Stability with Falling Costs in MLP Earnings

Last week saw the bulk of our MLPs reporting on quarterly earnings. The drop in crude oil and tightening election probably counted for more as the market was weak. But we felt earnings were generally in line with expectations with few negative surprises. There were plenty of questions on the regulatory environment for new projects. In response to a less certain and more drawn out approvals process, MLPs are revising their assumptions about how long projects take as well as steering away from less friendly areas such as New England. Several noted that pipes already in the ground have greater value as it becomes harder to build new ones.

Plains All American (PAA), reported results that were a little weaker than expected in spite of positive developments in the Permian. The existence of Minimum Volume Commitments (MVCs) makes it harder for them to forecast take-away demand even if they can forecast supply. This is because excess pipeline capacity in a region can cause E&P companies to take decisions that would otherwise seem uncommercial because of an MVC. If you’ve committed to buy pipeline capacity and have to pay for it regardless of whether or not you use it, this can cause you to ship oil or gas as long as the net revenue offsets some of the MVC. This squeezes margins and skews basis differentials. Since contracts are private, it’s hard to know who’s acting based on an MVC versus more normal economics. PAA CEO Greg Armstrong commented on this issue during their call and noted how even with PAA’s detailed knowledge it makes forecasting demand harder.

We are invested in Plains GP Holdings (PAGP) which will soon merge with PAA. We expect U.S. crude oil production to increase slightly over the next several quarters and significantly over the next several years and PAA/PAGP should see increased cashflows from higher utilization of their pipeline network.

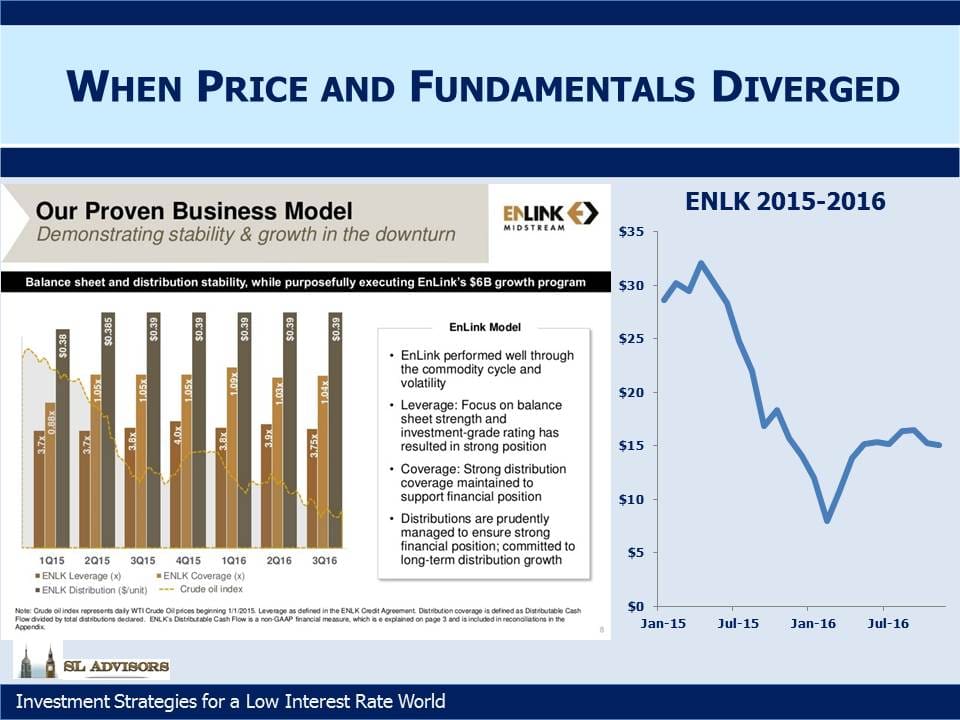

A couple of things stood out to us and are displayed below. Enlink Midstream Partners (ENLK) and its General Partner Enlink Midstream LLC (ENLC) reported solid earnings. In 2015 MLP prices fell far in excess of what was justified by the fundamentals. The slide from ENLK’s recent earnings call shows stability in metrics such as their Leverage Ratio, which ranged from a low of 3.7X to a high of 4.0X over the past seven quarters and is now back to 3.75X. Distribution coverage has stayed virtually unchanged. And yet in February ENLK had lost two thirds of its value from a year earlier. The emergency liquidation by many investors, seemingly without regard for the fundamentals, was responsible.

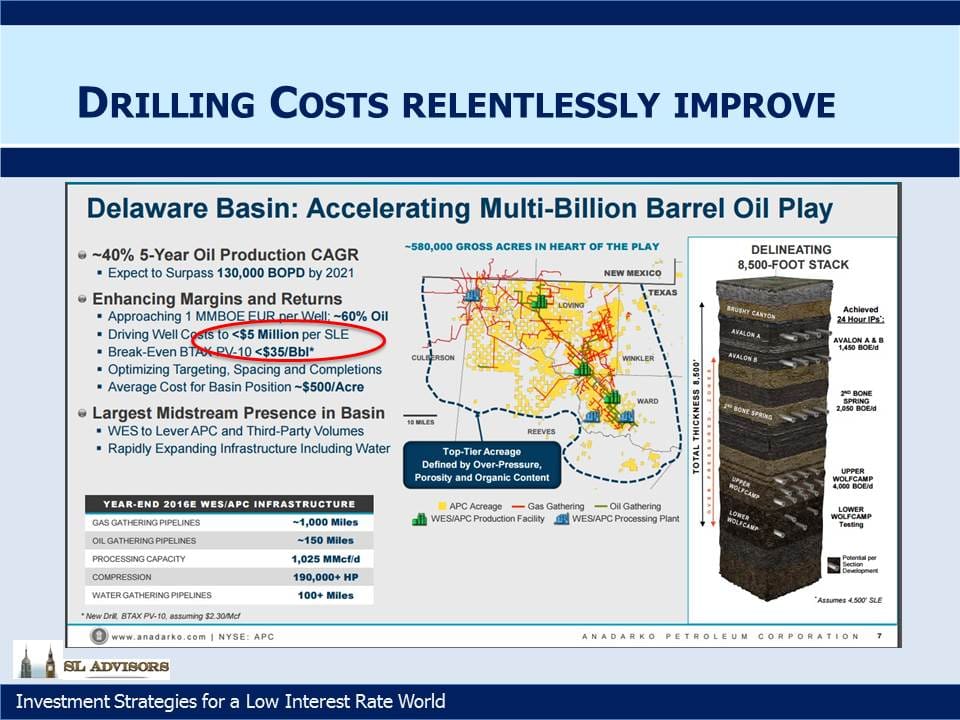

Another interesting chart was from Anadarko Petroleum (APC), who control Western Gas Equity Partners (WGP) by virtue of their 78% ownership. WGP in turn is the GP of Western Gas Partners (WES). APC’s onshore drilling activity is in the Delaware Basin in West Texas and DJ Basin in Colorado and Wyoming. They’re WES’s biggest customer, and so APC’s ability to reduce costs over the past couple of years impacts volumes passing through WES’s midstream infrastructure.

APC now reports that their cost to drill a well is below $5MM, and their breakeven to produce an acceptable return on capital is $35 a barrel. Shale drilling is characterized by numerous wells cheaply drilled with fast payback times, by contrast with conventional projects that require high up front investment and long payback times. This is why we believe U.S. producers with access to “tight” oil are becoming the swing producers; more nimble than conventional suppliers, they can respond more easily to price signals. For more on this, see Prospects Continue to Brighten for U.S. Energy Infrastructure and OPEC Blinks.

Regarding OPEC, the strategy embarked on two years ago of seeking market share at the expense of price has been a colossal failure. A recent article by the Petroleum Economist (only available to subscribers) noted that OPEC’s oil revenues had plunged from $0.75TN during the twelve months ending October 2014 to 338BN over the past year, a drop of 55%. OPEC may fail once again to restrain output among its members, but regardless they have helped usher in a far more efficient era in U.S. shale production (see Why the Shale Revolution Could Only Happen in America). The Petroleum Economist article closes with, “OPEC lost this battle – and it knows it. It is tired of cheap oil.”

We are invested in ENLC, PAGP and WGP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

While it is often said OPEC lost the battle, I think the question is what if they had chosen not to fight it, namely, had chosen to keep prices high at end of 2014? The world was clearly oversupplied with oil, with a flood of new oil coming online. By letting the market fall, OPEC (and by OPEC I mean the Saudis) set the stage for a decline if supply and demand increased slightly. The brakes have been put on deep sea offshore, tar sands and most other expensive developments. Many were in works and were completed despite the price of oil, but a halt was put on many on the drawing board. In 2017 or 2018 oil will turn, as the lack of project authorized in the last 2 years finally impact supply. Thus, OPEC had no good options, but letting prices fall as they did was in my opinion the lest bad option.