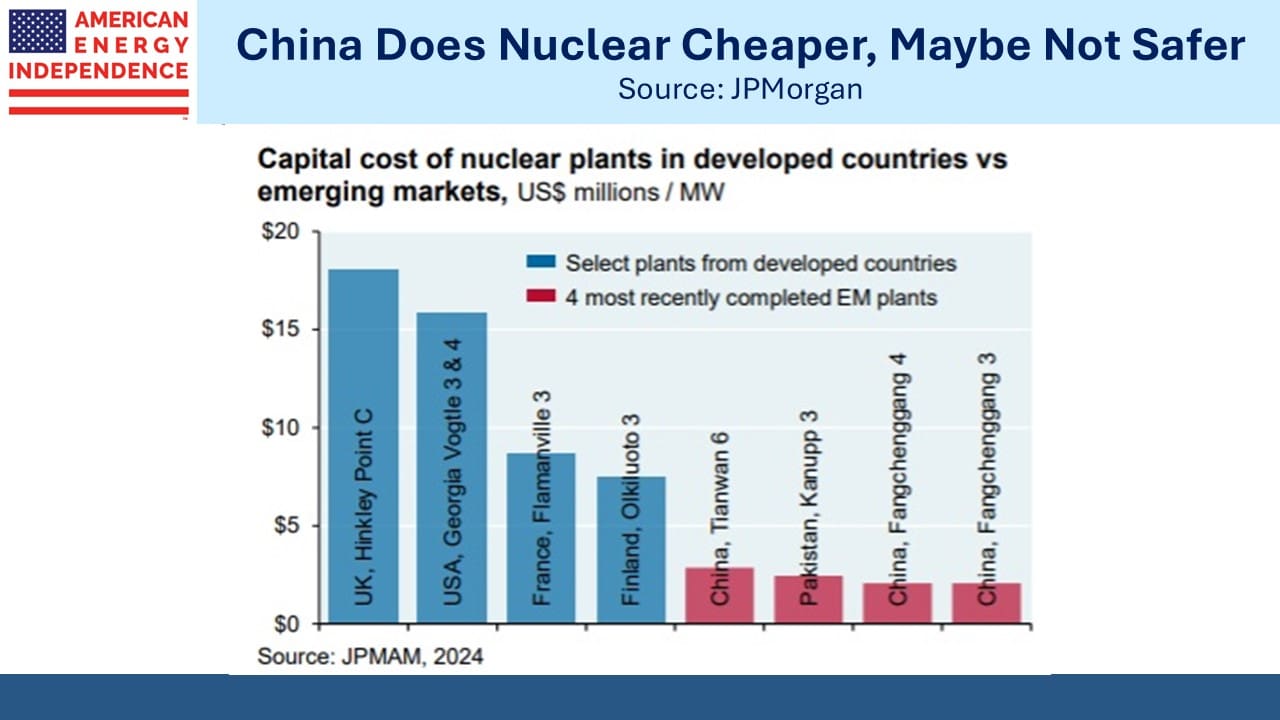

Unfortunately, western countries have a poor record of building new nuclear plants anywhere close to on time and on budget. The most recent nuclear facility completed in the US, the Vogtle plant’s Units 3 and 4 in Georgia, came in seven years late and $17BN over budget. They cost over $15 million per Megawatt of power generation.

The UK’s Hinckley Point C reactor cost $18 million per Megawatt and was built by France’s EDF. France gets around two thirds of its electricity from nuclear. This represents 35% of their primary energy, far more than any other country. Finland is second, relying on nuclear for 26% of their primary energy, but their output is a tenth of France’s.

So it’s disappointing that the leading French company delivered such an expensive result. The French government has even decided to cap nuclear at 50% of total power generation, versus 70% currently.

Western countries haven’t yet figured out how to build commercially viable nuclear plants.

Most of the addition of nuclear power is taking place in developing countries, led by China. Costs are far cheaper at around $2-3 million per Megawatt. This is partly because developers are unburdened by costly legal challenges from NIMBY homeowners. However, they’re also using cheaper technology that relies on sodium cooled fast breeder reactors. JPMorgan reports that these have been rejected in the US as having shorter useful lives and increased risk of fire.

China is today’s leader in developing new nuclear.

There are numerous efforts to resurrect nuclear power in the US, including restarting old reactors and placing small modular reactors on the sites of decommissioned coal plants where connectivity to the grid is already in place. We should hope these are successful, but given the time involved and cost, natural gas is unlikely to be threatened by nuclear for many years.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!