Stability with Falling Costs in MLP Earnings

Last week saw the bulk of our MLPs reporting on quarterly earnings. The drop in crude oil and tightening election probably counted for more as the market was weak. But we felt earnings were generally in line with expectations with few negative surprises. There were plenty of questions on the regulatory environment for new projects. In response to a less certain and more drawn out approvals process, MLPs are revising their assumptions about how long projects take as well as steering away from less friendly areas such as New England. Several noted that pipes already in the ground have greater value as it becomes harder to build new ones.

Plains All American (PAA), reported results that were a little weaker than expected in spite of positive developments in the Permian. The existence of Minimum Volume Commitments (MVCs) makes it harder for them to forecast take-away demand even if they can forecast supply. This is because excess pipeline capacity in a region can cause E&P companies to take decisions that would otherwise seem uncommercial because of an MVC. If you’ve committed to buy pipeline capacity and have to pay for it regardless of whether or not you use it, this can cause you to ship oil or gas as long as the net revenue offsets some of the MVC. This squeezes margins and skews basis differentials. Since contracts are private, it’s hard to know who’s acting based on an MVC versus more normal economics. PAA CEO Greg Armstrong commented on this issue during their call and noted how even with PAA’s detailed knowledge it makes forecasting demand harder.

We are invested in Plains GP Holdings (PAGP) which will soon merge with PAA. We expect U.S. crude oil production to increase slightly over the next several quarters and significantly over the next several years and PAA/PAGP should see increased cashflows from higher utilization of their pipeline network.

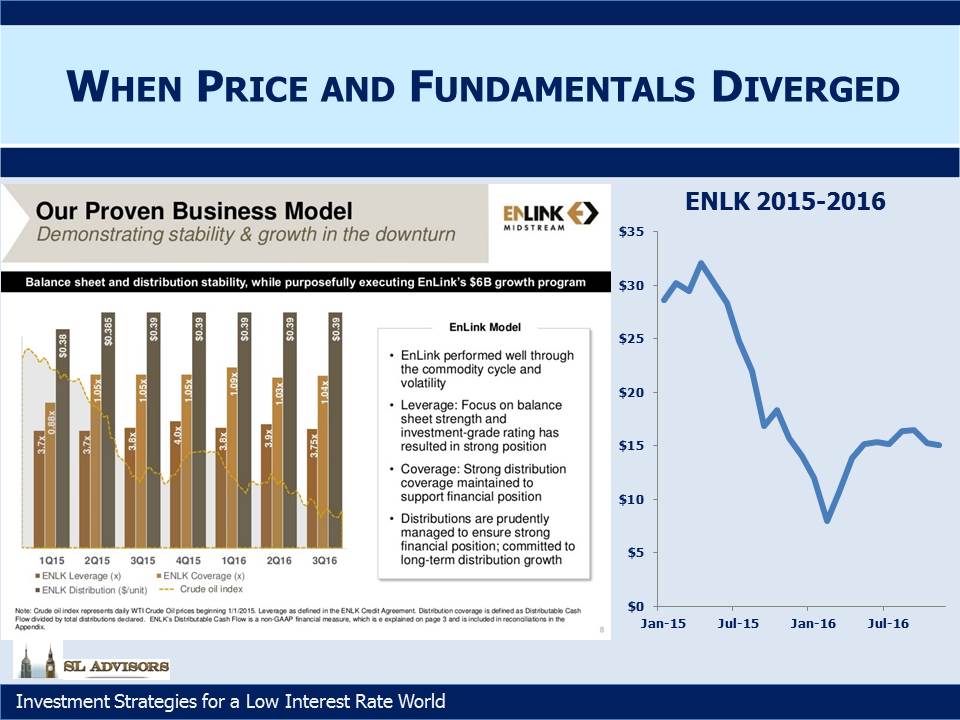

A couple of things stood out to us and are displayed below. Enlink Midstream Partners (ENLK) and its General Partner Enlink Midstream LLC (ENLC) reported solid earnings. In 2015 MLP prices fell far in excess of what was justified by the fundamentals. The slide from ENLK’s recent earnings call shows stability in metrics such as their Leverage Ratio, which ranged from a low of 3.7X to a high of 4.0X over the past seven quarters and is now back to 3.75X. Distribution coverage has stayed virtually unchanged. And yet in February ENLK had lost two thirds of its value from a year earlier. The emergency liquidation by many investors, seemingly without regard for the fundamentals, was responsible.

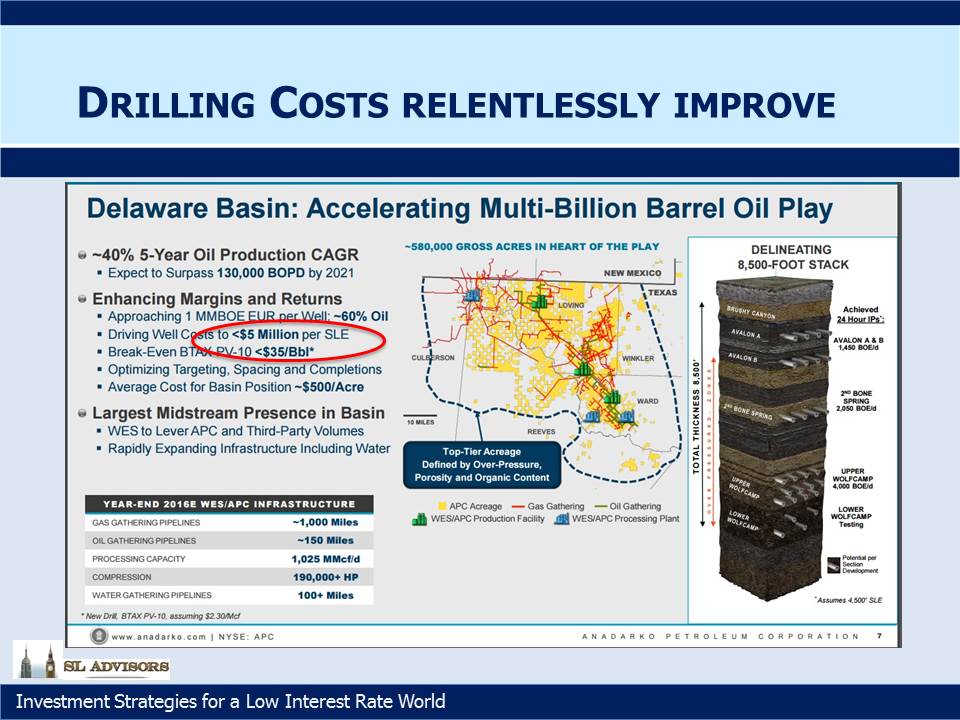

Another interesting chart was from Anadarko Petroleum (APC), who control Western Gas Equity Partners (WGP) by virtue of their 78% ownership. WGP in turn is the GP of Western Gas Partners (WES). APC’s onshore drilling activity is in the Delaware Basin in West Texas and DJ Basin in Colorado and Wyoming. They’re WES’s biggest customer, and so APC’s ability to reduce costs over the past couple of years impacts volumes passing through WES’s midstream infrastructure.

APC now reports that their cost to drill a well is below $5MM, and their breakeven to produce an acceptable return on capital is $35 a barrel. Shale drilling is characterized by numerous wells cheaply drilled with fast payback times, by contrast with conventional projects that require high up front investment and long payback times. This is why we believe U.S. producers with access to “tight” oil are becoming the swing producers; more nimble than conventional suppliers, they can respond more easily to price signals. For more on this, see Prospects Continue to Brighten for U.S. Energy Infrastructure and OPEC Blinks.

Regarding OPEC, the strategy embarked on two years ago of seeking market share at the expense of price has been a colossal failure. A recent article by the Petroleum Economist (only available to subscribers) noted that OPEC’s oil revenues had plunged from $0.75TN during the twelve months ending October 2014 to 338BN over the past year, a drop of 55%. OPEC may fail once again to restrain output among its members, but regardless they have helped usher in a far more efficient era in U.S. shale production (see Why the Shale Revolution Could Only Happen in America). The Petroleum Economist article closes with, “OPEC lost this battle – and it knows it. It is tired of cheap oil.”

We are invested in ENLC, PAGP and WGP