Growth Is Gassy Not Oily

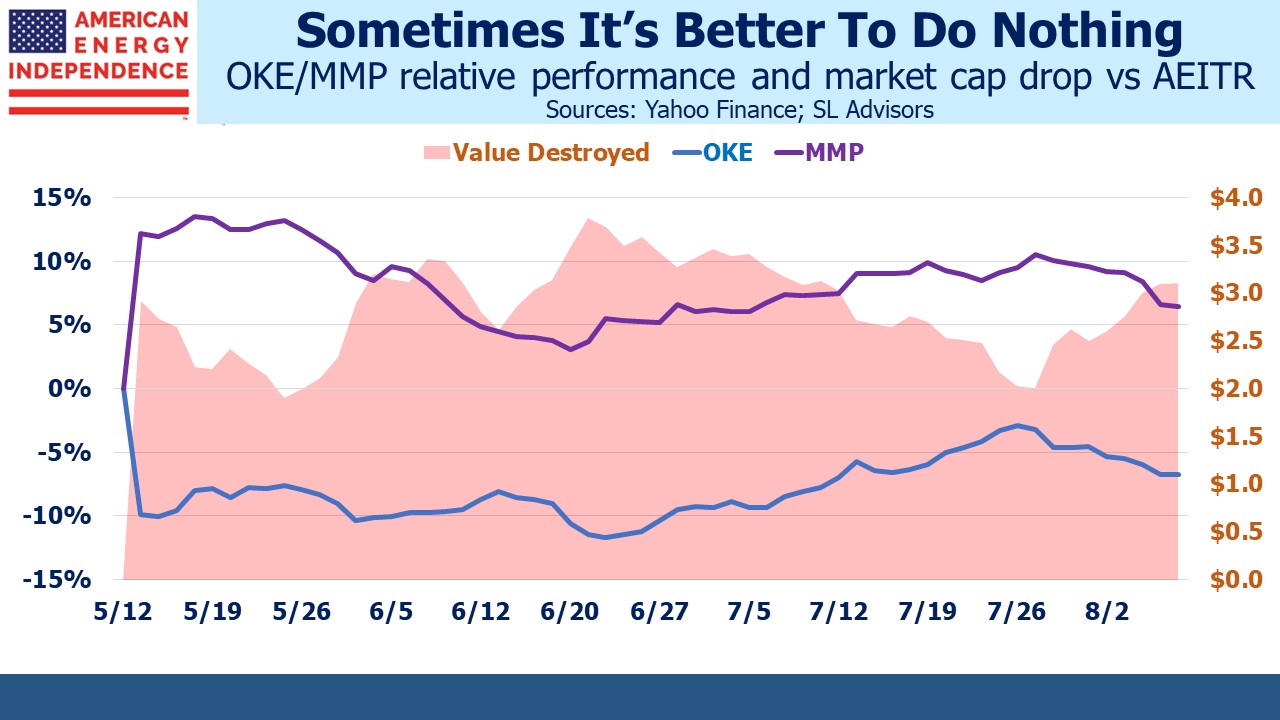

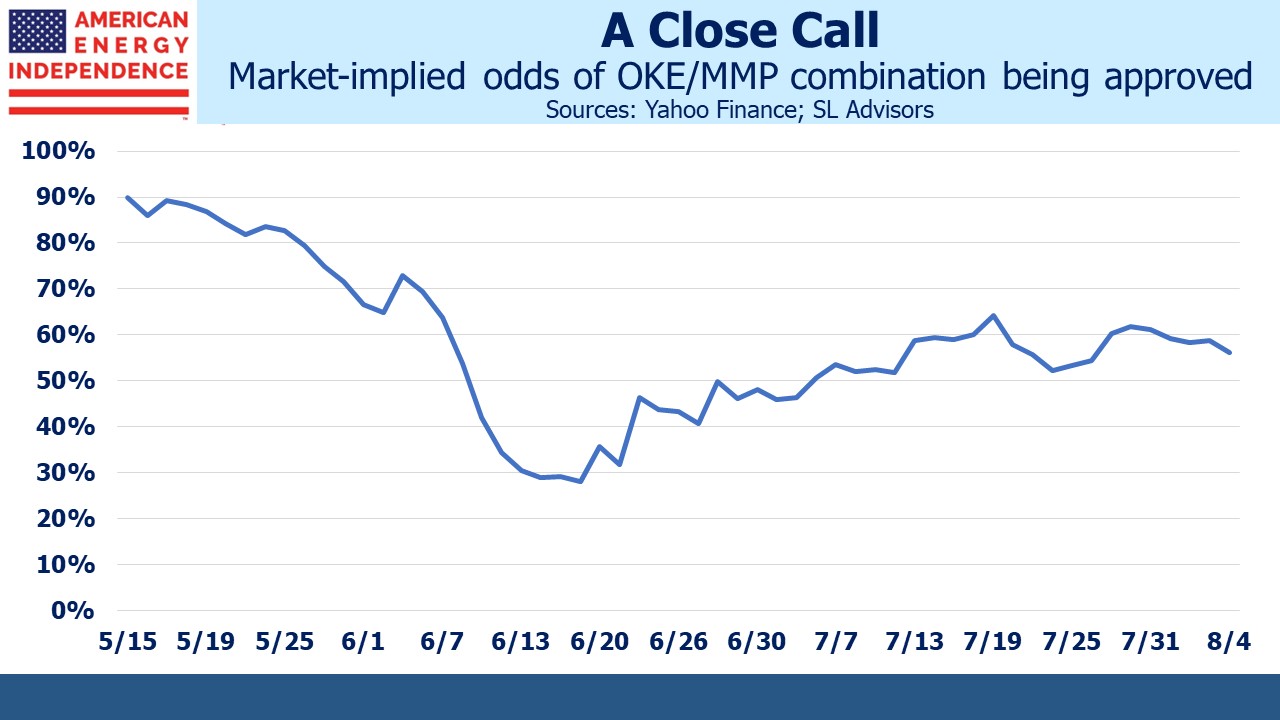

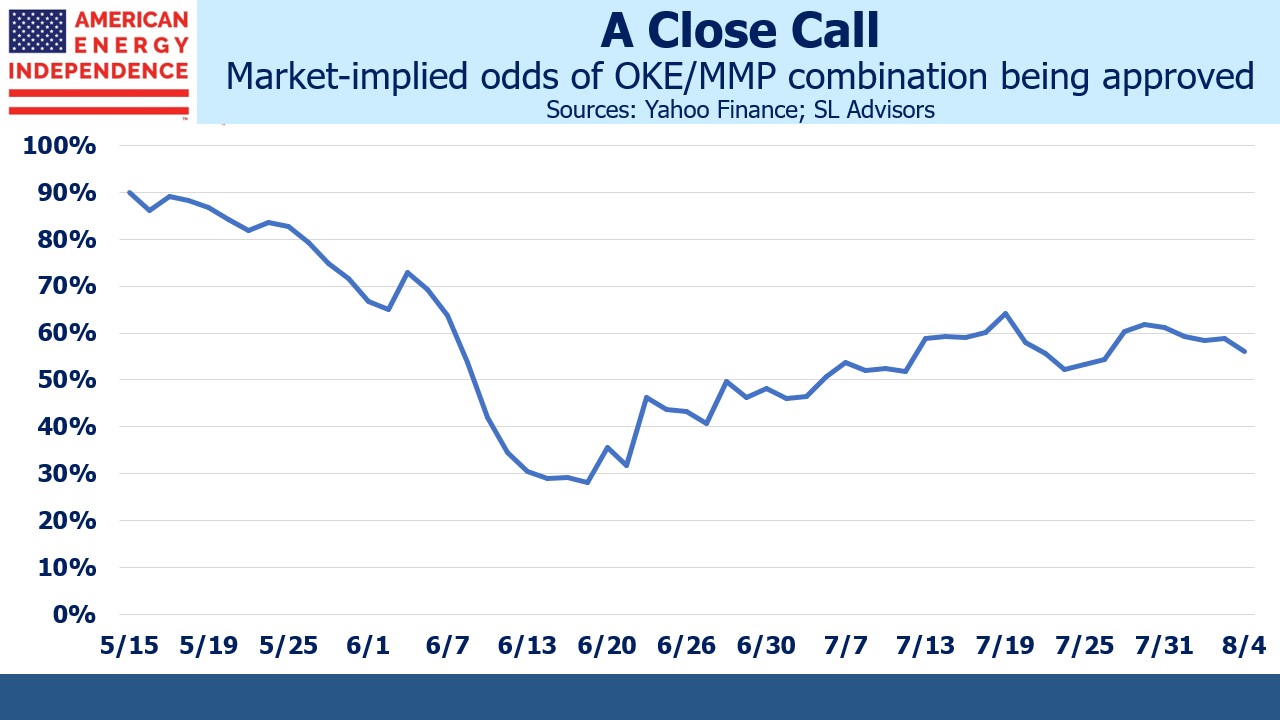

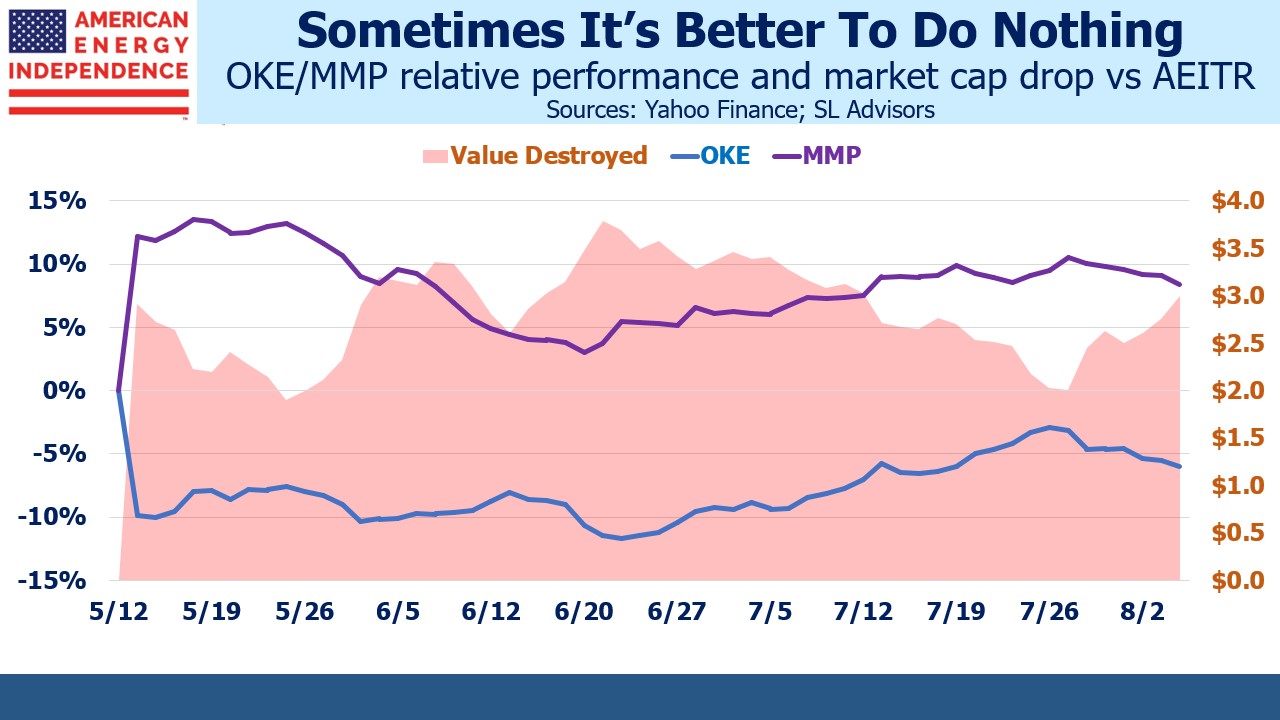

We’ve been critical of Magellan Midstream’s (MMP) proposed sale to Oneok (OKE) for months (see Oneok Does A Deal Nobody Needs), mostly because it forces MMP unitholders to pay taxes now that didn’t need paying and for some may never be paid. But we do agree with MMP CEO Aaron Milford that the growth opportunities in crude oil and refined products where they operate are not as attractive as in natural gas and natural gas liquids. Of course, MMP investors didn’t need him to sell the company because of that, anymore than a merger to create a more diversified business is justified. Investors can create their own diversification or high growth portfolio without M&A by management. But Milford’s not the only energy executive with the conviction that growth is more gassy and less oily.

Energy Transfer’s acquisition of Crestwood brings natural gas gathering and processing assets and reduces crude oil transportation to 20% of ET’s cash flows. This deal also doesn’t create any tax issues for owners.

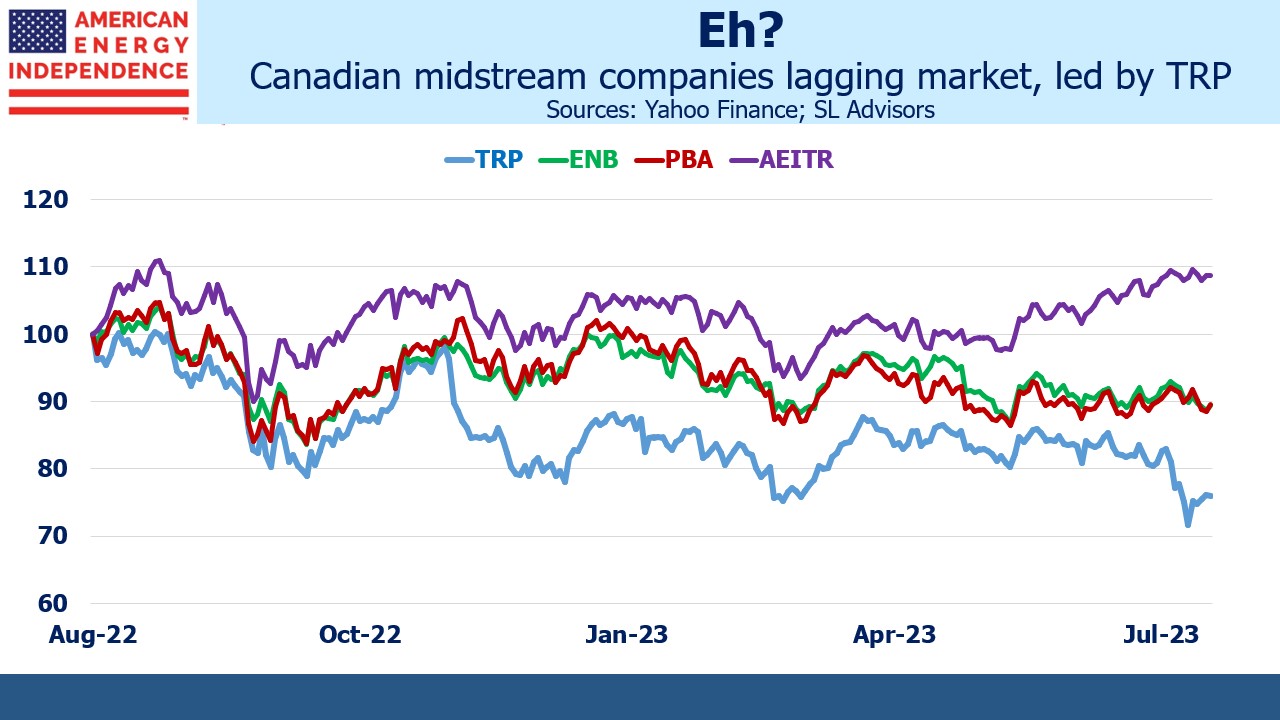

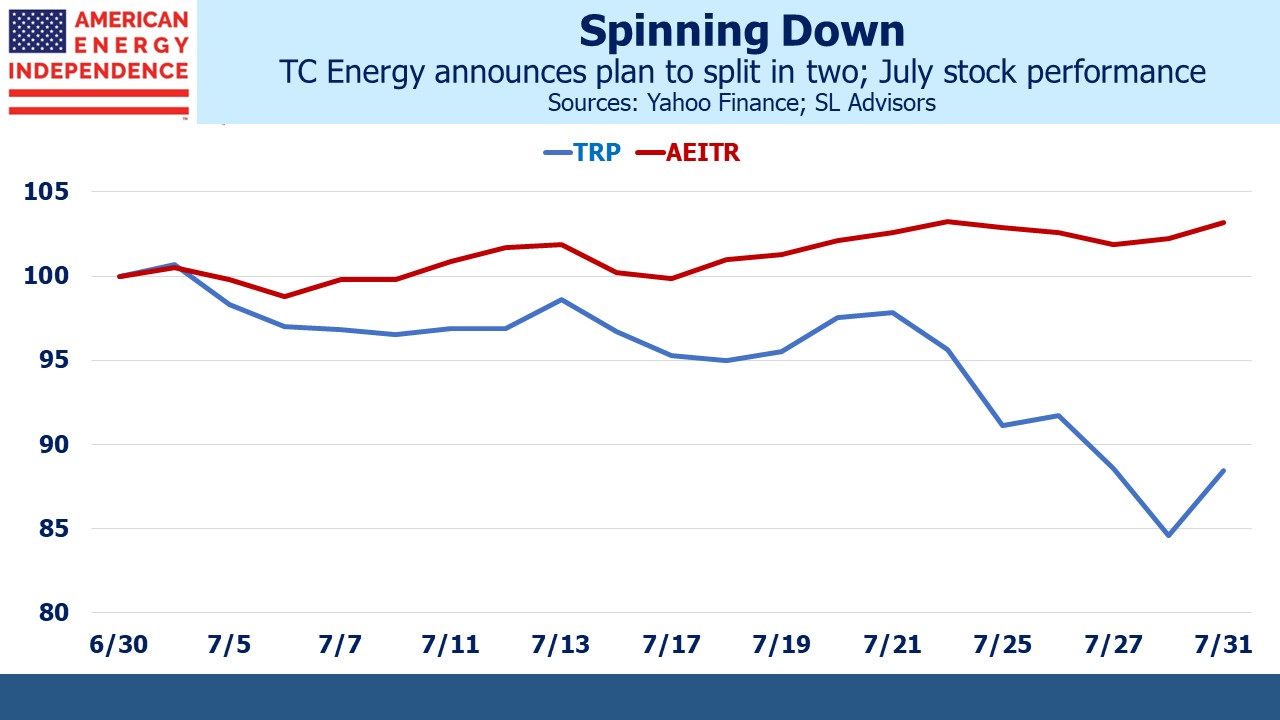

TC Energy (TRP) recently announced they’re spinning out their liquids business to a be a standalone entity, leaving them to be an “opportunity-rich, growth oriented natural gas and energy solutions company.” They expect their liquids business to offer “incremental growth and value creation opportunities.” This doesn’t sound very exciting. TRP had been lagging its peers because of its high capex. The spinoff announcement wasn’t well received because it caused investors to think a little more about the liquids business and its low growth prospects.

Blackrock and KKR recently sold their stake in an Abu Dhabi crude oil pipeline for $4BN.

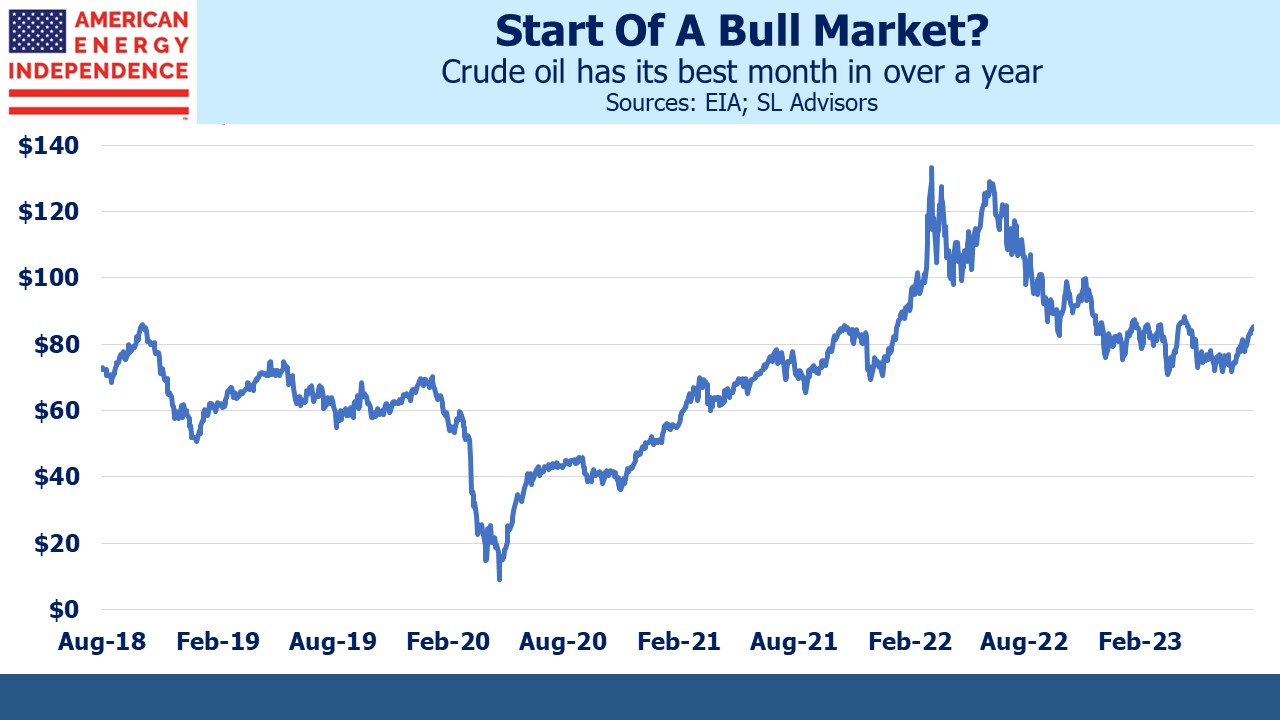

Most long term energy forecasts are political documents nowadays. If your projections don’t show a rapid transition away from fossil fuels, climate extremists accuse you of destroying the planet. BP struggled with this in recent years. They handed off their Statistical Review of World Energy to the Energy Institute last year. In 2022 their projections had the Orwellian names Accelerated, Net Zero, and New Momentum. The third was the realistic one showing current trends – the other two were useless for capital allocation.

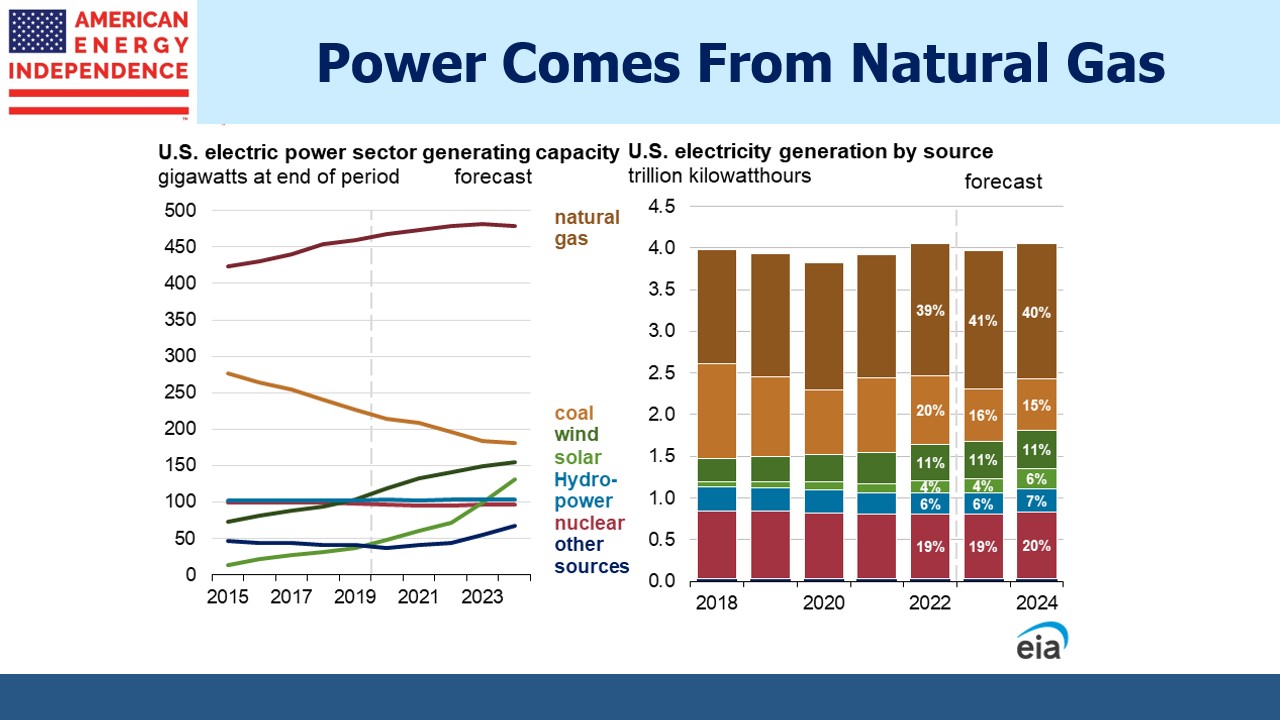

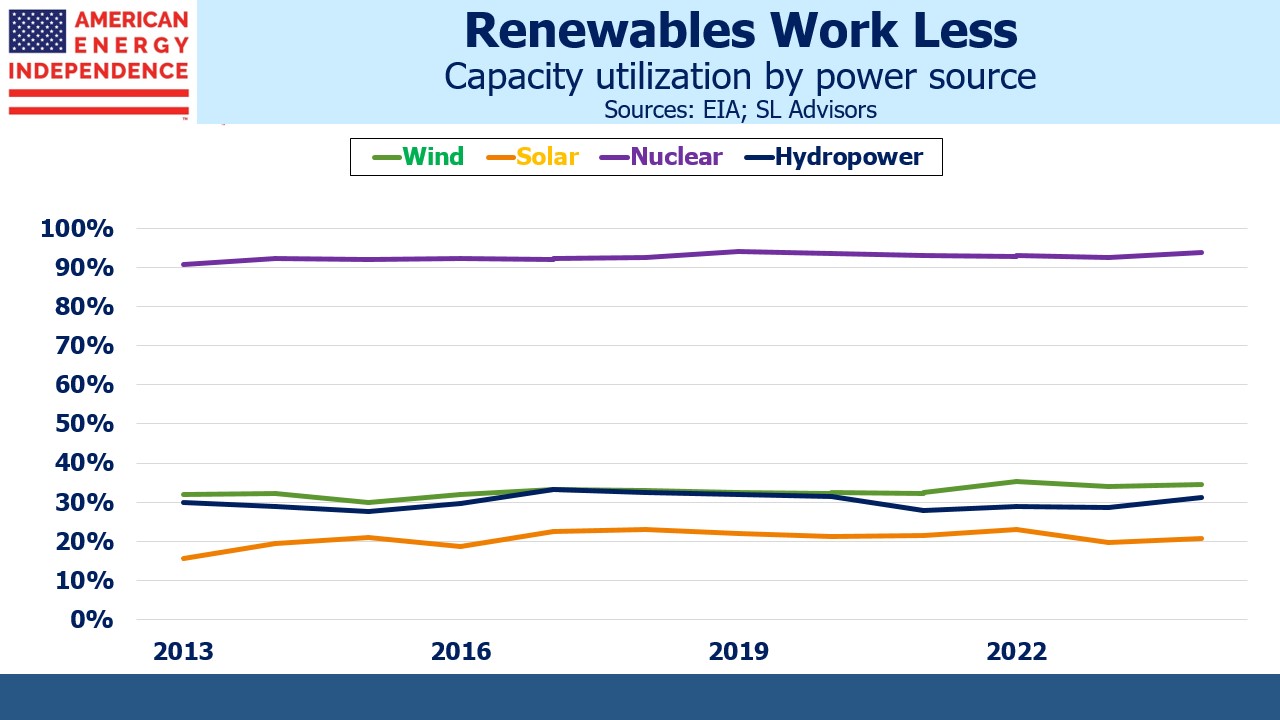

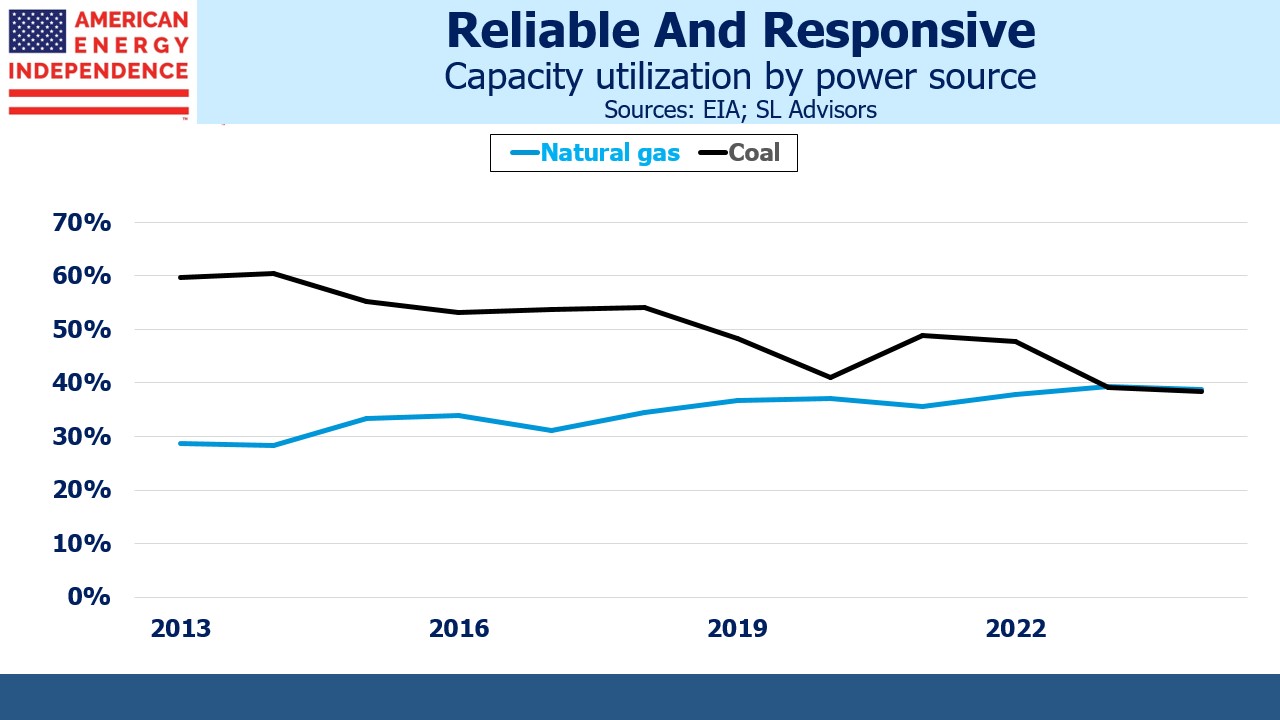

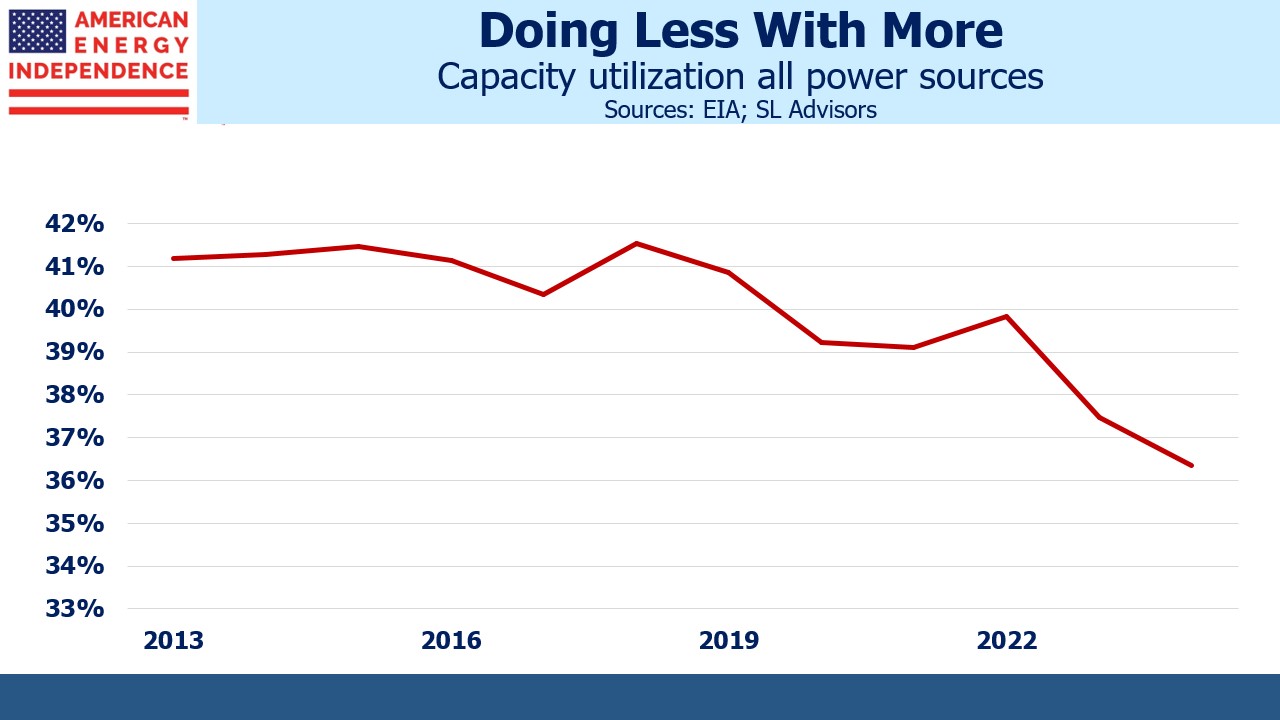

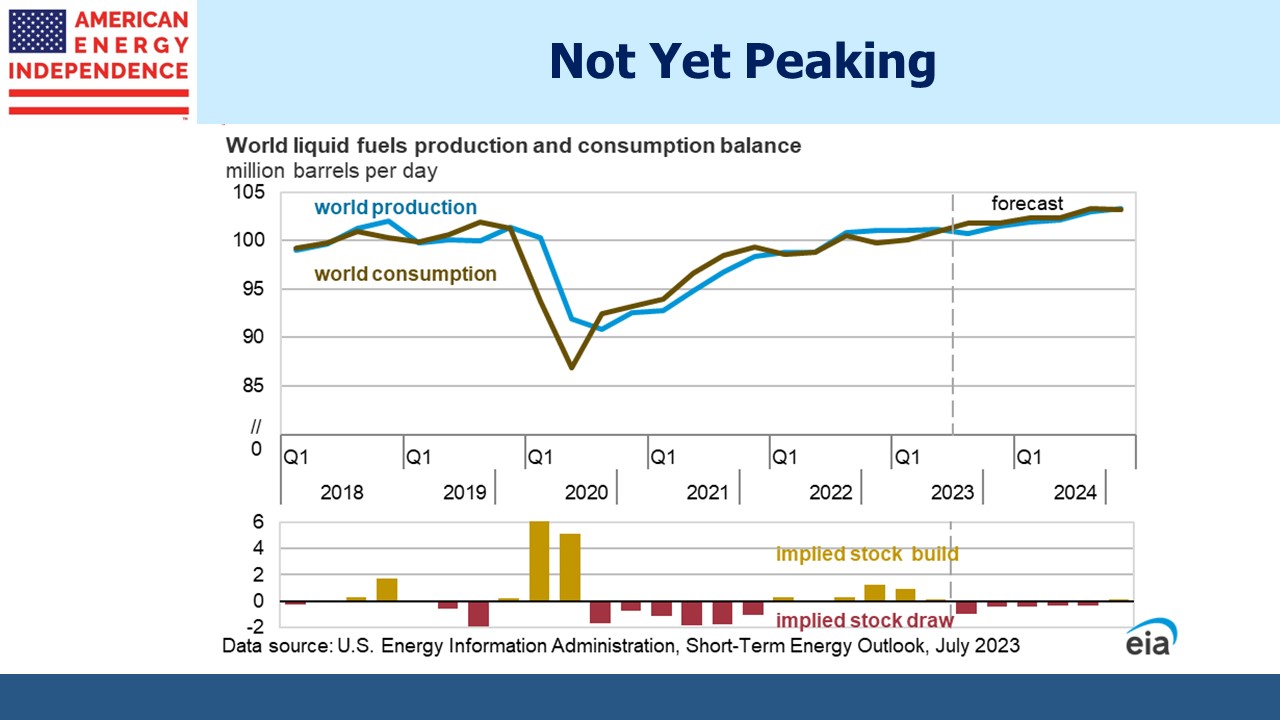

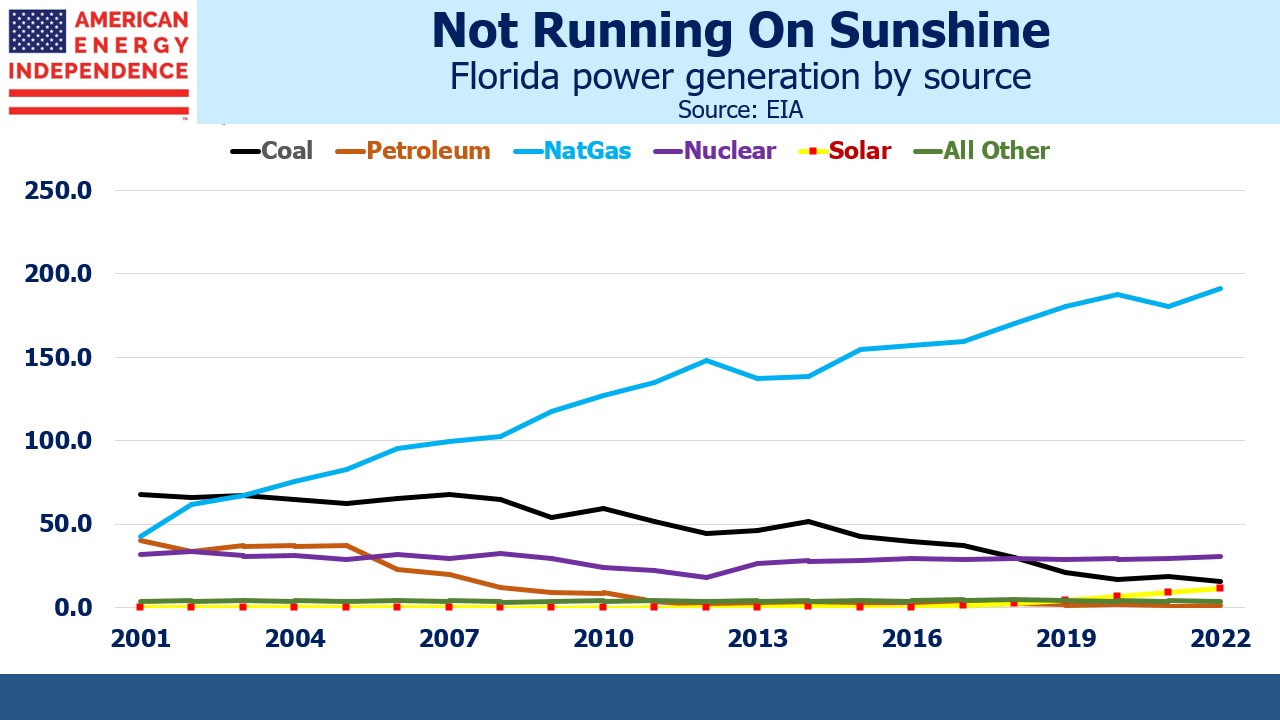

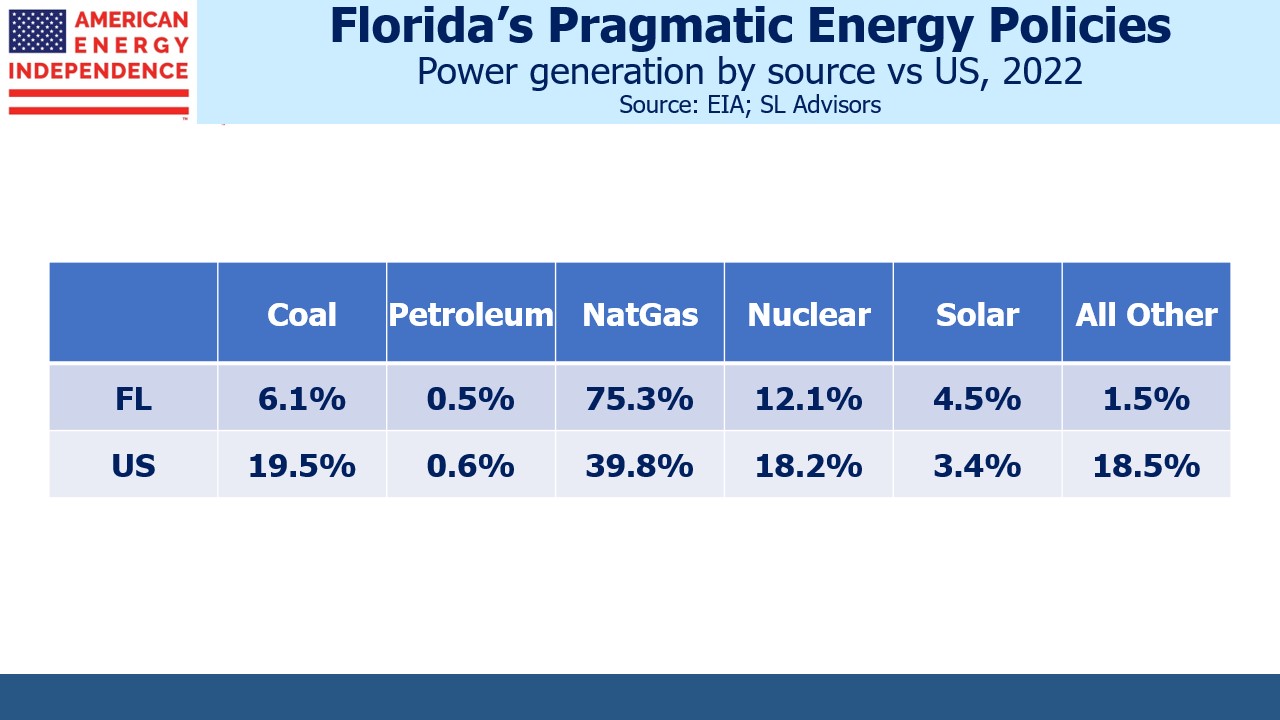

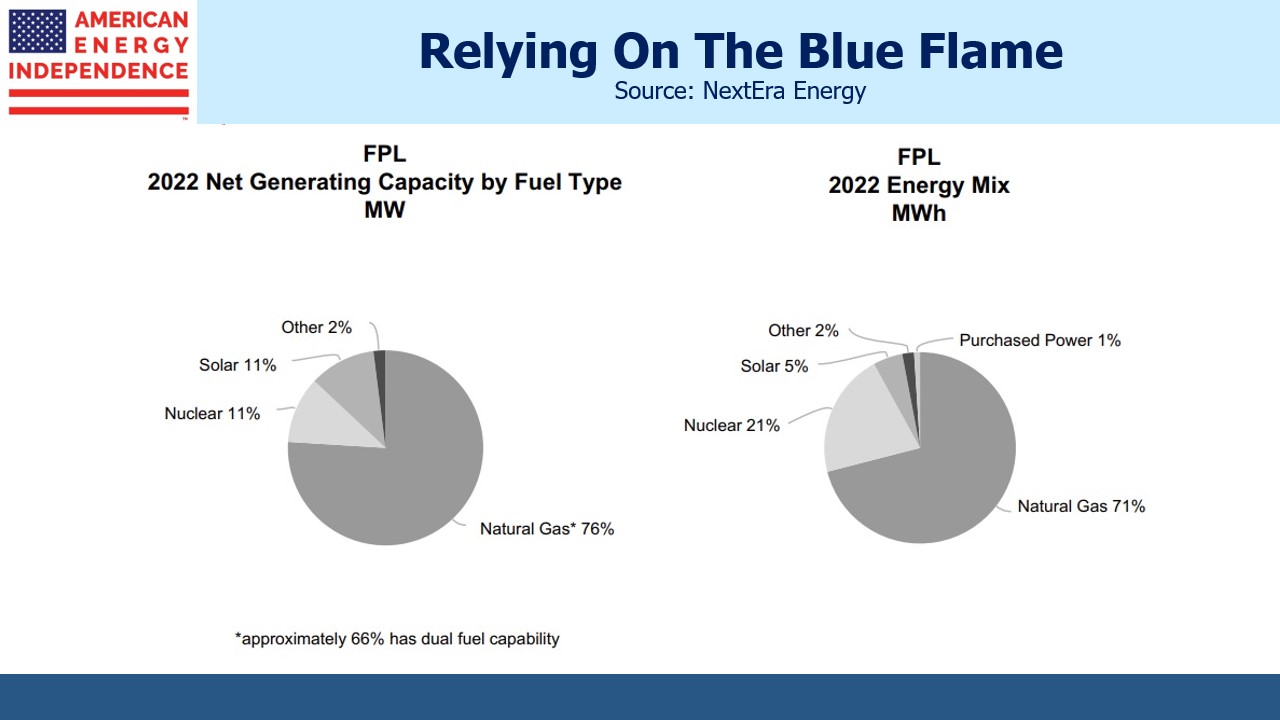

The US Energy Information Administration (EIA) makes long term forecasts that fortunately remain apolitical. Forecasts of crude oil demand become increasingly tenuous over time because the transportation sector dominates and public policy can more easily impact the move to electric vehicles. But natural gas is harder to replace, especially in the industrial sector where the EIA sees Incremental growth for the next three decades.

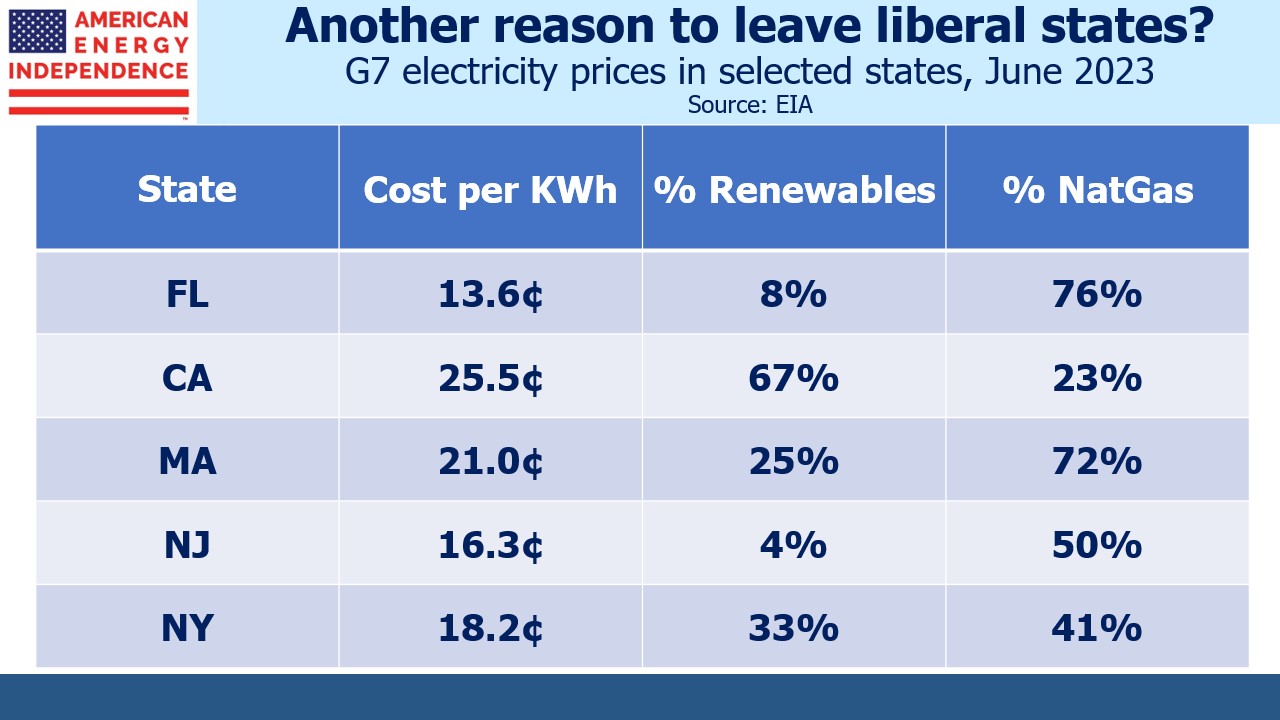

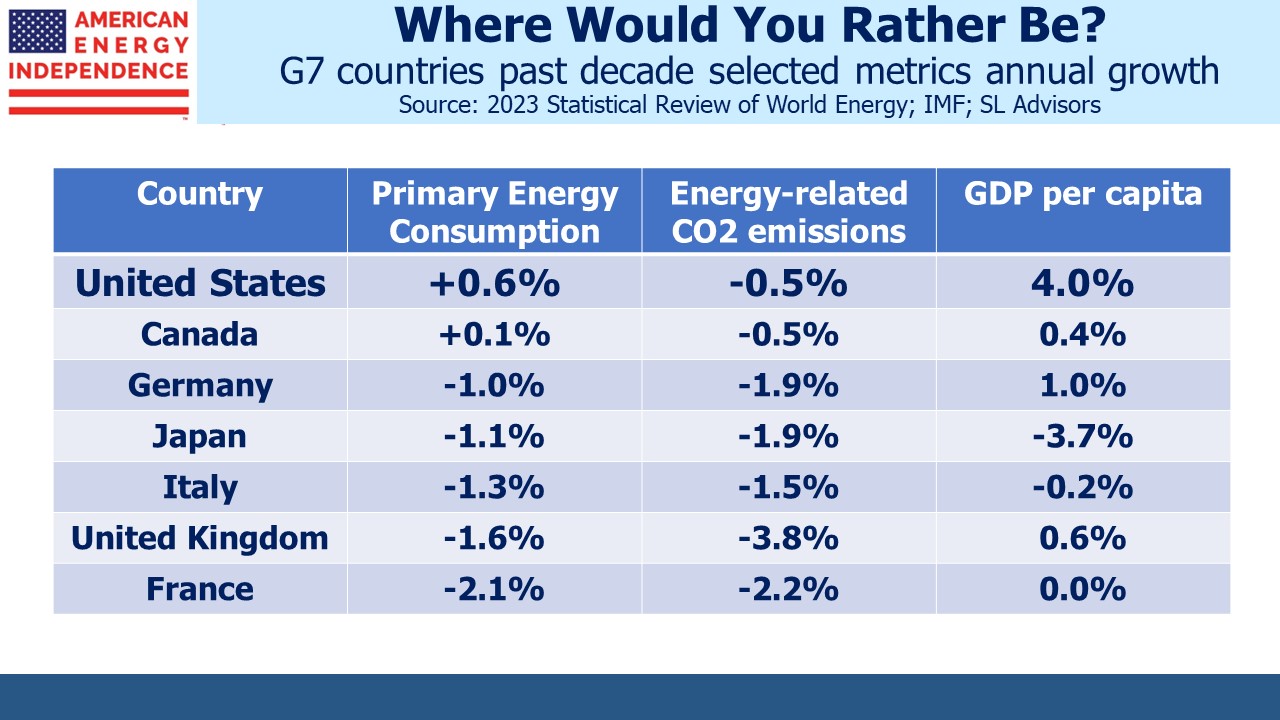

The Inflation Reduction Act is encouraging Foreign Direct Investment (FDI). Dutch fertilizer company OCI is investing $1BN to produce ammonia, a key fertilizer input, in Texas. Europe’s declining energy consumption following Russia’s invasion of Ukraine is in part due to de-industrialization caused by high energy prices. Chemical, metallurgic, glass, paper and ceramic industries have been closing factories across Europe. In a recent survey of 3,500 German companies, more than half felt the transition away from Russian natural gas and towards renewables was “very negative or negative” for their business. Some of these companies are transferring output to America. Since 2021 the US has been the world’s biggest destination for FDI.

US exports of Liquefied Natural Gas (LNG) are almost certain to enjoy strong growth as the US adds LNG terminals to send cheap US gas to foreign markets. Industry and LNG exports are the two main drivers of growth for US natural gas.

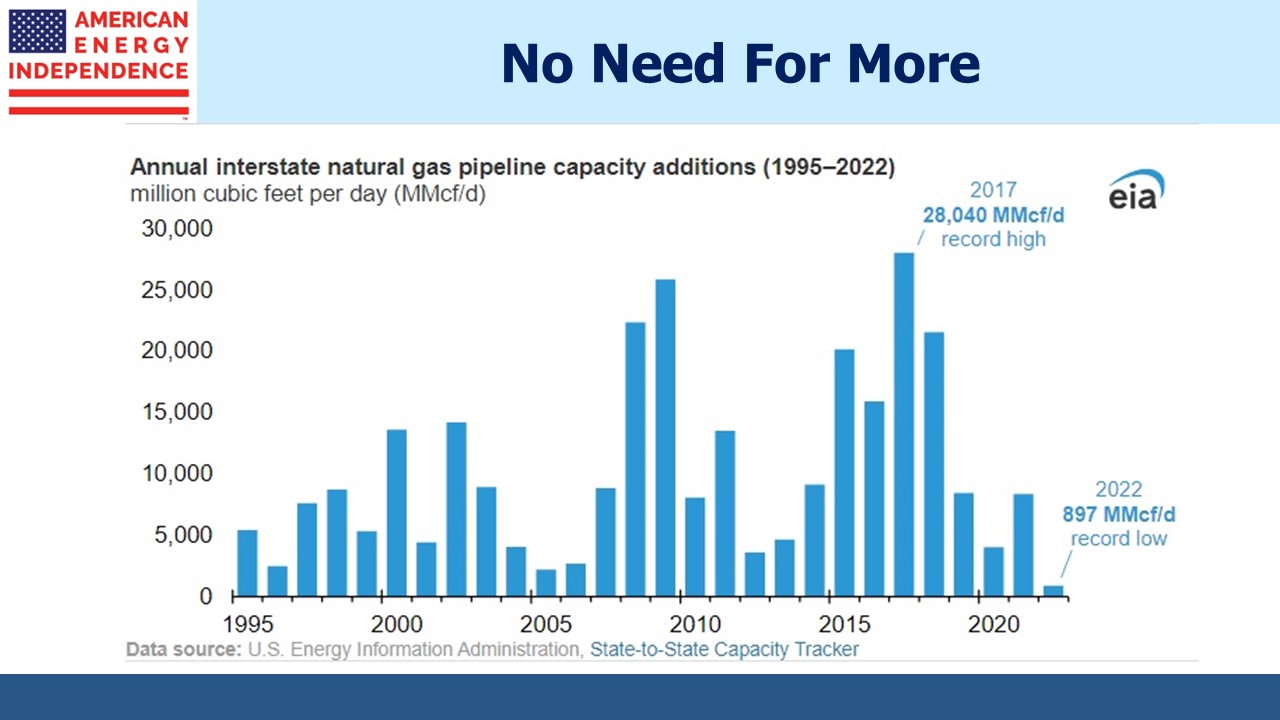

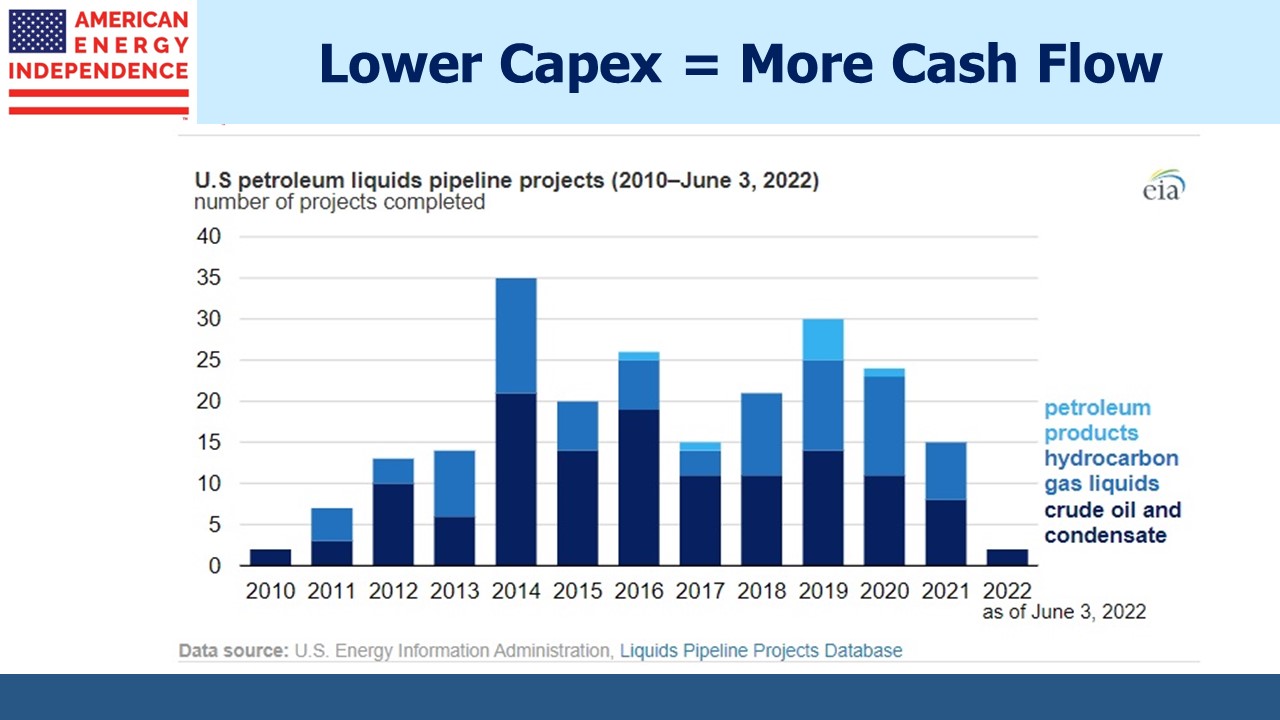

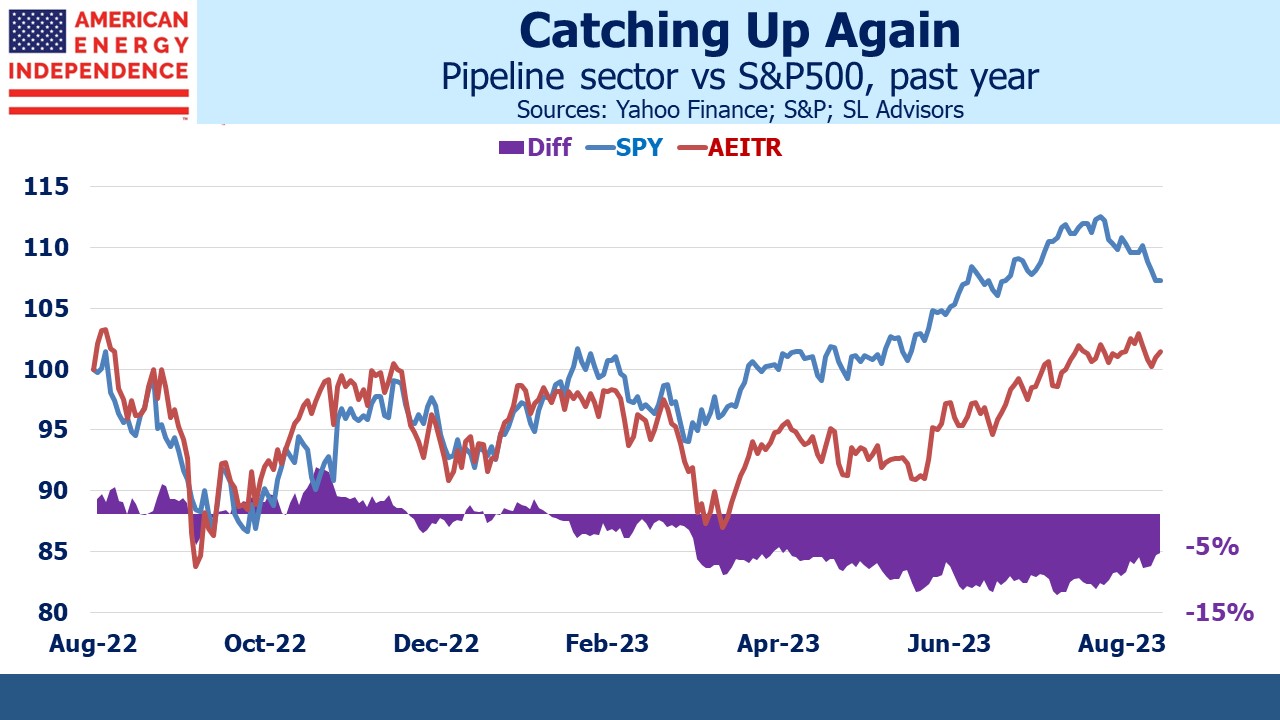

Construction of new pipelines for both crude oil and natural gas in the US is far below past years and is unlikely to recover anytime soon. We have what we need. This is why growth capex is down more than half from its peak, boosting cash flow and making the stocks attractive.

The only major crude oil pipeline project under construction in North America is the expansion of the Trans Mountain Pipeline which Kinder Morgan wisely sold to the Canadian Federal government in 2018 (see Governments And Their Energy Policies). Getting its oil to international markets is regarded as being in Canada’s national interest. But the same environmentalist activism and cost inflation that delay private sector projects have similarly hurt this one now owned by the public sector. The estimated cost has increased 4X since KMI’s sale.

Recently engineering difficulties in an approximately one mile stretch of tunnel through a mountain in British Columbia have triggered a request for regulatory approval to alter the route. The indigenous population is opposed. Further delays look likely, risking “significantly increased construction costs.”

Gas is a growth business. Capital and M&A decisions are starting to reflect that.

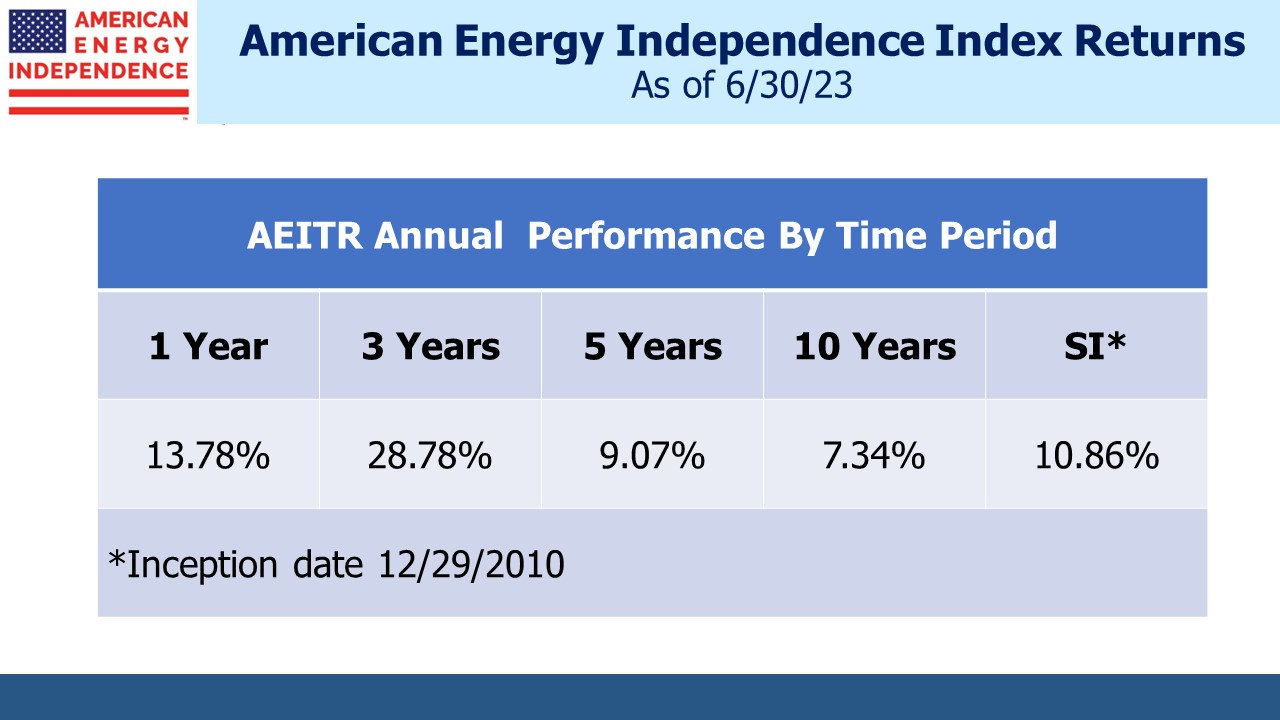

We have three funds that seek to profit from this environment:

![Slide1[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide11-1.jpg)

![Slide2[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide21-1.jpg)

![Slide3[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide31.jpg)

![Slide4[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide41.jpg)

![Slide5[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide51.jpg)

![Slide6[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide61.jpg)

![Slide1[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide11.jpg)

![Slide2[1]](https://sl-advisors.com/wp-content/uploads/2023/08/Slide21.jpg)