Climate Extremists Lack Serious Solutions

To be an energy investor is to consider the energy transition on a daily basis. You don’t even have to be certain that man-made global warming is happening. Simply accepting that it may be possible should still induce a prudent world into managing this risk. Climate is complicated, and certainty that increasing CO2 emissions will cause irreparable damage is as implausible as certainty that they won’t.

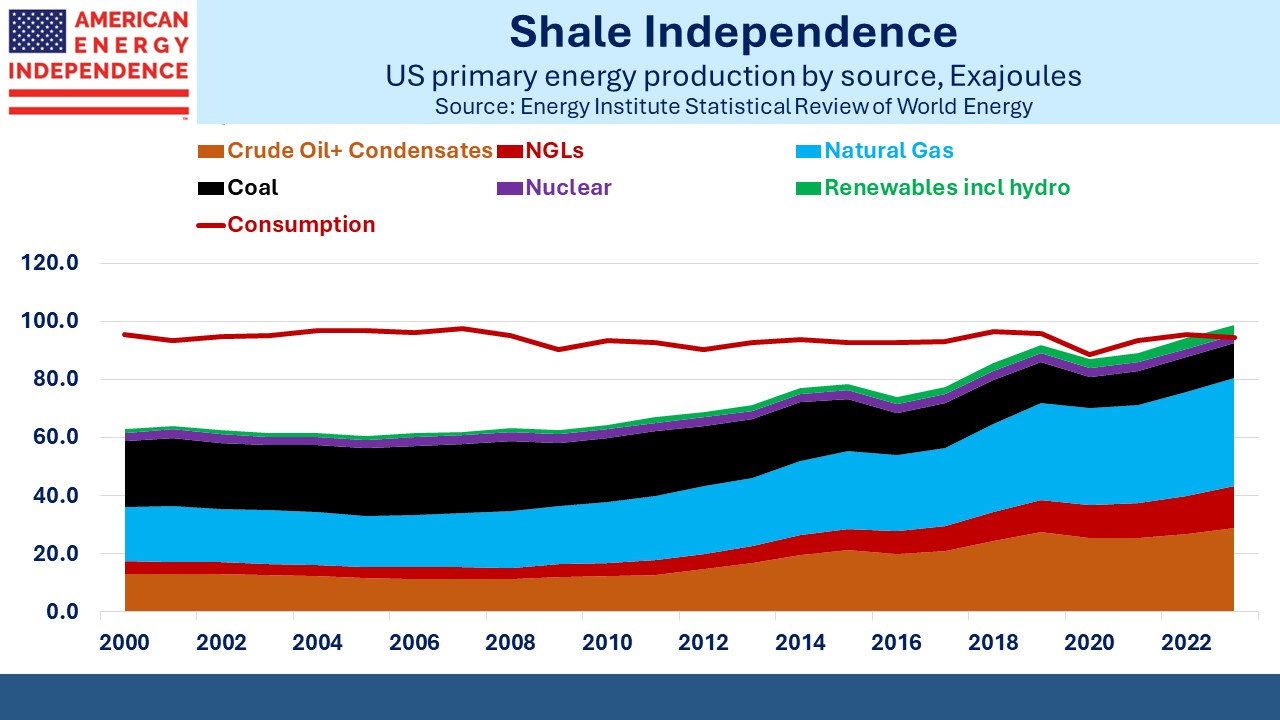

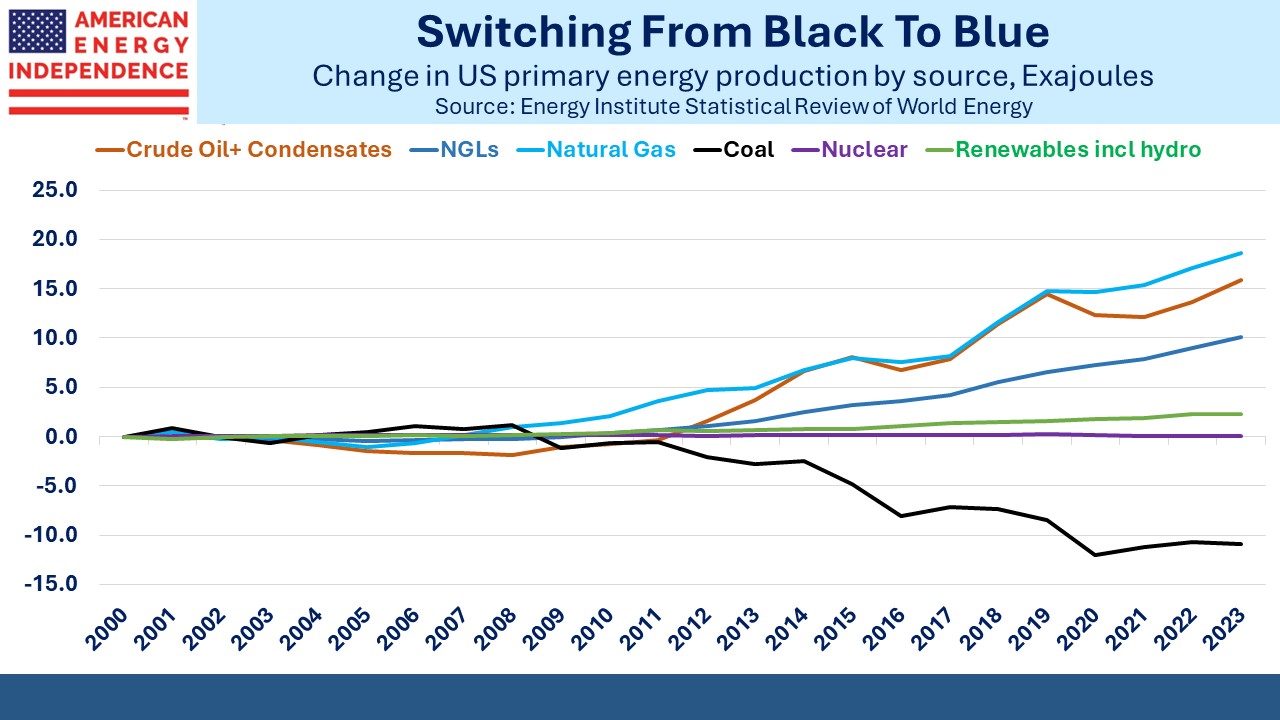

We won’t hit the UN Zero by 50 target, meaning eliminating CO2 emissions in 26 years, because it’s not taken seriously enough. That may sound odd. All you ever read is articles hailing the growth in solar and wind along with their plummeting cost. But even in the US, renewables provide just 3.5% of our primary energy output, up from 2.7% a decade ago.

Perusing data from The Energy Institute’s 2024 Statistical Review of World Energy reveals how far we are from tackling the problem.

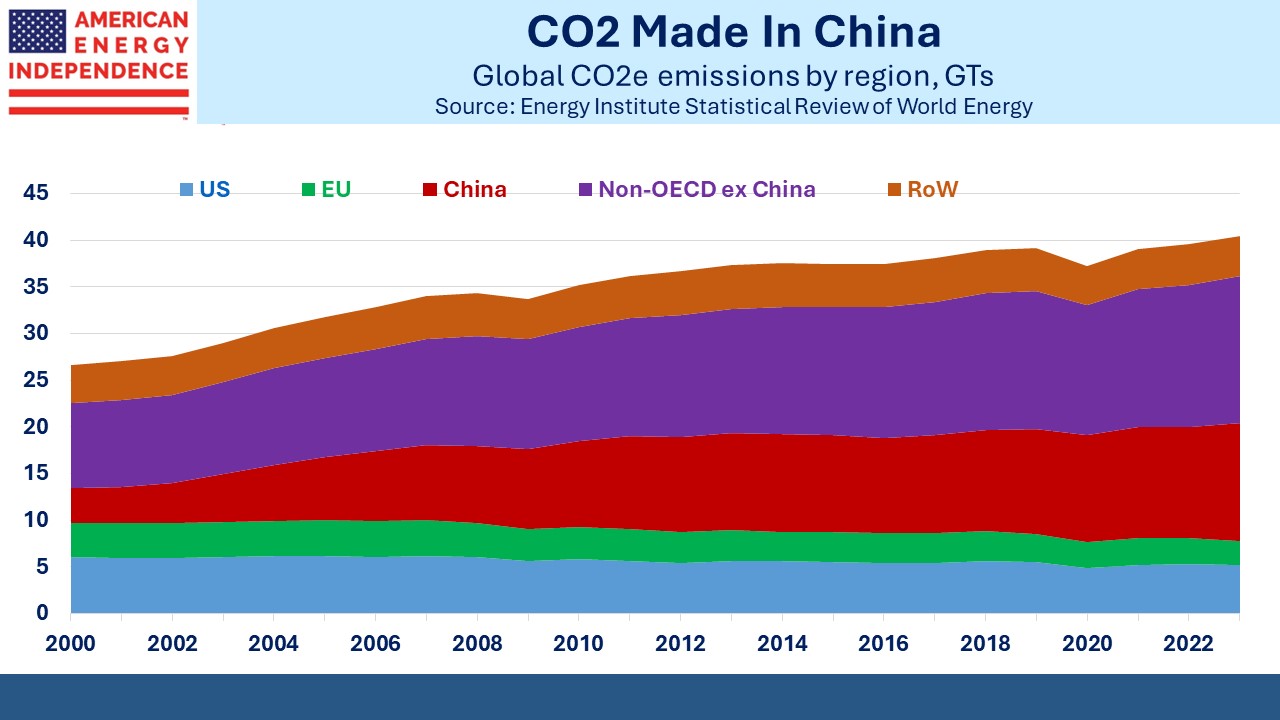

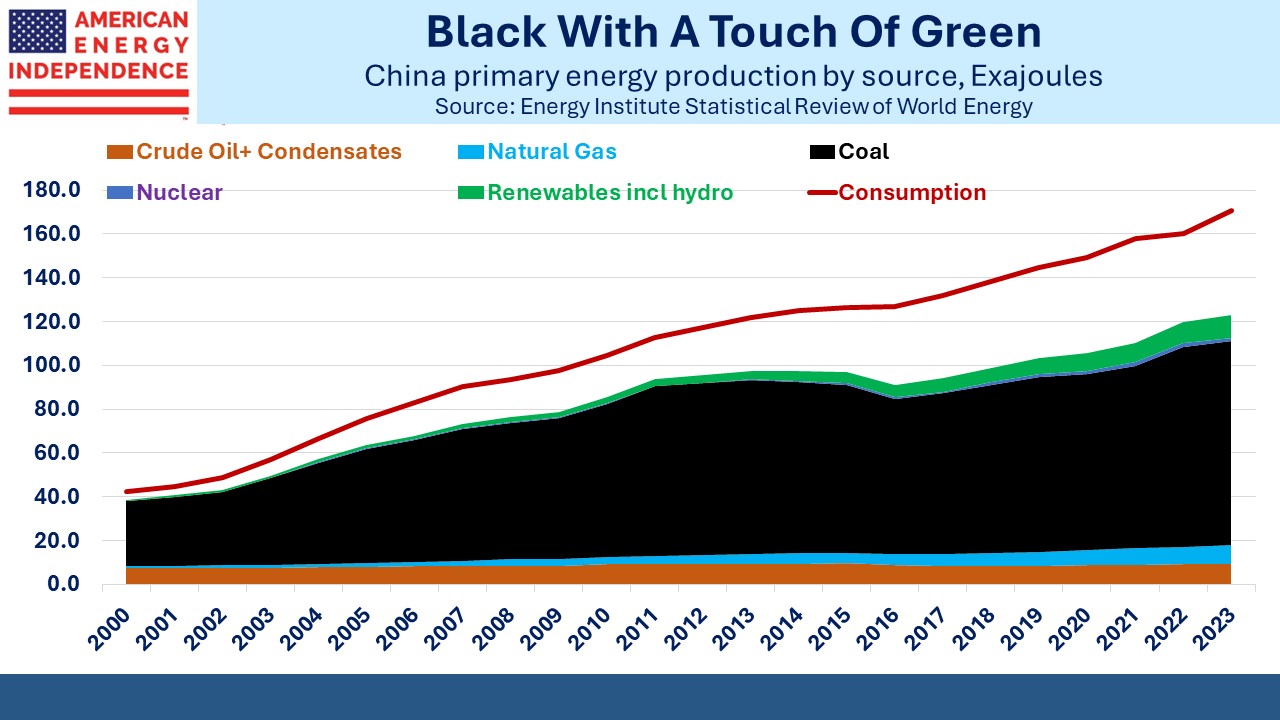

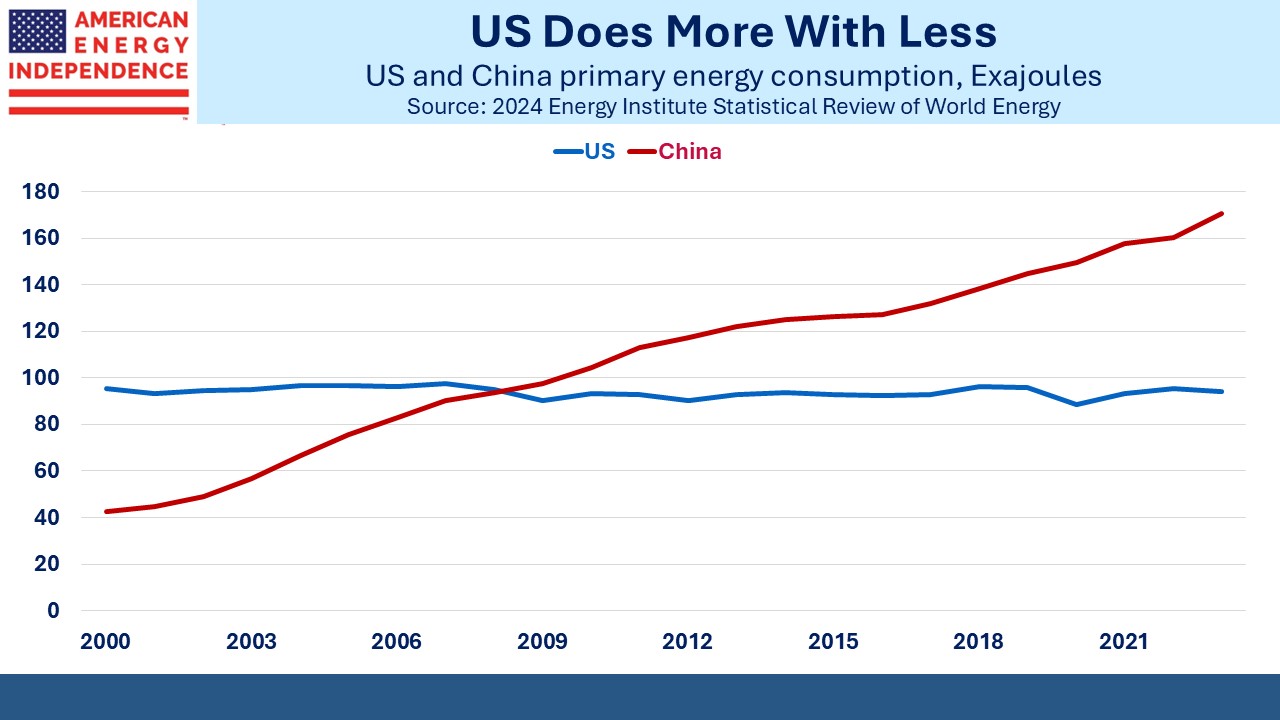

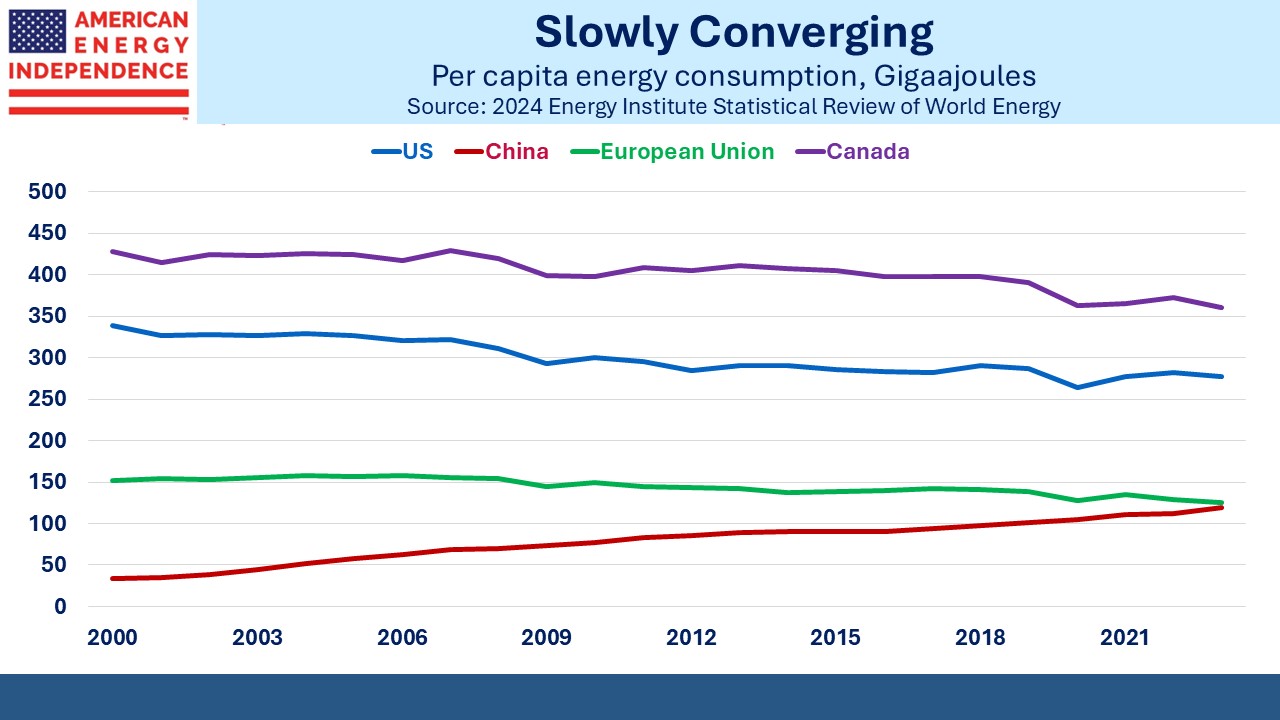

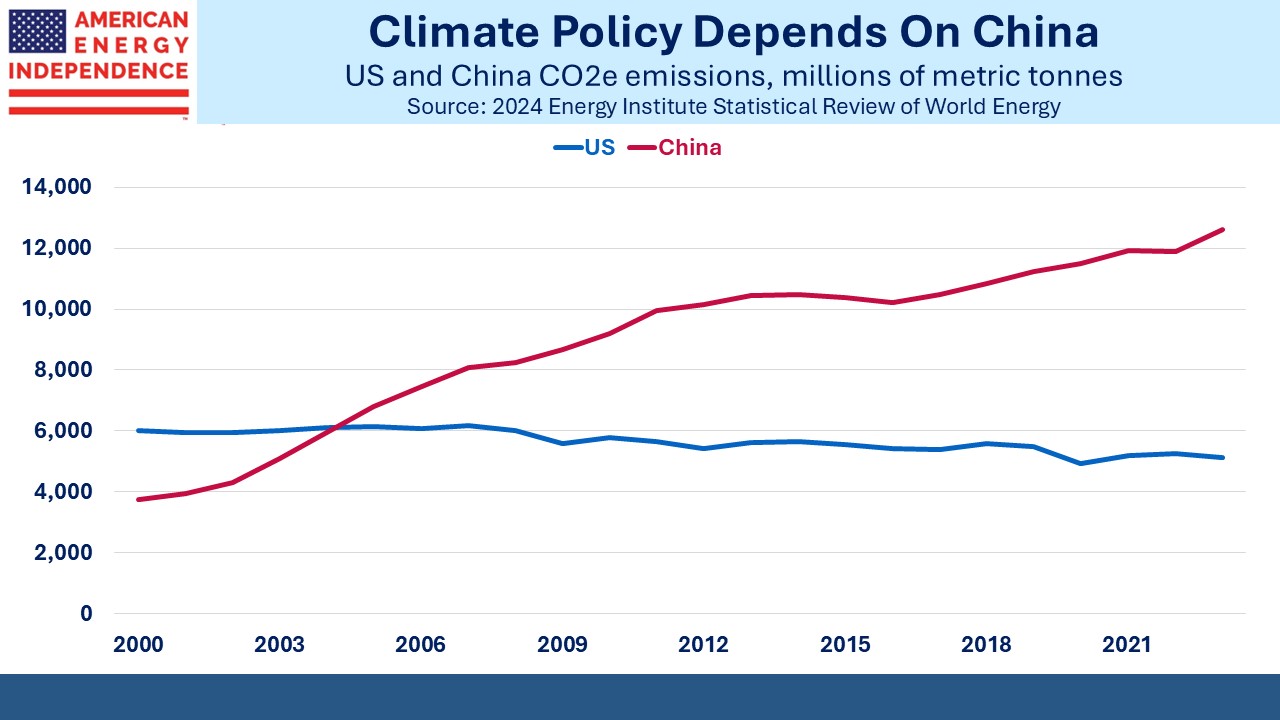

The first thing to understand is that global CO2 emissions will be determined by China, not the US or the EU. China’s 12.6 Gigatons (GTs, billions of metric tonnes) of CO2 equivalent (i.e. including methane) have increased by a factor of 3.4X this century. They are 31% of the total, up from 14% in 2000. Over this time the US and EU have each lopped around 1 GT off their emissions.

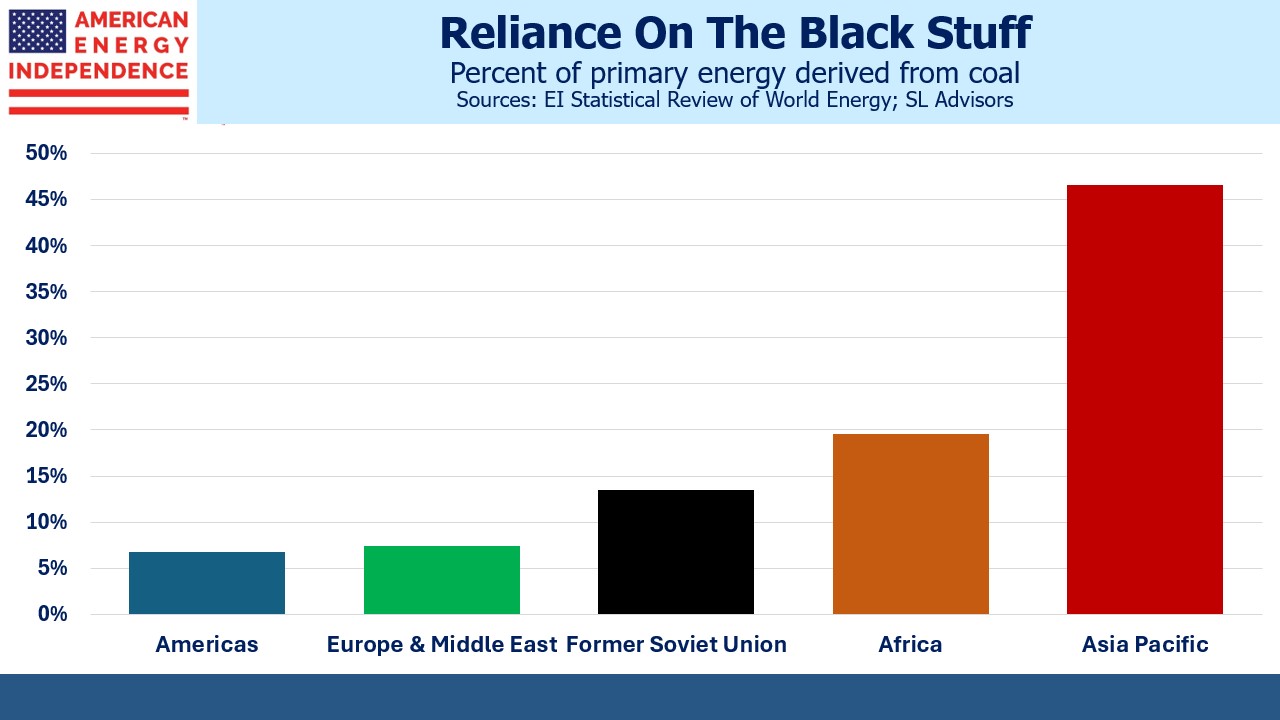

Non-OECD ex-China (ie the rest of the developing world) has gone from 9 GTs to almost 16 GTs. The data shows that concern about emissions rises with incomes. Everyone wants a western standard of living, which requires more energy. This is the inexorable force driving consumption of coal, oil and natural gas.

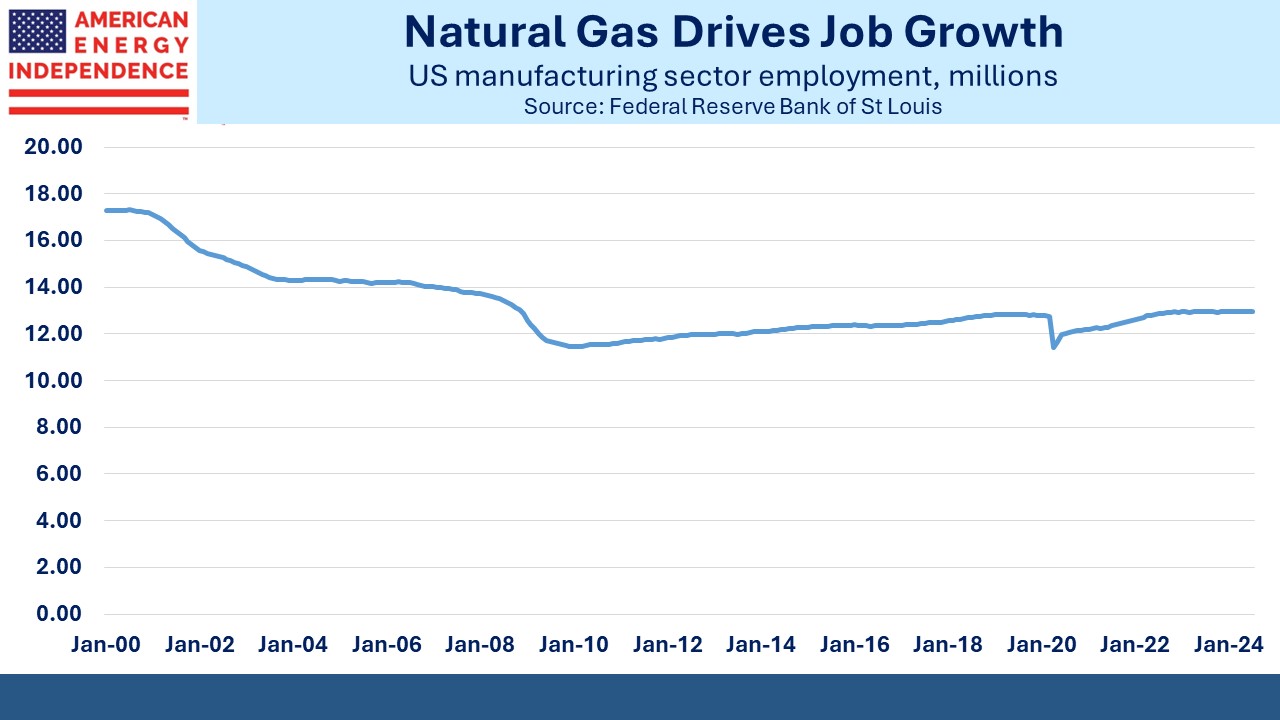

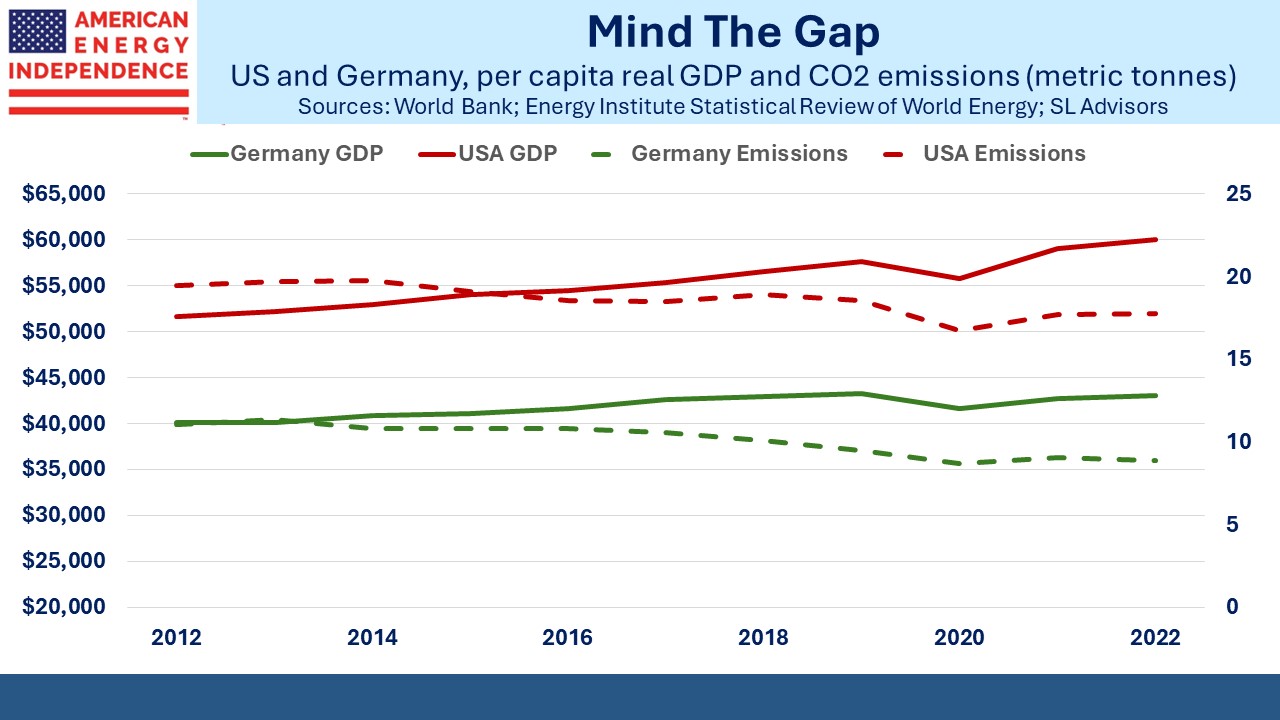

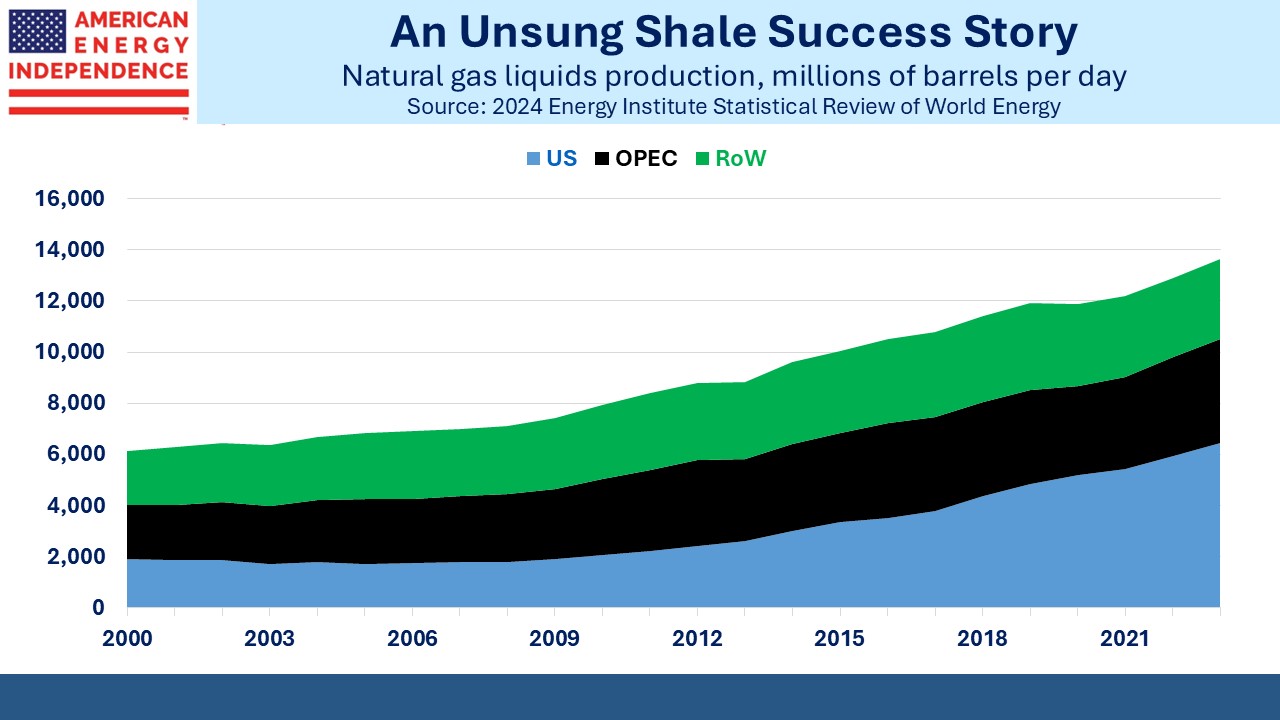

The success the US has enjoyed in reducing emissions has come from swapping coal for natural gas in power generation. It seems obvious to extend this benefit elsewhere through increased US exports of cheap Liquefied Natural Gas (LNG). But climate policy is driven by the marginal, most fringe views. Climate extremists have made it their misguided mission to impede US gas production at every step (see Sierra Club Shoots Itself In The Foot). These are the people most likely to prioritize climate change in casting their vote. Therefore, their policy recommendations hold outsized influence over public policy.

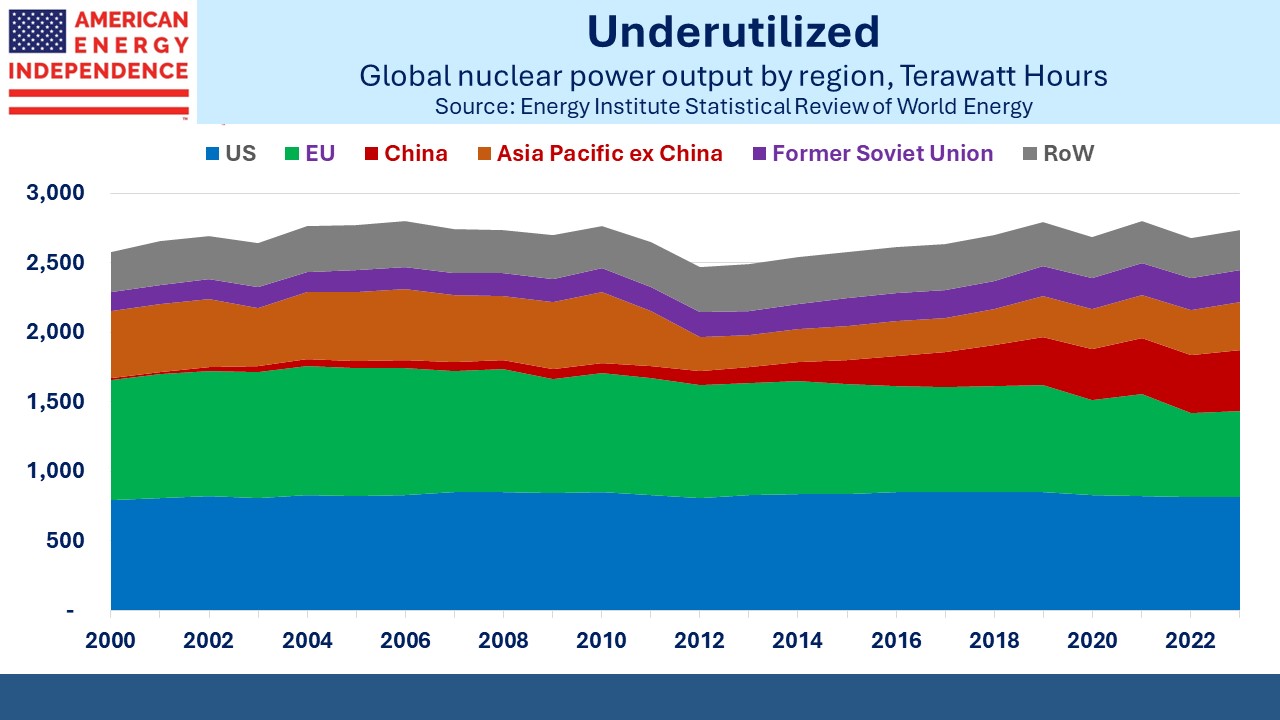

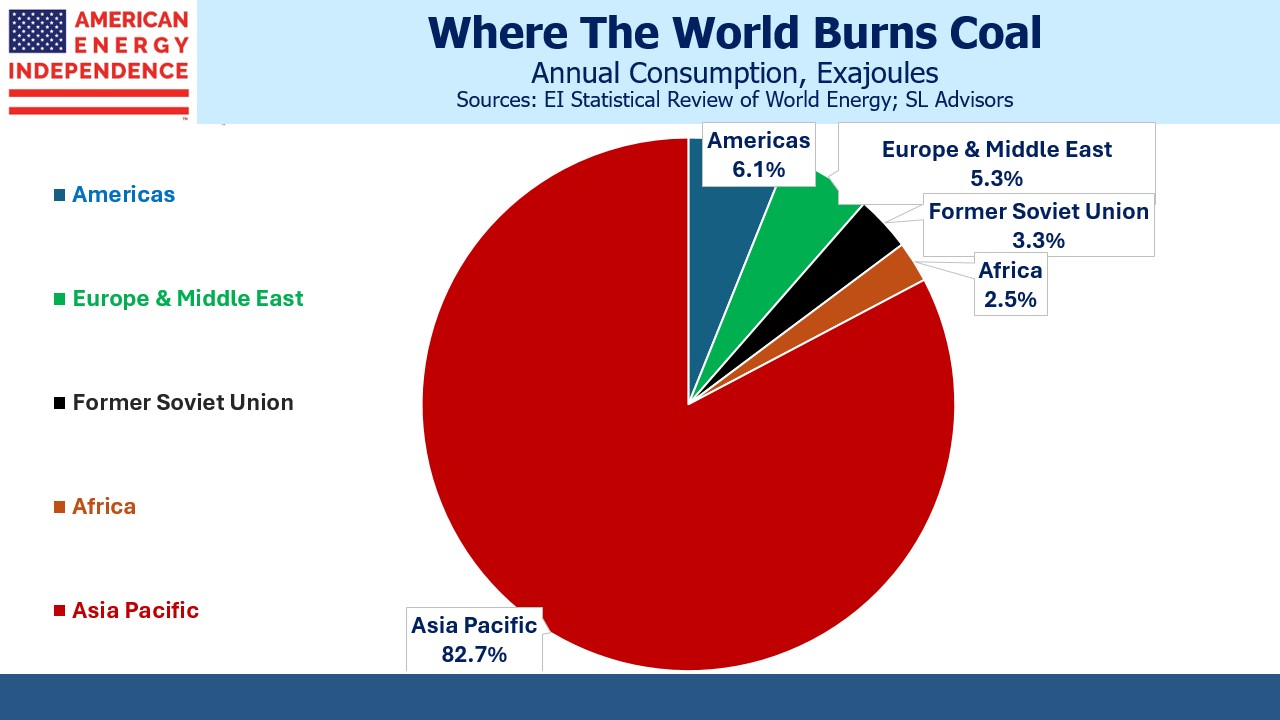

As a result, China’s coal consumption grows unchecked. Their substantial investments in solar and wind capacity are hailed as evidence that their policies are aligned with ours, but emissions keep growing. Climate extremists are so convinced that renewables can ultimately provide all our energy that they ignore the facts. They remain implacably opposed to nuclear power, even though it has the lowest fatality rate per unit of power generated of any source of energy. The Sierra Club believes that, “every dollar spent on nuclear is one less dollar spent on truly safe, affordable and renewable energy sources.”

Nuclear power output has barely risen this century. China is the one exception. The rest of Asia responded to Japan’s Fukushima disaster by shutting down nuclear. Germany followed suit. France remains a notable exception, deriving 65% of its electricity from nuclear power. The rest of the world is at 8%.

The US Navy has 72 nuclear-powered submarines, 10 aircraft carriers and one research vessel. They have never had a safety incident. Maybe they should run our nuclear program. Every form of energy production includes risks. Climate extremists who thought hard about the issue would use their outsized political influence to improve the process by which US nuclear reactors are approved in the private sector.

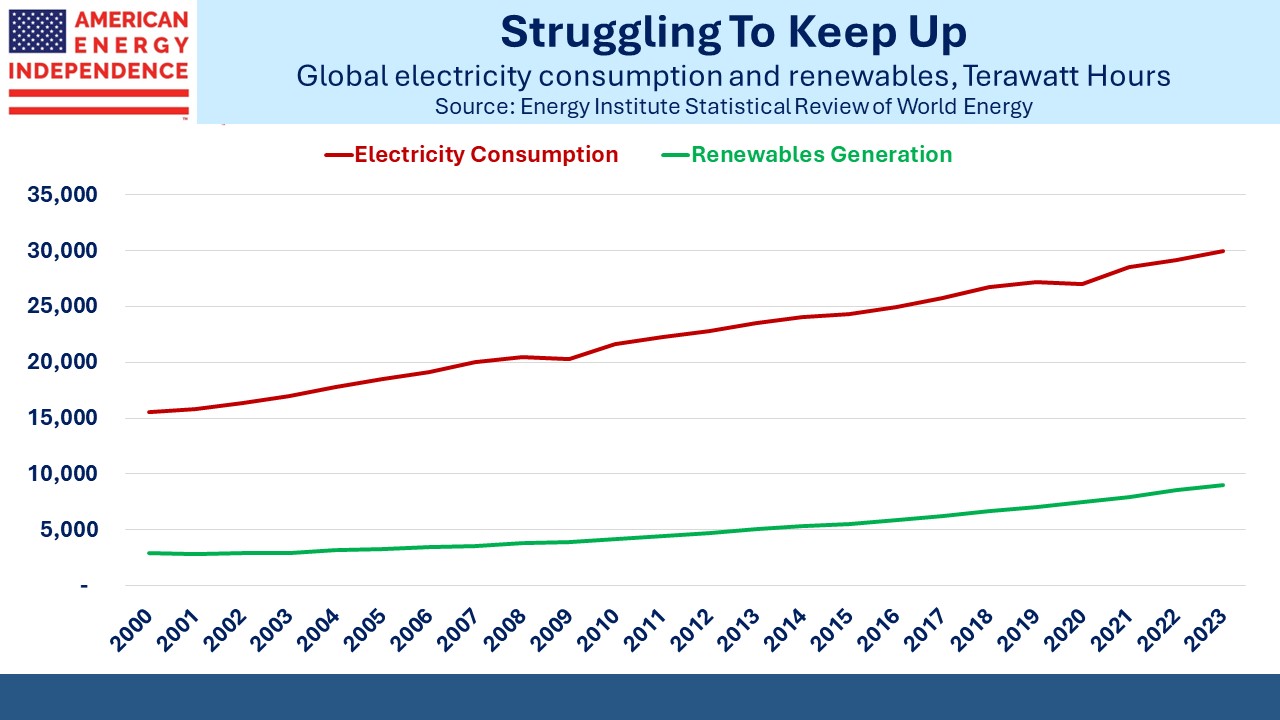

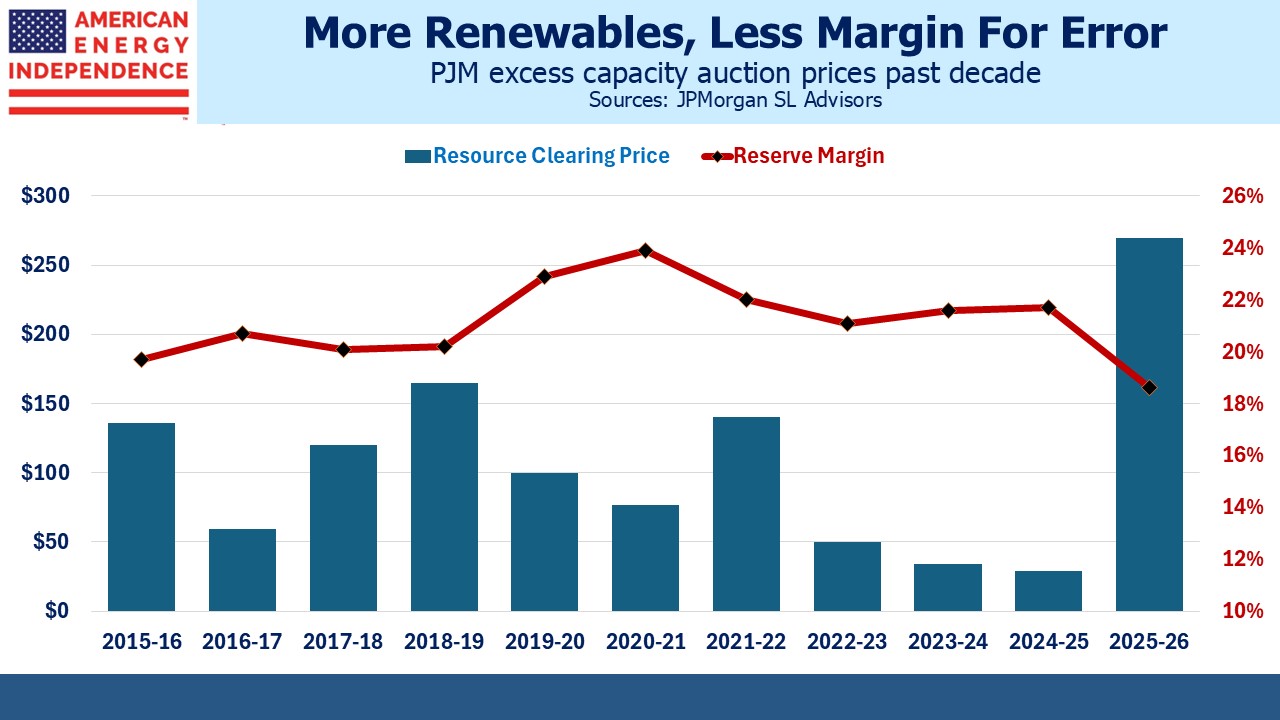

The futility of the solar/wind obsession can be seen in the chart comparing renewables generation with overall electricity. Global power consumption has grown at a 2.9% annual rate, and renewables at 5.1%. The analyst who tortures the data until it confesses what he wants interprets this as positive.

But another way to look at it is that global power demand has grown by 14,360 Terawatt Hours (TwH) and renewables by 6,124 (TwH). For all the media enthusiasm about weather-dependent energy, its growth has met less than half of the increase in global power demand so far this century.

This is why natural gas remains a great long-term bet. Policymakers may conclude that effecting a global coal-to-gas switch is a vital part of the solution. Or we may continue as we are. Both outcomes will see increased natural gas consumption.

I have this fanciful vision of the Sierra Club one day apologizing to the world for such narrow solutions while rising sea levels lap around their HQ (headline: Sierra Club Flooded). They are based in Oakland, CA, a mere 43’ above the Bay Area water, which seems imprudent given their prognostications. Or perhaps they don’t think it’s that serious, just like their policy solutions.

We have three have funds that seek to profit from this environment: