Oil and Gas Take Center Stage

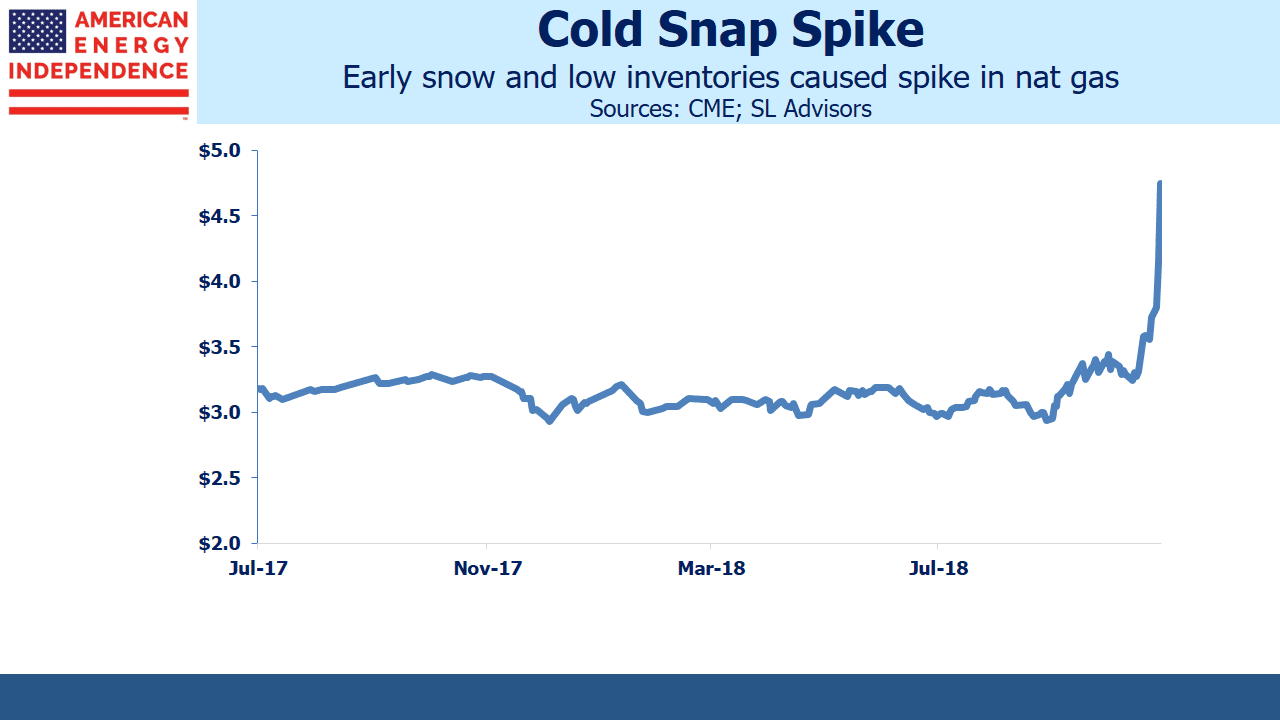

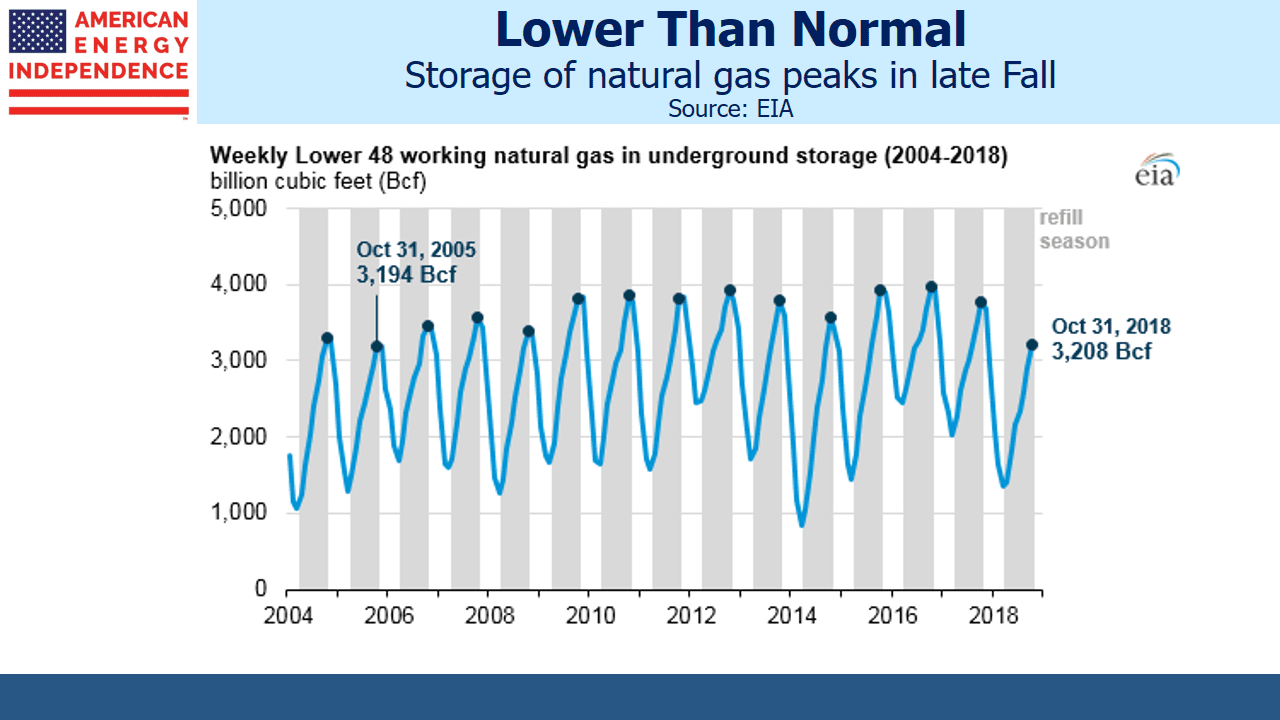

If pipeline stocks moved with natural gas rather than crude oil, their long-suffering investors could look back on a good week. On Tuesday crude was down $5 per barrel for the week, before recovering $2 by Friday. It’s tumbled $20 since early October, bringing Brent Jan ’19 to $66. By contrast, the Jan ’19 natural gas contract stormed out of its $2.90 to $3.50 per Thousand Cubic Feet (MCF) range that has constrained it all year, almost reaching $5 on Wednesday. Rarely have oil and gas been so disconnected.

The energy sector moves to the rhythm of crude. It’s is a global commodity, relatively easy to transport, which allows regional price discrepancies to be arbitraged away. Oil can move by ship, pipeline, rail or truck. Transportation costs vary from a few dollars per barrel for pipeline tariffs or waterborne vessel to $20 or more by truck. Although Canada’s dysfunctional approach to oil pipelines has led to deeply depressed prices, in most cases transport costs are a portion of the cost of a barrel.

By contrast, natural gas (specifically methane, which is used by power plants and for residential heating and cooking) generally only moves through pipelines or on specially designed LNG tankers in near-liquid form. Long-distance truck transportation isn’t common because liquefying methane to 1/600th of its gaseous volume requires thick-walled steel tanks. Methane moved as Compressed Natural Gas (CNG) is only 1% of its normal volume (i.e. requires 6X more storage volume than LNG) which generally renders long-haul truck transport uneconomic. LNG shipping rates from the U.S. to Asia are $5 or more per MCF, more than the commodity itself. The 10-15,000 mile sea journey is worth it because prices in Asia are $8-15 per MCF, compared with normally around $3 per MCF in the U.S.

The result is that natural gas prices vary by region far more than crude oil.

There are price discrepancies within the U.S. too. The benchmark for U.S. natural gas futures is at the Henry Hub, located in Erath, LA. This is where buyers of $5 per MCF January natural gas can expect to take delivery. By contrast, 700 miles west in the West Texas Permian basin, natural gas is flared because there isn’t the infrastructure to capture it. Gas is flared because it’s worthless. Mexican demand is coming, but construction south of the border is running more slowly than expected.

The price dislocation in U.S. natural gas highlights the ongoing need for additional pipeline and storage infrastructure. Price differences in excess of the cost of pipeline transport translate into pipeline demand. Although the spike in Jan ’19 natural gas futures reflects a temporary supply shortage that can’t be alleviated by a new pipeline given multi-year construction times, such events are generally good for midstream energy infrastructure businesses.

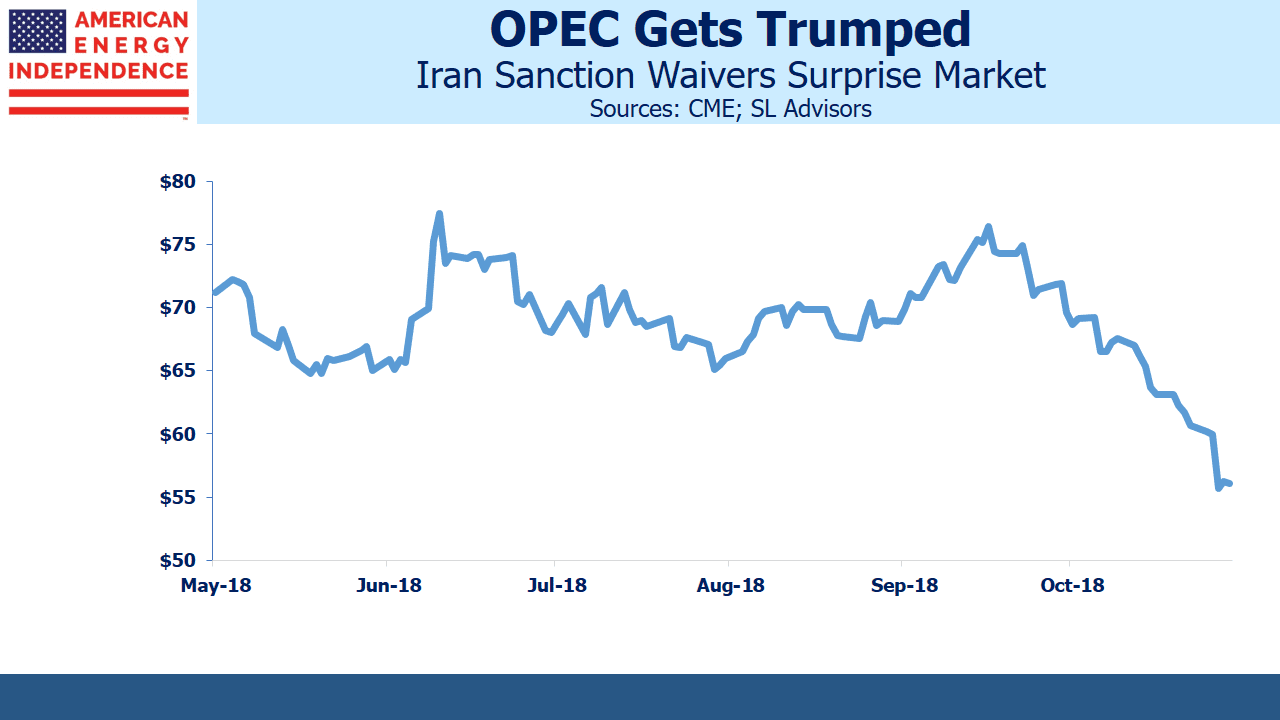

The oil price dislocation was at least partly due to hedging of option exposure by Wall Street banks that had sold put options to producers, such as Mexico. It has very little to do with midstream infrastructure. Having fretted for months over U.S.-imposed sanctions on Iran, the market was surprised by waivers that are softening the blow for Iran’s oil customers. It’s likely to create a reaction (see Crude’s Drop Makes Higher Prices Likely).

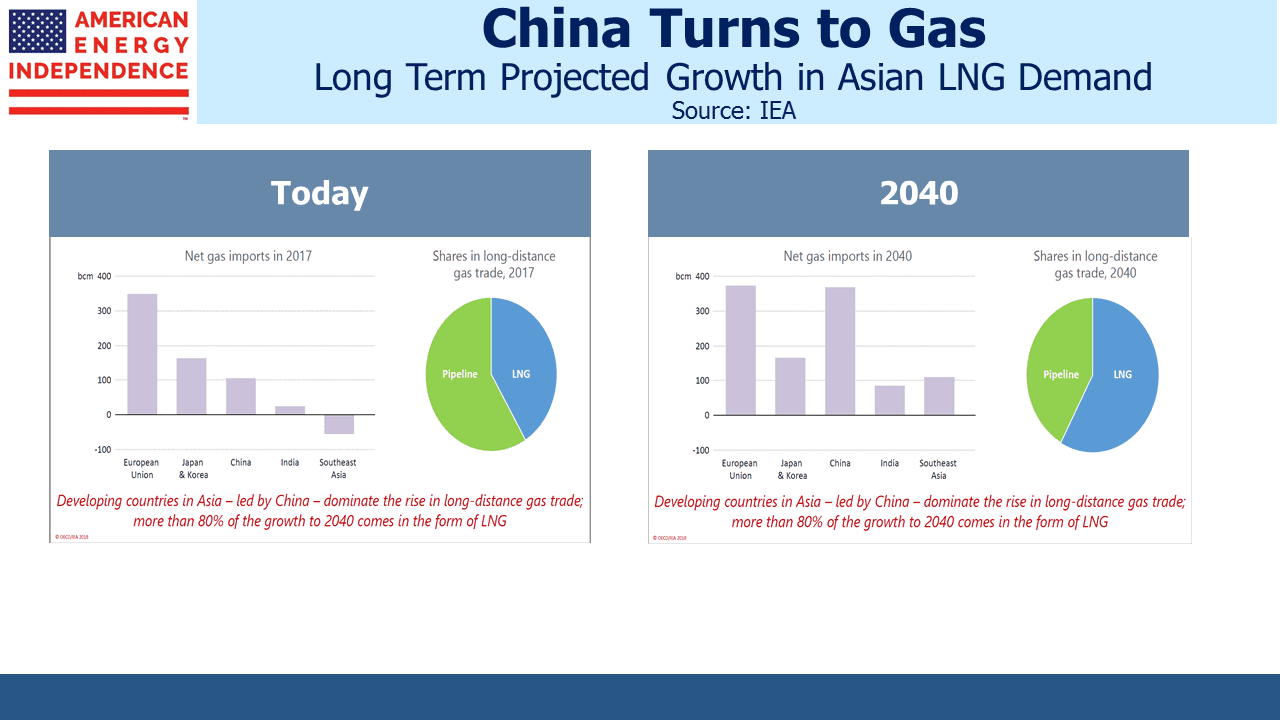

Long term forecasts of natural gas demand are less varied than for crude oil, and are driven by Asian consumption at the expense of coal for electricity production. Crude oil demand forecasts vary more, generally because of differing expectations for electric vehicle sales. Although both are growing, a bet on natural gas looks the safer of the two.

Nonetheless, crude oil moves the energy sector and U.S. pipeline stocks tag along. On Tuesday when crude oil was -6.6%, the S&P Energy ETF (XLE) and Williams Companies (WMB) both slid 2.3%. Jan ’19 natural gas was +9.1%. WMB derives virtually all its value from transporting and processing natural gas and natural gas liquids. Its inclusion in XLE probably causes it to move with the sector more than its business would suggest.

3Q18 earnings for pipeline companies have been largely equal to or better than expectations. The fundamentals remain strong – investors continue to ask when sector performance will reflect this. Although the recently declared dividend on the Alerian MLP ETF (AMLP) is 34% below its 2014 level, we expect corporations will start increasing dividends, with the American Energy Independence Index likely to experience 10% growth in 2019.

We are long WMB and short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It is a testament to the lack of insight in the creators of market moving algorithms that natural gas oriented MLPs, such as gatherers and processors and compression companies, trade at such high yields and low prices. That gap in understanding on the part of securities traders provides an opportunity for investors in MLPs to receive substantial income which is mostly or entirely tax deferred, thanks to yields which are irrationally generous, tax deductions which are truly meaningful and a structure which is beneficent.