The Upside Case for Pipelines

Client interaction has been overwhelmingly constructive – we haven’t had a single call from anyone wanting to “sell everything.” Our fund has seen very modest net outflows, and new money has been coming in every day.

One investor said on the weekend that we need to present the positive case more forcefully. So, here it is:

- Our midstream energy infrastructure investments and the components of the American Energy Independence Index are >75% investment grade companies. The industry has been reducing leverage and strengthening balance sheets since the 2014-16 oil collapse. Growth projects are increasingly funded with cash from operations, with less reliance on debt and no equity issuance. 4X Debt:EBITDA is common, using 2020 guidance which will be revised down in the coming weeks.

- We estimate around 80% of the customers of our portfolio companies are themselves investment grade. Cheniere Energy is 100% in this respect, so although they’re in the 25% of our companies that’s not investment grade, the credit quality of their customer base provides some comfort.

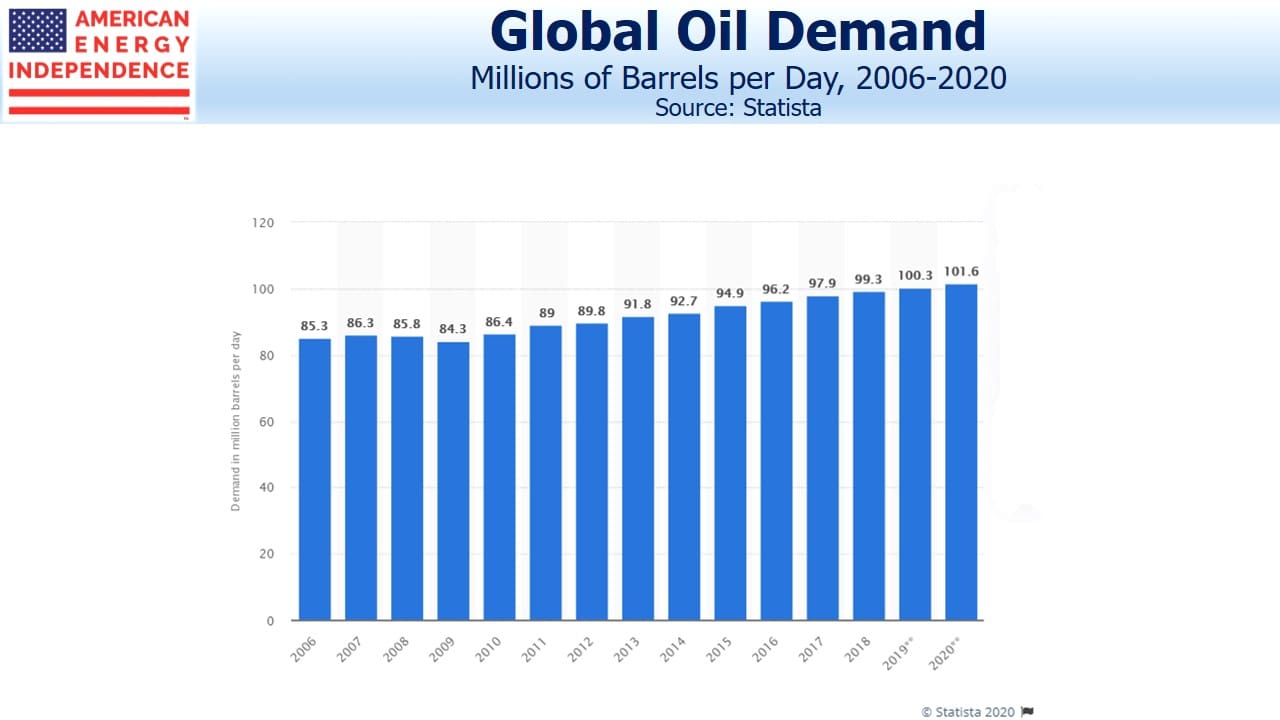

- While energy demand will dip, and economic activity is contracting, there’s plenty of reason to think that in the weeks and months ahead all the efforts at mitigation and control will leave society confronting a new but manageable virus. Getting through the near term is understandably everyone’s focus, but life will eventually return to something we all recognize. Global crude demand fell just 2%% from 2007 to 2009. Natural gas volumes were unaffected. Demand may fall more than then, and supply further still. Although exports are more important than before, the U.S. pipeline business is mostly natural gas and NGLs (primarily petrochemical feedstock), and is mostly about U.S. consumption. We estimate that crude & refined products contribute just 20% of cash flows.

- Companies can improve cash flow by curtailing growth projects. Upstream companies are likely to cut production and growth capex by 20-40%. So far, Oneok (OKE) is the only midstream company to have issued any revised guidance, and they reduced 2020 growth capex by $500MM (20%), while surprisingly reaffirming EBITDA guidance. In Updating the Coming Pipeline Cash Gusher we forecast 2020 Free Cash Flow (FCF) of $22BN (up from $9BN last year). This forecast relies on guidance from companies that is all pre-Coronavirus. However, it also incorporates $37BN of capex spending this year. It’s quite conceivable that pipeline companies’ capex reductions could more than offset any drop in cash flow from operations. We were assuming Distributable Cash Flow (DCF) of $59BN. FCF is derived from DCF minus growth capex. If DCF fell by 20%, which is not in any forecast we’ve seen so far, growth capex would likely drop by more, which would cushion the ultimate impact on FCF.

- Unlike the 2015 downturn, capex is now internally financed. Midstream energy infrastructure companies stopped accessing public markets for equity a couple of years ago, and have no need to do so now. Moreover, debt is long-term and staggered. We don’t see near-term debt financing problems.

- Lastly, assuming an average 20% decline in growth capex similar to Oneok’s announcement, the sector trades at a 2021E 15.6% FCF yield (that’s after capex), fully supporting its 13% dividend yield. Few other sectors have such valuation support today.

The energy sector has taken a triple hit from Coronavirus, OPEC+ collapse and Saudi supply hikes. Investors are most worried about which names will survive. Those with leverage were forced to sell last week, notably including MLP closed end funds. We don’t use leverage and haven’t been forced to sell anything, either for ourselves or for client accounts. Today for example, we have not made a single sale. Sit tight. This will eventually pass. It’s not inconceivable that prices could eventually double from here.

Once America confronts a challenge, history shows that we deploy unmatched resources to take it on and defeat it. The impact on society arrived like a thunderbolt in recent days, and as a country we’ve been knocked on our heels. But our response is coming, and no country is better equipped to come right back and do whatever is required to overwhelm this threat.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

thanks, Ray

Since you mention Oneok, do you have a view on the survivability of Bakken production? There is maybe only 1 to 2 years left of drilling in the core tier 1 land. What is the cost profile of tier2 production? I’m sure it would decrease over time as petroleum engineers are the most creative people on the planet. Plus WCSB uses Bakken oil as diluent for bitumen, something like 70/30 blend for pipeline flow or 87.5/12.5 for tank car, so may be insensitive to higher cost of shale if that’s what it takes to get their oil out of the sands basin, which is pretty cheap to produce anyway. And shale wells get gassier as they age. Lots of parts to consider. OKE has a big investment in the Bakken, are investors writing it all off? Oneok’s CEO and CFO just bought over 80,000 shares total last week.

Sorry, including COB they bought over 50,000 shares, must have hit a wrong key adding up all the trades.

In an additional update, more OKE insiders bought nearly 109,000 shares ranging in price from $13.06 to $22.70 during the period March 18 to March 25, including CoB, CEO, directors, and chief accounting officer.