Buybacks: Why Pipeline Companies Should Invest in Themselves

Weakness in the pipeline sector over the past couple of years has caused soul-searching and changes to corporate structure. Incentive Distribution Rights (IDRs), which syphon off a portion of an MLP’s Distributable Cash Flow (DCF) to the General Partner (GP) running it, have largely gone. Many of the biggest MLPs have abandoned the structure entirely, leaving its narrow set of income-seeking investors to become corporations open to global institutions.

The debate among investors, management and Wall Street about how to unlock value received some useful ideas recently from Wells Fargo. In a presentation titled The Midstream Conundrum…And Ideas For How To Fix It, they make a persuasive case that stock buybacks offer a more attractive use of investment capital than new projects.

This would be a significant shift for MLPs. As recently as five years ago, they paid out 90% or more of their DCF to unitholders and GP (if they had one). The Shale Revolution was only beginning to demand substantial new infrastructure, so they had little else to do with their cash. New projects were funded by borrowing and by issuing equity through secondary offerings.

Shale plays were in regions, such as the Bakken in North Dakota and the Marcellus in Pennsylvania/Ohio, inadequately serviced by pipelines. This broke the model, because the amounts of investment capital required grew substantially. The capital markets loop of paying generous distributions while simultaneously retrieving much of the cash through new debt and equity was no longer sustainable. Dozens of distribution cuts and lower leverage followed, leading to projects being internally financed. This is the new gold standard for the sector – reliance on external capital to fund growth is out.

Wells Fargo takes this logic a step further, asking why excess cash always needs to be reinvested back in the business rather than returned to investors via buybacks. In spite of professed financial discipline, midstream management teams invariably find new things to build, all expected to be accretive (i.e. return more than their cost of capital). Pipeline companies are not alone – the entire energy sector has been dragged by investors to prioritize cash returns over growth. But MLPs rarely buy back stock. Free of a corporate tax liability, MLP distributions aren’t subject to the double taxation of corporate dividends, so raising payouts is a simple way to return cash.

The Midstream Story over the past several years has largely been about financing growth projects. Investor payouts were sacrificed, but rarely did a company admit that its internal cost of capital was too high to justify a new initiative. Wells Fargo is challenging management teams to regard buying back their own stock as a more attractive use of capital than building or acquiring new assets. This is capital management 101 for most industries, but unfamiliar terrain for pipeline stocks. Growth is embedded in the culture. The original justification for the GP/MLP structure with IDRs was to incent management to grow the business. CEOs in other industries find the motivation without such complexity.

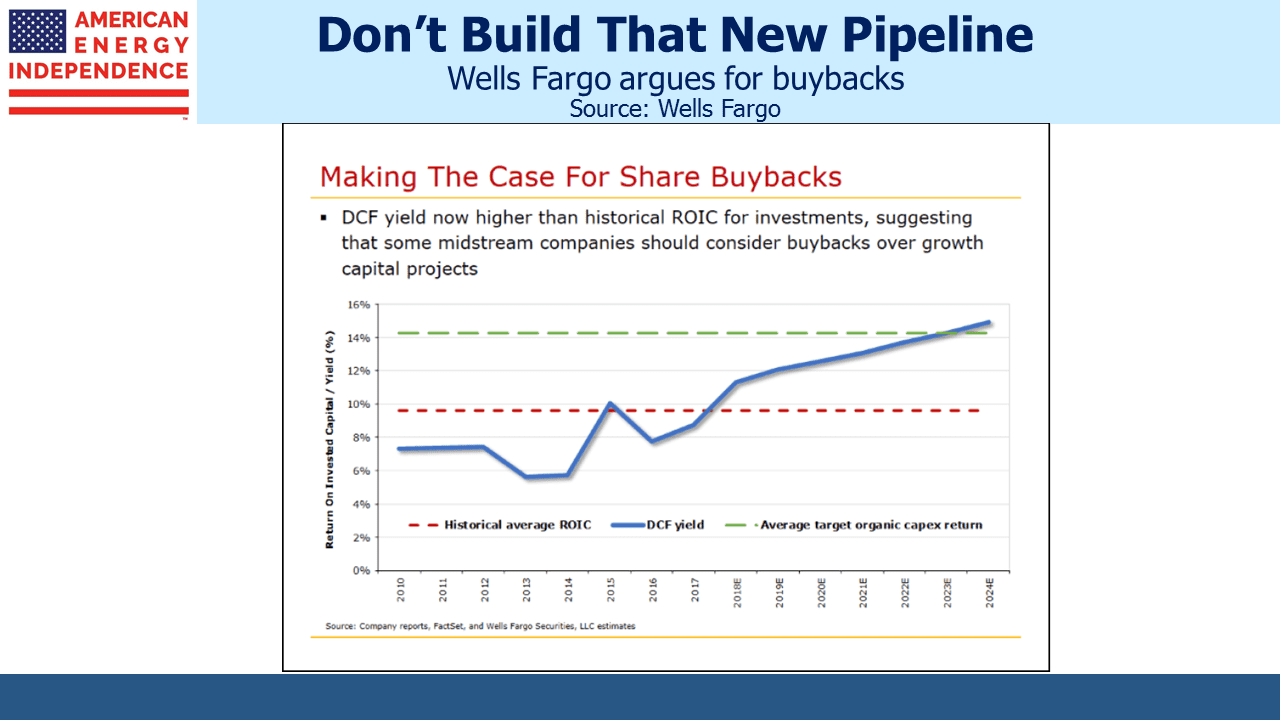

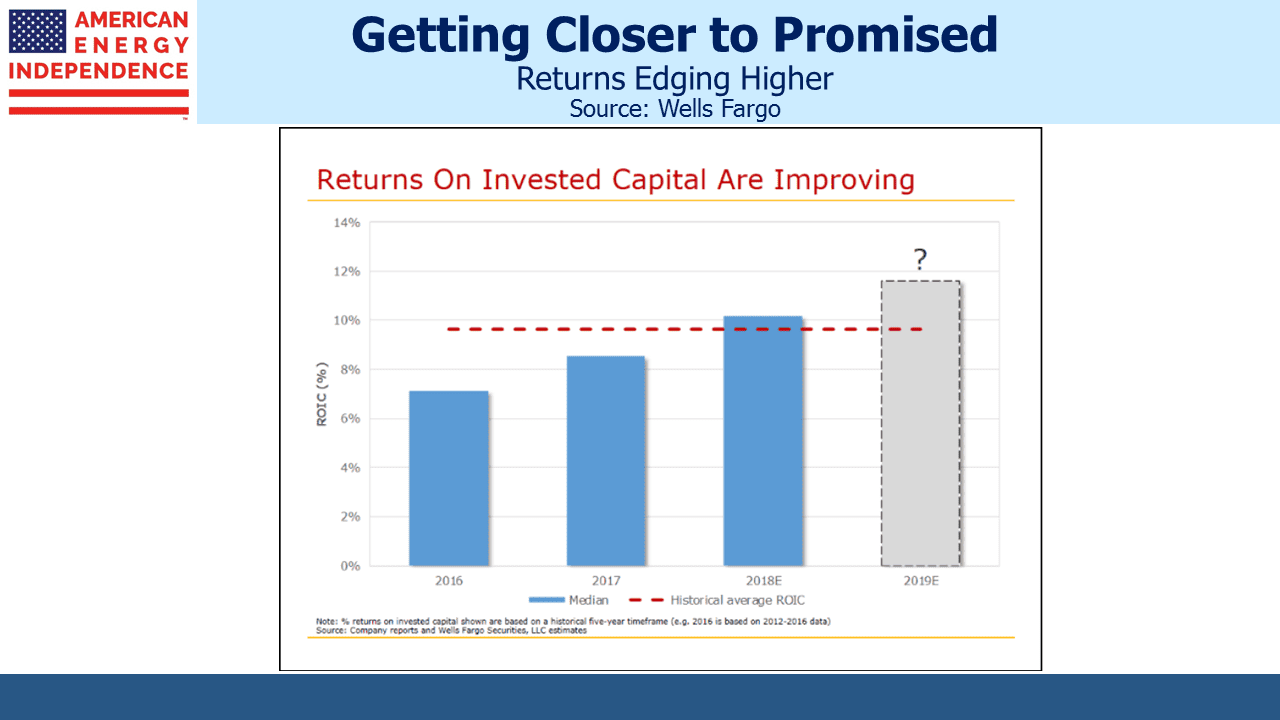

In October, virtually every 3Q18 earnings call included an optimistic outlook from management, usually coupled with disbelief at the continued undervaluation of their stock. Attractive valuations mean a high internal cost of capital. Valued by DCF, or Free Cash Flow (FCF) before growth capex, midstream yields are in some cases higher than many companies’ stated Return on Invested Capital (ROIC) targets. Moreover, historic ROIC for the industry has often turned out lower than promised, although it has been improving.

Energy Transfer’s (ET) 16% DCF yield almost certainly offers a higher return than all but their best projects, and suggests they should be repurchasing stock. SemGroup’s (SEMG) DCF is 20%, twice the industry’s historic ROIC.

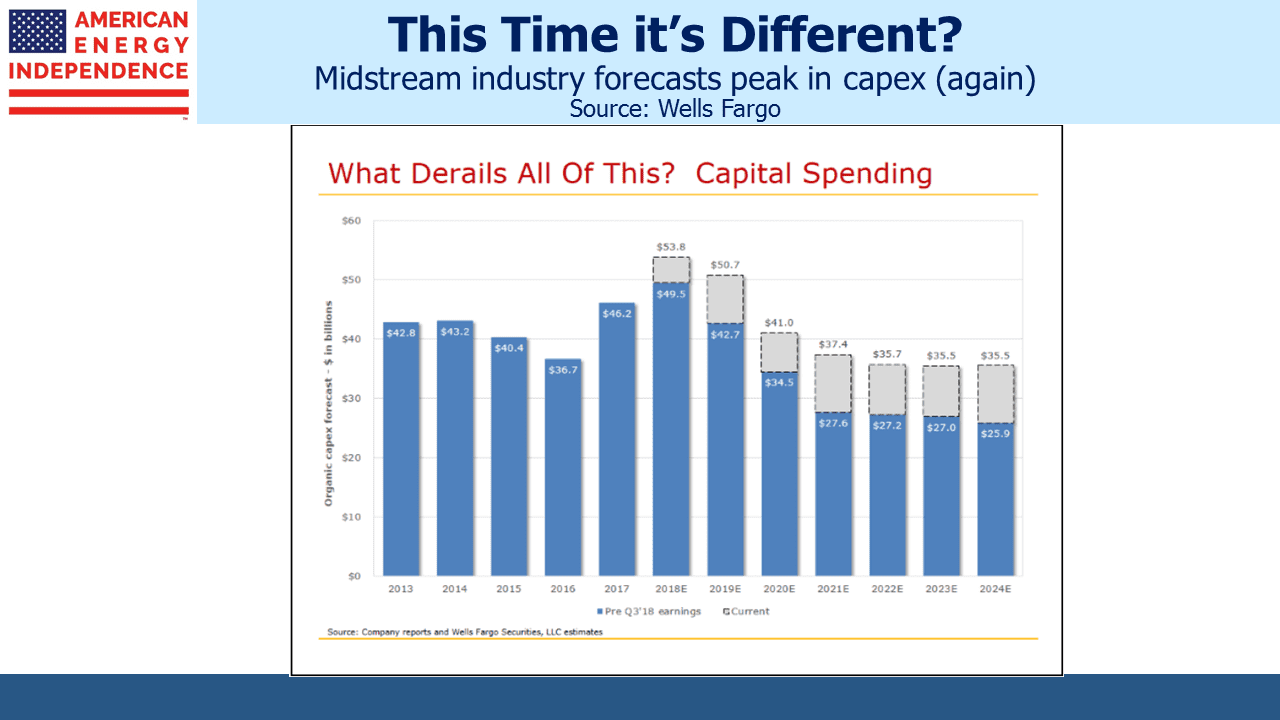

Growth caused the past four years’ upheaval, and today’s low valuations are the result. Capital discipline has been less present than CEOs often claim, which is why they’ve apparently responded coolly to Wells Fargo’s buyback recommendation.

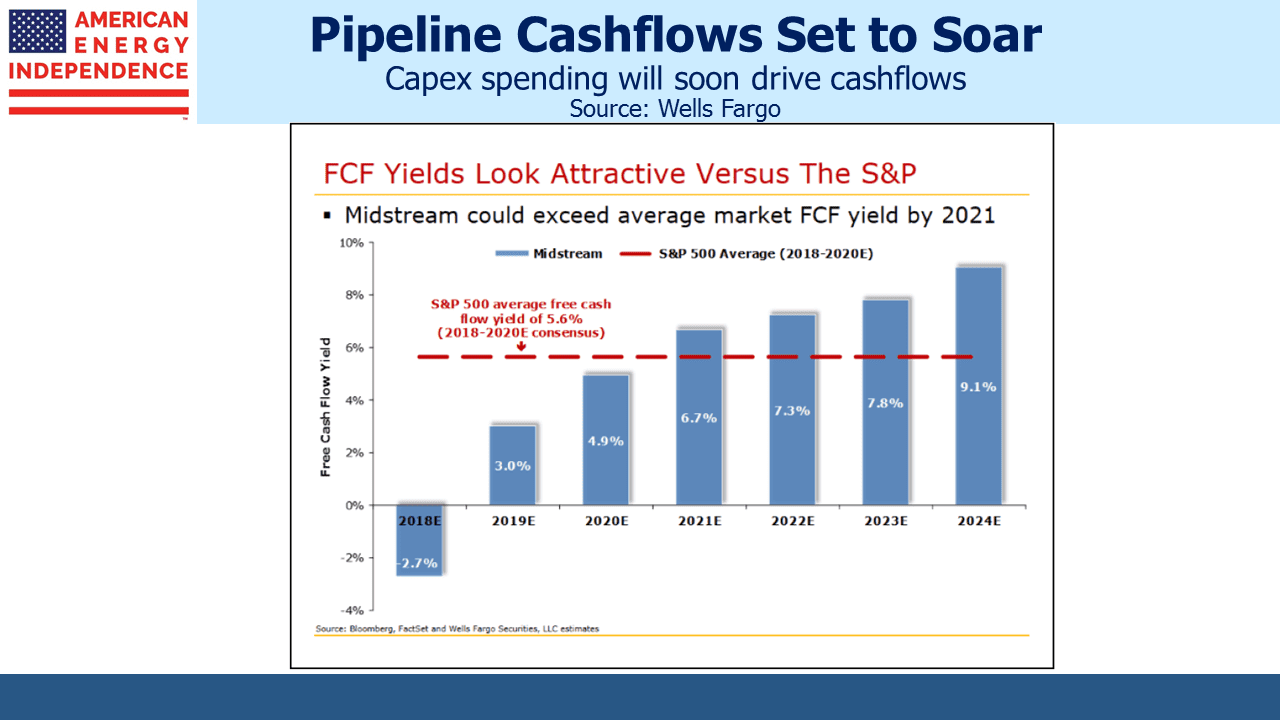

DCF yields of 10-14% or more (as with ET’s 16%) are dramatically higher than FCF yields of 3%, because DCF measures cash generated before funding for growth projects while FCF is after. FCF yields are set to rise sharply over the next few years, but this crucially relies on new investment coming down. The industry has a habit of showing that peak spending on new projects is imminent, only to push that back another year. 3Q earnings calls saw 2019 estimated capex creep up by almost 20%.

2018 is the fourth year of distribution cuts for MLPs, as reflected in the Alerian MLP ETF (AMLP). Corporations have fared better, and next year we expect dividends on the American Energy Independence Index to grow by 8-9%. If midstream companies are as financially disciplined as they claim, they’ll follow the advice from Wells Fargo in evaluating stock buybacks alongside new investments under consideration. It would complete their metamorphosis into more conventional companies.

We are invested in ET and SEMG.

We are short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Never, well never happen. Top guys are kingdom builders, every surplus dollar needs to be spent.

This will not change until their currency has no money raising value.

Given the slowing down of distribution cuts and stealth distribution cuts, why do you think MLPs are trading lower than in Jan-Feb 2016, when oil was $26?