MLPs Misbehaving

I’m currently reading Misbehaving: The Making of Behavioral Economics, by Richard H. Thaler. It’s a fascinating book that tells the story of the development of Behavioral Economics as a discipline, and a constant theme is the ongoing debate with his academic colleagues who adhere to the Efficient Markets Theory (EMT). Basically, EMT holds that security prices reflect all the available information and are therefore “correct” in that there’s nothing to be gained from trading or even holding an undiversified portfolio. All market participants are assumed to be perfectly rational, or at least the emotional ones are assumed to be irrelevant, perhaps because their irrational behavior has bankrupted them. Lots of people disagree with this informally, as evidenced by the enormous volumes of trading that take place every day. By contrast, Behavioral Economics as a field holds beliefs that are directly at odds with EMT, and its development has spurred a lively debate between the two camps. Behavioralists acknowledge that market participants are human and therefore make human, irrational decisions regularly. Exhibit One in the case against EMT might be the 1987 stock market crash when equity markets dropped over 25% in a single day without any meaningful news. If a stock price reflects the net present value of all the future cashflows derived therein, did their aggregate value truly fall by over a quarter one day? Few would argue that they did.

Less dramatic examples of this EMT violation occur regularly. In fact, I was reminded of this just last week during another period of falling MLP prices. Earnings reports from the sector have generally been unsurprising and solid, although this has not stopped prices from falling. Last week Plains All American (PAA) reported earnings that were only marginally weaker than expected. However, during the subsequent conference call PAA CEO Greg Armstrong warned that it was possible PAA would hold its distribution flat (i.e. not grow it as is the norm) so as to allow their distribution coverage to return to more conservative levels.

This was clearly a mildly negative comment, a piece of fundamental news that might well justify a modestly lower price for PAA and its General Partner Plains GP Holdings (PAGP). Investors and traders (sometimes they seem synonymous) reacted by driving the prices of both securities and the MLP sector down relentlessly. PAA finished the week 15% lower, and PAGP an astonishing 31% lower. Plains has one of the most respected management teams in the industry and a reputation for conservative stewardship. Our interpretation of the call was that flat distribution growth was a downside case rather than their guidance: possible, but not currently their Base Case. However, market prices moved to levels that reflect a far more dire outcome, pushing the yield on PAA up over 8%. PAGP meanwhile, which has no net debt and participates in PAA’s growth without ever having to provide capital to fund it, yields over 5% which is not such a bad return even if the distribution never grows. But it assuredly will as PAA grows its EBITDA and drops new projects into production. PAGP is like a hedge fund manager with permanent capital. They will continue to share in the cashflows generated by PAA for as long as they like, and PAA’s equity can never be withdrawn (i.e. investors can sell in the secondary market but they can’t force PAA to shrink), We are invested in PAGP.

Other MLP GPs reacted poorly, and the Alerian Index duly reached a more than 30% drop from its highs of a year ago. Under these circumstances, a long time MLP investor’s thoughts might understandably turn to another violation of the Efficient Markets Theory.

I have to say that we have selected our clients well — or more accurately, they have self-selected well. Our Separately Managed Account investors in our MLP strategy, most of whom have been with us for years, have reacted to developments with equanimity. Our ability to at least lose a good bit less than the index no doubt helps (past performance is not indicative of future returns). In a number of cases we have been asked to invest additional capital and open new accounts, reflective of the long term nature of the opportunity as well as the outlook of our clients.

It’s unfortunately no longer an original thought to state on this blog that MLPs are attractively priced, and regularly falling prices can challenge the conviction of those who rely on rising prices as a validation of their investment thesis. The market is being inconveniently uncooperative in endorsing the actions of more recent investors. However, the development of U.S. oil and gas resources will assuredly continue; operators with strong balance sheets and patient investors without leverage will in our opinion eventually benefit, as in the past. We continue to like our investments.

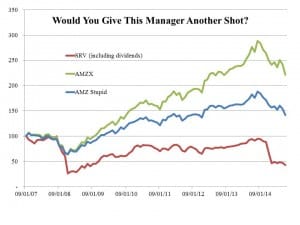

On a different topic, recently The Economist magazine weighed in on the hedge fund debate in an article titled Fatal Distraction. Readers may recall my book, The Hedge Fund Mirage, published way back in 2012 in which I showed that virtually all the gross profits earned by hedge funds had gone in fees to managers and funds of hedge funds. The Economist was one of several mainstream financial publications that reviewed my book positively. They even went so far as to check the spreadsheet I had built to calculate returns and fees, a step no other publication took and one which cemented their place atop my list of most trusted news organizations. Hedge fund returns have not been good since then, as I expected. Even beating a simple 60/40 stocks/bonds portfolio has been beyond the hedge fund averages since 2002 — not only for the past thirteen years but every single year too. 2015 is shaping up to be no different. The Economist correctly challenges hedge fund proponents on their consistent mediocre results delivered at great expense.

or most of the year and indeed throughout its life until the end of last year. CEFs usually trade at a discount to NAV and many individual investors trade them seeking to exploit this fact. The consistent premium at which SRV has traded reflects optimism by investors tragically not repaid by results.

or most of the year and indeed throughout its life until the end of last year. CEFs usually trade at a discount to NAV and many individual investors trade them seeking to exploit this fact. The consistent premium at which SRV has traded reflects optimism by investors tragically not repaid by results. ed while stock dividends grow. The S&P500 currently yields around 2%. Historically, dividends have grown at around 5% annually. So if you invested $100 in stocks today you’d receive a $2 dividend after the first year but if past dividend growth of 5% annually continued, in ten years your $2 dividend would have grown to $3.26. Put another way, if dividend yields are still 2% in ten years time, your $100 will have grown to $162.89 (that’s the price at which a $3.26 dividend yields 2%). Since returns on stocks come from dividends plus their growth, a 2% dividend plus 5% growth equals a 7% return. Naturally, the two imponderables are (1) will dividends grow at 5%, and (2) will stocks yield 2% in 10 years (or put another way, where will stocks be?). These are the not unreasonable questions of the bond investor as he contemplates a larger holding of risky stocks in place of bonds with their confiscatory interest rates.

ed while stock dividends grow. The S&P500 currently yields around 2%. Historically, dividends have grown at around 5% annually. So if you invested $100 in stocks today you’d receive a $2 dividend after the first year but if past dividend growth of 5% annually continued, in ten years your $2 dividend would have grown to $3.26. Put another way, if dividend yields are still 2% in ten years time, your $100 will have grown to $162.89 (that’s the price at which a $3.26 dividend yields 2%). Since returns on stocks come from dividends plus their growth, a 2% dividend plus 5% growth equals a 7% return. Naturally, the two imponderables are (1) will dividends grow at 5%, and (2) will stocks yield 2% in 10 years (or put another way, where will stocks be?). These are the not unreasonable questions of the bond investor as he contemplates a larger holding of risky stocks in place of bonds with their confiscatory interest rates. xes, around $0.38. This assumes the Federal dividend tax rate and the ObamaCare surcharge but excludes state taxes.

xes, around $0.38. This assumes the Federal dividend tax rate and the ObamaCare surcharge but excludes state taxes.