Pipeline Earnings Provide A Boost

Investors often ask, what will it take to get pipeline stocks moving upwards? Attractive valuations and the prospect of higher cashflows are compelling, but when will investors start acting?

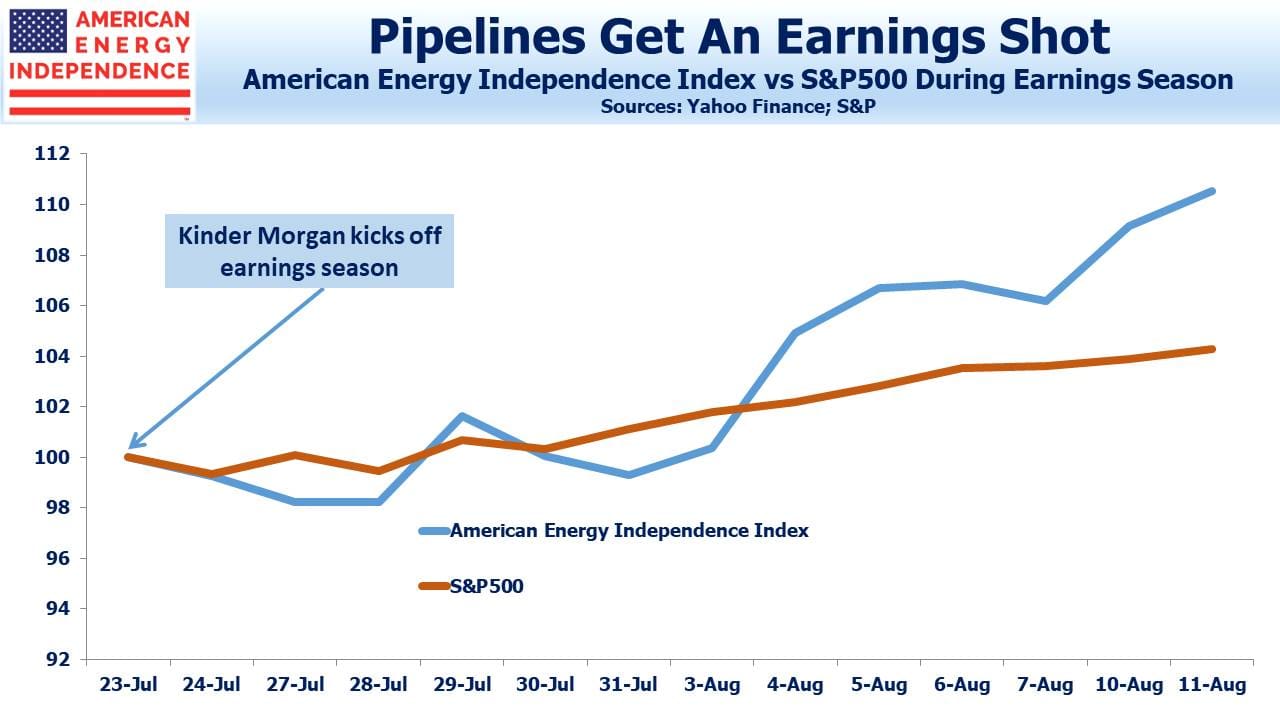

They may already being doing so. Kinder Morgan kicked off earnings after the close on July 23rd. Since then, results for the sector have generally come in as expected, with more positive surprises than negative. The encouraging free cash flow outlook remains intact (see Pipeline Cash Flows Will Still Double This Year). The most positive among the big companies was Williams Companies (WMB), whose earnings scarcely showed any impact of the pandemic (see Williams Has Covid Immunity). Their gathering and processing business held up better than volumes across the country, and WMB took another $100MM off their 2020 growth capex which further cheered investors. WMB was up 8% following the announcement.

The two big Canadians, Enbridge (ENB) and TC Energy (TRP) were both resilient. ENB even added $100MM to their growth capex plans – they’re probably the only company that could do so without seeing their stock sell off. TRP has one of the bigger capex budgets, mostly driven by the perennially delayed Keystone XL. Joe Biden has committed to withhold the required Federal approval of this cross-border project, reflecting a leftward shift in his platform. If he wins the election, Canadian oil producers will suffer but investors in TRP will likely benefit from higher free cash flow without the Keystone spending.

Cheniere Energy (CEI) reported $405MM of cargo cancellation revenues. Cheniere has always maintained that their 100% investment grade customer base and very long term contracts insulated the company from fluctuating volumes. Falling demand for shipments of Liquified Natural Gas (LNG) caused some weakness in CEI earlier in the quarter. The $405MM represents some tangible evidence of the security of the contracts. Typically, when a buyer cancels a contract CEI takes ownership of the LNG shipment and is free to find a new buyer.

Energy Transfer (ET) remains one of the cheapest big pipeline companies – their eye-popping 17% yield is in part because of CEO Kelcy Warren’s opportunistic ethical lapses (see Energy Transfer’s Weak Governance Costs Them). Questions remain around their elevated leverage, which is still above 5X. Some analysts would like to see them cut their distribution so as to delever faster. The company believes they can rely on growing EBITDA, although CFO Tom Long did say, “…the distributions are a topic when we discuss how to get the leverage down.” So that 17% yield isn’t secure.

Oneok (OKE) saw weaker than expected gathering and processing results, and they revised full year EBITA guidance to the low end of the range so they see continuing softness.

We thought Plains All American (PAGP), which is all crude oil, should have done better in their Supply and Logistics (S&L) segment. The dislocation in April was manifested by the negative price for front month of futures. This should have been a perfect environment to own storage assets in multiple locations and the pipes to connect them. Disappointingly, PAGP’s S&L segment adjusted EBITDA came in at only $3MM, and is running at $144MM for the first half of the year. During 1H19 they did $478MM. Management has done a good job at lowering analyst expectations for this business. Enterprise Products Partners’ (EPD) Marketing segment turned storae and contango opportunities into $185MM in 2Q20. PAGP should be aiming higher.

Overall, midstream energy infrastructure earnings were good, and with dividend yields still above 8% it is poised to move higher.

We are invested in the names mentioned above and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!