Energy Transfer Shows Who's the Boss

Ten days ago, investors in Energy Transfer Partners (ETP) were content with a high distribution yield of 11%, albeit with little growth and (if they were honest with themselves) some risk of a cut in the future. Investors in Sunoco Logistics (SXL) had similarly come to terms with a 7.6% yield bolstered by the prospect of high single digit growth. The buyers of each security had self-segregated to the combination of current income and growth prospects that suited them.

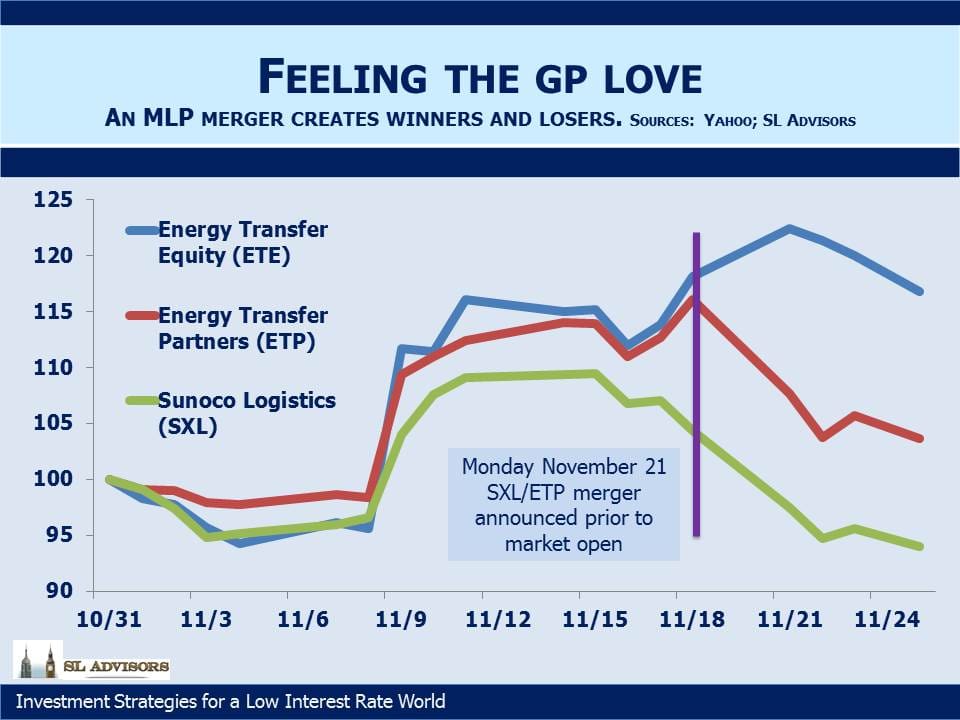

Once again, Energy Transfer Equity (ETE) CEO Kelcy Warren has surprised, creating sharp price movements and fresh blog material in the process. As General Partner (GP) of ETP and SXL, ETE controls them both, and that control was on full display. So it is that SXL is acquiring ETP, upsetting the basis on which investors in both securities had made their decisions. ETP investors currently receive a $4.22 annual distribution. In exchange for their ETP units they’ll receive 1.5 SXL units. SXL pays a $2.04 distribution, so the new $3.06 distribution (i.e. $2.04 X 1.5) represents a 27.5% cut for ETP investors. They weren’t happy.

Meanwhile, SXL’s high single digit distribution growth prospects may now be challenged following its combination with the slower-growing ETP assets, although the $200MM in annual operating synergies will help. In short, ETP and SXL investors will both shortly own something different than they bought. If ETP investors had favored growth over income they would have already held SXL. It was a demonstration that Limited Partners (LPs) in MLPs are limited in more ways than one.

Both ETP and SXL were down sharply once the deal was announced. It’s not an obviously bad transaction, and Kelcy Warren made a good case for the combination on a conference call later the day of the announcement. It just imposes a different return profile on current investors than they sought. So there will probably be some turnover as the unhappy sell their holdings to the optimistic.

The winners include ETP bondholders, since less cash paid to equity holders in the form of distributions means improved debt coverage. The other winner is ETE, which shouldn’t be surprising because that’s where Kelcy Warren invests his money. Although near term Distributable Cash Flow (DCF) to ETE will be lower than before, since distributions to the former ETP investors will be lower, it makes the Incentive Distribution Rights (IDR) forgiveness that ETE has extended likely to lapse within a couple of years rather than possibly continuing on. The new SXL will be larger and more diversified, which should in time lead to a lower cost of capital.

We’re invested in ETE, alongside management because that’s what we do. Even that close alignment doesn’t always guarantee success; earlier this year we noted how Kelcy Warren issued new convertible preferreds to himself and the management team that gave them the ability to reinvest dividends at a fixed, low price of ETE (see Is Energy Transfer Quietly Fleecing its Investors?). As a result, Kelcy is regularly buying new ETE units at $6.56 each, the level they hit earlier this year because of his ill-advised pursuit of Williams Companies (WMB), even though the collapse of that transaction and subsequent rebound in the sector has taken ETE back as high as $18.

Investors in ETE are there rather than ETP or SXL precisely because we understand the favorable asymmetry that benefits the GP. The dilution of ETE investors that these convertible preferreds causes was therefore a bitter pill for the non-management ETE investors to swallow. A class action lawsuit followed (Energy Transfer Equity LP Unitholder Litigation), in which the plaintiffs alleged these securities unfairly transferred wealth from them to management. Based on reviewing the transcript of oral arguments earlier this month, the memorably named Judge Glasscock appears to be sympathetic to this claim although allowed that he needs to study the relevant documents before ruling. If the offending securities are cancelled as they should be, a future transfer of well over $1BN in ETE interests to management will not take place.

Faced with the prospect of investing in someone who so easily abandons his fiduciary obligation to his investors, we were tempted to give up on ETE. However, they’re a smart management team and fortunately we allowed our commercial instincts to trump our principles. It’s what Kelcy would have done.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The difference between you and Warren is that you have principles to overcome by your commercial interests. He has only commercial interests and does not appear to be burdened by an excess of principles.

Let’s hope principle triumphs over Warren’s commercial interests when Judge Glasscock has finished studying the documents.

This what is happening in corporate America-too much greed!!!

That is why I am becoming an activist for shareholders and employees against management.

Also, this is another red flag against mlp’s!!

Simon, how sensitive has ETE been to the Feds interest rate adjustments?

Year end…K-1’s or 1099’s?

Whatever sensitivity ETE has to the Fed has been overwhelmed by issues specific to them, such as the WMB merger. Given this, there is no discernible correlation between ETE and short term rates. ETE holders get a K-1.