More on the Changing MLP Investor

Last week’s blog post, The Changing MLP Investor, received more interest than usual. There’s no shortage of research explaining why MLPs are cheap, but it seems few stop to consider the mindset of those who decline to act on this opportunity. Sometimes it’s more helpful to understand the non-buyers.

Following the collapse two years ago (see The 2015 MLP Crash; Why and What’s Next) the sector staged a strong recovery in 2016. However, over the last six months prices have sagged. Oil weakness earlier in the year was blamed, but in June crude began to recover and the previously high correlation with MLPs inconveniently fell. Prices for oil and MLPs are linked when sentiment dictates, but are economically not that close. Consequently, the relationship can weaken with little warning, revealing their transitory affinity for one another.

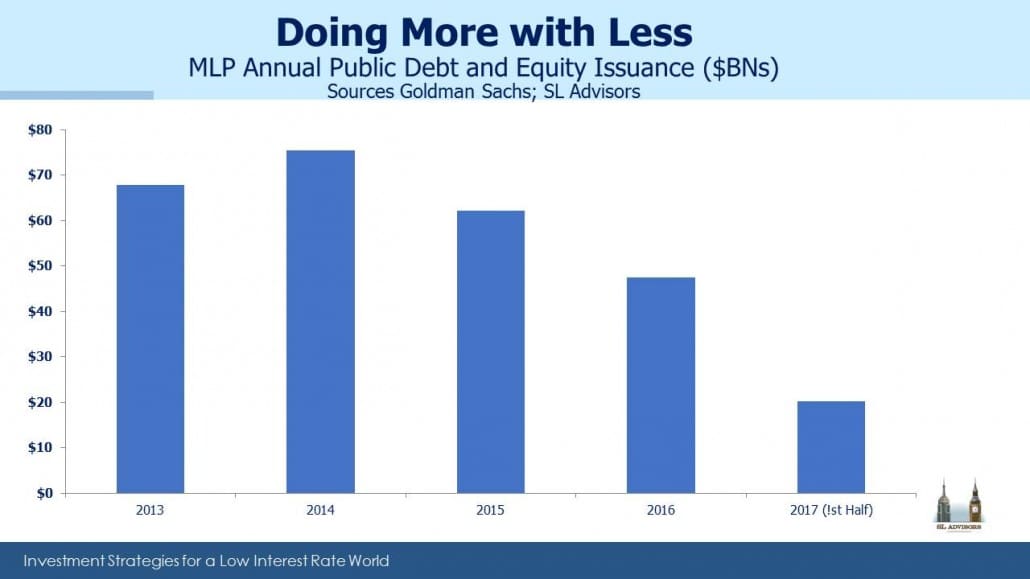

Continuing the theme from last week’s blog that focused more on investors, for a time the Shale Revolution led MLPs to substantially increase their annual capital needs. Subsequently, some lost access to equity financing. The result was that acquisitions, new projects and expansions led to increased use of internally generated cash, leaving less for distributions. In some cases there were distribution cuts. But there are indications that we are over the hump – a higher cost of equity for those firms needing more of it has imposed discipline, and projects are increasingly financed without tapping the capital markets. Annual capital needs are down for the third successive year and are running at about half the pace of 2014.

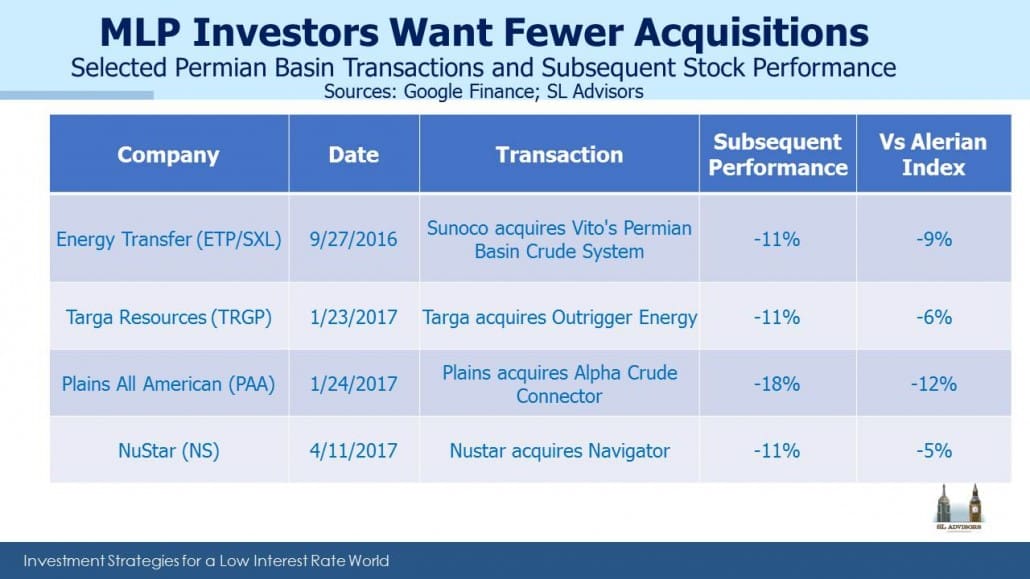

Nonetheless, investors continue to punish those firms that are growing their asset base. The table below highlights four transactions in the past year that have all led to stock price underperformance. The message is that traditional MLP investors prefer income over growth. The choice of many management teams to favor asset growth has led to investor turnover and today’s attractive valuations.

Interestingly, Blackstone recently acquired Harvest Fund Advisors, an MLP investment manager, reflecting their recognition that long-lived energy infrastructure assets offer attractive returns.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!