MLP Investors Digest Supply

My partner Henry Hoffman and I spent Thursday last week at the Capital Link MLP Investing Forum in New York. The mood was cautiously optimistic but certainly wary of another commodity-linked swoon in prices. Meeting one-on-one with company managements is often the best part of such events. We had a very useful discussion with Crestwood’s (CEQP) Heath Deneke, COO and President of their Pipeline Services Group, along with Josh Wannarka, Investor Relations. We gained an improved understanding of CEQP’s strategic partnerships with long-time sponsor First Reserve and JV partner Con Edison. Both these relationships are important to CEQP’s growth prospects and represent a key differentiating feature.

Companies have been reporting 4Q16 earnings over the past few weeks. For Master Limited Partnerships (MLPs), the generally positive outlook has been at odds with market performance. In February the “Trump Bump” rally in the S&P500 was only weakly reflected in MLPs, resulting in +4.0% versus +0.4% respective performance.

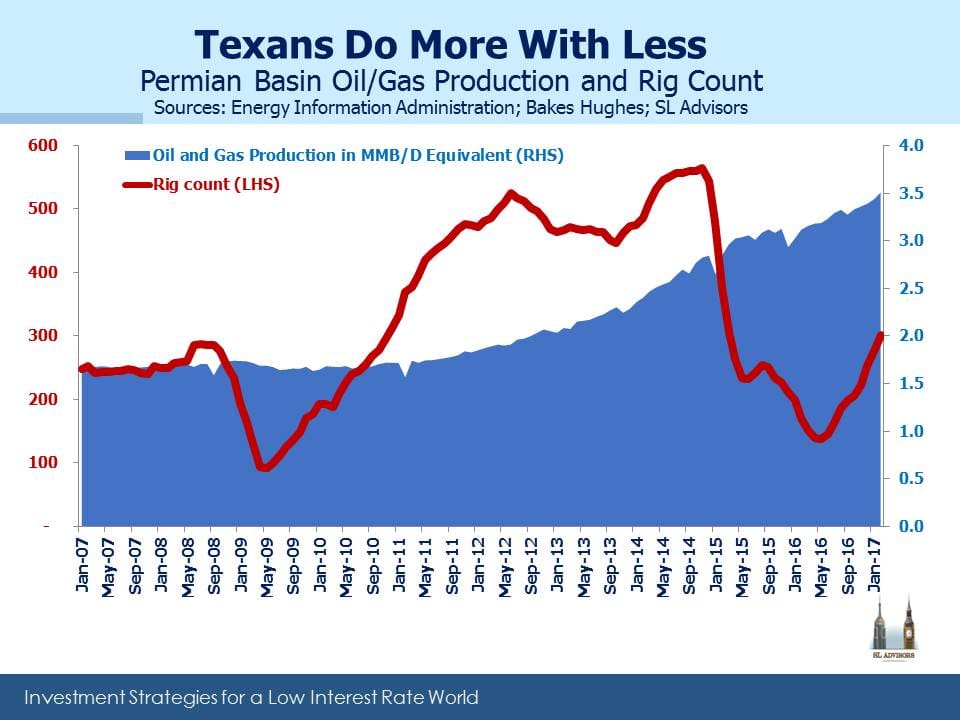

The Permian Basin in West Texas remains the hottest area for shale production in the U.S. Earnings calls with those companies active there focused on growing production and whether the existing take-away infrastructure would be sufficient. The U.S. produces around 9 MMB/D (Millions of Barrel per Day) of crude oil. Approximately half of that is “tight”, and half of that comes from the Permian Basin (currently producing around 2.25MMB/D). When combined with Permian natural gas output on an energy equivalent basis, production is almost 3.5MMB/D.

Permian output was the most resilient of any of the major shale plays through 2015-16 with production continuing to grow almost oblivious to the collapse in pricing. This was entirely due to the ongoing productivity improvements that have led to high single digit annual cost improvements for Exploration and Production companies operating there. The Energy Information Administration (EIA) forecasts U.S. crude production will increase by another 0.5MMB/D 2017-18, and much of that is likely to occur in the Permian.

Reflecting the increased production forecast by E&P companies, several MLPs with Permian assets announced plans to increase take-away pipeline capacity where needed. These include 60MB/D (Thousand Barrels per Day) on Plain’s All American (PAGP) Cactus pipeline to Gardendale, Texas, 100 MB/D on the BridgeTex line into Houston (jointly owned by Magellan Midstream (MMP) and Plains All American (PAGP)) and 300 MB/D on the Permian Express II to Nederland, TX owned by Sunoco Logistics (SXL). In addition, Energy Transfer Partners (ETP) has an existing 100MB/D pipeline that is currently idle but could be restarted if demand was there. In summary, industry debate on this issue revolves around the ability to move increasing volumes.

This increased production is not necessarily consistent with OPEC’s objectives when they announced their own production cuts late last year. A gently rising oil price with minimal variability is their preferred scenario. Reports indicate that some OPEC members would like to see $60 oil so as to stimulate additional long term investment in new supply, thereby lowering the odds of a short-term, ruinous price spike that could hurt demand. As we’ve noted before (see The Changing Face of Oil Supply), conventional projects with their large up-front capital commitments and long payback times are vulnerable to U.S. shale production in a way that wasn’t previously contemplated.

Relying on the spot price of oil in assessing a 10+ year project is nowadays recklessly simplistic, making investments in conventional new supply riskier than in the past. Although U.S. production is growing, it won’t be sufficient to meet new global demand plus make up for depletion from existing fields (estimated at 6MMB/D, see Listen to What the Oil Price is Saying). Gently higher prices remain the most likely outcome but there’s more risk of a sharp move up rather than down.

Exxon Mobil (XOM) CEO Darren Woods reflected this new mindset in recent comments: “More than one third of the capex [capital and exploration spending] will be invested in advancing our large inventory of … short-cycle opportunities. They are primarily Permian and Bakken unconventional plays and short-cycle conventional work programs. This component of our investment plan is expected to generate positive cash flow less than three years after initial investment.”

In other words, long payback times are risky. Short payback projects are in the U.S.

The MLP investor who feels she’s missing out on the recent equity rally is rather non-plussed by this optimistic analysis. “If you’re so smart, how come I’m not richer?”

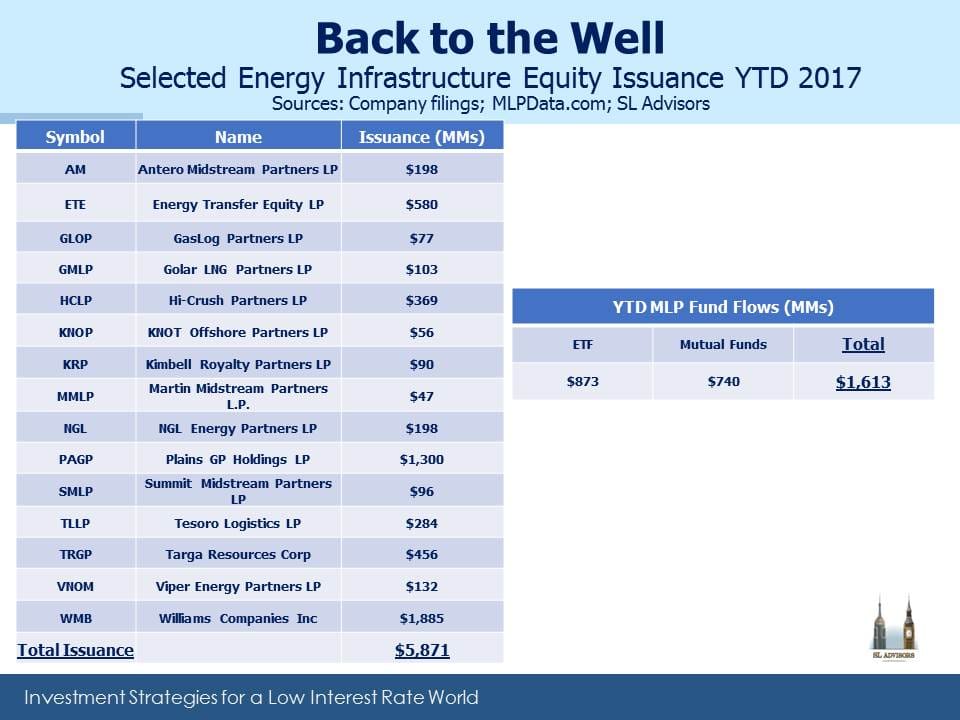

One reason is the overhang of equity being issued by some MLPs, to strengthen balance sheets and fund new projects. PAGP issued $1.3BN in equity; Targa Resources (TRGP) issued $450M to help fund it’s acquisition of Permian focused Outrigger Energy. There was also a sale of 7.2MM shares in Targa Resources (TRGP) by a private equity investor who converted warrants acquired a year ago, booking a nice profit. And a few weeks earlier Williams Companies (WMB) raised $1.9BN. The table shows the many issues of new equity in recent weeks, as well as inflows to mutual funds and ETFs. It’s an incomplete picture, and by definition the almost $6BN in equity sales has been matched with an equal amount of buying. The use of this new capital, mainly to strengthen balance sheets and fund accretive growth, is definitely positive. But over the near term this new supply approximately absorbed 1Q distributions paid by MLPs.

Another headwind is that it’s once again been a mild winter. Rapidly receding snow has plenty of appeal, but the downside is that it reduces natural gas demand. MLPs care about volumes, and we’re using less natural gas than expected to heat homes in the north.

Nonetheless, valuations remain compelling. For the momentum investor it’s easy to feel good buying stocks. But for the more discerning who care about values, at a time when most sectors of the stock market are close to all-time highs, the Alerian Index yields around 6.8%, 4.6% above the ten year treasury and still 1.2% wider than the 20 year average. We may have bounced 75% off the low of February 11th, 2016 but still remain 27% off the August 2014 high.

We are invested in CEQP, MMP, PAGP, TRGP, & WMB

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Thanks for the post – always insightful. You’ve written in the past about the market structure in MLPs – the high concentration of HNW capital in the market & the challenge of attracting institutional investors. The capital needs you cite above make me think of the KMI/KMP (C-Corp from MLP) transaction (& a couple others like it) where the LP’s were stuck w/ a slashed dividend and tax bill (if I understand that correctly). My guess is that this is somewhat issuer specific, but I’m trying to understand the degree of that risk for the sector in general. Thank you!

I don’t think there are too many cases remaining where that could happen apart from Energy Transfer.