The Trump Put

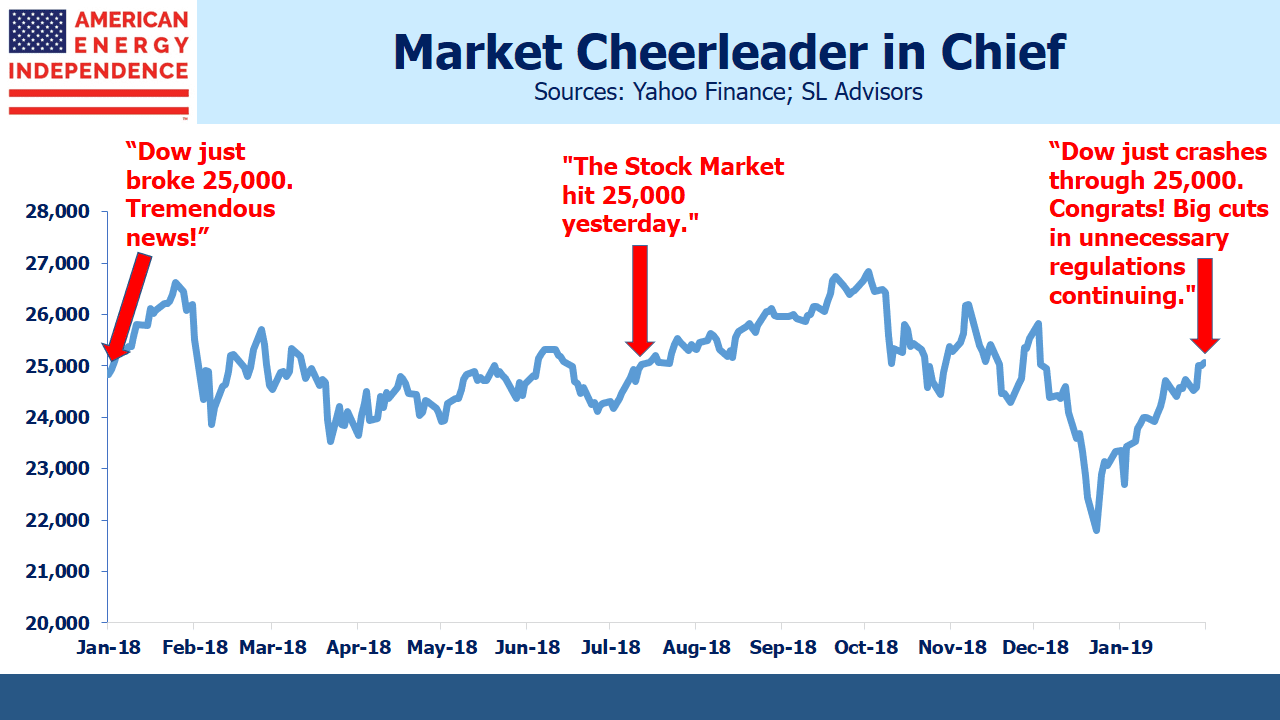

Last week President Trump tweeted, “Dow just broke 25,000. Tremendous news!” It wasn’t the first time the Dow had risen through that threshold. On July 14th, the President tweeted, “The Stock Market hit 25,000 yesterday.” A year ago, on January 4th, 2018: “Dow just crashes through 25,000. Congrats! Big cuts in unnecessary regulations continuing.”

This president probably cares more about short term moves in stocks than any predecessor. He has adopted it as a report card of how his administration is doing. Past presidents have generally positioned themselves above the fray, concerning themselves more with economic data such as GDP growth and unemployment. These are important to President Trump too, but the Dow provides a real-time gauge of his performance, reflective of today’s social media supported news.

His cabinet colleagues clearly recognize this. We winced at Treasury Secretary Steve Mnuchin’s comments in December that banks had “ample liquidity”. Stocks were very weak, largely because of problems caused by the government. The trifecta of growth –inhibiting tariffs, a looming federal government shutdown and Fed chair Powell’s communication missteps were the main cause (see Problems Made in DC Can Be Fixed There). But nobody had questioned banks’ liquidity until Mnuchin’s amateurish intervention.

Compared with the Goldman colleagues who preceded him, this betrayed the absence of a deft touch, and briefly raised more concerns than it settled. But it reflected the attention this administration pays to any substantive moves in equities.

President Clinton’s former campaign manager, James Carville, once commented that in his next life, “…I would like to come back as the bond market. You can intimidate everybody.” He also coined “The economy, stupid.” This phrase came to symbolize Clinton’s campaign singular focus and its improbable victory over George H. W. Bush.

GDP reports are too slow in providing feedback, so movements in the Dow offer more immediate information. Given the Tweets that follow when it reaches milestones (even if those milestones have been reached before), you can assume Trump badly wants to brag about the market going into next year’s election. Policies that are good for the economy must be good for stocks; therefore, when the Dow signals dismay, it’s likely to draw a reaction.

That doesn’t guarantee economic policies that will support stocks – the trade frictions with China are an example. But it does mean that there’s limited overall tolerance for pursuing policies that damage the market. The federal government shutdown lasted longer than expected. It quickly ended, without the wall that was its purpose, once a major airport had to shut because of missing air traffic controllers. This likely won’t be repeated, and emergency action to build the wall will be tied up in the courts where it’ll be symbolic and harmless.

Trade friction is taking its toll. U.S. objectives are broad but not specific. We are approaching March 2nd, when the U.S. is set to impose additional import taxes on $200 billion of Chinese exports. As the deadline nears, expect Trump to find a way to claim victory and avoid the inevitable market swoon that would otherwise follow.

For years, the ‘Greenspan Put’ provided investors some comfort that the Fed would rescue them from economic weakness. Much of what moves stocks today emanates in Washington DC. As attention turns to the next presidential election, equity investors are likely to see the ‘Trump Put’ become the ultimate arbiter of what is administration policy.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

In other words, we have a President who is willing to be unpopular in order to achieve goals, results over rhetoric.

Stop policitizing the market. As if Trump has done nothing positive for the economy ( lowest unemployment in 50 years’, less people on food stamps, welfare, no more NK neuclear tests, oil exporter, you know the rest) . Why don’t you write a piece on the positives he has accomplished ?