Why You Should Only Buy China Through the S&P500

Last week’s article by Jason Zweig (see Think Before You Fish for Bargains in Chinese Stocks) caught my eye, because it warns against investing in Chinese stocks with the expectation of high GDP growth driving high equity returns. A major reason investors allocate to emerging economies is because they expect that relationship to reward them, although there’s plenty of evidence that it doesn’t work.

Zweig references a 2004 academic paper (Economic growth and equity returns) which highlighted one important reason: GDP growth can be driven by technological innovation among new, private companies. This does nothing for current investors in public equities. Technological improvements are usually good for consumers but less often for public companies, unless they can exploit their advantage without meaningful competition. The true driver of returns comes from earnings paid out as dividends, and the return on retained earnings that are reinvested back in the business. Chinese public companies have been poor at the latter.

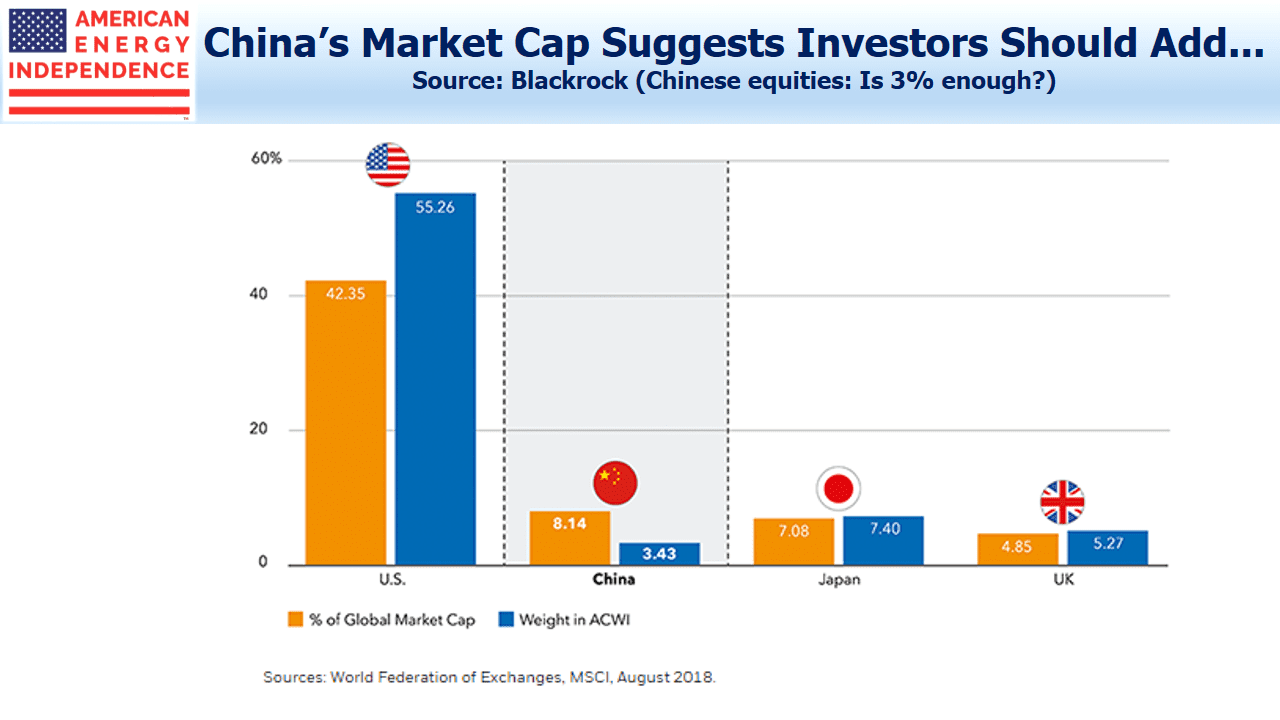

Moreover, the market cap of the MSCI China stock index has grown largely through new equity issuance. So global investors who allocate passively based on market size are induced to increase their China exposure, even though returns on invested capital have been poor.

A 2010 paper from MSCI Barra (Is There a Link Between GDP Growth and Equity Returns?) similarly found no meaningful connection between the two.

Jason Zweig generously concludes that Emerging Markets (EM) investing can still make sense if a country’s market looks cheap. But if GDP growth doesn’t correlate with equity returns, the justification for an EM investment becomes weak. What’s left is a tactical move based on what looks like temporarily weak pricing. That’s not a long term strategy for most people.

American investors are accustomed to a market with the world’s toughest rules all designed to promote fairness. Protecting investors from bad actors lowers the overall cost of equity, which does boost GDP growth. But it’s easy to assume that America’s standards are global, which they are not. I remember some years ago chatting with a senior regulator from the Reserve Bank of India. I asked him how many insider trading cases are typically prosecuted in a year, to which he replied, “None. There is no insider trading in India.”

Or the hedge fund friend who described how two or three Mumbai-based hedge funds would trade a small local stock amongst themselves, generating volume and a higher price. This would attract, “the New York hedge funds” in search of a rising stock with good liquidity. Having hooked one, the local hedge funds would dump the stock on the naive foreigner (see The Hedge Fund Mirage, pg 42).

An emerging market doesn’t mean the participants are unsophisticated – in fact, the comparative absence of rules mandates more highly attuned street smarts than is required in developed markets.

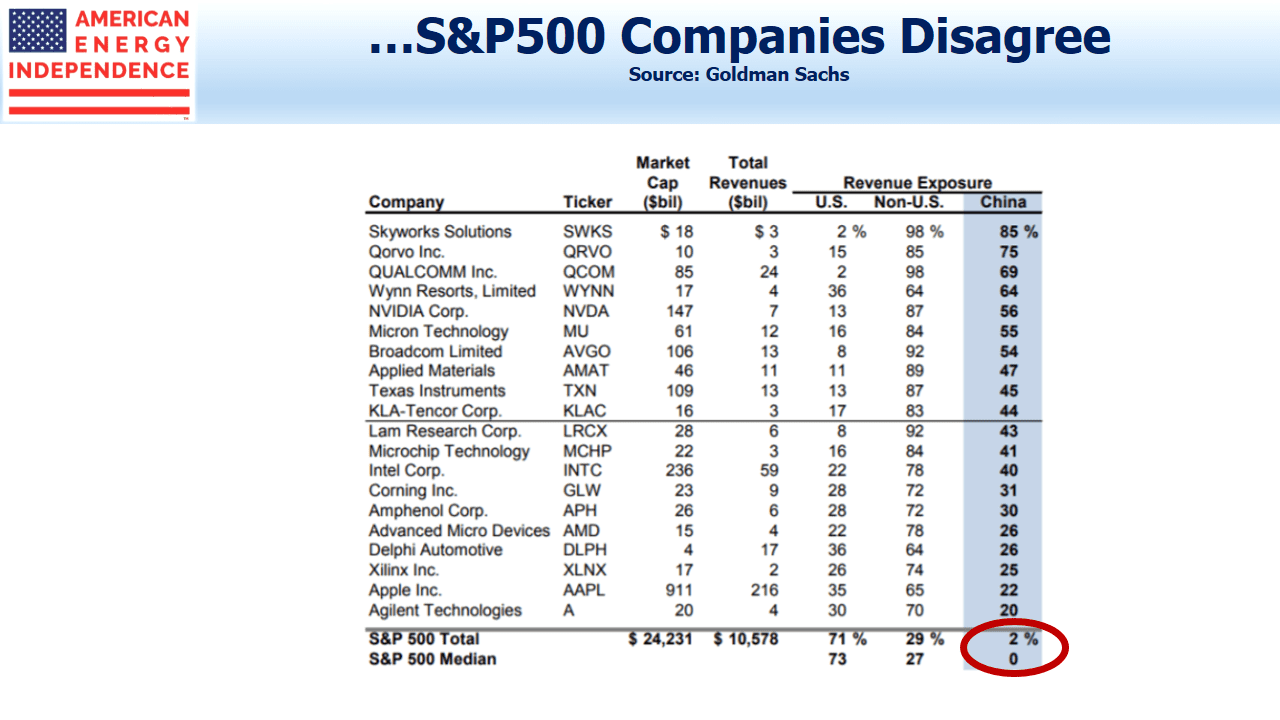

Almost every company in the S&P500 does business in China and other emerging economies. They are infinitely better suited to allocate their capital where returns are highest. They’re far better equipped to protect their property and future cashflows from nefarious activity. This means that an investment in a broad portfolio of U.S. stocks includes exposure to the growth of emerging economies. And the portion of that portfolio’s overall EM exposure is the aggregate of hundreds of capital allocation decisions by the senior executives of those companies.

Blackrock published a paper last year suggesting that China’s 8% global weighting should drive an investor’s China allocation. But this seems too simplistic. The S&P500 derives 2% of its revenues from China. 500 management teams from America’s biggest companies have collectively arrived at 2% as the optimal exposure. An investor who deviates from this 2% figure needs a good reason. Size of market is not one of them, because Jason Zweig’s article shows that most of the growth in China’s equity market cap has come from new issuance, not appreciation. Blackrock’s suggestion ignores the conclusion of hundreds of companies doing business there that have settled on 2%. And when they collectively decide to go to 3%, your exposure will change without you having to think too hard about it.

Relying on the S&P500 to determine your EM exposure must surely be better than simplistically relying on market cap or trying to figure it out yourself. Simple can be better, and in investing it usually is. Invest in America’s global companies. Let them allocate to EM for you. Stay away from EM funds. You’ll sleep better, and the research shows you’ll get better results too.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!