Environmentalists Mistakenly Choose Perfect Over Good

All three TV networks recently carried stories of northern state Electric Vehicle (EV) owners stranded. Chicago’s very cold weather reminded EV owners that not only do their batteries hold less charge when temperatures drop, but they are slower to charge as well. Public charging stations saw vehicles lined up – some EVs ran out of power before they could even pull up to the charging station. Not all charging stations were working.

The cold weather caused some drivers to sit in their EVs with the heat on, further slowing recharging. One driver reported seeing ten flatbed trucks taking away dead EVs. Because you can’t just get a gallon of gasoline and bring it to your car. The flat EV must be taken to a source of electricity.

A 2019 study by AAA found that temperatures below 20 degrees can reduce EV range by up to 41%.

This was an extreme weather event. Every Tesla driver I know loves their car. But they all own another gas-powered car and would have used it at a time like that. The drivers on the network news didn’t look as if their EV was a second car. They looked as if it was their car, and as such it needed to do better than work most of the time in most conditions.

Given the negative press around slowing EV sales, the industry didn’t need this. Hertz is selling a third of its EV fleet because of low demand. They found repairs were more costly than expected. And who seriously wants to rent an EV in an unfamiliar region and worry about finding somewhere to charge it? Hertz’s embrace of EVs always looked like a dumb move. They expect to take a $245MM charge in 4Q23 for EV depreciation.

It increasingly looks as if hybrids would have been a more sensible intermediate step while EV technology improves beyond its current standard.

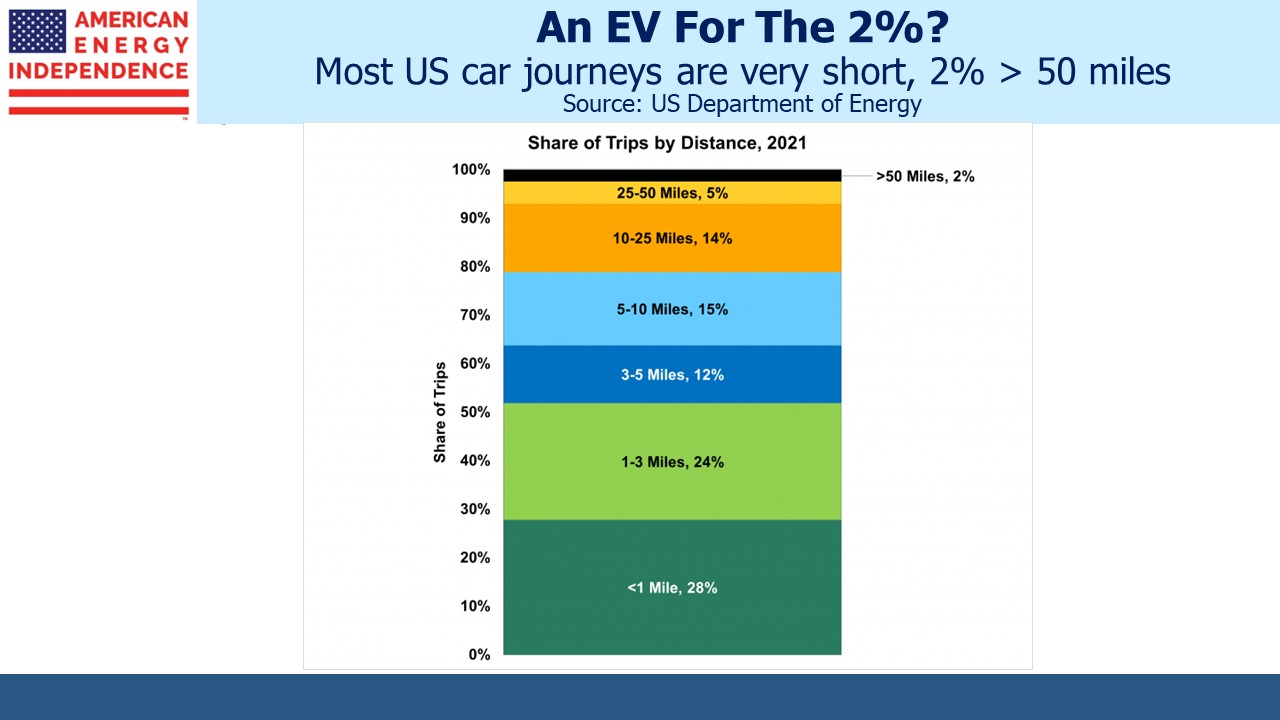

Over 60% of car trips are less than five miles. Over 90% are under 25 miles. Most of these can be supported by a hybrid’s battery, recharged when the owner is at home. The gasoline assures that a long journey or a cold one won’t end with a flatbed truck. The average hybrid gets over fifty miles per gallon.

Policymakers have chosen the perfect over the good. The White House has a goal that half of US auto sales be EVs by 2030. Hybrids are included in this, which is just as well because anyone who relies on a single EV to get around is taking more risk of getting stranded than the owner of a conventional car.

Progressive liberals, many of whom live in urban environments with adequate public transport, naturally believe we should transition straight to fully electric EVs. Americans (1) drive long distances, (2) like bigger cars, and (3) benefit from cheaper gasoline compared with other OECD (ie rich) countries. We are less likely than others to embrace EVs absent even more substantial tax breaks until the reliability improves.

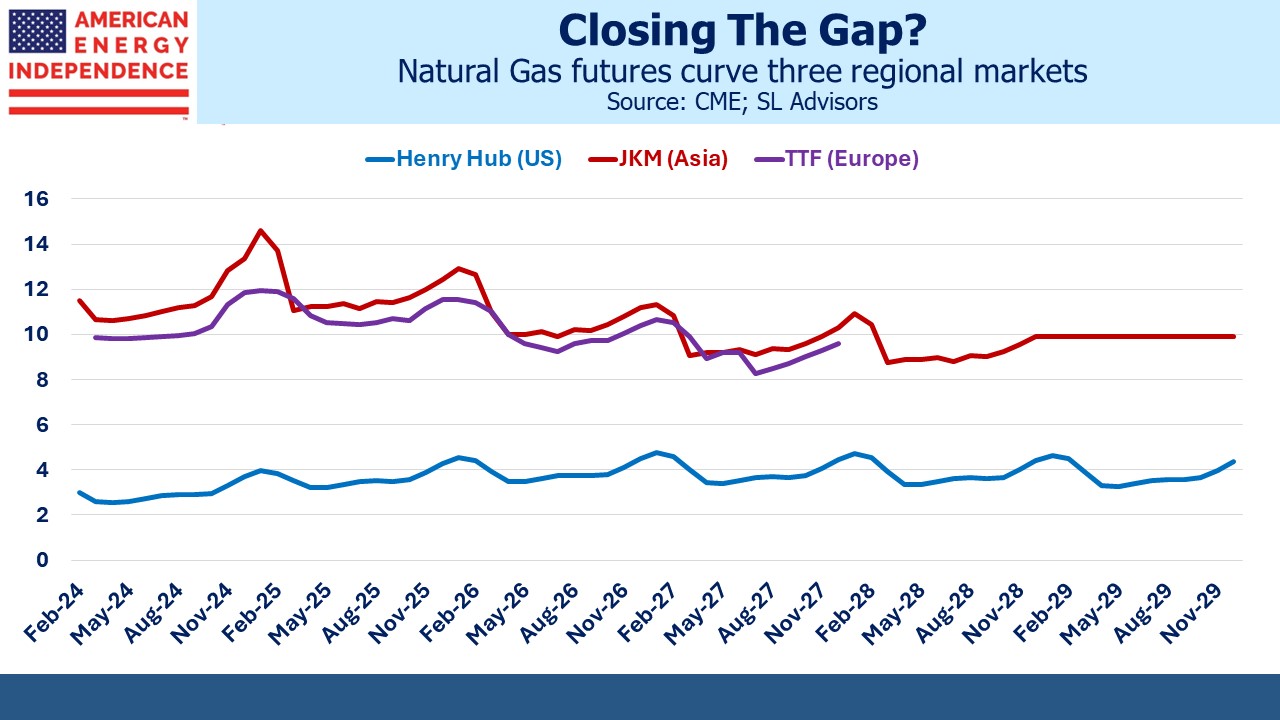

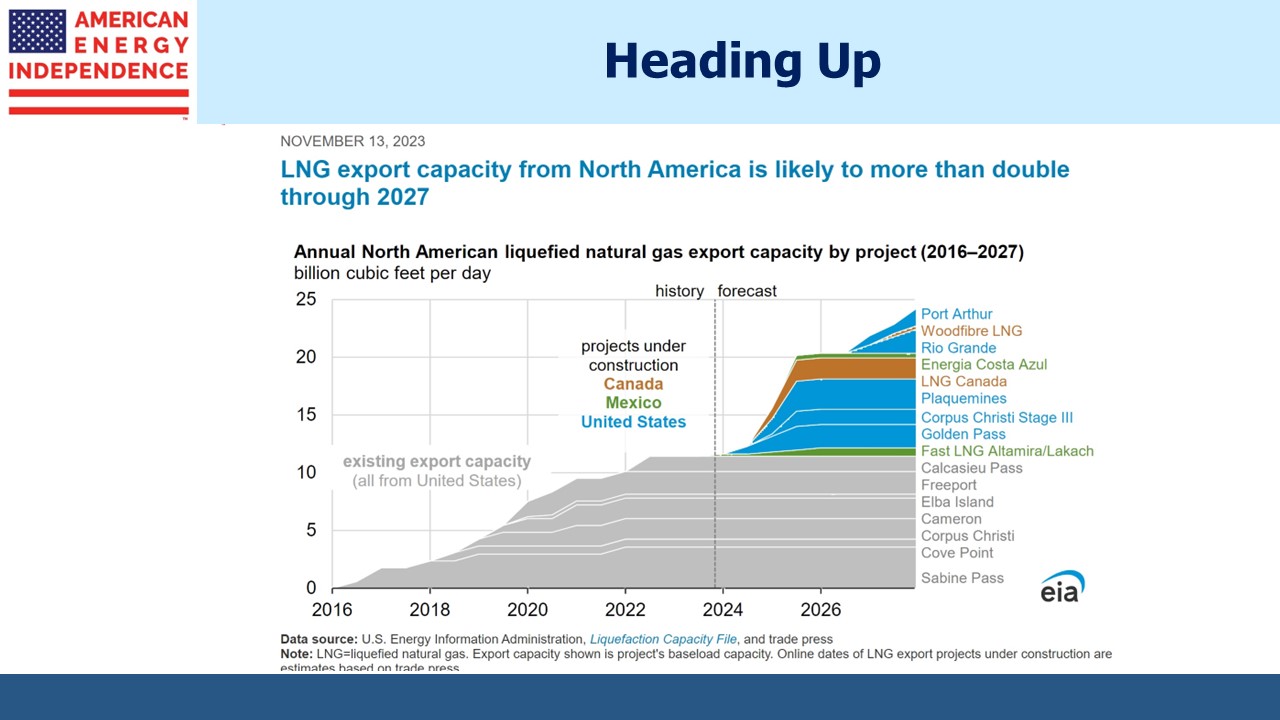

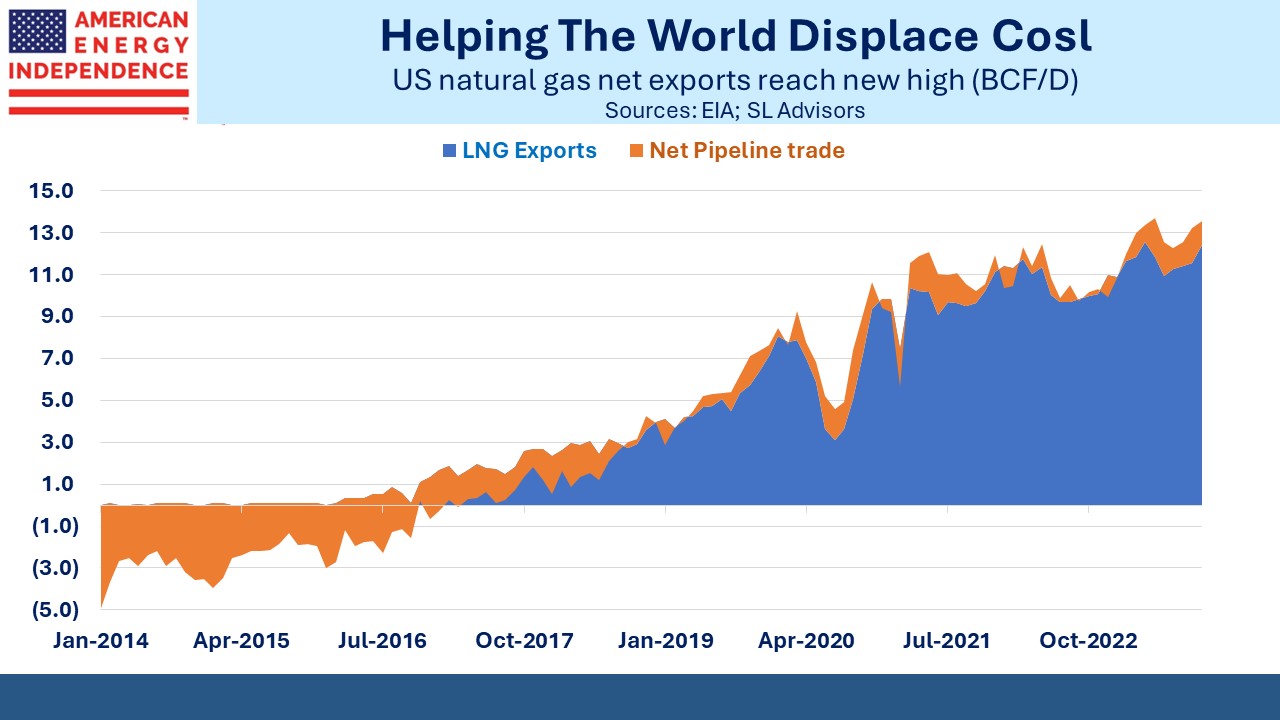

Another example of progressive liberals increasing greenhouse gas emissions by pursuing perfection is the recent news that the White House is considering tougher rules before approving new Liquefied Natural Gas (LNG) export terminals. Environmental extremists calculate the emissions the additional LNG exports will generate when consumed by foreign buyers. They naively think that limiting LNG availability will support more solar and wind power in Asia.

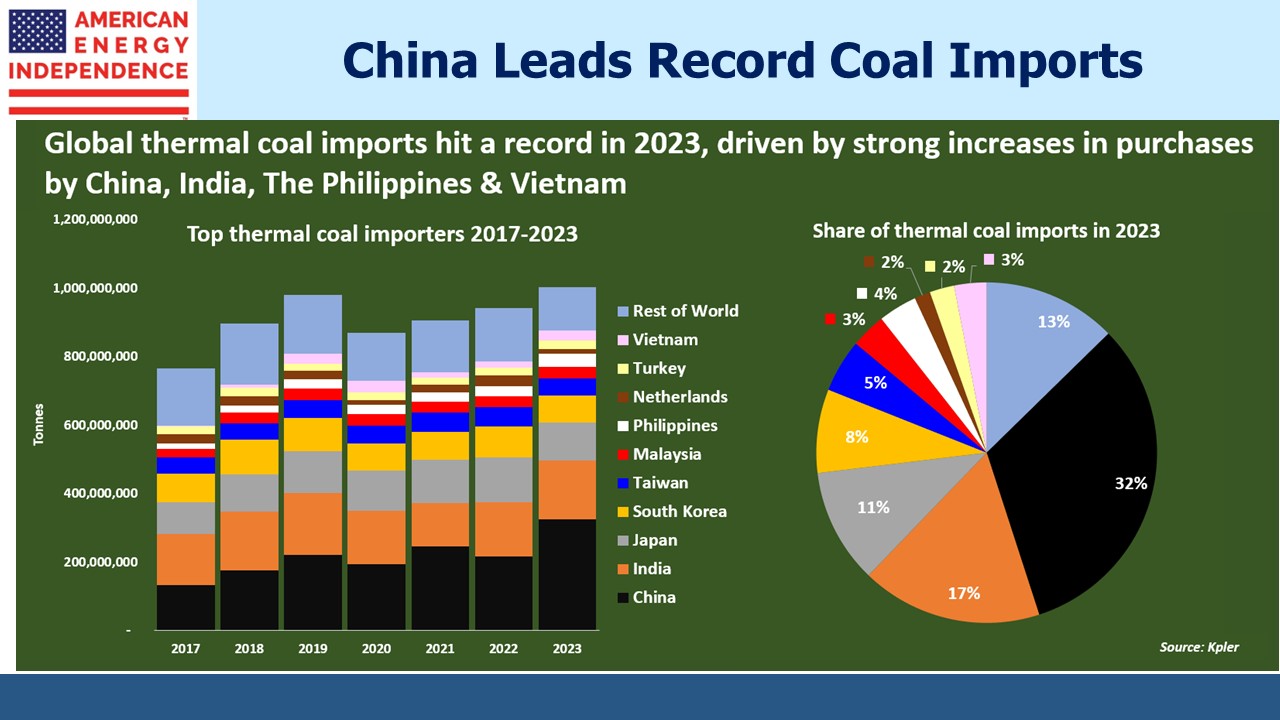

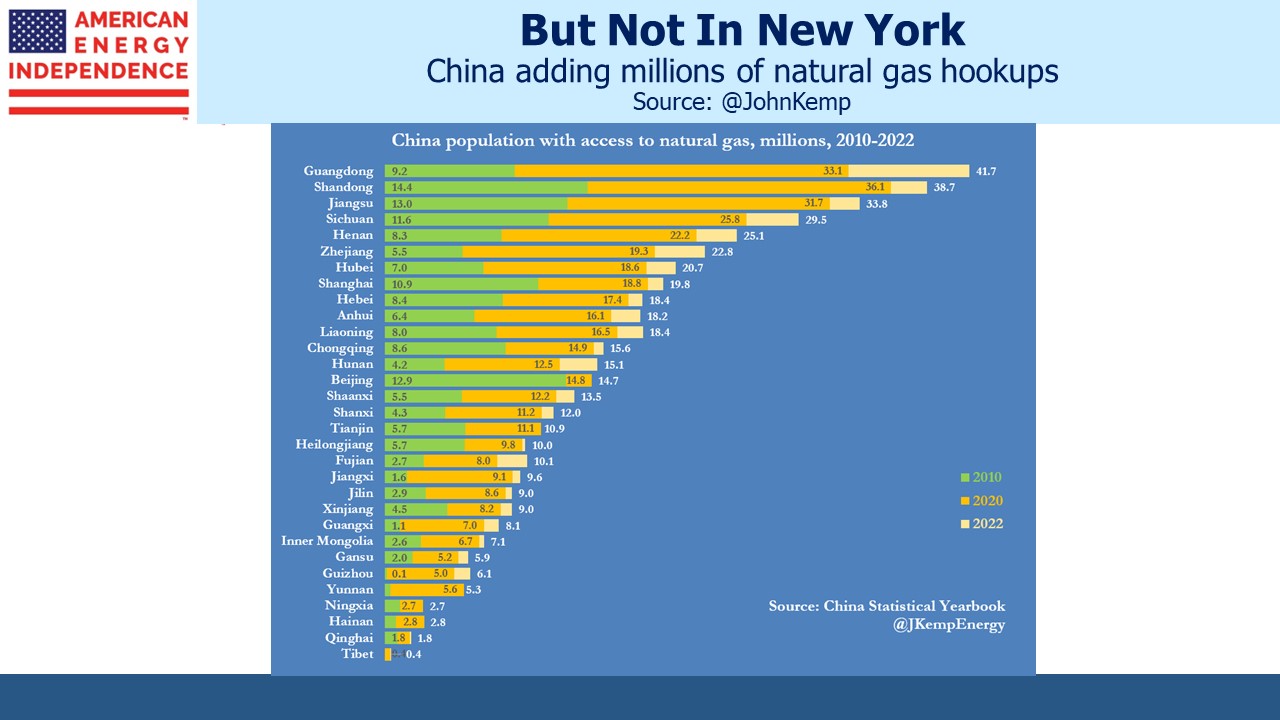

Meanwhile, power generation from coal hit a new global record last year. 82% of all coal-fired power generation was in Asia, up from 75% in 2019. Reductions in Japan and South Korea were almost completely offset by growth in Vietnam alone. Along with China, India and the Philippines they all saw strong import growth last year.

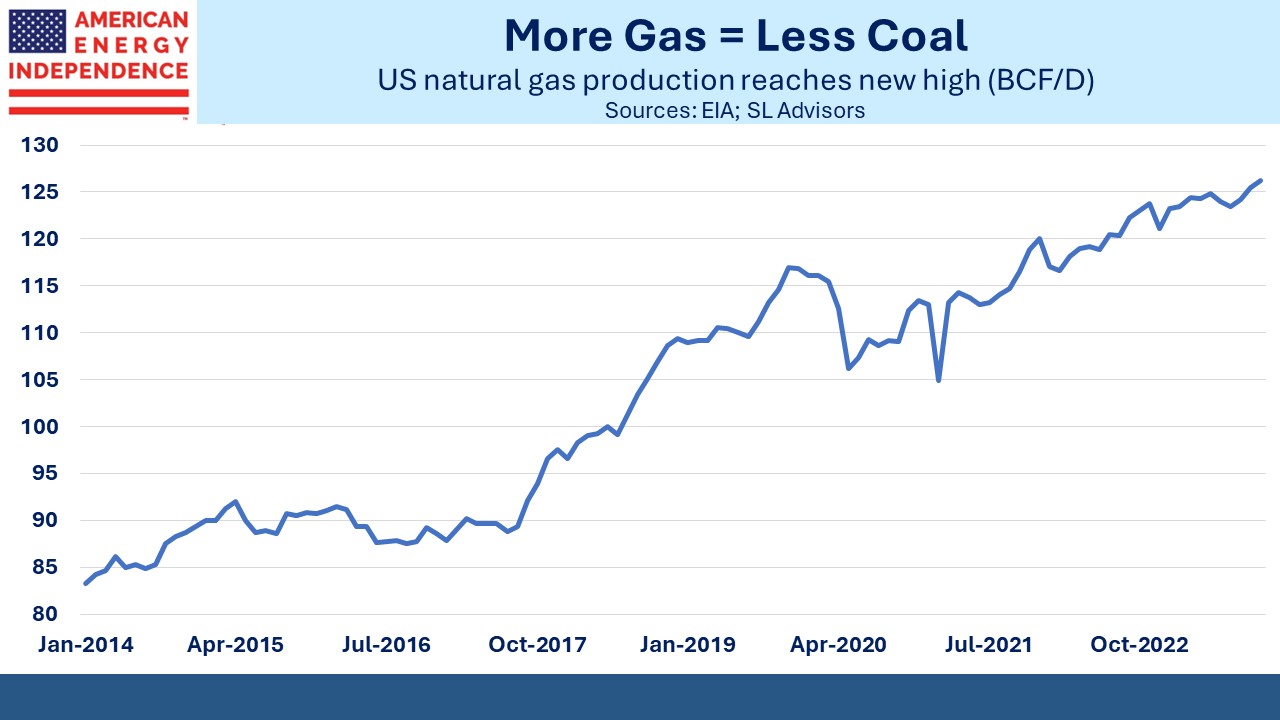

Coal is cheap and reliable. It also generates on average 2X the emissions of natural gas.

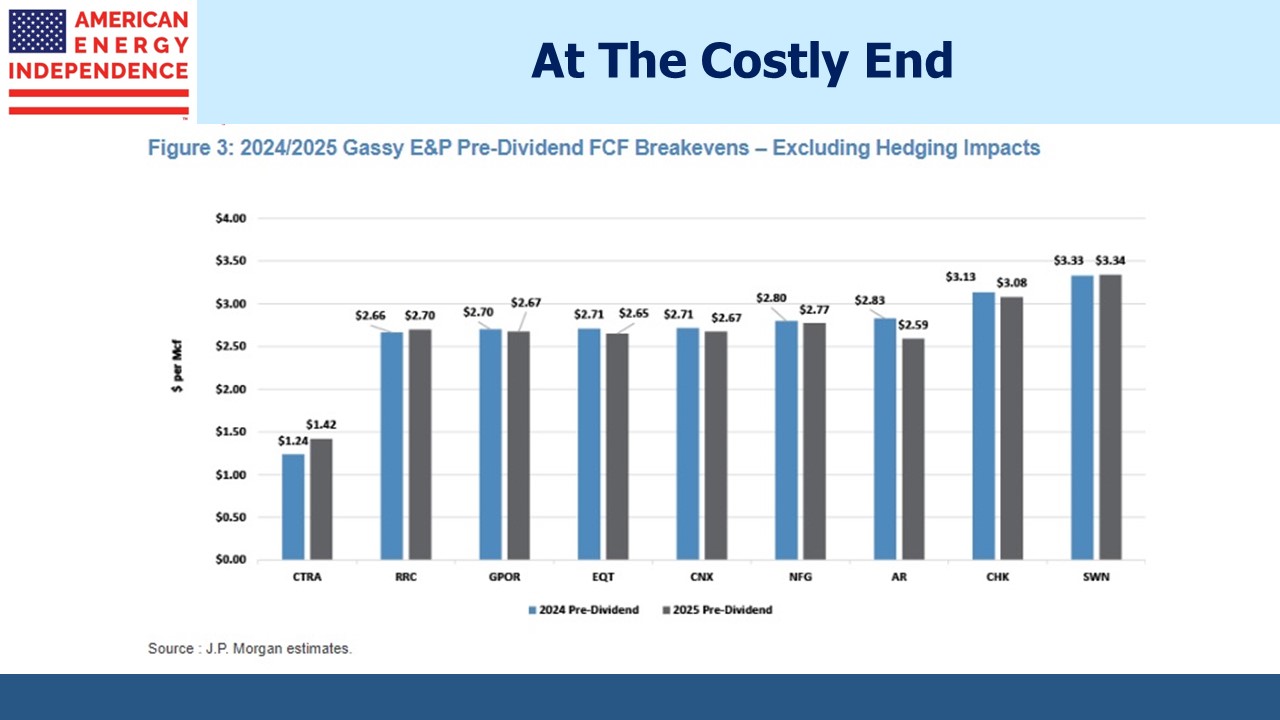

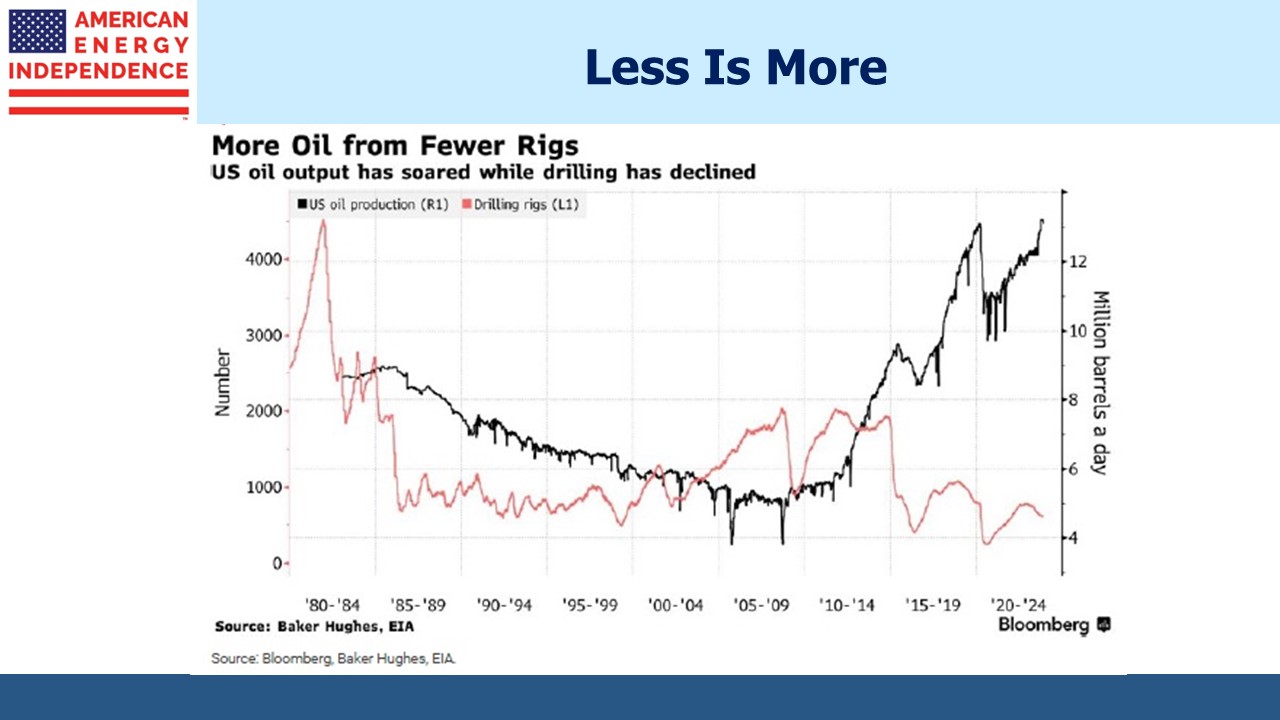

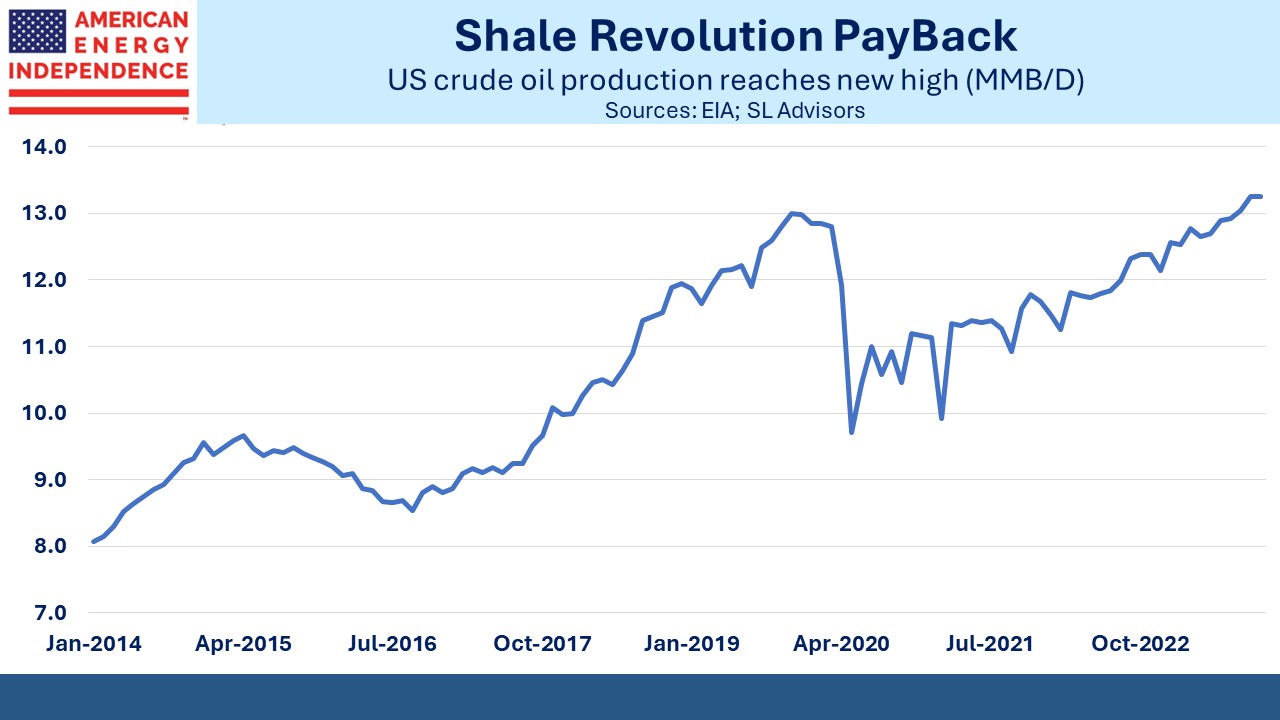

The most effective way for the US to help developing countries in Asia reduce their coal consumption is to send them more LNG. The correct analysis of LNG’s impact on emissions would consider what energy source it’s displacing. In the US, coal to gas switching is our biggest success on emissions. We should be helping other countries do the same.

The White House appears to be adopting the superficial analysis described above as a soundbite to the progressives rather than trying to solve the problem. If you want to invest in lower emissions, natural gas infrastructure is a more certain bet than renewable energy.

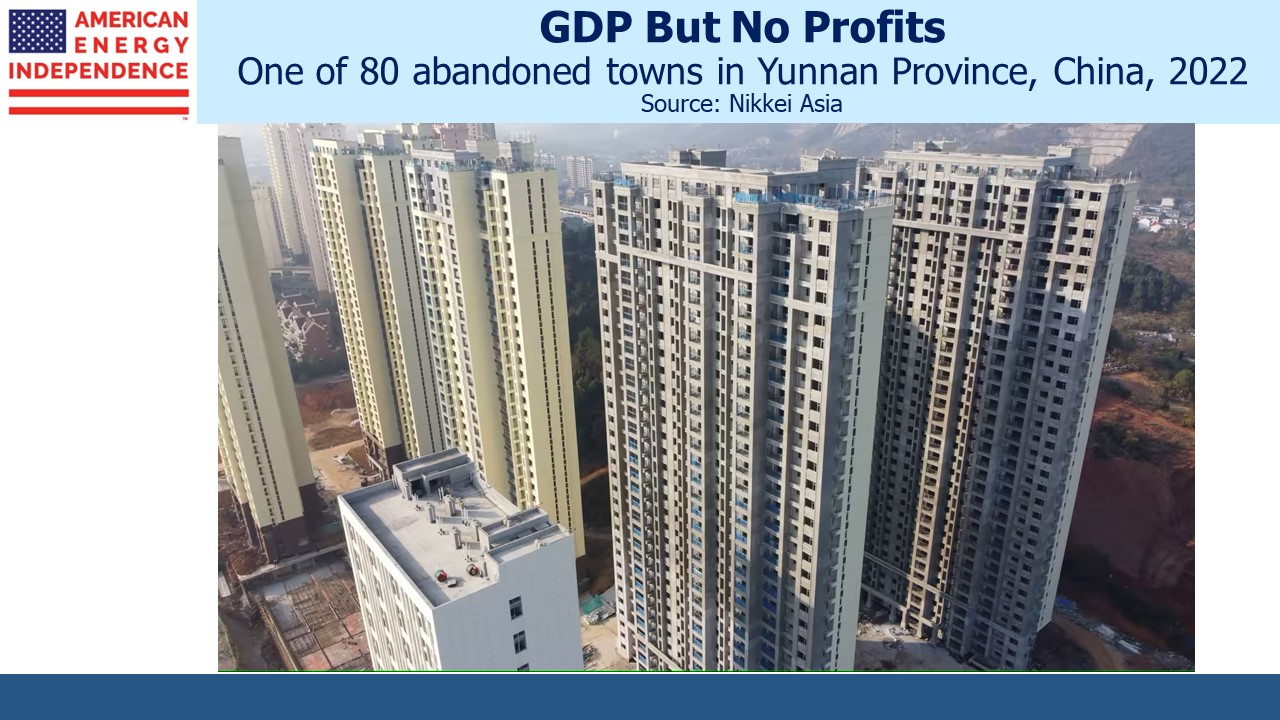

Progressive liberals are often the biggest hurdle to sensible energy policies that recognize the reality of developing countries’ prioritization of growth over climate. Outgoing climate czar John Kerry will be remembered as a booster of what he perceived as China’s commitments to reduce emissions even while they have grown by burning half the world’s coal production. That’s the dominant source of the power than runs through China’s EVs.

Pragmatic climate policies will have better success than the idealism too prevalent on the left.

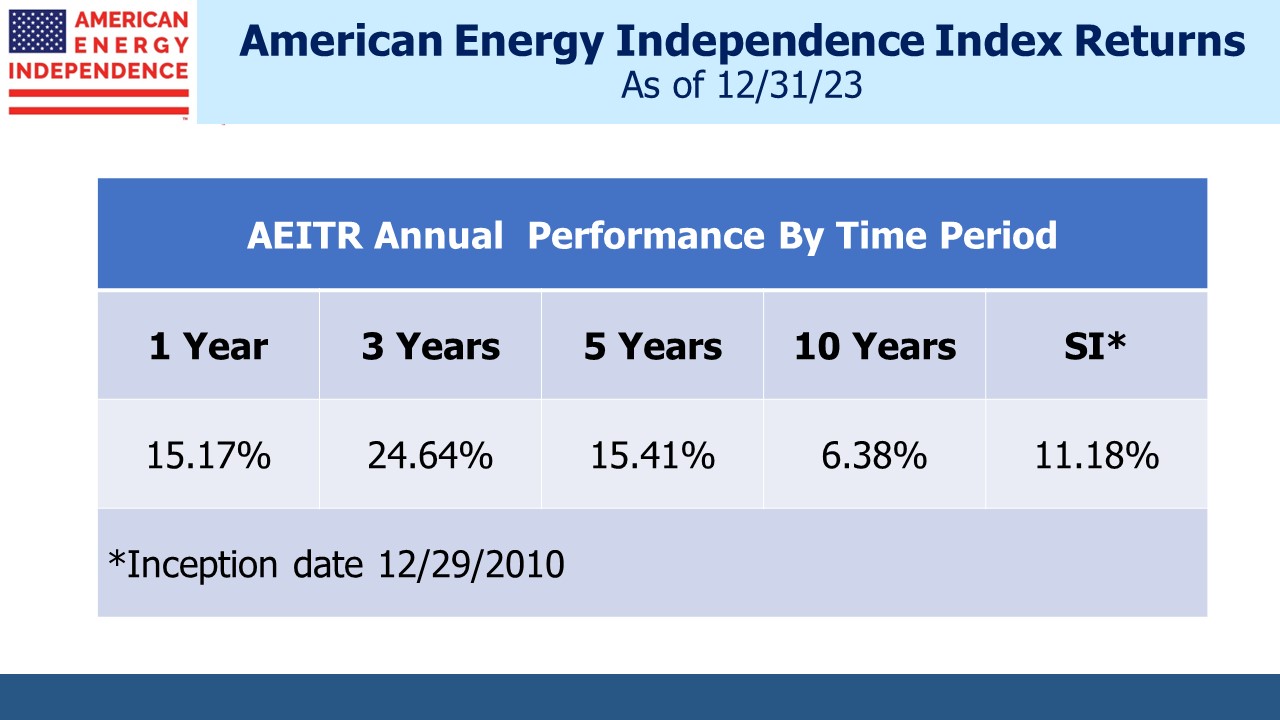

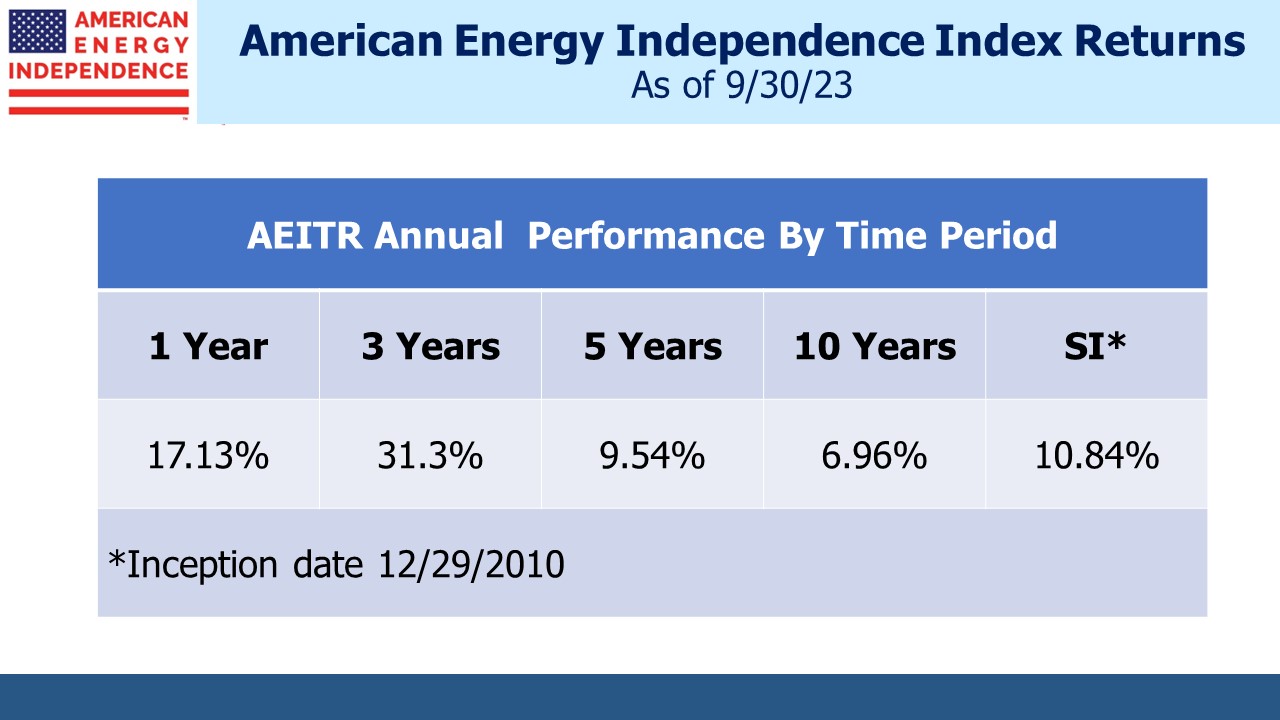

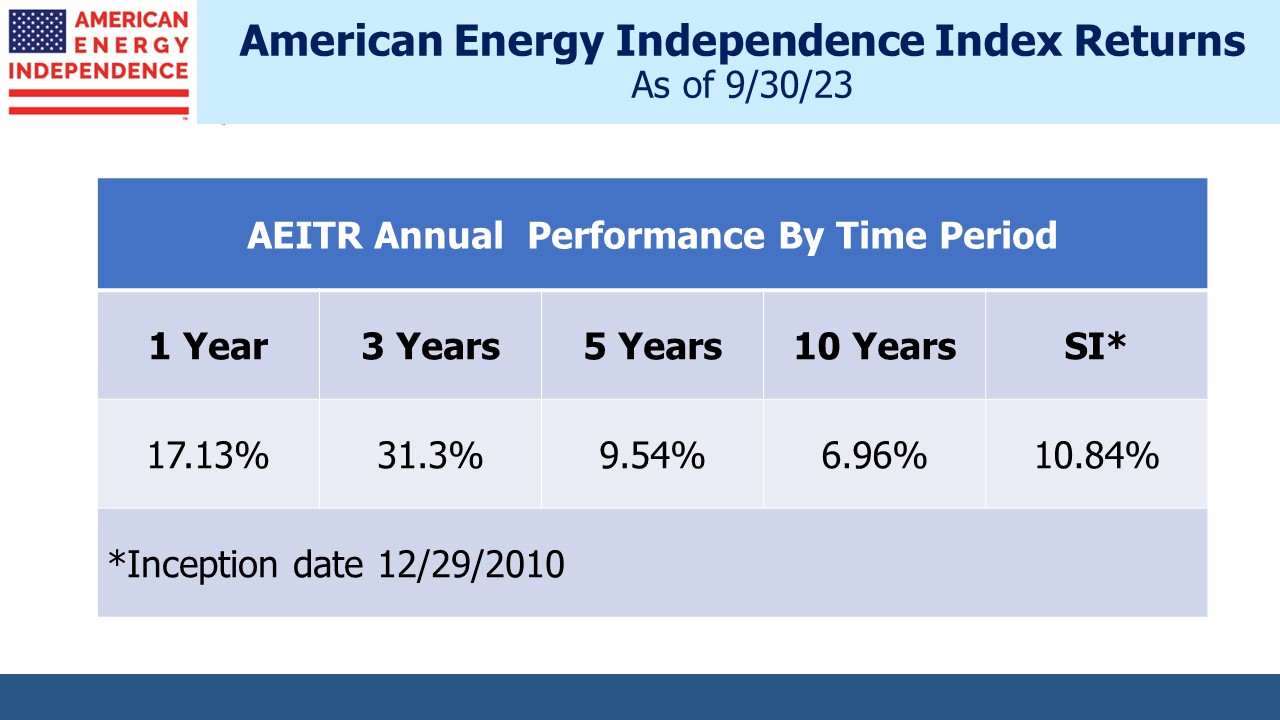

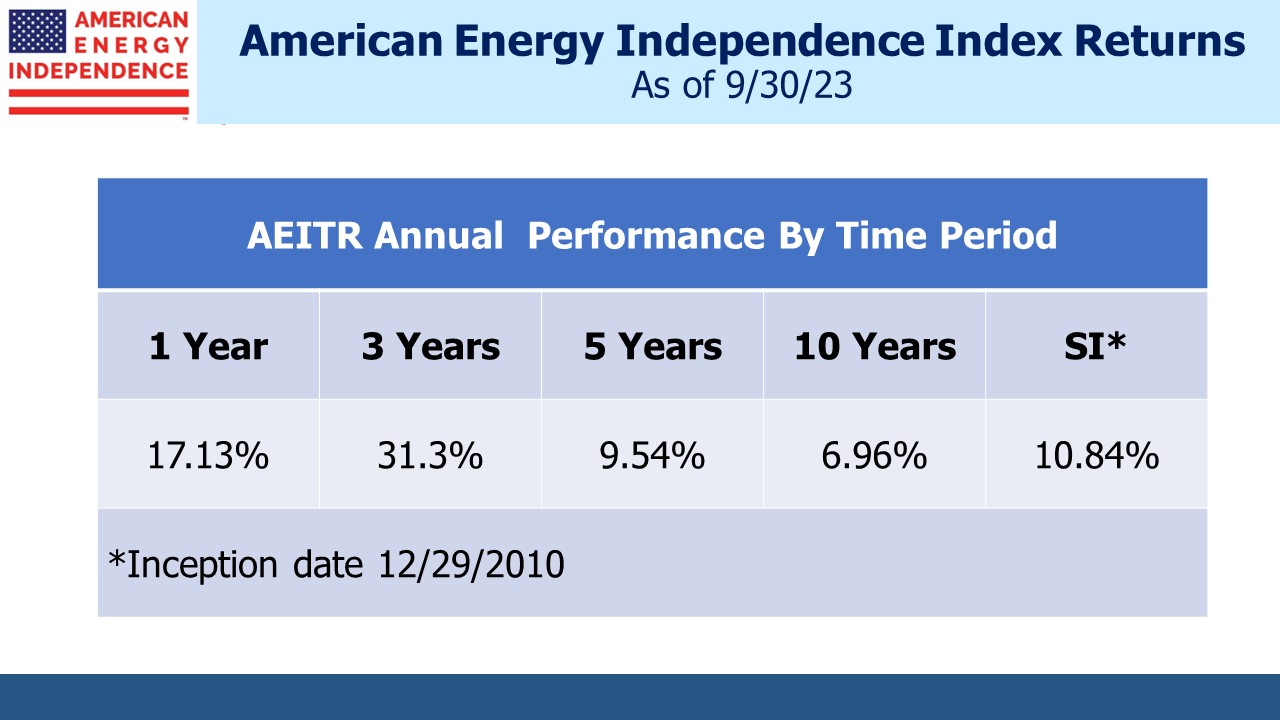

We have three have funds that seek to profit from this environment: