Natural Gas Is The Future Fuel

On Monday the market dipped back below its pre-election level. The proximate cause was Trump’s ambiguous response when asked if there will be a recession. He has warned that the tariffs will likely cause “a little disturbance.”

To this observer, the problem is more the rapid unpredictability with which new import taxes are announced and modified than the concept. We hope and expect that perhaps within weeks the desired policy outcomes on immigration and fentanyl will be deemed achieved by the White House.

But Trump 2.0 has discovered a tool that he can wield with relative autonomy, using powers Congress has granted the president in an emergency, which this apparently is. It’s going to be in his toolkit for the next four years, brandished as needed. Investors making long-term capital commitments will contemplate the possibility of further little disturbances for a while yet.

The market must price for this.

Treasury Secretary Scott Bessent has said there’s no “Trump put,” a decline of sufficient magnitude to cause a policy reversal. But then, he could hardly say the opposite without becoming the ex-Treasury secretary.

More correct is to say that falling US stock prices will be more than accompanied by economic pain among our trade partners, the targets of the tariffs. Our trade deficit was $918BN last year. We buy a lot more than we sell. While trade friction is essentially a lose-lose game, the economic pain is likely to be more acute in other countries than in the US.

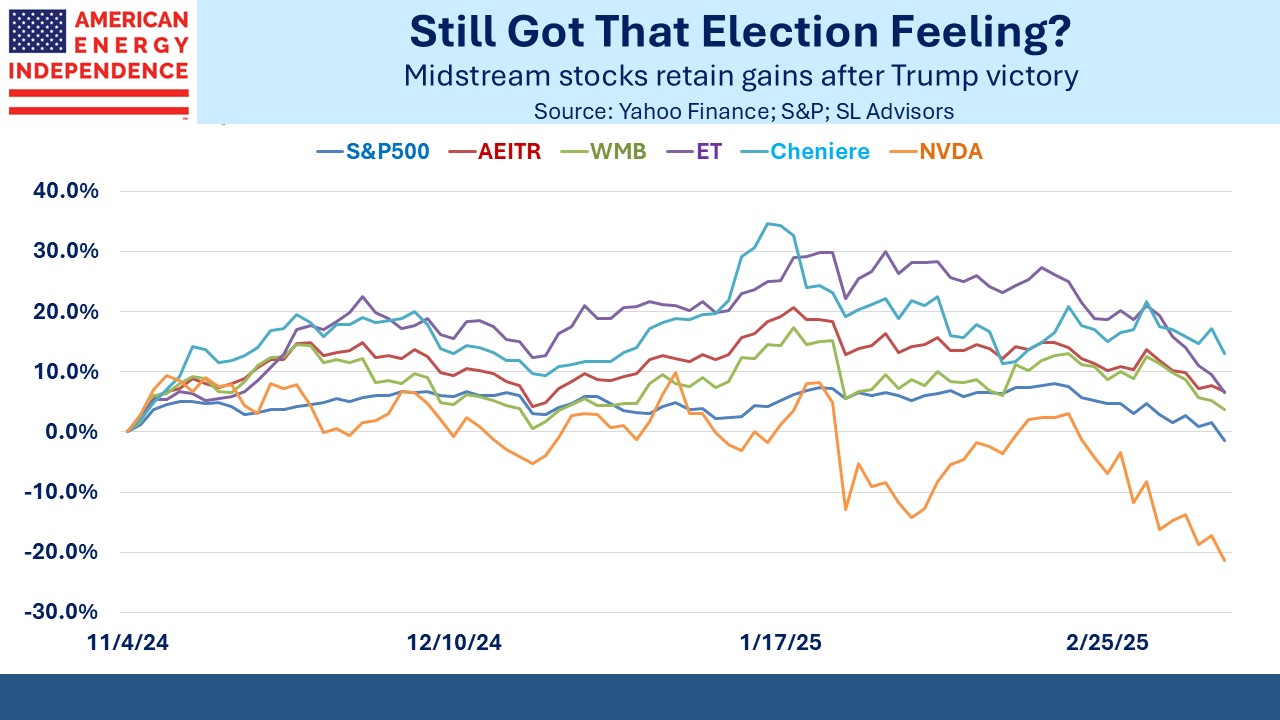

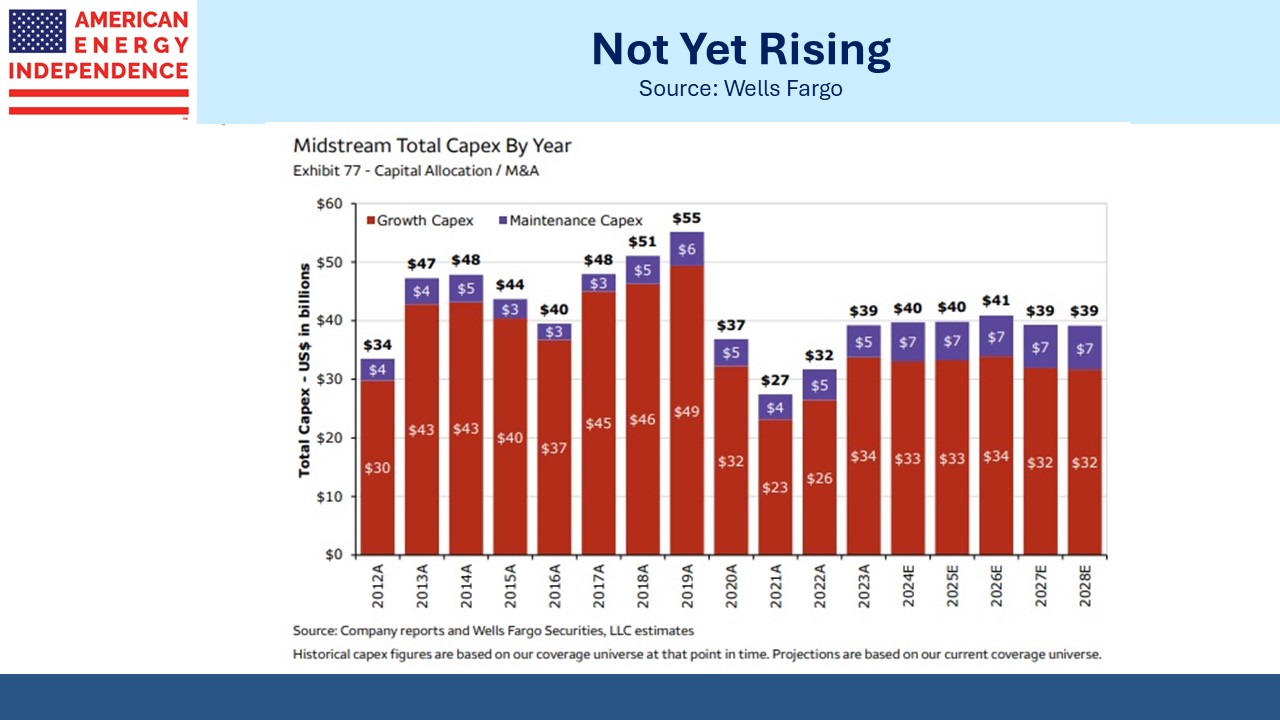

For the investor seeking relative safety from the carnage that has hit previous market leaders such as Nvidia (NVDA), we think midstream energy infrastructure, especially that supporting natural gas, is worth consideration.

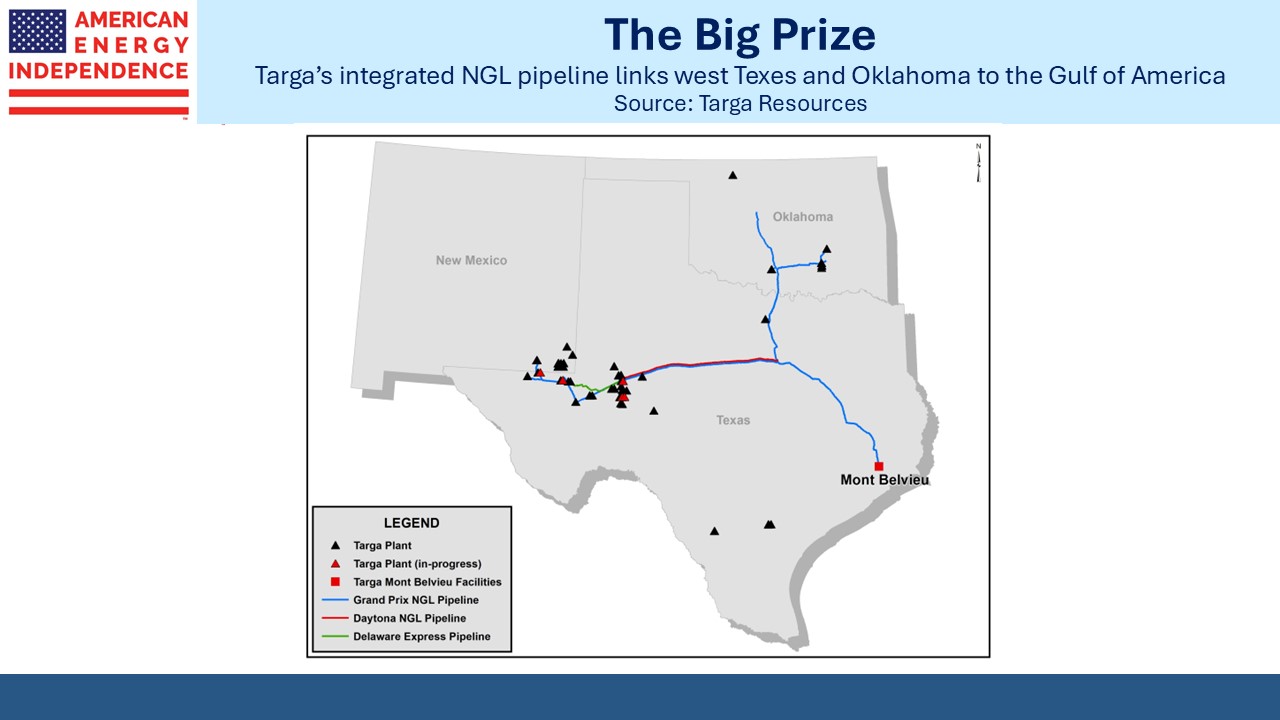

The American Energy Independence Index (AEITR) has outperformed the market since November’s election. Stocks with natural gas exposure including Cheniere, Energy Transfer (ET) and Williams Companies (WMB) have held up better than the overall market because they have limited exposure to tariffs.

Energy is the president’s favorite sector. Buying more US oil and gas is part of the tariff exit ramp for many countries.

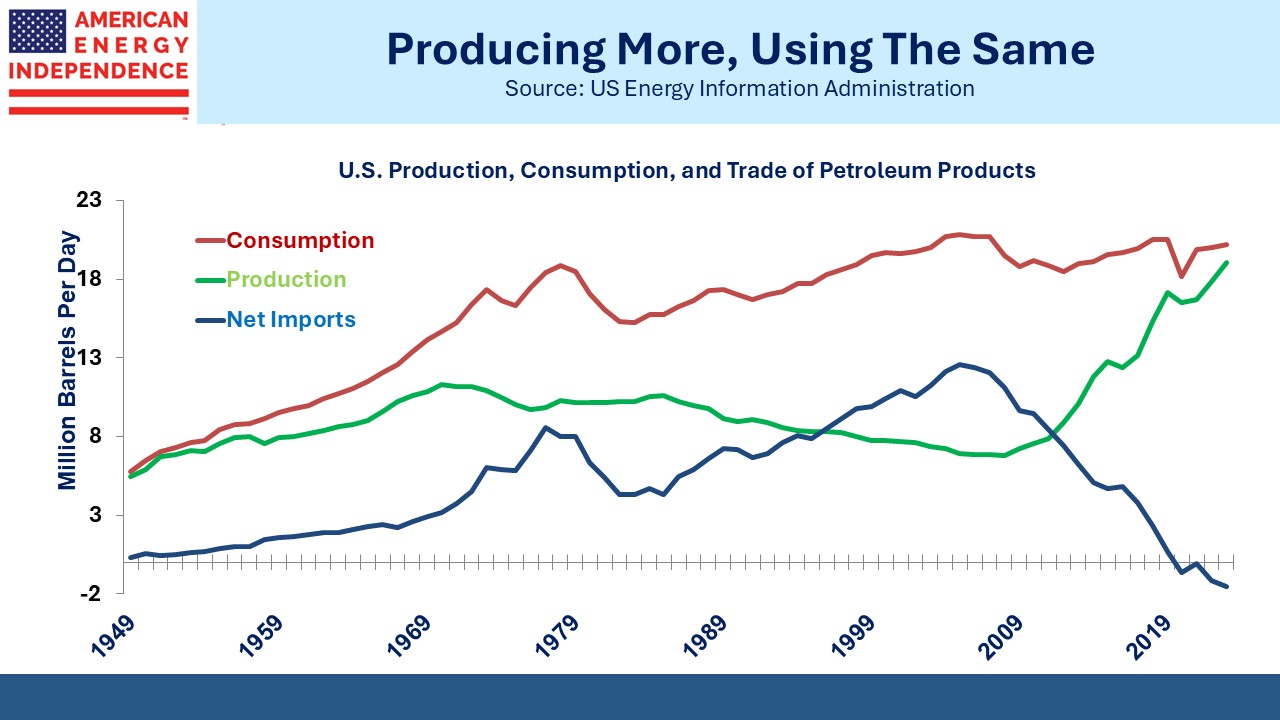

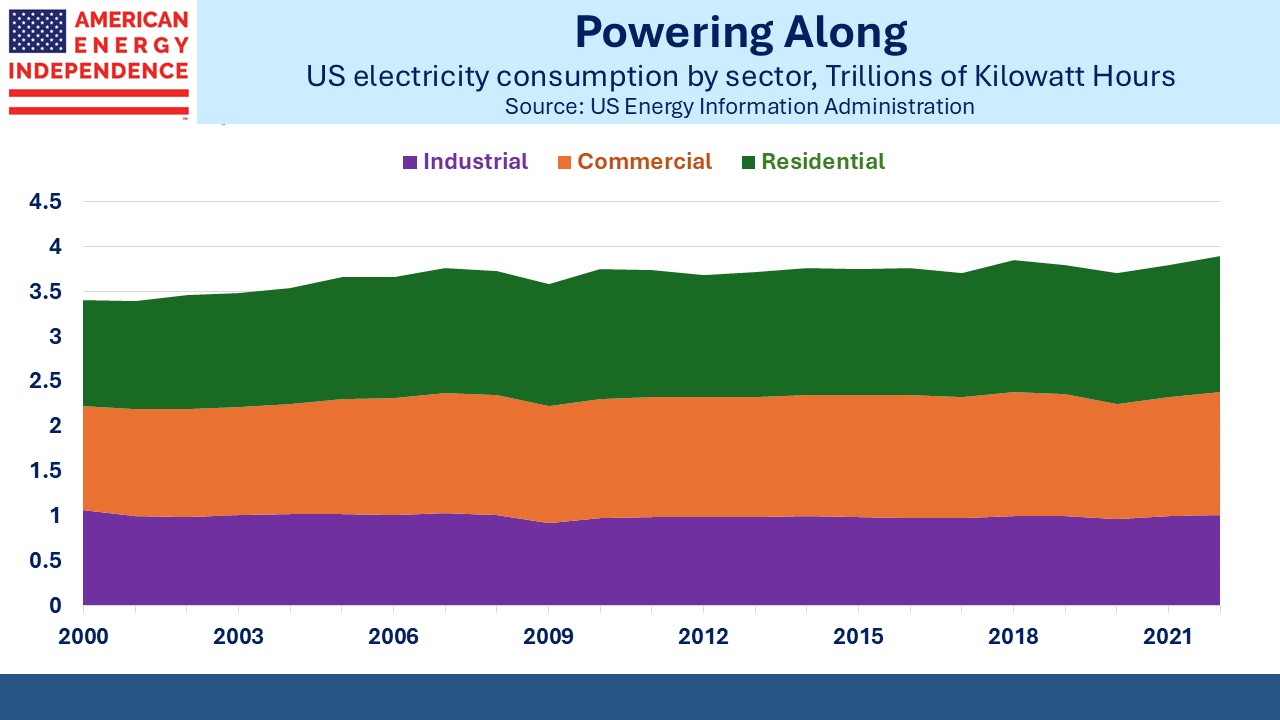

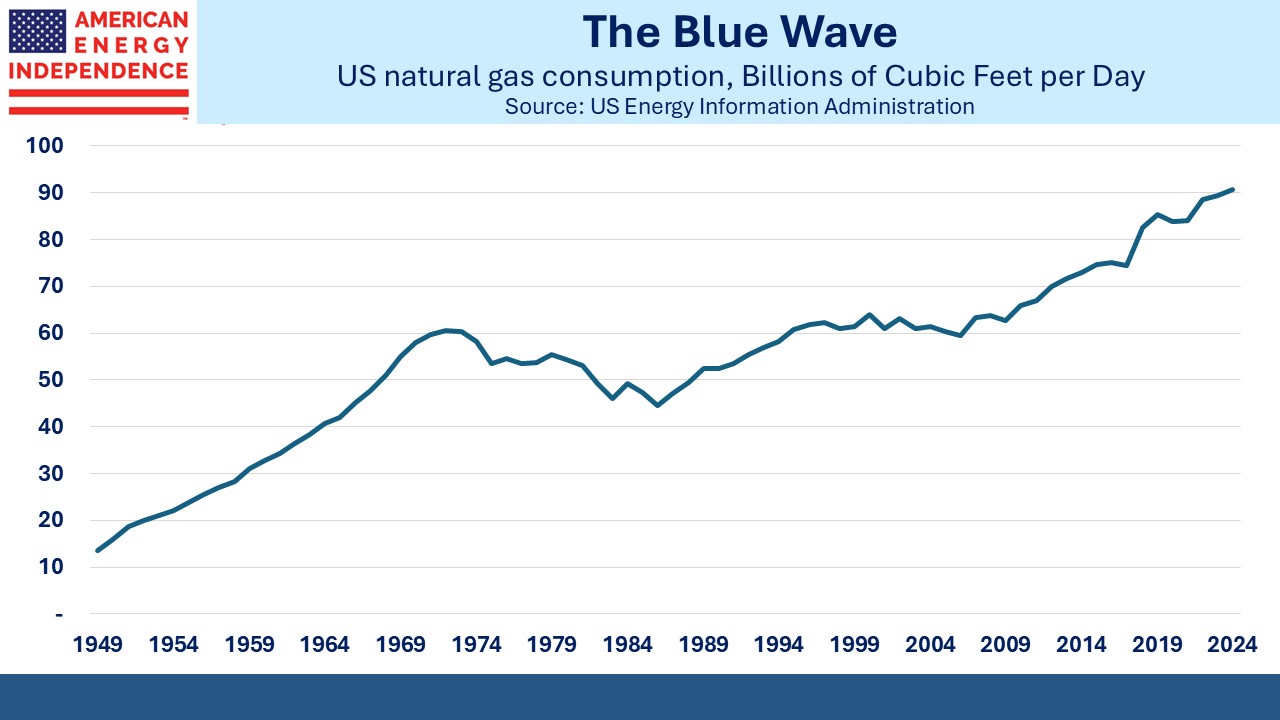

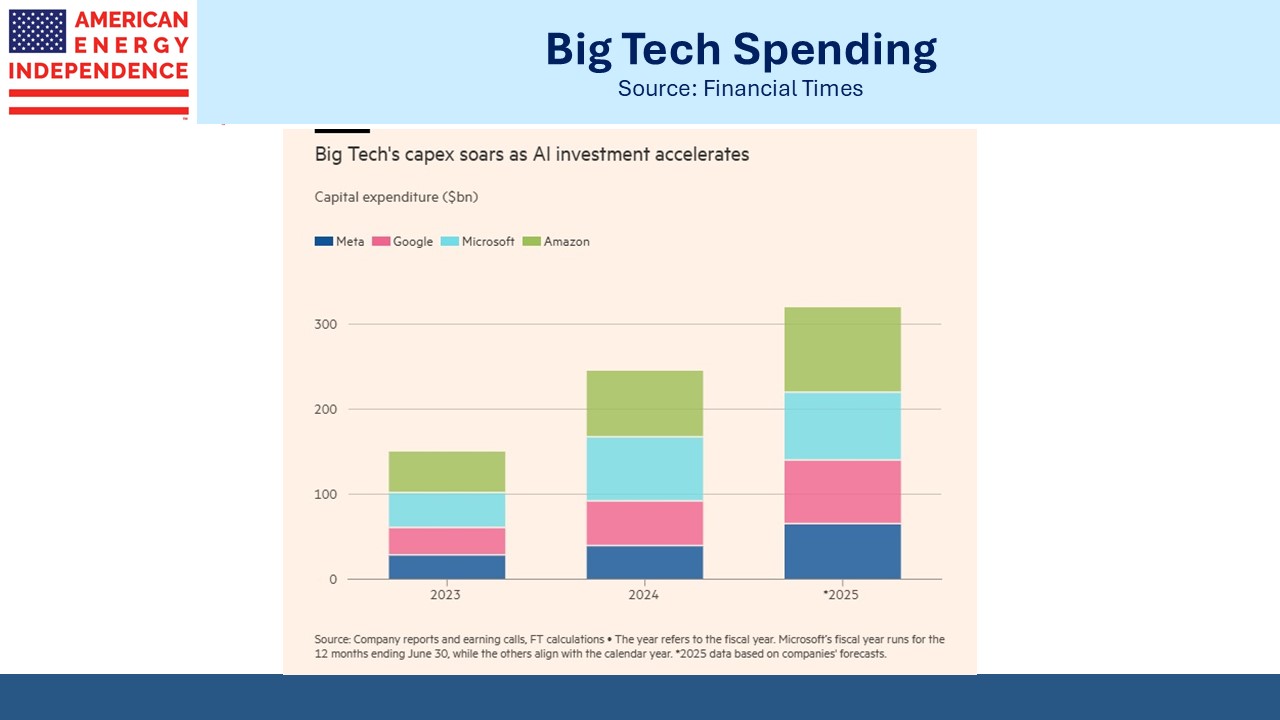

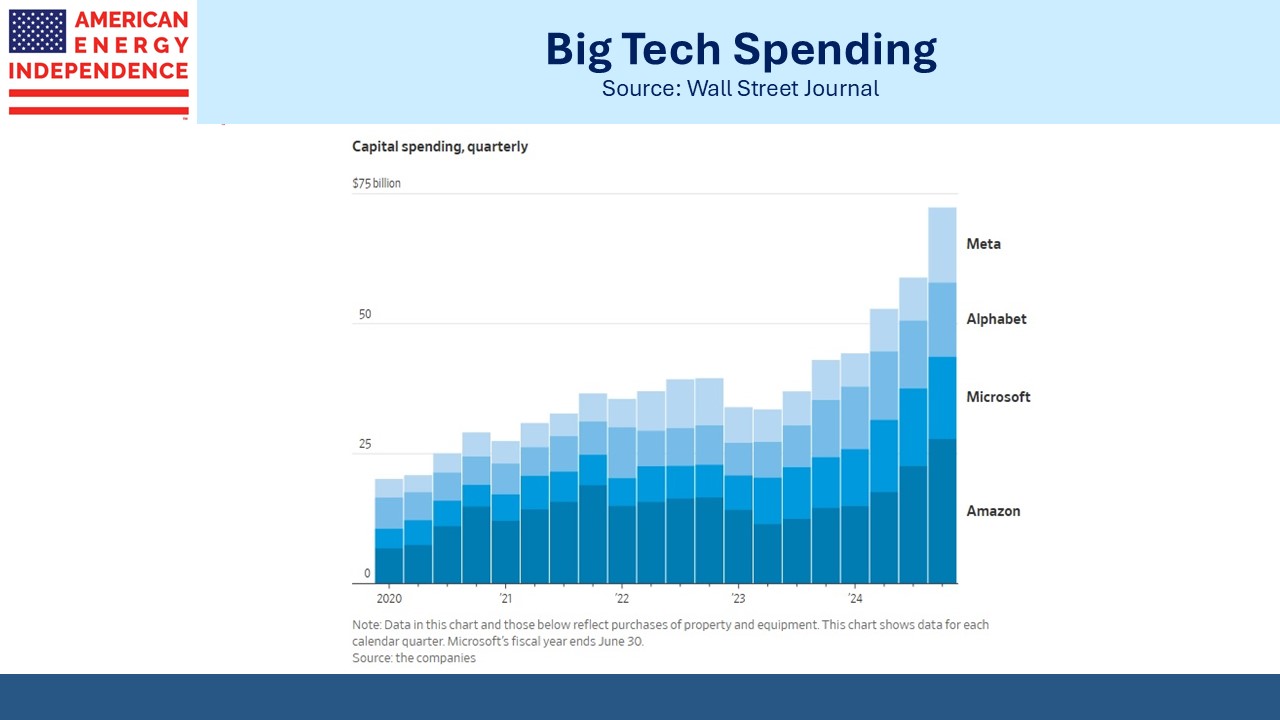

As we noted in a recent blog post (see Midstream Is About Volumes) investors in this sector care about quantity not price. The outlook for natural gas is especially good, with new data centers and Liquefied Natural Gas (LNG) exports both driving demand higher.

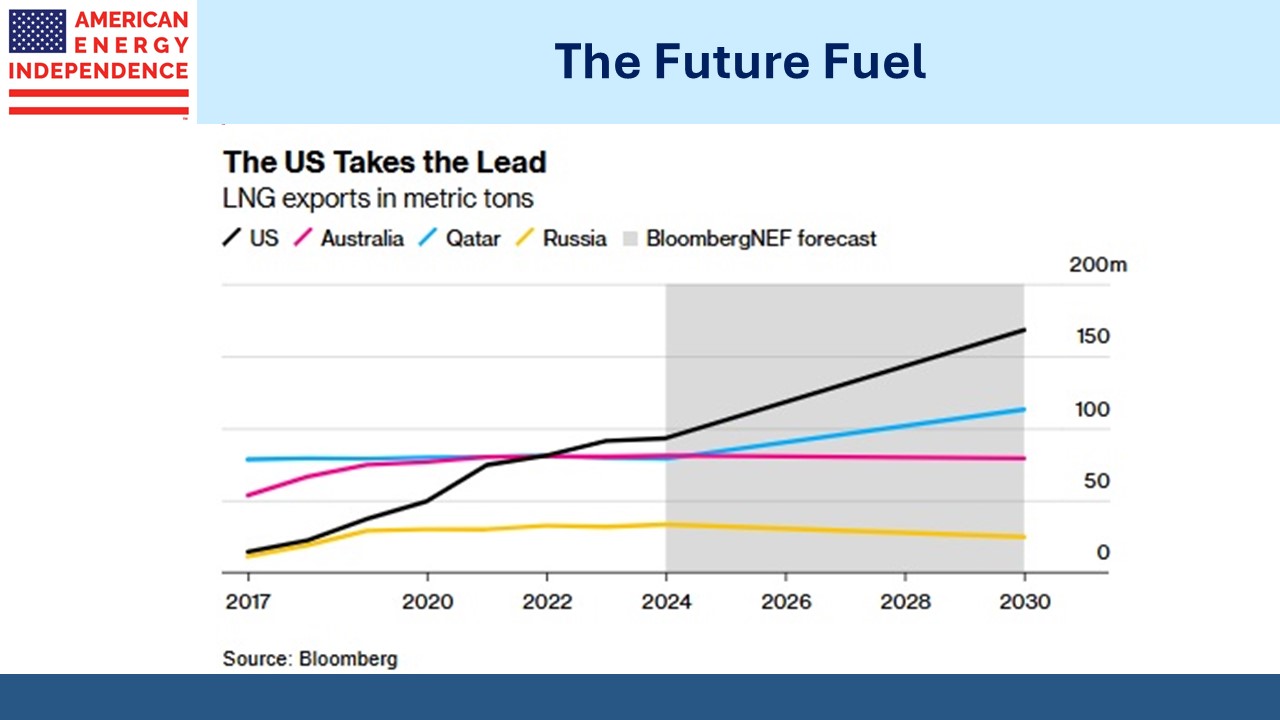

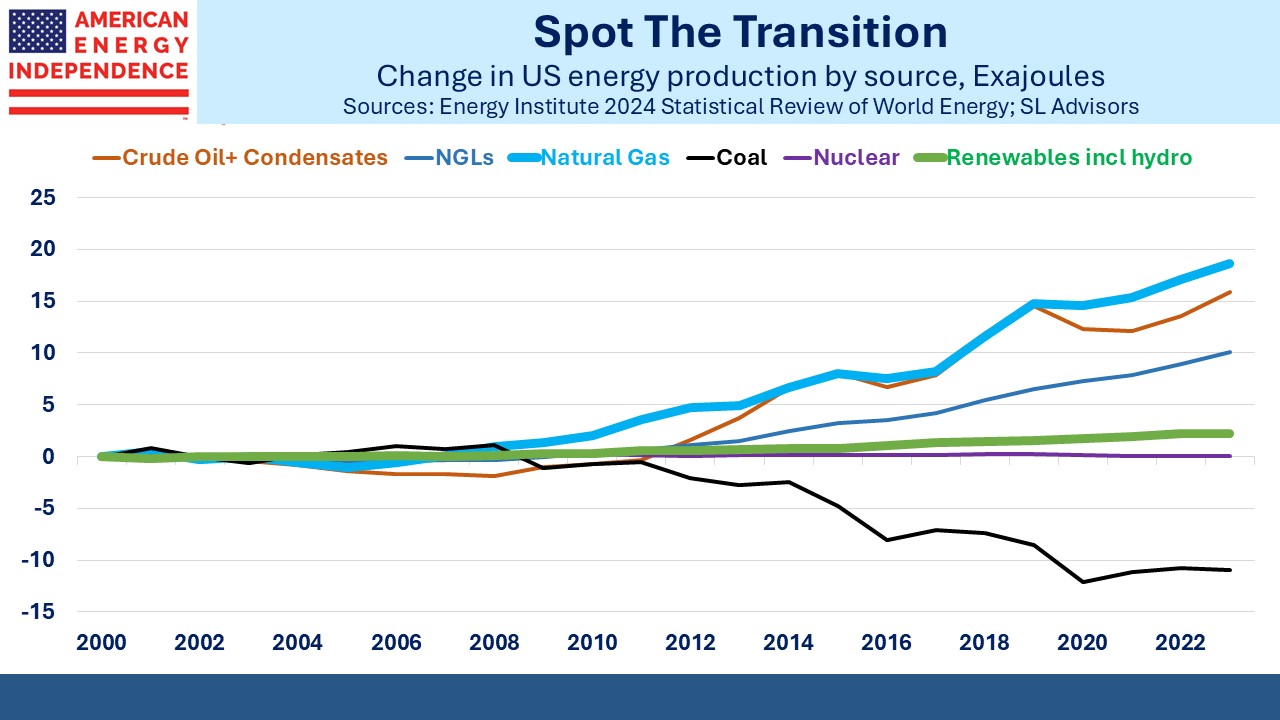

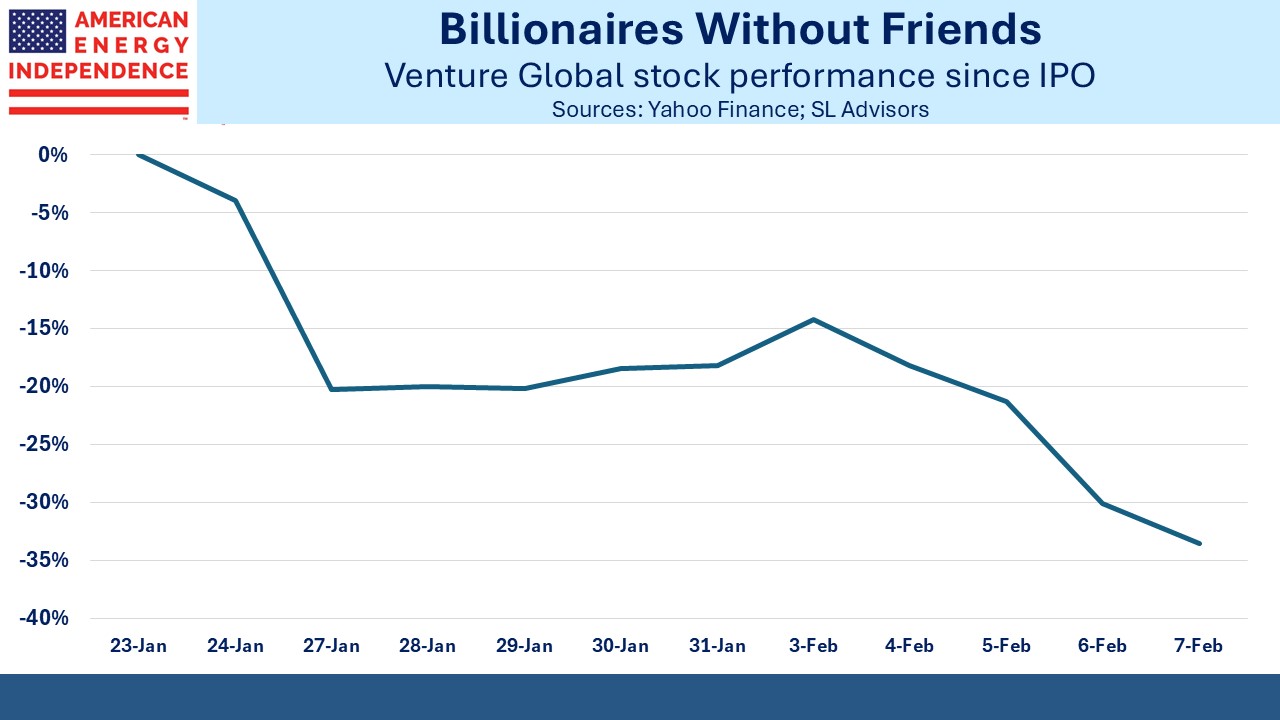

The US is going to pull ahead of Qatar and Australia (#2 and #3) as the world’s biggest exporter of LNG. Natural gas has long been thought of as a transition fuel by those expecting the world to exist fully on renewables. They suggested it was a transition fuel helping the energy transition. A temporary fuel to enable the eventual move to fully rely on solar and wind.

The opponents of natural gas fear that its market share gains won’t be temporary, and for good reason. If the world had already been carpeted with solar panels and wind turbines before the shale revolution, unleashing reliable energy would have changed that.

Transitioning off natural gas to unreliable power will require big incentives. As we’ve often noted, the Natural Gas Energy Transition is the only one that’s making an impact.

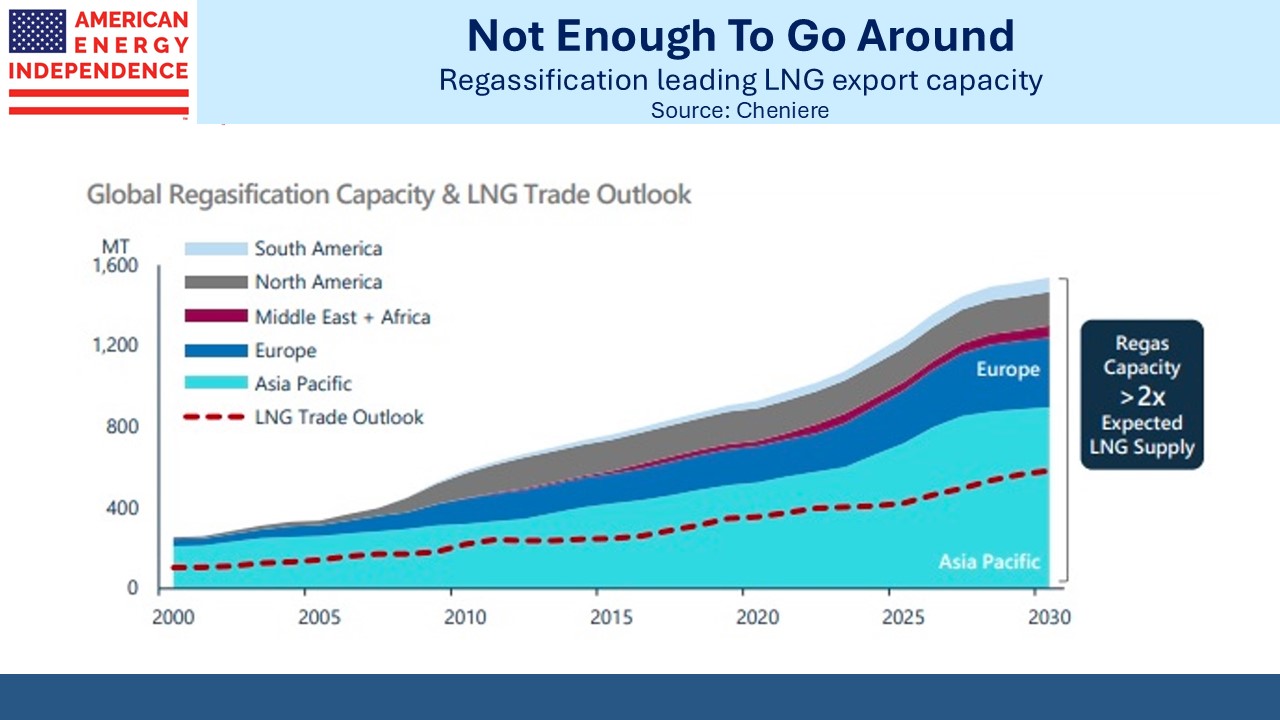

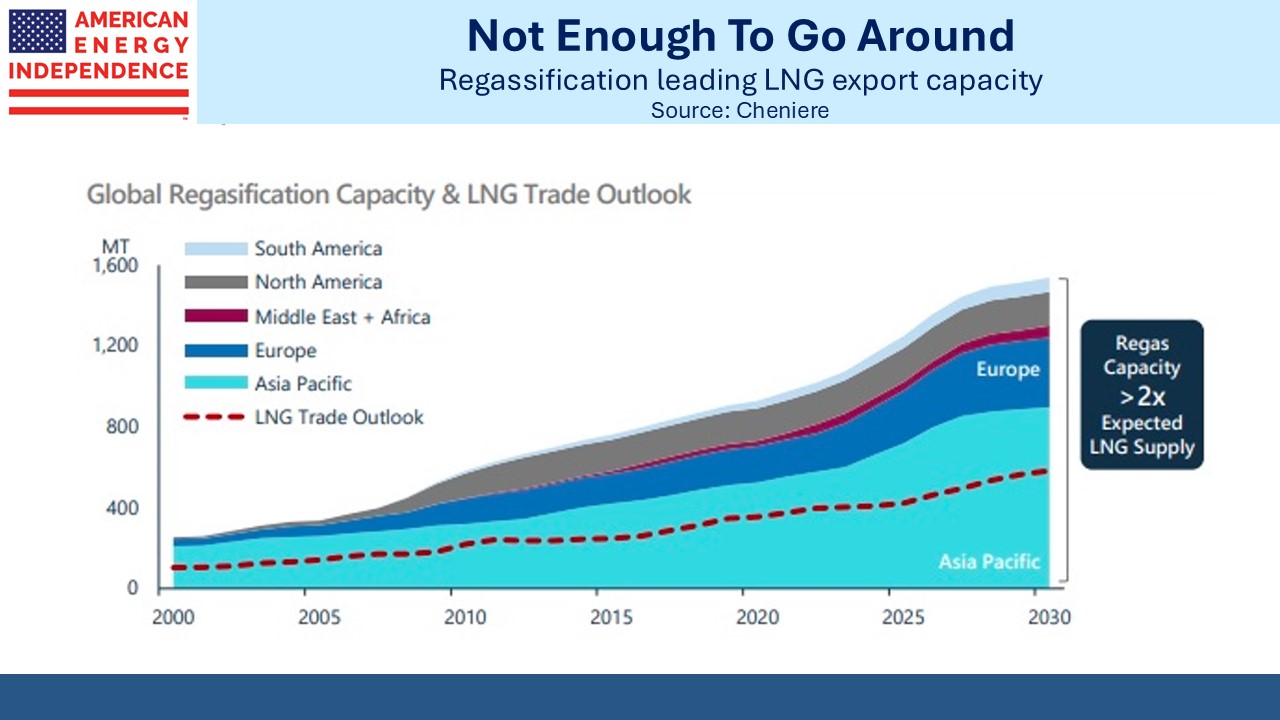

An investor asked me the other day if we should worry about a glut of LNG exports, led by the US and Qatar. We think the opposite is more likely. The world is ramping up its ability to buy. Regassification capacity, the reversal of liquefaction that chills natural gas to –256F in preparation for loading onto an LNG tanker, is growing too. It’s more probable we’ll have a shortage of exports.

Energy Secretary Chris Wright told the CERAWeek energy conference that “We need more energy. Lots more energy.”

Mike Sommers, chief executive officer of the American Petroleum Institute, said “It’s clear now that natural gas is the future fuel.”

Midstream energy infrastructure investments are aligned with US policy as well as commercial incentives.

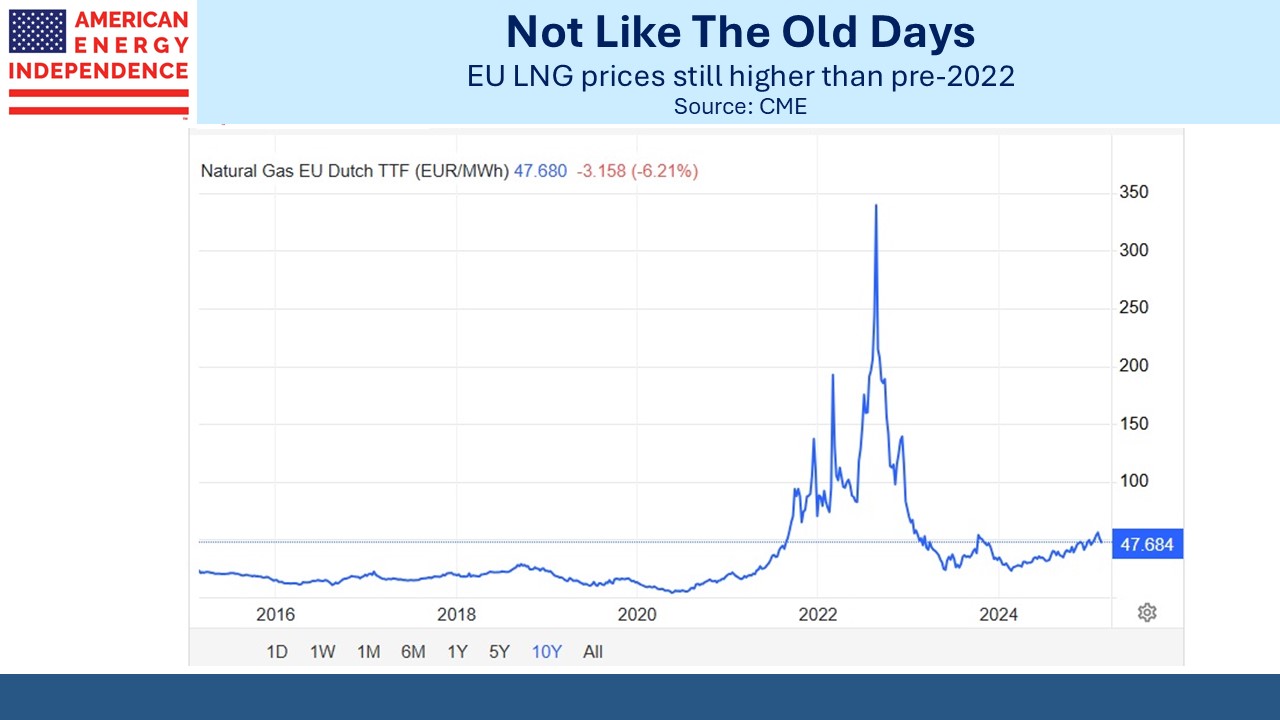

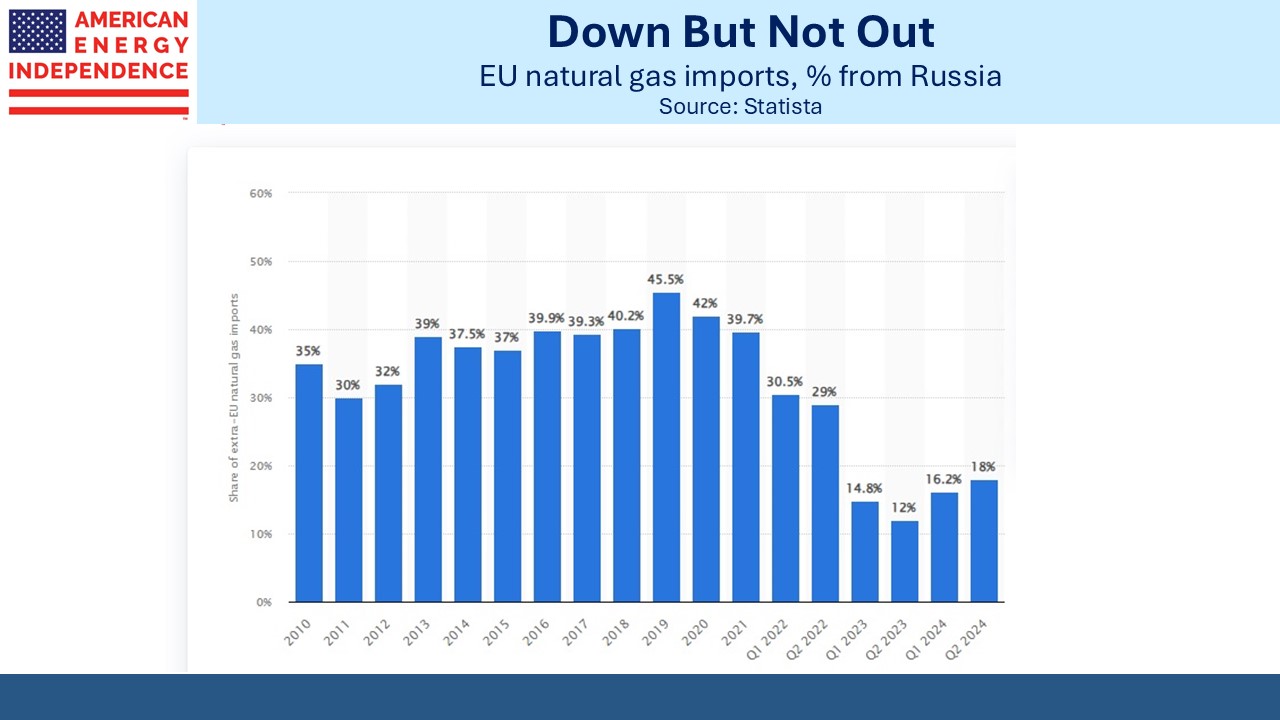

Tariffs aren’t going to be a big factor for US energy exporters. Most countries aspire to have cheap energy like the US. The EU has done an exemplary job of reducing emissions at great cost, freeing up global capacity to accommodate China’s steady increase from burning over half the world’s coal. They have the world’s biggest EV market, and it largely operates on power from burning the dirtiest fossil fuels.

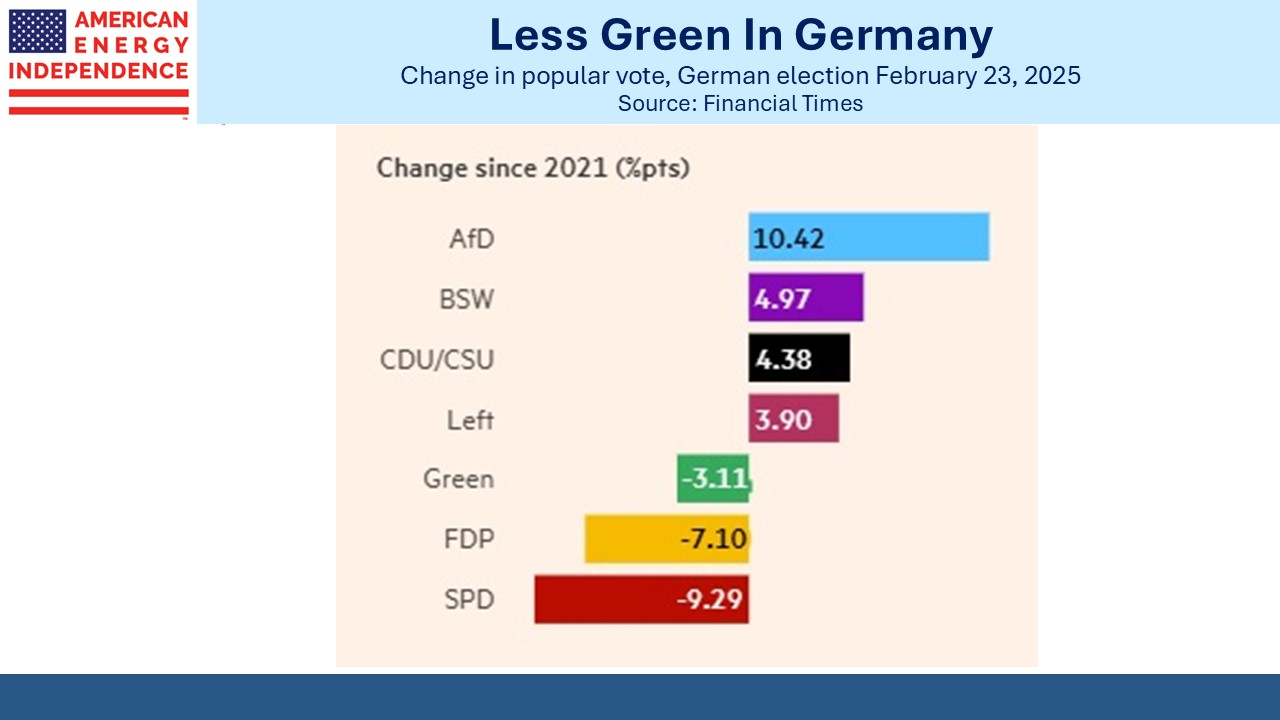

Many western governments have accepted the huge financial burden of embracing intermittent energy while developing countries across Asia make it worse. Buying US LNG won’t get their power prices anywhere close to ours, but it will at least moderate the economic damage caused by the Energiewende, or energy transition.

Natural gas offers a welcome respite from the daily tariff trauma.

We have two have funds that seek to profit from this environment: