Why Are MLP Payouts So Confusing?

It’s surprisingly difficult to figure out what dividends are doing for midstream energy infrastructure. Just about every company has a free pass on cutting its payout nowadays. Prudent cash management isn’t going to draw much criticism with the size of the economic shock we’re enduring. Given the beating energy stocks suffered during 1Q20, a few dividend cuts would have been forgiven.

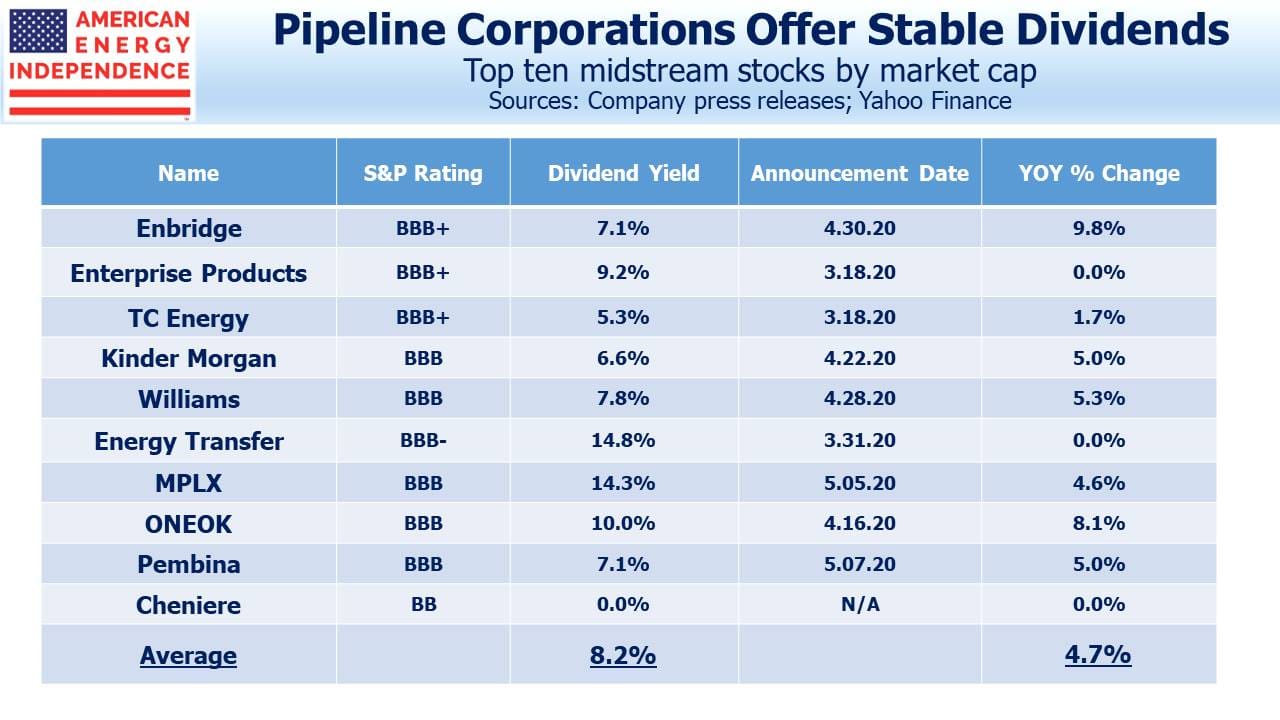

In spite of this, the biggest midstream energy infrastructure companies have maintained their payouts. In 1Q earnings calls, the overall message was that while it was hard to make confident long term forecasts, management teams felt comfortable with the resiliency of their businesses. The result is that the top ten midstream energy infrastructure companies by market cap have raised their payouts by an average of 4.7% over the past year.

None of them reduced dividends at their most recent announcement dates. Cheniere Energy, Inc. (LNG) doesn’t pay a dividend. Kinder Morgan (KMI) raised theirs by 5% compared to the prior quarter.

As we noted recently, free cash flow growth remains a positive story for these companies (see Pipeline Cash Flows Will Still Double This Year).

Alerian has echoed the positive news about distributions. They noted that, “The majority of midstream constituents grew or maintained dividends over 1Q19.” This was supported by a chart showing 68.5% of Alerian MLP Infrastructure Index (AMZI) components by market cap did just that. It sounds like a great story.

Unfortunately, characterizing distributions in this way presents a misleading picture. A majority maintaining or growing suggests that aggregate payouts for the group are similarly stable. They are not.

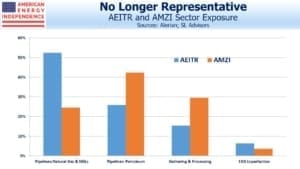

Distribution cuts at MLPs have been far more prevalent than at corporations – because the AMZI index consists of MLPs, it is more exposed to crude oil pipelines and to gathering and processing than the American Energy Independence Index (AEITR), which reflects the North American midstream sector as a whole. AMZI doesn’t reflect the industry. MLPs also tend to have lower credit ratings. As a consequence, MLP distributions are turning out to be less resilient than those paid by pipeline corporations.

Most companies tend to raise distributions/dividends gradually, by a few percent at time. By contrast, cuts are often 50-100%. So even though the majority of AMZI by market cap maintained or raised their distributions, the payout on the Alerian MLP ETF, AMLP, has just been cut again.

The AMZI is down to only 20 constituent companies now, and because 11 of them slashed their distributions, this was enough to force AMLP to cut its payout. This contrasts with the story for AMLP’s index, AMZI, which is being spun to sound superficially good.

It turns out that size matters. The three biggest MLPs, which are in the top ten midstream companies by market cap, all maintained or grew their payouts. The biggest companies in this sector tend to be more stable and have higher credit ratings.

AMLP investors care more about another cut than the spin being put on its index.

SL Advisors publishes the American Energy Independence Index

We are invested in KMI and LNG

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Midstream companies do essentially have a free pass to cut payouts this year, though they must all know that surviving the Covid-19 crisis without cutting will inspire investor confidence and become a strong selling point moving forward. As if to say: “We’re so stable and well-managed that not even the worst financial crisis in a century affected our distributions.”