“A monkey could make money in this business right now.” Kelcy Warren, Energy Transfer Partners CEO, August 2nd, 2018.

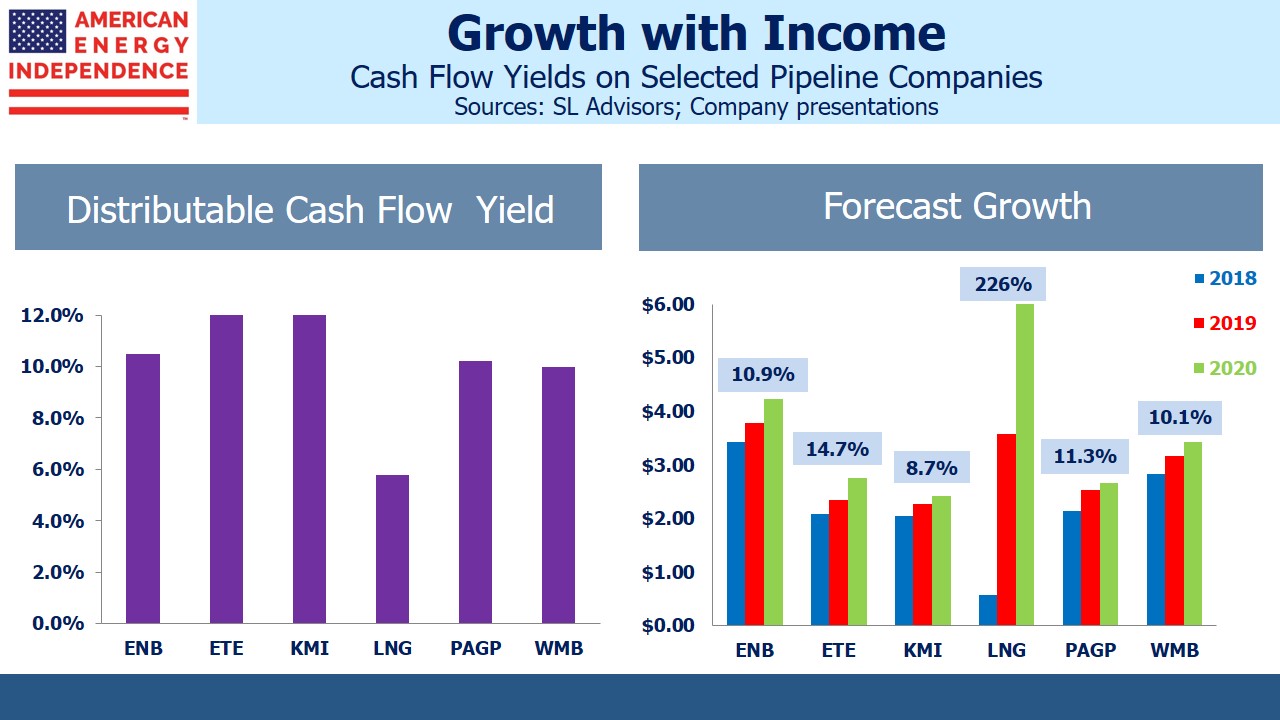

Presumably when Energy Transfer Partners (ETP) announces earnings next week they’ll be good. That was the clear message in the attention grabbing combination of ETP with its General Partner (GP), Energy Transfer Equity (ETE). The 1.28 exchange ratio represented an 11% premium but also a 30% distribution cut for ETP investors, given ETE’s lower payout. The new company anticipates coverage of 1.6X-1.9X by 4Q18, a Distributable CashFlow (DCF) yield of 11.5% based on its current price.

Presumably when Energy Transfer Partners (ETP) announces earnings next week they’ll be good. That was the clear message in the attention grabbing combination of ETP with its General Partner (GP), Energy Transfer Equity (ETE). The 1.28 exchange ratio represented an 11% premium but also a 30% distribution cut for ETP investors, given ETE’s lower payout. The new company anticipates coverage of 1.6X-1.9X by 4Q18, a Distributable CashFlow (DCF) yield of 11.5% based on its current price.

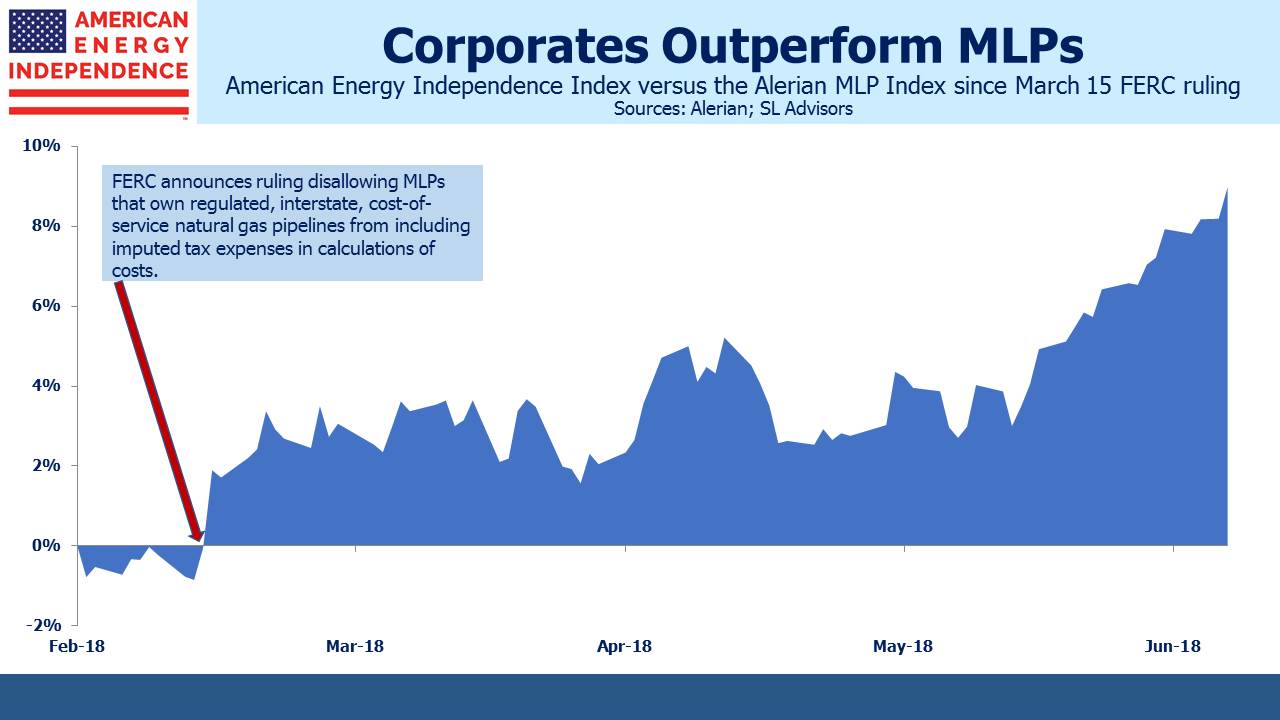

Kelcy Warren’s comment on favorable conditions contributed to positive sentiment across the sector, something that has been sorely missing until recently. Wall Street’s most recent solution to the weak MLP market has been eliminating the GP/MLP structure, and with it the Incentive Distribution Rights that boost the GP’s share of DCF. ETE endorsed that recommendation, but still retained some special rights through the issuance of “A” class shares to insiders. Overall though, we think this move shows ETE’s attractive valuation.

In 2Q results, pipeline companies reported earnings buoyed by higher volumes. Output of natural gas, Natural Gas Liquids (NGLs) and crude oil are all hitting new records. The U.S. is on track to be the world’s biggest oil producer by late 2019 – if infrastructure bottlenecks don’t delay that for a year.

As pipeline capacity out of the Permian Basin has dwindled, it’s caused a spectacular widening in regional differentials. Crude oil in Midland, west Texas is worth $17 less per barrel than in Cushing, OK. This reflects the cost of moving the marginal barrel, which has to go by truck since there’s no spare capacity on pipelines or railroads. This $17 differential is a thing of beauty to a pipeline owner with some uncontracted availability. For oil producers faced with unexpectedly steep shipping costs, it’s a hit to profitability. The larger companies tend to have committed transport which guarantees them access to market. For example, Devon Energy (DVN) reported realizations on crude oil production within 2% of the Cushing benchmark. It’s the smaller, more speculative companies that stand last in line.

Enterprise Products (EPD) reported Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) of $1.767BN, $202MM ahead of consensus. One analyst announced, “EPD Embarrasses Street Estimates”, while his own equally inaccurate earnings forecast sat alongside an “Overweight” recommendation. Wrong, but right too. EPD reported strong volumes across NGLs, crude, natural gas and propylene (feedstock can be ethane or propane).

EPD is the biggest MLP, and they’re succeeding by behaving like the corporation many of their peers have become. Although MLPs pay out 90% or so of their DCF, EPD sports a coverage ratio of 1.5X (i.e. pays out only two thirds). Consequently, they announced almost $500MM in retained DCF which they plan to reinvest in the business. While MLPs historically have funded growth with new issuance of debt and equity, EPD is self-financing. While they’re not planning to buy back stock, their 5.9% distribution yield compares favorably with the S&P500 yield from buybacks and dividends of 4.5%.

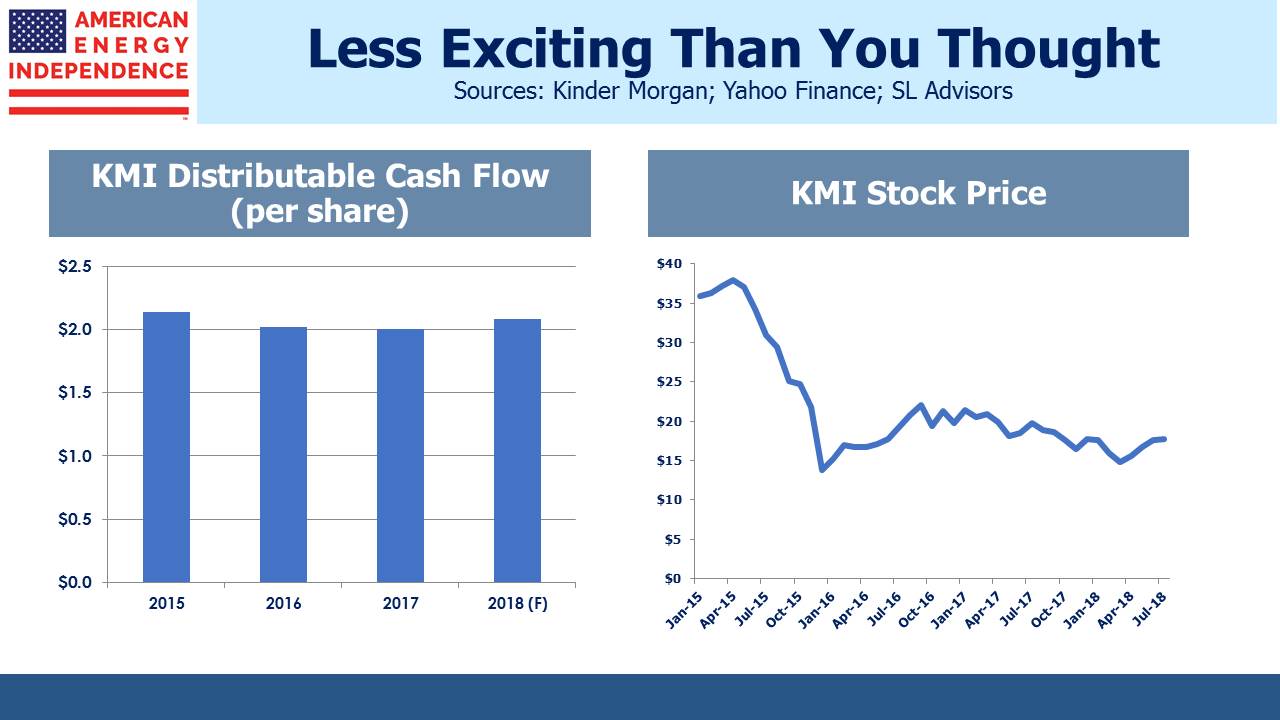

EPD hasn’t over-borrowed and then cut its distribution to fund growth, like many MLPs. By behaving unlike MLPs, it’s remained one, while many others have offended their investors and decamped in search of new ones as a corporation. American Midstream Partners (AMID) is a small MLP that shrunk further following a 75% distribution cut. They plan to redirect the savings, “…towards accretive growth projects and reduce debt.” Their income-seeking investors, now substantially deprived and less excited than management about this redirection of cash, let the stock fall 50%.

EnLink Midstream, LLC (ENLC), the GP of Enlink Midstream Partners (ENLK), beat EBITDA expectations by 5%, while raising guidance. This propelled both ENLC and ENLK sharply higher. Regrettably for the EPD analyst noted above, his miss on earnings was compounded with an Underweight on ENLC.

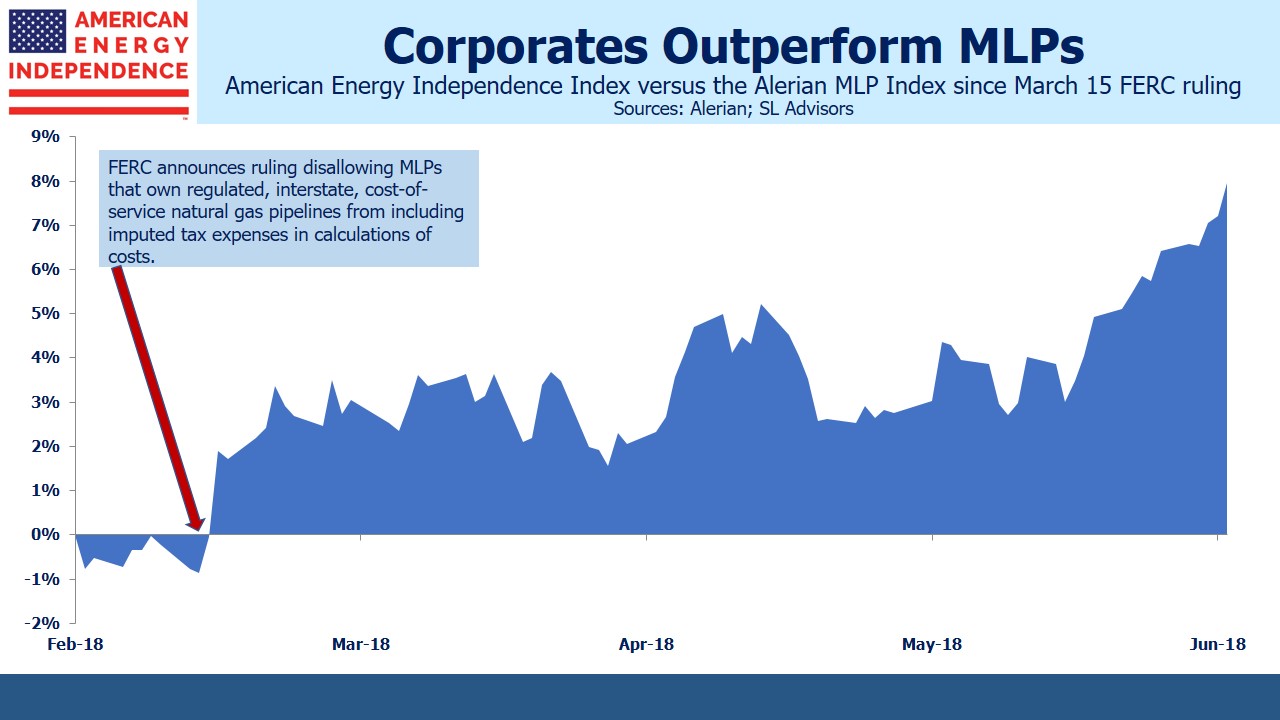

Oneok (OKE) reported increased pipeline utilization and modestly increased full-year guidance. Since absorbing their MLP last year OKE has become the poster child for such conversions, outperforming the Alerian MLP Index since then by over 35%. In the ensuing year OKE has announced $4.3BN of growth projects and in January issued $1.2BN in equity. Their Debt/EBITDA is down to 3.4X. Former Oneok Partners (OKS) investors endured an adverse tax outcome as they swapped their LP units for OKE shares, so at least the subsequent rally offers some vindication.

Williams (WMB) met expectations but guided to higher capex on new projects. Investors liked the prospect of accretive growth and drove the stock up 3%.

Crestwood (CEQP) raised guidance again, continuing a strong run of operating performance under CEO Bob Phillips.

It was hard to find any bad news in energy infrastructure. The sector also diverged pleasingly from the S&P500 Energy ETF (XLE), as mixed earnings from large producers such as Exxon Mobil (XOM), Conoco Phillips (COP) and Devon Energy (DVN) weighed.

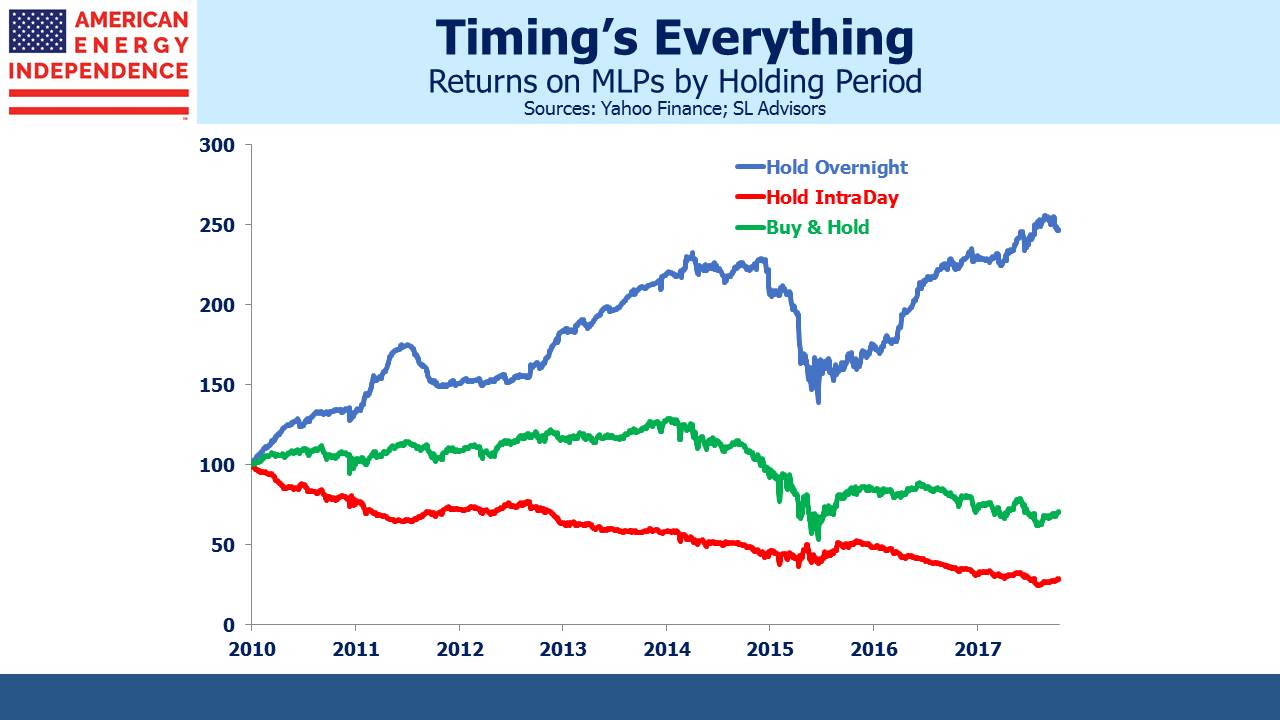

If MLPs had all behaved like EPD, and unlike AMID, there would be more MLPs today. Elliot Miller is a frequent commenter on our blog. We had the opportunity to meet Elliot in person in May, at the Orlando MLP and Energy Infrastructure Conference. Elliot is a very thoughtful investor who gently chides us from time to time for not being more constructive on MLPs. We attended a couple of investor events with Elliot, and his pointed questions were well-aimed and entertaining. He’s right that MLPs’ enhanced tax status gives them an advantage, and Elliot might agree that EPD represents investor-oriented management at its best. ETE clearly intends to retain the tax benefits of an MLP as well.

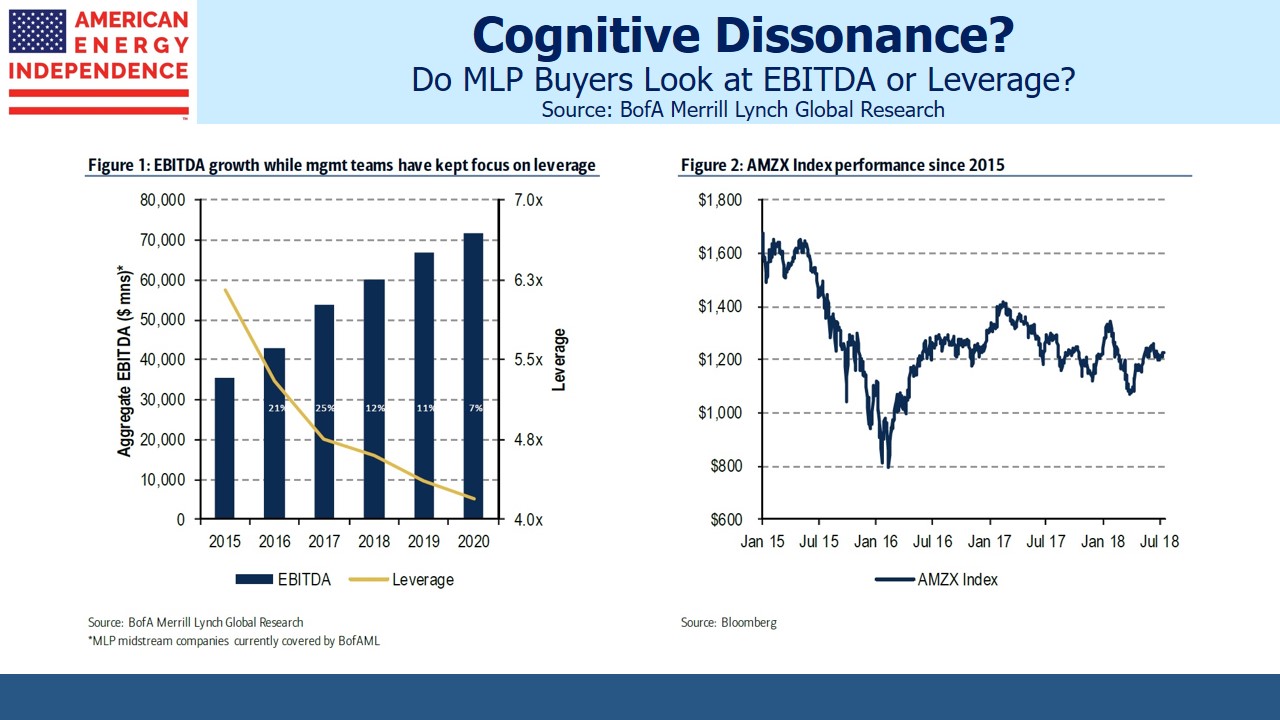

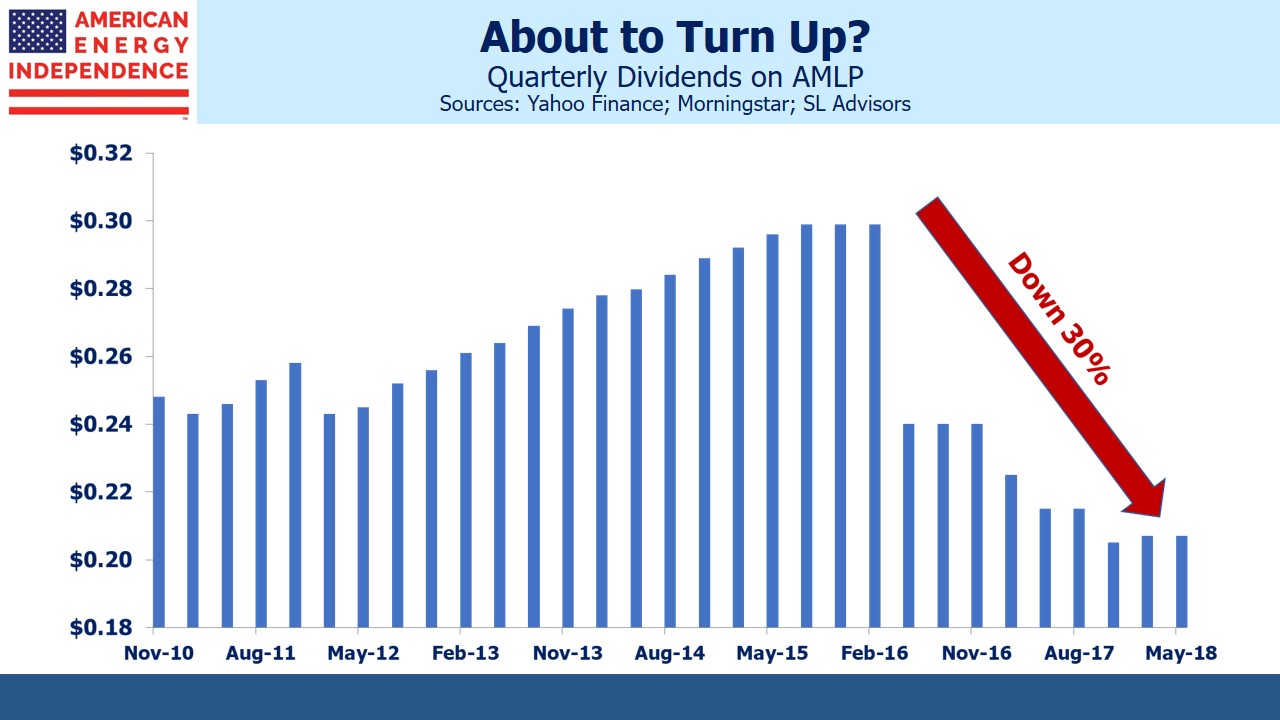

Just as too few MLPs have behaved like EPD, there are too few Elliot Miller-like investors willing and able to do careful research. Many traditional MLP investors are disillusioned with distribution cuts to fund growth (see Will MLP Distribution Cuts Pay Off?). More Elliots would have led fewer MLPs to convert to corporations.

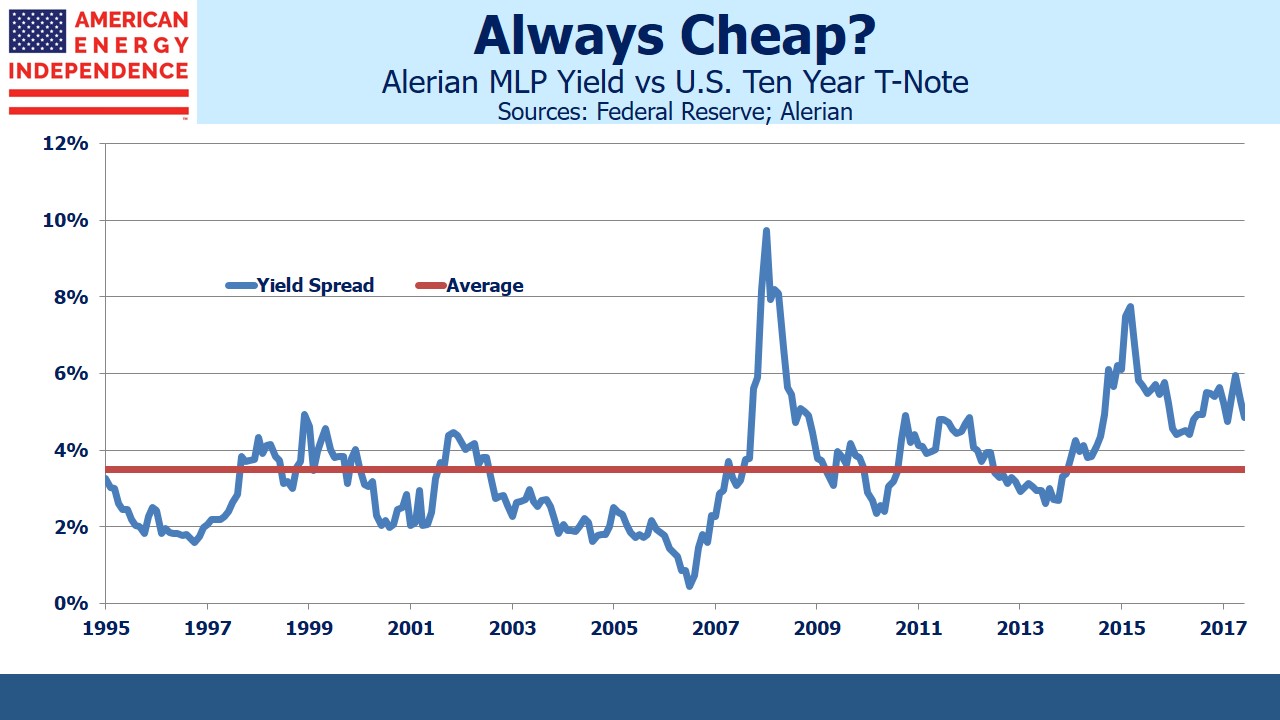

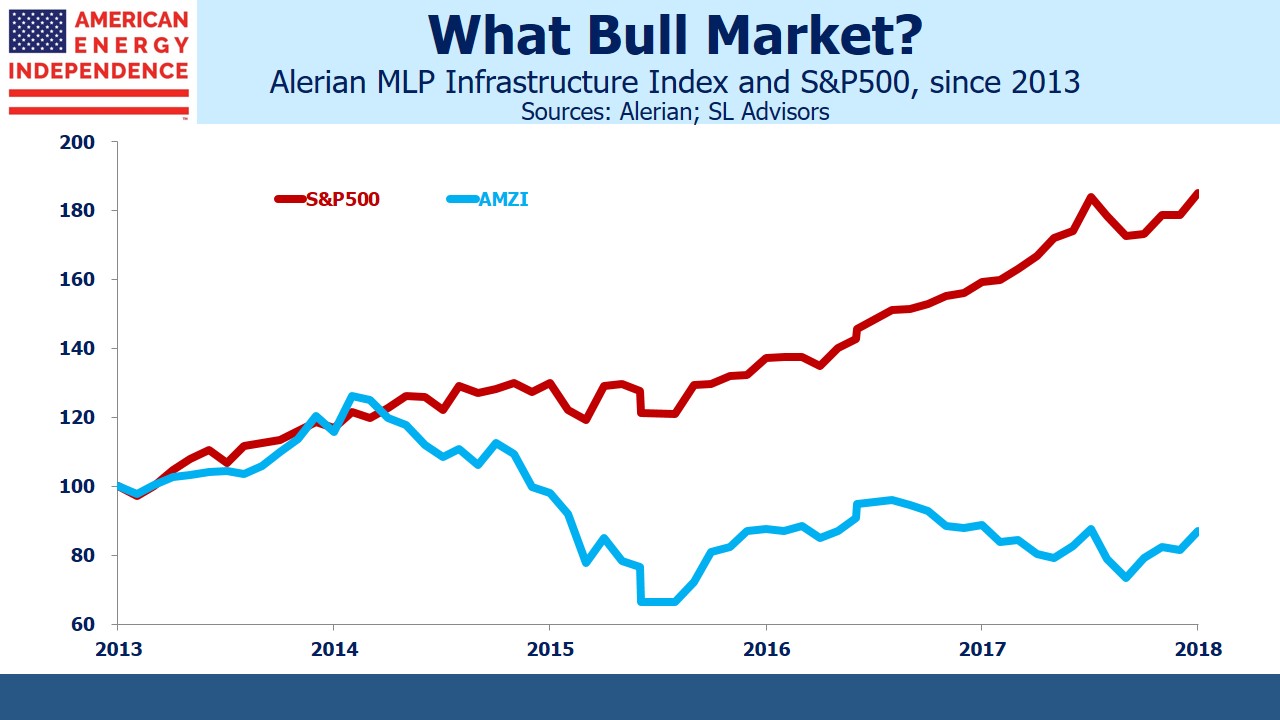

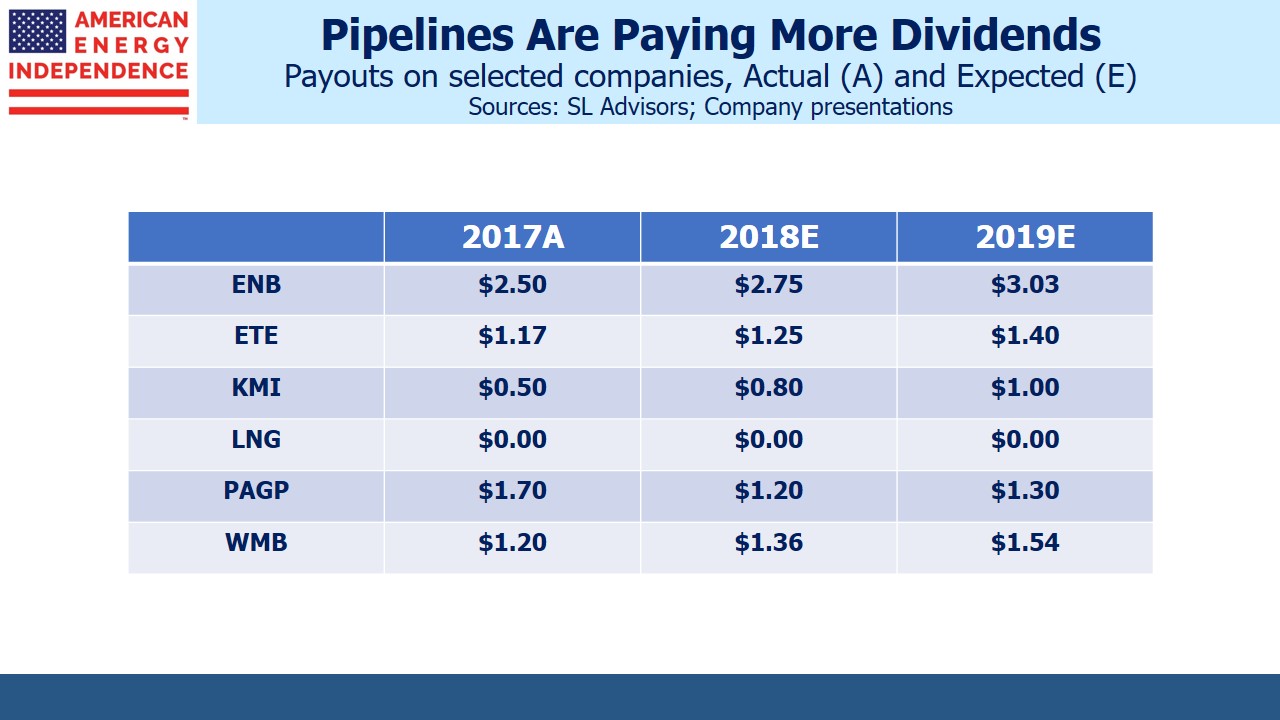

Many potential buyers are attracted by valuations but fearful of a repeat of the 2014-16 collapse. We’ve long maintained that this was chiefly caused by issues of financing growth, with midstream operating performance back then remaining generally satisfactory. Valuations are good, and corporate dividends growing. The corporate-heavy American Energy Independence Index has seen 9% dividend growth year-on-year, with >10% likely next year.

As the memories of the ‘14-‘16 sell-off recede and increased hydrocarbon throughput continues to drive profits, additional investors will be drawn to the sector.

We are long CEQP, ENLC, EPD, ETE, OKE, WMB.

Presumably when Energy Transfer Partners (ETP) announces earnings next week they’ll be good. That was the clear message in the attention grabbing combination of ETP with its General Partner (GP), Energy Transfer Equity (ETE). The 1.28 exchange ratio represented an 11% premium but also a 30% distribution cut for ETP investors, given ETE’s lower payout. The new company anticipates coverage of 1.6X-1.9X by 4Q18, a Distributable CashFlow (DCF) yield of 11.5% based on its current price.

Presumably when Energy Transfer Partners (ETP) announces earnings next week they’ll be good. That was the clear message in the attention grabbing combination of ETP with its General Partner (GP), Energy Transfer Equity (ETE). The 1.28 exchange ratio represented an 11% premium but also a 30% distribution cut for ETP investors, given ETE’s lower payout. The new company anticipates coverage of 1.6X-1.9X by 4Q18, a Distributable CashFlow (DCF) yield of 11.5% based on its current price.