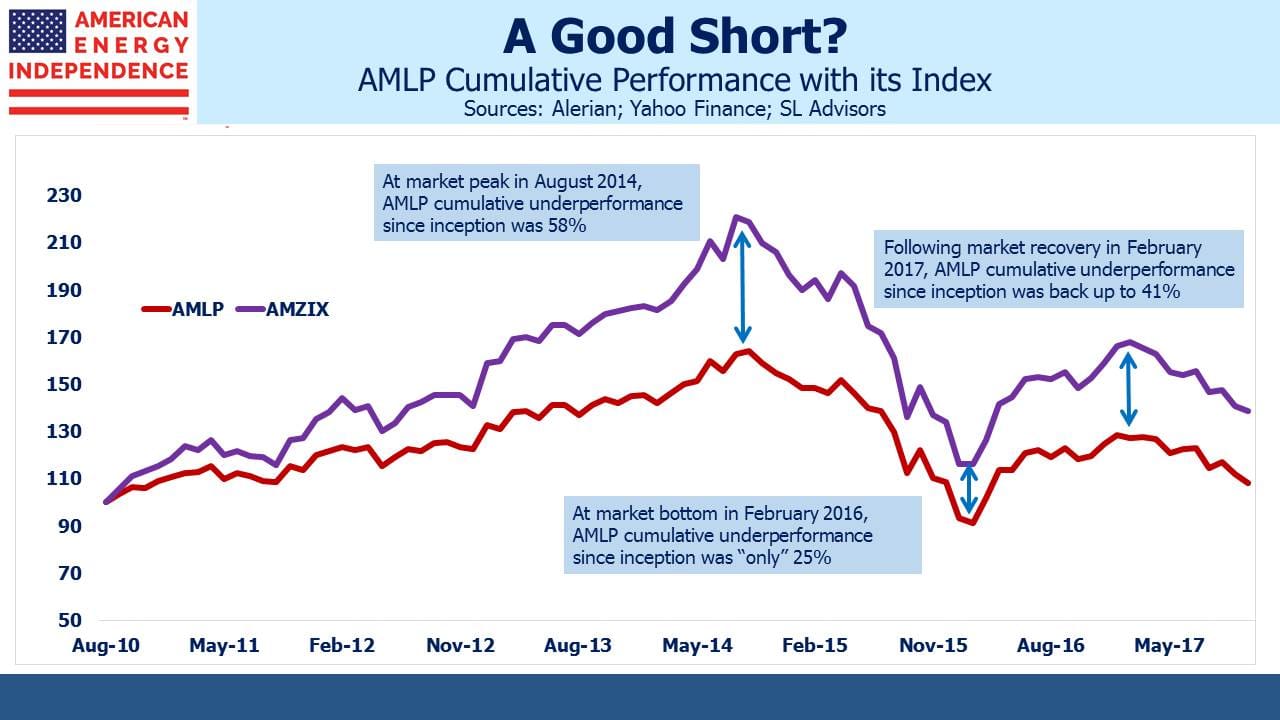

It’s not easy to hedge energy infrastructure stocks or MLPs. The relationship with crude oil is unreliable. There’s no MLP futures contract, and if you think the K-1s that come with owning MLPs are onerous, try shorting one and see how complex the tax reporting can be. The past few months has been a time when hedging such exposure would have reduced a lot of angst. For those interested in protecting against short term adverse price moves without completely foregoing upside, shorting the Alerian MLP ETF might make sense. We’ve written before about the tax drag that faces owners of AMLP (see Are You in the Wrong MLP Fund and Some MLP Investors Get Taxed Twice). This comes about because AMLP is a C-corp, rather than a Regulated Investment Company (RIC). Most ETFs and mutual funds don’t owe corporate tax, but AMLP does, at least when it makes money. When it’s down, its taxes owed are reduced. If it’s +1% pre-tax, its NAV will move up 1% less taxes owed. If it’s -1% pre-tax, its NAV will fall less than 1% because it’ll get a credit for owing less in tax. This makes AMLP less volatile than its index (the Alerian MLP Infrastructure Index) most of the time, since the taxes owed rise and fall with the market. However, it’s generally bad for owners because the taxes have contributed to AMLP lagging its index by 2.6% annually since inception in 2010, a cumulative 31%. It does best in a falling market, but since the point of owning it is to profit from the sector rising, the tax drag hurts. AMLP probably has the worst track record in the history of passive ETFs.

There’s an added wrinkle though, which is that taxes are only owed on unrealized gains. When the market falls enough to wipe those out, the tax issue temporarily disappears. Unrealized losses don’t create any tax benefit, so AMLP just roughly follows its index with similar volatility. What’s interesting is we’re close to an inflection point, in that we estimate AMLP’s unrealized losses will swing to unrealized gains with 5-6% further rally in the sector. As it crosses the line from losses to gains, AMLP will once again be subject to tax drag. So we’re close to a point at which it falls with the market but rises less than the market. Hedge funds were widely believed to be using AMLP to short the sector in just this fashion two years ago. This asymmetry could make it an interesting short position today. Its $9.5BN market cap means it isn’t hard to borrow. It could be used to hedge an existing portfolio of energy infrastructure securities, or even paired with a RIC-compliant fund not subject to corporate tax. The lower corporate tax rate will not alter AMLP’s taxable status, but will reduce its magnitude. Its future volatility will also rise closer to that of its index. Its value as a short position highlights its poor use as an investment, so if you’re simply long AMLP, the chronic history of underperformance will continue to work against you. We are short AMLP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.