The Energy Transition Towards Natural Gas

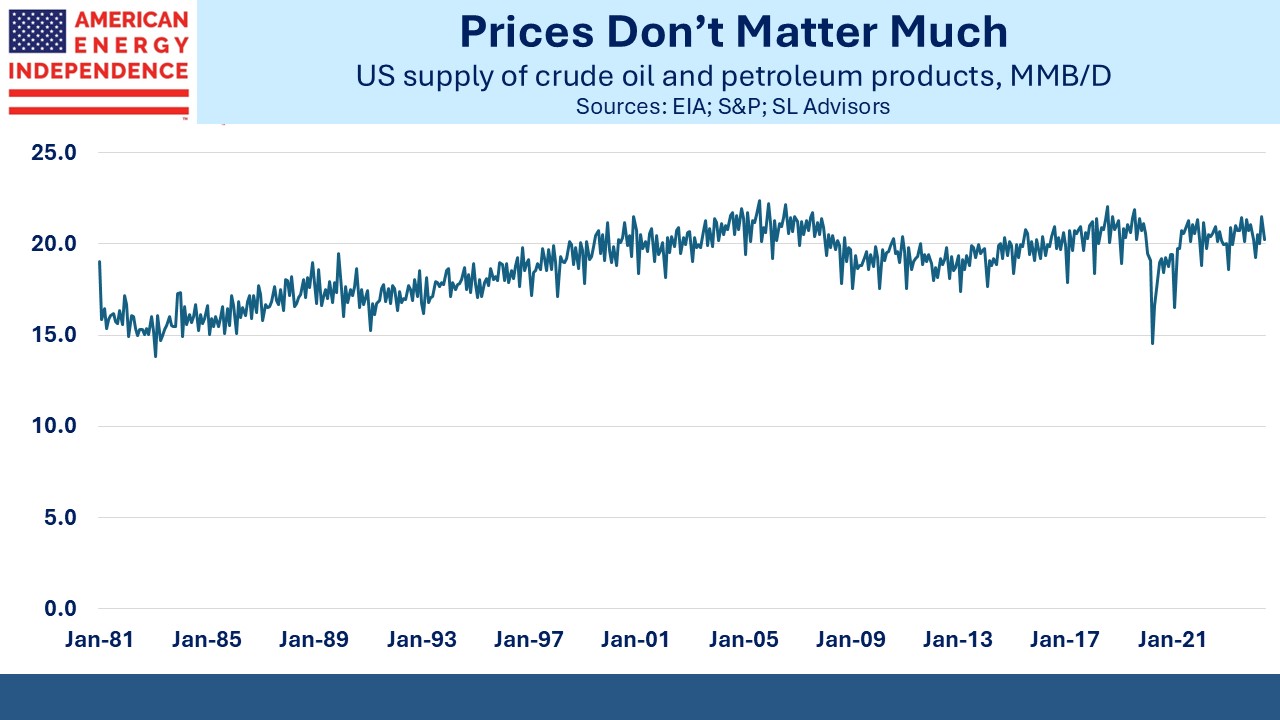

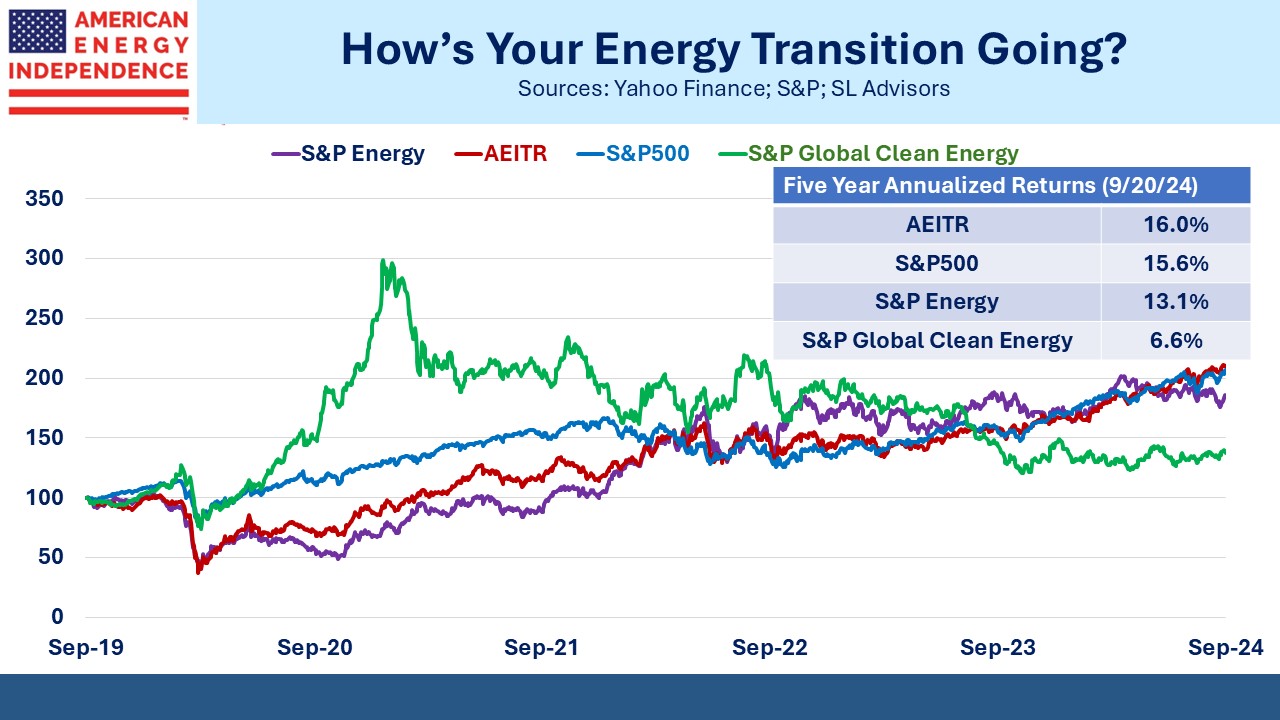

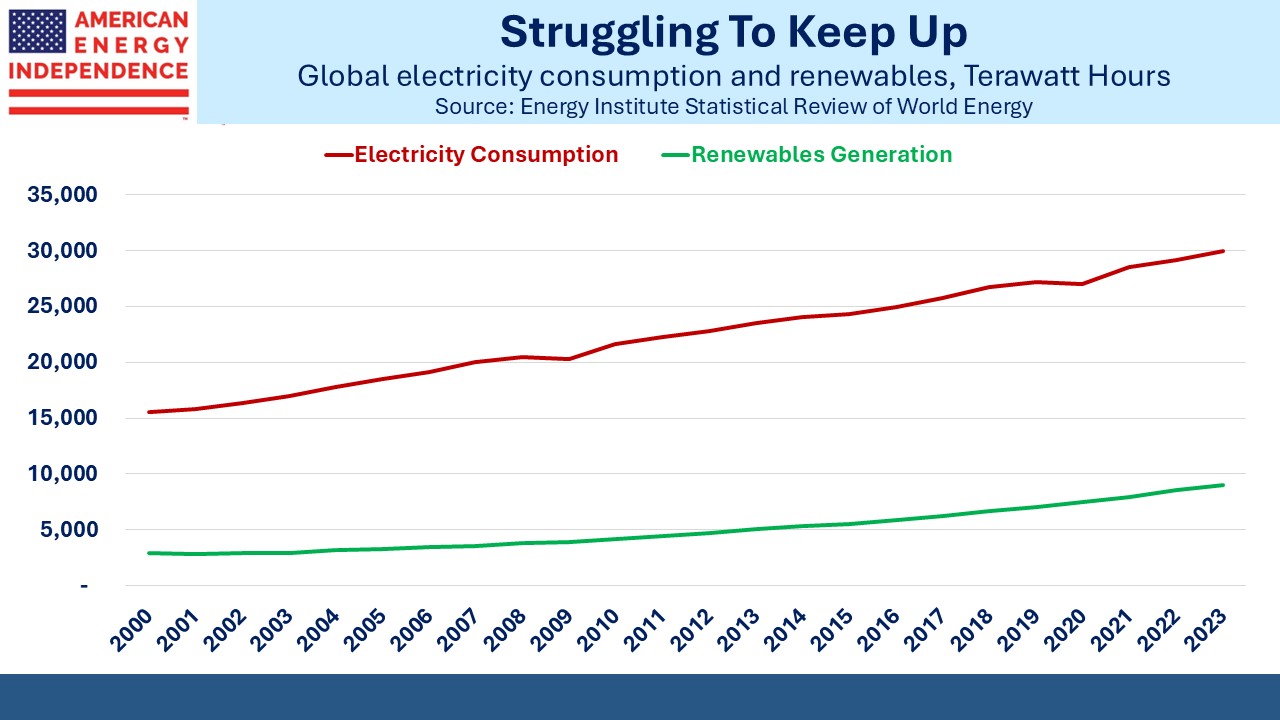

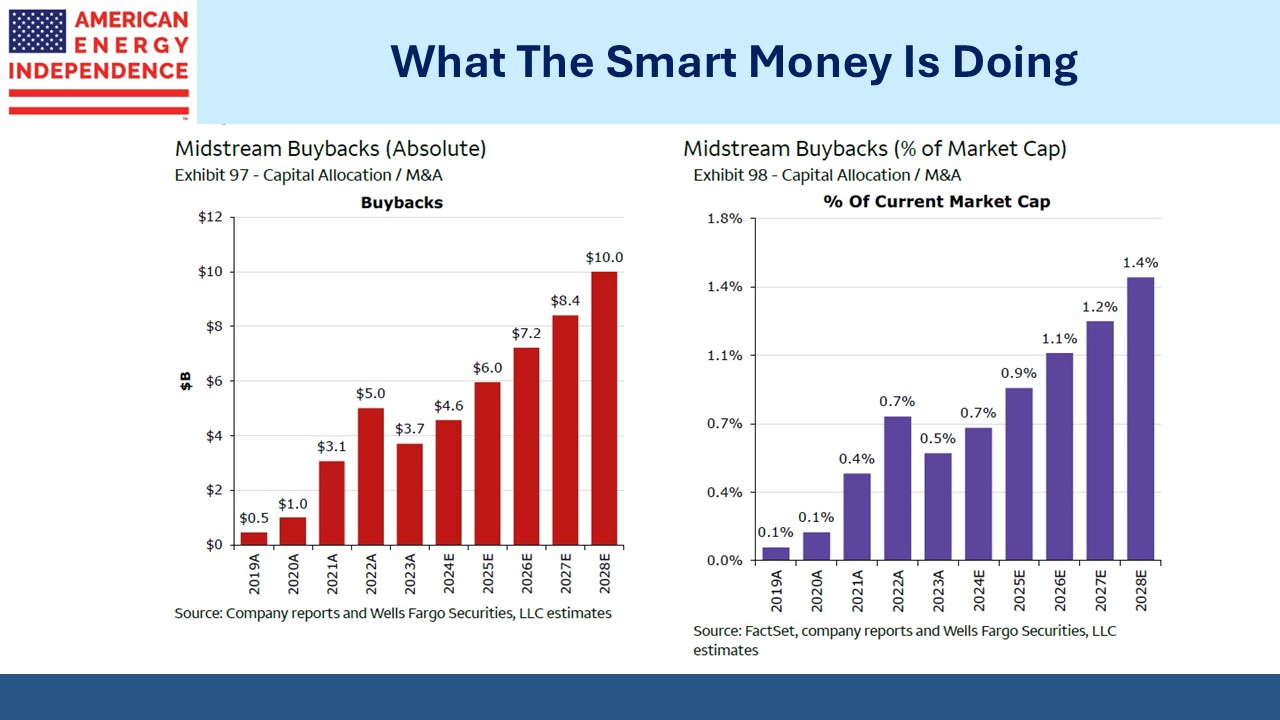

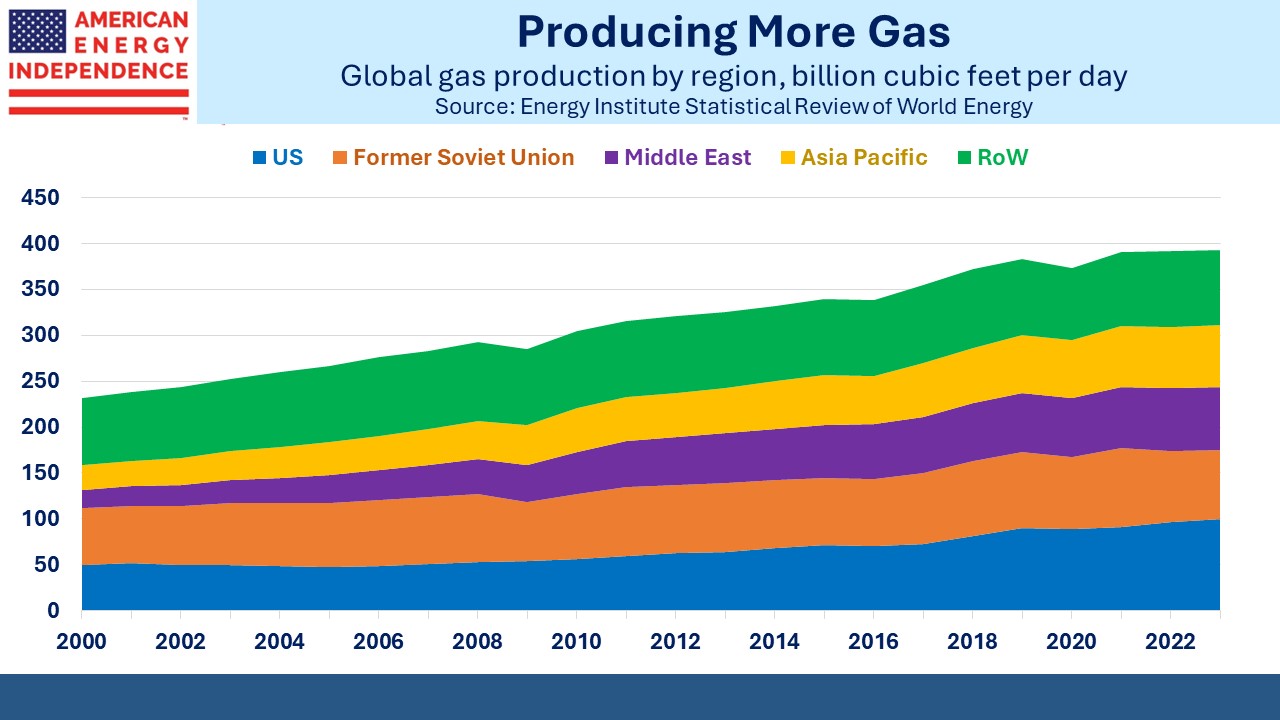

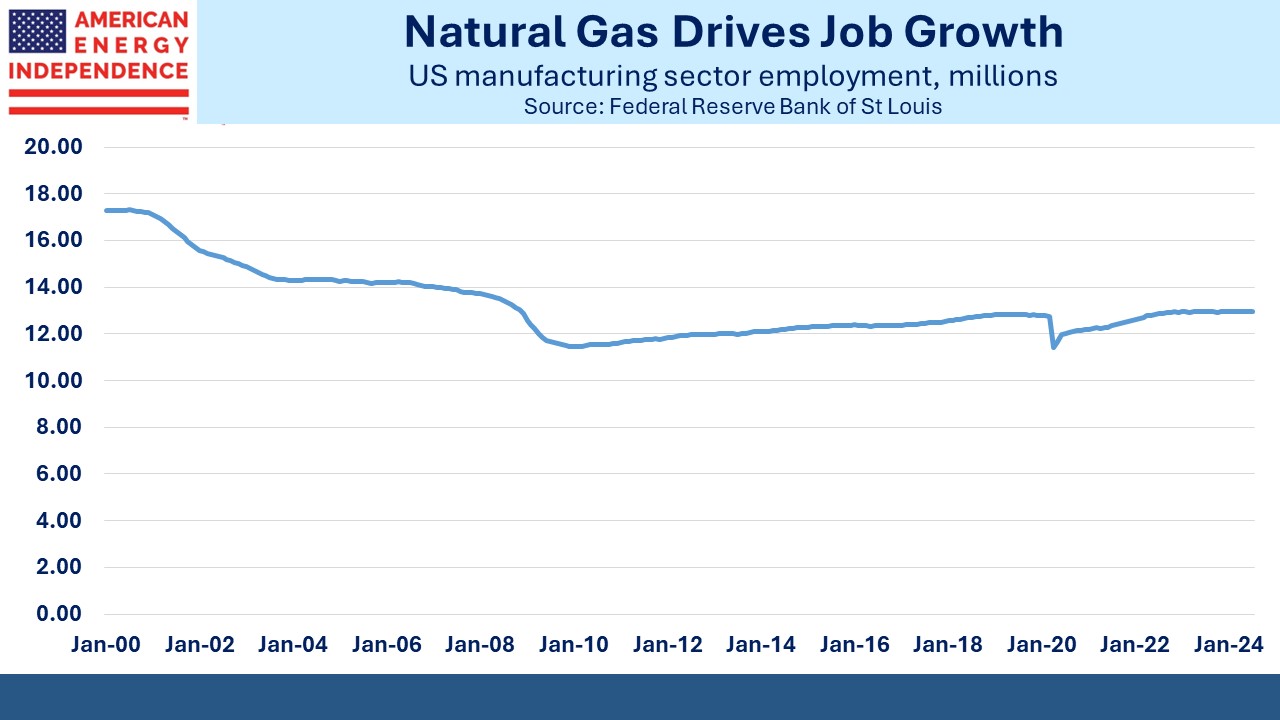

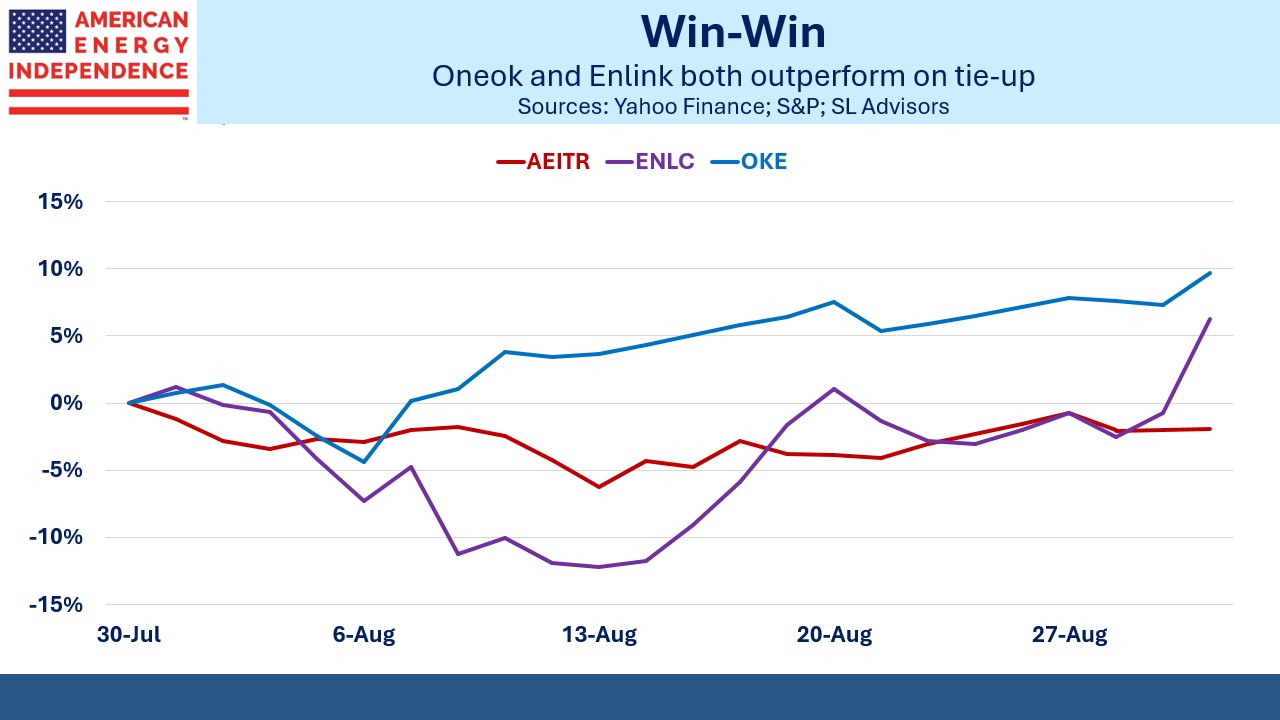

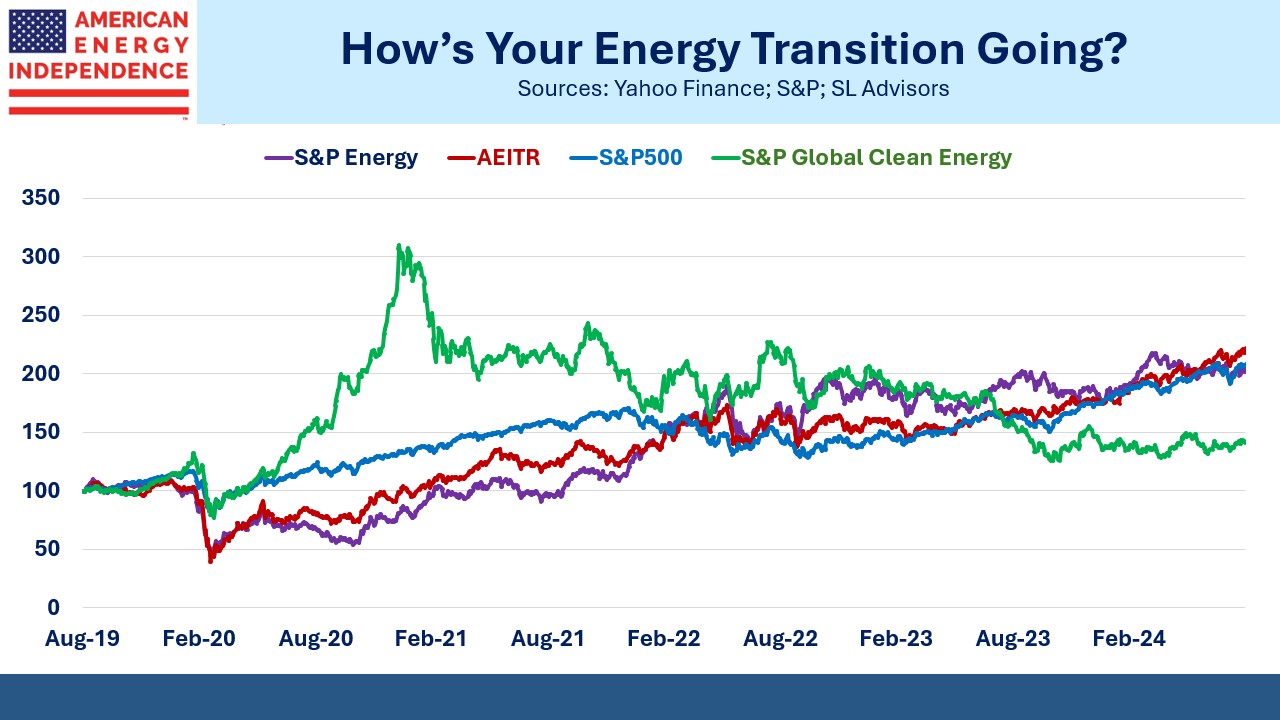

Revisions this year for the ten year growth outlook for US power demand because of AI data centers have provided support for midstream energy stocks, as additional natural gas will be needed (see The Coming Fight Over Powering AI). A recent report from Morgan Stanley (Global Clean Power – At a tipping point) expands this outlook to the rest of the world and reaches a similar conclusion.

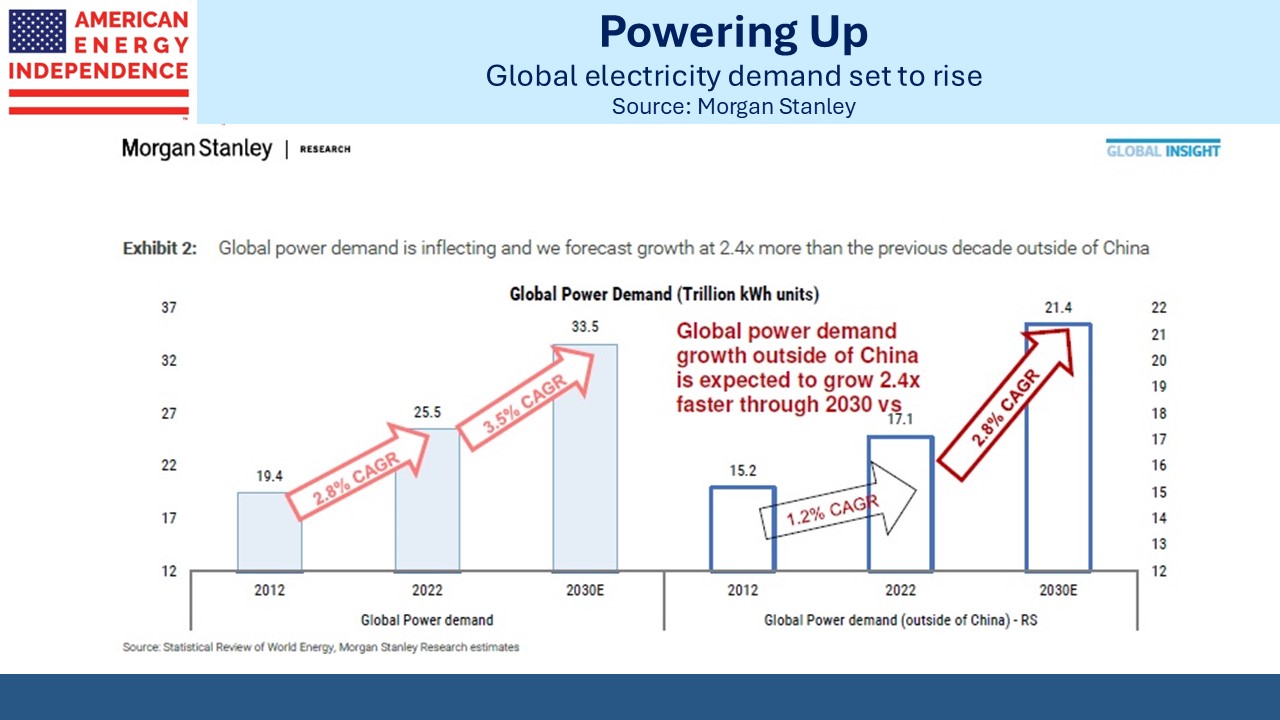

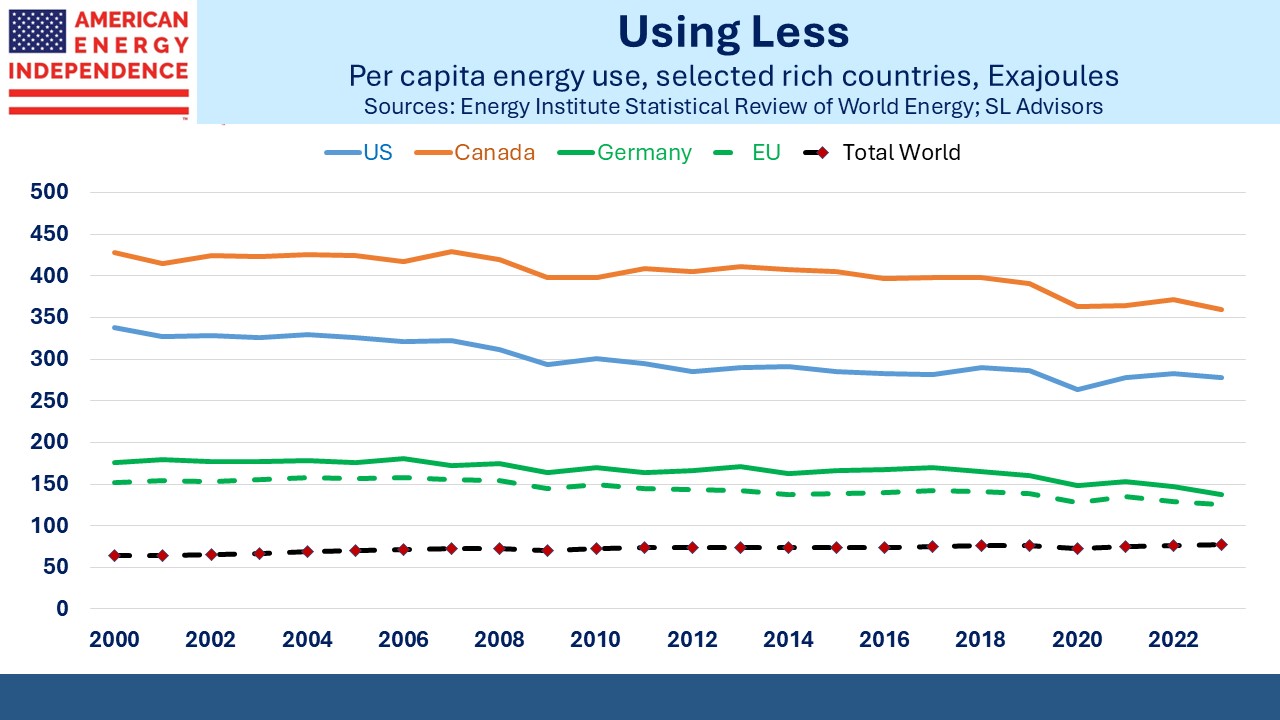

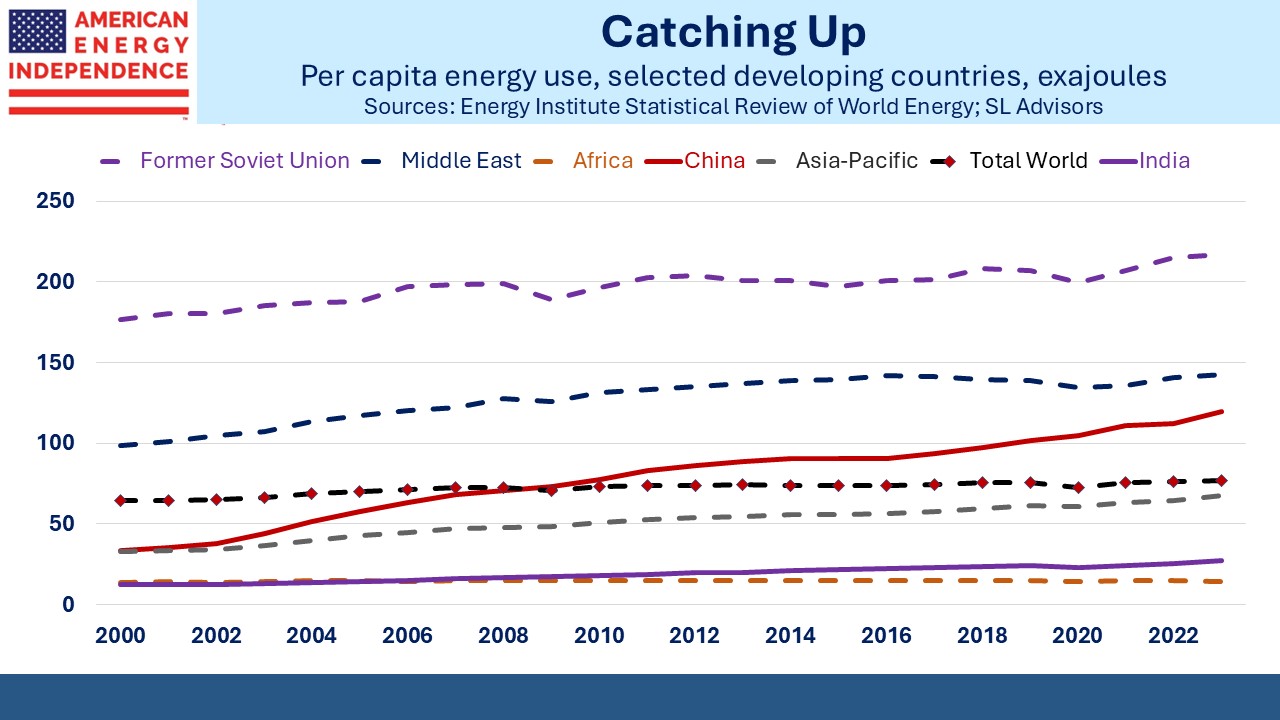

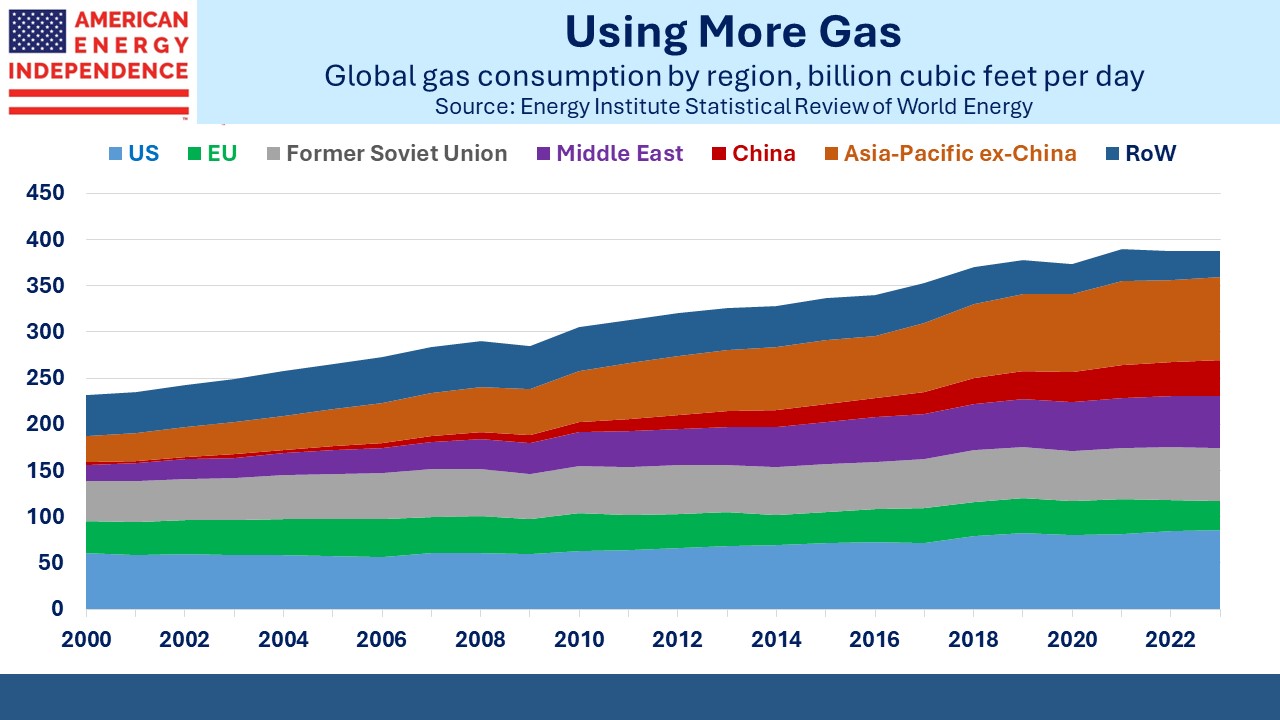

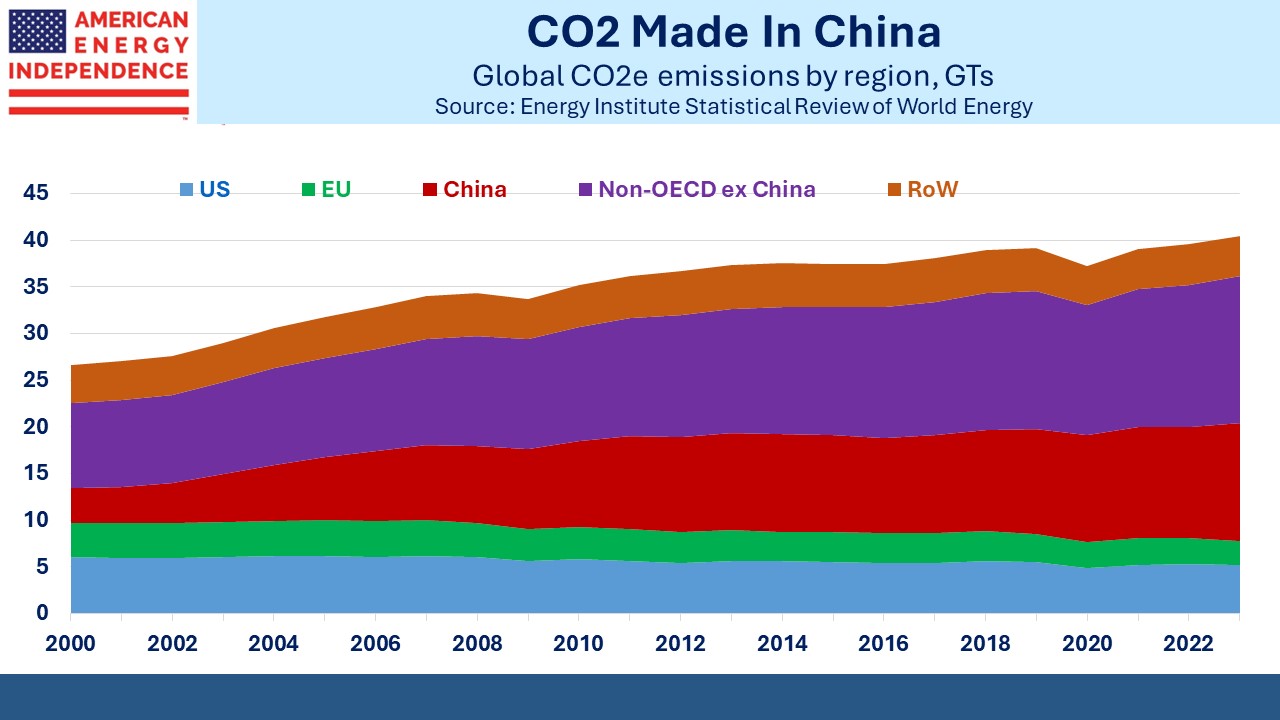

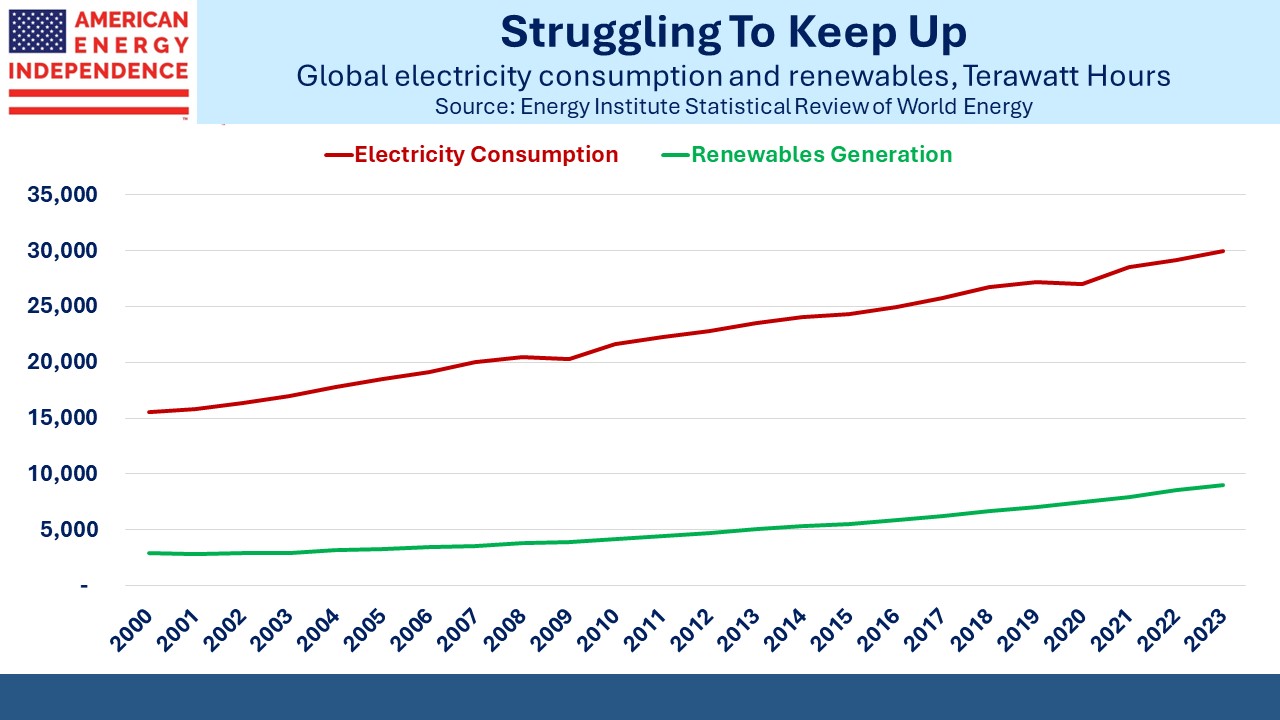

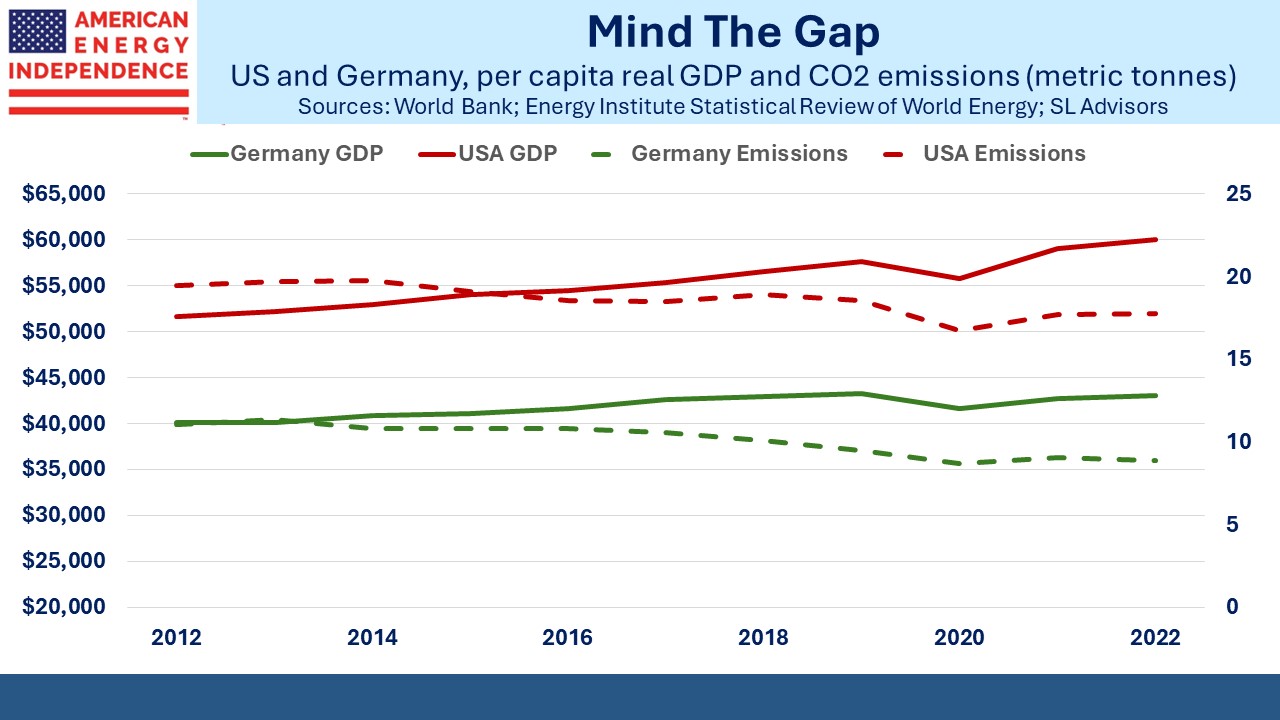

Since the report is focused on renewables the positive outlook for solar and wind is not surprising. Morgan Stanley is forecasting a 3.5% annual growth rate 2022-2030 for global electricity demand compared with 2.8% over the prior decade. AI data centers will be 20% of demand growth. Along with EVs, they also expect an impact from rural electrification in countries such as India, where they expect 7.6% annual growth through 2032. China was two thirds of global power demand growth 2012-22 but is expected to drop to a fifth over the next decade as the rest of developing Asia gains ground.

Overall, around half of global demand growth will originate in Asia.

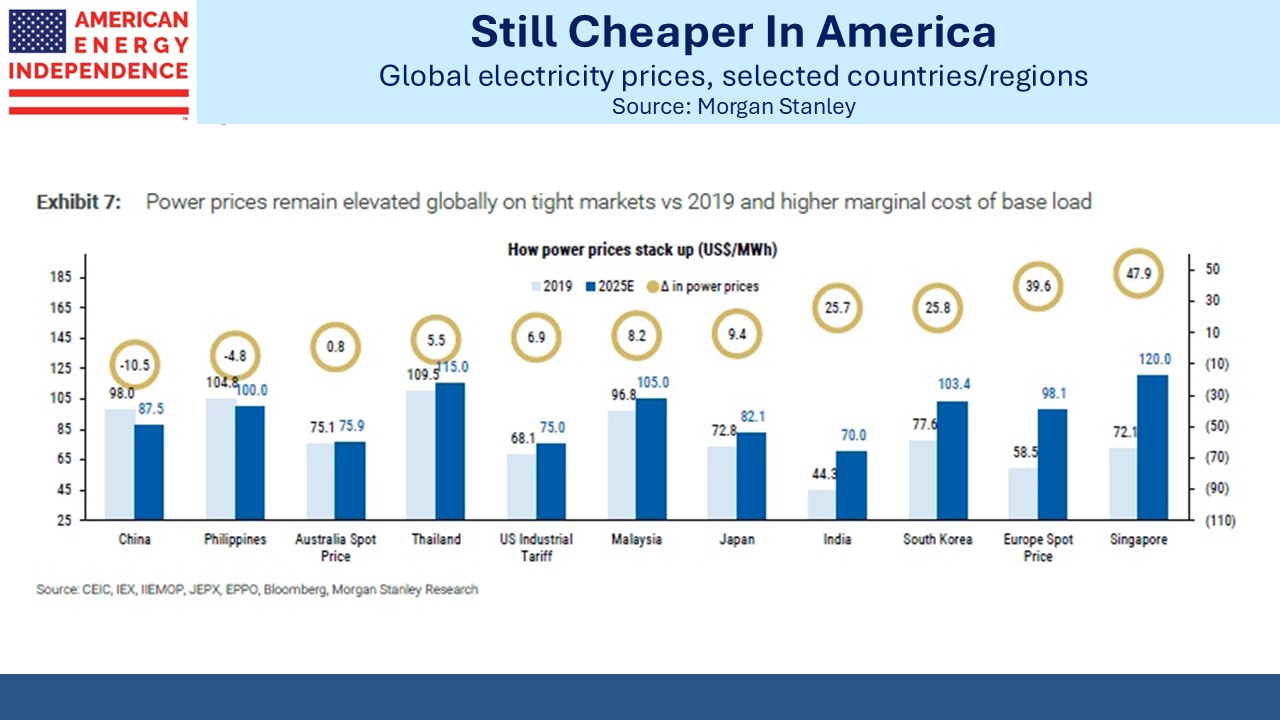

This is going to make electricity markets tight, causing higher prices and, the report argues, will create a positive environment for power companies. Global prices for long term power contracts are +15% over the past year.

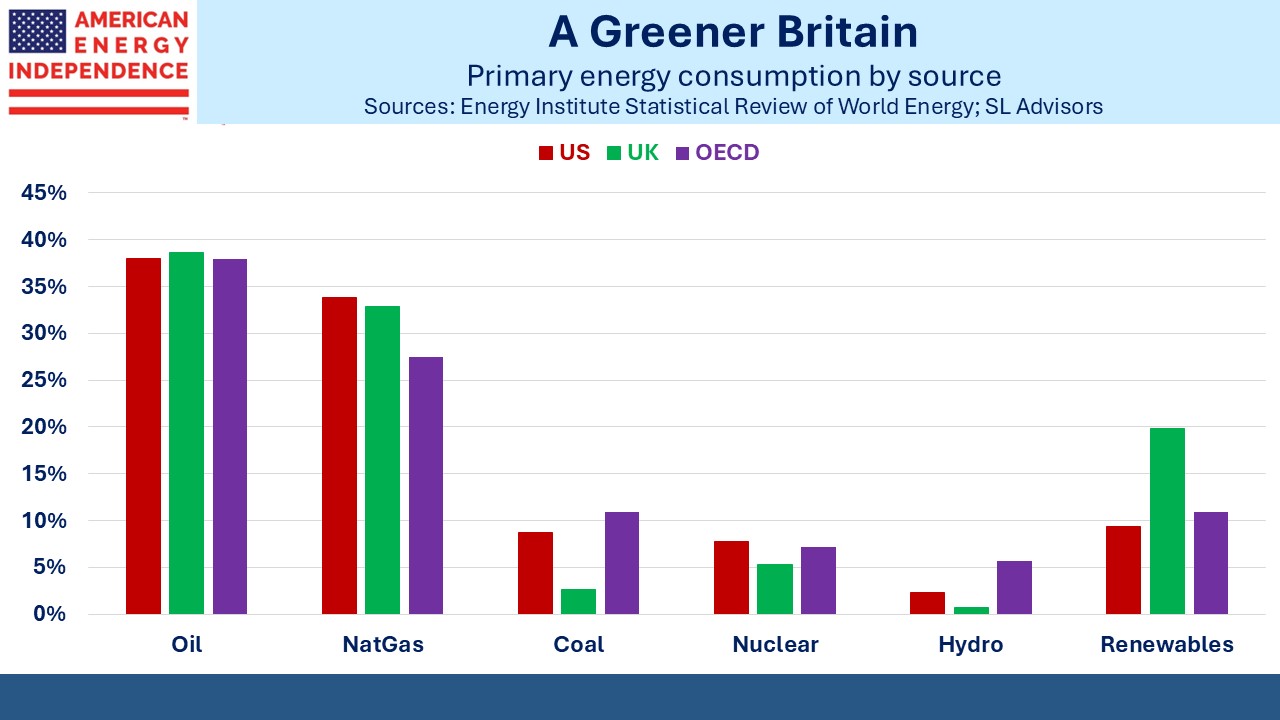

Hybrid generators that combine renewables with natural gas will play an important role in meeting this new demand. The report notes that wind/solar hybrids with natural gas have seen a sharp increase in tenders in India.

Williams Companies CEO Alan Armstrong has often noted that renewables growth was driving demand for the natural gas that moves through his company’s pipeline network. Weather-dependent, intermittent electricity sorely needs a back-up capability that can come online when needed. Natural gas power plants provide that. Tenders for power generation in India regularly receive more than half their bids from hybrid solutions where the cost is around $50-60 per Megawatt Hour (MwH). This compares favorably with wholesale prices expected to average $70 per MwH by 2025.

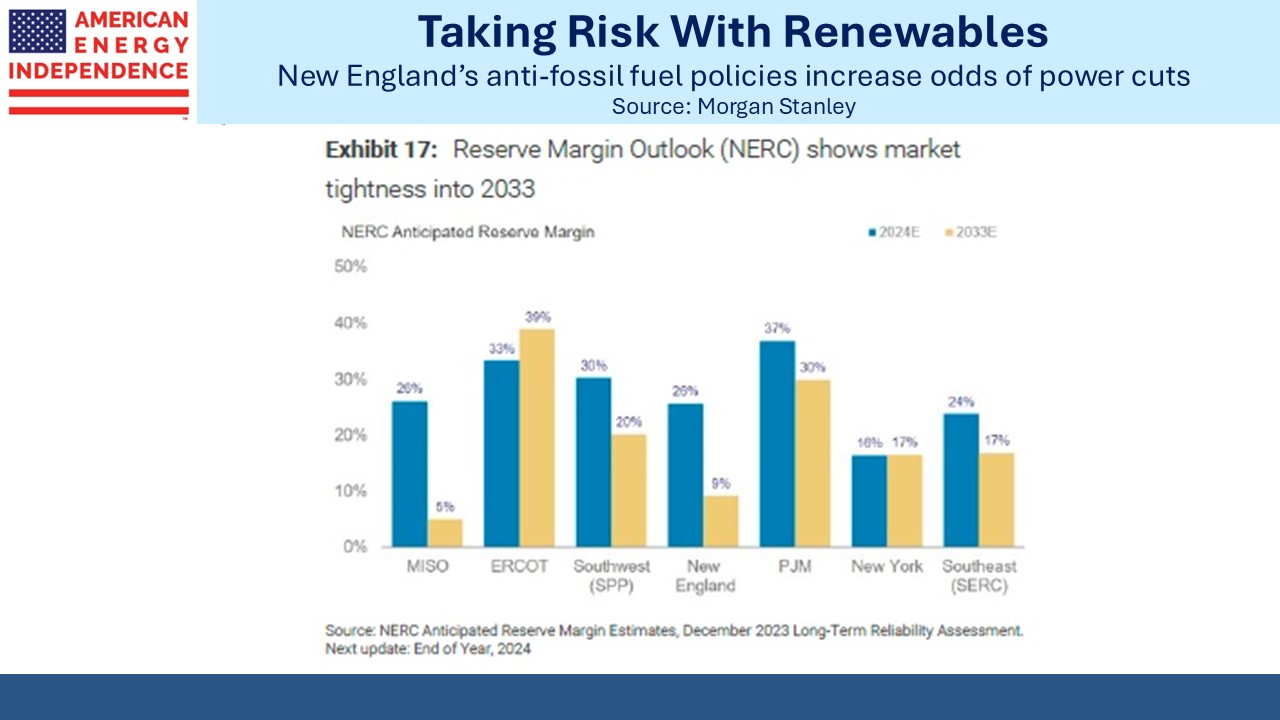

Once renewables reach 30-40% of a grid’s power supply their dependence on sunny and windy days tends to be a limiting factor. In the US this is reducing the safety margin across almost all of our grid systems. New England runs the biggest risk of power cuts in the future because of its poorly conceived energy policies (see Why Liberal States Pay Up For Energy).

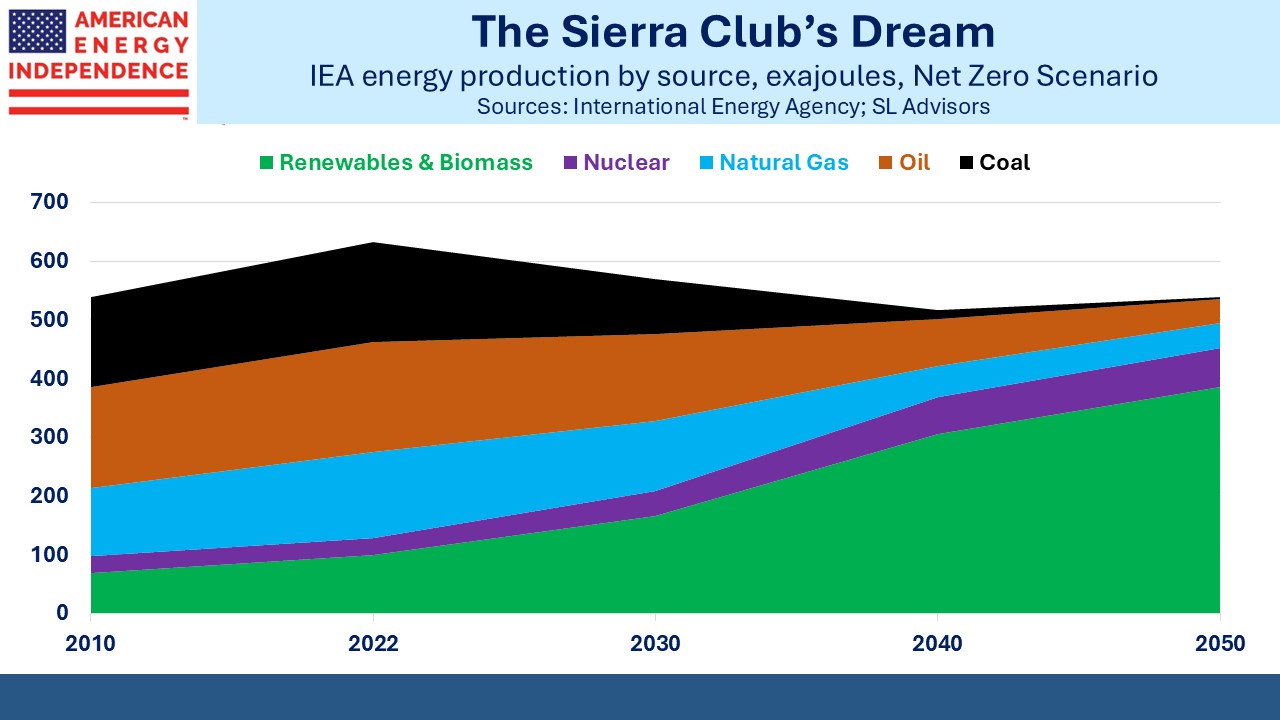

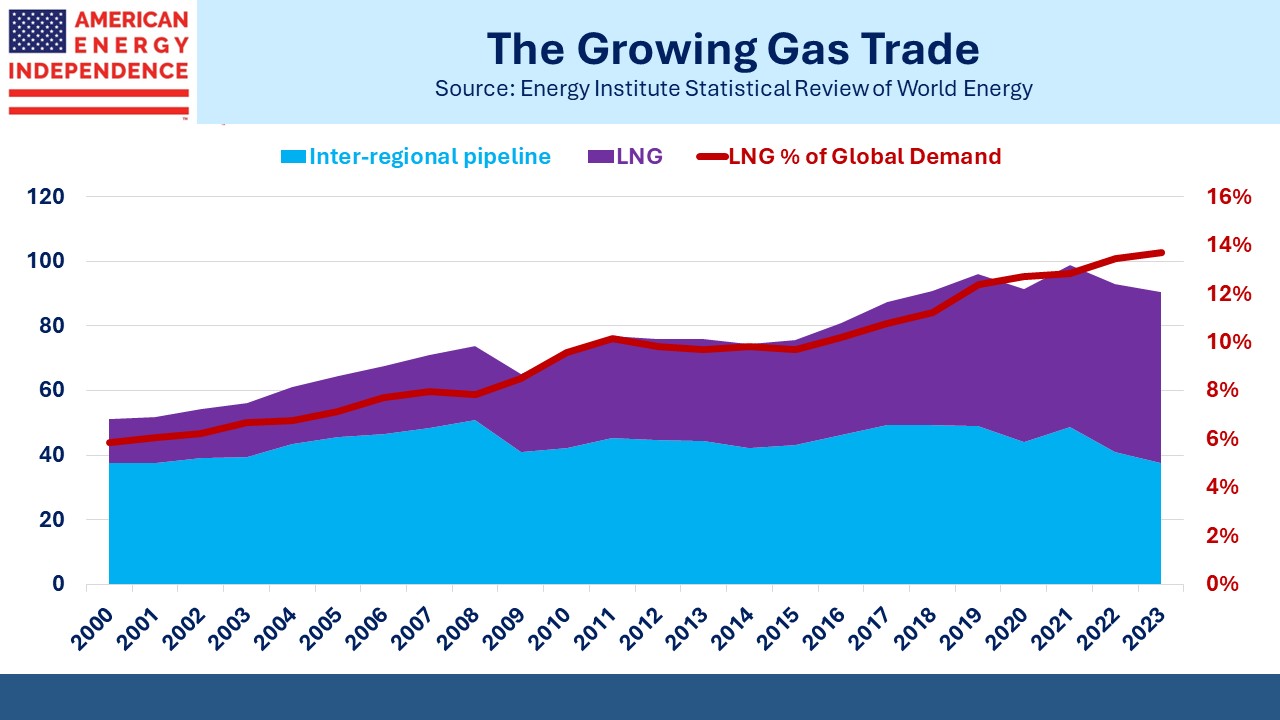

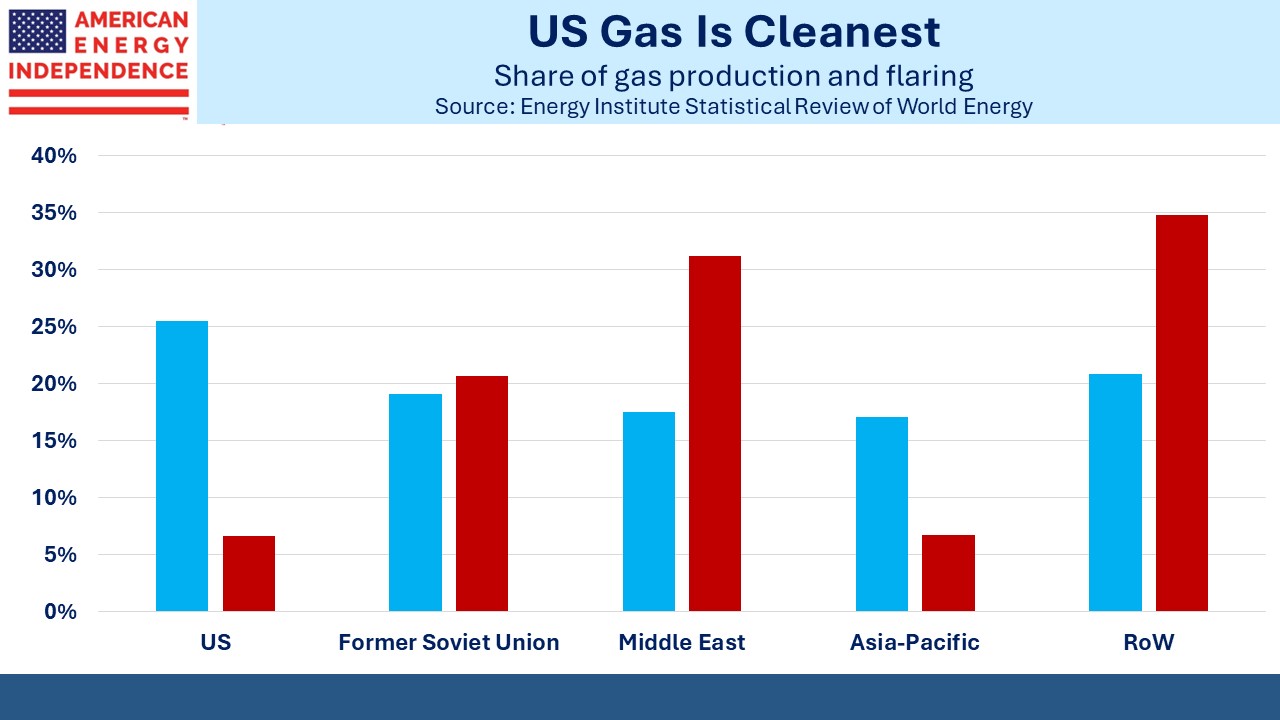

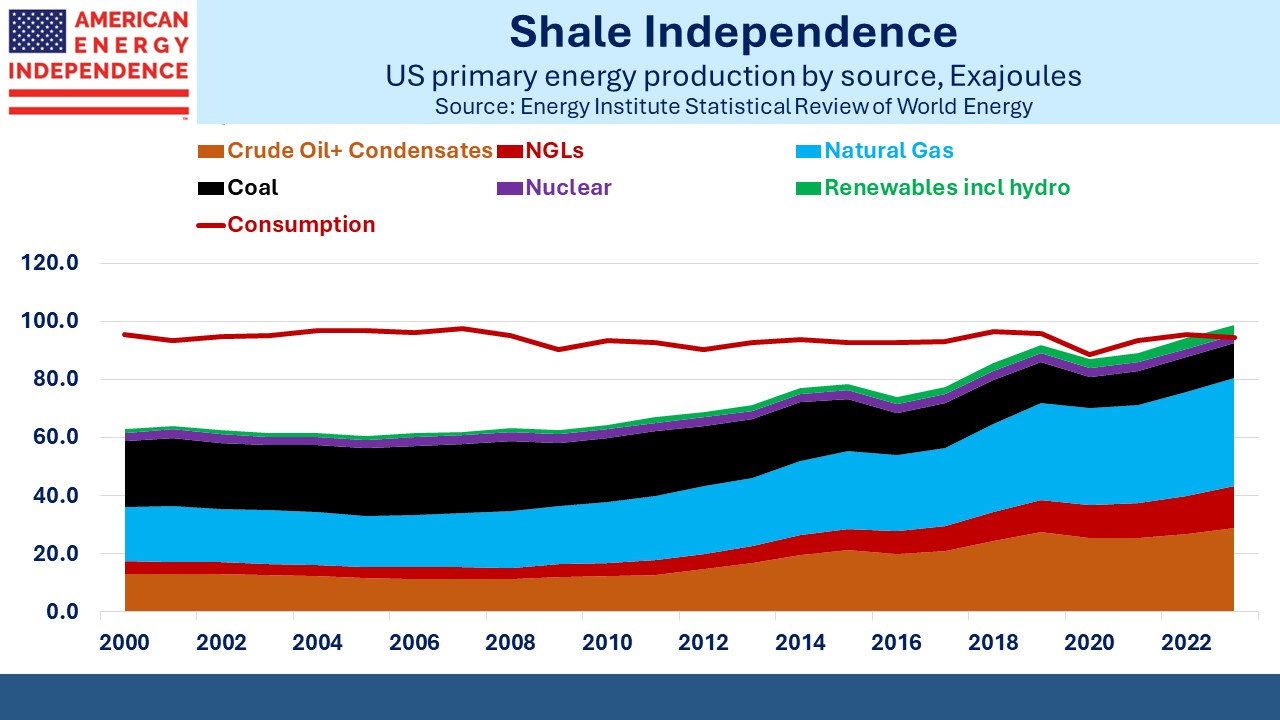

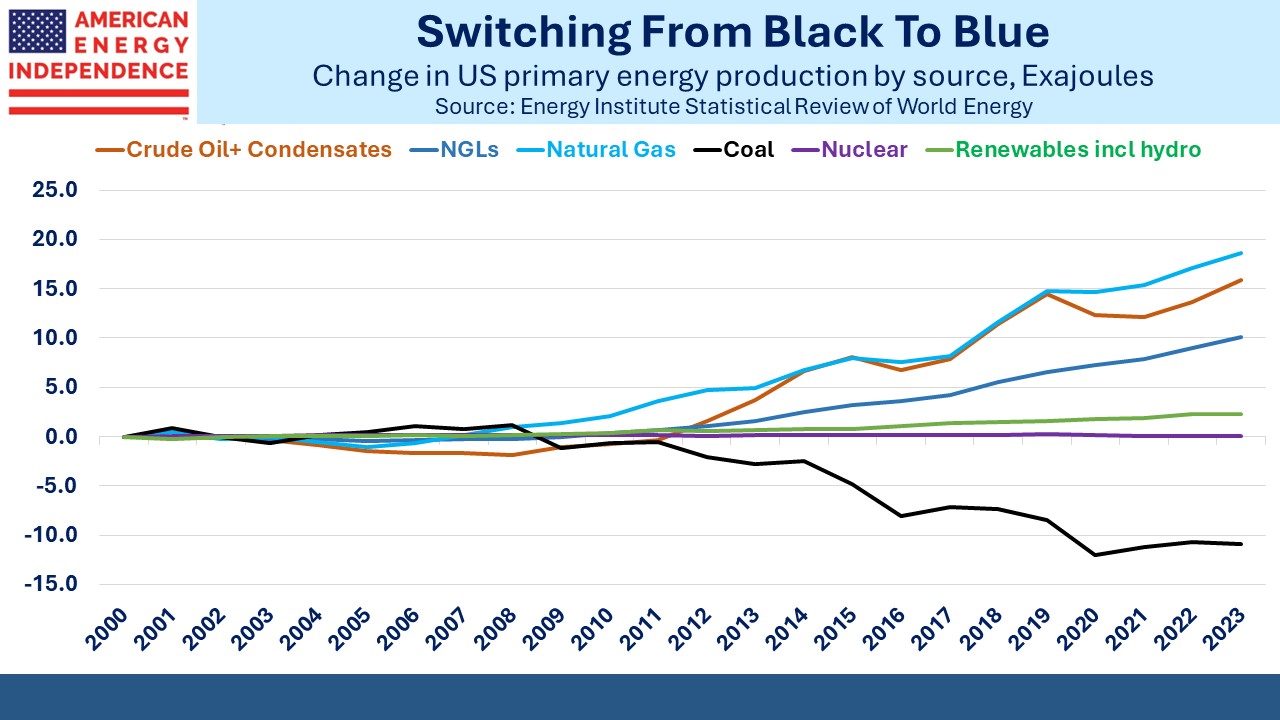

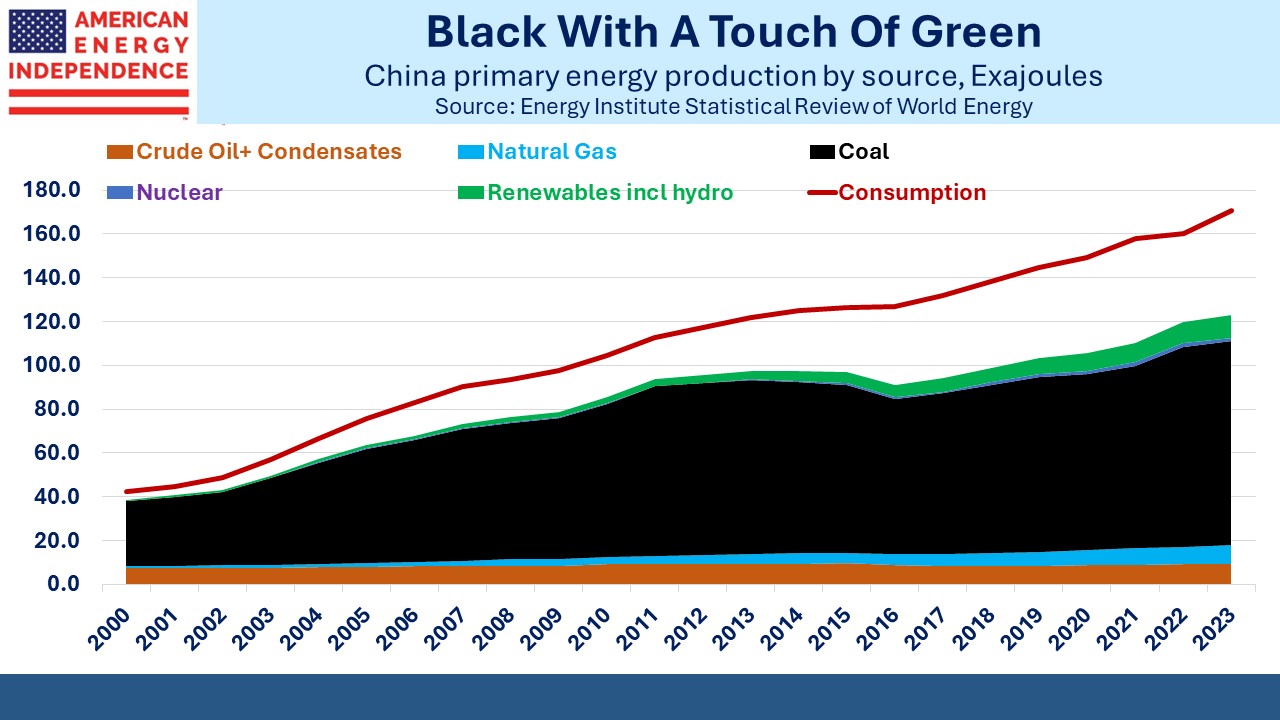

Interestingly, one of the risks to the hybrid power outlook is a slowdown in US LNG export permits. This will favor coal consumption, something that’s clear to the careful observer but evidently not the Sierra Club, who opposes US LNG (see Sierra Club Shoots Itself In The Foot). Orders for 15 gigawatts of new natural gas power plants were placed in 1Q24, the strongest demand in almost a decade.

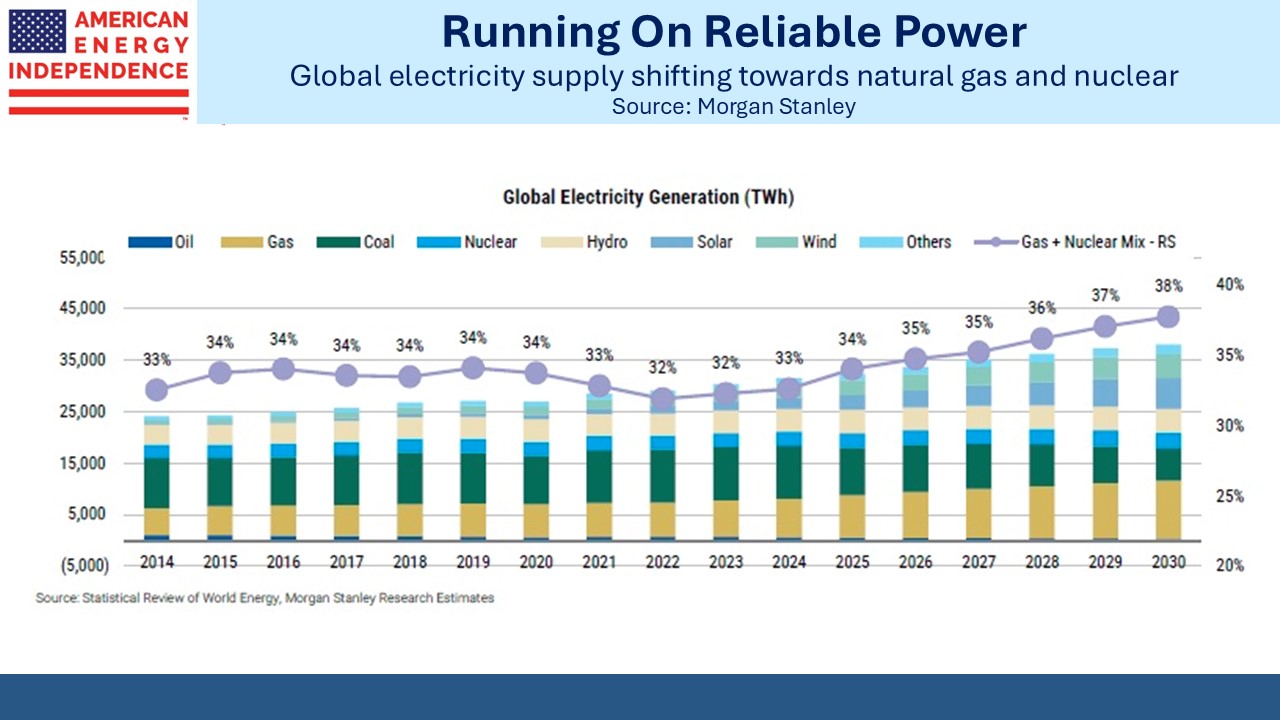

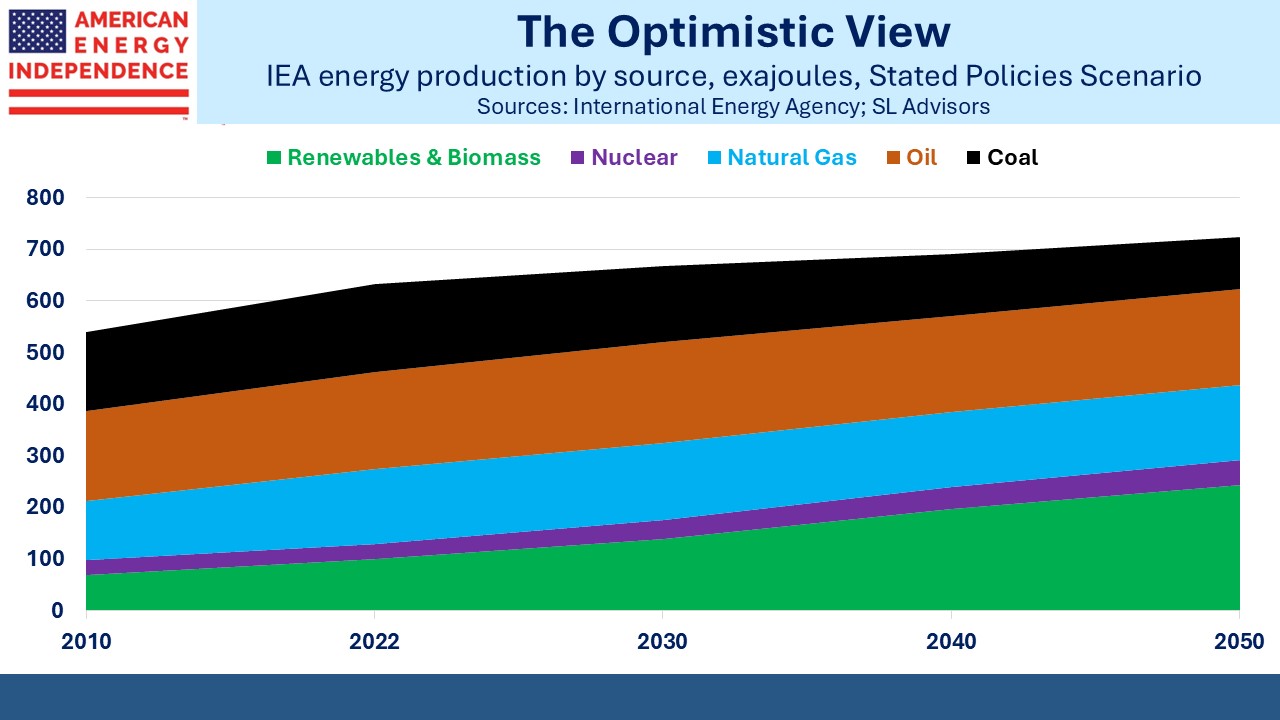

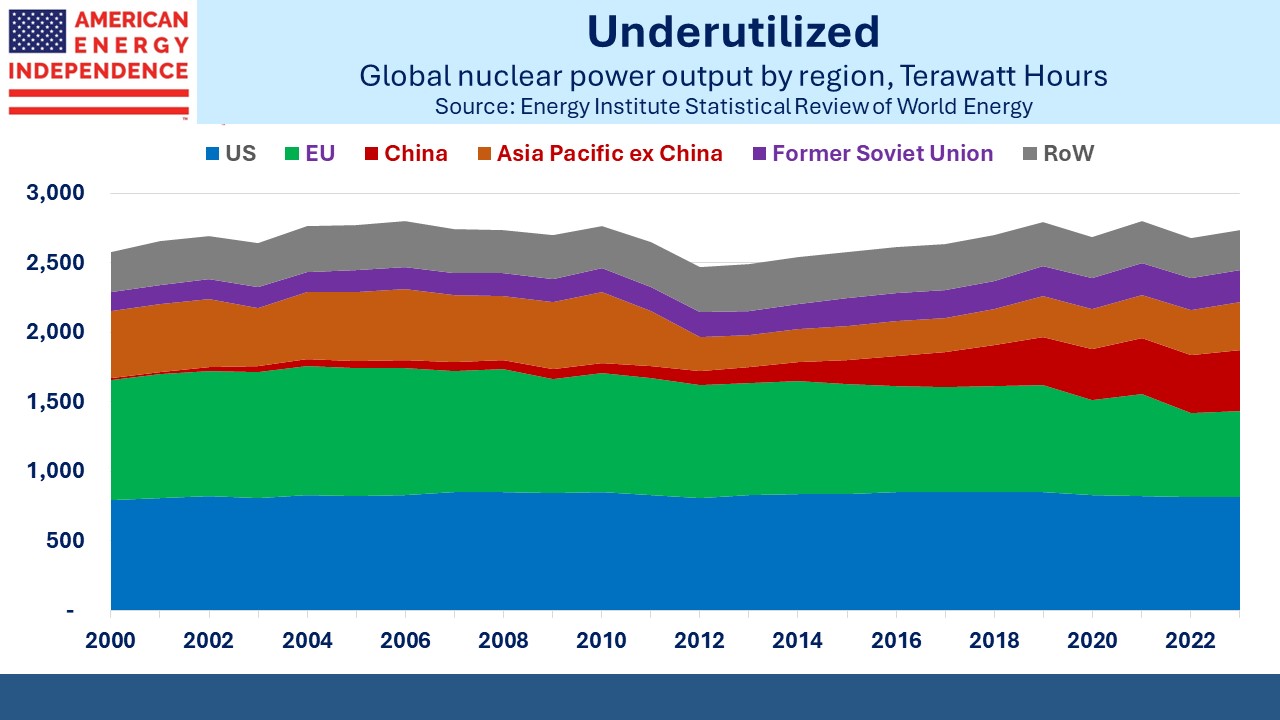

Nuclear power is also enjoying a resurgence. Japan and Germany notably cut back following the 2011 Fukushima accident, although in Japan its importance is now growing again. China is the clear leader, with plans to add capacity of 168GW, followed by the US at 50GW. Morgan Stanley thinks power generation from nuclear could roughly double from its current 390GW and expects output to hit a record next year.

An example is Microsoft’s recent agreement with Constellation Energy to restart a unit at the Three Mile Island nuclear plant in Pennsylvania. Data center operators often have ambitious low-carbon objectives. Microsoft is building one roughly every three days somewhere on the planet. Because AI servers need stable power 24/7, solar and wind are a poor choice.

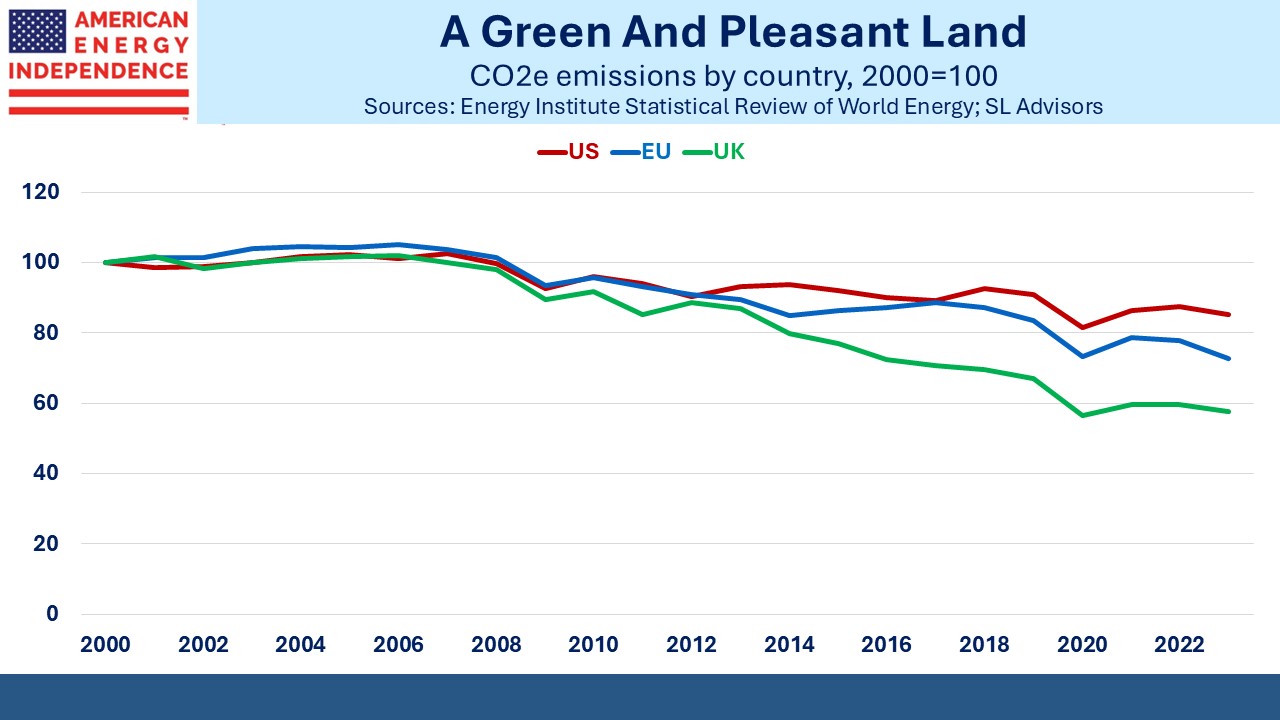

Many will be surprised to learn that nuclear and natural gas are set to increase their share of global power generation from 32% to 38% by 2030. By displacing coal this will represent a success for those who want to see reduced emissions, albeit one that’s contrary to the goals of climate extremists.

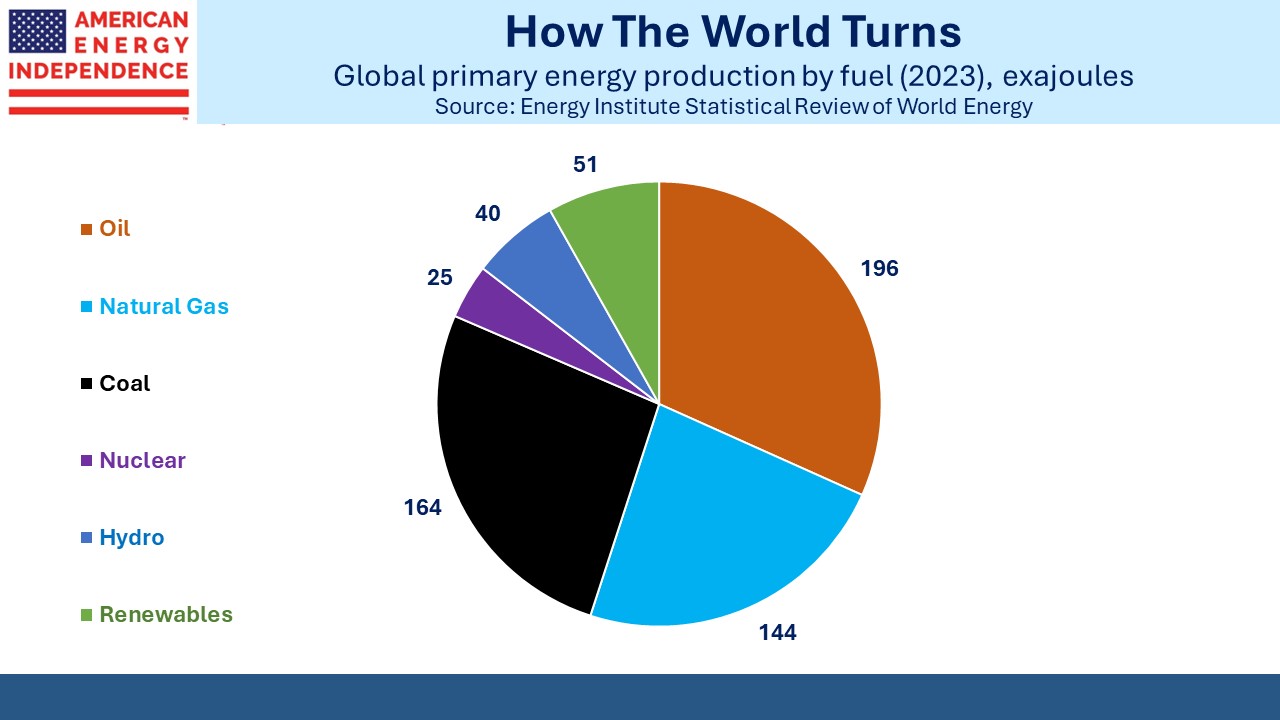

The outlook for natural gas demand is strong, because it generates less CO2 per unit of energy than coal and can compensate for the shortcomings of solar and wind. Increasing US LNG exports will help electricity reach more people in developing countries.

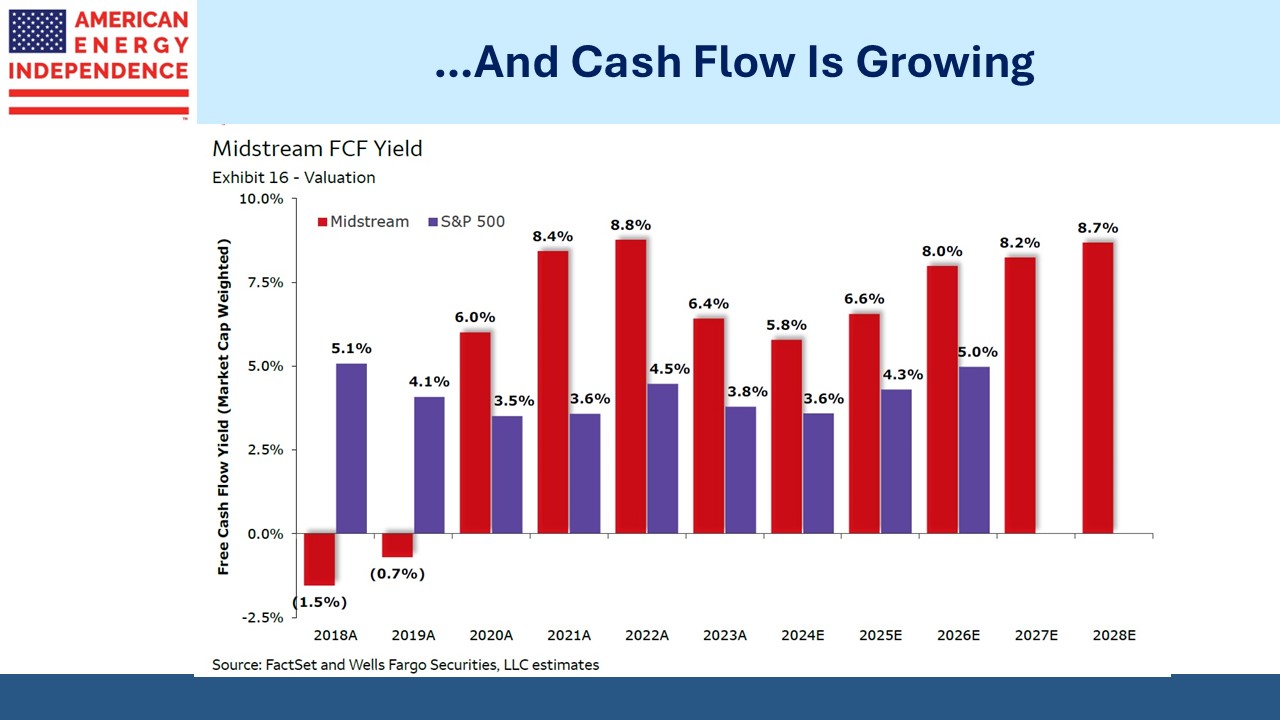

Morgan Stanley believes global power demand is at a tipping point, and it’s why the outlook for natural gas remains strong. We believe it will continue to support attractive returns from midstream energy infrastructure.

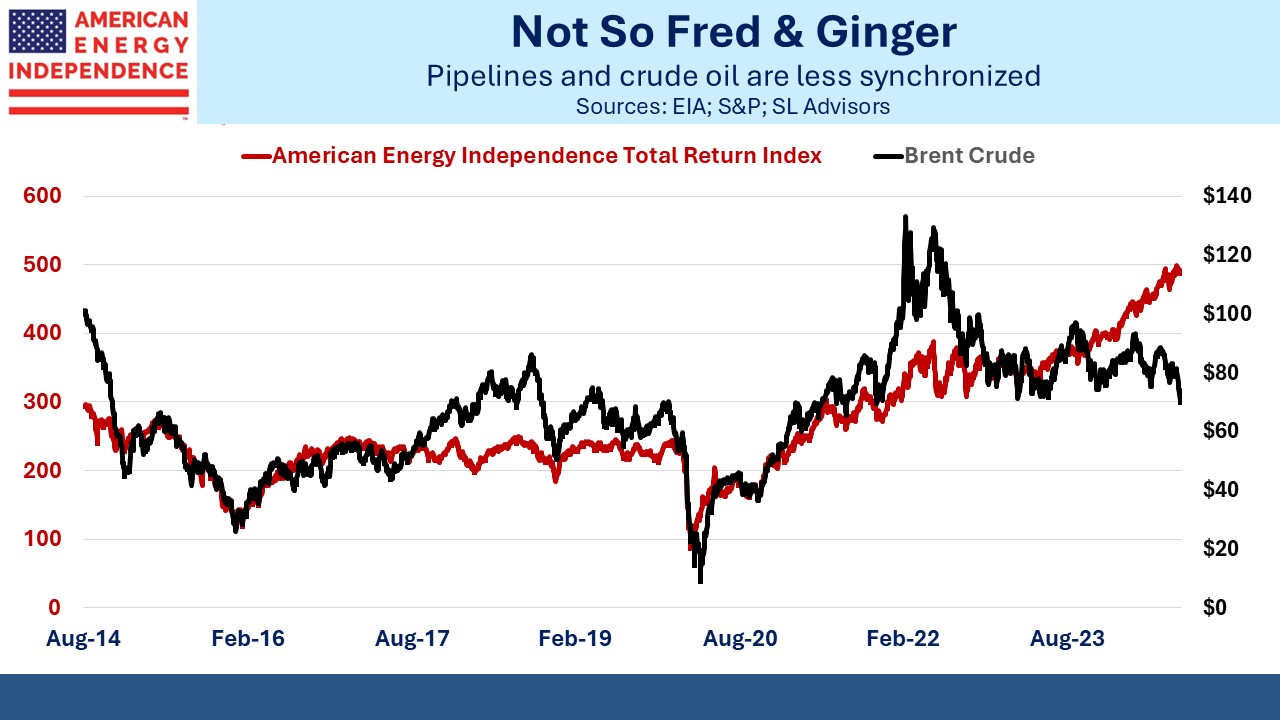

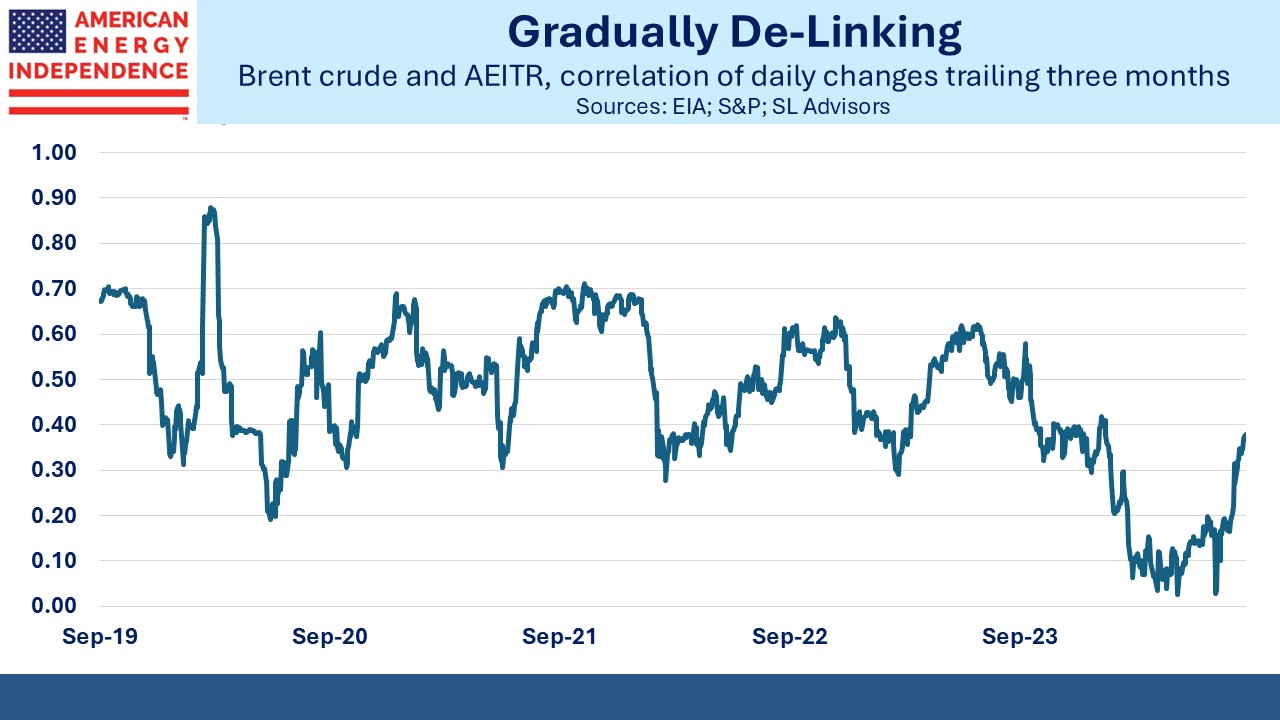

In other news, Saudi Arabia’s apparent willingness to abandon its $100 price target for oil is offsetting any geopolitical concerns caused by Israel’s demolition of Hamas and Hezbollah. Iran’s inability or unwillingness to respond to the decimation of its two proxies is reducing the market’s assessment of the risk of oil supply disruption. Weaker oil did correspond with softness in midstream stocks last week, especially those with more crude exposure such as Oneok and Targa Resources. However, the sector’s link with crude has steadily weakened in recent years as leverage has dropped (see Oil And Pipelines Look Less Like Fred And Ginger).

We have three have funds that seek to profit from this environment: