Will Europe Feed The Crocodile?

Among Winston Churchill’s many memorable quotes is, “An appeaser is one who feeds a crocodile, hoping it will eat him last.”

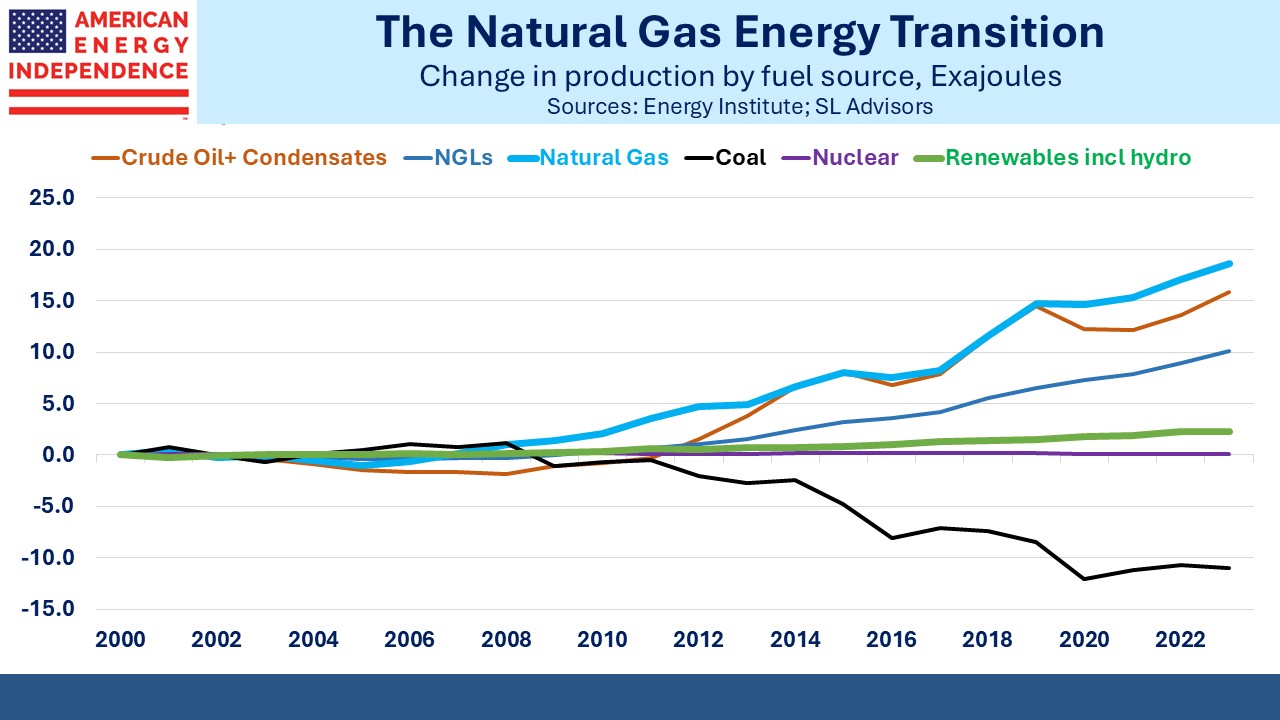

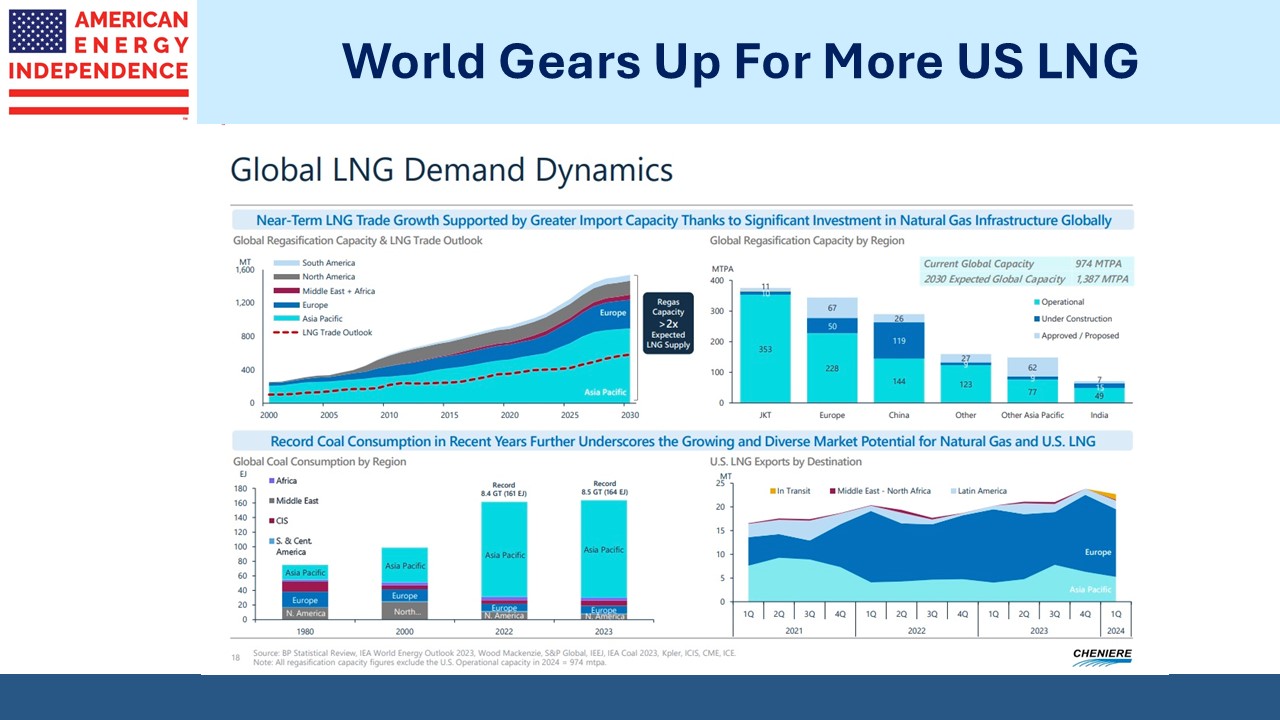

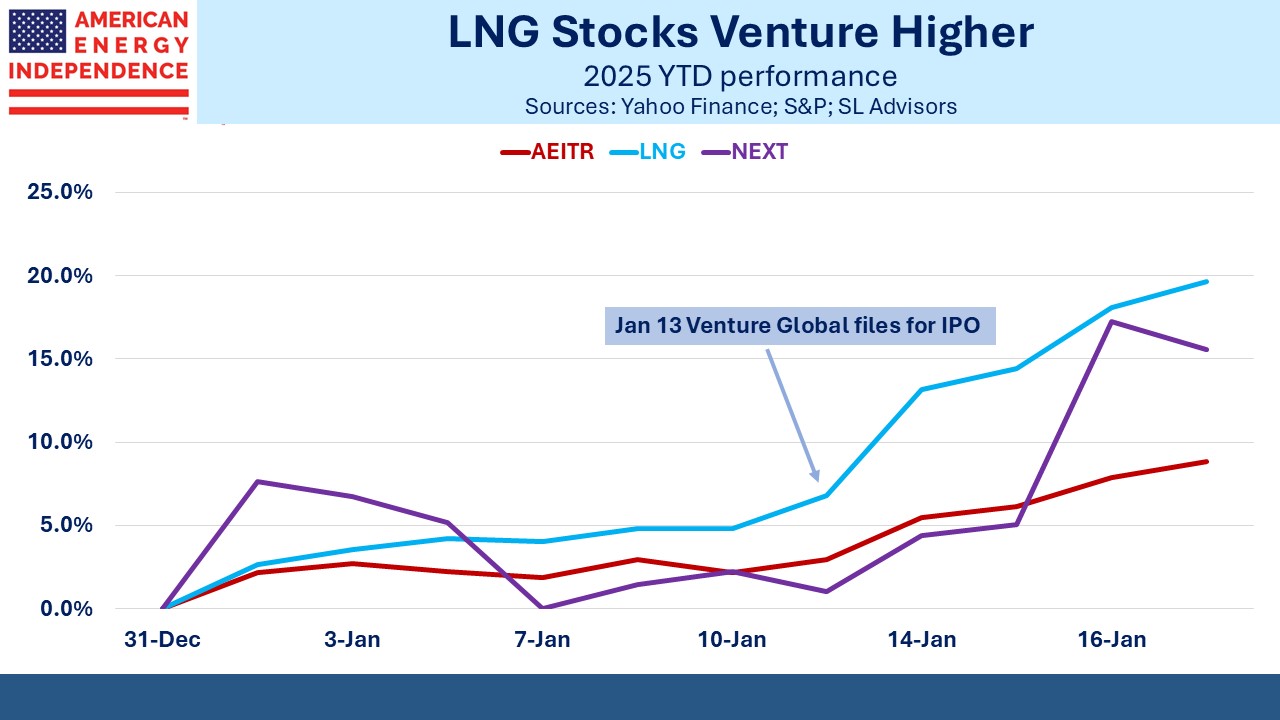

This applies to some European countries’ posture towards Russia. The Economist recently asked, Will Europe return to Putin’s gas? Could they return to their reliance on Russian energy? The question has been buffeting LNG stocks in recent days. It would appear inconceivable that the continent should go back down that road, after Russia weaponized its gas supply following the invasion of Ukraine.

Volumes through Nord Stream gradually fell throughout 2022 until an explosion ruptured three of the four pipes that make up Nord Stream 1 and 2 in September. Germany scrambled to lease Floating Storage and Regasification Units (FSRUs). Europe’s LNG benchmark TTF soared by over 10X.

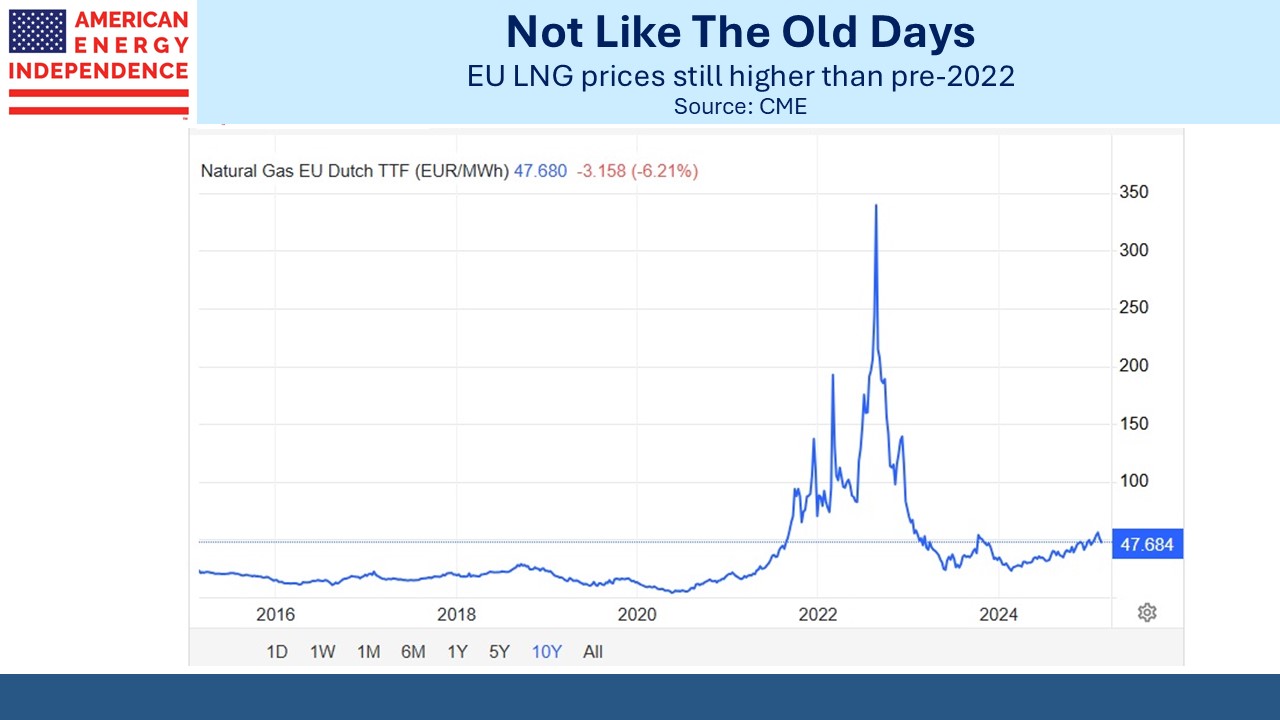

Even today, the TTF benchmark trades at over $15 per Million BTUs (MMBTUs) versus $3.60 in the US.

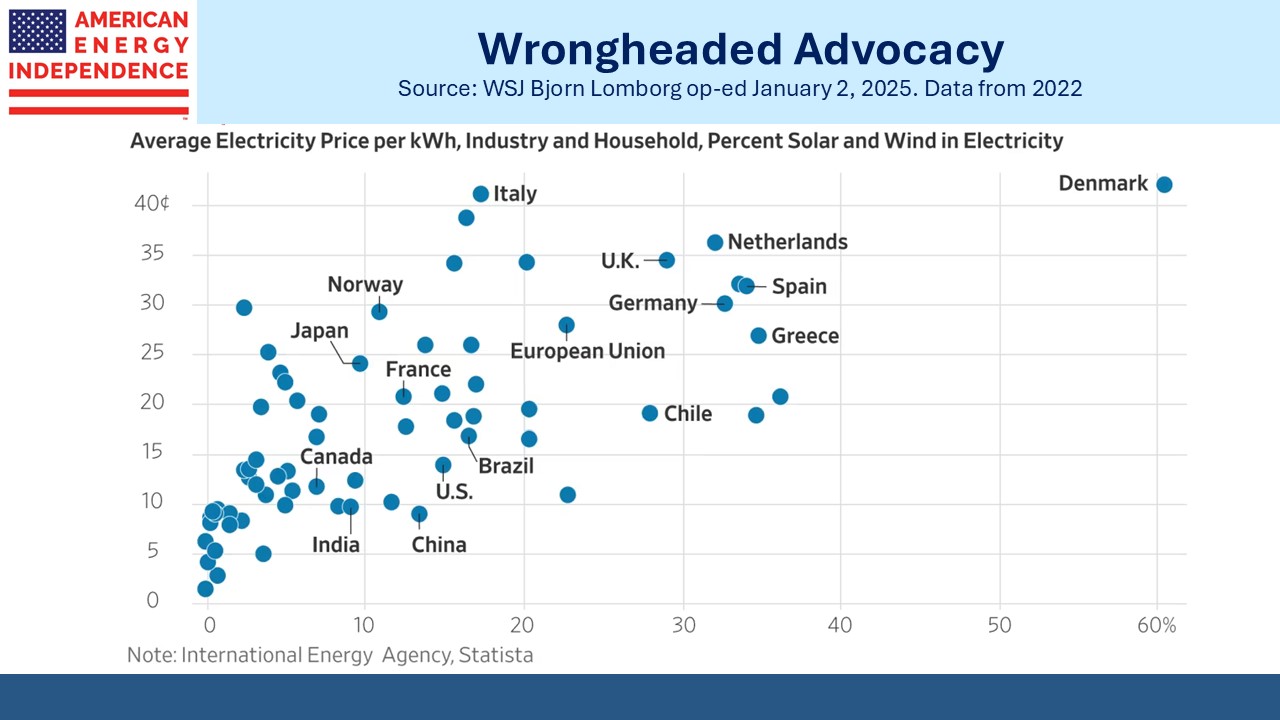

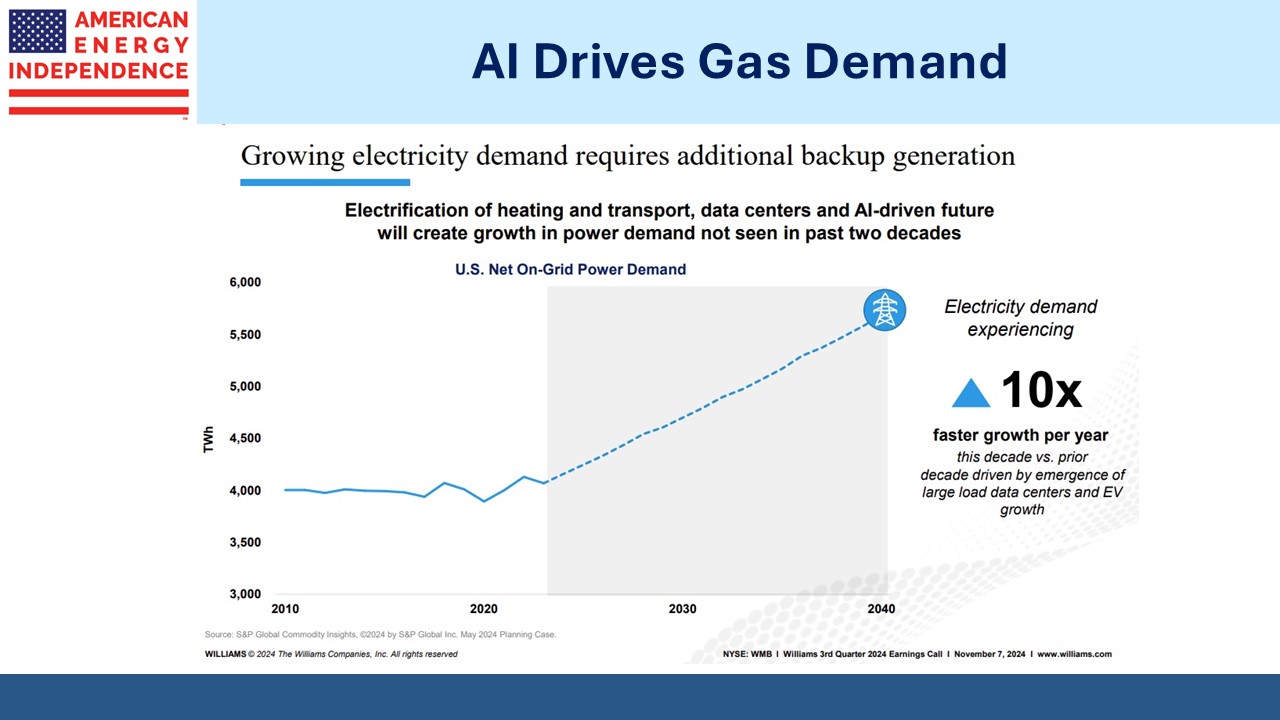

High energy prices are a headwind to GDP growth. Euro-area growth of 0.7% last year and this compares unfavorably with the US which is chugging along at 2.8%. Europe has lagged the US for many years and their green energy policies are partly to blame for persistent underperformance.

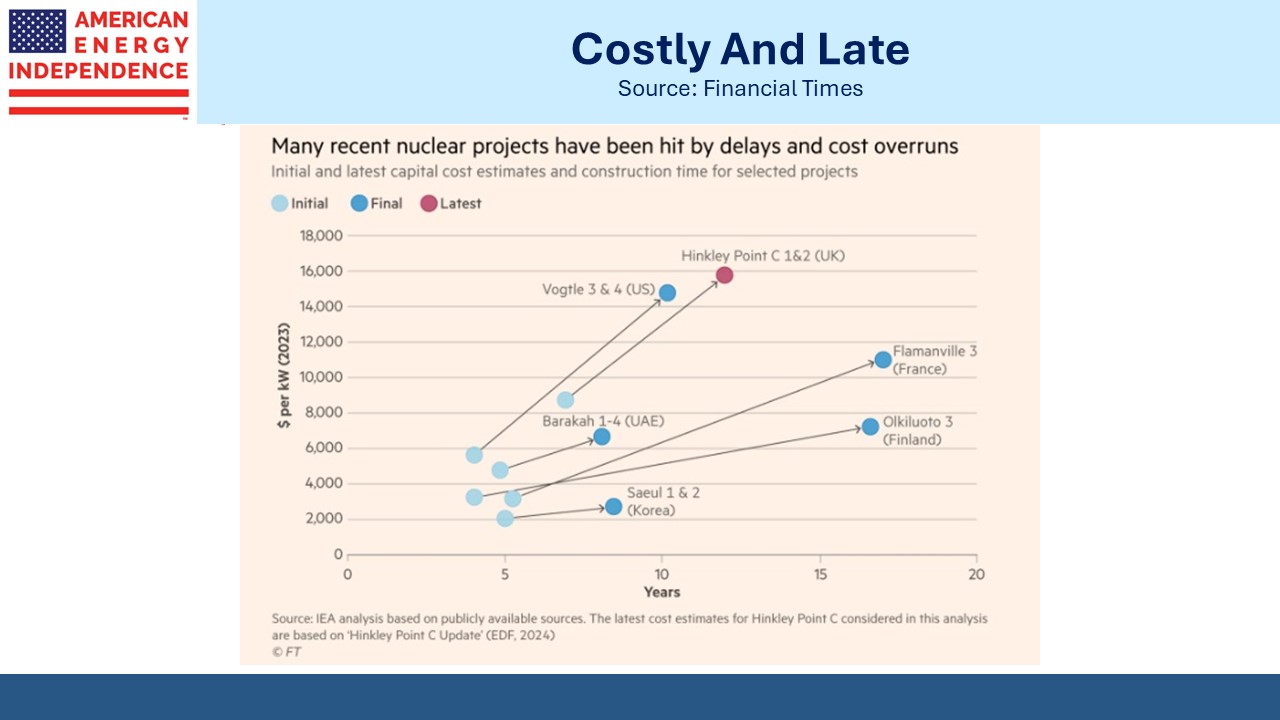

Germany has the worst energy policies of any country (see Germany’s Costly Climate Leadership). Their energy transition, or “Energiewende” has seen a huge focus on solar and wind even while they’ve shut down nuclear. Dependence on Russian gas was another strategic blunder. They’ve even coined “dunkelflaute”, the name for cloudy, calm days when renewables are just expensive junk. Germany has endured periods of dunkelflaute in recent years, forcing them to use more coal and gas (see Lemming Leadership).

Gas prices have remained high since the invasion. This has caused many companies to complain that they can no longer manufacture profitably in Germany (see Germany Pays Dearly For Failed Energy Policy).

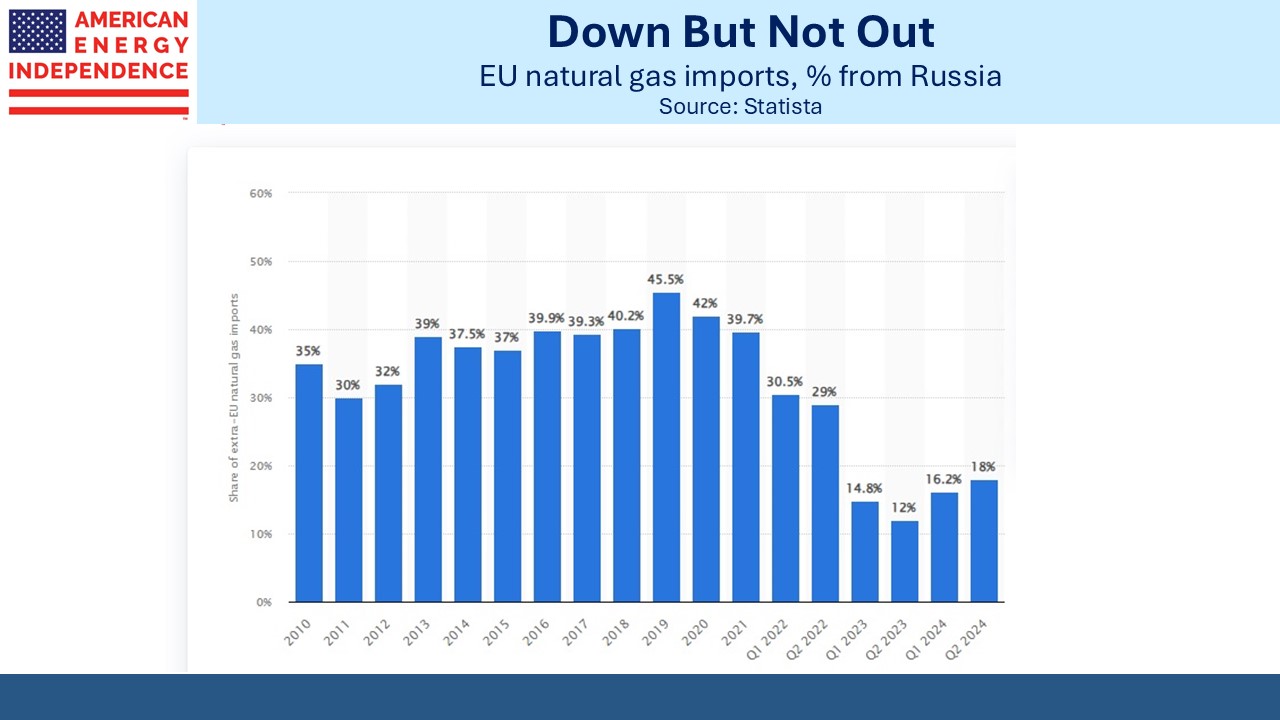

Russian gas imports have fallen but not disappeared. Europe’s stance towards Ukraine’s efforts to repel its invader is one of qualified support. They’re providing money and certain weapons in a calibrated manner intended to avoid causing too great offense. They’d like to constrain Russian energy exports but still need some natural gas so prices don’t go too high.

US direct negotiations with Russia over Ukraine therefore open the question of what Russian gas exports will look like following the end of hostilities. Much of the gas Russia used to send through Nord Stream has remained in place in Siberia, although they have been able to increase LNG exports.

Negotiations with China on building the Power of Siberia 2 pipeline have dragged on for years. This would more than double the pipeline’s current capacity, but China has shown little urgency to reach an agreement.

Since Europe never completely stopped buying Russian gas, they’d presumably be open to buying more. This has caused some to consider whether the sabotaged Nord Stream pipeline could be repaired and re-opened.

There’s no precedent for such a project. The pipeline runs from northern Russia across the Baltic to Germany. It’s made of steel 1.6 inches thick, with another 4.3 inches of concrete wrapped around them. There are around 100,000 sections of pipeline each weighing 24 metric tonnes.

Following the explosion in 2022 three of the four pipelines flooded with seawater. It’s not clear this could ever be restored to service. The pipelines have been suffering corrosion for the past two and a half years. Repairs would mean either replacing the damaged sections or patching them up in place.

This would require specialized ships with cranes strong enough to lift the components. The pipeline would then need to be laboriously inspected along its entire length. Scores of divers would be required. Much of the pipeline lies at depths of 250-300 feet.

The seawater would need to be pumped out, not a trivial task since the pumps and compression stations were designed to move natural gas, not much heavier water.

Two years ago the owners (majority owner Gazprom along with Wintershall, Engie, Gasunie and E.ON) met to discuss how to preserve the pipeline for possible re-use in the future. E.ON has already written its stake to zero. It’s currently mothballed. Many observers think it’s beyond repair.

Assuming technical solutions could be implemented to restore gas supplies on Nord Stream, would this mean a political agreement? In his first term President Trump railed against Germany’s planned construction of Nord Stream, rightly asking why US troops were stationed in Germany offering a defense again their gas supplier.

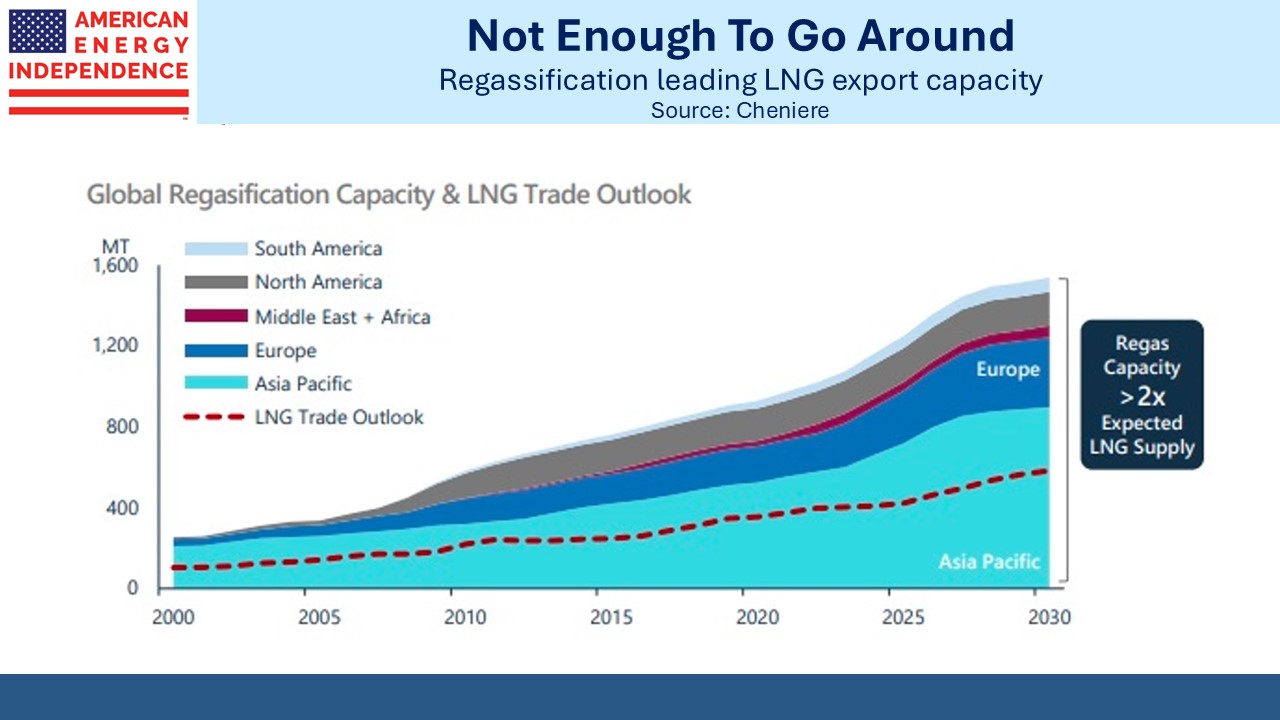

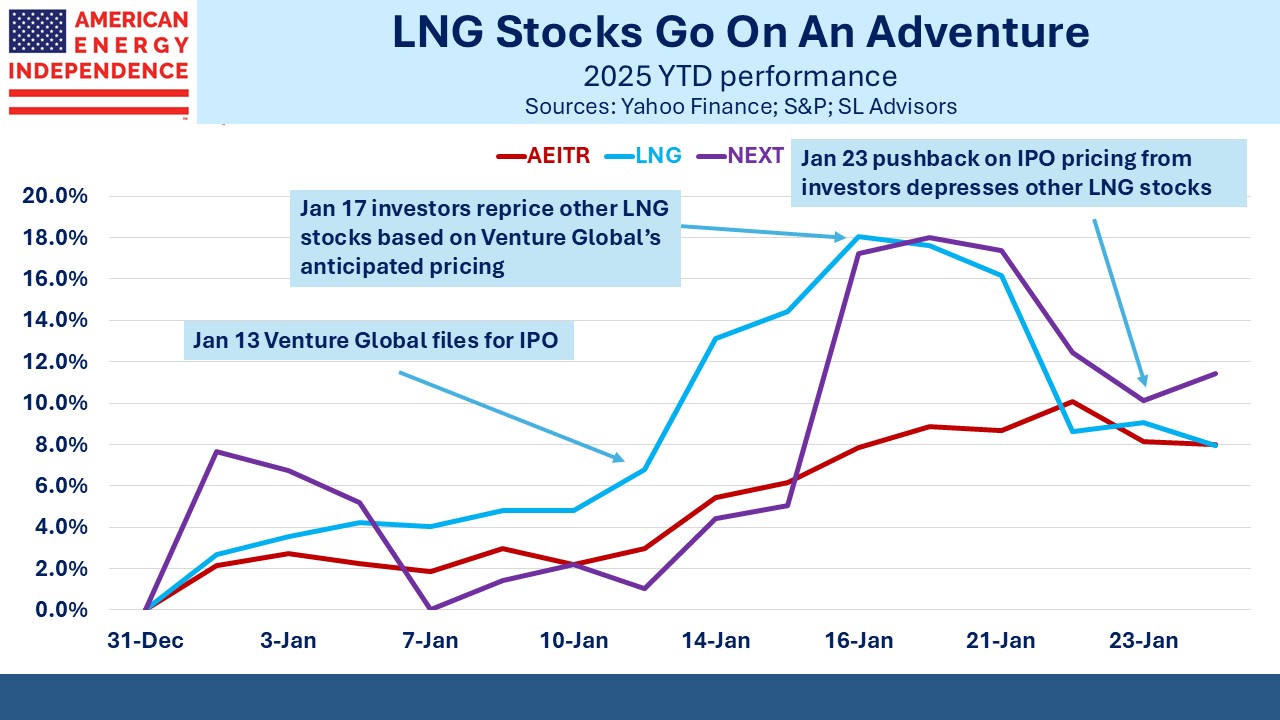

It’s hard to imagine Europe increasing gas imports from Russia without Trump raising the same issue. US LNG exports to Europe surged following the loss of Russian supply. It’s no exaggeration to say that America kept the lights on in Europe over the past couple of years. Nonetheless, so far this year Europe’s LNG imports from Russia are running at record levels.

Trump has been a vocal proponent of growing US oil and gas exports. He’s suggested to the EU that LNG exports could be linked to tariff negotiations.

Markets have been interpreting a Ukraine cease fire as causing Russian gas exports to Europe to displace those from the US. We don’t think that’s likely.

We have two have funds that seek to profit from this environment: