Kinder Morgan: Great, But Stick to Pipelines

Kinder Morgan (KMI) kicked off pipeline company earnings last week. Their results contained no big surprises. Distributable Cash Flow (DCF) for the year came in at $4.73BN, up 5.5% versus 2017’s $4.48BN. Leverage finished the year at 4.5X (Net Debt/Adjusted EBITDA). KMI has argued previously that their diversified business could sustain a 5.0X ratio, something not always supported by the rating agencies. The sale of their TransMountain pipeline to the Canadian government (see Canada’s Failing Energy Strategy) created a cash windfall that they used to pay down debt. KMI now expects to remain at 4.5X for this year.

Like many investors, we think KMI’s continued investment in its CO2 business is a drag on value. Because Enhanced Oil Recovery (EOR) doesn’t generate the same recurring revenues as pipelines and terminals, we think the market assigns little value to the approximately 10% of DCF this segment represents. Moreover, the $1.6BN in capex planned for CO2 is 28% of the total backlog and three times what the company spent buying back stock in 2018. The commodity sensitivity of this segment is an unwanted distraction. If they can’t sell it, they should at least reduce the new cash deployed there.

Using a real estate analogy — if building and running pipelines is like constructing and owning rental property, then EOR is more akin to building houses and flipping them. For flippers, what matters is the net profit and not proceeds from each sale. Rental income (i.e. pipeline tariffs) are stable; profit from building and selling properties (i.e. oil production) is not. So DCF is the wrong valuation metric for the CO2 business, and basing a dividend on such unpredictable cash flows is inappropriate. Midstream investors are not fooled by this, which we believe explains KMI’s persistent low valuation.

The uncertain recurring nature of the CO2 business causes many to overlook it. This lowers the DCF yield by about 1/10th to 11.2%, which is nonetheless still very attractive. Considering KMI’s incredible position in natural gas pipelines, the market is applying a hefty discount. When asked, management typically responds that selling its CO2 business would be dilutive, because in a sale it would command a lower EV/EBITDA multiple than KMI as a whole. But we think the company’s valuation remains burdened by a business segment that doesn’t obviously belong there. We were happy to see reports late on Thursday that KMI was exploring its possible disposition.

Putting that aside, we still think KMI is cheap. DCF is analogous to Funds From Operations (FFO), a common metric used in real estate and one we discussed in a video last year (see Valuing Pipelines Like Real Estate). It’s the cash generated from their existing business before growth projects. KMI is forecasting $5BN, or $2.20 per share in DCF for 2019, which is a 12.5% yield (11.2% ex the CO2 segment). However, they’re planning to invest $3.1BN in new projects during the year, and since this will be funded internally their Free Cash Flow (FCF) will be lower by this amount.

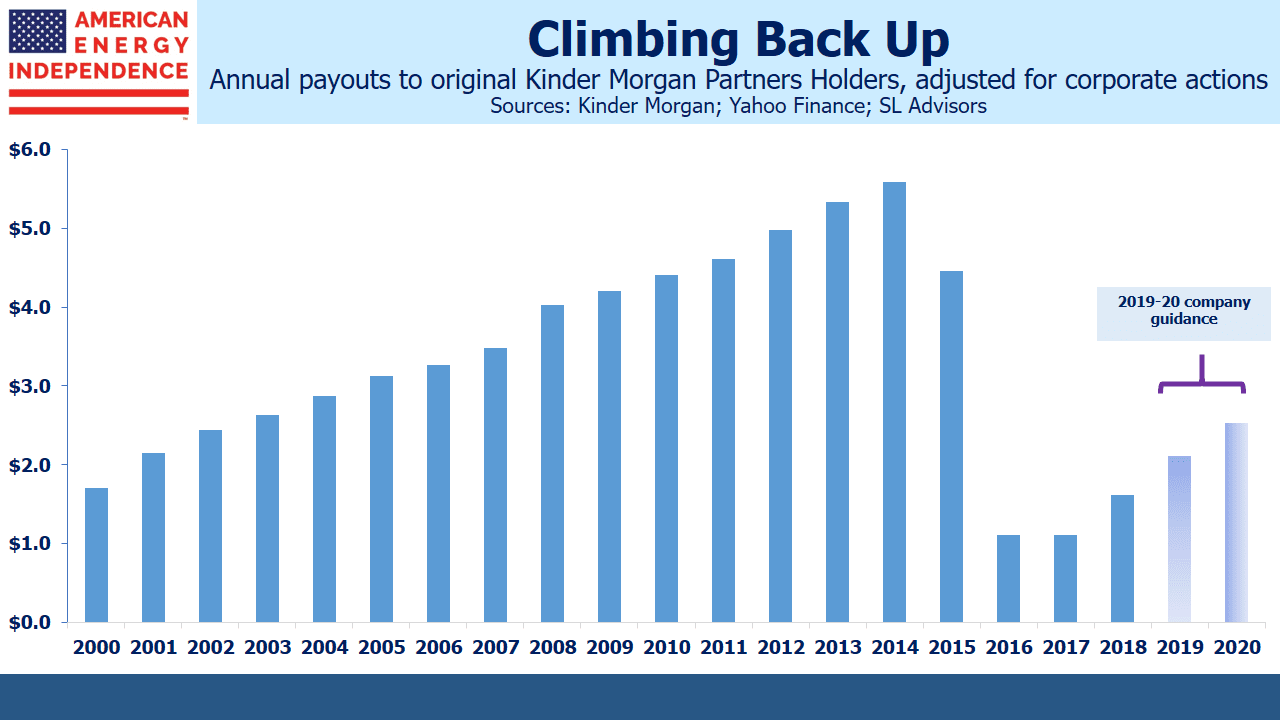

KMI’s $0.80 annual dividend is expected to rise to $1, a 5.7% yield. The company has projected another increase in 2020, to $1.25. Yield-seeking buyers will increasingly take note.

They will need to forgive the past. Prior to 2014, KMI and its former MLP Kinder Morgan Partners (KMP) were owned for income. The conflict between a high payout ratio and ambitious growth plans resulted in the absorption of KMP’s assets by KMI. In the process, KMP units were each replaced with 2.2264 KMI shares. KMI’s $2 dividend worked out to be $4.45 per KMP unit, 20% less than the $5.58 they were receiving previously. There was a cash payment of $9.54, but KMP unitholders also suffered that infamous adverse tax outcome, which many regarded as more costly.

Moreover, the $2 KMI dividend, which was promised to grow at 10% annually, was instead slashed by 75% a year later. For many companies, such a dramatic reversal would reflect poorly on the finance function and result in management changes. However, KMI’s CFO Kimberly Dang was subsequently promoted to president. Sell-side analysts won’t highlight this for fear of losing access, but that track record isn’t a positive for the stock. Regrettably for the company’s founder, being “Kindered” is now a widely used term when your promised distributions lose out to a company’s growth plans.

The Shale Revolution continues to be a fantastic success story for America, but increasing oil and gas production requires new infrastructure to gather, process, transport and store it. Like many companies afterwards, KMI ultimately chose to direct more cash towards growth projects and correspondingly less to shareholders.

Therefore, the drop in growth capex is a critical development. Five years ago as midstream energy infrastructure embraced a growth business model, it soon became clear this was incompatible with high payout ratios, and the income-seeking investors they had sought. We are now coming down the other side of the capex mountain, which is supporting a resumption of dividend growth. For KMI investors it’s been an unpleasant journey, but a DCF, or FFO yield of around 11% (after backing out the CO2 business) is substantially greater than REITs, a sector with which MLPs used to be compared.

In 2014 KMI had a five year backlog of $18BN in projects under way, which was financed in part by the reduced dividends. Today they expect $2-3BN in annual growth capex, and have $5.7BN in projects at various stages of completion.

KMI’s rising dividend should support growing realization that energy infrastructure stocks are returning more money to shareholders. Its yield is rising to a level that should attract new income-seeking investors willing to forgive past mistakes by management.

We are invested in KMI.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

EOR is more an upstream than a midstream function and has no place in KMI’s repertoire. Aren’t you concerned that Rich Kinder is another Kelcy Warren and more self-friendly than shareholder (or unitholder) friendly?

Instead of selling it, they should opportunistically use that cash flow to buy back stock. They do earn a high return on that CO2 business on average over time, so why sell it at a discount? If the market undervalues the company because of the CO2 business, especially if the discount also applies to the steady pipeline business, use that irregular but sizable cash flow to reduce share count whenever it gushes cash.