In the Sweet Spot of Economics and Public Policy

The shift from natural gas importer to exporter has occurred in the U.S. over a remarkably short period of time. We’ve periodically written about this (see U.S. Natural Gas Exports Taking Off and The Global Trade in Natural Gas). Only a few years ago Cheniere Energy (LNG) was investing in facilities to import Liquified Natural Gas (LNG), anticipating that the U.S. would need to rely on foreign suppliers such as Australia and Qatar. The Shale Revolution changed all that, and the conversion of planned regasification plants to liquefaction began.

The story of how this shift occurred is only complete when the role of Cheniere’s founder Charif Souki is included. Greg Zuckerman’s wonderfully absorbing 2013 book, The Frackers paints colorful portraits of several key protagonists, and Souki is among them.

A Lebanese immigrant to the U.S., Souki’s early career was with a small U.S. investment bank where he raised money for deals in the Middle East, relying initially on his father’s contacts in the region. He was quite successful but eventually became tired of the deal making and travel. For several years he and his family lived in Aspen where he ran a restaurant. The relaxed lifestyle was a welcome change, and he enjoyed the regular visits of stars such as Jack Nicholson and Michael Douglas. However, the restaurant business wasn’t lucrative and eventually with his savings low he decided to shift directions again.

Given this background, Charif Souki was an unlikely energy pioneer. However, he applied his deal-making skills to the energy business and eventually wound up running tiny E&P company Cheniere Energy. The best part of the coverage of Souki in The Frackers describes how he convinced other investors to back him in developing LNG import facilities, only to subsequently have to raise more capital to convert them for export. It must have taken all his sales and deal-making skills to follow up one compelling vision with another, but he did.

Having brought Cheniere to the point at which it could start exports, Souki was forced out of the company by Carl Icahn. Souki’s substantial risk appetite had eventually paid off, but by then his shareholders were looking for rather less excitement. With $BNs in capital invested and contracts lasting 20+ years, the owners were looking for steady, reliable progress to realizing promised returns. Charif Souki was not that type of corporate leader.

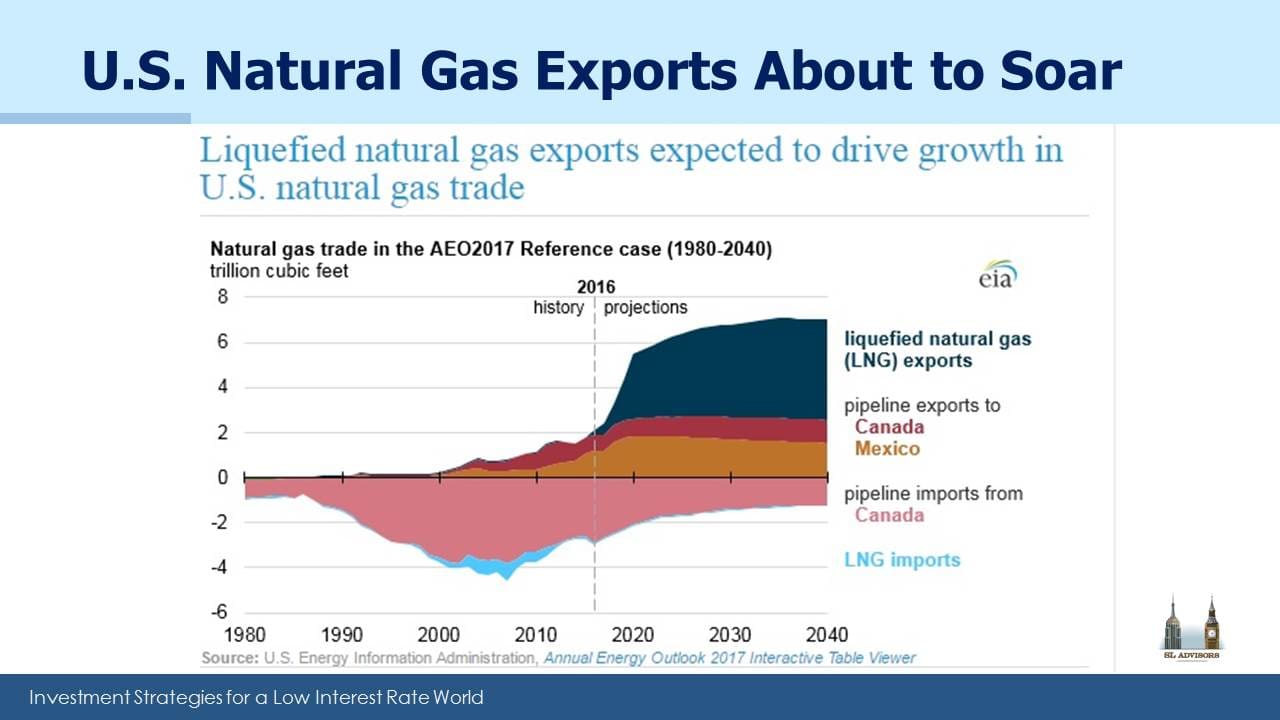

I was reminded of all this the other day when perusing company presentations from a recent Energy Information Administration (EIA) conference. This year U.S. LNG exports at times have exceeded imports, driven in no small part by Cheniere. EIA projections through 2040 show the U.S. quickly becoming a substantial exporter.

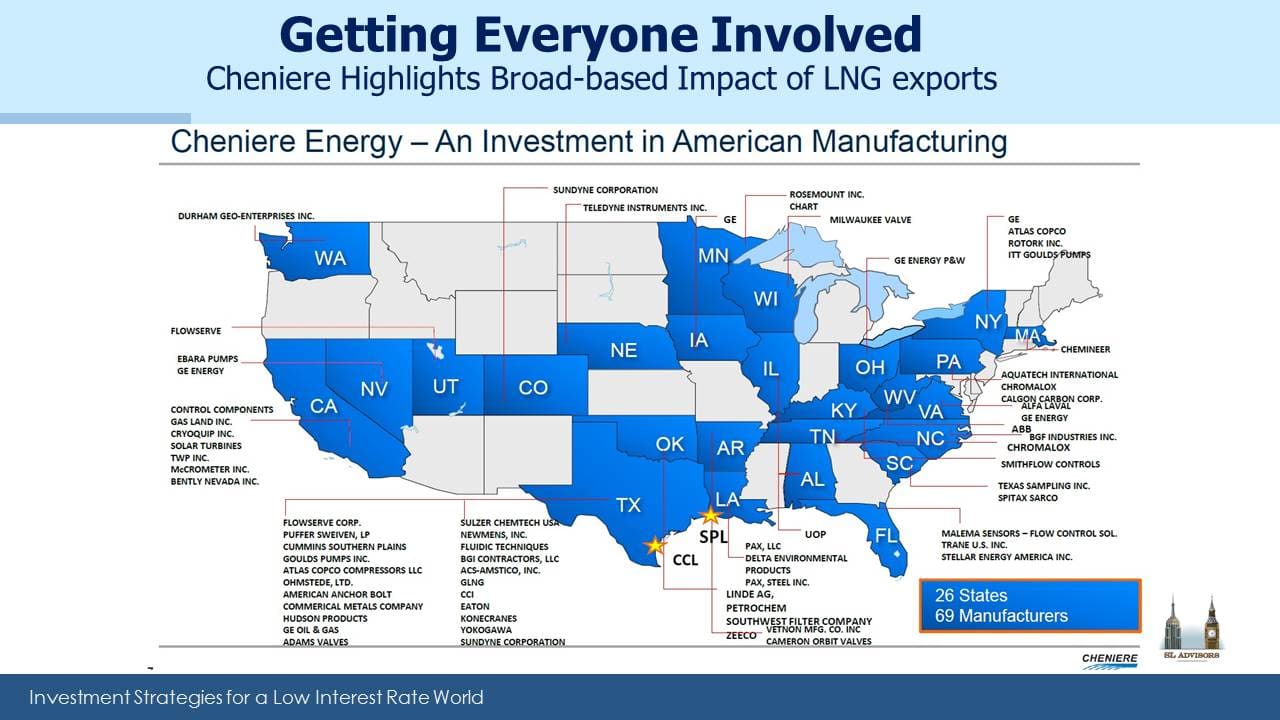

Much of the shift to U.S. exports is well known to those who follow the industry closely. What’s less appreciated is how Cheniere is aligning itself with Federal policy. The President clearly likes to promote America when he travels, and be associated with deals. On his recent trip to Poland he was pushing LNG exports. There’s no doubting the energy security benefits across Europe from diversifying their supplies of natural gas so as to be less reliant on Gazprom. Energy exports and armaments will be part of the dialogue in virtually every Presidential trip abroad, as U.S. foreign policy promotes buying energy from a stable democracy and (for NATO members) spending more on their own defense.

But Cheniere also understands the importance of domestic politics, as this slide shows. What could resonate more effectively with the White House than exporting domestically produced energy security around the world? Cheniere isn’t the only company to understand that they’re in the sweet spot of alignment between corporate profitability and public policy objectives.

We are invested in Cheniere Energy (LNG)

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!