MLPs and Tax Reform

We’ve had a number of questions over the past 24 hours about the impact of the White House tax proposal on Master Limited Partnerships. Therefore, we’re posting our thoughts now rather than in our normal Sunday morning missive.

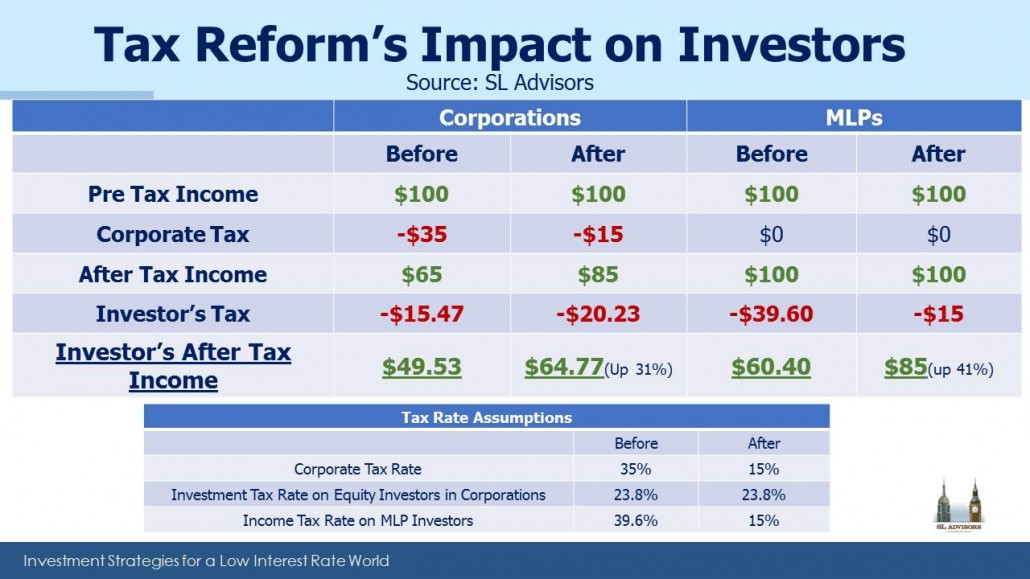

There’s not a great deal of specifics so far, but we’ve put together a table illustrating how it might impact after-tax returns for MLP investors and also how it might affect equity investors in corporations. Because MLPs are pass-through entities with no corporate tax liability, the tax reform proposal implies that the new, low corporate tax rate would apply to investors in MLPs rather than personal tax rates on investment income.

The proposed tax changes are good for most businesses. The biggest losers are likely to be taxpayers living in high-tax states such as NY, NJ or CA who currently receive significant deductions for state and local taxes (including property taxes) paid. We’ll leave that analysis to others.

For corporations, the lower corporate tax rate leaves more after-tax income to be paid to equity investors. We’ve assumed that tax rates on personal income and investment income are unchanged so as to focus in on the impact of the corporate tax rate change. We’ve also limited this analysis to Federal taxes. MLP investors often benefit greatly from deferring taxes on most of their distributions, which lowers their effective tax rate. We’ve ignored this deferral benefit as well for the analysis, although many investors (your blogger included) have MLP holdings that date back many years. But we’ve also assumed that corporations distribute all their after-tax income whereas in most cases they reinvest a portion back in their businesses and buy back stock which also defers taxes for the long term holder. Tax analysis inevitably requires making lots of assumptions.

With all these caveats, the boost to after tax income for all investors is significant, although it’s larger for MLP investors. It’s also worth noting that the relative attractiveness of MLPs compared with corporations increases with tax reform. In our example, MLP investors currently retain $60.40 from their investment versus $49.53 in a corporate structure, or 22% more. This advantage increases to 31% ($85 versus $64.77) following tax reform.

There are secondary effects too – if tax reform boosts GDP, corporate profits should rise as should energy consumption, which will drive increased demand for energy infrastructure. Furthermore, while not specifically addressed in the proposal the administration has signaled its openness to accelerated write-offs benefiting capital intensive industries with large growth capex opportunities, such as the energy infrastructure sector. They’ll also want to avoid creating economic uncertainty, so we shouldn’t expect contractionary moves, such as the ending of deductions for business-interest payments.

We think tax reform could provide a significant boost to MLPs by increasing the after-tax return to investors.

This blog discusses tax issues specific to MLPs. However, this is not intended to be specific personal tax advice. Each investor’s tax situation is unique and for specific advise you should seek the counsel of your own tax adviser.