A Chat with Tallgrass CEO David Dehaemers

Continuing our series of interviews with senior energy executives, we recently had the opportunity to catch up with David Dehaemers, President and CEO of Tallgrass Energy GP (TEGP). The theme of our discussions was: How has the Shale Revolution changed your business? Behind the miserable recent performance of energy infrastructure securities lies the most fantastic American success story. U.S. oil and gas production have significantly altered global markets, culminating with OPEC’s 2016 about-face on low oil prices (see OPEC Blinks).

OPEC tried to bankrupt the U.S. Shale industry and failed, because the American capitalist system showed its flexibility. Innovation and productivity improvements substantially lowered break-evens for U.S. producers. Since then, a constant source of investor frustration has come from trying to reconcile booming domestic production of hydrocarbons with the languishing stock prices of the businesses that gather, process, transport and store them.

The Shale Revolution has impacted Tallgrass as much as any business. CEO Dehaemers noted that their Pony Express crude oil pipeline that runs from Wyoming to Cushing, OK probably wouldn’t exist without it. Even more striking has been the change to Rockies Express (REX), the natural gas pipeline originally built to supply Rocky Mountain gas to Ohio and beyond. As Marcellus Shale production turned the region from an importer to an exporter of natural gas, REX’s prospects, especially at its eastern sector, dimmed.

So Tallgrass reversed the flow of the pipeline, allowing Pennsylvania gas to supply Chicago and the midwest. In the process they created a “header” system that, by running in both directions across the northern U.S. can link up with north-south pipelines to add further supply routes. We’ve written about this in the past (see Tallgrass Energy is the Right Kind of MLP).

As well as the impact on Pony Express and REX noted above, Dehaemers commented that the Shale Revolution had allowed better use of their existing assets. Like all midstream businesses Tallgrass works closely with their producer customers, seeking to ensure that infrastructure capacity is synchronized with growing oil and gas production. The trend is towards fewer vertical wells as drillers employ multi-pads (“mega-pads”), often consisting of up to 16 wells within 400 yards of one another, each with multiple horizontal wells branching off. This is a significant source of the dramatic productivity improvements that many Exploration and Production (E&P) companies have enjoyed in recent years.

Tallgrass recently announced the combination of their General Partner, TEGP, with their MLP Tallgrass Energy Partners (TEP). Several of their peers have executed “simplifications”, beginning with Kinder Morgan in 2014. Generally they’ve been disappointing, resulting in a distribution cut for MLP holders and sometimes an unexpected tax bill if the combination is determined to be a sale of the assets. A lower stock price has duly followed, and simplification has come to mean loss of value for investors. Unusually, Tallgrass managed to pull off their GP/MLP combination without a distribution cut, and although TEP investors will face a tax bill it won’t be much as the income tax deferral only dates back to the 2013 IPO. Few such simplifications have been well received by the market, but this one was thoughtfully done and investor response was positive.

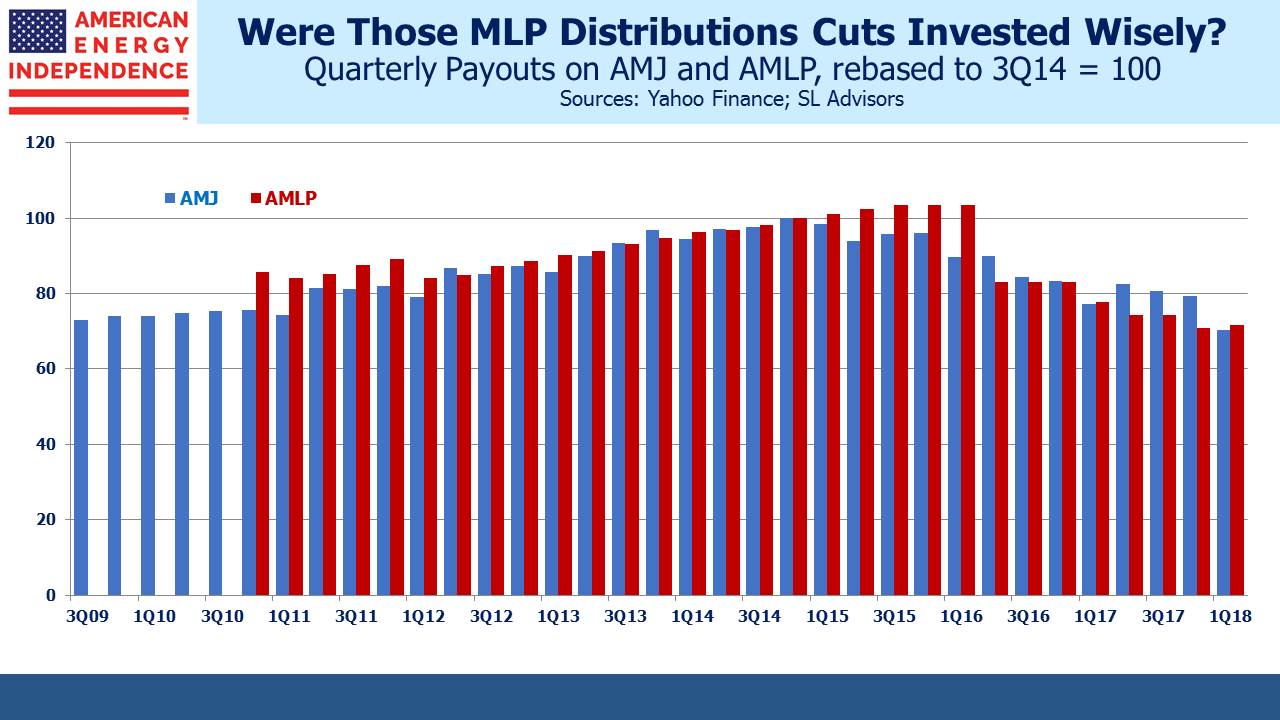

We were interested to learn why Dehaemers had decided the MLP structure was no longer appropriate, given that only five years earlier they’d floated TEP as a publicly traded MLP. He felt that some businesses had been launched as MLPs without the stable underlying cashflows that the investor base typically seeks. He also felt that K-1s were a bigger impediment than generally thought. We believe a still underappreciated fact is that older, wealthy Americans are the main source of MLP demand. Their distributions have been cut as cashflows have been redirected to reduce imprudent leverage and finance growth projects. The consequent 30% drop in distributions (as seen on Alerian-linked products, see Will MLP Distribution Cuts Pay Off?) renders high yields less compelling. David generally agreed with this assessment, noting that some other firms had unfortunately “gotten over their skis” with more risk than was appropriate. We’d add here that Tallgrass has been a welcome exception, having delivered consistently strong annual distribution growth (32% at TEP and 55% at TEGP since its 2015 IPO).

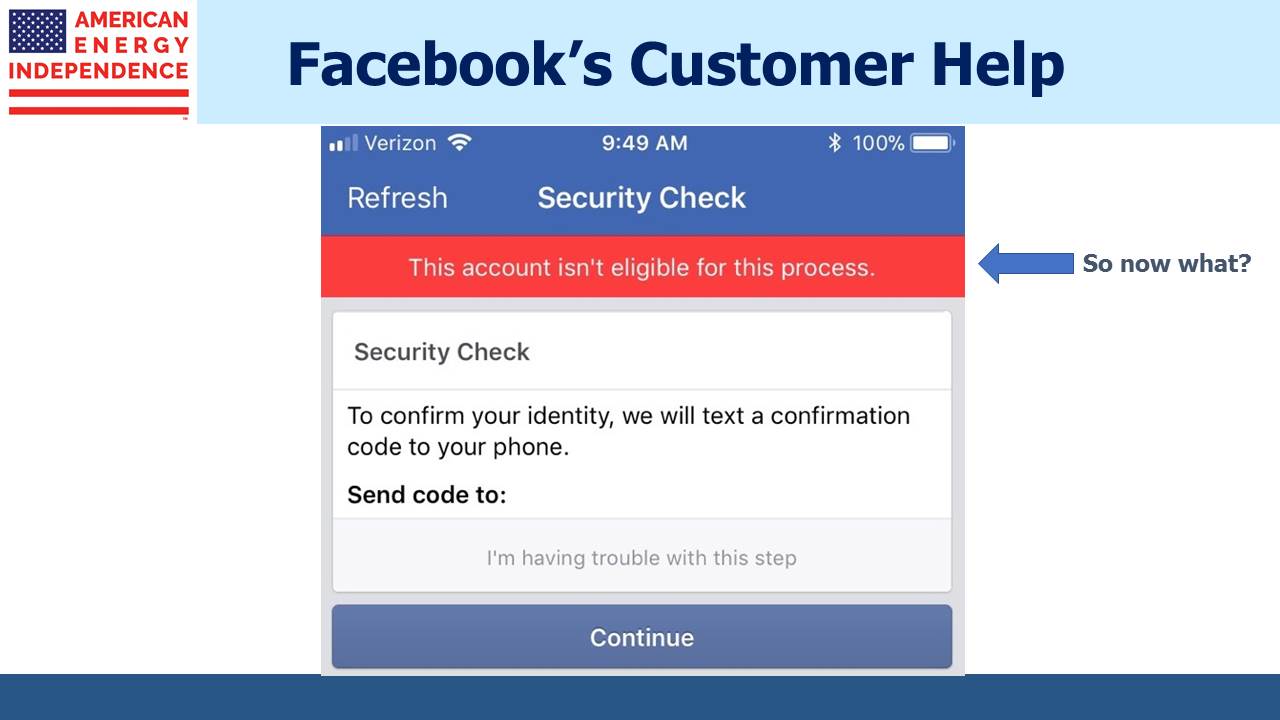

Although the MLP structure retains its advantageous tax treatment compared with corporate ownership, Dehaemers felt that the sector was unlikely to enjoy a resurgence as a substantial source of capital anytime soon. Incentive Distribution Rights (IDRs), whereby the GP earns preferential economics for running the MLP, have been widely criticized. We’ve long thought that this issue is overplayed, as investors in hedge funds and private equity routinely accept preferential economics for their fund managers. However, David noted that social media pays far less attention to these private vehicles than to publicly traded securities, and he felt that growing IDR opposition was a factor.

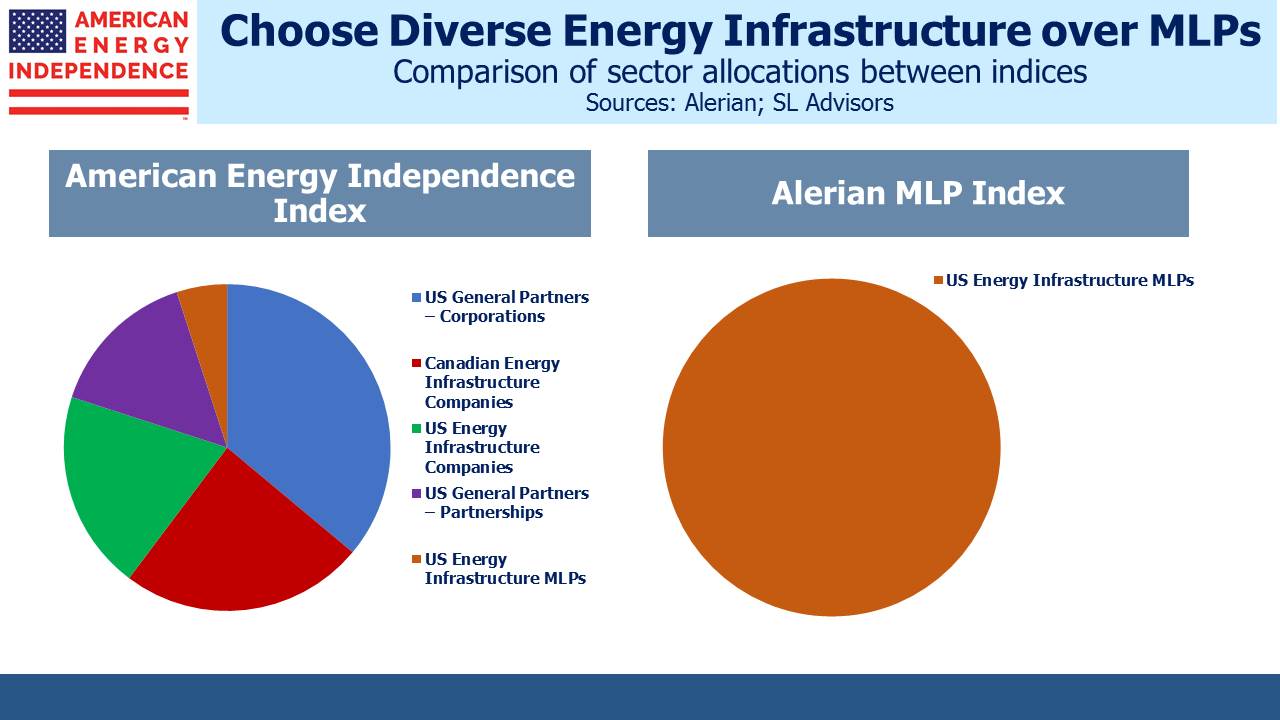

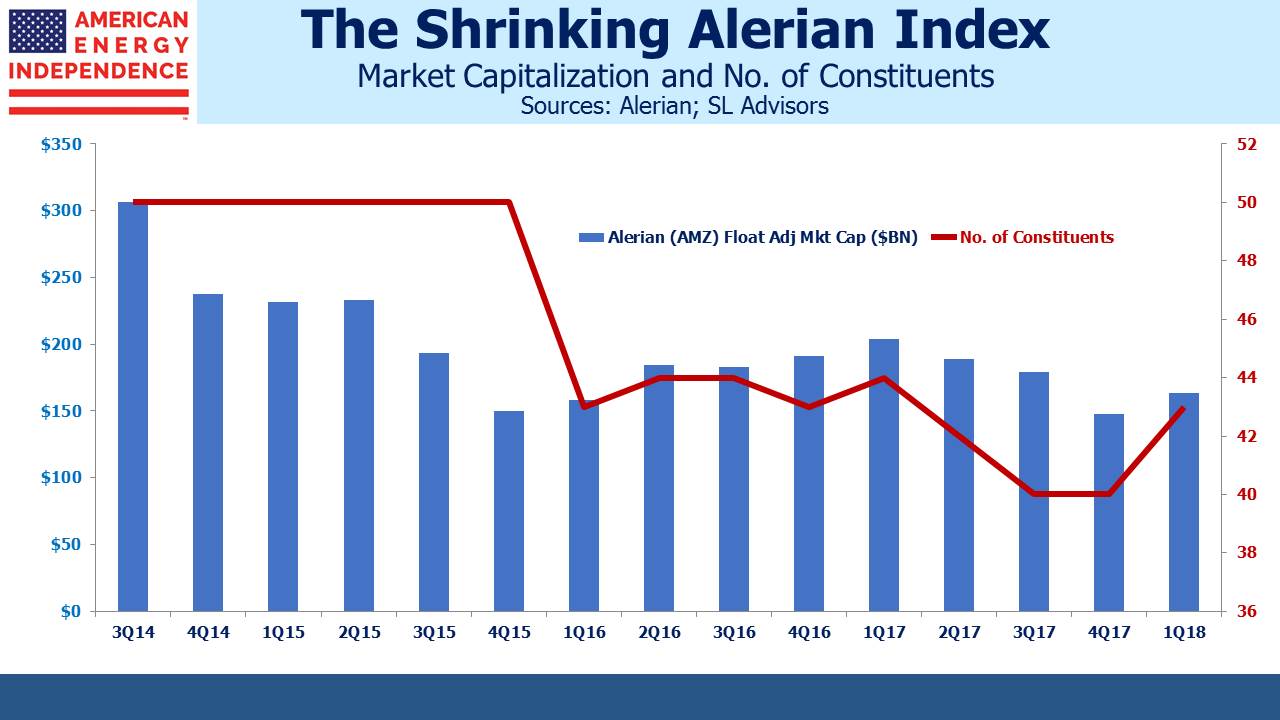

We were curious to know whether Dehaemers thought Tallgrass Energy (TGE), the entity resulting from the combination of TGP and TEP, would be included in the Alerian Index. Given the shrinking number of MLP names, the index is becoming less representative of energy infrastructure (see The Alerian Problem). TGE is unique in that it’s a single partnership electing to be taxed as a corporation with no publicly traded affiliate, so it’s unclear whether Alerian’s current rules would include it. Dehaemers had not given this much thought, perhaps because the point of the combination is to access a broader set of investors than those interested in MLPs.

Tallgrass is a company that we expect to benefit from American Energy Independence, and it’s included in our similarly named index.

Lastly, we noted the high 9.6% yield on TEP (TGE after the combination), and asked how they think about the division of cash between investor returns and paying for new projects. Dehaemers felt the 1.2X distribution coverage should encourage buyers to drive the yield down, and combined with mid-to-high single digit % growth TEP is an attractive investment. We agree, and will continue to follow Tallgrass’s progress with interest.

We are invested in TEGP

On Tuesday, May 8th we’ll be ringing the 4pm closing bell at NYSE in recognition of our recently launched ETF. We’ll post further updates on our blog.