U.S. Oil and Gas Exports: A New Weapon

Start with Iran. In May, Trump withdrew from the Nuclear Accord over strong opposition from foreign allies and domestic policy experts. America announced it would unilaterally impose sanctions on Iran from November 1. Critics said this would be ineffective. Since then, Iranian oil exports are down 25% and likely to fall further. Any company trading with Iran risks losing access to the U.S. banking system, a penalty sufficiently onerous that buyers of Iranian oil are wasting no time sourcing alternatives. Companies from South Korea, France, Japan, Greece, Spain and Italy have all reduced or halted purchases in recent months. U.S. oil and gas exports are a new weapon.

Coincidentally, this has also created an opportunity for exports of ultra-light condensate oil from Texas to meet Asian demand, with buyers increasingly shunning Iranian condensate. U.S. oil and gas exports are playing a bigger role.

The loss of Iranian crude oil on world markets has pushed prices higher. But the Shale Revolution has moderated the U.S. economy’s sensitivity to energy prices. The negative of consumers spending more on gasoline will be mostly offset by a resurgent domestic energy sector. The New York Times published a rare Trump-positive story, noting that the Iran strategy was working.

Germany’s heavy reliance on renewables to provide electricity has been hampered by its use of coal. Since it’s not always sunny and windy, solar and wind can’t provide a complete solution. In Germany, dirty coal-burning power plants provide the reliable baseload supply every electricity grid needs. Their emissions have negated much of the benefit of renewables, so Germany wants to burn more natural gas, which is cleaner. Its lower CO2 output makes it a natural complement to renewables (see Pipeline Investors Fight Climate Change).

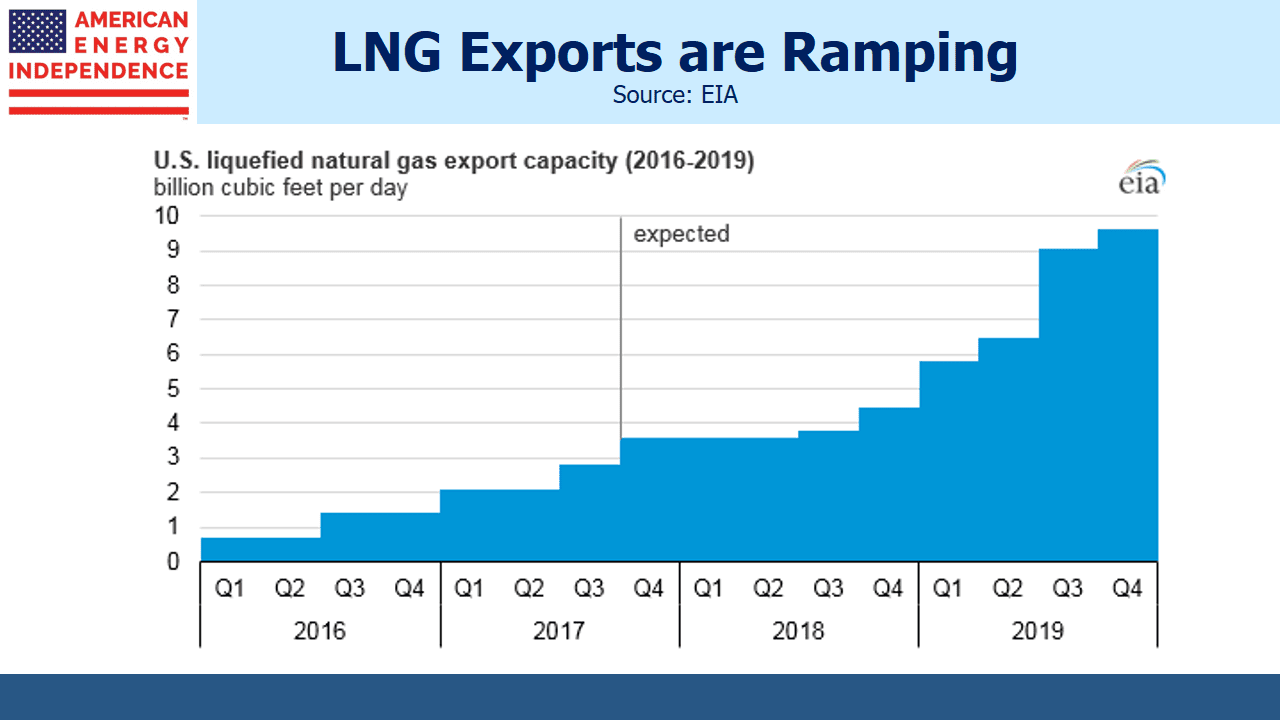

Consequently, Germany is planning Nord Stream 2, a controversial pipeline that will bring natural gas from Russia to Germany. Trump is correct to ask, “What good is NATO if Germany is paying Russia billions of dollars for gas and energy?” But America can do more than just criticize; Liquified Natural Gas (LNG) from the U.S. provides an alternative not susceptible to mid-winter maintenance. Russia has used this tactic before, when negotiations with Ukraine weren’t going in the desired direction. Shivering Ukrainians found they had little leverage with Gazprom, Russia natural gas company, who is not an attractive supplier. Last week Trump promoted U.S LNG to Poland, another NATO ally.

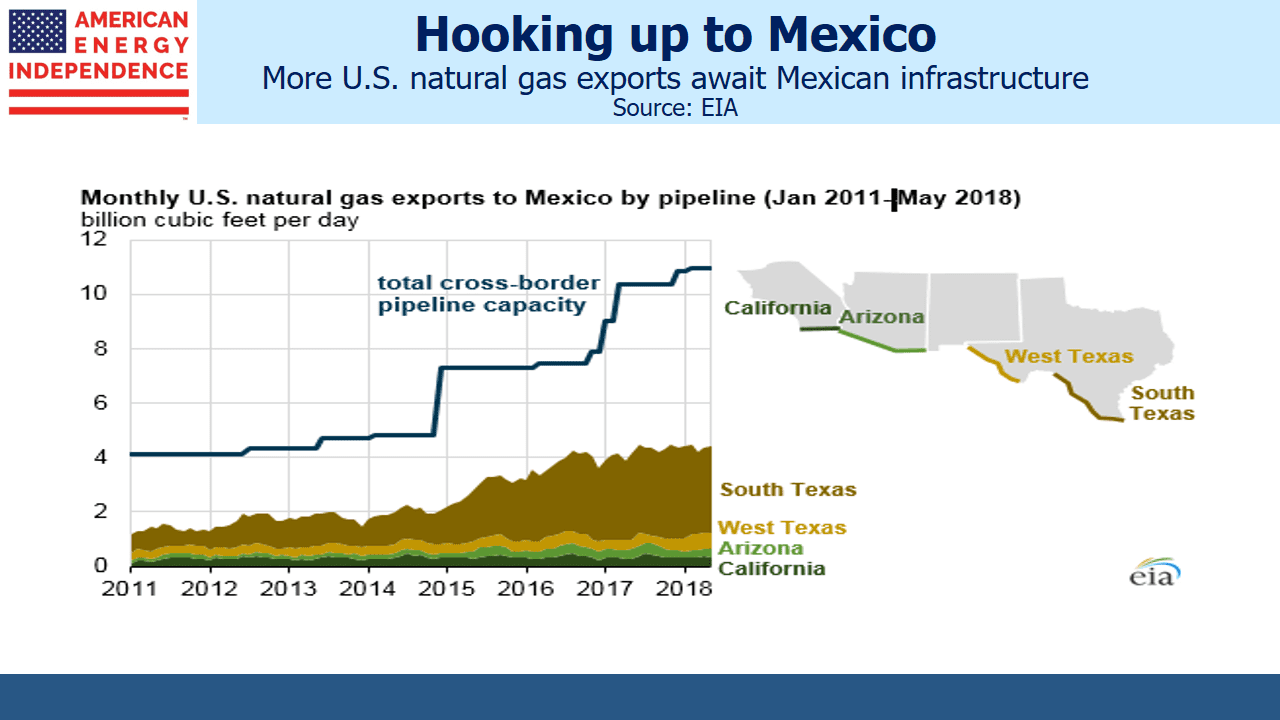

In North America, the U.S. is providing more natural gas to Mexico, which needs it to meet growing demand for electricity. There is 11 Billion Cubic feet per Day (BCF/D) of pipeline capacity, of which Mexico is only using 4.5BCF/D. Meanwhile, the Permian in west Texas is producing more natural gas than the existing takeaway infrastructure can handle. This is limiting oil production (since gas and oil often both come out of the same well) and resulting in flaring of unused gas which nobody likes. As additional pipelines connect natural gas burning power plants south of the border, they will consume more Permian output.

Canada struggles with access for its oil exports, in part due to domestic politics (see Canada’s Failing Energy Strategy). This is why Transcanada’s (TRP) planned Keystone XL Pipeline is so important to them, since it will add up to 830,000 barrels a day of transport capacity for a country chronically short of it.

Trump overturned Obama Administration impediments to Keystone XL shortly after taking office. Although they’ve since had to contend with legal challenges at the state level, TRP expects to begin preliminary work on the pipeline in Montana later this year.

Marcellus natural gas is displacing Canadian imports in the eastern U.S., which is helping our trade balance at a moment when the Administration is focused on imbalances. Construction of Keystone XL is a big help to our northern ally. Energy is a vital component of our bilateral Canadian relationship.

Three quarters of global LNG trade occurs in Asia. Following Japan’s 2011 Fukushima earthquake and tsunami, they virtually shut down their nuclear power industry, which has made them big buyers of LNG. China and India are both looking for cleaner alternatives than coal to meet growing electricity demand. Although China recently imposed a 10% tariff on U.S. LNG imports, they previously exempted U.S. crude oil. China’s reduced purchases of U.S. LNG are being offset by other Asian buyers.

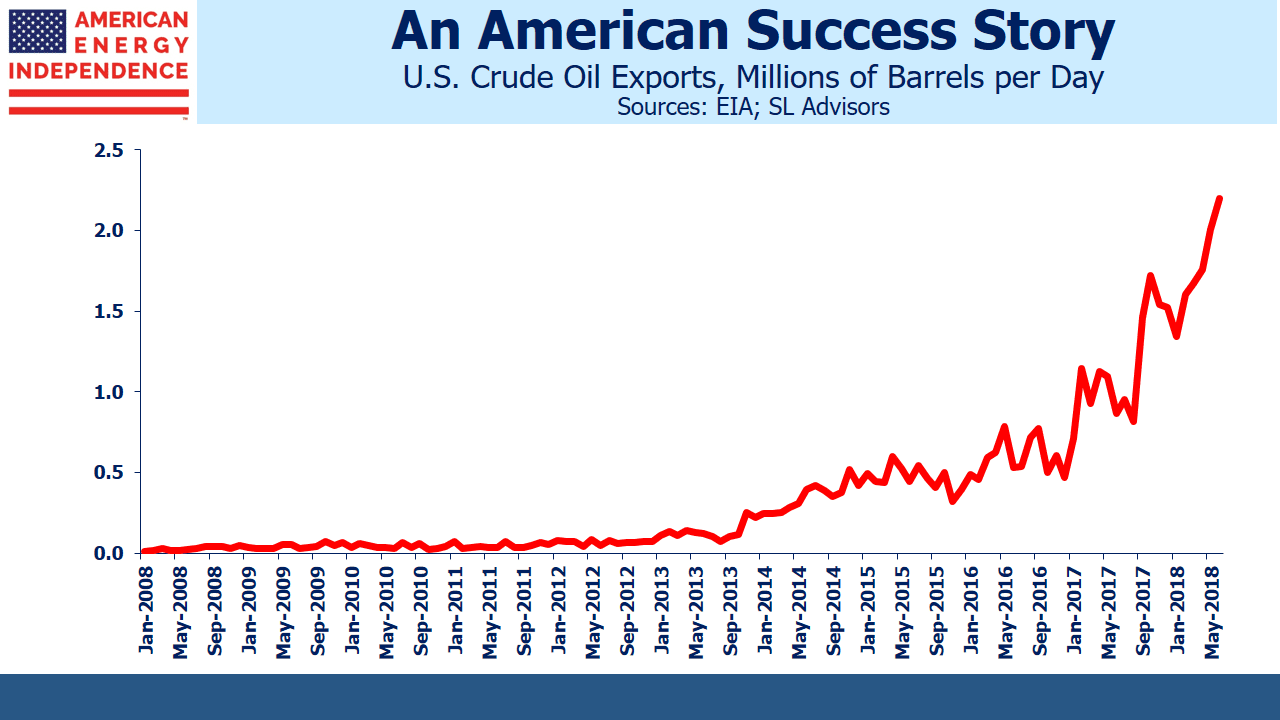

In June, U.S. crude oil exports reached 2.2 Million Barrels per Day (MMB/D). China bought almost a quarter, but other destinations included India and South Korea. We even exported 0.2 MMB/D to Canada, although they remain our biggest provider of crude with 4.5 MMB/D of different grades coming back the other way.

Exports of crude oil, natural gas liquids and LNG are all set to rise sharply in the years ahead, as new infrastructure is completed.

U.S. oil and gas exports are providing additional negotiating leverage over allies and adversaries. The Shale Revolution and energy infrastructure investments are providing vital support.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!