Energy Is The New Market Leader

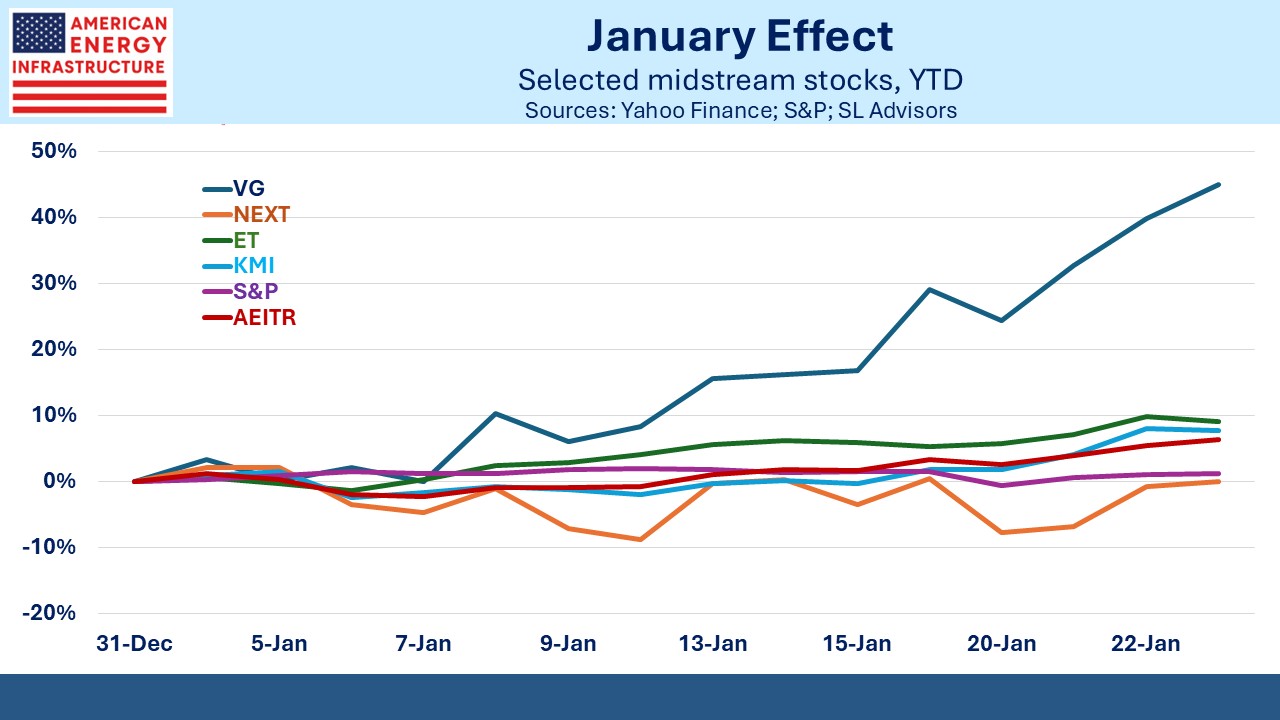

January was a good month for midstream energy infrastructure. The American Energy Infrastructure Index was +9%, the 10th best month of the past decade and the best since November 2024. For those who like simple statistical patterns, over the past ten years the direction of January’s performance has correctly predicted the full year 70% of the time.

Put another way, annual performance and January’s are both usually up.

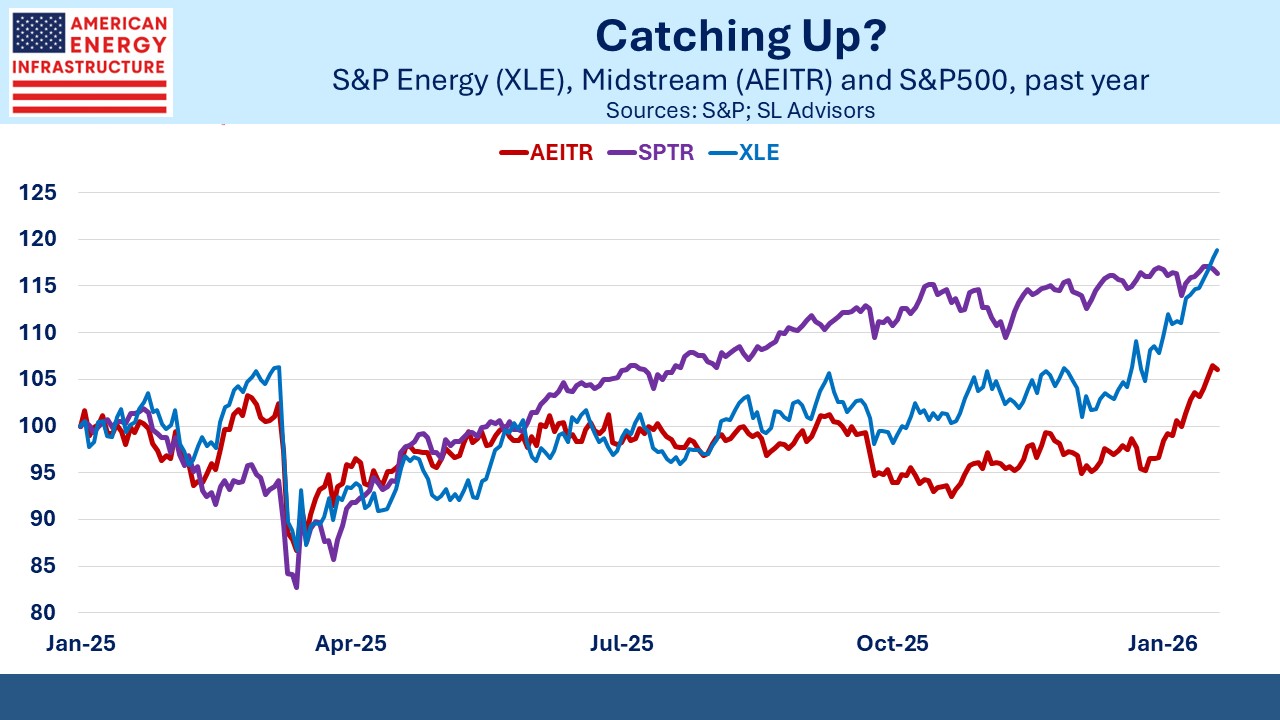

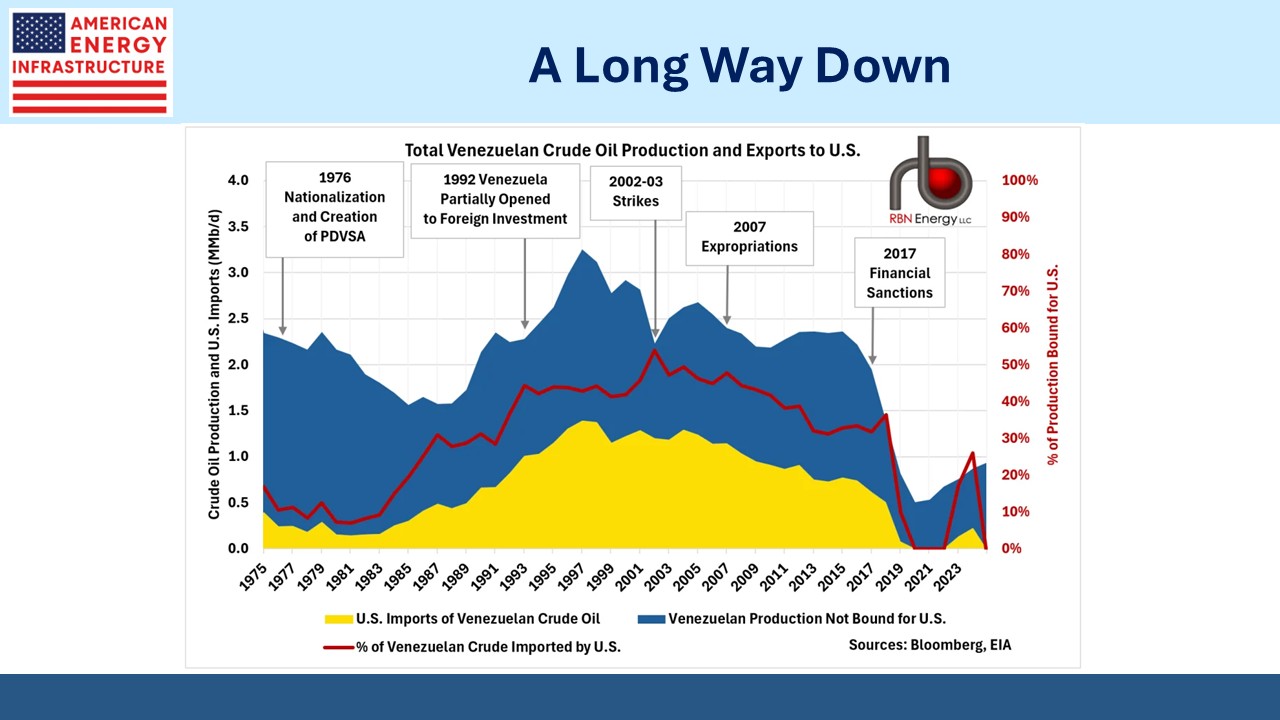

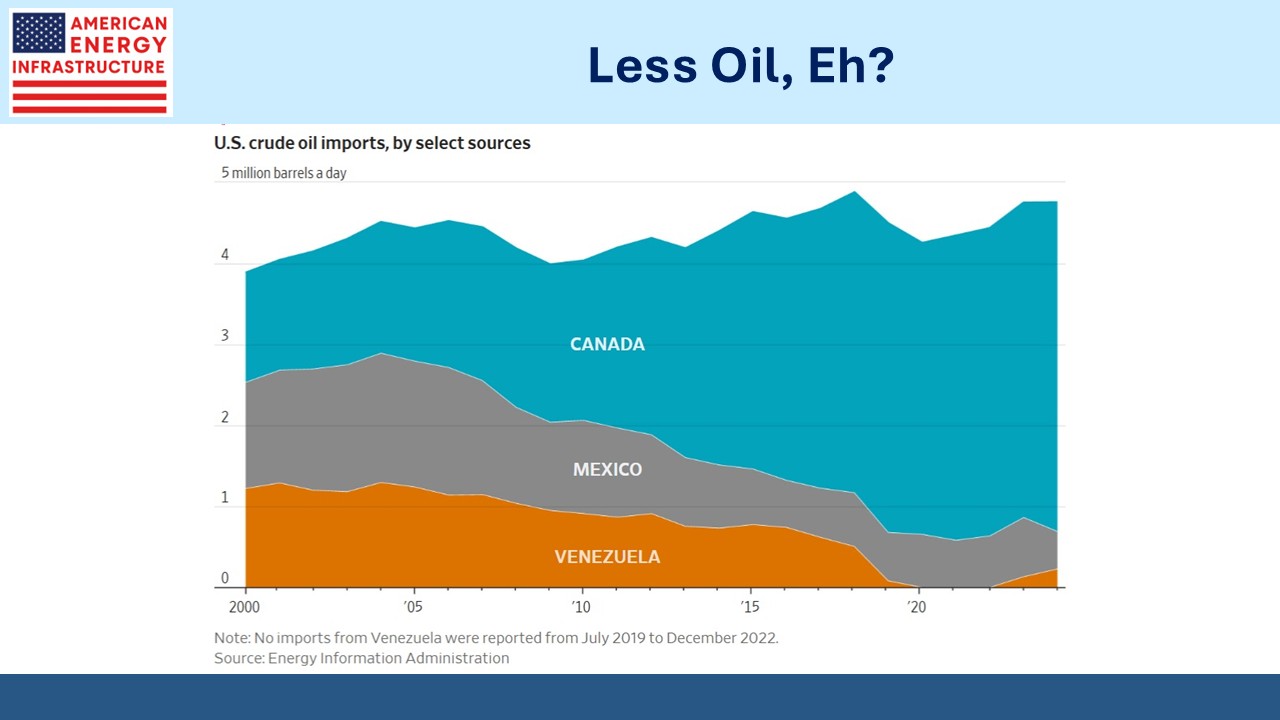

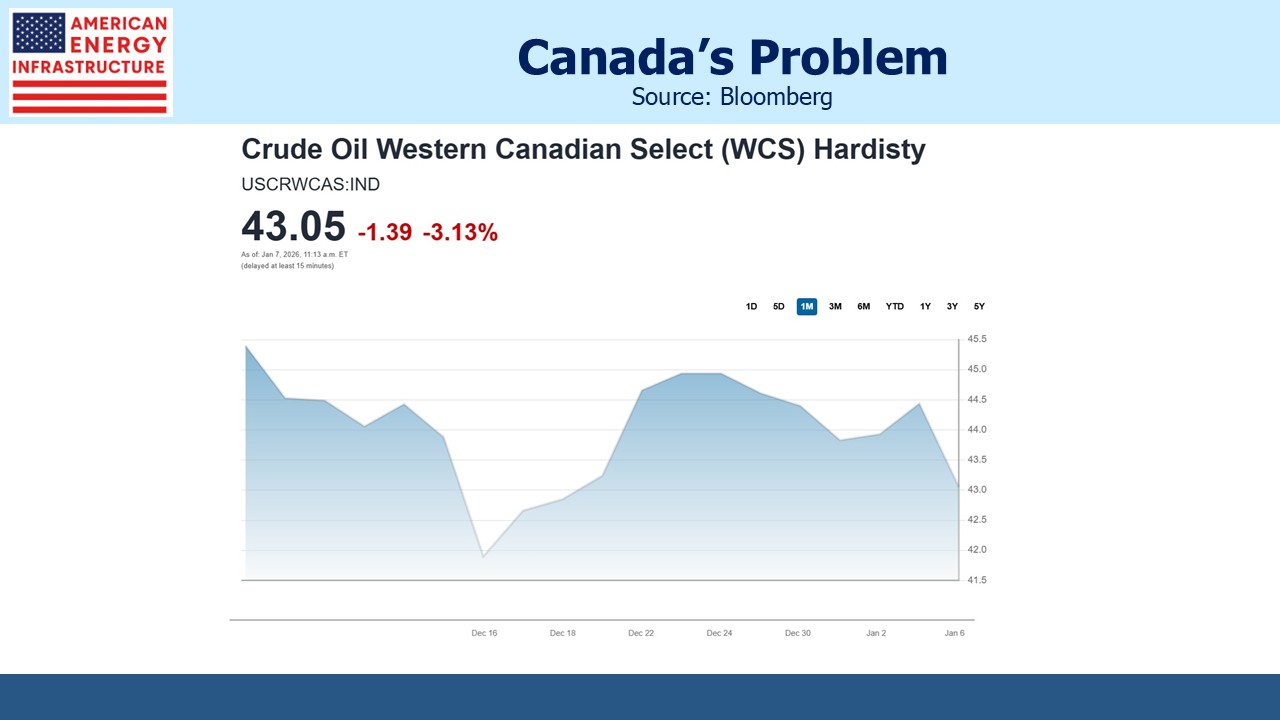

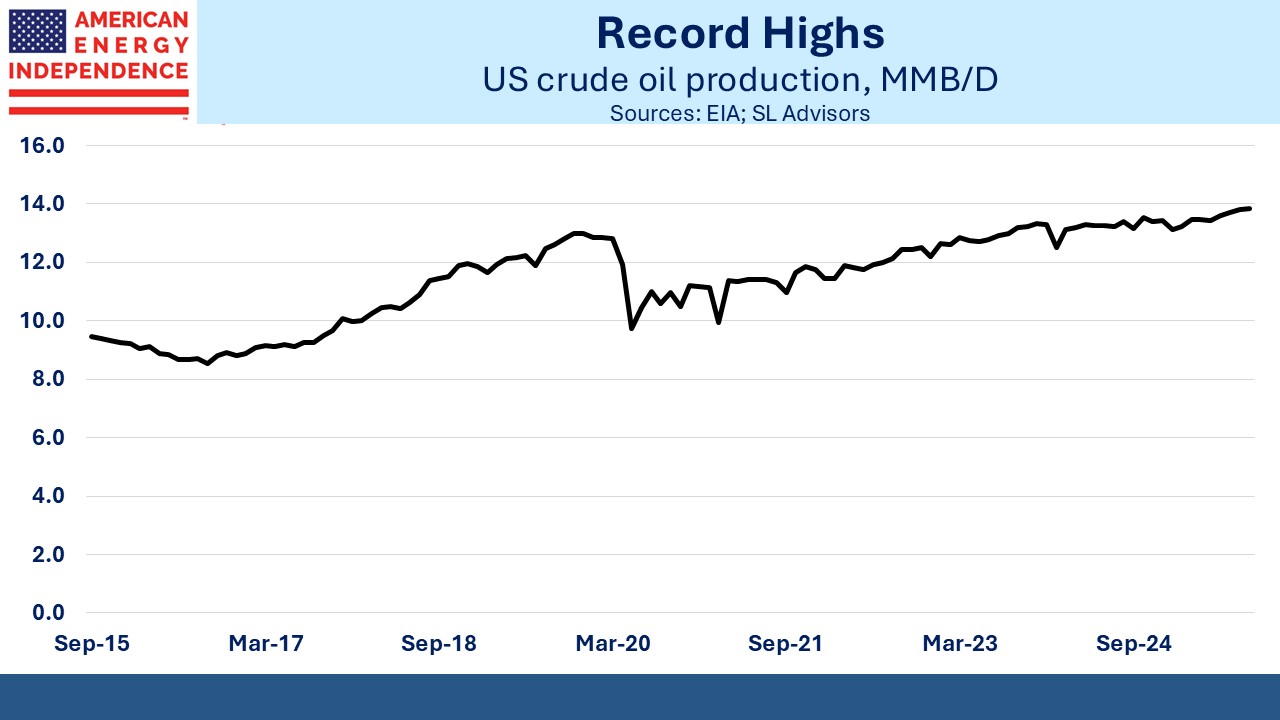

Energy is back in favor. The S&P500 Energy Sector (XLE) was +14% last month. Exxon Mobil (XOM) and Chevron (CVX) represent 42% of its holdings, and investors have been encouraged by rising oil production even with soft prices. Continued efficiency improvements are boosting sentiment, perhaps helped by signs that CVX can increase Venezuelan oil output without following the White House’s desire that they ramp up capex there.

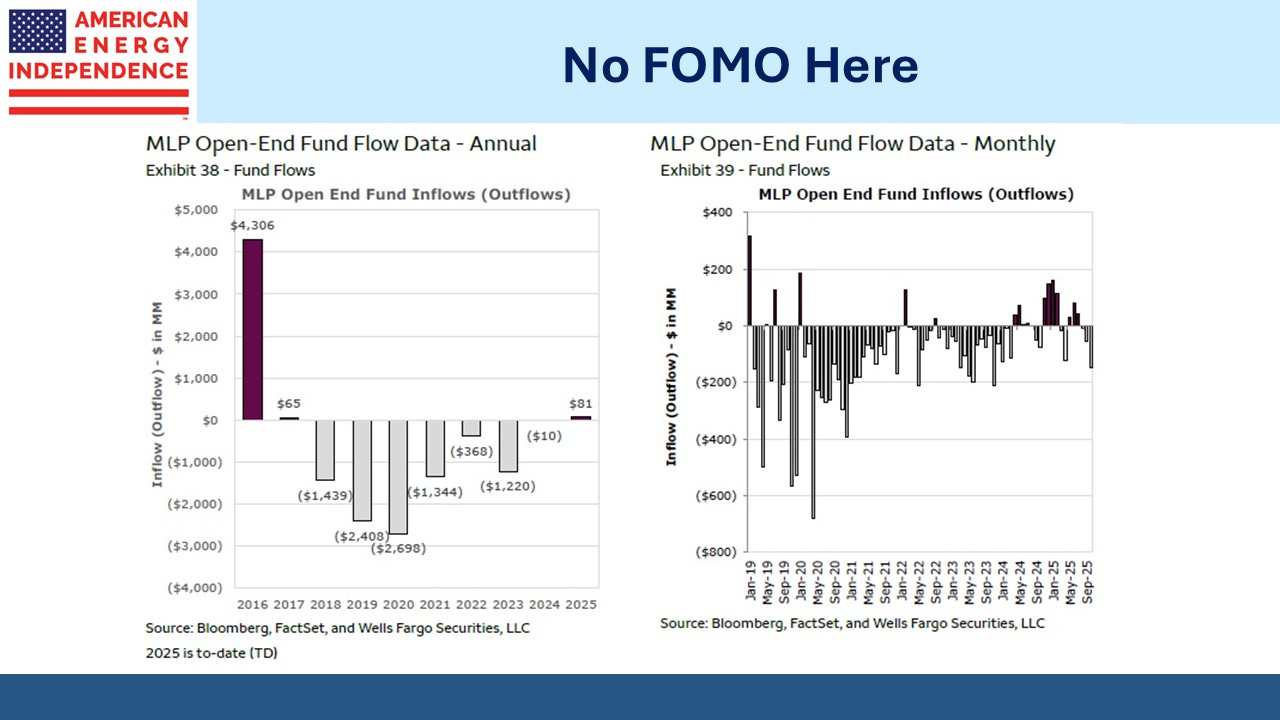

XLE fund flows were consistently negative last year. Perhaps the strong start to the year will draw in buyers to upstream and midstream who like to see good price action before committing capital. Over the past twelve months it’s now beating the market.

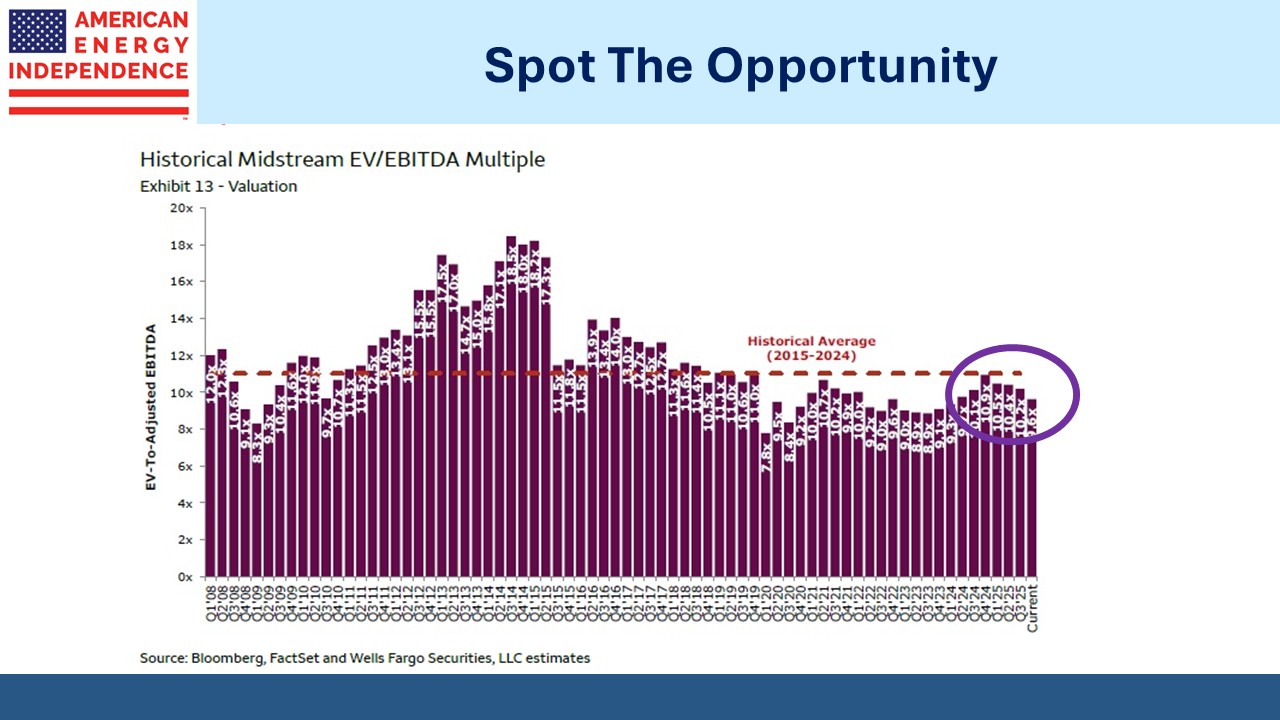

The news for midstream was generally good in January, although to us the sparkling performance was a belated recognition of the already positive fundamentals. ChatGPT guided me to a wildly bullish article from an obscure website (see The Gilded Age of Infrastructure: Why 2026 is the Breakout Year for US Midstream and Energy).

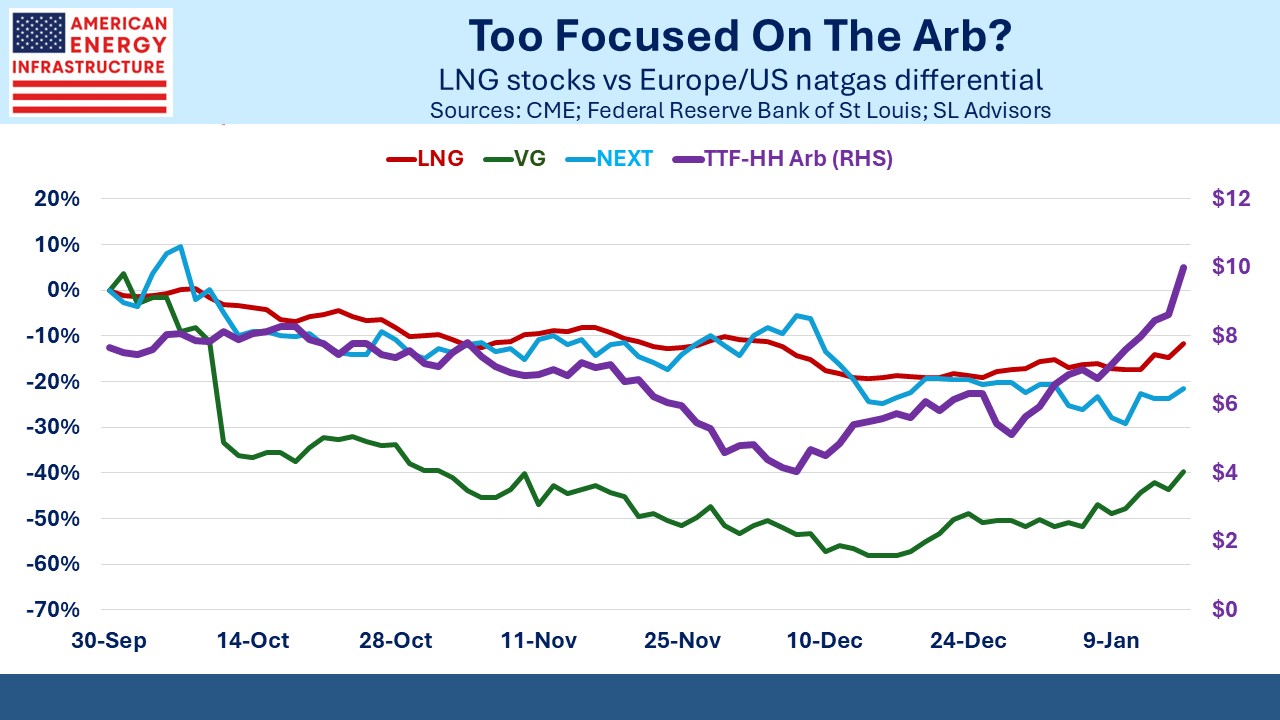

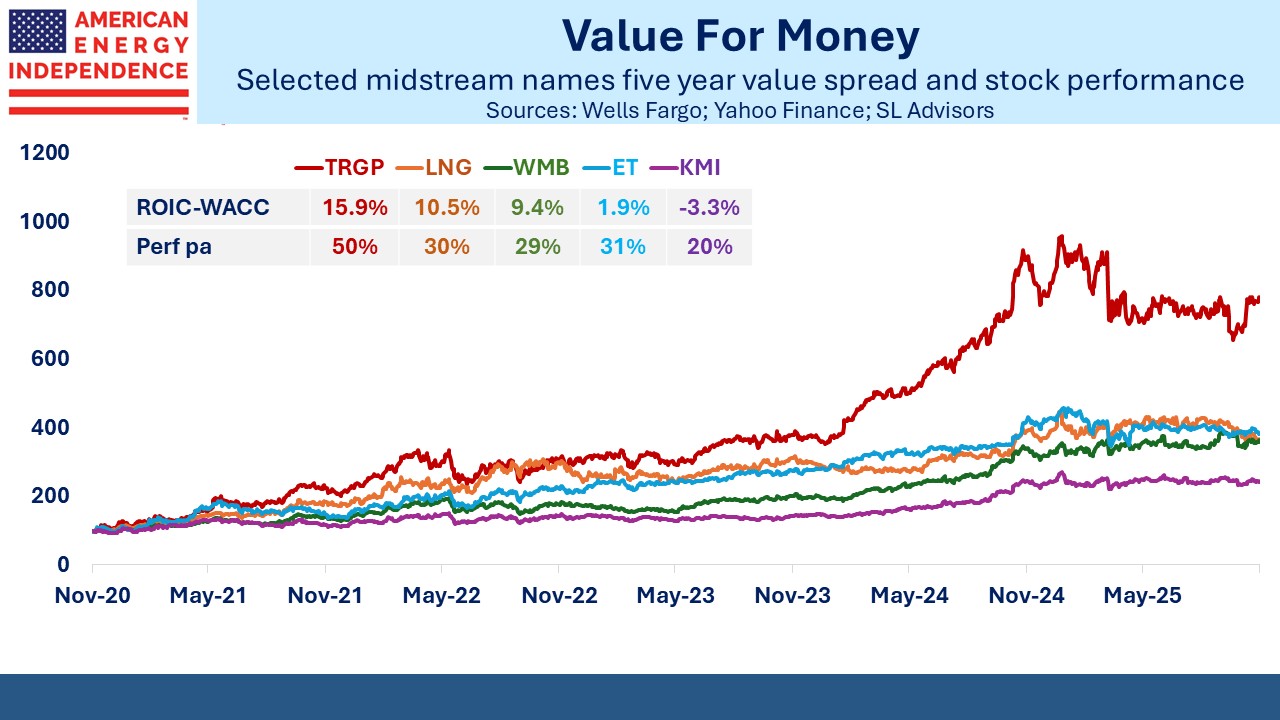

Venture Global stood out at +43%, buoyed by a positive arbitration outcome (see Energy Leads The Market). Energy Transfer responded to the strong seasonal pattern that usually boosts MLPs. Even though Winter Storm Fern doesn’t seem to have created the type of energy market dislocations seen five years ago that netted them $2.4BN, ET held on to the gain registered in anticipation.

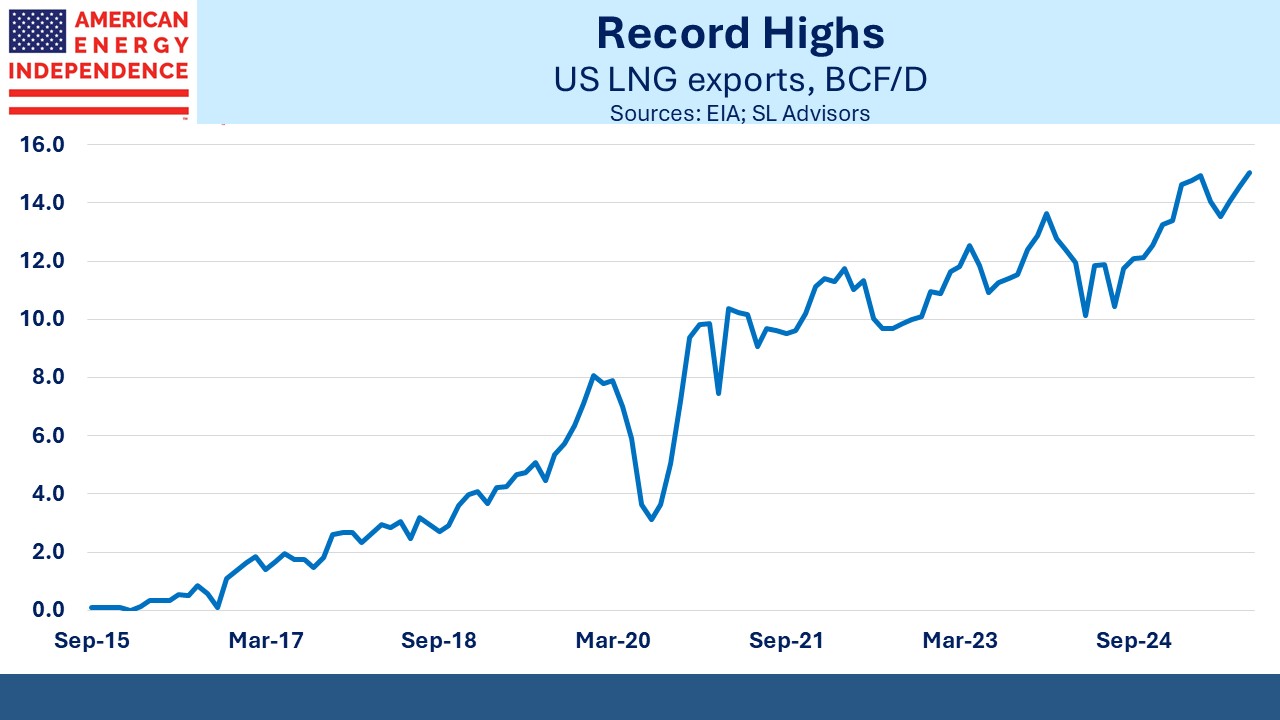

Last week Abu Dhabi’s state oil company ADNOC added 7.6% to its stake in Phase Two of NextDecade’s Rio Grande LNG export terminal. ADNOC acquired the stake from Global Infrastructure Partners by exercising an option they acquired back in May 2024 when they invested in Phase One.

ADNOC is presumably pleased with the progress to date.

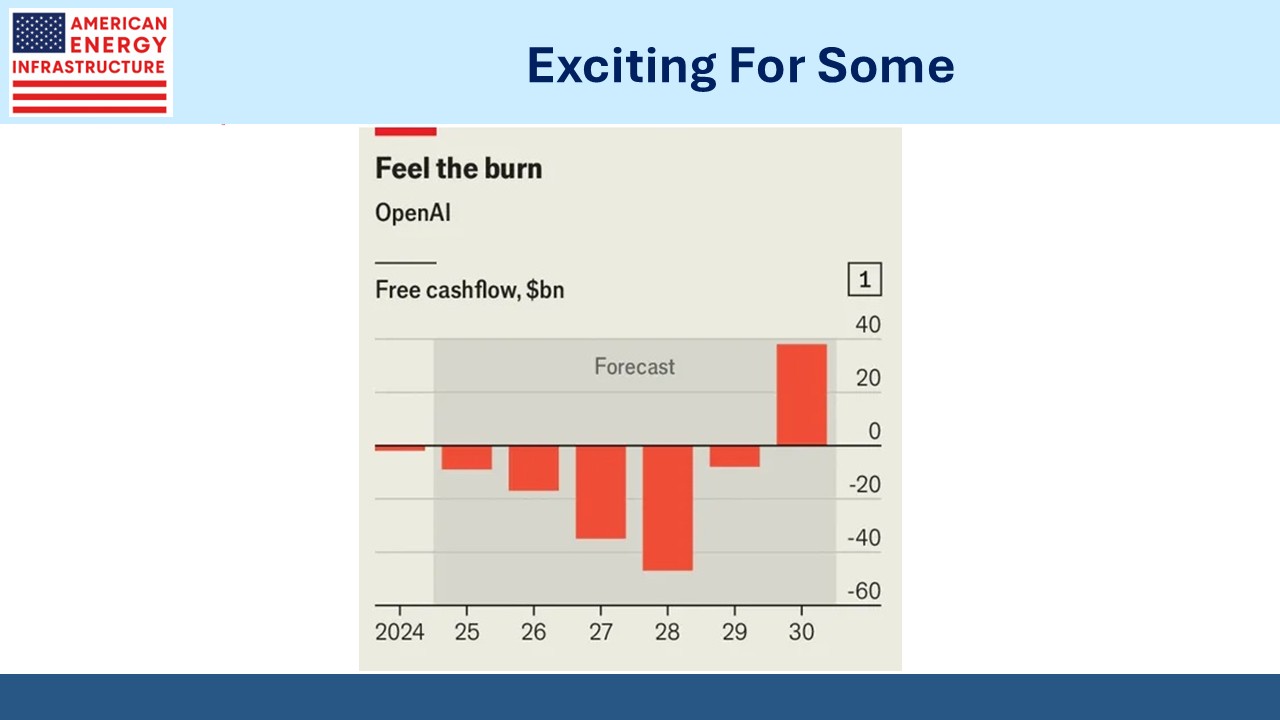

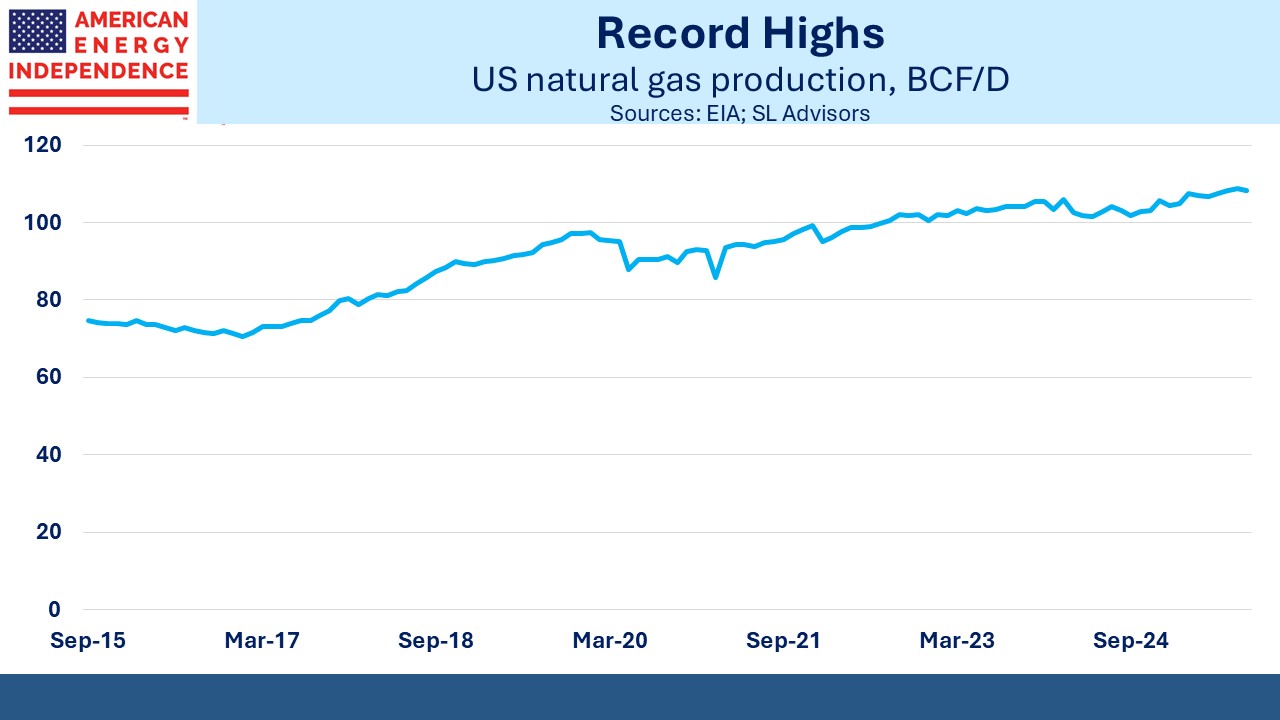

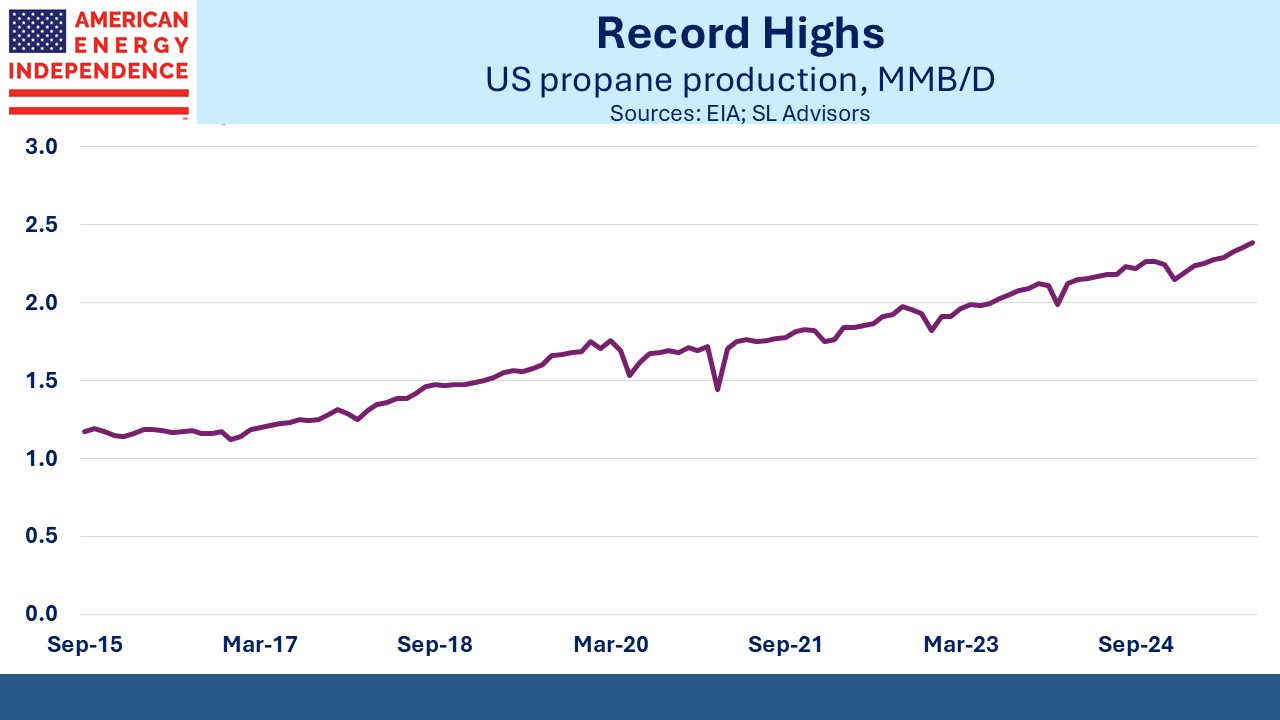

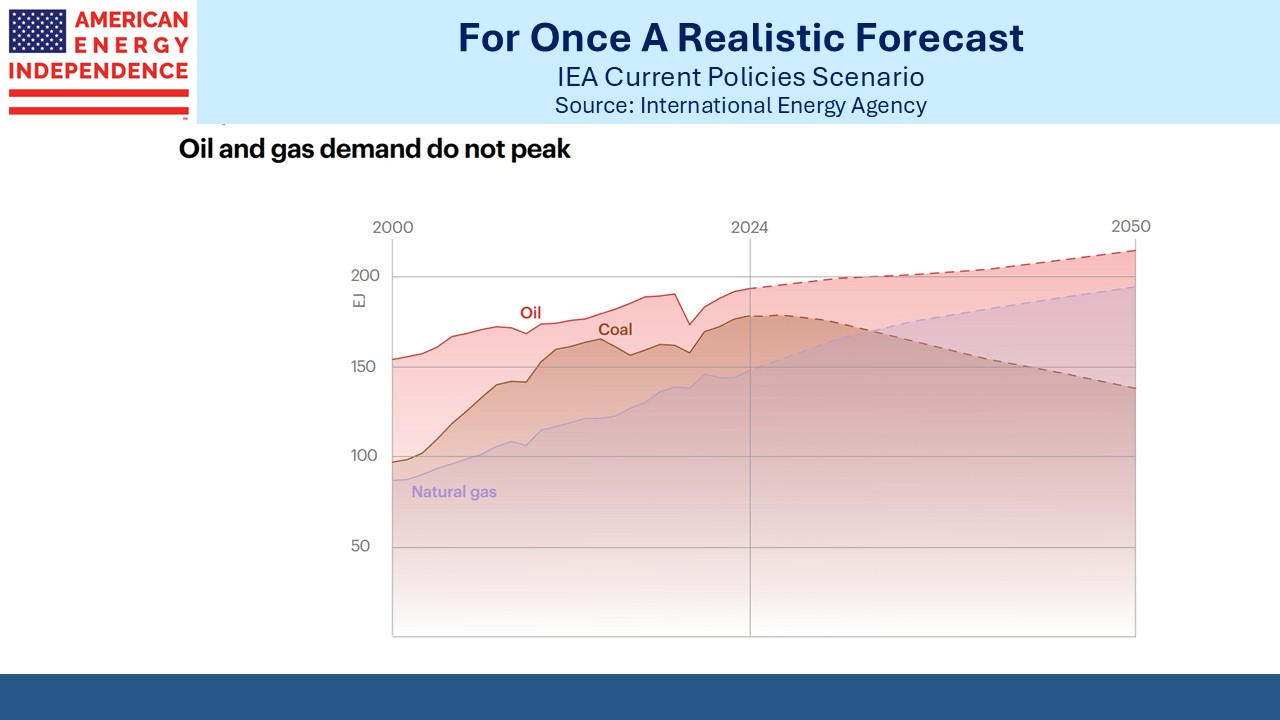

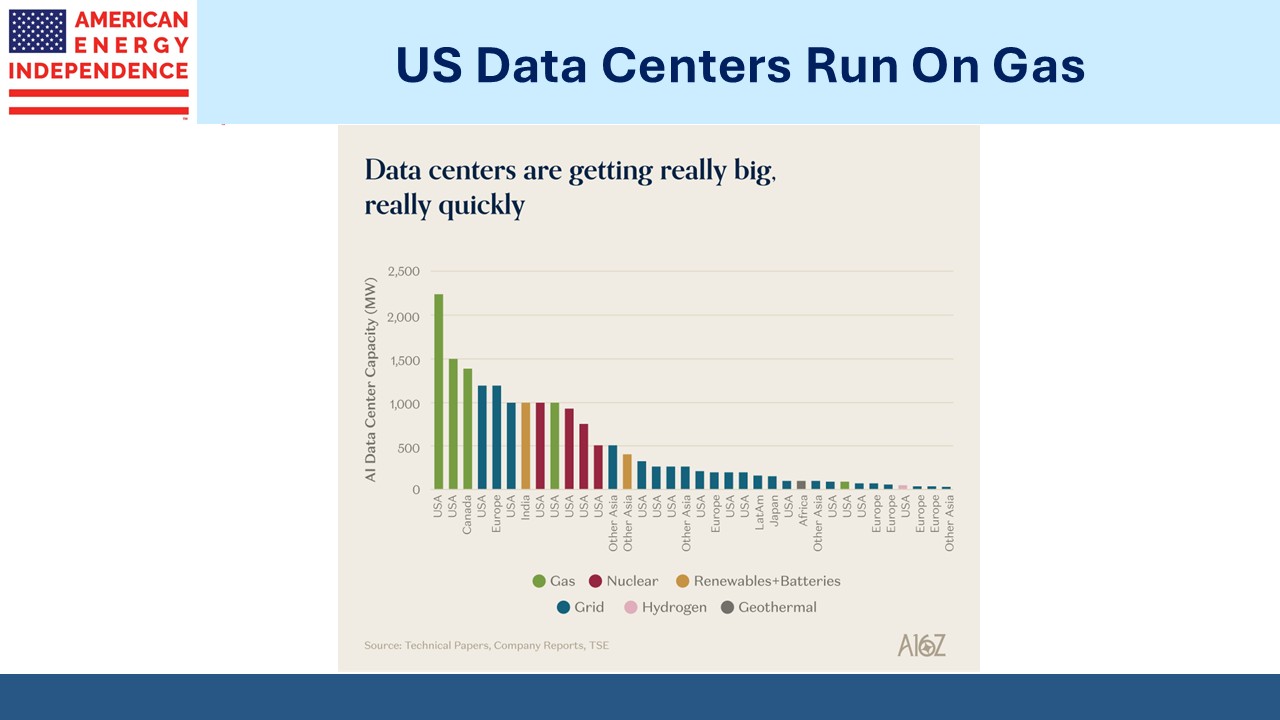

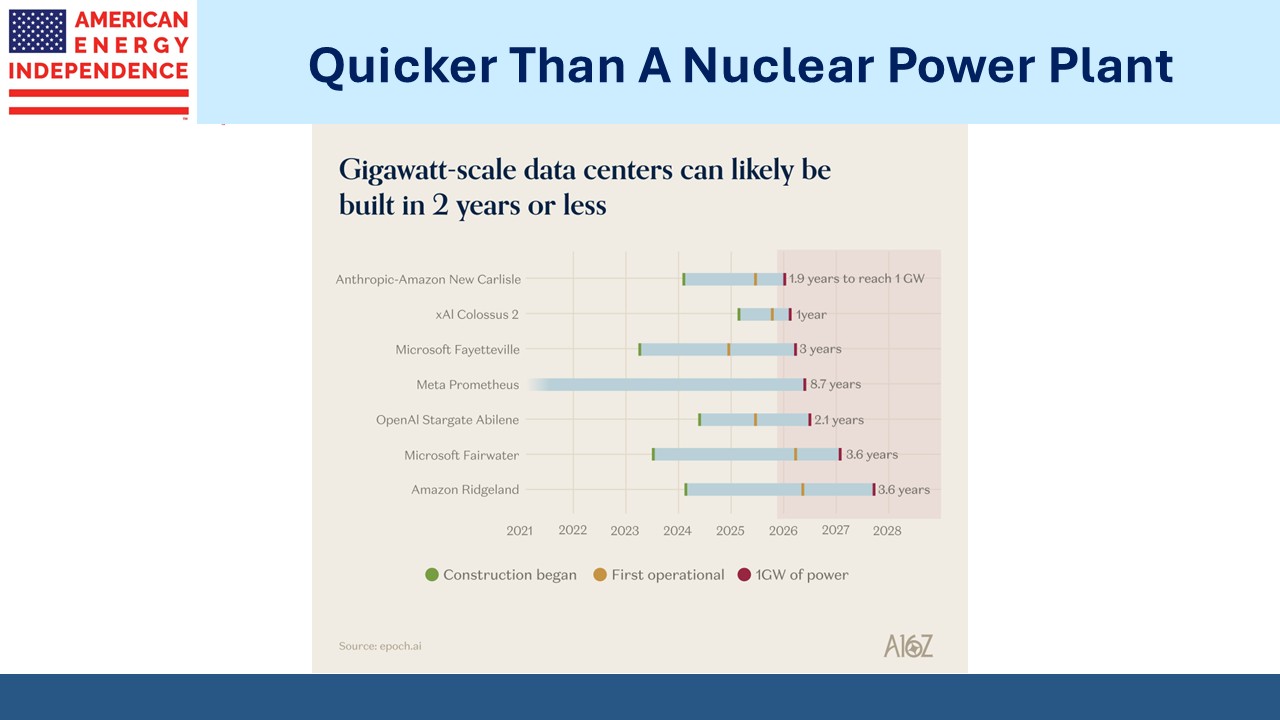

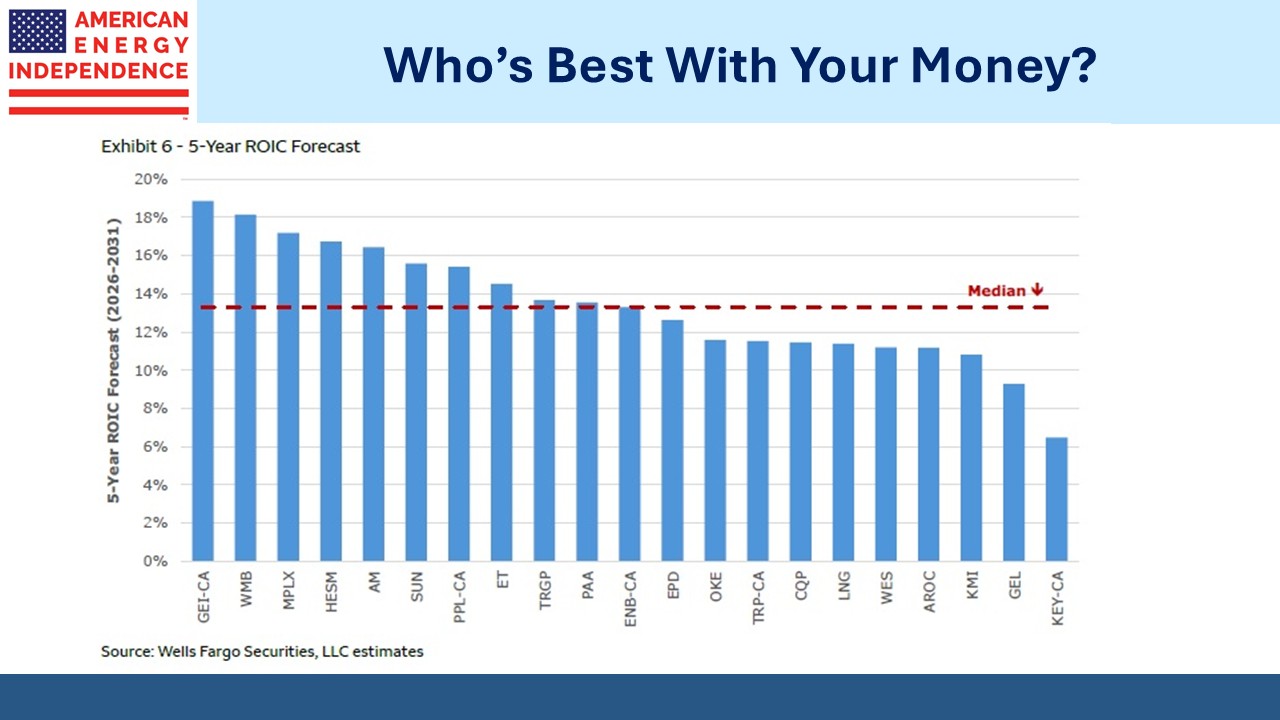

Natural gas oriented capex plans from Kinder Morgan and Energy Transfer were both positively received. The underlying demand from LNG exports and power generation for data centers is no less compelling than for the past couple of years. But perhaps when hyperscaler Microsoft can shed in value half the midstream’s entire market cap, as the stock did following earnings on Thursday, it can reflect favorably on an un-hyped sector.

Although Winter Storm Fern didn’t result in the widespread loss of power that Uri caused five years ago, it did once again highlight vulnerabilities in the reliability of the country’s grid.

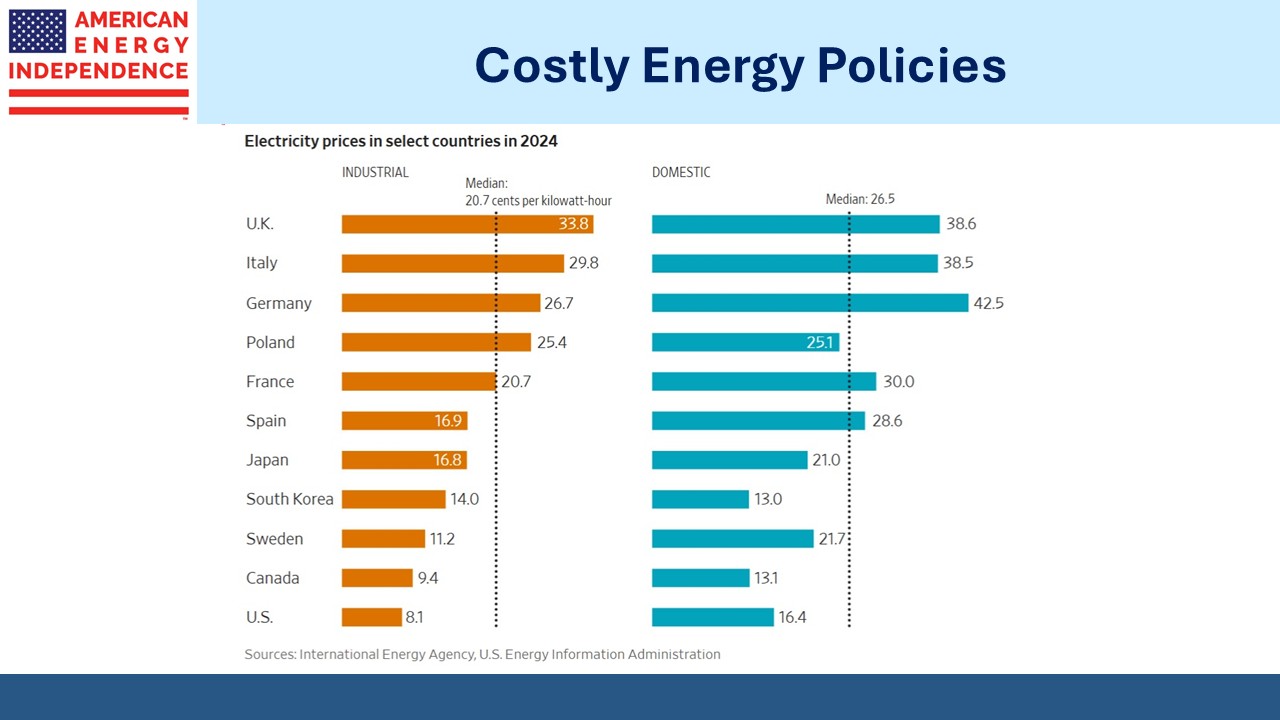

New England relied on fuel oil to generate as much as 40% of its electricity. Other than in the Middle East where crude is cheap and abundant, oil isn’t used for power generation. Progressive energy policies in Massachusetts and across the region have raised prices and the risk of disruption for little discernible benefit.

The North American Electric Reliability Corporation (NERC) released their 2025 Long Term Reliability Assessment in January. They found that 13 of the 23 assessment areas will face resource adequacy challenges over the next decade. Grid planning takes place over years, so while warnings such as this rarely appear urgent, much of the US faces a growing risk that power supply will become less reliable.

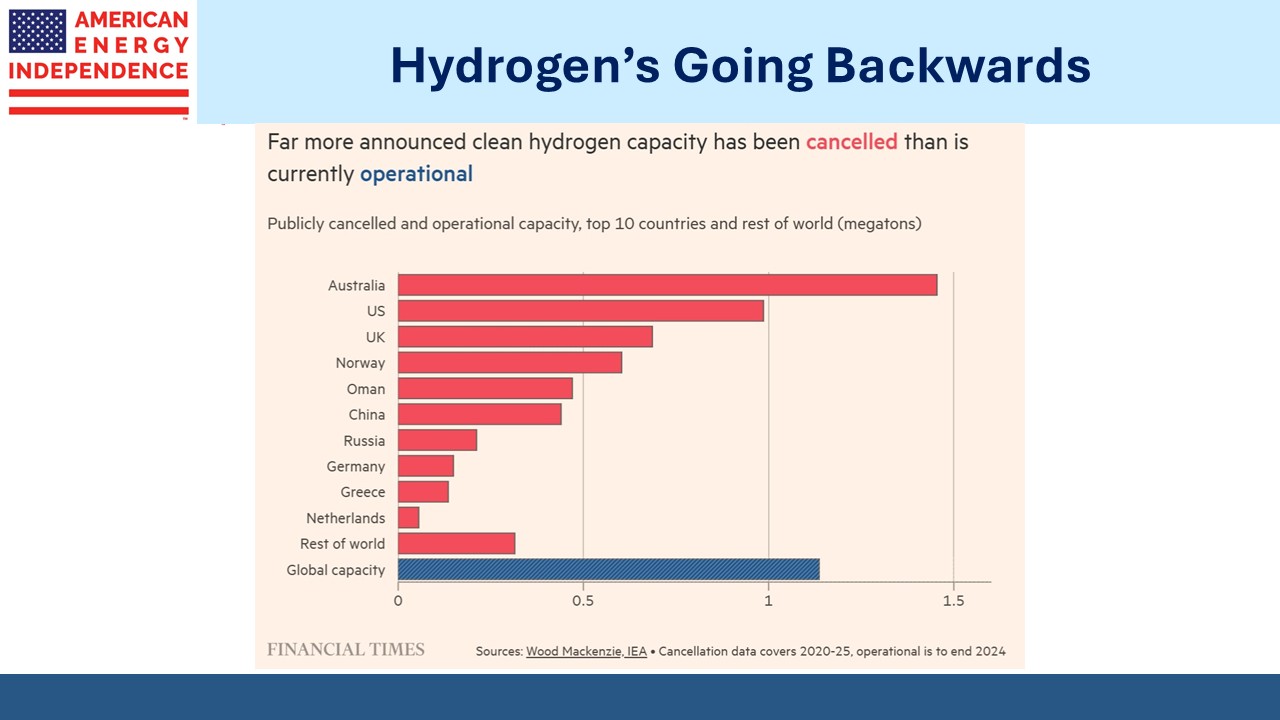

There can be no doubt that left wing energy policies are the cause. NERC blames the increased investment in solar and the requisite battery backup along with decreasing investment in reliable gas-fired power. This is reducing the overall capacity utilization of the nation’s power–generating assets, creating grid complexity because of the increased reliance on intermittent generation and raising costs.

The PJM Grid, the country’s biggest which extends from the md-Atlantic as far west as Illinois and includes New Jersey, our summer home, is rated as High Risk from 2029. Recently elected NJ governor Mikie Sherril looks set to continue Phil Murphy’s misguided policies based on recent executive orders she issued to favor renewables. A mandate that 100% of electricity be generated from carbon-free sources by 2035 has disincentivized any investment in gas-powered generation.

There are some encouraging signs. NERC found that retirements of peak seasonal capacity, while still high at 105 Gigawatts (GW), were down by 10 GW from a year earlier as some power plants had their useful lives extended. PJM and other grids such as MISO (midwest) and ERCOT (Texas) have started addressing the biggest vulnerabilities noted by NERC and implementing plans to curtail power to certain users.

Underlying these challenges is the growing demand from data centers, some of which are accepting that at times of high usage they’ll need to rely on alternatives, such as diesel.

Natural gas looks like a clear winner as grid operators and customers look for reliable power. It’s why we’re invested there.

We have two funds that seek to profit from this environment: