Debt Monetization And Pipelines

I just finished reading Andrew Ross Sorkin’s new book 1929, which relies on a lot of previously unpublished material to tell the story of the Great Crash through some of the protagonists. For those who enjoy economic history or even a good story, this will not disappoint.

Benjamin Strong ran the Federal Reserve until his untimely death in 1928, and some historians think the collapse of the stock market’s speculative bubble might have been better handled had Strong been around.

During the 2008-09 Great Financial Crisis (GFC) we benefited from insightful financial leadership from Hank Paulson at Treasury, Tim Geitner at the New York Fed and then Fed chair Ben Bernanke, as Ross Sorkin chronicled in Too Big To Fail.

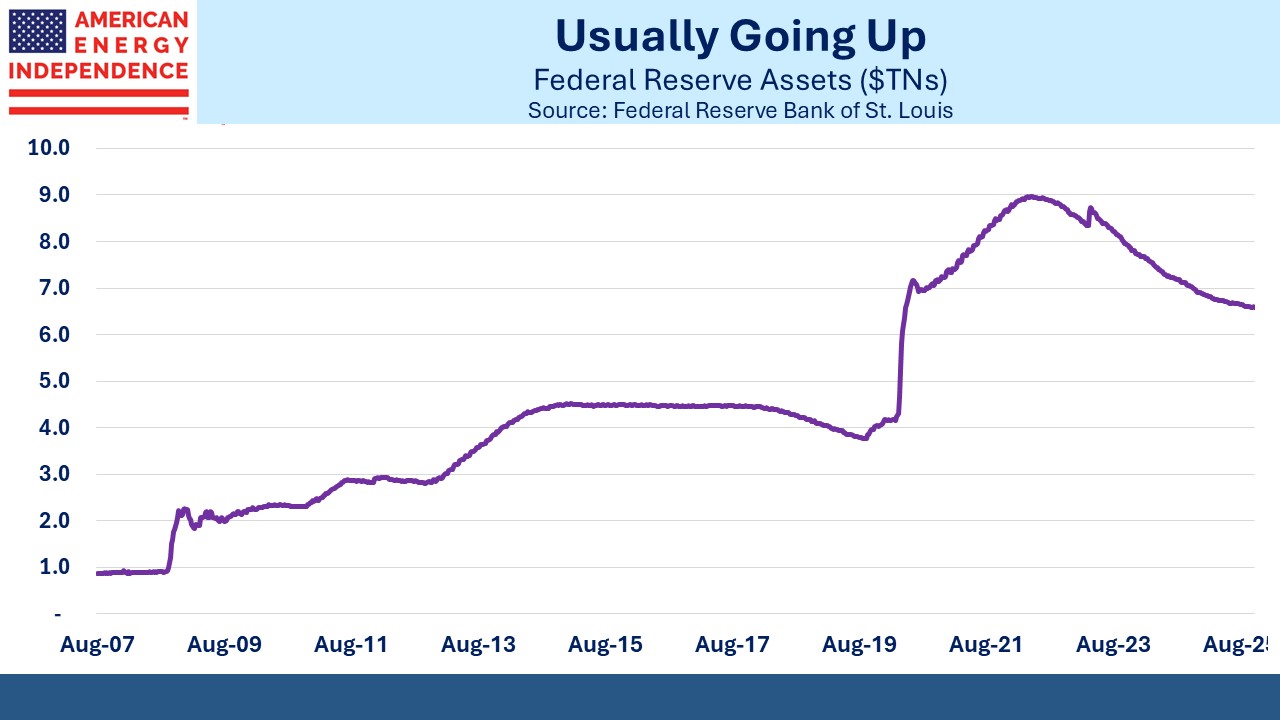

Bernanke used the Fed’s balance sheet to great effect, initiating Quantitative Easing (QE) under which the Fed bought far more treasury securities than it needed to conduct monetary policy, with the goal of forcing long term rates down. Many thought this would be inflationary, but QE turned out to be a vital tool to compensate for a near-paralyzed financial system.

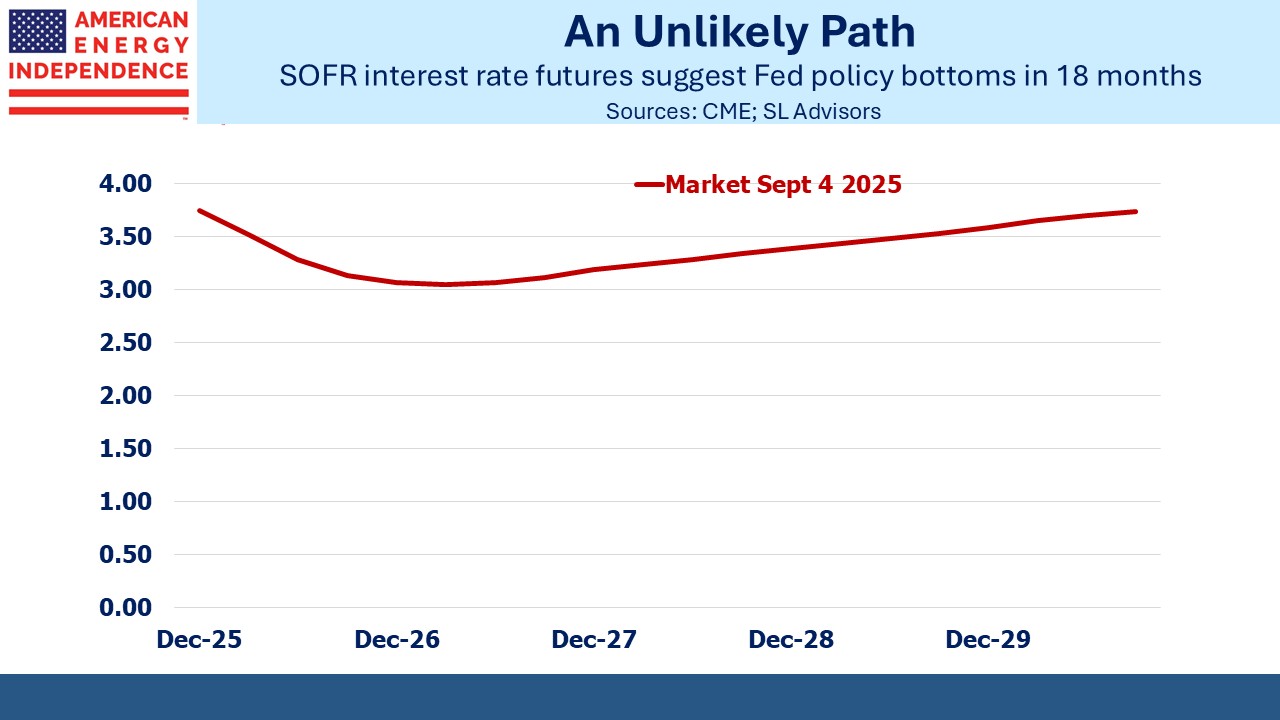

QE should have been a one-off measure, reversed via Quantitative Tightening (QT). But somehow the time has never been quite right for the Fed to exit the long term bond market.

It took the Fed until 2017 to start to unwind the original QE, and that was soon derailed by the pandemic, which took their balance sheet to $9TN by April 2022. It was then allowed to decline until last week when Chair Jay Powell announced an end to QT. He said, “At a certain point, you’ll want . . . reserves to start gradually growing to keep up with the size of the banking system and the size of the economy,”

The Fed’s current holdings are six times bigger than in 2008 while the economy is twice as big.

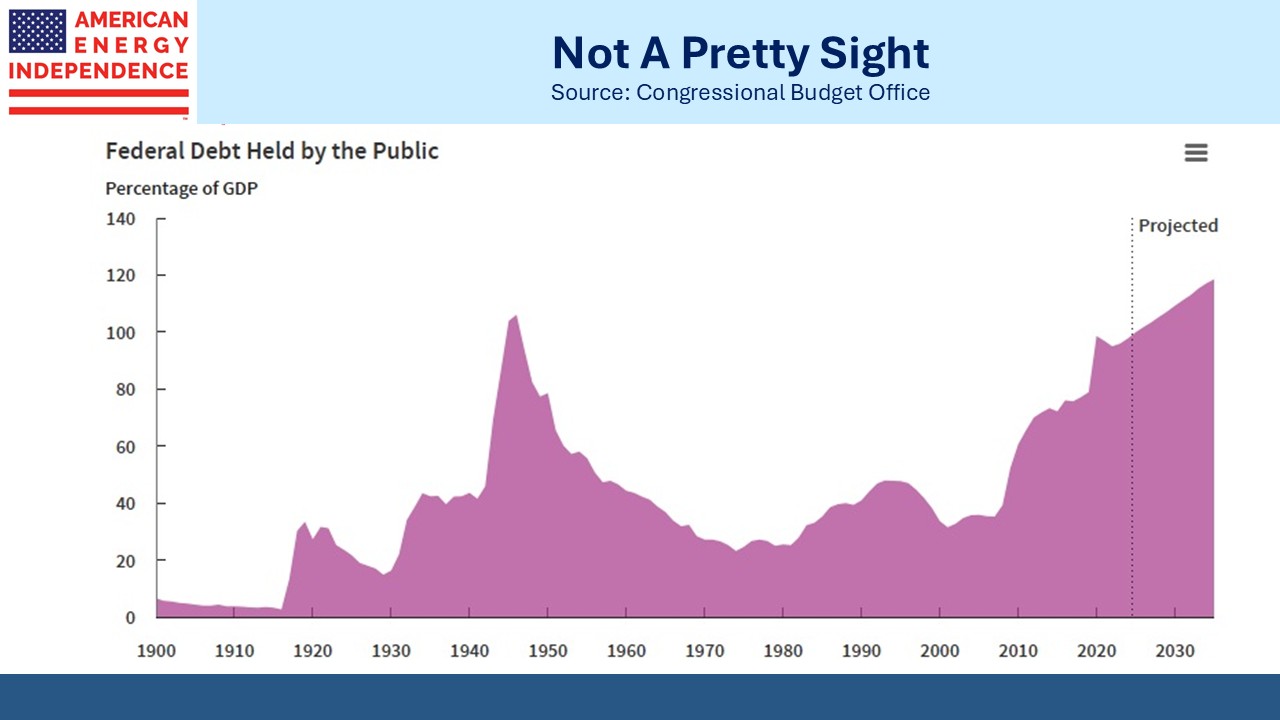

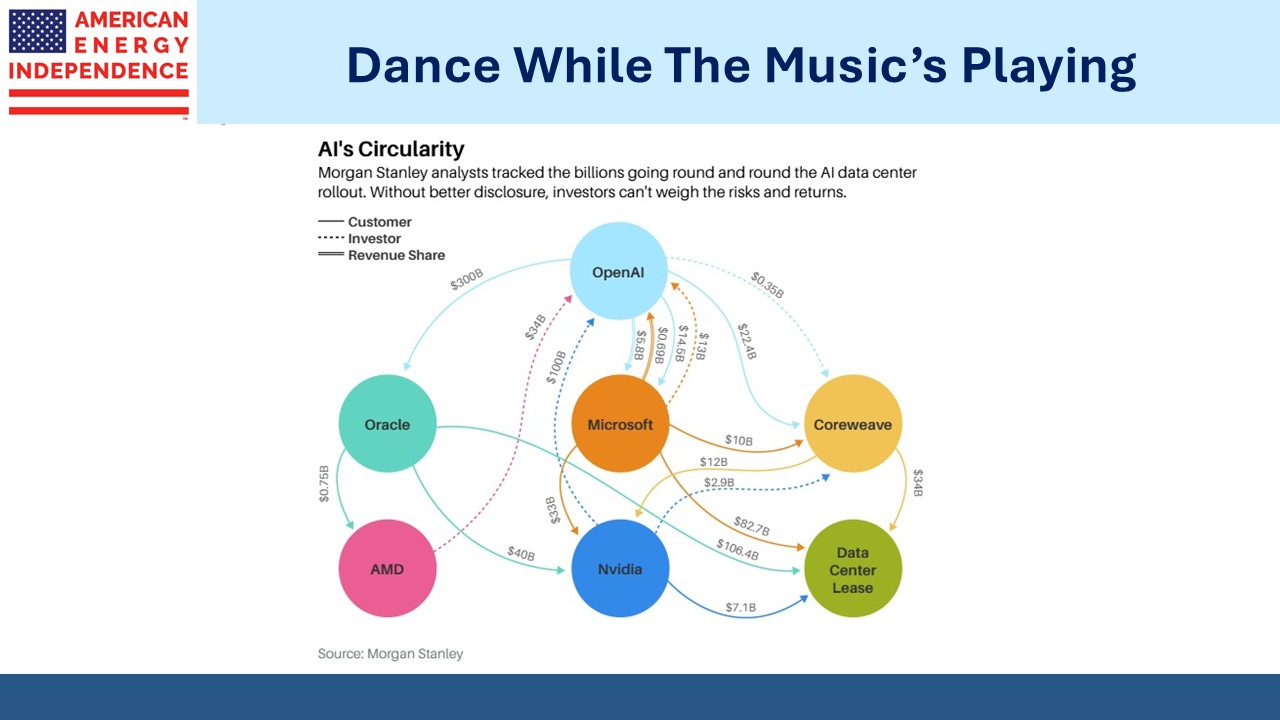

A permanent holding in excess of what’s needed for monetary policy is simply debt monetization. On this basis, the Fed has monetized at least $4TN of our $36TN outstanding and plans to do more. It is a monetary narcotic, a habit we can’t kick.

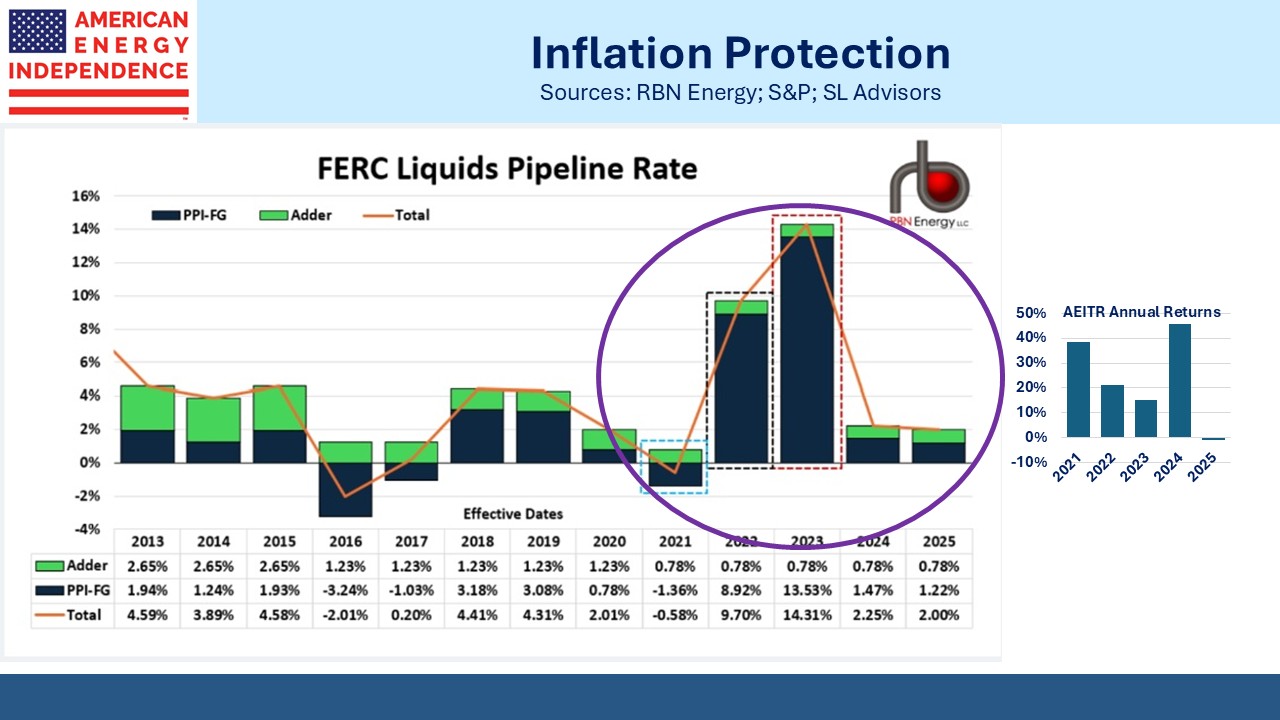

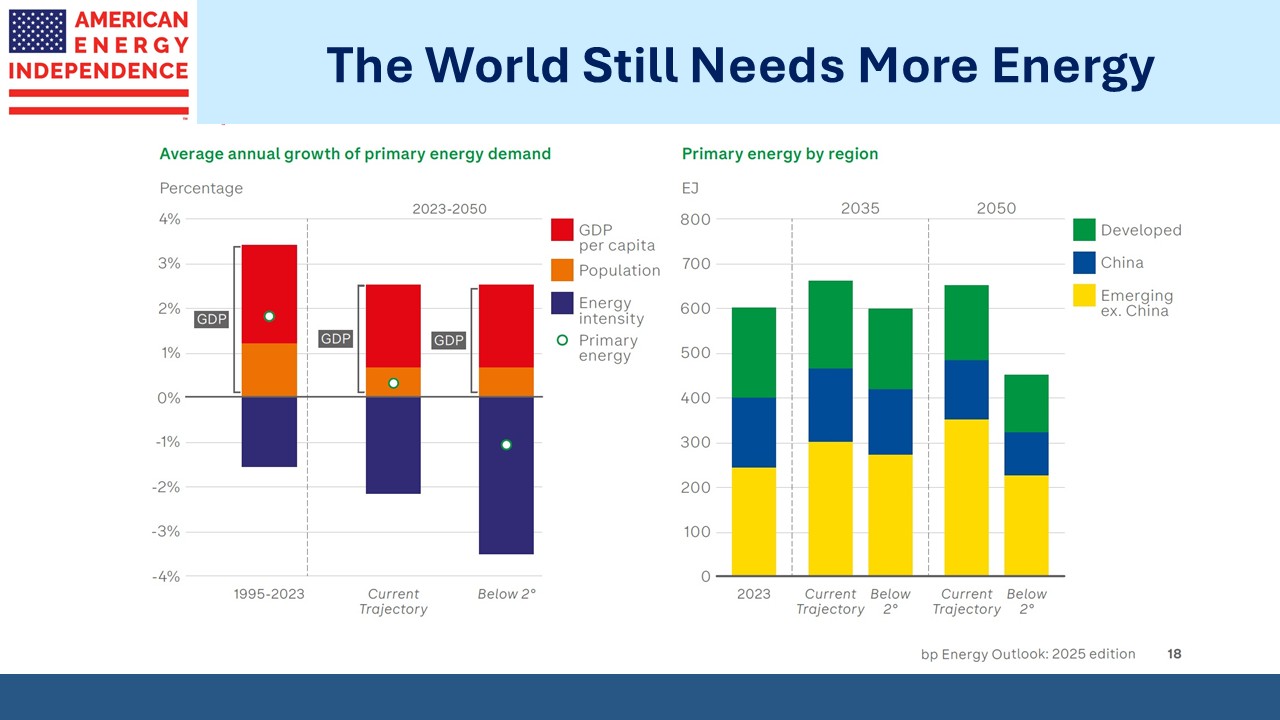

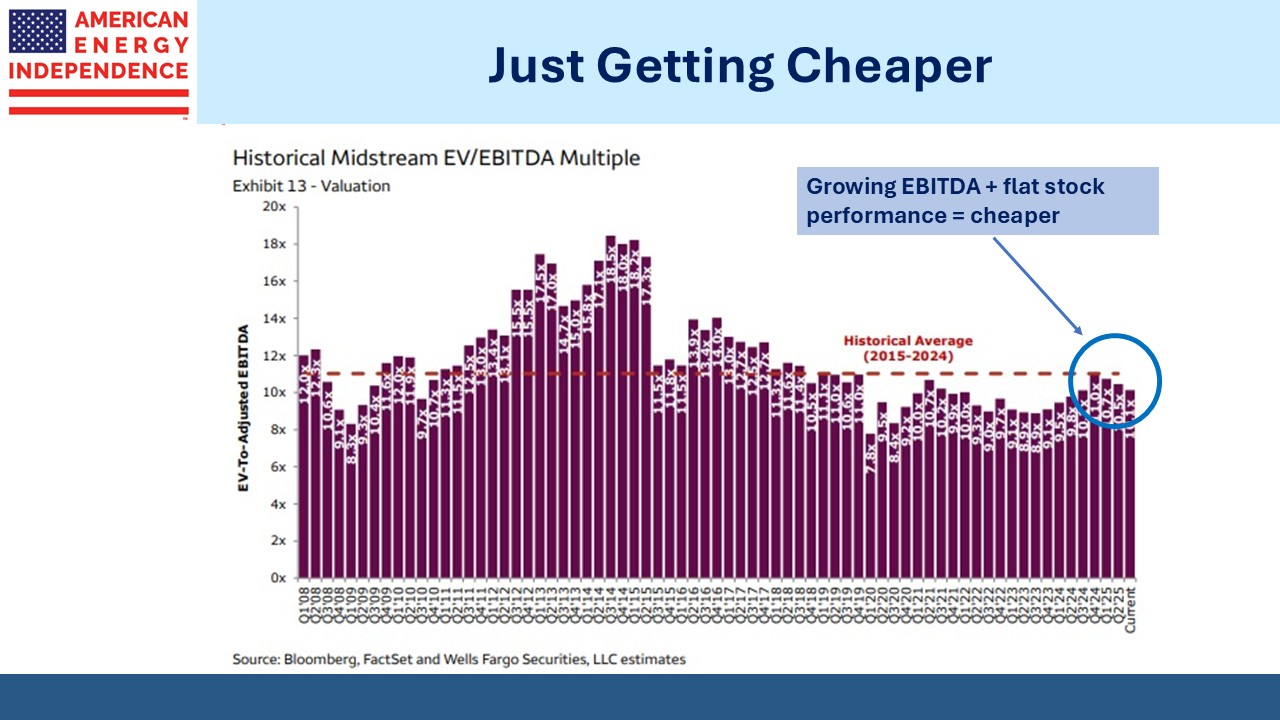

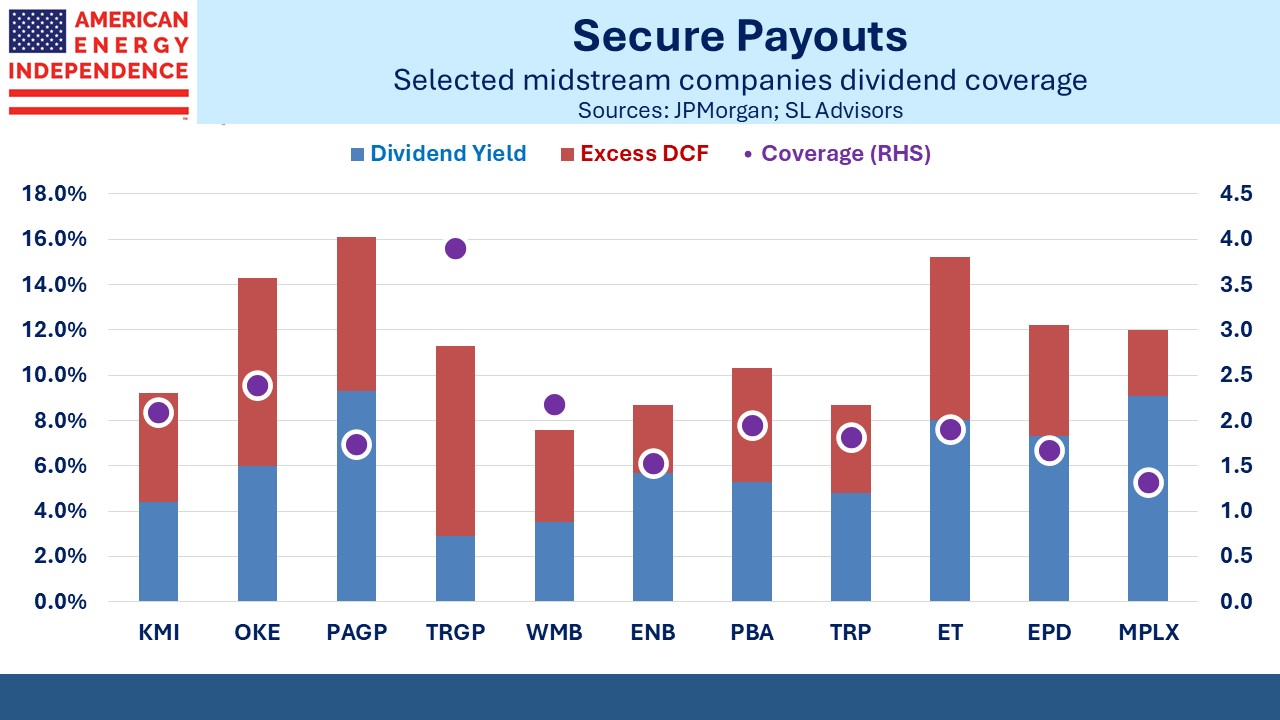

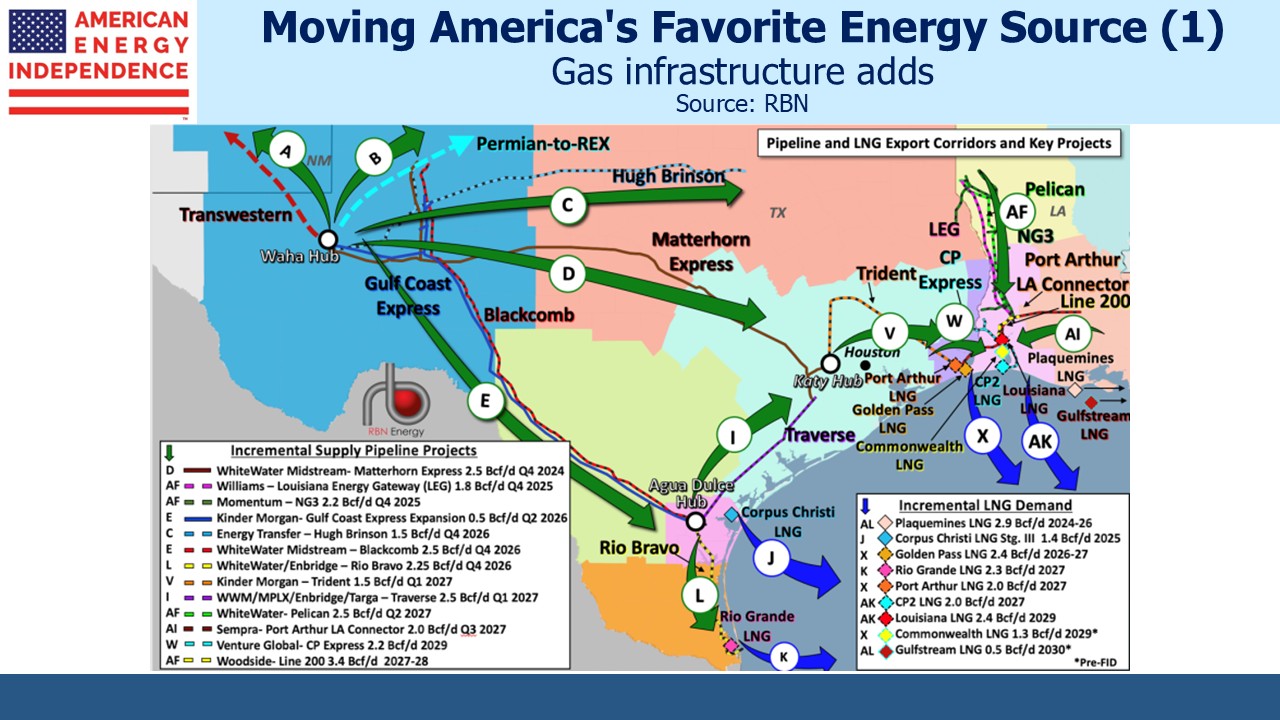

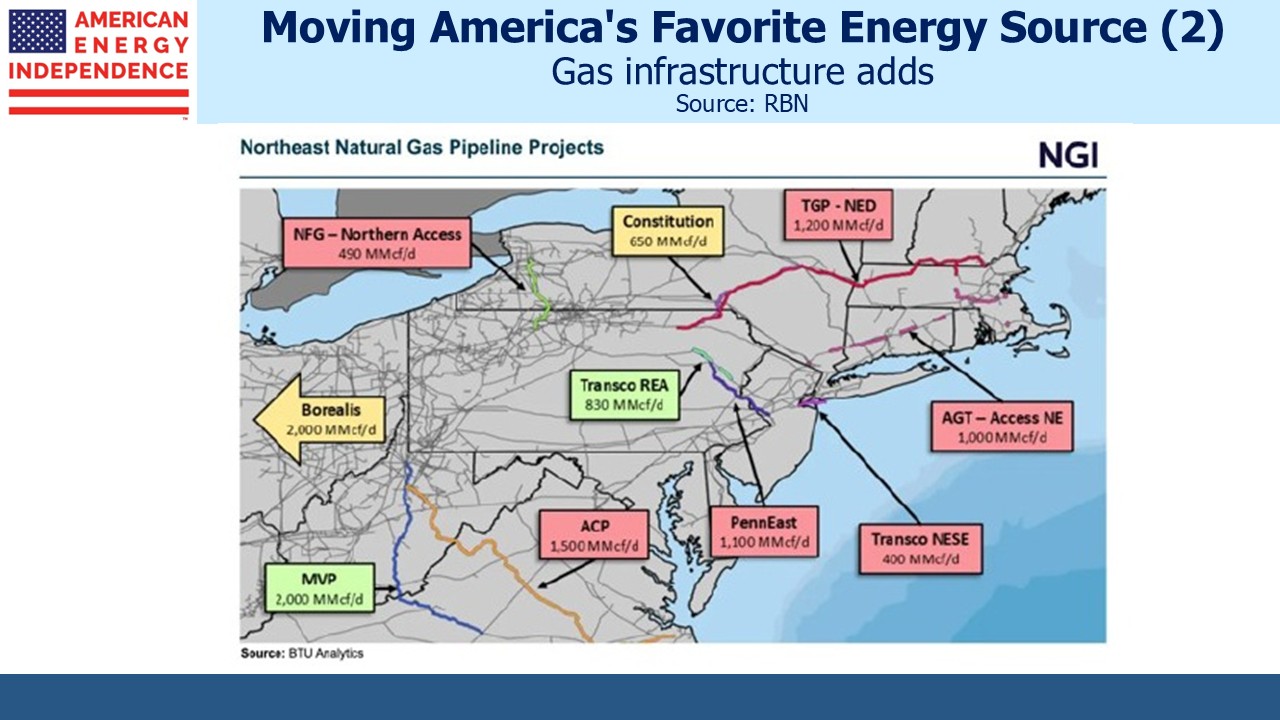

The next financial crisis will take it higher still. All the political pressure is aimed at keeping rates low and risking price stability. 3% inflation remains more likely than 2%. Midstream energy infrastructure with its PPI-linked contracts offers some protection in our opinion.

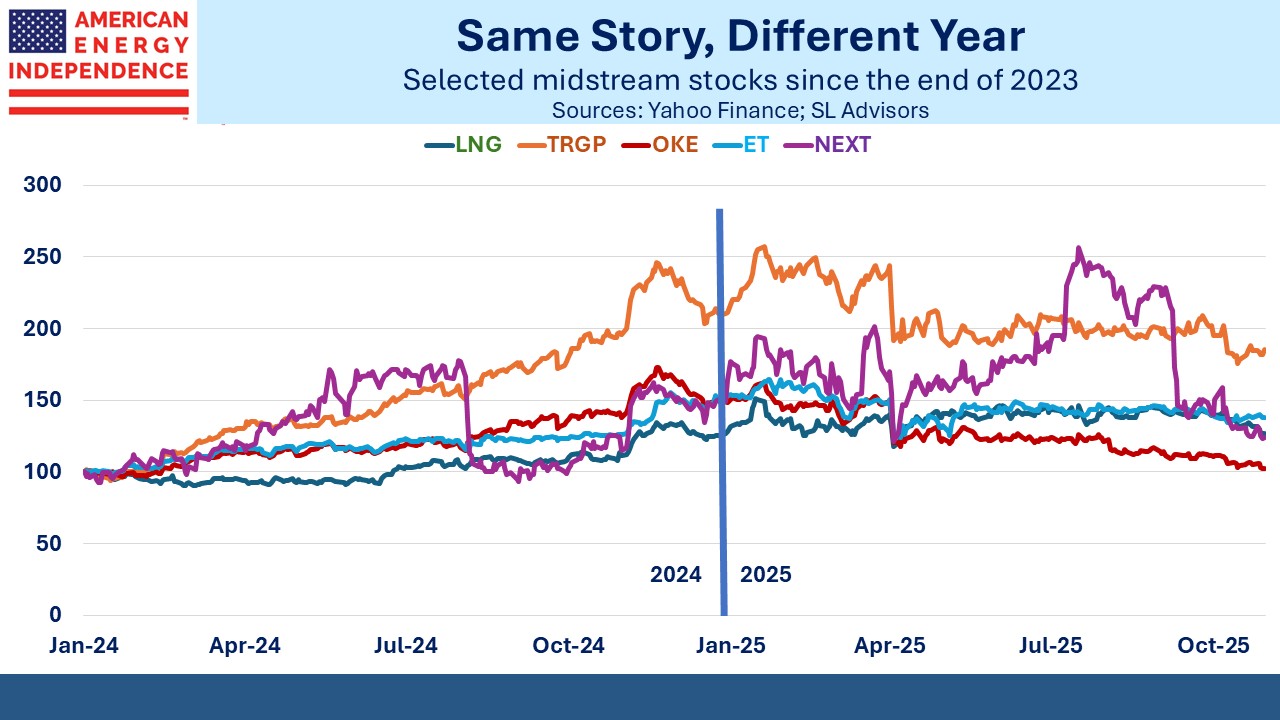

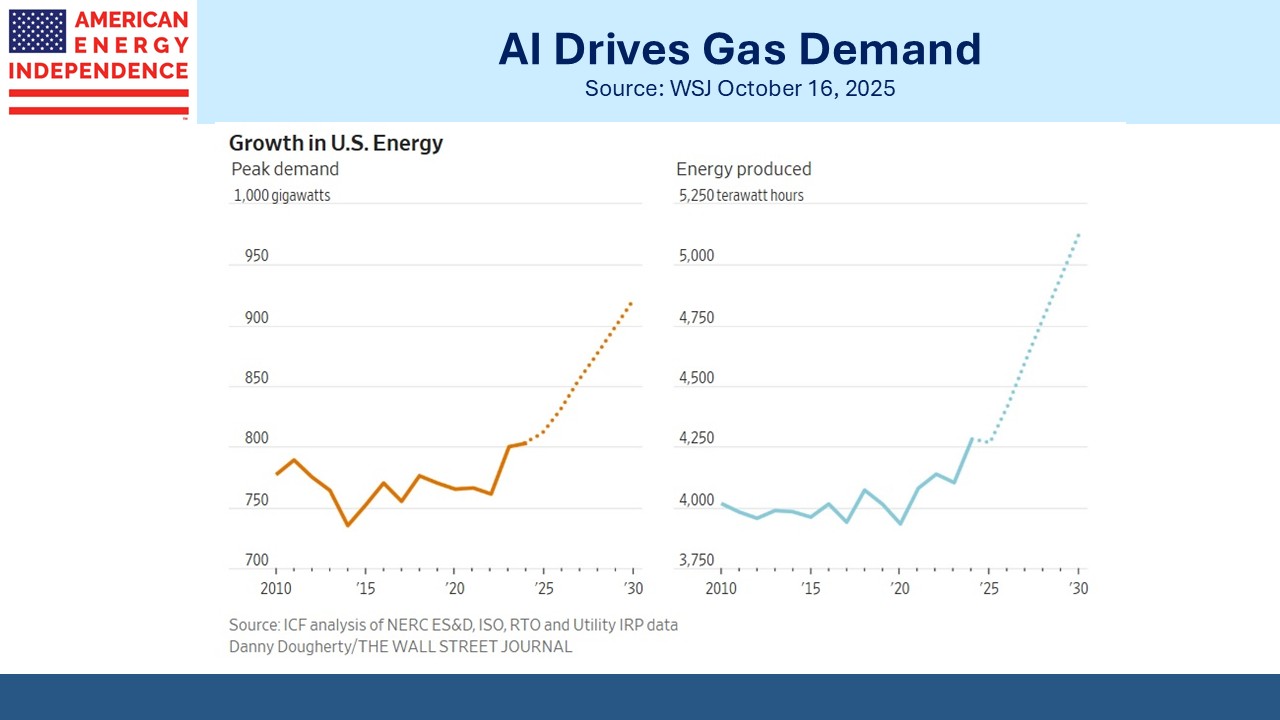

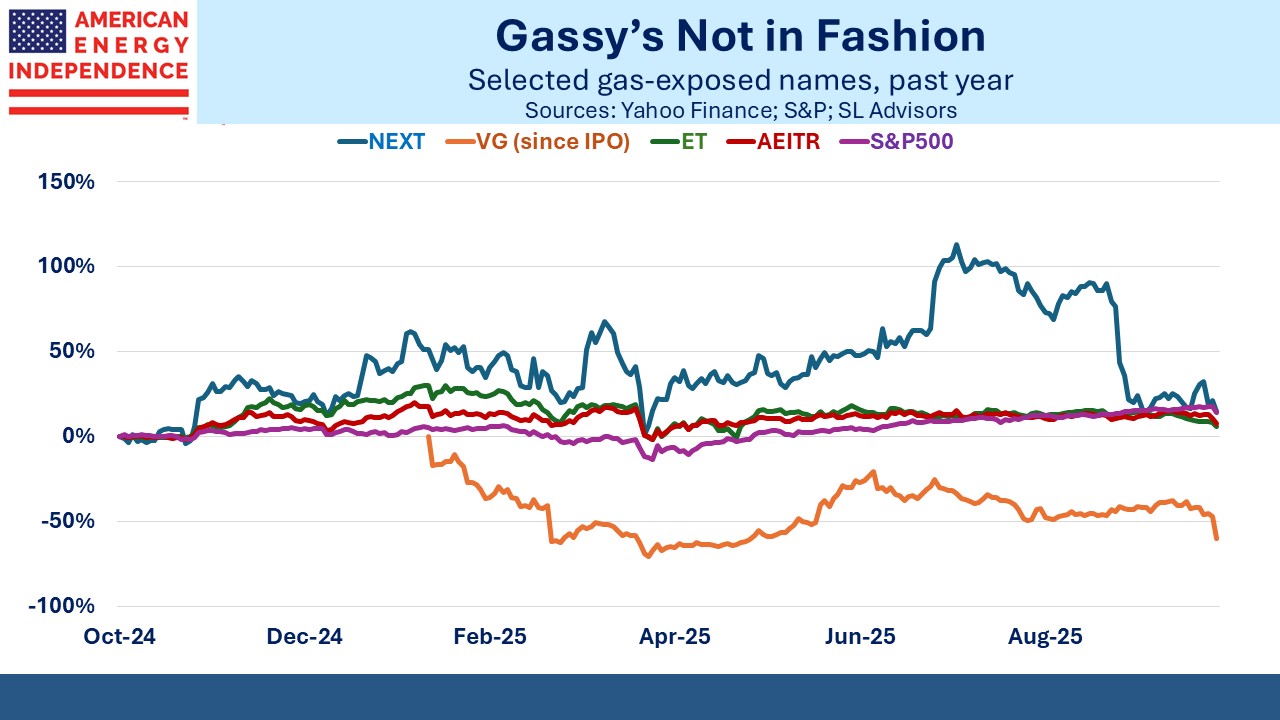

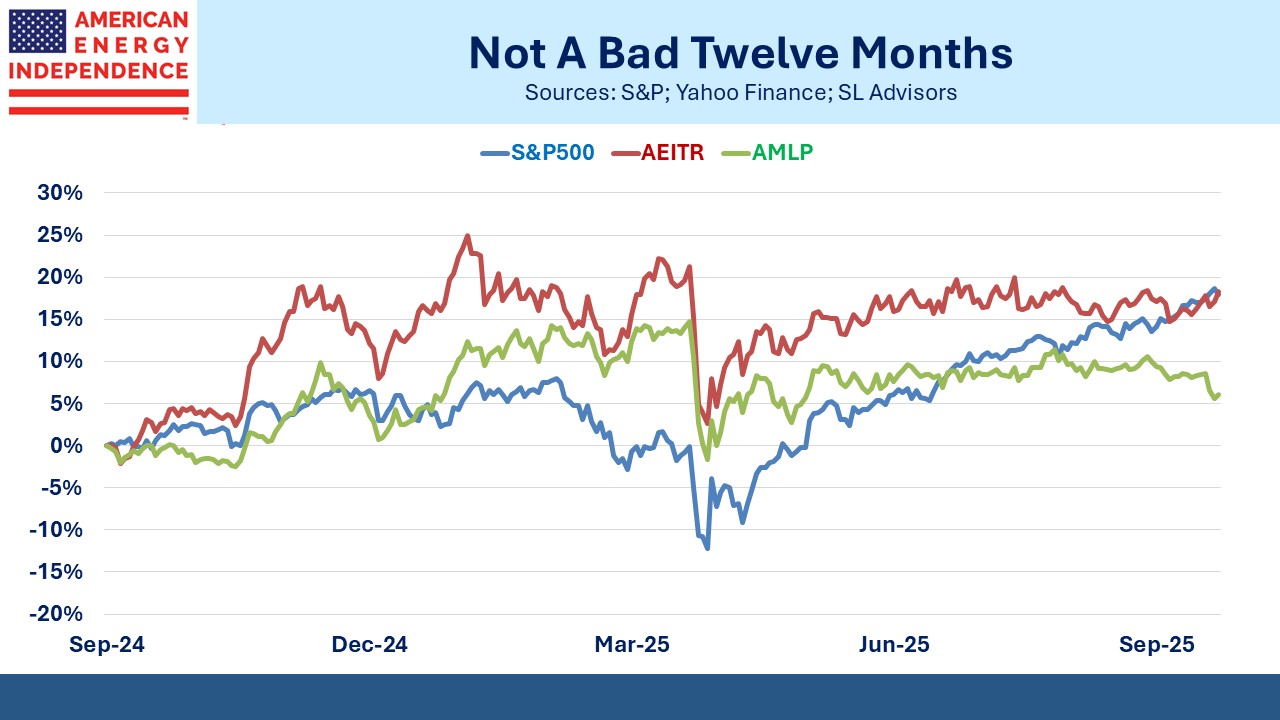

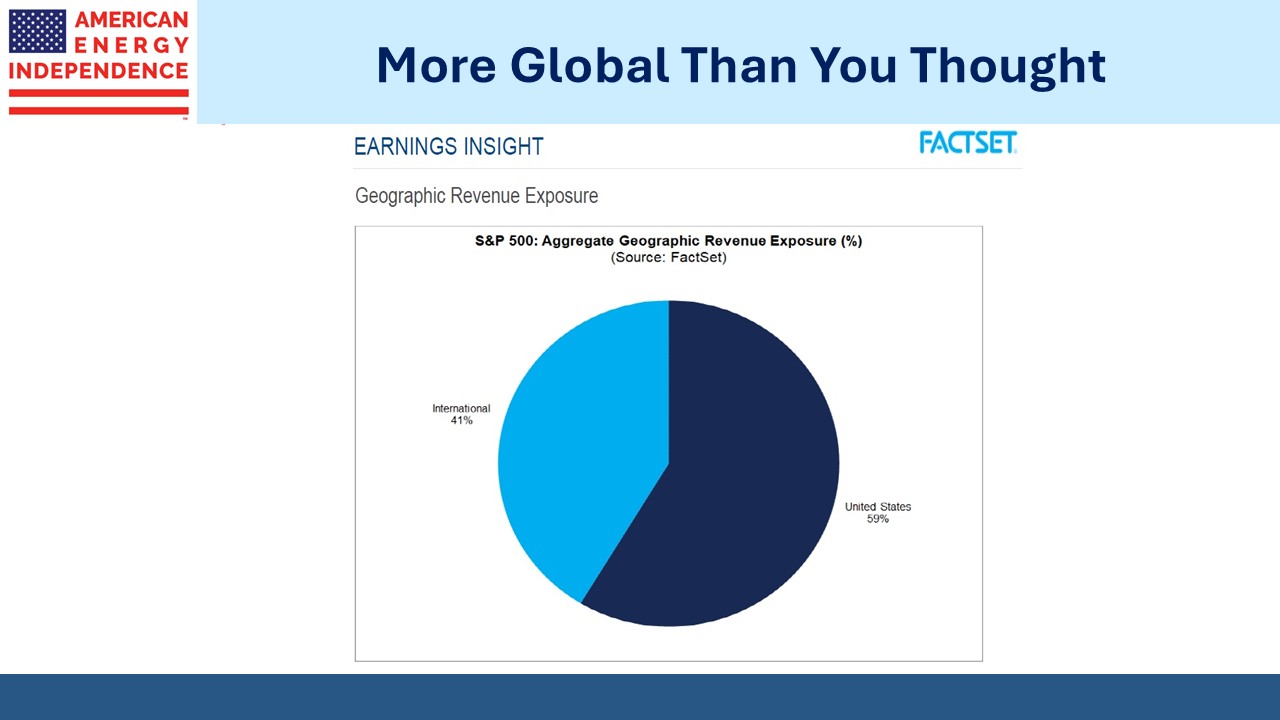

Midstream energy has been a passive bystander to the AI-fueled excitement of the S&P500.

If they were private companies not subject to constant revaluation, as investors we’d feel the macro outlook remains positive and operating performance has been good.

But we’re burdened with a public opinion of that view on a continuous basis, and this year’s mood does not match last year’s. Oil-linked names such as Oneok (OKE) have sagged with oil prices, even though domestic crude oil production reached a record 13.8 million barrels per day in August – we’ll have more recent data once the Federal government re-opens. Exxon and Chevron both increased output in 3Q25.

OKE’s 2024/2025 YTD performance is +48%/-31% respectively.

Targa Resources has built a vertically integrated business for hydrocarbons that allows multiple opportunities to touch a molecule. Its 2024/25 performance is +111%/-12%.

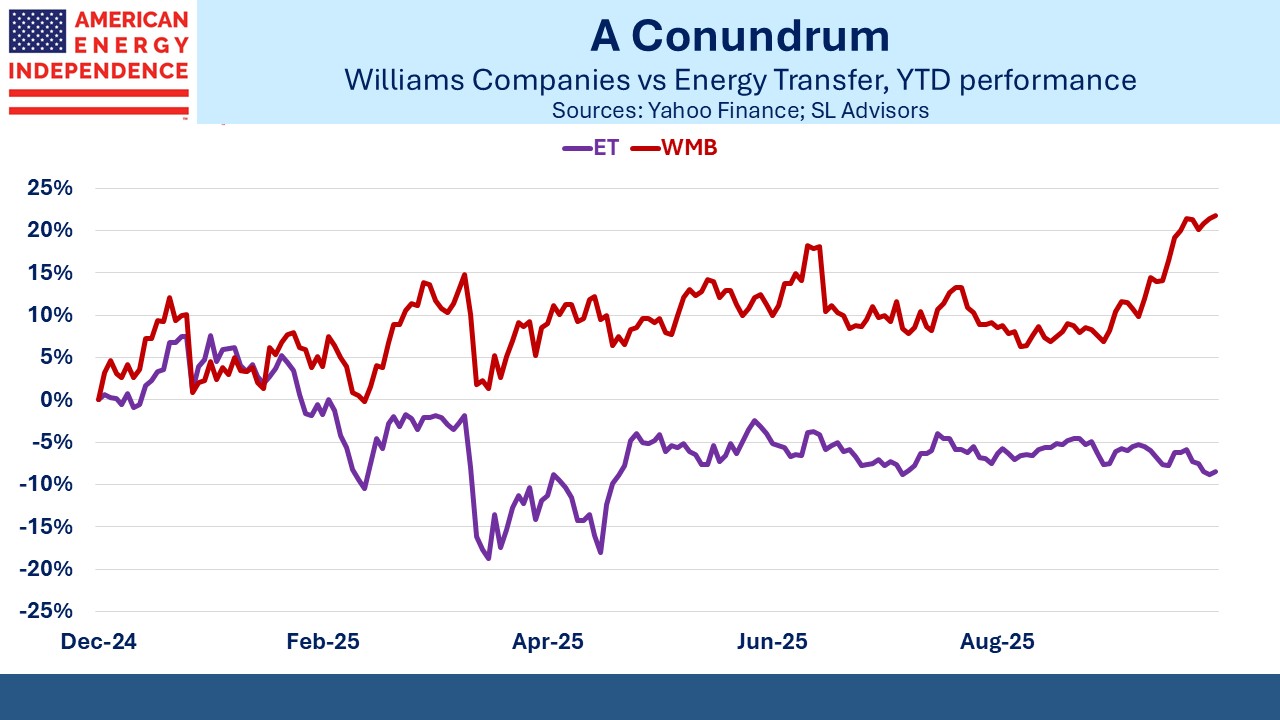

Energy Transfer (ET), perennially cheap in part because it’s an MLP but well positioned to profit from the build out of data centers in Texas, is +53%/-10%.

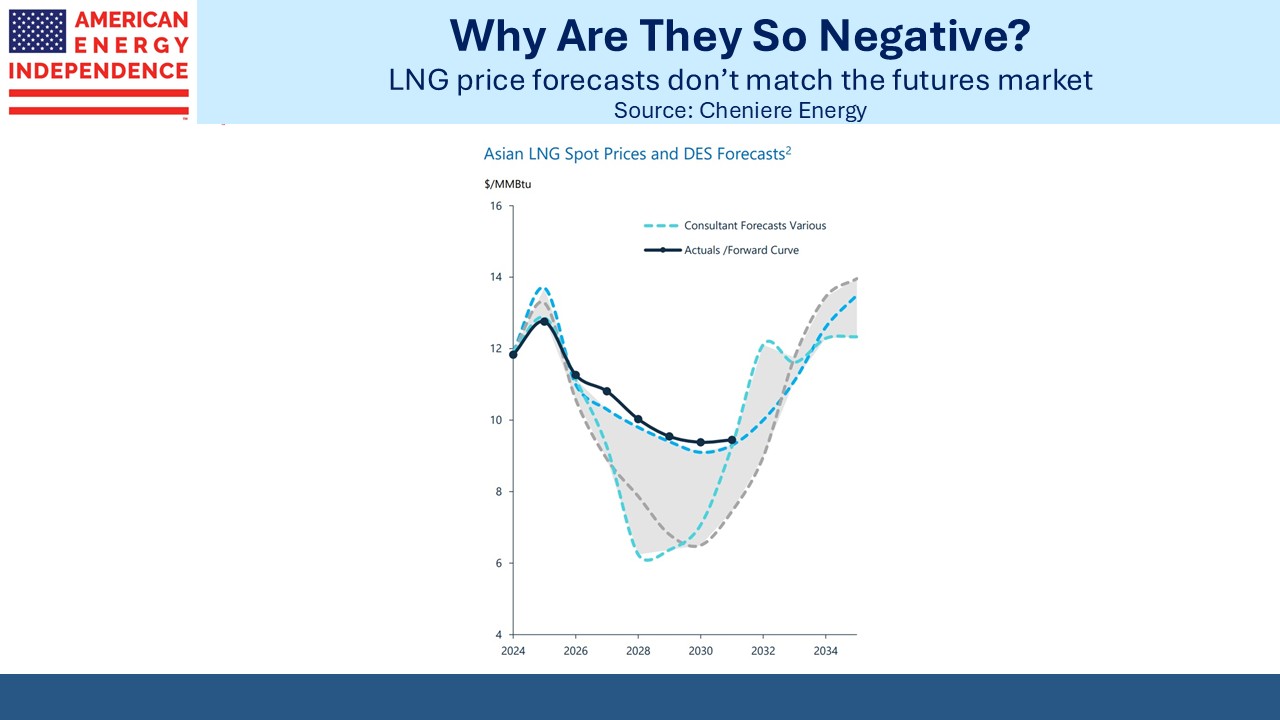

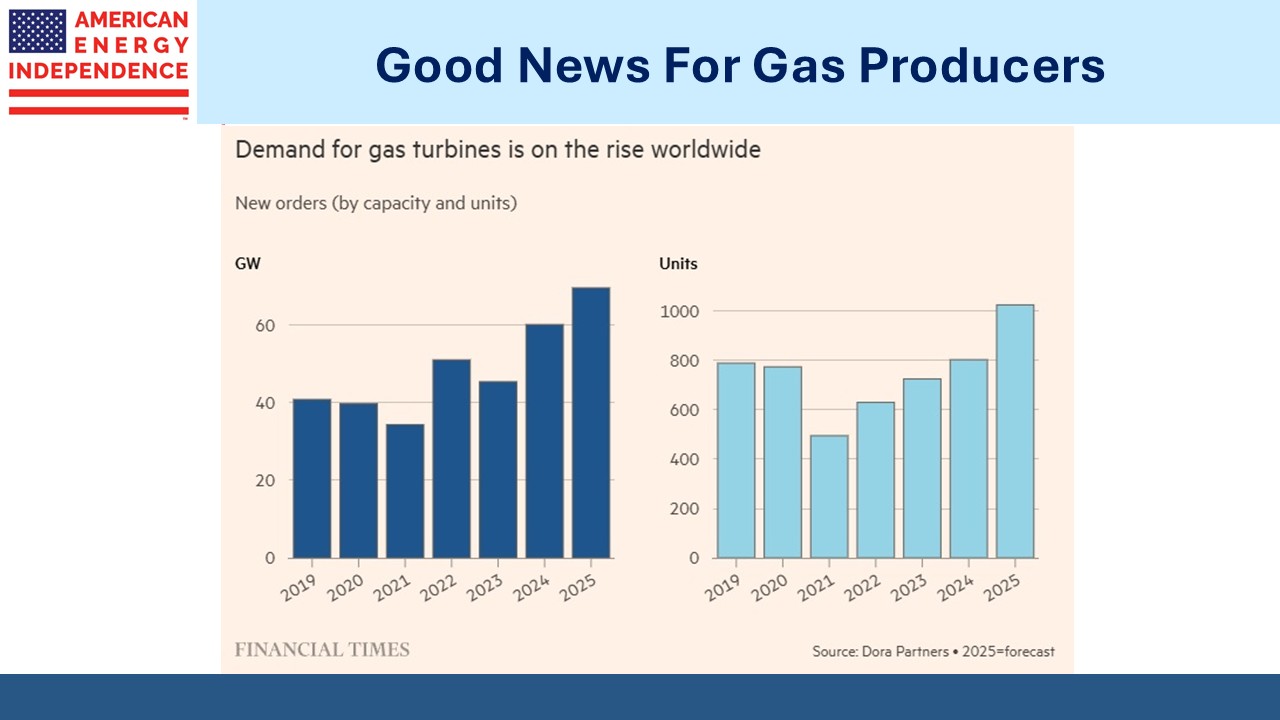

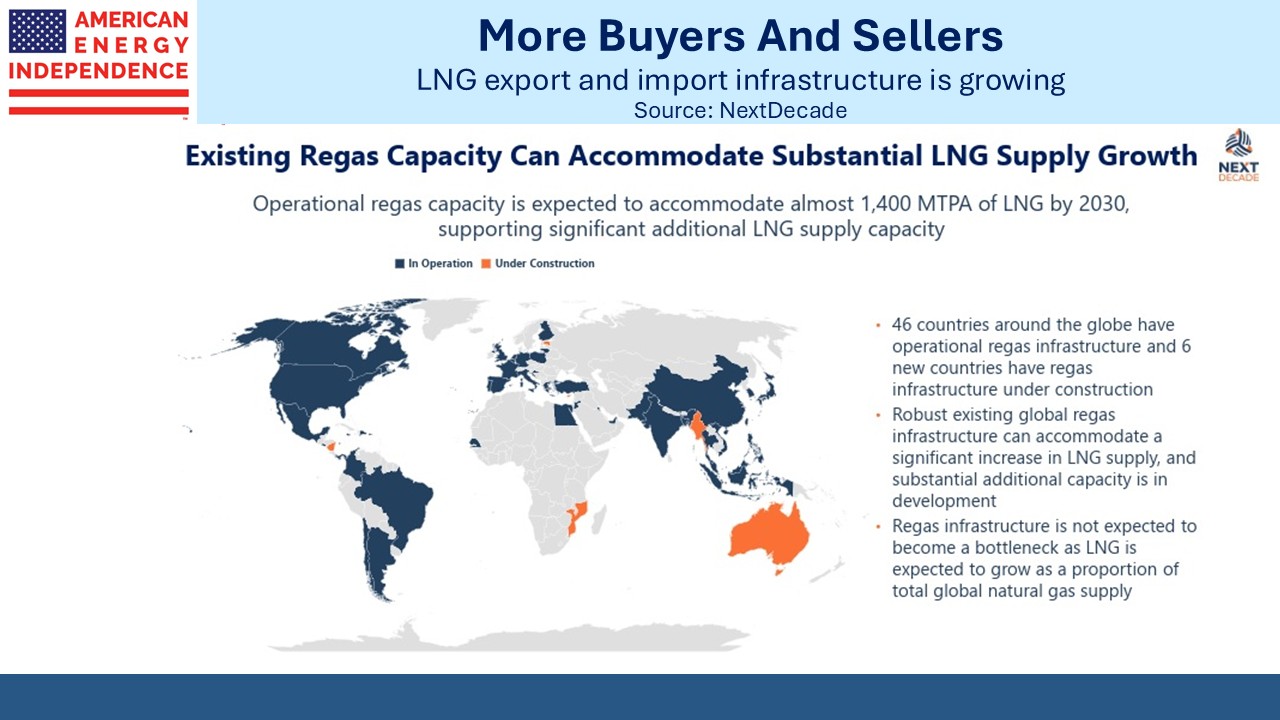

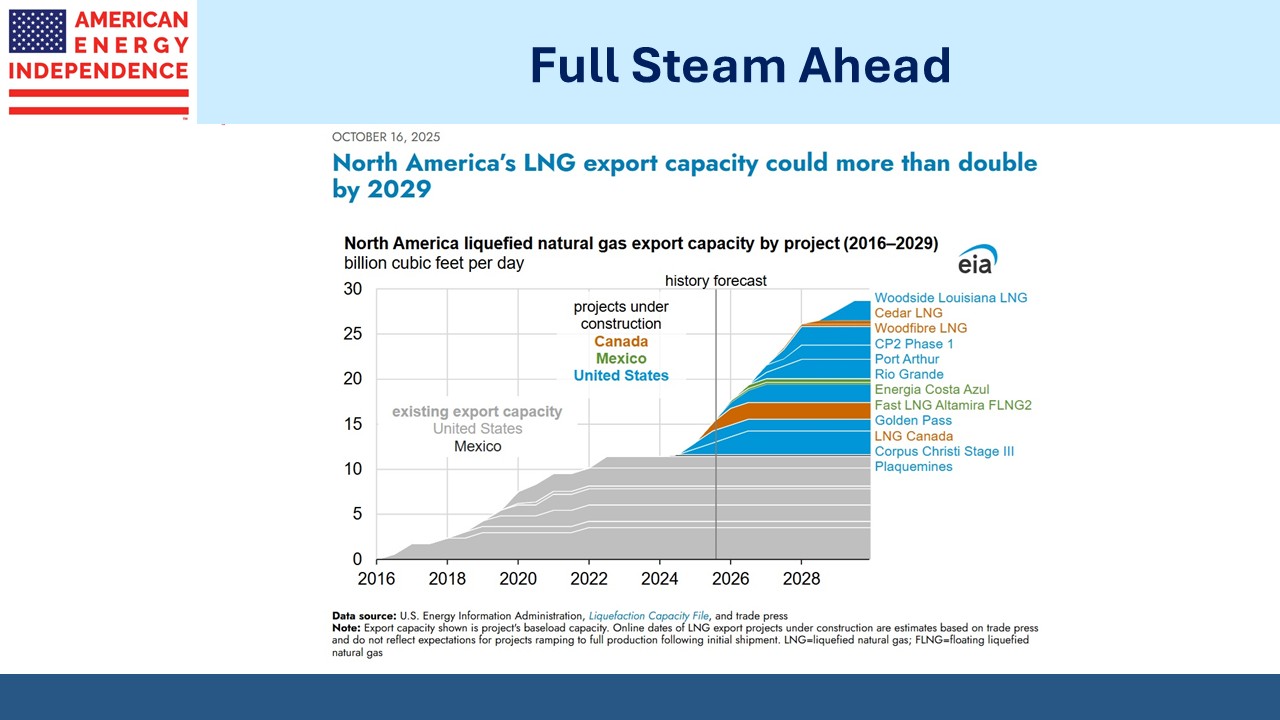

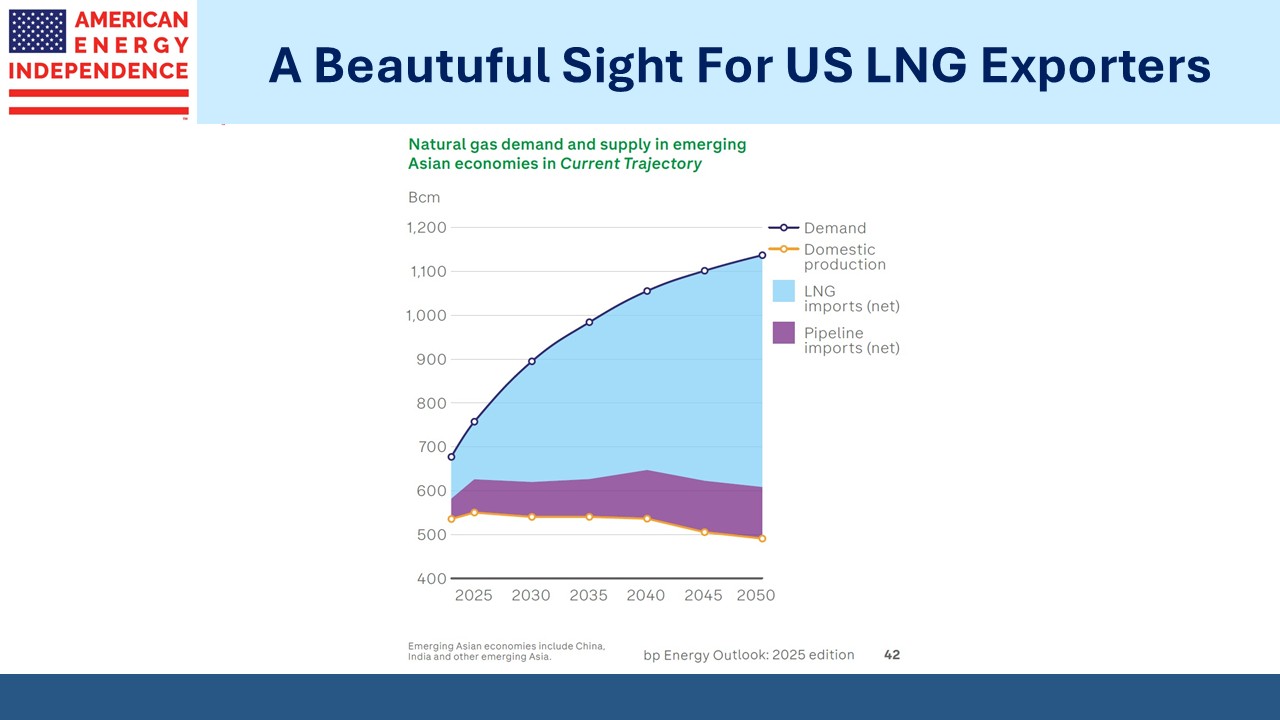

Cheniere Energy (LNG), our leading exporter of natural gas, continues to expand its capacity under budget and ahead of schedule. Many analysts are warning that global LNG export capacity will flood the market, depressing prices and volumes. Oddly though, the futures market is more sanguine than the more dire forecasts weighing on the sector.

Moreover, Cheniere operates with 95% of its capacity pre-sold through 2035, giving it unparalleled cash flow visibility. In 3Q they repurchased $1BN of stock. Its performance is +28%/-1%.

NextDecade (NEXT) reached final investment decision on Trains 4 and 5 with much better economics than on the first three and has plans for further expansion. Its story improved. Its performance is +54%/-25%.

Maybe these stocks and others outran their positive fundamentals last year. Their outlook and operating performance have only improved. Or perhaps it’s a growth year, and AI exposure is where investors want to be.

In any event, long term investors in the sector, which very much includes your blogger, are enjoying 5% yields with growth, strong balance sheets and inflation-linked pricing power on pipeline fees. Our president is a fan of energy exports and easy money. Pipelines offer the opportunity to compensate for fiscal profligacy. It’s the place to be.

We have two have funds that seek to profit from this environment: