US Leads Natural Gas Demand And Supply

/

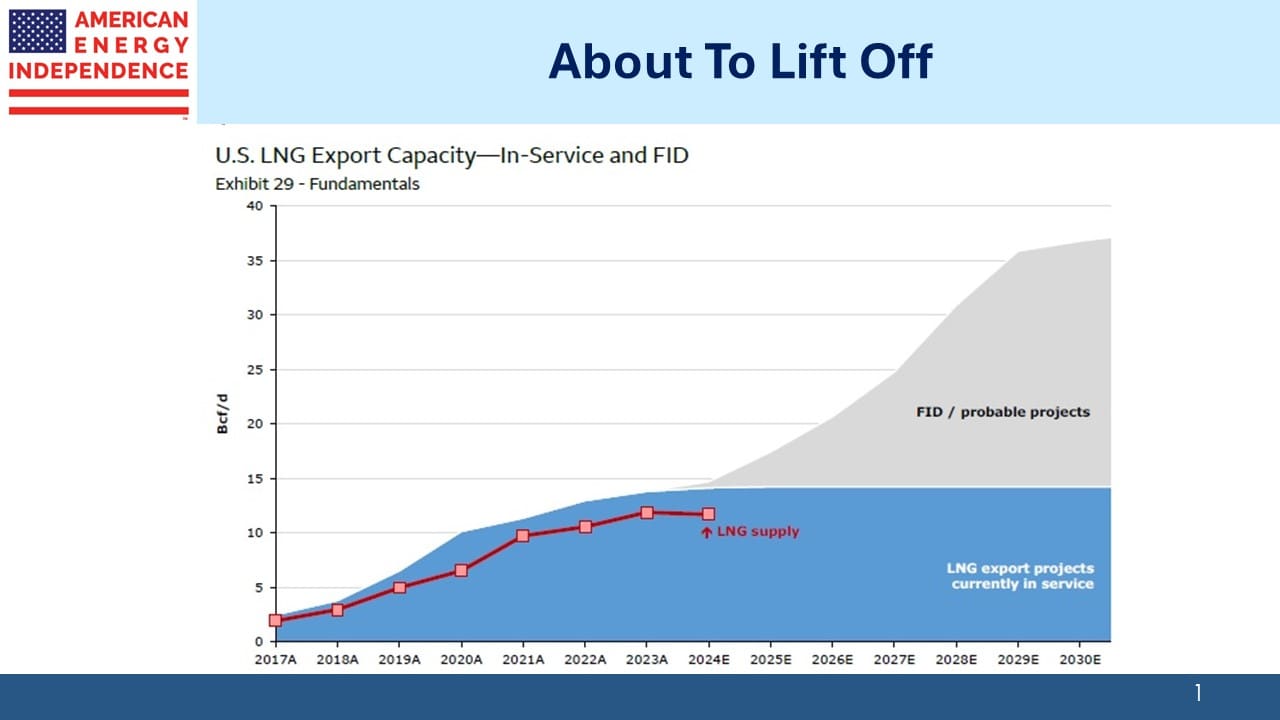

It’s clear that natural gas demand is heading higher over the next few years. It’s less certain that this will push prices higher. New LNG export terminals are going to double our volumes sent overseas over the next five years. The widely criticized pause on LNG permits that President Biden imposed last January only applied to new projects.

Previously issued permits were unaffected and those construction projects largely continued. The pause did inject uncertainty into contract negotiations for projects that were seeking enough commitments to reach a Final Investment Decision (FID). Japan is one foreign buyer that expressed concern at the time over the uncertainty this created about the US as a supplier.

Incoming President Trump is widely expected to lift the permit pause soon after he’s in office. This will lead to more visibility about export volumes from 2030 and on, given that it’s not uncommon for a new project to require five years to build following FID.

The second source of new demand is from new natural gas power plants to power all the new AI-related data centers that are planned. JPMorgan reported that global gas turbine orders are +33% YoY, driven by demand in Saudi Arabia which is replacing many older turbines with more efficient models, and the US because of data centers. Excluding China orders are +61% measured by GW of output capacity.

Demand for heavy-duty turbines able to provide baseload supply (defined as 100MW of output), is similarly strong.

Continued coal-to-gas switching, our biggest source of reduced CO2 emissions in the US, is a third source of natgas demand.

A google search of, “Is solar power cheaper than gas?” delivers numerous affirmative responses, including Google’s AI result. There are at least that many journalists toiling away in willful defiance of overwhelming evidence to the contrary. Saudi Arabia is a reliably sunny place and they’re driving the growth in gas turbine demand.

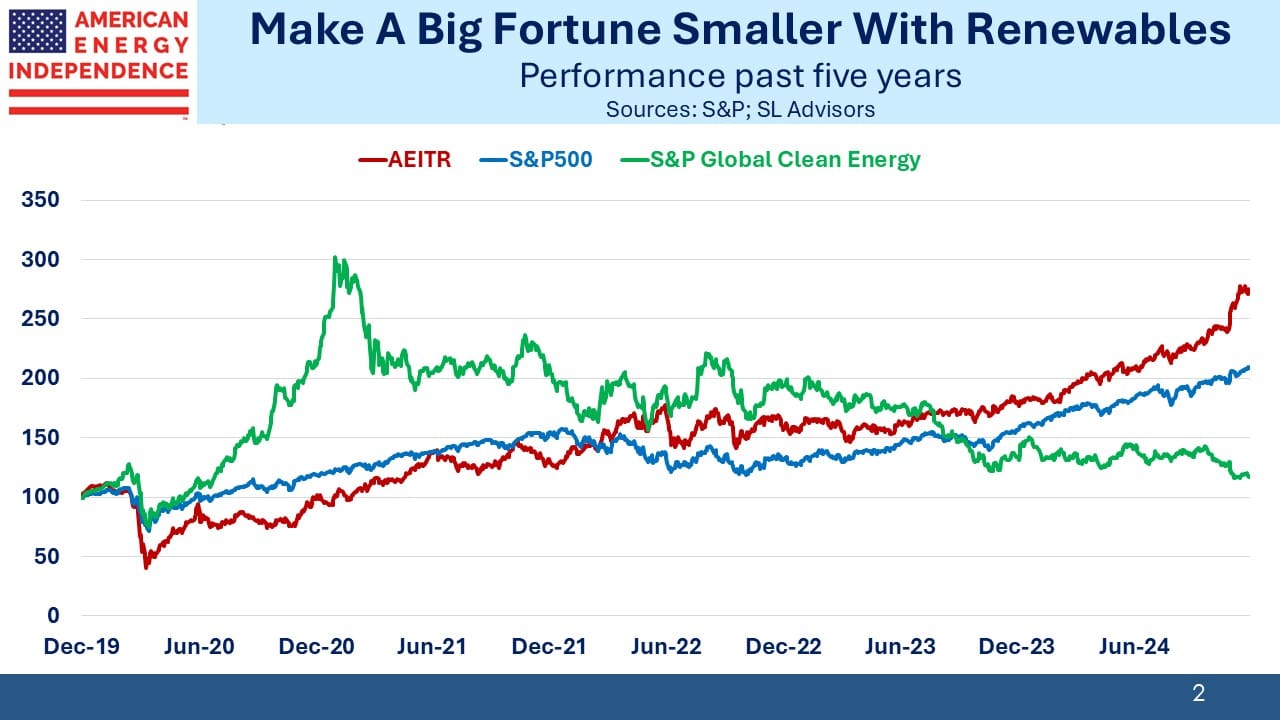

In the US, renewables’ advocates routinely overlook the cost of intermittency. In the marketplace for reliable power, solar and wind have no place. The persistent championing of renewables by the International Energy Agency and other progressive commentators denies empirical evidence to the contrary. They’ve helped countless investors create small fortunes from big ones by investing in clean energy. The real money has been made from independent thinking.

It’s clear that demand for US natural gas is headed higher. But even though US gas volumes are set to rise prices, which are perennially among the cheapest in the world, may remain low as supply increases commensurately.

US oil output is likely to rise somewhat. Trump’s new Treasury Secretary Scott Bessent’s “3-3-3 plan” targets 3% GDP growth, 3% deficit to GDP and 3 million barrels a day of new oil production. His ability to influence oil output is limited. For example, Chevron expects this year to be their peak capex spend in the Permian as they prioritize growing free cash flow over production.

Markets still expect some higher production in response to more pro-energy regulation and greater access to Federal land. Increased oil from the Permian in west Texas could add to the supply of associated gas, an unsought companion to the crude that’s produced there.

In their investor day recently, Enbridge raised 2025 EBITDA guidance modestly on the back of organic growth in their natural gas pipeline business which is their major area of focus.

Nuclear power can be part of the solution for new data centers, albeit not until the 2030s given how long new plants require for construction. Small Modular Reactors (SMR) have seemingly been on the horizon for years. However, earlier this year the Department of Energy released a guide to help companies use the sites of retired coal plants for nuclear facilities. This takes advantage of already existing connections to the grid.

TerraPower, led by founder and chairman Bill Gates, recently broke ground on its Natrium SMR project in Kemmerer, WY which would be the first nuclear plant to be situated on a former coal plant. It’ll use molten salt (natrium is the Latin word for sodium) rather than water as coolant, since it has a much higher boiling point.

As Terrapower points out, it is the only “coal-to-nuclear project under development in the world.” Why isn’t the Sierra Club behind efforts like this?

Between increased natural gas and ongoing innovation in nuclear, one day we’ll find we’ve transitioned away from intermittent renewables. Among the many positives will be that wretched little girl Greta being consigned to the dustheap of history.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!