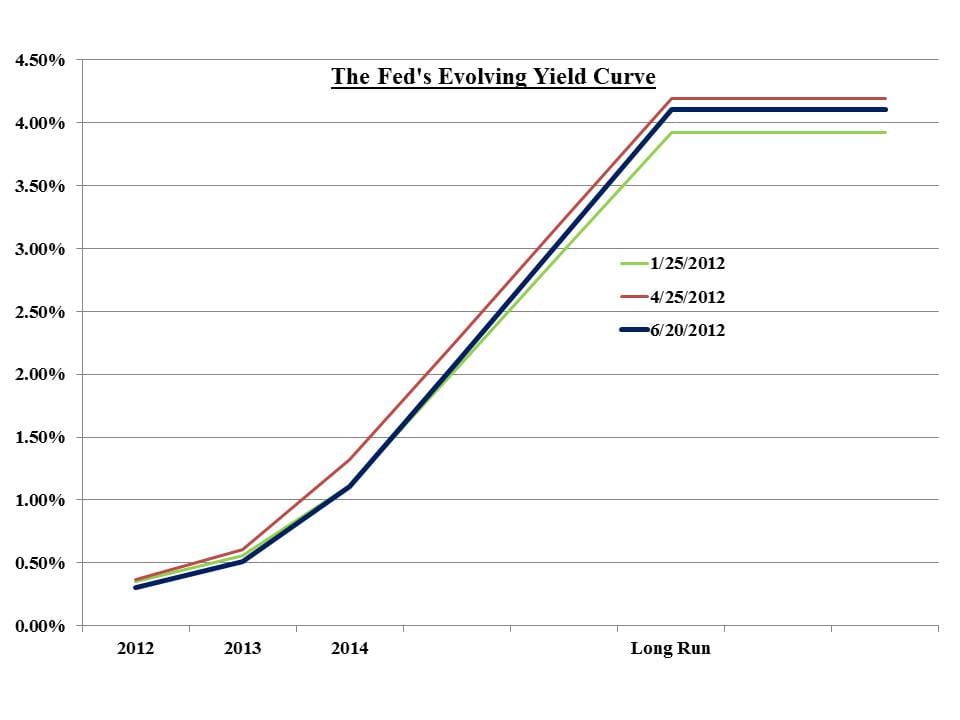

The Fed's Evolving Yield Curve

On Wednesday the Federal Reserve released their third set of detailed interest rate forecasts this year. Following Ben Bernanke’s philosophy of open communication, the FOMC publishes forecasts for short term rates from each voting member. While they don’t link a name with each number, you can see what members expect short term rates will be at the end of this year, 2013, 2014 and over the long run (whose start is not defined).

In effect you can construct a crude yield curve incorporating their collective outlook. Comparing their yield curve with the market is fascinating, although market yields and implied rate forecasts have been steadily diverging from those issued by the Fed. In fact, the Fed’s own forecast has been remarkably stable even while ten year treasury yields have traversed a 1% range reaching 2.5% before falling recently to 1.5%. The chart below is derived from the average of all FOMC member’s rate forecasts at year-end. So there’s a clear discrepancy between the Fed’s statement that short term rates will remain low through the end of 2014 and the six FOMC members who expect rates to be higher (three of whom target hikes as soon as next year). At the same time that the Fed extended Operation Twist to the end of this year, they reaffirmed that the long run equilibrium short term rate is around 4%. Long term bonds continue to trade at yields that defy that forecast. The Long Run is still some ways off, but today’s bond buyers are fairly warned.

There is growing evidence that the “Fiscal Cliff”, looming in January 2013, will take a toll on the economy before its arrival. Although reports suggest that both parties are discussing a resolution to the sudden tax hikes and spending cuts that will take place under current law on January 1st next year, there’s little tangible evidence of such. There is growing evidence that companies are managing their businesses by incorporating this uncertainty into today’s spending decisions. It occurs to me that, while most economic forecasts project a substantial (3%+) GDP hit in 1Q13 IF no action is taken, few have considered that waiting until December’s lame-duck session of Congress to do the inevitable is quite likely to depress growth in the meantime. The non-partisan view surely blames both sides for placing the purity of their own political beliefs ahead of the pragmatism of removing at least one element of uncertainty.

The comments from many Congressmen that the planned tax hikes and spending cuts will assuredly be rolled back would be more credible if they didn’t insist on waiting until the last possible moment do do so.

For our part, we remain generally fully invested across our strategies. Owning steady, dividend paying stocks combined with a beta neutral hedge provides an uncorrelated source of return while markets are being buffeted around. Our most recent decisions have been to exit the last remaining shares of Family Dollar (FDO) which no longer provides compelling value given its recent increase in price. We have added modestly to Coeur d’Alene (CDE) which recently announced a share buyback given the large discount of its stock price to the estimated net asset value of its gold and silver reserves.

We have largely exited the short Euro position which has been held in our Fixed Income strategy as useful protection for the holdings of bank debt (given their equity sensitivity). It worked well for quite a while, but a few weeks ago I heard a reporter from the New York Times confidently announce on a radio interview that the Euro was going down and Greece would soon exit. Short Euro is probably too widely held, and isn’t that interesting any more.

Disclosure: Author is Long CDE

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!