The 8X Energy Transition

/

Over the years I’ve developed a few soundbites to help investors remember why they should invest in midstream energy infrastructure. Once it became clear that climate extremists’ efforts to impede new pipeline construction were boosting free cash flow, I proclaimed that we should all hug our local climate protester and drive them to their next event.

As the absence of profits in renewables led inevitably to poor returns, I noted that the way to make a small fortune in solar and wind was to invest a big one and wait.

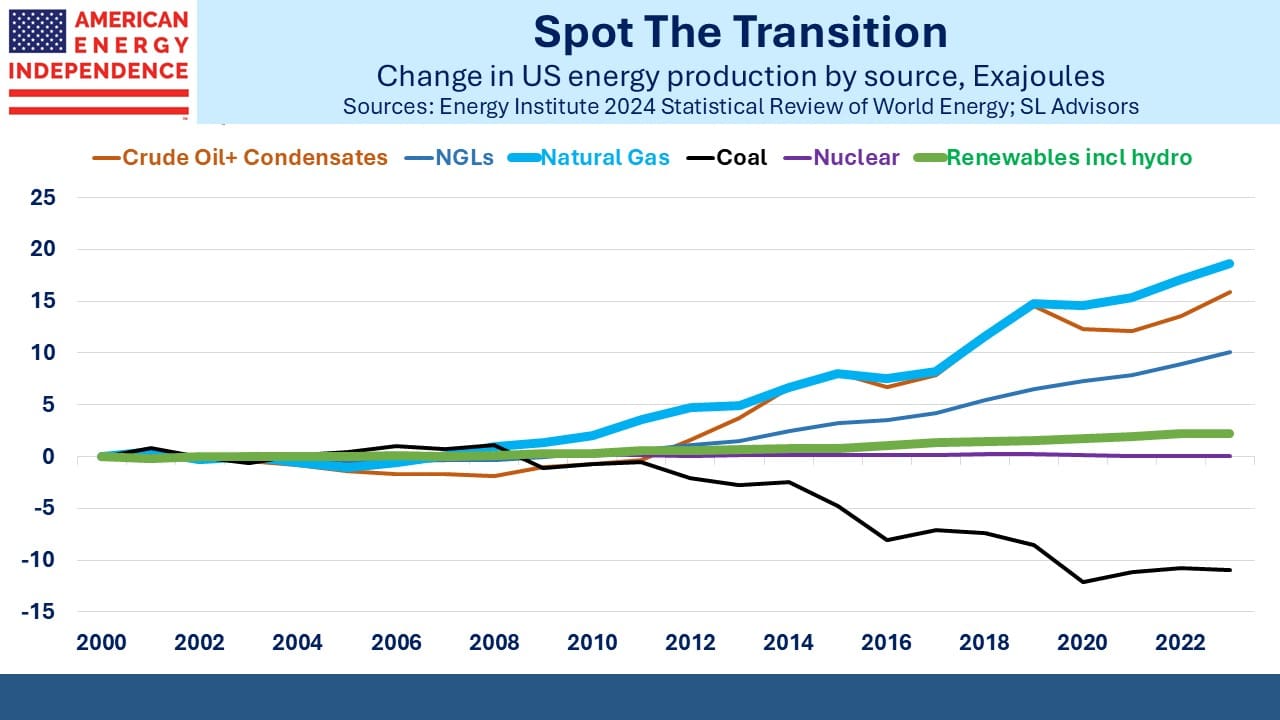

More recently, I’ve enjoyed using data to highlight that the Natural Gas Energy Transition is the only transition of any consequence in America. One of the least appreciated statistics is how growth in US gas production has swamped the increase in renewables.

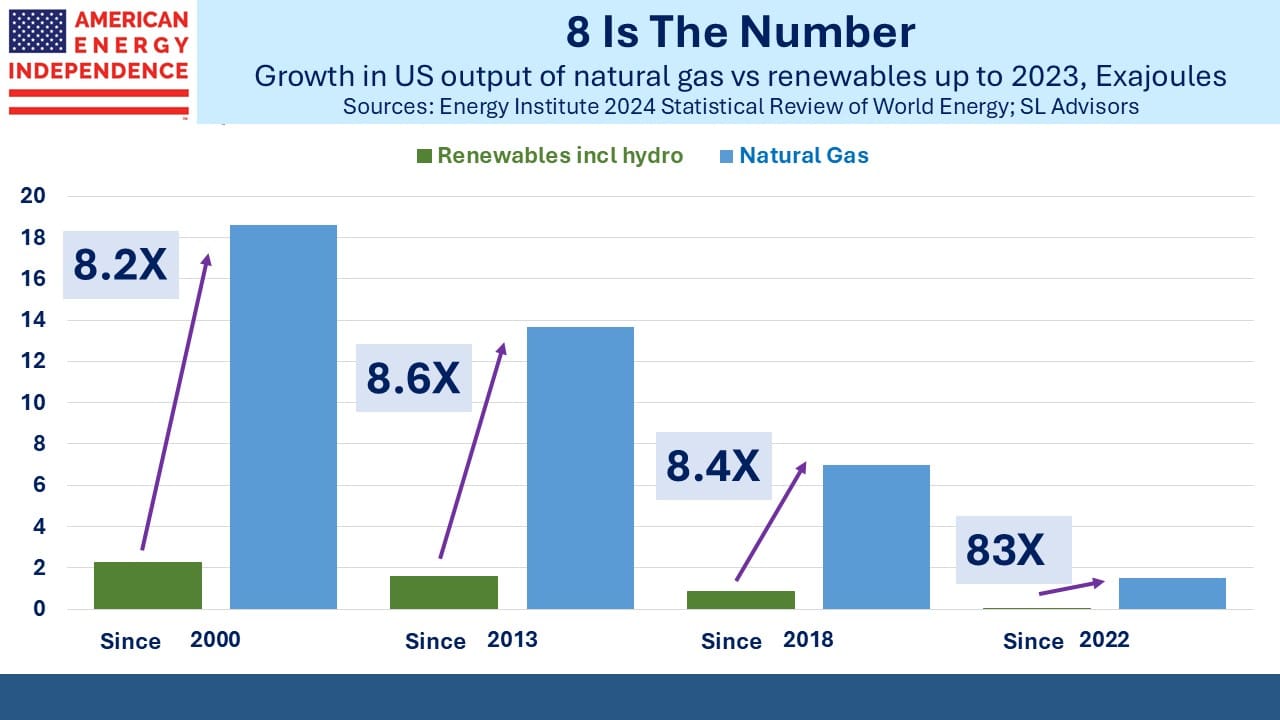

Solar and wind output have almost tripled since 2000, from 1.2 Exajoules (EJs) to 3.5 EJs last year. Left-leaning and superficial journalists routinely hail this as clear evidence that hydrocarbons are on the way out.

What they willfully ignore is that natural gas production has grown from 18.7 EJs to 37.3 EJs over the same period. This is a mere doubling, a compound annual growth rate of only 2% versus renewables 2.7%. This is the type of arithmetic sleight of hand on which so much energy reporting rests.

But in energy equivalent terms, natural gas production is up by 18.6 EJs vs 2.3 EJs for renewables. We’ve added 8X as much new energy from gas as from solar and wind combined so far this century.

The Natural Gas Energy Transition is 8X as big as the renewables version.

8X

This is the statistic that every apologist for intermittent, weather-dependent power should explain before they mistakenly talk about the wrong transition.

Some might argue that this is too long a period, that solar and wind have really taken off more recently. Over the past decade, natural gas production has increased by 13.7 EJs versus 1.6 EJs for renewables. That’s a ratio of over 8X. It’s a similar story over five years, and from 2022 renewables growth has stalled.

It could be argued that since some of this production has gone to exports, the comparison overstates the penetration of natural gas in our economy. But domestic consumption has still grown by 9.3 EJs over the past decade, 4X the growth in renewables.

The sudden jump in power demand for AI data centers will provide further impetus to domestic natural gas consumption. There are no reports of frantic purchases of new solar and wind output, because data centers need power 24X7. In time nuclear power will hopefully meet some of this need, but given the time required even to restart an existing nuclear plant, natural gas is the only viable solution. So consumption will grow at a higher multiple of renewables in the future.

By any objective measure we are pursuing a natural gas energy transition. If left wing journalists were focused on this objective instead of their dystopian one of limited, intermittent and expensive energy, they could claim the right side of history. If they’d also embraced nuclear and used their platform to promote the low risk of this carbon-free energy, they might have helped sway public opinion behind a virtuous gas/nuclear combination that would displace coal and render solar and wind obsolete.

But they didn’t.

The Natural Gas Energy Transition is a huge success in that millions of words have been spilled on climate change, providing consumers with all the information they could need to make choices. That burning hydrocarbons raises CO2 levels has been understood for at least fifty years.

Many people have changed their behavior. They’ve installed solar panels, bought EVs that hopefully don’t run on coal like China’s, and switched from heating oil to gas to heat their homes (like your blogger).

But generally, with the exception of a handful of left-wing states, choices have been driven by incentives, not imposed by taxes. We’ve lowered greenhouse gas emissions from their 2007 peak of just under 6.2 Gigatonnes (Billion Metric Tonnes, GTs) of CO2 equivalent to 5.1GTs. We’ve dropped from 18.2% of the world’s total to 12.7%.

We’ve done it without impoverishing people or crushing our economy. Germans now watch for Dunkelflaute, periods of cloudy calm weather that renders those solar panels and windfarms little more than expensive, useless hardware. For an energy strategy to avoid, look no farther than Germany.

Incoming President Trump can tell the rest of the world they could do worse than emulate our energy mix. And our natural gas exports are here to help them do it.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Any thoughts on this:https://x.com/matthewcgray/status/1612754456810061825 ?