Steel Tariffs Show Up in Surprising Places

The G20 meeting on the weekend produced a mildly surprising rapprochement between the U.S. and China on trade. Most commentators regard the Administration’s serial imposition of tariffs negatively. Stocks certainly liked the possibility of a lower temperature around this rhetoric.

In spite of the U.S.’s many trade disputes, the economy shows little sign of suffering. Unemployment is 3.7% and interest rates remain supportive, with ten year treasury yields at 3% offering scant competition for equities (see Bonds Still Can’t Compete With Stocks). Consensus expectations are that next year S&P500 earnings will increase by 10%.

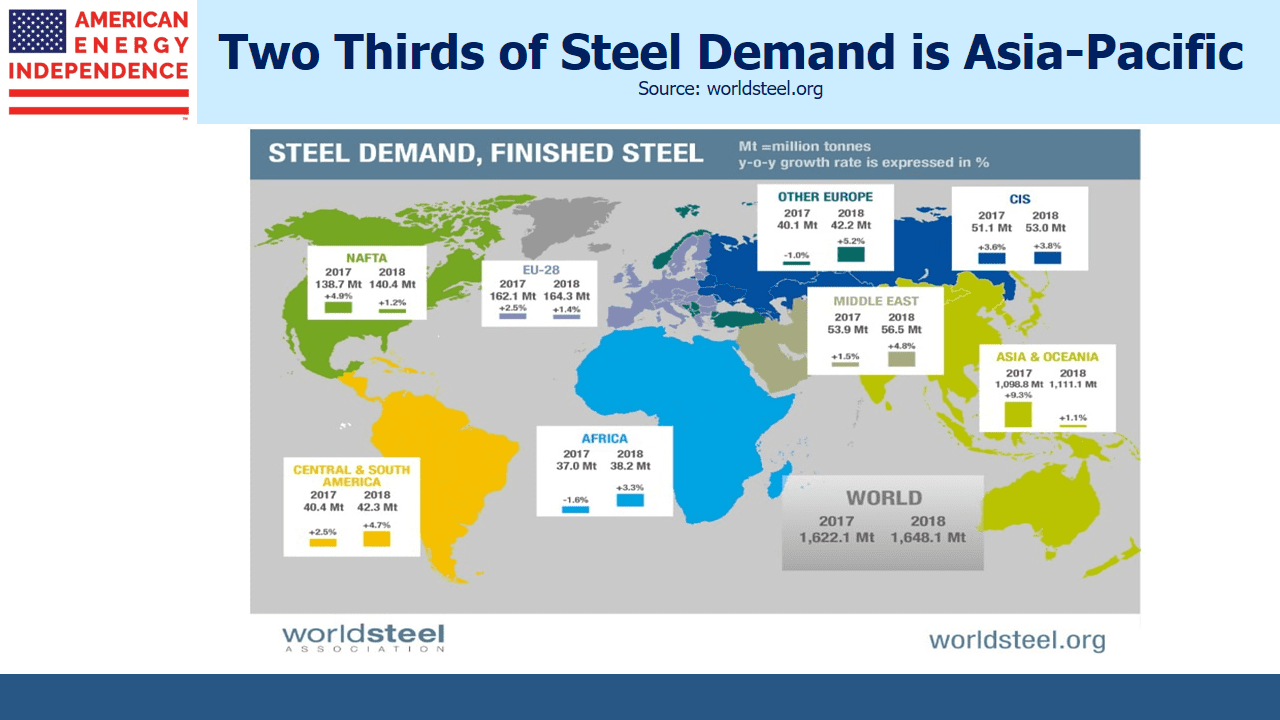

Nonetheless, tariffs do have an impact. Steel shipments have been a controversial topic, with many developed countries accusing China of selling below cost (“dumping”). The Administration has imposed tariffs on steel imports from a wide range of countries, on the grounds of national security. Commerce Security Wilbur Ross said, “Economic security is military security. And without economic security, you can’t have military security,”

Tariffs have their effect in subtle ways. They are a form of sales tax, and taxes are borne both by the producer and the customer in proportions determined by their relative elasticities. For example, if a buyer of a product now subject to tariffs had no alternatives available and had to have the product, the price would go up by the amount of the tariff. The more choices a buyer has, the less impact the tariff has on the product’s price, meaning more is absorbed by the producer.

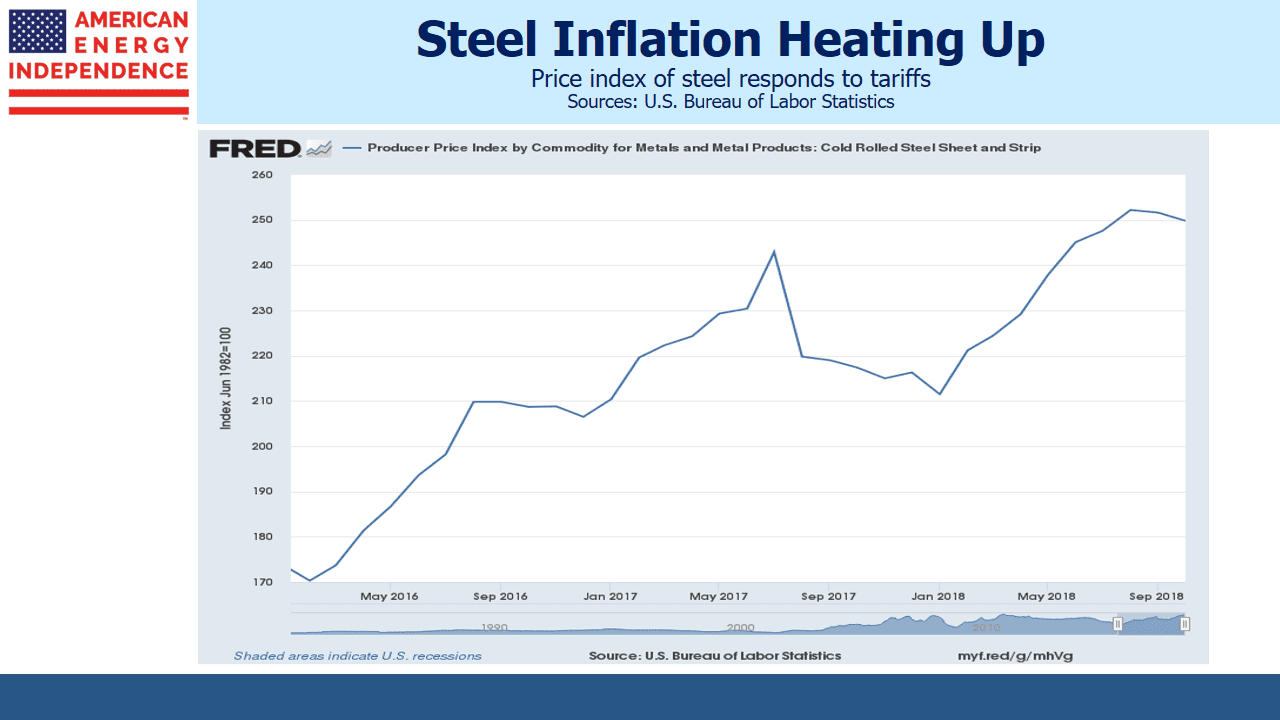

The Federal Reserve Bank of St. Louis shows that steel prices have risen by around 17% since the 2016 election, the point at which steel buyers and sellers might have begun to contemplate tariffs. The tariffs ultimately implemented were 25%, which suggests that buyers have borne more of the cost than producers. Domestic producers were able to raise prices protected by tariffs. Since the 17% increase relates to all steel whereas the tariffs were only imposed on imports, producers benefitted further at the expense of buyers. The Bureau of Labor Statistics forecast that steel prices would rise by 21%, so further price hikes may be ahead.

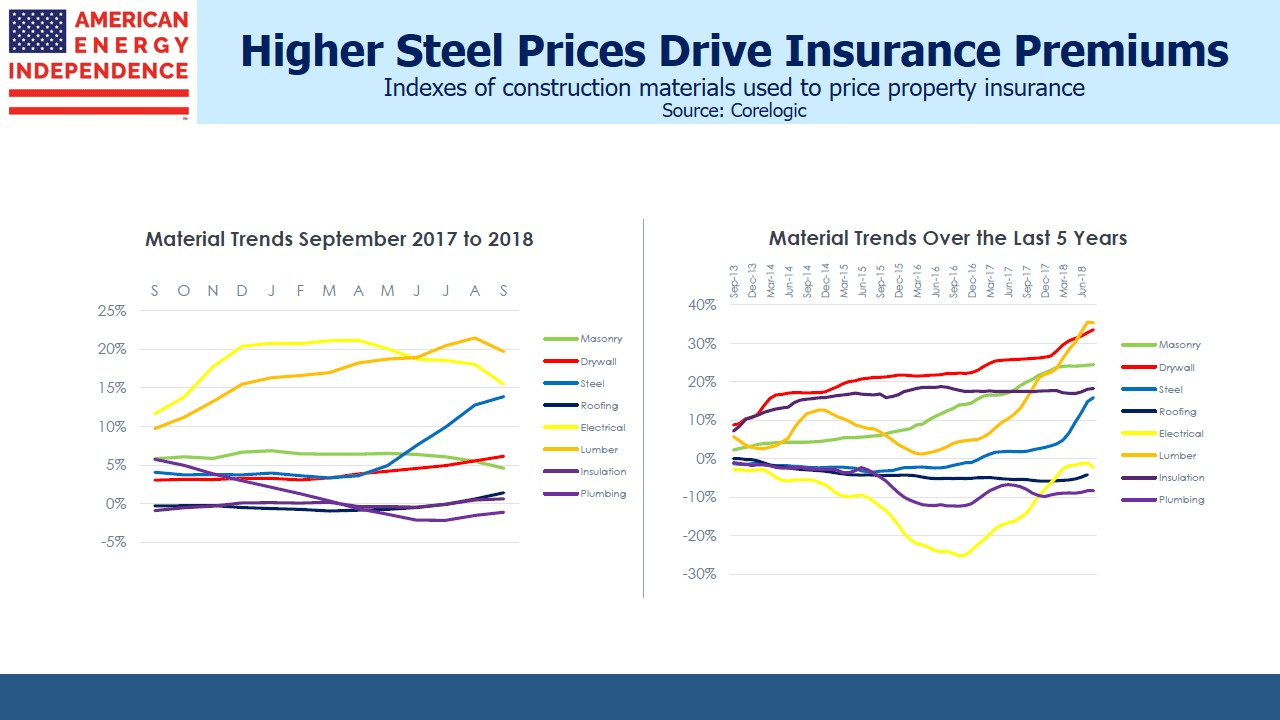

Few of us buy steel directly so the impact appears inconsequential. A recent report by CoreLogic, who advise the insurance industry on construction costs, showed steel prices rising at 14% year-on-year. Property and casualty companies will factor this in to the cost of insurance coverage for buildings that use steel – excluding one-to-four family houses, most other structures require it. So apartment dwellers and office building owners will see an incremental cost increase through insurance premiums higher than they would otherwise be.

Another example relates to energy infrastructure. Plains All American (PAGP) was inadvertently caught up in the tariffs because of specialty steel they had ordered from Greece to complete their Cactus II crude oil pipeline. In effect it was a retroactive tariff, because they’d placed the order long before the imposed tariffs resulted in a $40MM charge. Their appeal for a waiver was denied.

Capacity on the pipeline was fully committed by February, before the tariffs were formally announced. The increased cost of the pipeline will be borne by shippers, to the extent contracts allow the tariff to be passed on, and the excess by PAGP stockholders.

In both cases the tariffs represent a redistribution of income, from customers to the Federal government (which is why it’s a tax) and to domestic steel producers through higher prices. The effects are both subtle and numerous, as these examples show. The Administration has defended tariffs as a short-term, negotiating tool and not part of a long-term strategy. Whatever the merits of tariffs on domestic politics, equity markets clearly look forward to the time when the goals of tariffs have been achieved.

We are invested in PAGP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!