Trading Futures With The Fed

Last week’s big story was the sharp drop in bond yields. Ten-year treasuries dropped below 1.3% on Thursday, down 0.30% on the month. Big moves in bonds usually have a visible catalyst, but there was no obvious driver of last week’s move. Inflation expectations dropped somewhat, which is typically reflective of a change in the economic outlook. But around half the drop in bond yields has been caused by falling real yields, which are typically less sensitive to economic data. Today’s investors in ten-year treasuries are willingly accepting a loss, after CPI inflation, of almost 1%. Non-commercial buyers, including central banks and pension funds with rigid investment mandates that require fixed income allocations are setting bond prices today.

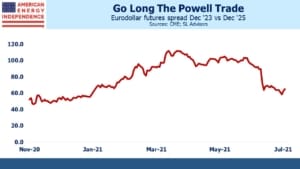

Eurodollar futures continue to provide a fascinating counterpoint to the FOMC’s Summary of Economic Projections (SEP). The infamous “blue dots” from the SEP are overlaid on the eurodollar yield curve below. They show the median forecast for the Fed’s overnight policy rate – the blue dots provide annual readings for 2021-23, and a long-term forecast. So we’ve assumed the equilibrium real rate of 0.5%, what the FOMC calls “r*”, is reached by 2026. With their 2% inflation target, that results in a 2.5% neutral Fed Funds rate.

We’ve also added in Fed chair Jay Powell’s blue dots. The SEP doesn’t disclose dot ownership, so we’ve simply assumed he’s the most dovish dot in each year which is consistent with his public comments.

If Jay Powell was allowed to trade eurodollar futures, he would surely bet on a steeper yield curve from 2023-2025. Even though he constantly warns us not to pay too much attention to the dot plot, he provides a forecast himself like the other FOMC members.

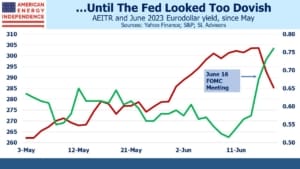

We’re told they will move slowly in raising rates, and the most dovish dots are 0.75% below eurodollar yields for 2023 even after the recent bond rally. But five years out even the most dovish FOMC member is 0.25% above eurodollars. The discrepancy was more pronounced on Thursday morning when the bond market’s recent rally faltered.

Although FOMC doves think the market is ahead of itself in anticipating the beginning of monetary tightening, it’s also too relaxed about the pace of tightening once the FOMC gets started.

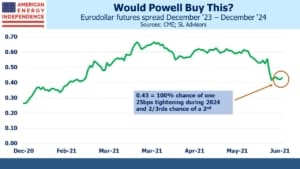

This shows up in calendar spreads. On Thursday the spread between December ‘23 and December ‘25 eurodollars narrowed to 0.55%, implying the Fed will be on a pace of barely more than one 25bps hike annually during that time. This is historically very slow, and at odds with what FOMC members expect. In March, the market was priced for almost five tightenings over this two year period. By the end of the week, this spread had widened back out to 0.65%.

For those who are familiar with the colors of each year of futures, the Jay Powell trade is to go “long the green Dec gold Dec spread.”

Betting against the FOMC made sense early this year, when the yield curve was too flat. Six months ago the market was priced for only a one in five odds of a tightening by the end of next year. Today, seven out of 18 FOMC “blue dots” are forecasting such, and the market has adjusted accordingly.

But the opportunity is shifting towards later rather than sooner, which is in line with Fed chair Powell’s view. Former NY Fed president Bill Dudley noted that the employment situation is likely to remain unclear until Federal unemployment benefits fully expire in September and children finally return to in-person school. So it’s going to be at least another couple of months before the Fed can conclude “substantial further progress” towards full employment has been made.

Being an inflation hawk has gradually gone out of fashion, not least because persistently low inflation has rendered such a stance out of touch. But even today’s dovish FOMC expects to raise rates within two years – their internal debate will be one of speed.

Joe Biden will have an opportunity to influence the FOMC’s composition. Fed chair Powell is up for reappointment next year and looks likely to stay. Vice chairs Richard Clarida and Randal Quarles are also both up for reappointment, and one of the seven Fed board seats is vacant, with a term that expires in 2024.

This offers the president an opportunity to modify the FOMC somewhat to reflect his views. Don’t expect anything so crass as public advice on monetary policy from the White House, but subtle pressure out of the spotlight is likely. This makes a slow pace of monetary tightening more likely, because the FOMC’s dovish tendencies will be reinforced.

Chair Jay Powell is likely to have a say in any appointments. He’s already suggested that monetary policy has a role to play in reducing income inequality. There are many considerations the FOMC could include in setting rates, and they’re all likely to lead to more dovish outcomes than a simple focus on inflation.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.