Situations We’re Following

/

The Mountain Valley Pipeline (MVP) has suffered countless delays because of continued legal challenges from environmental extremists. Permits issued by Federal agencies were on many occasions rescinded by judges. No infrastructure of any kind can be built with such a process. When the recently passed debt ceiling legislation deemed completing MVP “in the national interest” it implicitly acknowledged that the permitting process is broken. This overrode the prior legal judgments. Let’s hope this provides impetus for reform.

Equitrans (ETRN), whose frustrated efforts to complete MVP led to its extraordinary approval by legislation, has gained over 50% as a result. The stock had previously included no value for MVP, priced as if it would never be completed. NextEra, a partner in MVP, wrote its carrying value down to zero last year.

But ETRN remains well short of fully reflecting MVP’s value. Morgan Stanley has estimated a $14 sum-of-the-parts price target for ETRN. RBC has a Base Case of $10 and an Upside Case of $14. It’s currently at $9.50. The threat of further legal challenges remains. The legislation removed the jurisdiction of any court over actions by Federal agencies on this matter. But it allowed any claim against the law’s validity to be heard by the DC District US Court of Appeals. Analysts believe it’s highly unlikely any further legal challenges can disrupt MVP’s completion.

We think ETRN remains attractively priced.

Another situation we’ve been following is NextDecade (NEXT), whose planned Rio Grande LNG export project will be located on the northern shore of the Brownsville Ship Channel in Texas, with easy access to the Gulf of Mexico. By combining carbon capture with the condensing of natural gas that’s loaded onto LNG tankers, NEXT says it will be the only such US facility offering CO2 emissions reduction of more than 90 percent.

In April FERC re-approved the construction of Rio Grande. The next step is for NEXT to approve a Final Investment Decision (FID) so that construction can move ahead. CEO Matthew Schatzman expects FID to come before the end of this month.

Substantial uncertainty remains over how it will be financed. We estimate that building three trains with 2.3 Billion Cubic feet per Day (BCF/D) will generate $1.8BN in revenues and around $450MM in income to NEXT annually beginning by 2028. This is an $11-12BN project for a company whose market cap is below $1BN.

NEXT valuation estimates have a wide range. So any estimate of NEXT depends heavily on the mix of debt, preferred and common equity that’s used for financing. The FID announcement should provide enough detail about how Rio Grande LNG will be financed to provide sufficient cash flow visibility that its perceived risk will fall.

We think at current levels it offers an attractive return potential.

The proposed combination of Oneok (OKE) and Magellan Midstream has dominated our recent blog posts. We won’t relist our reasons for being opposed as we’ve covered them extensively (see Oneok Does A Deal Nobody Needs).

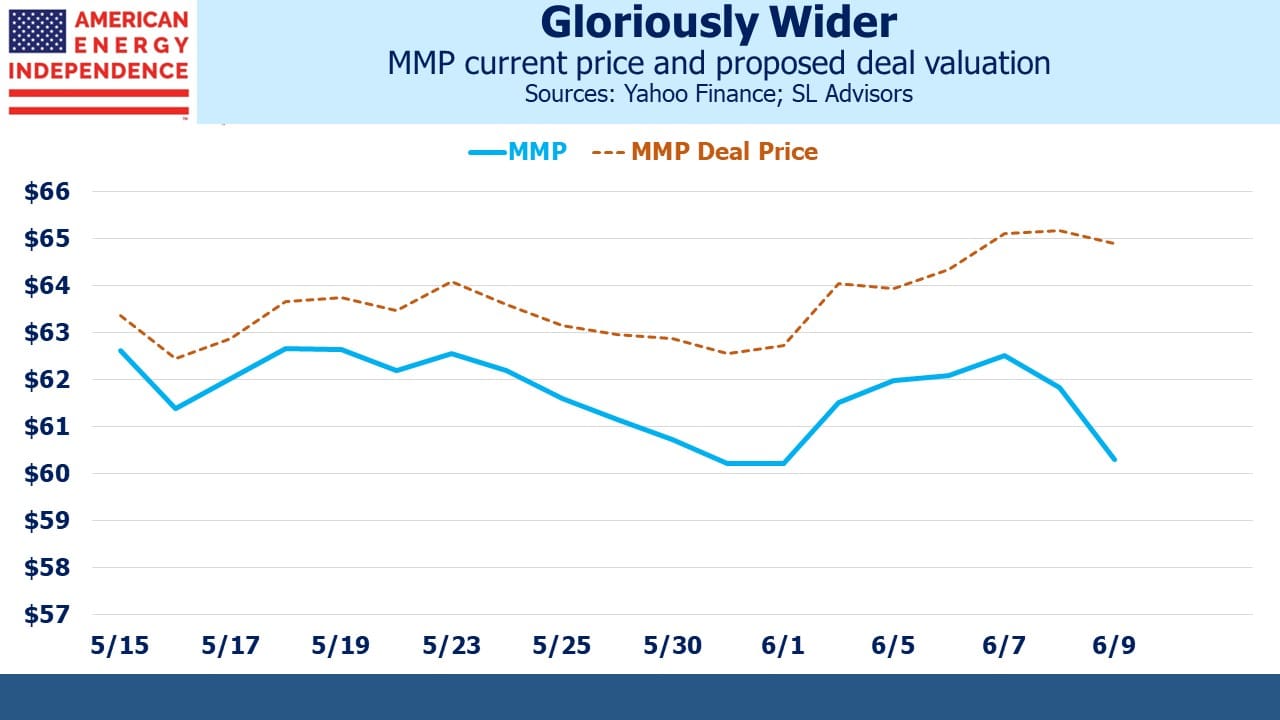

The market-implied probability of the transaction closing has dropped steadily since it was announced on May 15, because the gap between MMP’s current and proposed price is widening. Jim Murchie of Energy Income Partners recently wrote an open letter to MMP where he voiced criticisms similar to ours in objecting to the deal. Investor mood is turning against. Both companies will need to address the market’s cold response to their work.

In recent conversations with investors, several have expressed surprise that the midstream sector isn’t performing better. Equity market leadership is incredibly narrow (see AI And The Pipeline Sector) so unless you own the half dozen or so stocks benefitting from the AI frenzy it’s hard to keep up.

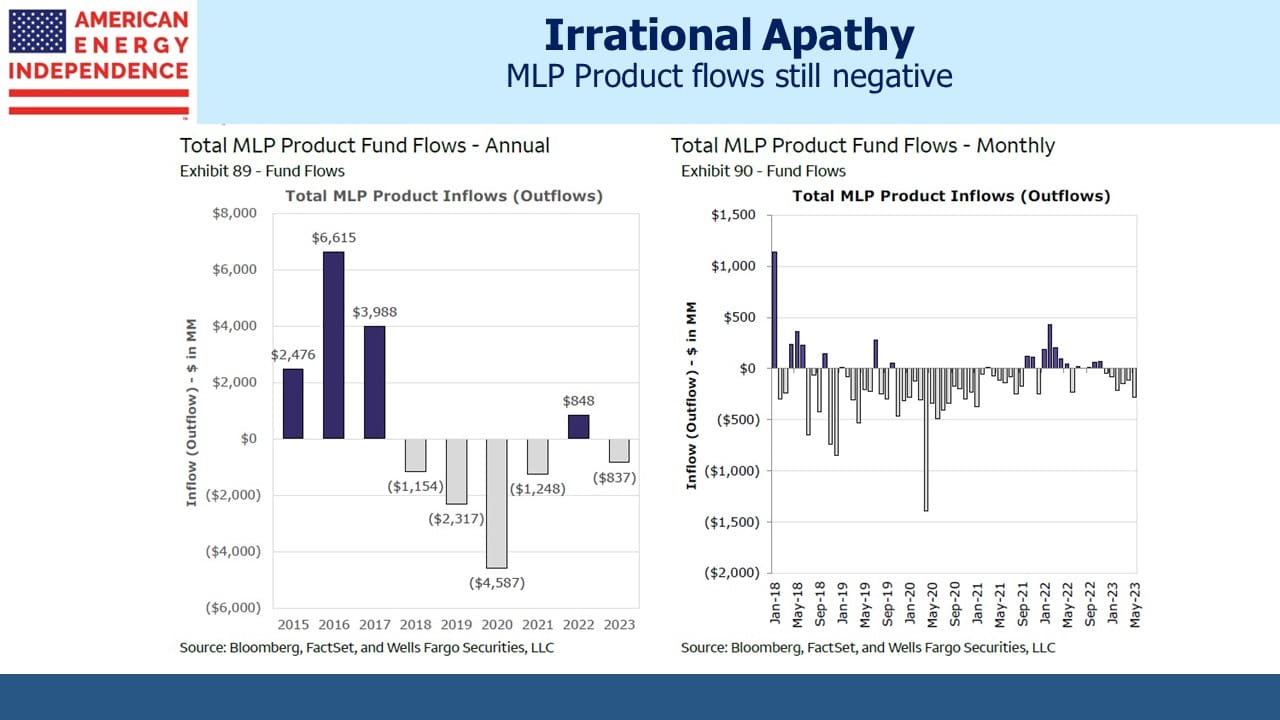

But fund flows into MLP Products, which is a decent proxy for mutual funds and ETFs in midstream energy infrastructure, have been negative every month this year. Last year’s inflow followed four negative years.

1Q23 earnings were good. Capex remains low, helped by opposition to new projects (hug a climate extremist and drive them to their next protest). Dividends are growing by our estimation 2-4%, and buybacks are retiring 2-3% of the sector’s market cap annually. Together with 6%+ yields, this provides the basis for annual returns of 10% or more.

Clearly there’s no irrational exuberance causing investors to throw money at the pipeline sector. Irrational apathy might be more accurate. But the $837MM of net outflows through the first five months of this year is more than offset by the rate at which companies are buying back stock. There’s also the explicit link to inflation in that many pipeline contracts, representing up to half the sector’s EBITDA according to research from Wells Fargo, reprice using either PPI or CPI.

Eventually these persistently strong fundamentals will cause inflows to resume, as they did last year.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

And if contracts don’t provide inflation protection then most regulators (such as the Texas Railroad Commission) will do so for pipeline operations.

However, since I invest in the midstream energy sector for irrationally high yields, the fact that unit and share prices are not higher does not disturb me until I finish my buying (which may be years from now)..