Merry Christmas and Happy Holidays!

Christmas pudding is among my favorite traditions of the season. Like marmite, it’s only offered by English parents, and failure to acquire a taste when young quickly becomes permanent. Our children were offered a perfunctory opportunity and only one chance at rejection, a rule I imposed to ensure an adequate supply for the rest of us.

My wife secured three this year, a compromise only reached when I warned of plenty of capacity in my suitcase for imports during a trip to London. She can rightfully claim to be guarding my health – a typical recipe includes a pound of suet (animal fat). A portion is correctly served heated and bathed in heavy cream, and the first slice always appears inadequate. One year my mother betrayed uncommon agility in securing the remaining slice for seconds. She is my only real competition. My grief was poorly disguised, which is why this year we have increased supply.

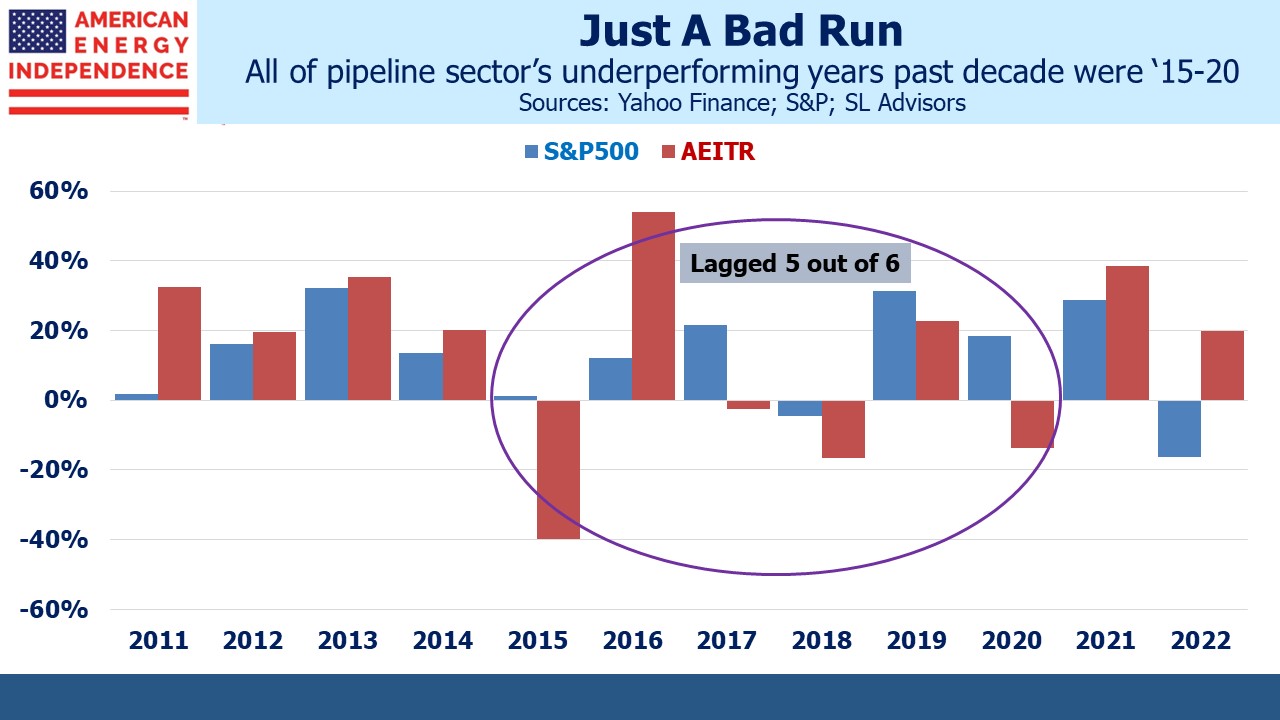

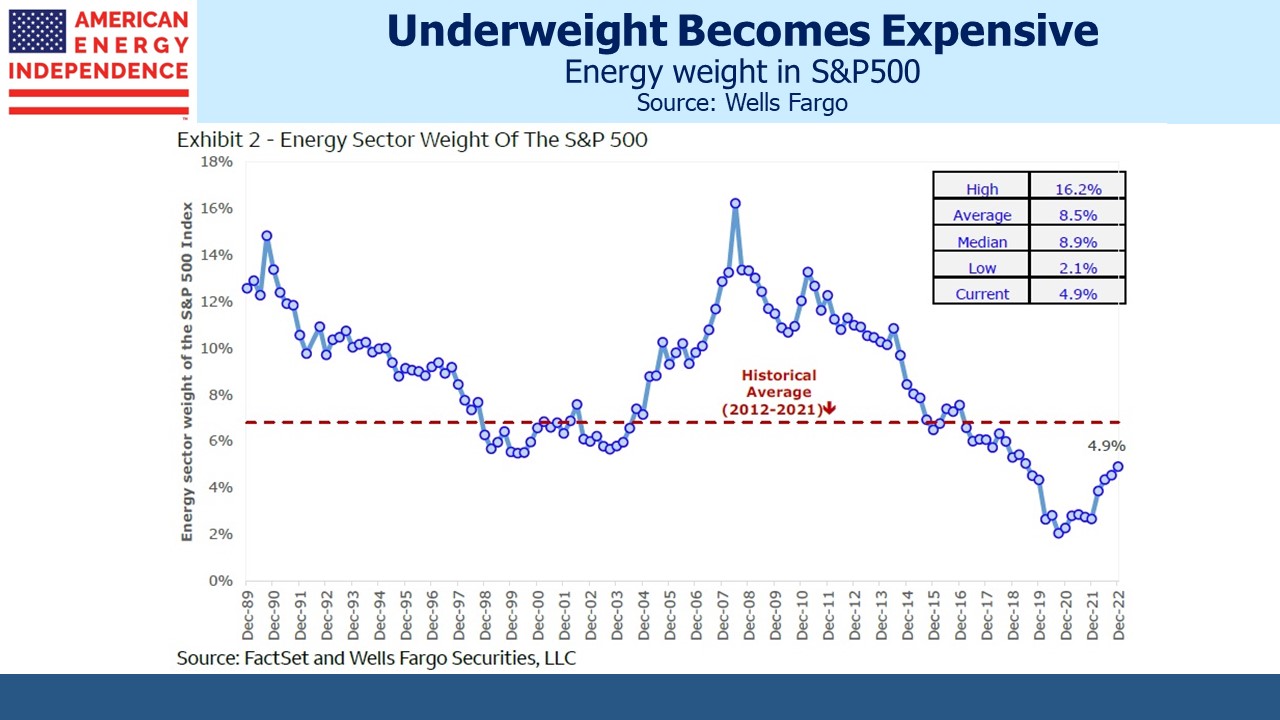

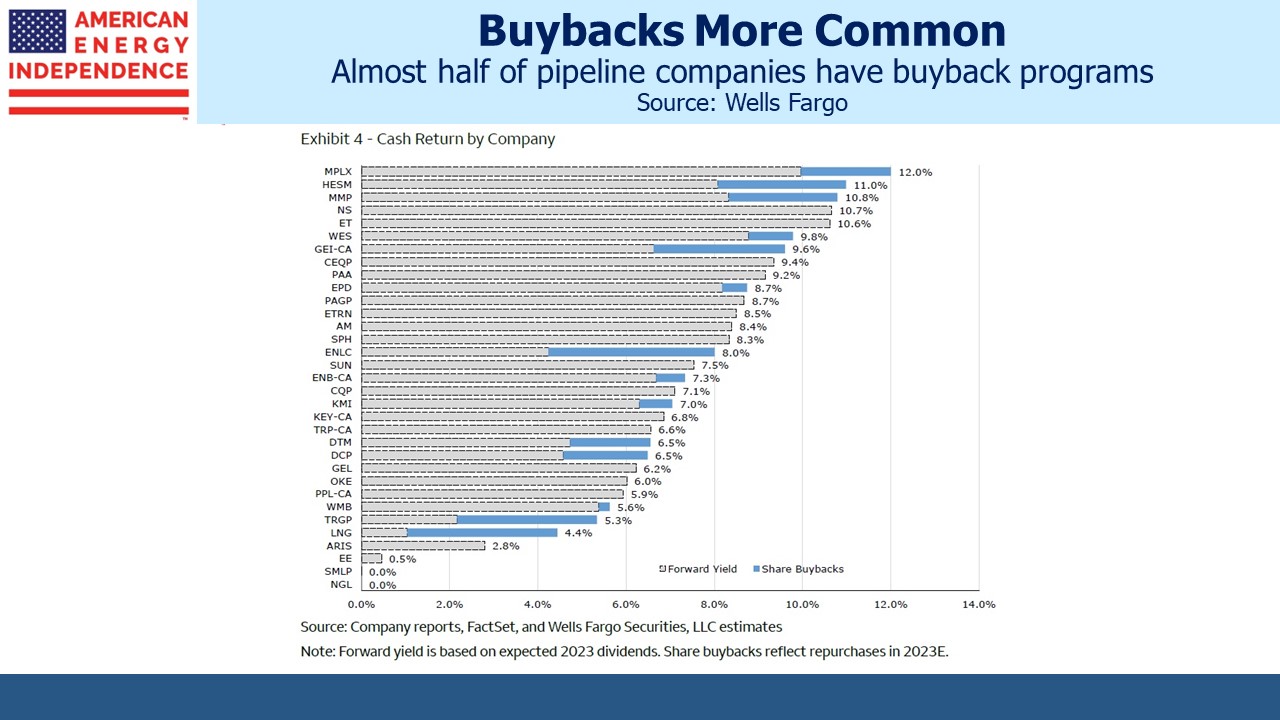

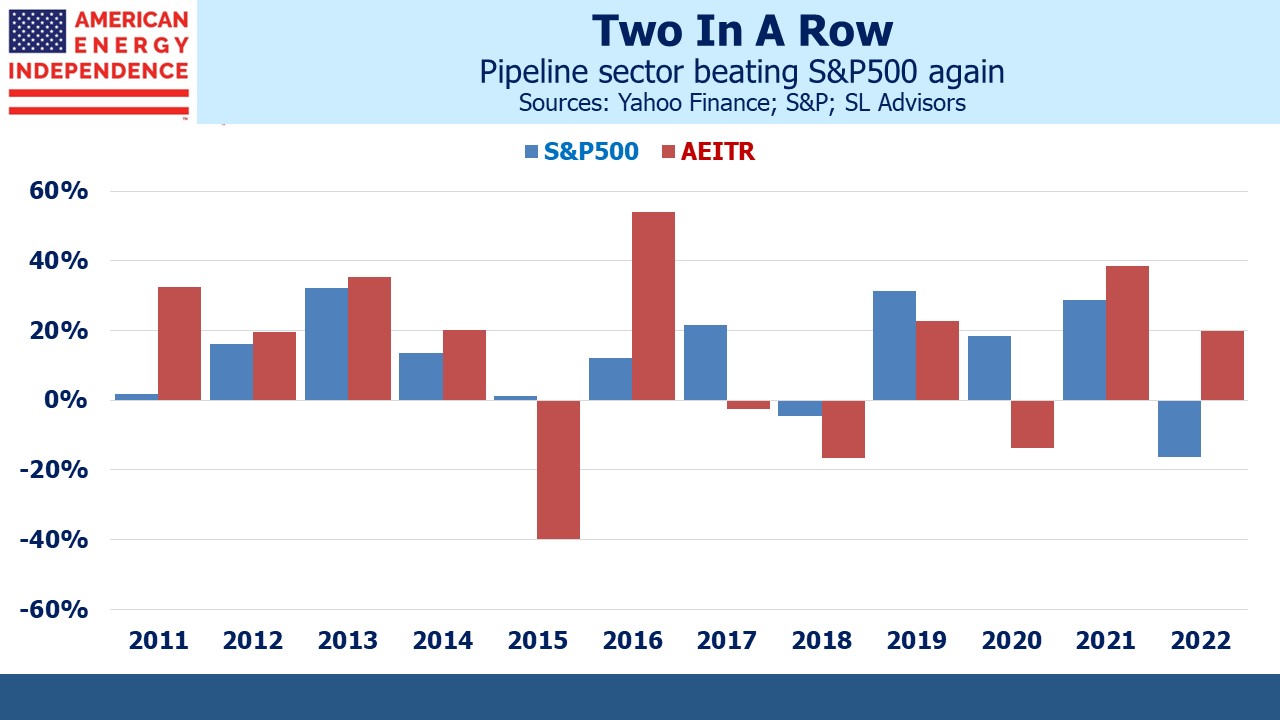

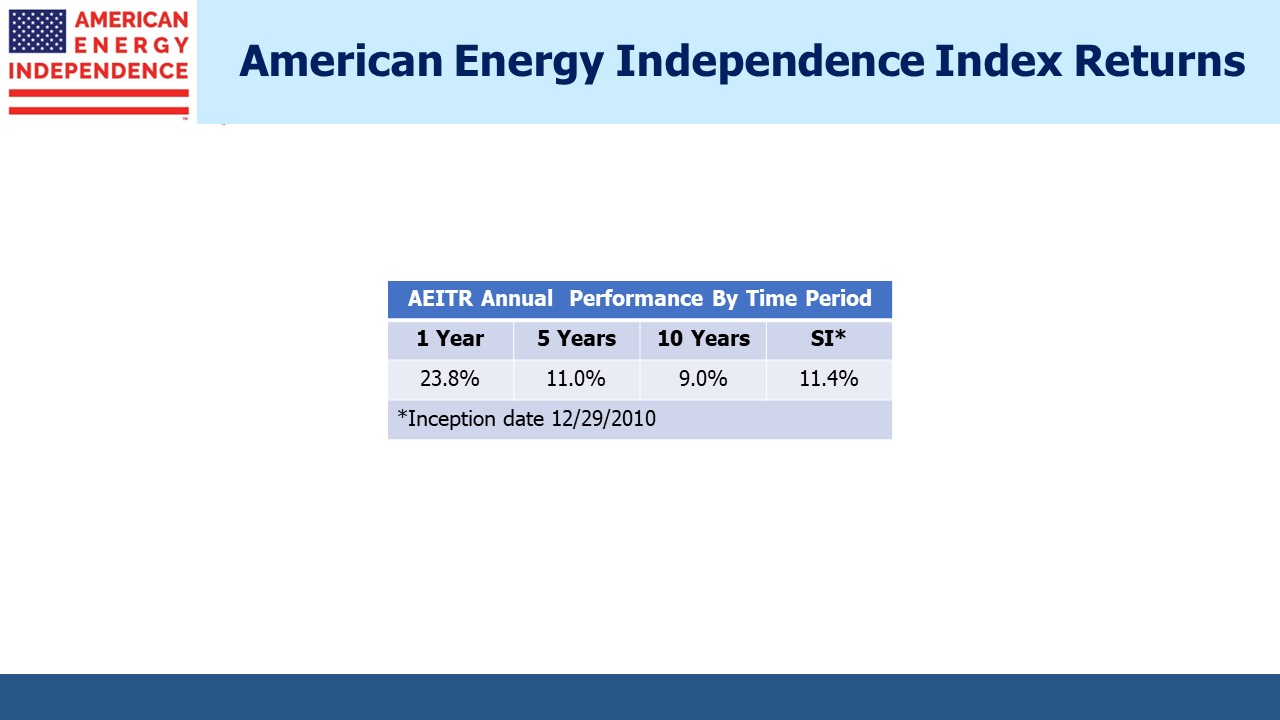

International travel finally returned. For three years we stayed in the US, unwilling to gamble with the mandatory covid test prior to coming home. How do you ask friends if you can extend your stay so as to self-quarantine? My wife and I made many domestic trips, and where possible saw clients as well. I love investing, but an unexpected bonus is to share objectives, investment outcomes and a meal with like-minded people. This year offered more opportunities than in the past. I know each friendly reception was genuine, but energy’s outperformance provided agreeable circumstances.

It’s rare to be jealous of one’s children. But I was envious of our younger daughter’s four-month semester abroad in London. She seized every conceivable weekend tourist opportunity, mastering European travel on a student budget (in truth modestly subsidized). She finally returned to the US last week, the best Christmas gift.

It’s four decades since I left the UK, and every trip back is too brief to see everyone. We shan’t live there again, but one week a year is inadequate to stay in contact with those worth the effort. And I miss going to English football games. My son and I watch most of Arsenal’s games on TV. I cherish our time together but still miss being there in person. I shan’t be a regular at Arsenal Football Club but in future will aim for at least two visits a season.

Nostalgia is Christmas, as is the chance to make new memories for tomorrow. Our Christmas traditions were formed in England and persist through our children today. When my six-year-old granddaughter solemnly reports on her meeting with Santa Claus, it reminds me of her mother as an adorable little girl a generation ago but also informs future reminiscing. Fond memories combined with youthful hope are a delicious recipe – family, fellowship and adequate dessert make it close to perfect.

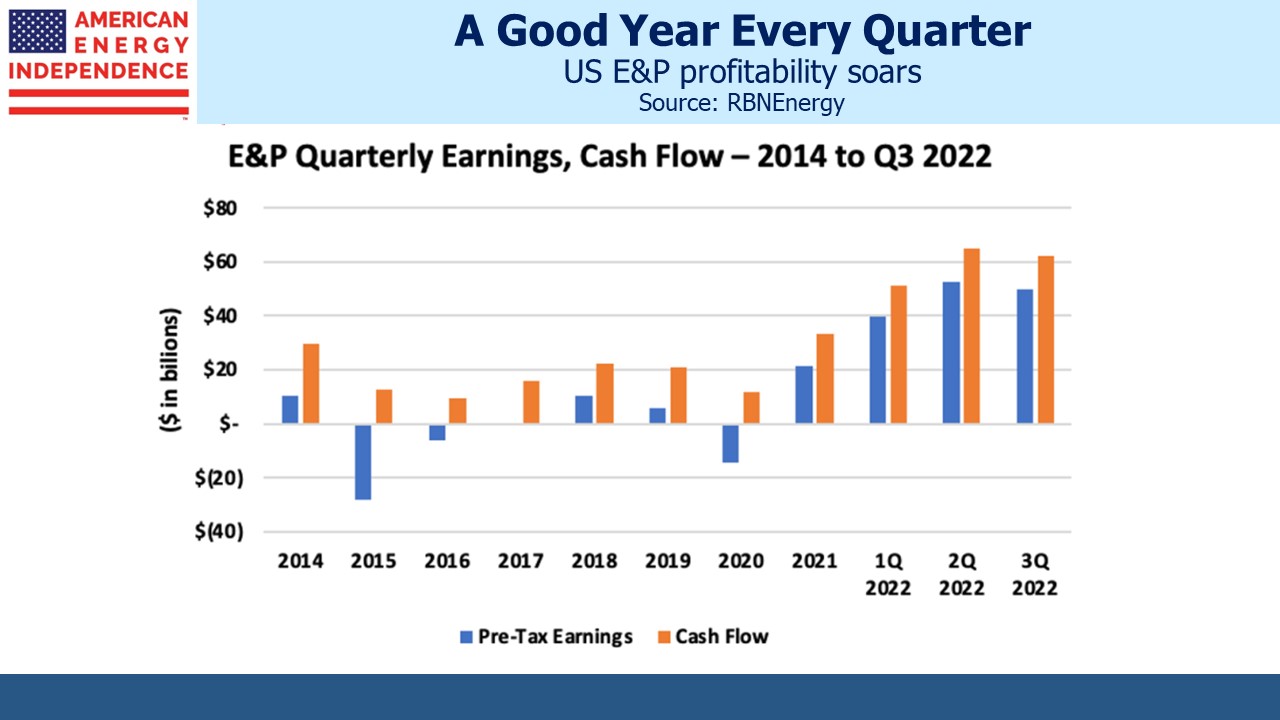

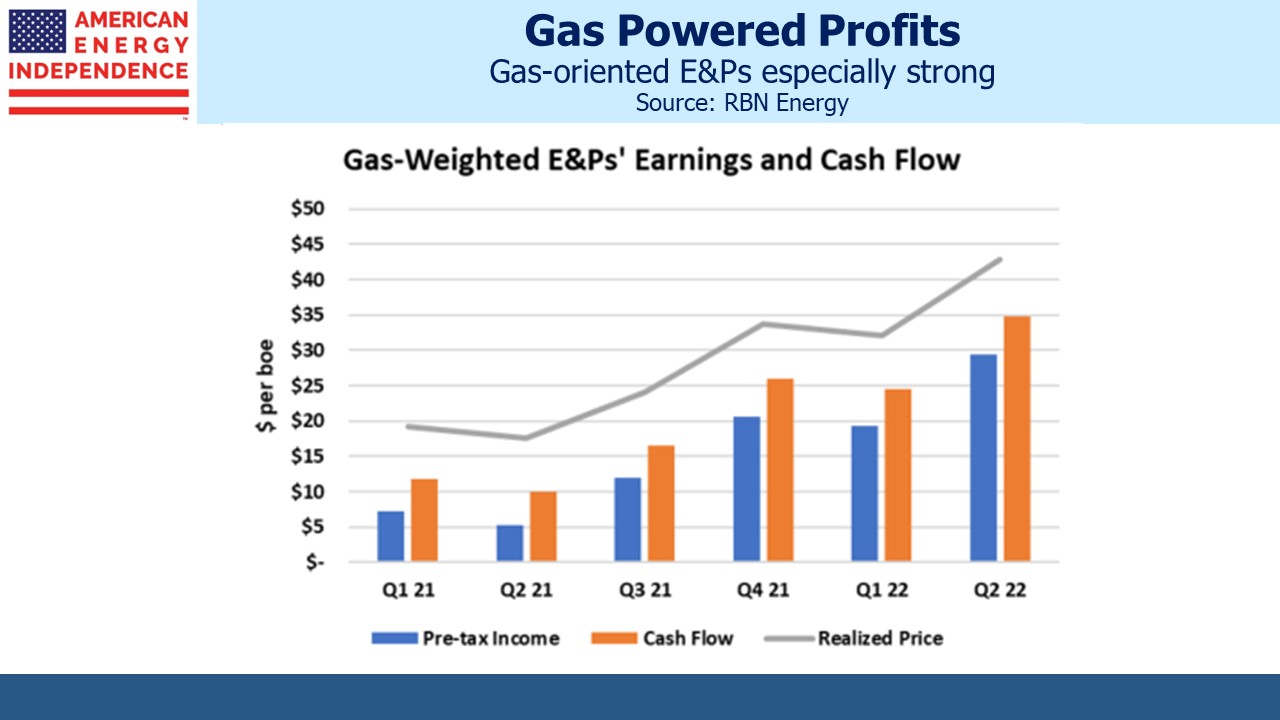

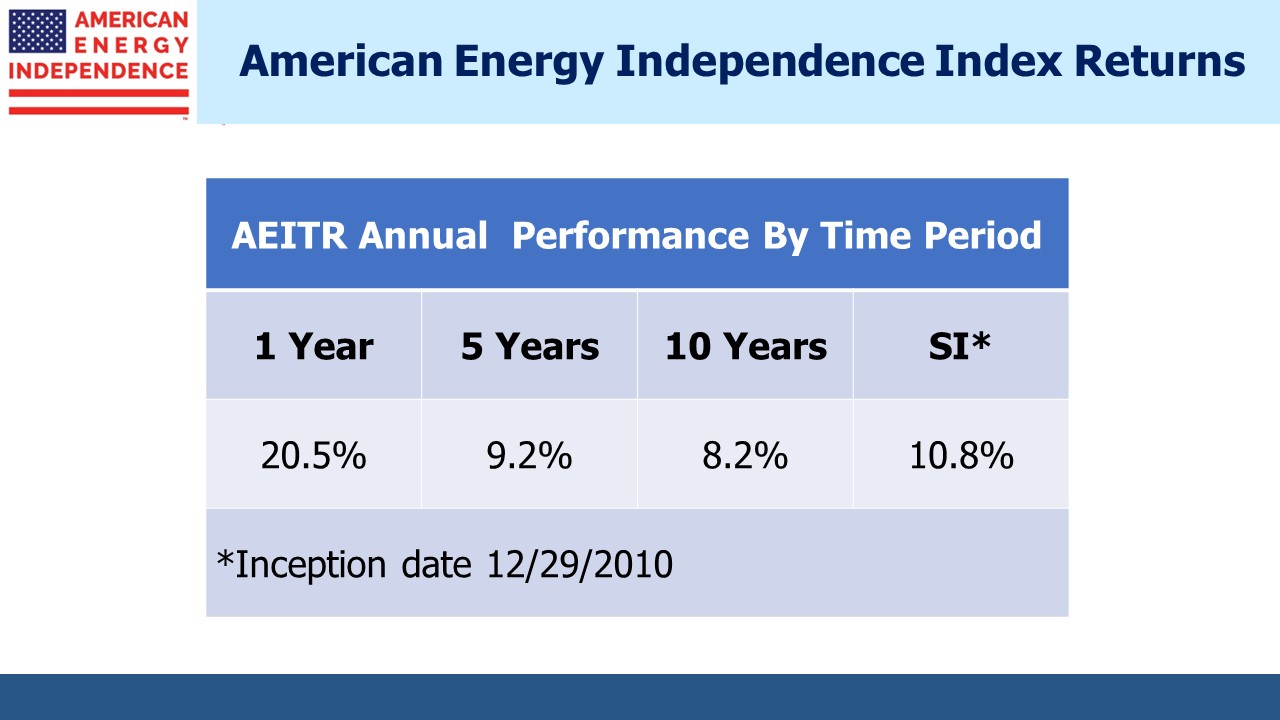

To our friends and clients, whatever challenges you faced in 2022, energy was assuredly a bright spot and hopefully not the only one. From SL Advisors we wish all of you a wonderful holiday season and a prosperous 2023.

We have three funds that seek to profit from this environment: