MLP Humor — A Target-Rich Environment

Humor can be a most effective weapon against your adversaries, especially when more extreme measures are unavailable. MLP management teams have made many poor capital allocation decisions in recent years, providing a rich source of material for an observer armed with both wit and a deep knowledge of the sector’s history. On Twitter, such a combination exists in the anonymous Mr. Skilling, who has been aiming rapier-like thrusts at many of the industry’s worst offenders, to hilarious effect.

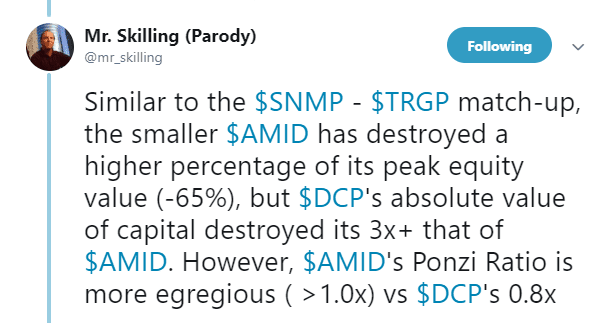

Inspired by the NCAA basketball bracket, he constructed a 64-team equivalent for present and past MLP managements. The winner of each match-up was decided by votes, with Mr. Skilling helpfully providing recent form, such as “total equity value destroyed”, number of distribution cuts, and the priceless “Ponzi Ratio” (equity raised divided by distributions paid out). This is one competition nobody wants to win, and any progress through the tourney presents an investor relations challenge.

Competitors were assigned to four regions, with names like “Corporate Governance? Never Heard Of It”. They were seeded, with the top seeds being assigned to the worst offenders. Perhaps this will lead to a new due diligence question (“What’s the highest seeded holding in your portfolio?”).

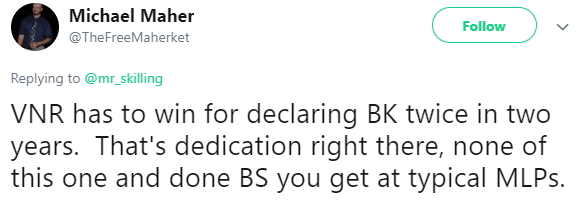

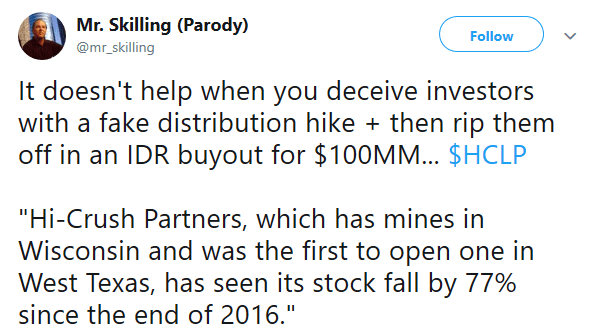

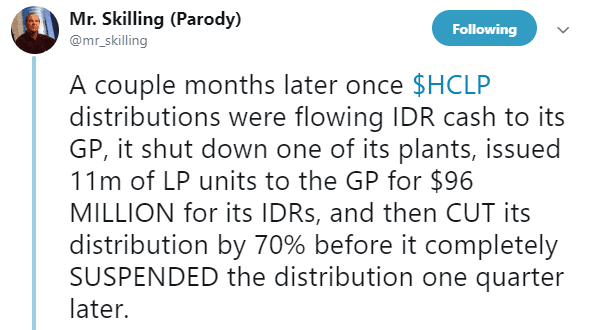

Prior to each match-up, Tweeted commentary set the stage.

Some companies had achieved a head start by already going bankrupt – and Vanguard Natural Resources’ two bankruptcies gave them a clear edge.

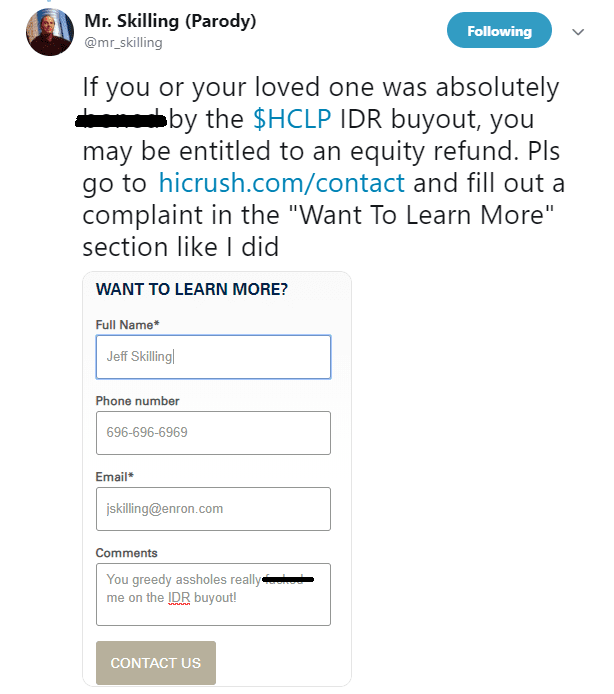

HiCrush (HCLP) showed an exquisite touch in fleecing their investors. They temporarily raised their distribution to an unsustainable level which threw off increased Incentive Distribution Rights (IDR) payments to the General Partner (GP). These IDR’s were then cancelled in exchange for new equity issued to the GP, before the distribution was then slashed.

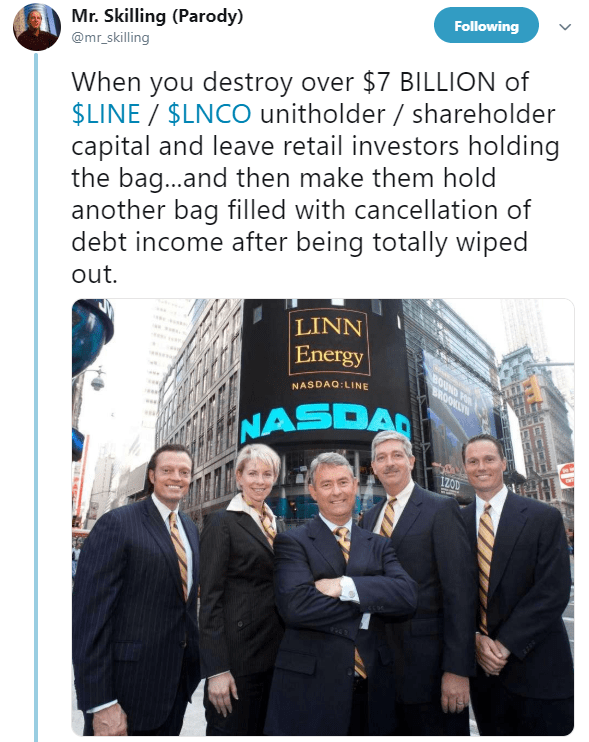

Such a record would seem to be unassailable, but Linn Energy’s bankruptcy provided unanswerable competition by saddling their investors with an additional taxable gain for debt forgiveness on top of their worthless LP units.

Failed companies should dominate such a tournament, but Targa Resources (TRGP) progressed to the “Sour Sixteen”, propelled by repeated poor investment decisions led by CEO Joe Bob Perkins of the now infamous “capital blessings” comment.

Mr. Skilling spares few, including Alerian who inducted Energy Transfer CEO Kelcy Warren into their Hall of Fame.

Kinder Morgan’s sale of their TransMountain Expansion also won an award for best acquisition, although there’s little doubt the Canadian taxpayer got the worse end of the deal.

Hinds Howard, who follows the sector for CBRE Clarion Securities, was inspired to add this little gem.

The humor is biting, and entertaining if you’re not financially scarred by the miscreants. But beyond the hilarity there are a couple of takeaways. The traditional MLP-GP structure, under which MLP investors endured weak governance rights and paid IDRs to the GP, has always looked to us like the relationship between a hedge fund and the hedge fund manager.

It’s widely accepted that hedge fund investors have done poorly (see The Hedge Fund Mirage). This recognition is why we have long favored the GP versus the MLP, although few such situations remain. It’s also why we don’t invest in any MLP that’s paying IDRs. Our portfolios haven’t avoided poor stewards of capital, but in always being aligned with management we have sidestepped the worst examples listed above.

The other point is that the industry has changed substantially. Simplifications have removed the GP’s ability to direct their MLP into dilutive projects while increasing IDRs. Governance has improved with the conversion of many large MLPs into corporations. Projects are increasingly self-financed and leverage is coming down.

The sheer quantity of episodes of investor abuse reflect the opprobrium so widely earned, and yet reputations lag reality on the way down as well as on the way back up. Depressed valuations reflect the past, far more than the future of sharply growing cashflows.

Mr. Skilling worries that, “…the same clowns that destroyed value are still running these companies” but is “…more positive on the space now that most IDRs have been killed off.”

Investors who learn from past mistakes, amply displayed on Twitter, can exploit a sector still priced for the misdeeds of old while positioned for a much better future.

The final is on Monday, April 8th. Make your voice heard by voting.

We are invested in ET, KMI, TRGP. We are short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I am glad some one is calling these bad actors out. Thank you for amplifying Mr. Skilling’s comments. Arclight’s behavior on AMID was abusive, bad for capitalism and I wish it was criminally punishable.

Well done. The interactive bracket was the icing.