Europe Follows California Into Renewables Oblivion

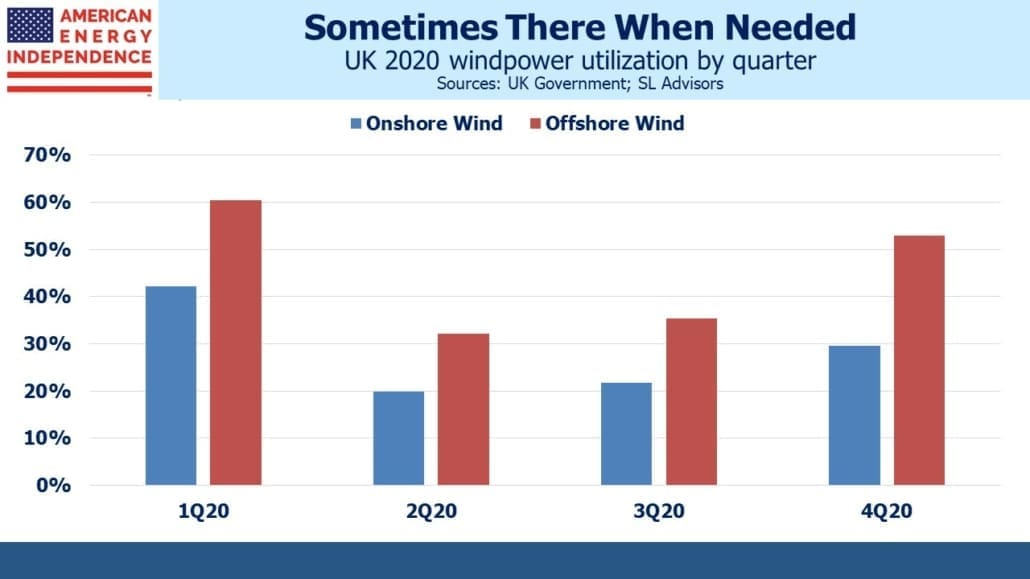

A feature of renewables not widely acknowledged is their relatively low capacity utilization. Solar is limited to daytime, with peak generation around midday. Output is typically 20-25% of capacity, meaning a 10 MW solar farm would generate 48-60MWh every 24 hours. The UK’s windpower capacity utilization was 37% last year, higher than is typical. As the chart shows, it bounces around unpredictably.

Offshore wind tends to produce more often than onshore, which is why the UK has been adding installations in the windy North Sea. The recent tranquility has cut wind to 7% of UK power generation, from 24% last year, likely bringing capacity utilization down to 10-11%. The sheep in the photo have evidently learned that windmills can offer relief from the sun at least as often as they produce electricity. It’s true the tower is stationary, but careful examination of the photo also reveals sheep standing in the shadow of the (presumably motionless) blades.

Three years ago efforts to develop fracking of natural gas in Britain were abandoned following relentless pressure from environmental extremists (see British Shale Revolution Crushed: America’s Unique Ownership of Oil and Gas). The UK’s Lord Ridley, a member of the House of Lords, warned that Russia was funding the opposition to these efforts to reduce Britain’s reliance on imported energy. NATO’s secretary general had voiced similar concerns as far back as 2014.

Ridley recently referred to Friends of the Earth, a vocal opponent of fracking in the UK, as “useful idiots” during a radio interview. They shared Russia’s objective of crushing domestic gas production, albeit for different reasons. Now the IEA is calling for Russia to increase such exports to Europe. Russian funding of western environmental opposition to natural gas production has delivered Russia an astronomical IRR, about to be paid for by European governments forced to subsidize household energy bills.

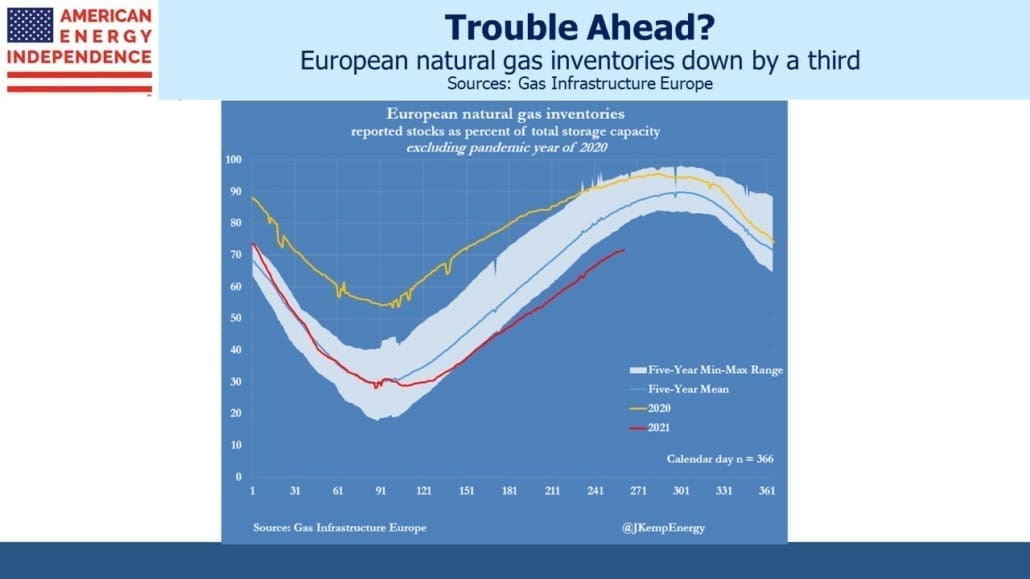

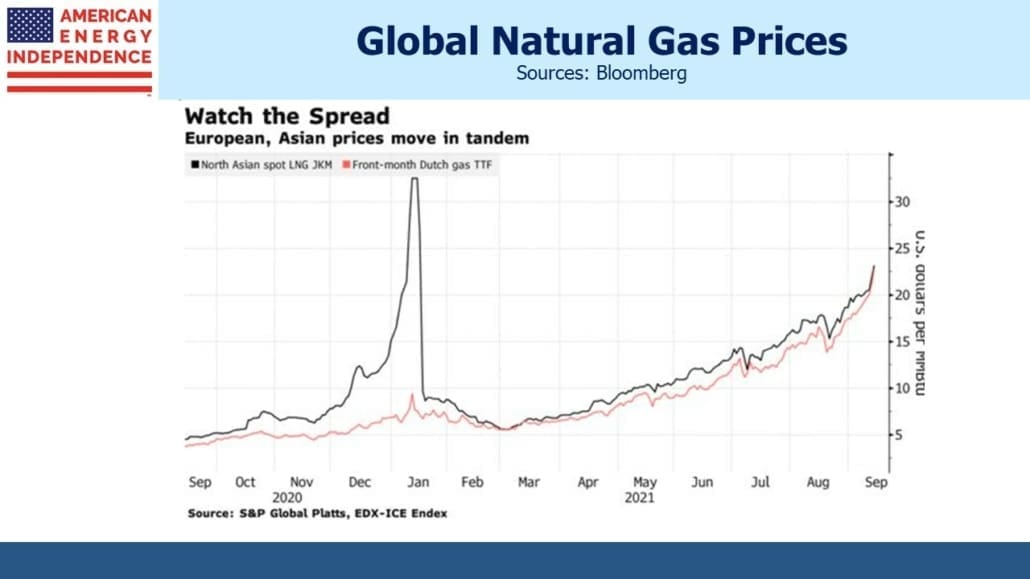

The energy squeeze confronting western Europe is coming at a time when energy demand is usually low. Cooler weather as summer ends is when natural gas supplies are typically built up in preparation for winter. For reasons that include mysteriously low Gazprom exports and a Brazilian drought that has lowered hydropower, global natural gas prices are soaring.

Analysts are warning that Europe faces a real possibility of power cuts if unusually cold weather exposes low gas inventories. Compounding matters, Gazprom CEO Alexey Miller recently said that, “… the Asian market is more attractive for producers and investors despite the record-breaking prices in Europe.”

Asian and European natural gas prices have risen together, with Asian buyers especially keen to avoid a repeat of last January’s winter squeeze. As a result, they are often outbidding European buyers for shipments of liquified natural gas.

European governments are being forced to respond to sharply higher household electricity bills and bankruptcy risk among electricity providers. An Italian government source said, “a plausible amount to tackle the issue [of soaring energy costs] could reach up to €4.5bn.” U.K. Business Secretary Kwasi Kwarteng warned that the country faces a “long, difficult” winter with high energy prices tipping power suppliers into bankruptcy.

So far the UK is not planning to bail out power suppliers that fail, and PM Johnson has refused to scrap “green levies” on power bills even though they’ve helped cause the problem by subsidizing windpower investments.

Since the energy transition is all about new technologies, policymakers need to look beyond intermittent sources of energy. Direct Air Capture of CO2 is another example of what might be possible while allowing reliable electricity generation to continue.

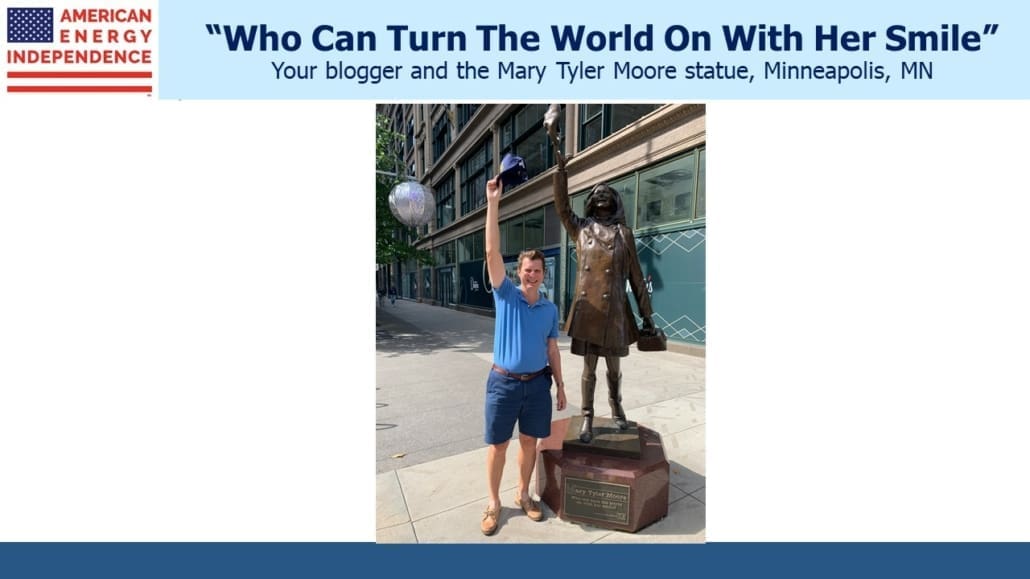

On a different topic, my wife and I were disappointed to find downtown Minneapolis almost deserted on a recent Sunday lunchtime, still reeling from the twin blows of Covid lockdowns and violent protests following George Floyd’s murder. Nicollet is described as “downtown’s core shopping and entertainment artery” on the city’s hopelessly out of date website.

I posed next to the Mary Tyler Moore statue watched by two bored cops and no one else. A 20 minute drive north, a local strip mall had lost all its tenants except for a Dollar Tree. Afterwards we headed to Duluth, on Lake Superior, which was more vibrant.

We went to Minnesota to visit my wife’s penpal of 45 years, a relationship that began when they were both in middle school. Their friendship through writing predates our own. They had shared life’s events via air-mail letters and birthday cards, retaining this medium even when email because ubiquitous, but had never met until now. Over several very agreeable hours we became friends with a warm and friendly family, typical of the midwest. Our next meeting won’t take as long.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Minneapolis, Seattle, Portland, LA, San Francisco, etc. downtown cores are empty, or covered in tents and feces’ welcome to the left’s vision for America.