U.S. Oil Output Approaches Record

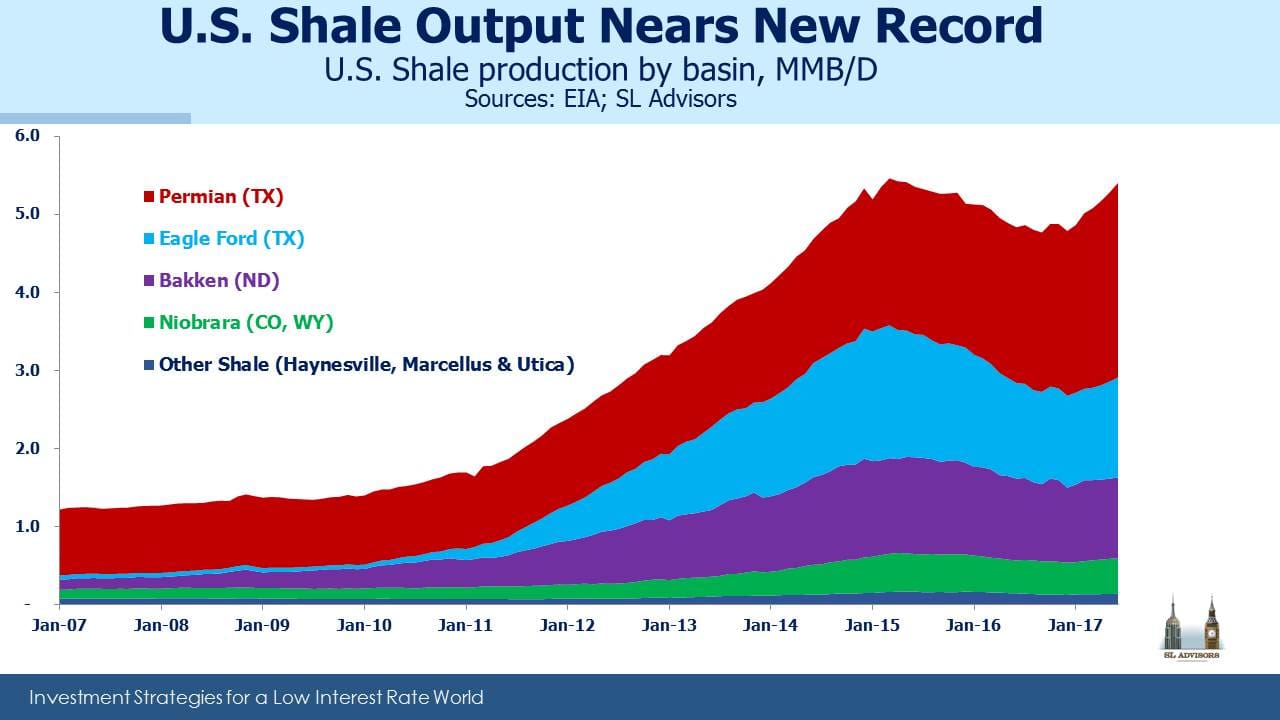

With the resurgence in U.S. crude oil production over the last year, it was only a matter of time until shale output reached a new record. Based on recent actual production and the EIA’s forecast for a June increase of 122 MB/D (thousand barrels a day), the peak of March 2015 is only 57 MB/D away.

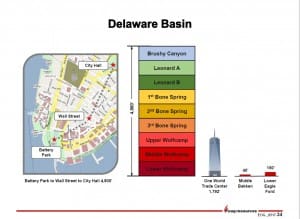

The Permian Basin in West Texas has been the principal driver of this increase in production. The depth of the play, as illustrated in the slide from a recent presentation by EOG (displayed above), holds substantial reserves and has benefited from extraordinary improvements in efficiency by the operators there which has brought down break-even levels. Many have underestimated the ability of the U.S. private sector to harness technology as effectively as they have. This is activity that OPEC expected to choke off through a ruinously low price of oil. Instead, they were forced to switch gears last November and concede steadily increasing market share to U.S. producers. Recently, OPEC quietly raised their 2018 forecast of total U.S. oil production (shale and conventional) to 10 MMB/D (million barrels a day). Given the capital being invested by drillers it’s plausible that by 2018 the U.S. could be the world’s biggest crude oil producer.

The most visible recent pipeline protest was against Energy Transfer’s (ET) Dakota Access Pipeline (DAPL) earlier this year. One of President Trump’s first actions was to correctly overturn an Obama-era executive order blocking its completion. But public demonstrations against fossil fuels continue elsewhere, even if their mentally agile adherents comfortably drive to join their friends in shouting against oil and natural gas.

As a consequence, managements of energy companies are recognizing that they need a strategy to deal with such protests, since a delayed pipeline can quickly become costly. At their Investor Day earlier this month, Williams Companies (WMB) CEO Alan Armstrong discussed their evolving attitude towards groups that seek to frustrate the implementation of infrastructure projects. Striving to learn from ET’s experience with DAPL, Armstrong described a policy of actively engaging with opponents to find common ground. He also noted the potential of other groups, such as construction unions keen for the jobs, to line with WMB in pushing projects forward.

Expect to see more savvy use of media by energy companies, including video of American workers making America Great accompanied by fast-paced, inspiring music. The WMB Analyst Day included a couple of short clips. Here’s another on WMB’s blog page (called “Pipe Up”), extolling the benefits of their Northeast Supply Enhancement project.

The education of investors about tax-inefficient MLP funds received a welcome boost from Barron’s. A letter from Mike Flaherty noted the tax drag on many poorly structured MLP funds included in a recent article, “Best ETFs for Income“. Flaherty correctly pointed out the value-destroying corporate tax liability incurred by AMLP and AMZA amongst others. Asked to respond, one PM blandly referred investors to seek tax advice, which is what you’d say if you ran a poorly designed fund and wished to change the subject. Barron’s hasn’t yet assigned a journalist to write on this topic, in spite of our suggestion that they’d be performing a useful service to countless MLP fund investors. But perhaps they will soon.

We are invested in Energy Transfer Equity (ETE) and WMB

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!