MLPs and Tax Reform

We’ve had a number of questions over the past 24 hours about the impact of the White House tax proposal on Master Limited Partnerships. Therefore, we’re posting our thoughts now rather than in our normal Sunday morning missive.

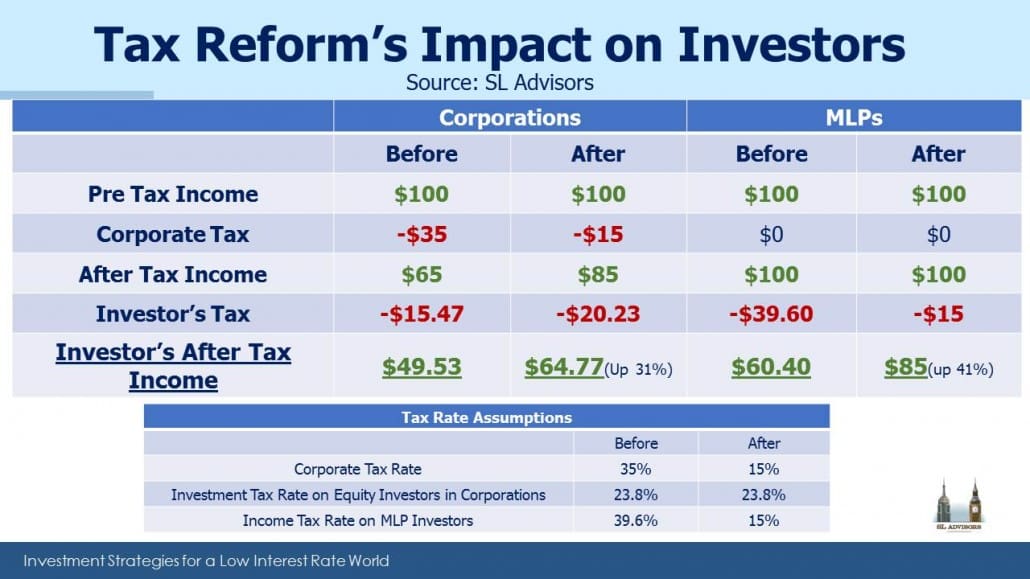

There’s not a great deal of specifics so far, but we’ve put together a table illustrating how it might impact after-tax returns for MLP investors and also how it might affect equity investors in corporations. Because MLPs are pass-through entities with no corporate tax liability, the tax reform proposal implies that the new, low corporate tax rate would apply to investors in MLPs rather than personal tax rates on investment income.

The proposed tax changes are good for most businesses. The biggest losers are likely to be taxpayers living in high-tax states such as NY, NJ or CA who currently receive significant deductions for state and local taxes (including property taxes) paid. We’ll leave that analysis to others.

For corporations, the lower corporate tax rate leaves more after-tax income to be paid to equity investors. We’ve assumed that tax rates on personal income and investment income are unchanged so as to focus in on the impact of the corporate tax rate change. We’ve also limited this analysis to Federal taxes. MLP investors often benefit greatly from deferring taxes on most of their distributions, which lowers their effective tax rate. We’ve ignored this deferral benefit as well for the analysis, although many investors (your blogger included) have MLP holdings that date back many years. But we’ve also assumed that corporations distribute all their after-tax income whereas in most cases they reinvest a portion back in their businesses and buy back stock which also defers taxes for the long term holder. Tax analysis inevitably requires making lots of assumptions.

With all these caveats, the boost to after tax income for all investors is significant, although it’s larger for MLP investors. It’s also worth noting that the relative attractiveness of MLPs compared with corporations increases with tax reform. In our example, MLP investors currently retain $60.40 from their investment versus $49.53 in a corporate structure, or 22% more. This advantage increases to 31% ($85 versus $64.77) following tax reform.

There are secondary effects too – if tax reform boosts GDP, corporate profits should rise as should energy consumption, which will drive increased demand for energy infrastructure. Furthermore, while not specifically addressed in the proposal the administration has signaled its openness to accelerated write-offs benefiting capital intensive industries with large growth capex opportunities, such as the energy infrastructure sector. They’ll also want to avoid creating economic uncertainty, so we shouldn’t expect contractionary moves, such as the ending of deductions for business-interest payments.

We think tax reform could provide a significant boost to MLPs by increasing the after-tax return to investors.

This blog discusses tax issues specific to MLPs. However, this is not intended to be specific personal tax advice. Each investor’s tax situation is unique and for specific advise you should seek the counsel of your own tax adviser.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

If tax reform provides for an immediate deduction of capital expenditures, rather than depreciation, then the deferral portions of the distributions would likely be enhanced even further.