Crude’s Drop Makes Higher Prices Likely

Crude oil just set a record of sorts, by falling for eleven consecutive days (as of this morning). Fears that sanctions on Iran would cause a supply shortage, leading to a price spike, now seem unfounded. Not long ago, many were surprised at the high degree of compliance. France’s energy giant Total’s CEO said it was, “…impossible for big energy firms to work in Iran.”

The big stick America wields on this issue is access to the U.S. financial system. If a company is deemed to be trading with Iran, it can find itself unable to conduct financial transactions in US$. This is a surprisingly powerful tool, since a substantial amount of trade is conducted in our currency. Total concluded that being unable to transact in US$ would be too disruptive to contemplate.

In the summer, the U.S. appeared to be taking an uncompromising approach, and Iranian crude exports were forecast to fall from 2.5 Million Barrels per Day (MMB/D) to as little as 1 MMB/D. Crude oil futures correspondingly rose. Pressure was put on Saudi Arabia to provide offsetting increased output, as the Administration fretted over high gasoline prices before the midterms.

More recently, waivers granted by the White House to eight importers of Iranian crude have calmed fears of a price spike. China and India, who are both continuing to buy Iranian crude as a result, imported over 1 MMB/D last year. As a result, the January ’19 Brent Crude month futures contract has slid from $86 in early October back to $68 where it was in the Spring. For now, it seems that the Iranian sanctions aren’t that significant.

Saudi Arabia probably expected the U.S. to be stricter in following through on sanctions, and was surprised by the waivers. They have just reduced December exports by 0.5 MMB/D. The Saudis surely expected to be selling oil at higher prices a month ago. Recent data shows that Saudi exports to the U.S. have been falling, and floating storage (i.e. crude on tankers in transit) is the lowest in four years. Some believe that Saudi Arabia is unable to sustain production above 10.6 MMB/D or so without damaging their oilfields.

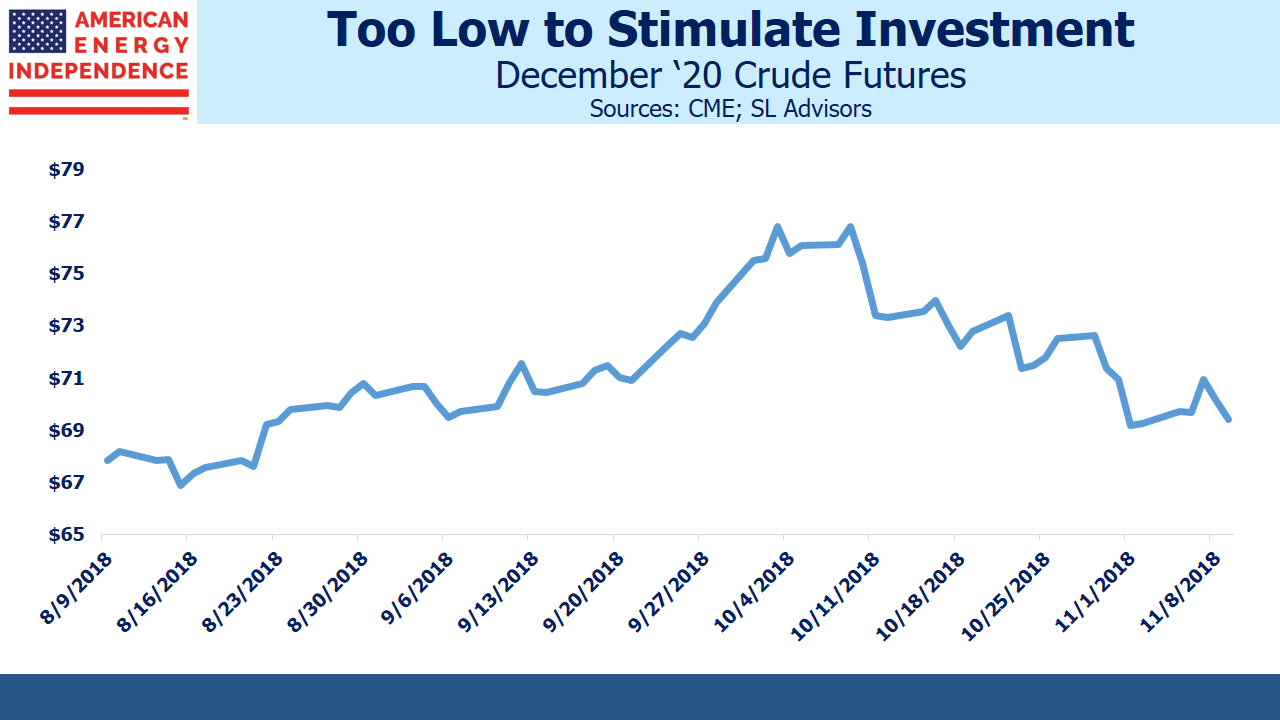

Although the gyrations of the front month futures contract have commanded attention, crude prices farther out have moved much less. The December ’20 futures contract fell from $76 to $70. Fear of sanctions had caused backwardation (near contracts higher than farther out ones), and this has corrected.

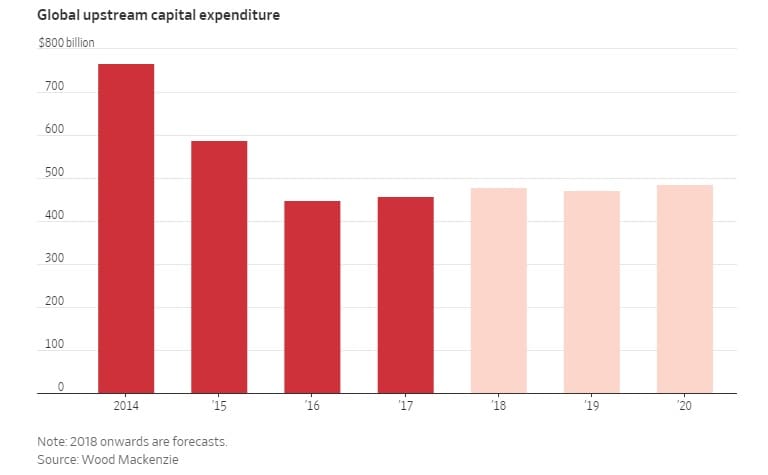

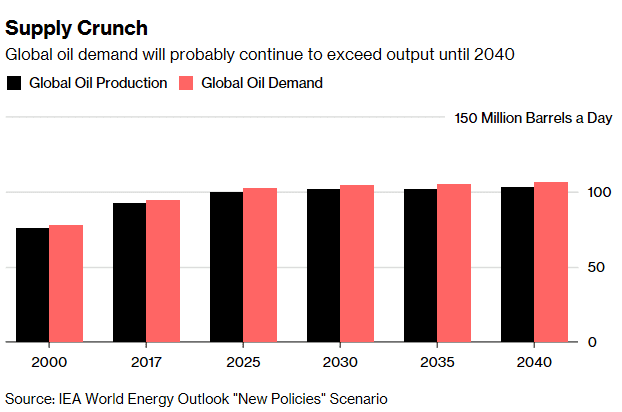

Investments in conventional oil production are driven by the price of crude expected to prevail over the life of the project. The front month gets the attention, but it doesn’t drive the decision. Because new oil projects take several years to reach production, many in the industry continue to worry that falling investment levels will eventually cause higher prices. The International Energy Agency (IEA) recently released their World Energy Outlook. They warn of a looming supply crunch, with the world seemingly too reliant on increasing U.S. production to meet demand growth. Investment spending collapsed during the 2015-16 industry downturn, and remains more than one third lower than it was in 2014. Discoveries of conventional hydrocarbon reserves are correspondingly down.

Crude oil along the futures curve is still at levels that have drawn repeated warnings of future supply shortfalls. Moreover, Saudi Arabia is finding that the U.S. administration ultimately wants low prices, with Trump recently tweeting, “Hopefully, Saudi Arabia and OPEC will not be cutting oil production. Oil prices should be much lower based on supply!” Expecting Americans to tolerate higher pump prices so as to pressure Iran is an unlikely strategy for any president to pursue. But Saudi Arabia needs higher prices to balance their budget. These conflicting goals will continue to impact oil prices.

Low investment means higher prices are likely over the intermediate term; perhaps sooner, based on the drop in Saudi exports.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!