Installed Pipelines Are Worth More

Sunday’s blog (see Pipeline Opponents Help Free Cash Flow) drew some interesting feedback. It seems odd to favor constrained growth opportunities, and it’s contrary to how most management teams will assess their outlook. But for many pipeline investors, including your blogger, the pre-Shale years of steady returns were what made the sector attractive. Anti-fossil fuel activists refuse to acknowledge how the world works, but they are making new pipelines cost-prohibitive, just as nuclear opposition has done for that source of power.

Investors have asked about the prospects for the Dakota Access Pipeline, DAPL (listen to Judicial Over-Reach on the Dakota Access Pipeline). Judge Boasberg ruled that DAPL should shut down, and allowed only 30 days for it to be emptied of crude oil even though the owners argued that was too little time. Once shut down, there is a real question as to whether it will ever re-open. Since the pipeline is built and in use, you’d think shutting it would require extraordinary circumstances.

Yesterday evening, a U.S. Appeals Court granted an administrative stay while it considers whether the line, long opposed by local tribes and environmental activists, should be shut.

In this case, the government has been found to have incorrectly issued the permit allowing it to be built. Ludicrous analogies are easily constructed – if you can’t safely build with government approval in hand, nothing much could get done in this country. The courts will decide if Judge Boasberg is correct on the law, but if he is it means the law is wrong and needs to be fixed. We think this is a unique case, and that existing pipelines are not at risk of being shut down.

Even if the shut-down order is ultimately overturned, the Army Corp of Engineers has been told to carry out a more robust environmental study than was originally done. Although the Trump administration could appeal this requirement, it appears that there is insufficient time to do so before the election. One of Trump’s first acts following his inauguration was to direct the Army Corp of Engineers to issue the necessary permit. That legal challenges have outlasted the term of this administration with DAPL’s prospects still not resolved further highlights the challenges of new projects.

Investors have to consider the possibility of a Biden victory, which will lead to a changed emphasis towards climate change in the White House. In this scenario, DAPL’s prospects would be unclear. If it’s been shut down pending a revised environmental study, it may never re-open. The hit to Energy Transfer (ET) is around 3.5% of EBITDA, which we think is already priced in.

Although Biden is calling for $2 trillion to be spent on clean energy, Covid is causing a ballooning Federal budget deficit, currently $2.7 trillion with three months of the fiscal year remaining. As a % of GDP we’re approaching World War II levels. Being better prepared for another pandemic is likely to be more important than in the past, so cheap, plentiful domestic natural gas will continue to gain market share in providing energy to Americans. It’s confidence in this future that underpinned Berkshire recent acquisition of Dominion’s pipeline and storage assets.

Meanwhile, existing pipelines are more valuable. Dominion and Duke Energy abandoned their Atlantic Coast Pipeline (ACP) even though they had successfully fended off legal challenges and had plenty of customer commitments. So Transco, owned by Williams Companies (WMB) and operating from Texas to New York, is well positioned to meet some of this unsatisfied demand. They may even find a way to bring Appalachian natural gas to customers in North Carolina by building on to their existing network. They’ll have no competition.

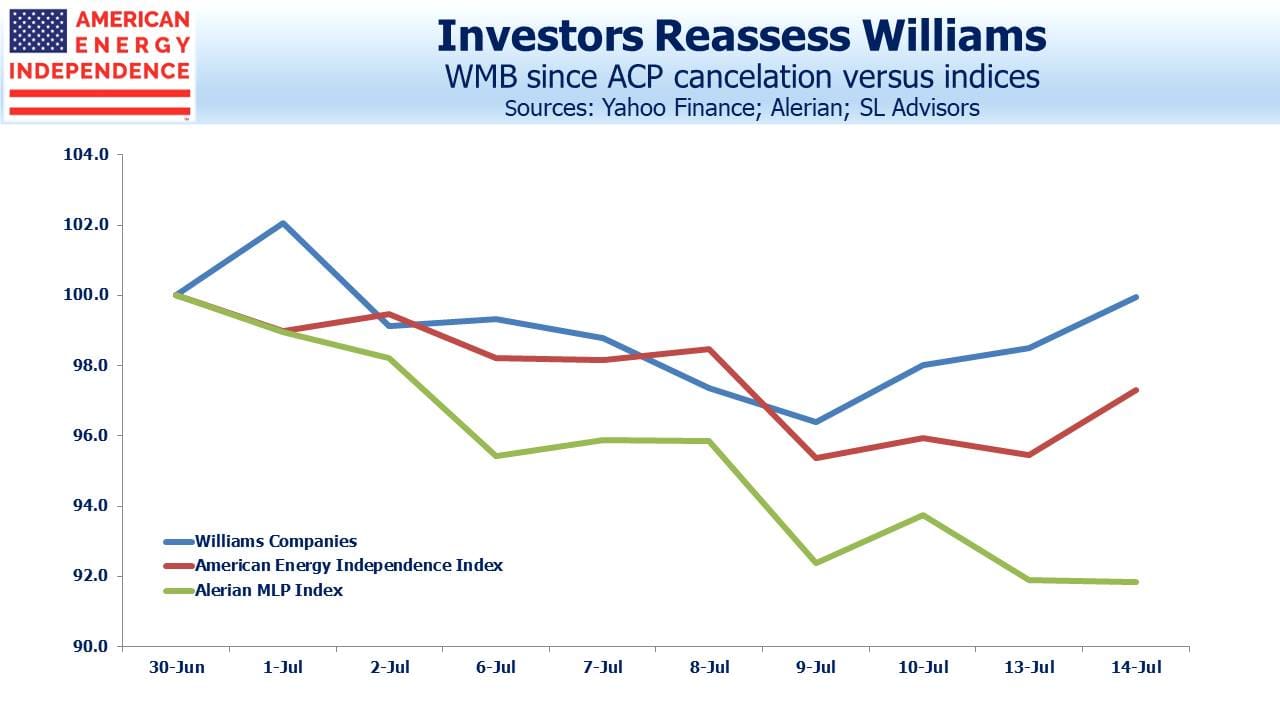

Since the ACP cancelation WMB has outperformed the sector, as defined by the broad-based American Energy Independence Index. Both have outperformed the Alerian MLP Index, since investors continue to avoid concentrated MLP exposure.

We are invested in ET and WMB.

We publish the American Energy Independence Index

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Biden is calling for $2 trillion to be spent on renewable energy, not merely “clean energy”, since natural gas is also clean energy.Pathetically that fact is not recognized by the political hacks such as Elizabeth Warren, Bernie Sanders and AOC, to whom Biden is pandering.