Powering AI With Gas

The Magnificent Seven may be shrinking to the Fab Four as the number of AI-linked market leaders diminishes. Tesla and Apple are down on the year while Alphabet lagged the S&P500. That leaves Nvidia, Meta, Amazon and Facebook leading. As with the dotcom bubble 25 years ago, if you can link your business to the new craze your stock will soar.

Natural gas driller EOG Resources was relying on “machine-learning” at least seven years ago to optimize their E&P operations. Devon Energy uses AI to help achieve “sustainable growth.”

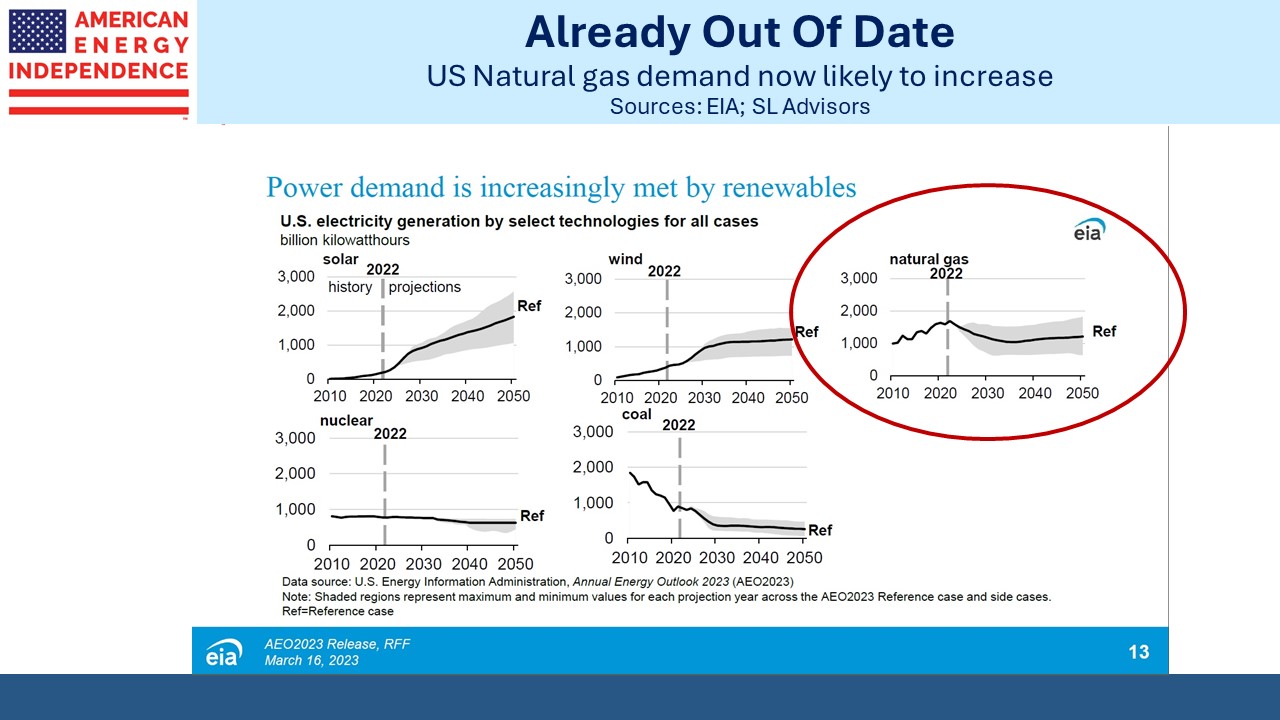

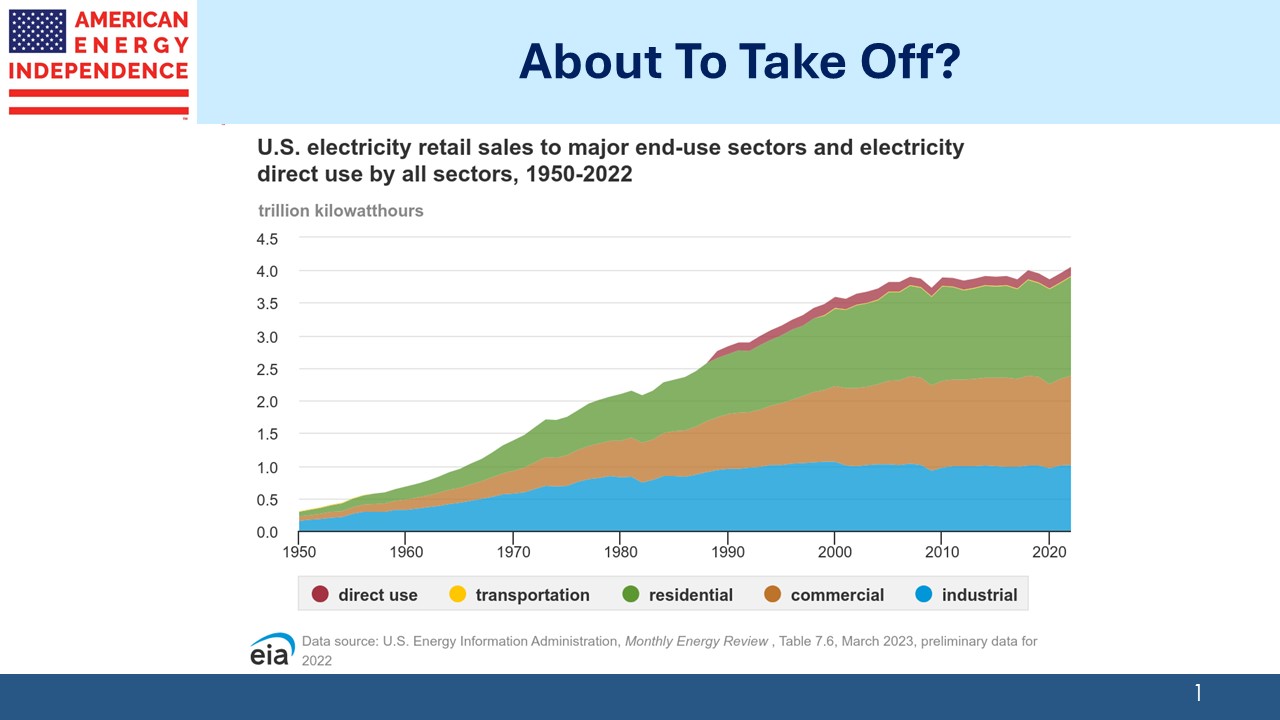

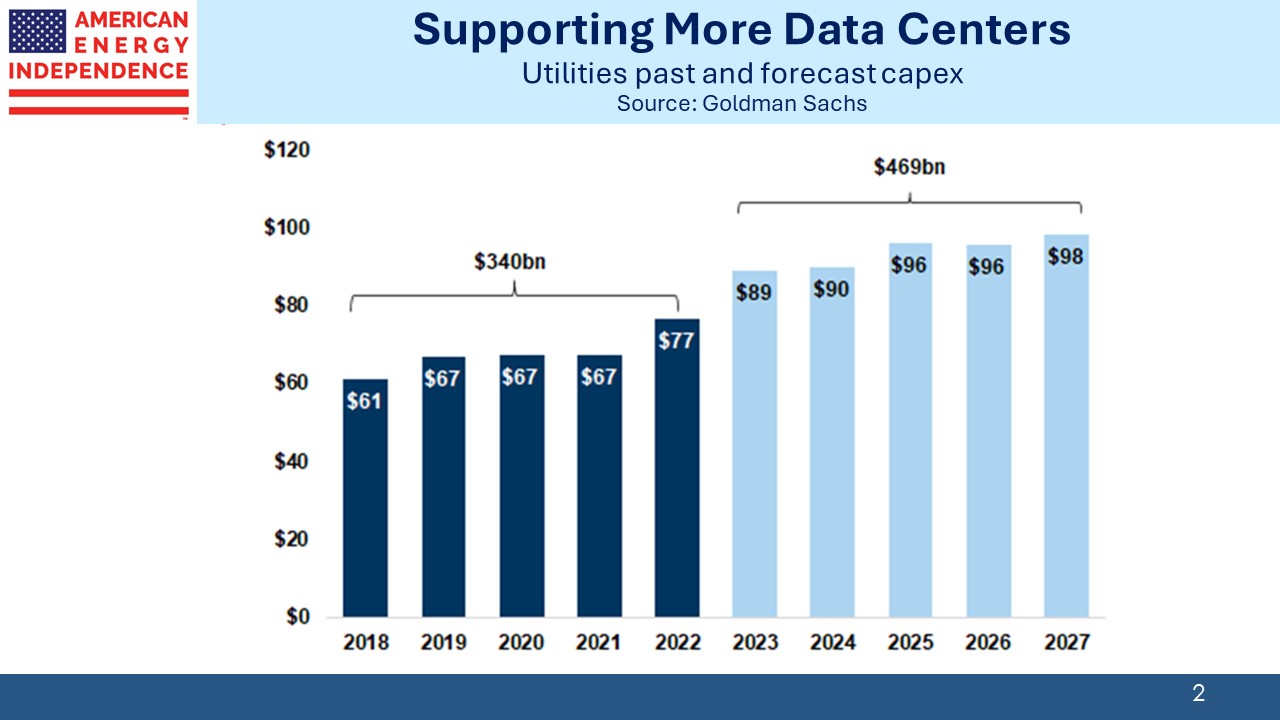

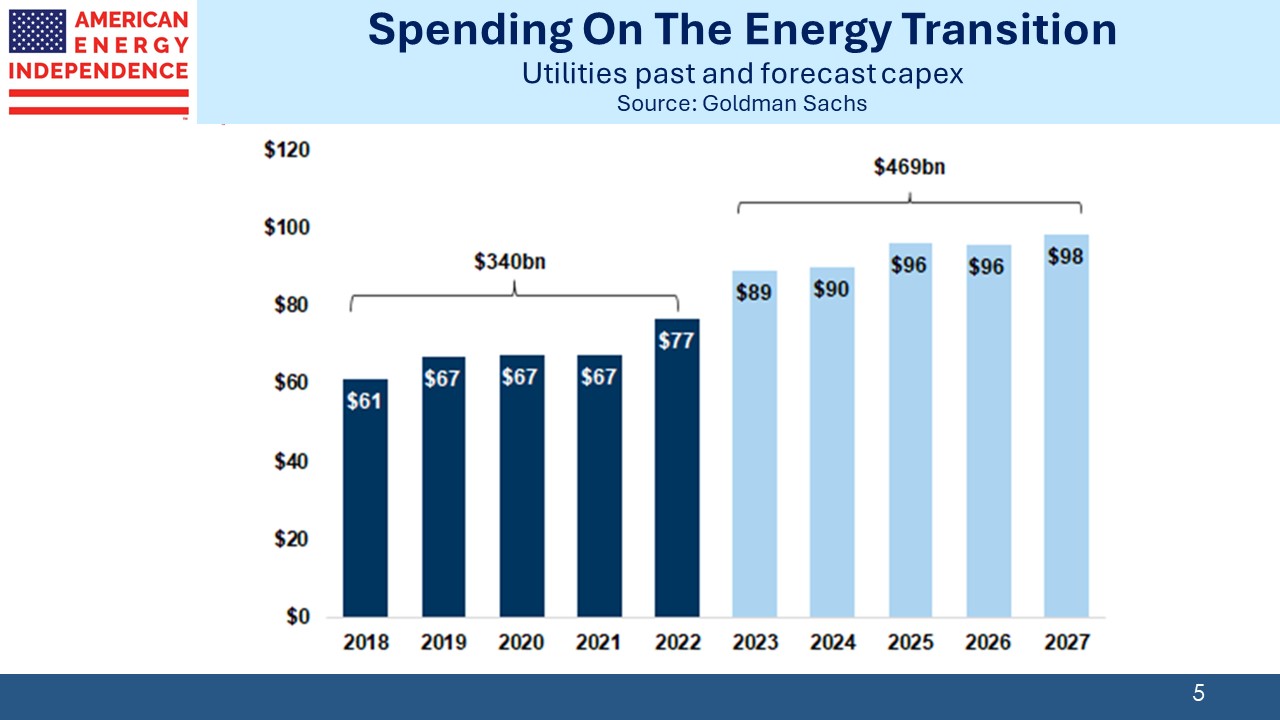

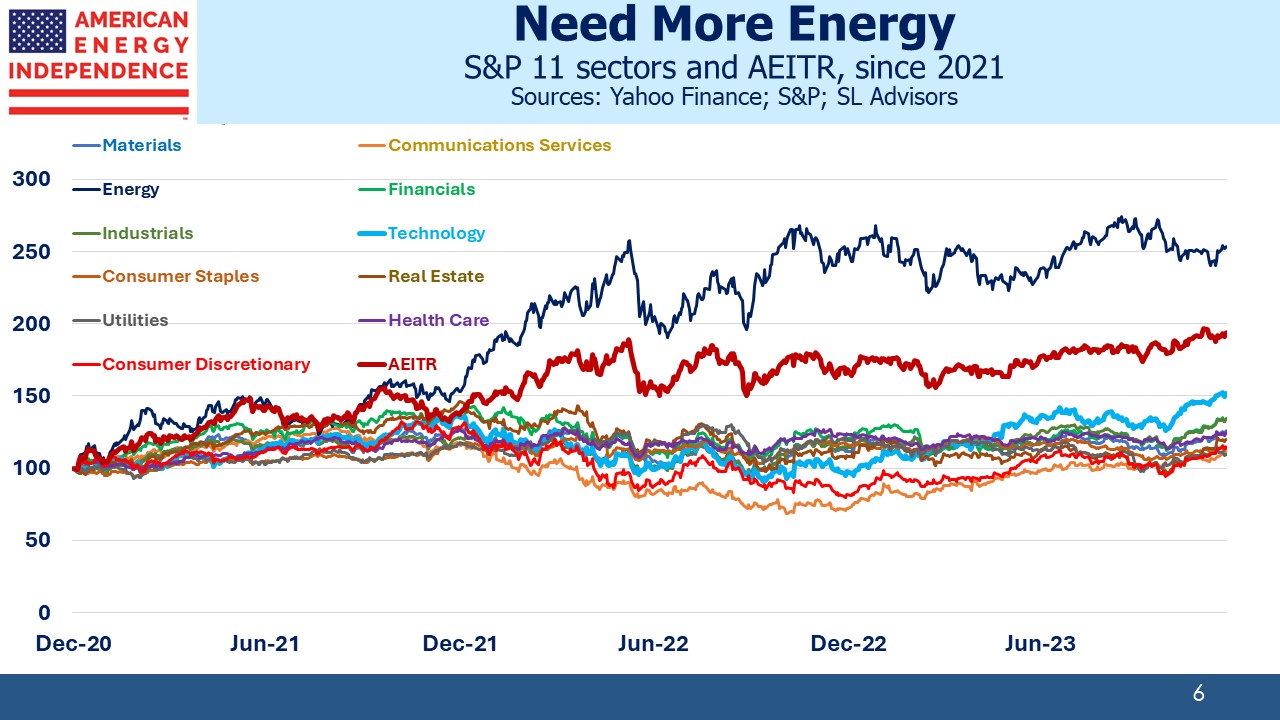

Natural gas has a stronger link to AI than the examples above. Given the substantial increase in electricity needed to power new data centers, the efficiencies promised by the AI revolution won’t be achievable without it. Executives are becoming increasingly bullish in their outlook. “It will not be done without gas,” says Toby Rice, CEO of EQT America’s biggest producer of natural gas. Growth in data centers has led to sharp upward revisions in forecast electricity demand, now 3-4% pa versus just 1% a year ago (see AI Boosts US Energy). Microsoft is opening a new data center somewhere in the world on average every three days.

US data centers are forecast to consume a tenth of US electricity by 2035, up from an expected 4.5% next year.

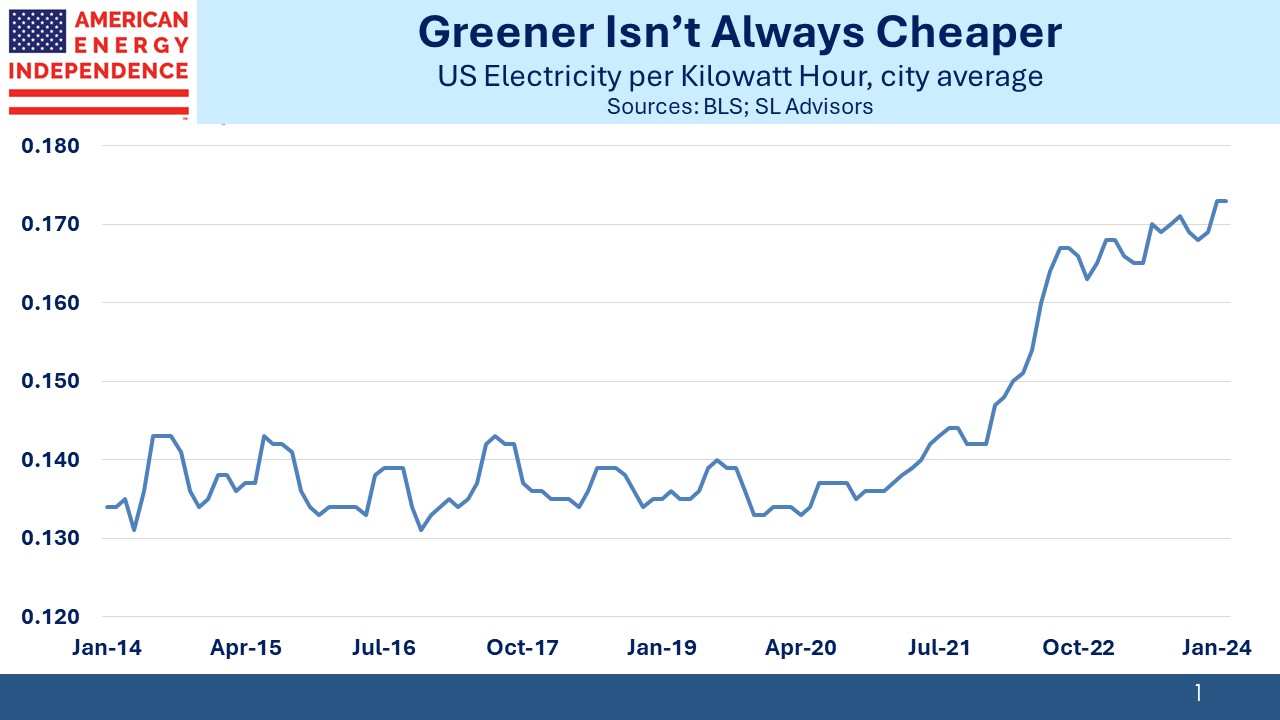

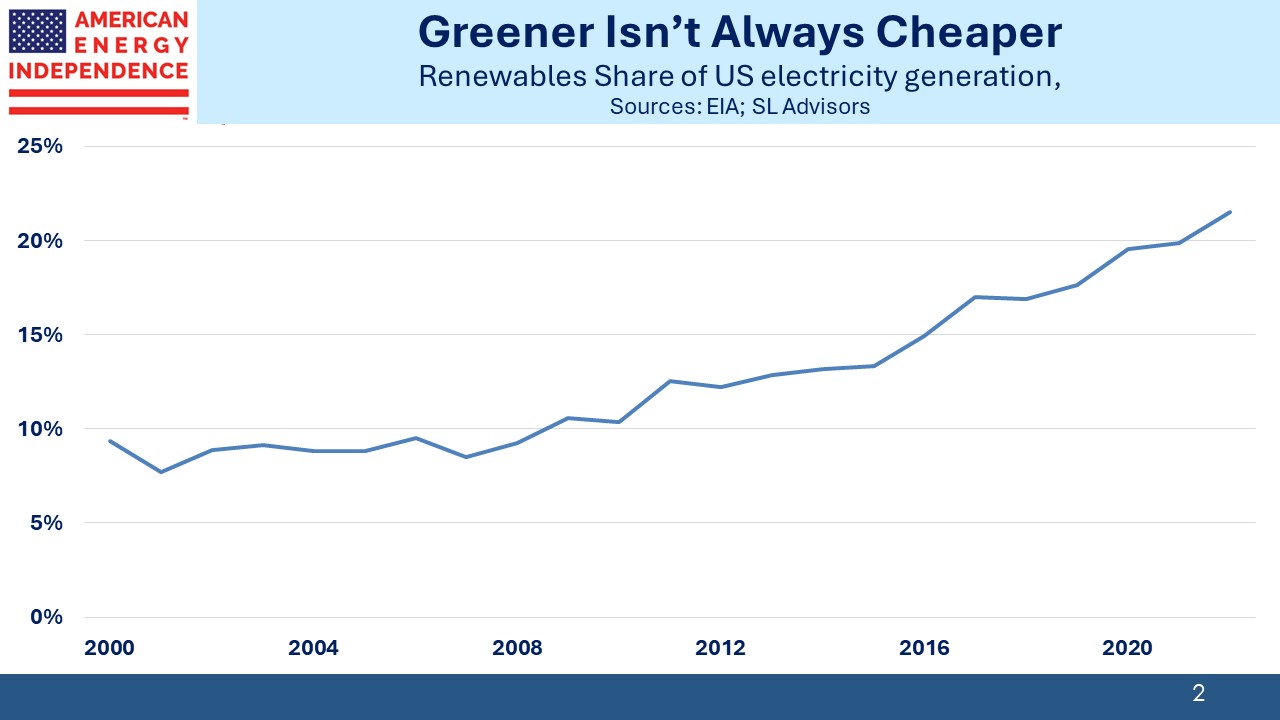

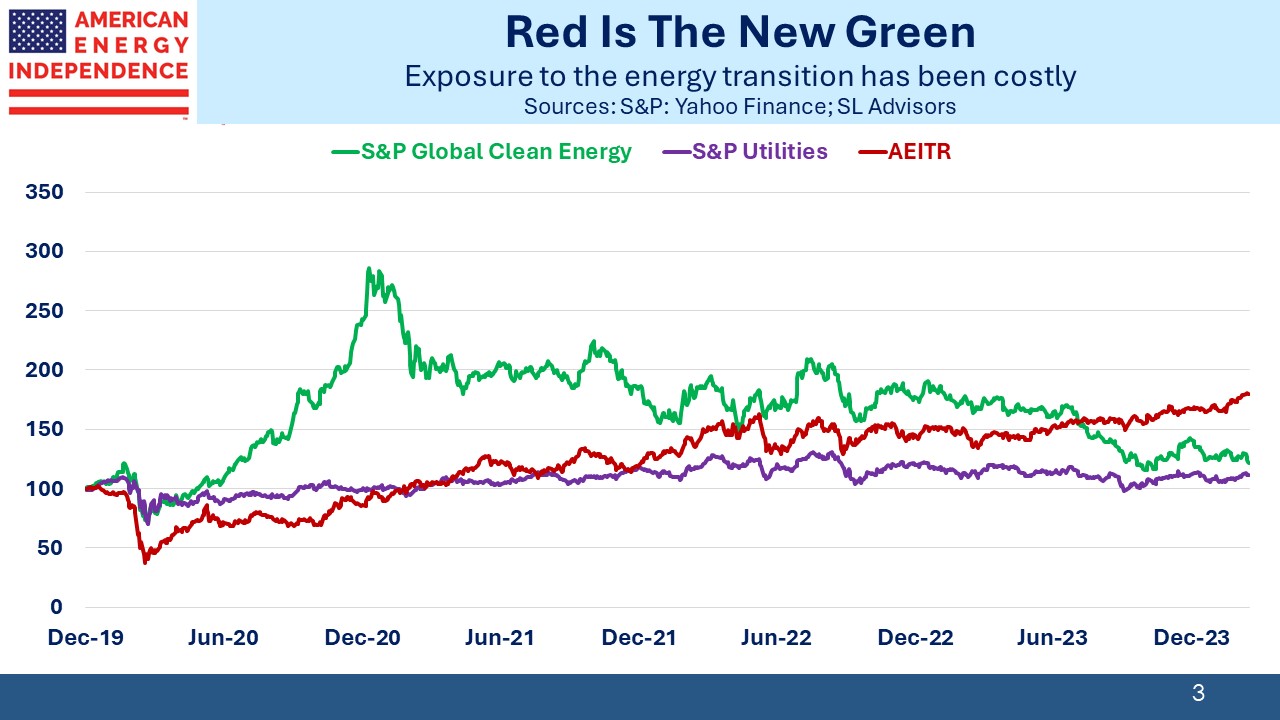

“Intermittent renewables is not going to cut it.” warns Enbridge EVP Colin Gruending. 21st century technology relying on weather-dependent seems incongruous.

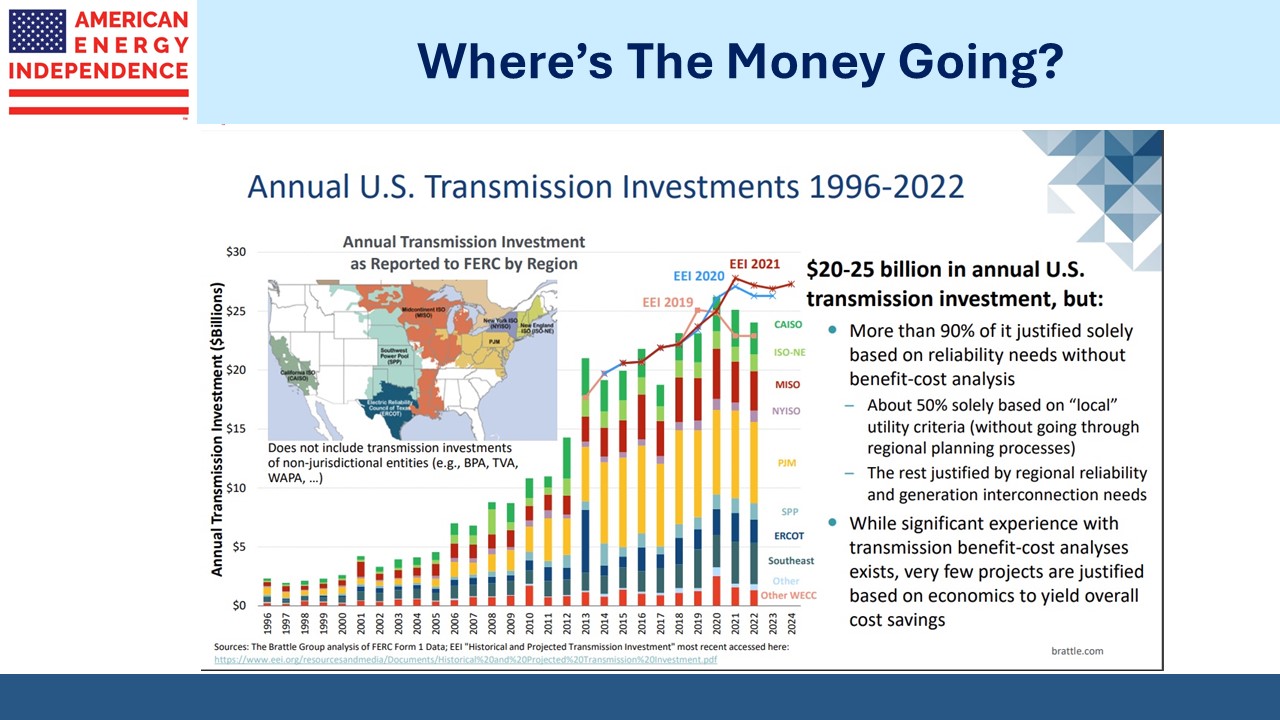

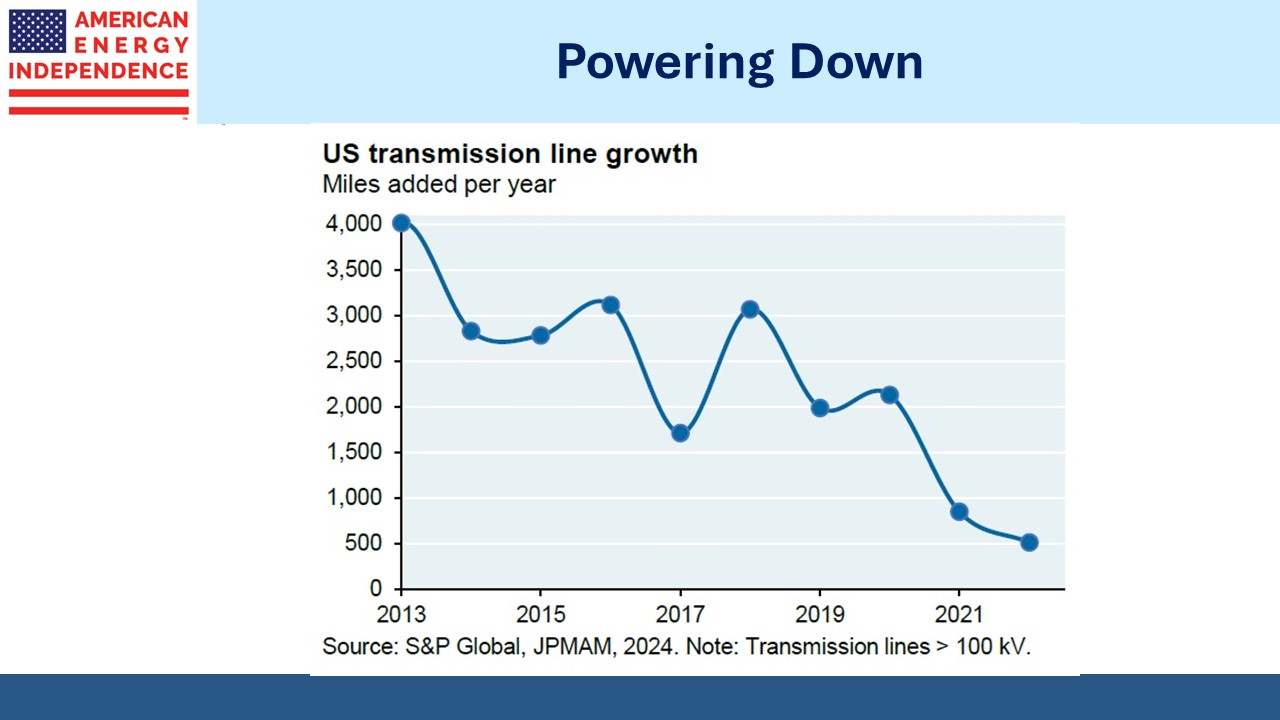

Using more electricity will limit the market share gains of renewables. The slow pace at which we’re adding high voltage transmission lines is already impeding the hook-up of new solar and wind farms (see Renewables Confront NIMBYs).

Many IT companies have made their own carbon commitments, and some worry that they’ll insist on zero-carbon energy. This sounds prosaic for revolutionaries, and it’s likely they’ll find creative ways to meet those obligations. Natural gas generated power with carbon capture technology is one possible solution. Or companies could simply buy carbon credits, a demand Occidental Petroleum is preparing to meet (see Carbon Capture Gaining Traction).

US natural gas remains very cheap. The Henry Hub benchmark trades at under $2 per Million BTUs. In west Texas, gas is often produced along with oil. The shortage of infrastructure to move the gas has pushed prices negative at the Waha hub, meaning buyers get paid to take it.

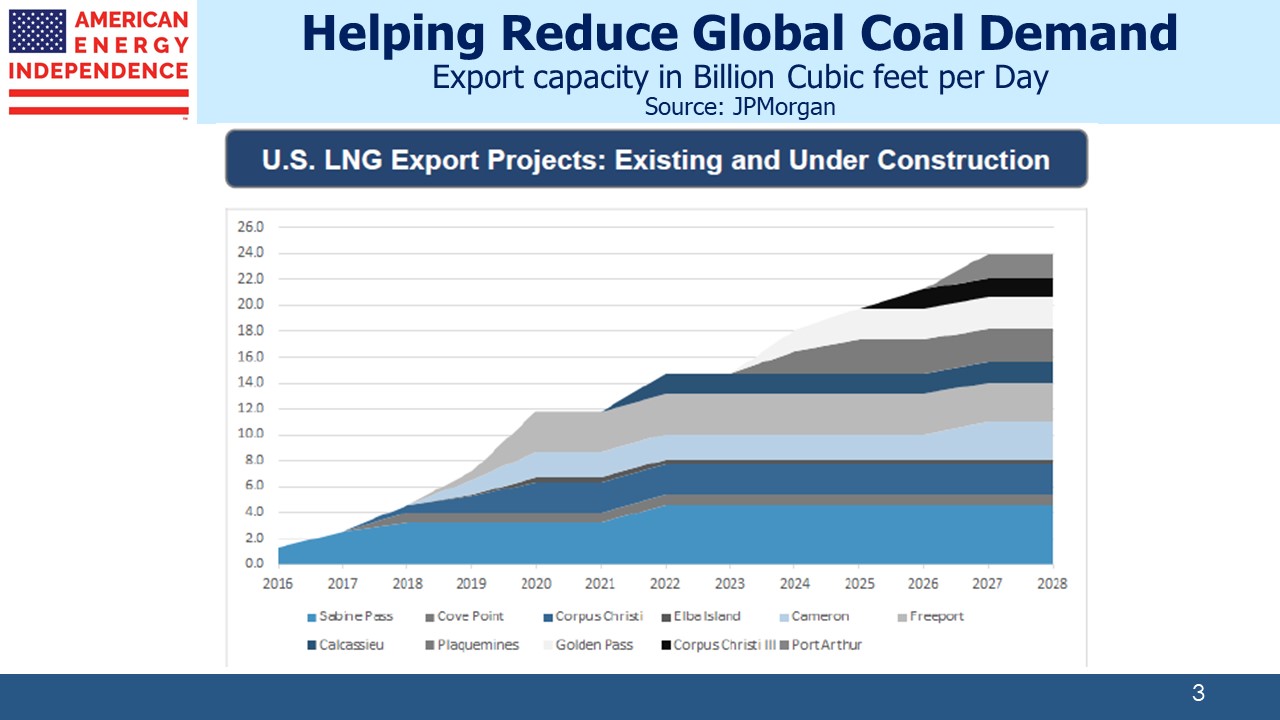

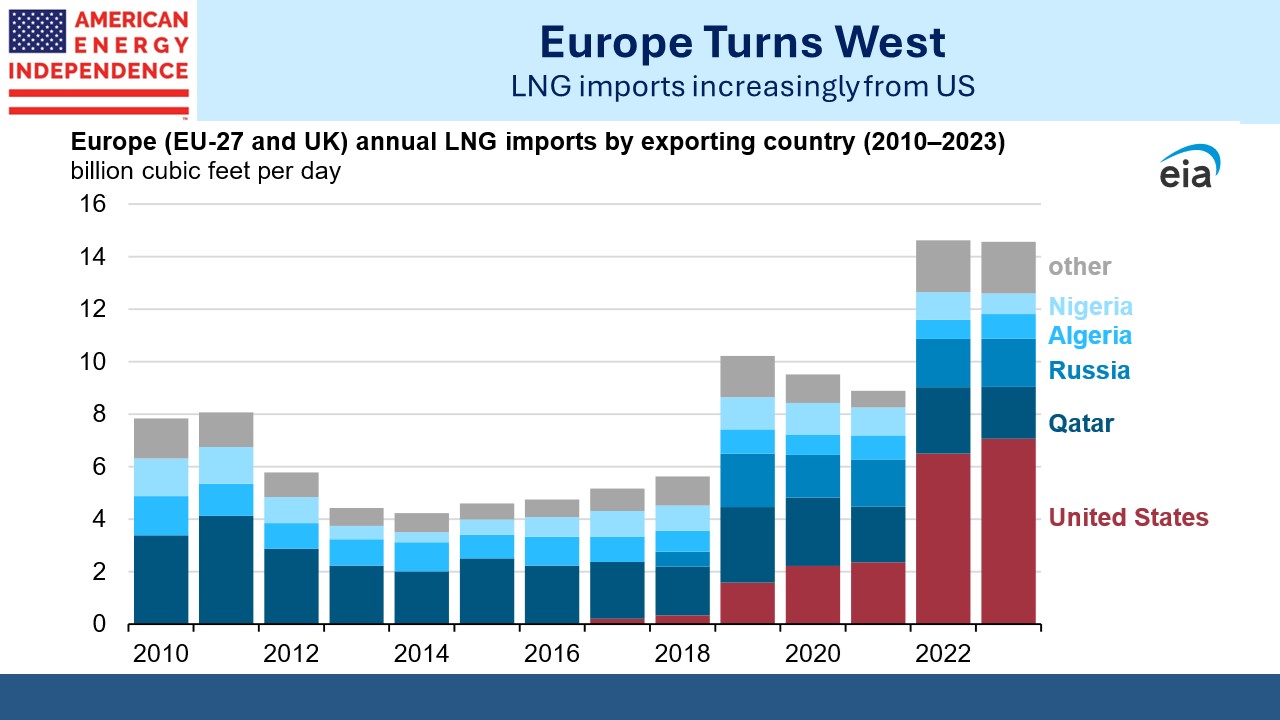

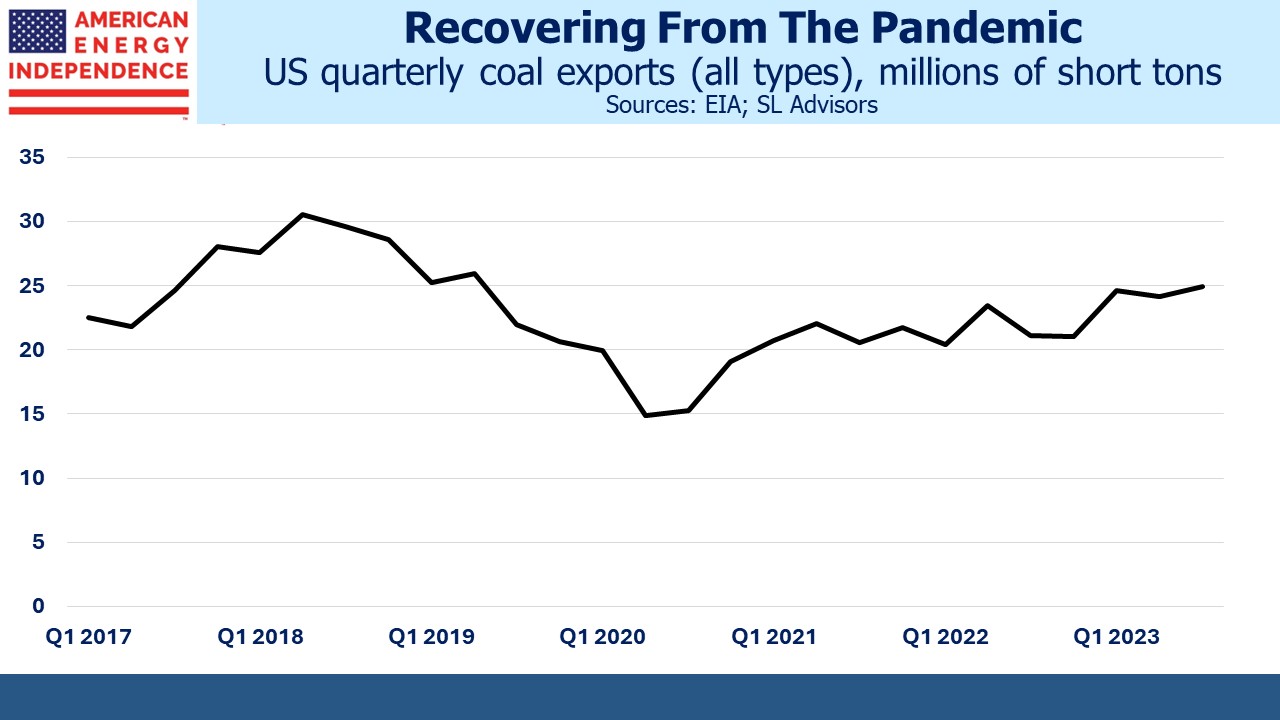

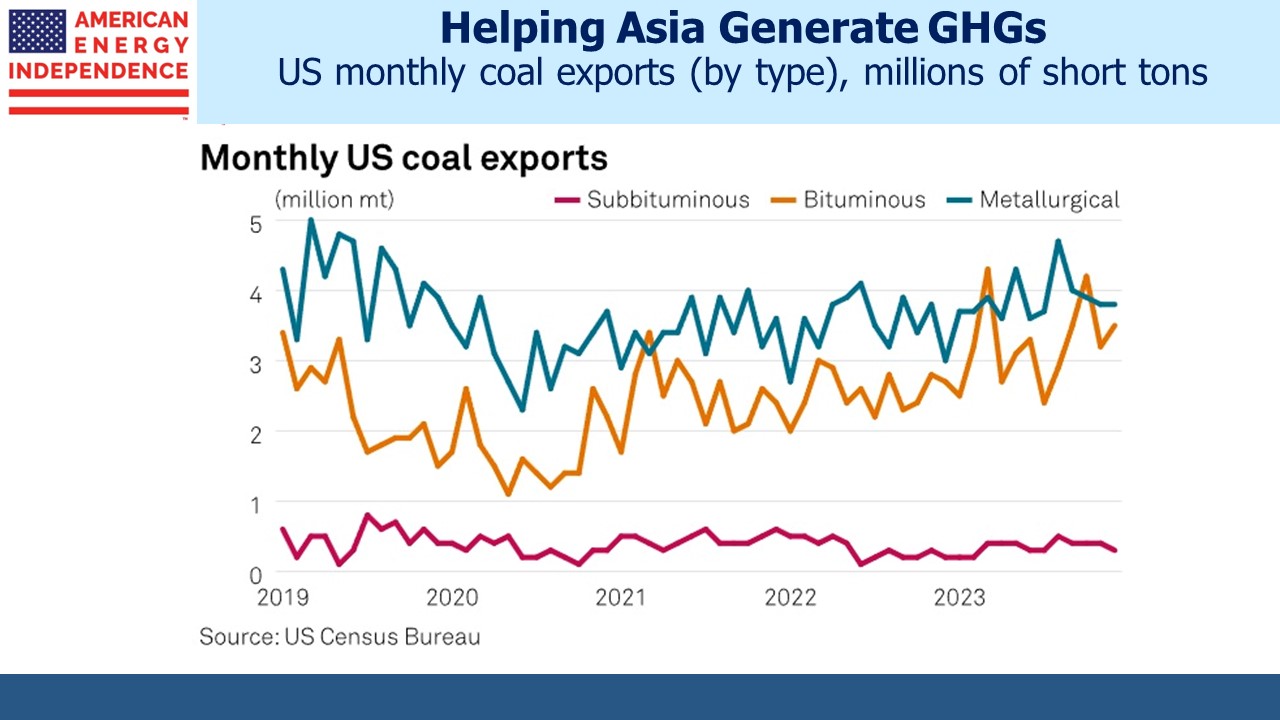

The US was the world’s biggest exporter of Liquefied Natural Gas (LNG) last year, averaging 11.9 Billion Cubic Feet per Day. We eclipsed Australia and Qatar who have been vying for top slot in recent years. The world wants more of what we have in abundance. LNG exports will double over the next four years. The Biden administration’s recent pause on new LNG permits threatens to halt further growth, harming efforts to reduce CO2 emissions elsewhere (see LNG Pause Will Boost Asian Coal Consumption).

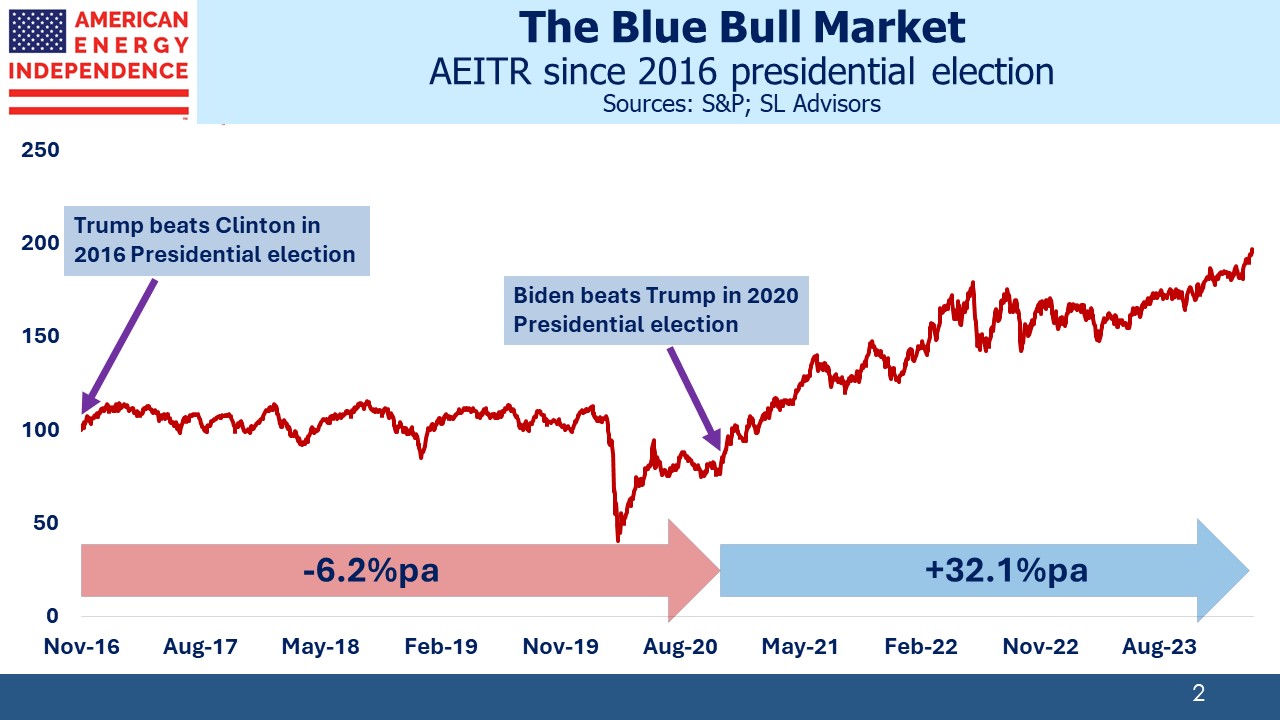

Energy executives have roundly criticized the pause. Our aging president is desperate to excite young progressives about four more years. It’s a bad policy likely to be rescinded after the election regardless of the victor. Surging power demand from data centers may lift domestic natural gas prices without additional LNG exports.

In other news there’s an absorbing interview between BBC journalist Stephen Sackur and Guyana’s President Irfaan Ali as this South American country prepares to exploit its offshore oil reserves. The Stabroek Block is a prolific region, with Exxon announcing a new discovery earlier this year (Bluefin).

The BBC’s Sackur tried to put President Ali on the defensive over Guyana’s plans to export more fossil fuels, counter to the UN’s objective to eventually limit their use. The optics of a wealthy journalist from a rich western nation berating the leader of a poor country whose citizens aspire to higher living standards was powerful. In one interview it encapsulated the entire climate change conundrum. OECD countries have generated most of the world’s excess CO2 and want to reduce them. This will disproportionately benefit poorer countries like Guyana who are less able to afford climate change mitigation.

And yet the president of Guyana (GDP per capita $25K) tells a reporter from the UK (GDP per capita $52K) that they’ve preserved a rainforest the size of England and Scotland combined which acts as a carbon sink. Where is the money from rich countries to pay for that, asks President Ali.

Guyana wants to use its oil reserves to create wealth and reach western living standards. This will be an enduring problem unless OECD countries provide substantial financial incentives to induce the actions they’d like to see.

The interview clip is the global climate conundrum.