JPMorgan Explains Electravision

JPMorgan’s 14th Annual Energy Paper (subtitled “Electravision”) is as always packed with data and insights. Mike Cembalest has few peers among investment writers. Two themes, the slow electrification of western economies and the challenges of Electric Vehicles (EVs) stood out.

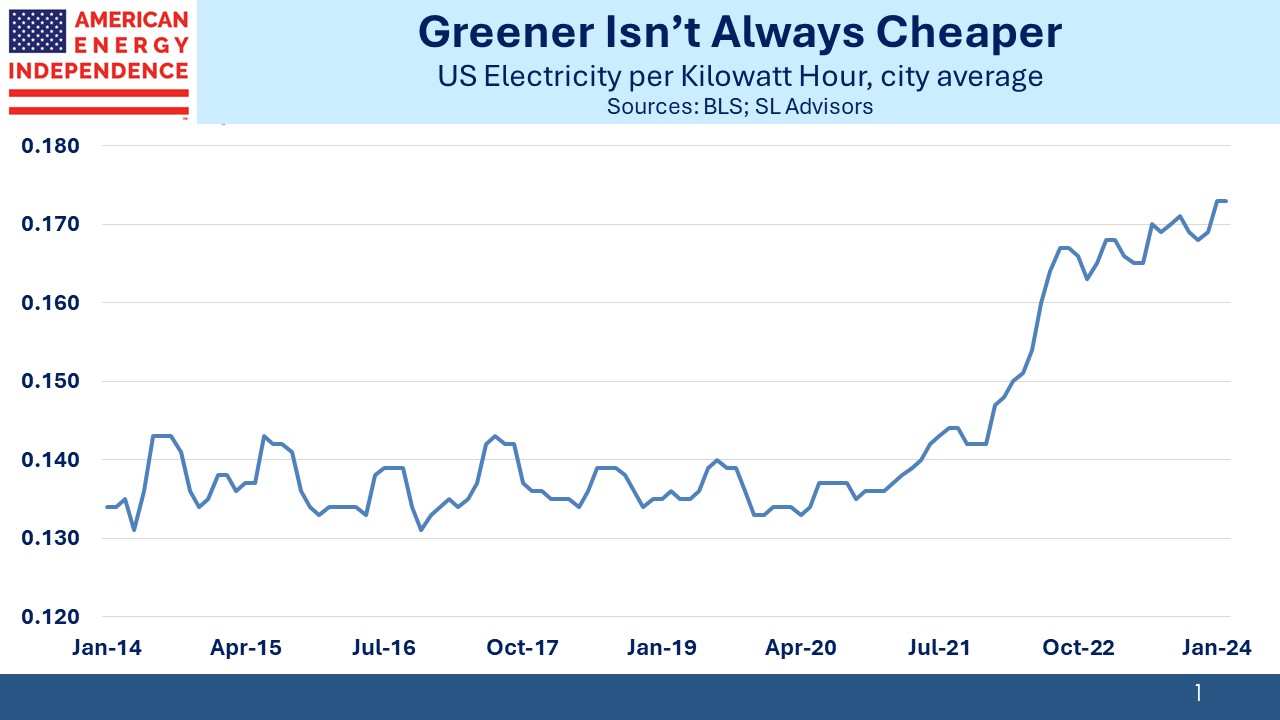

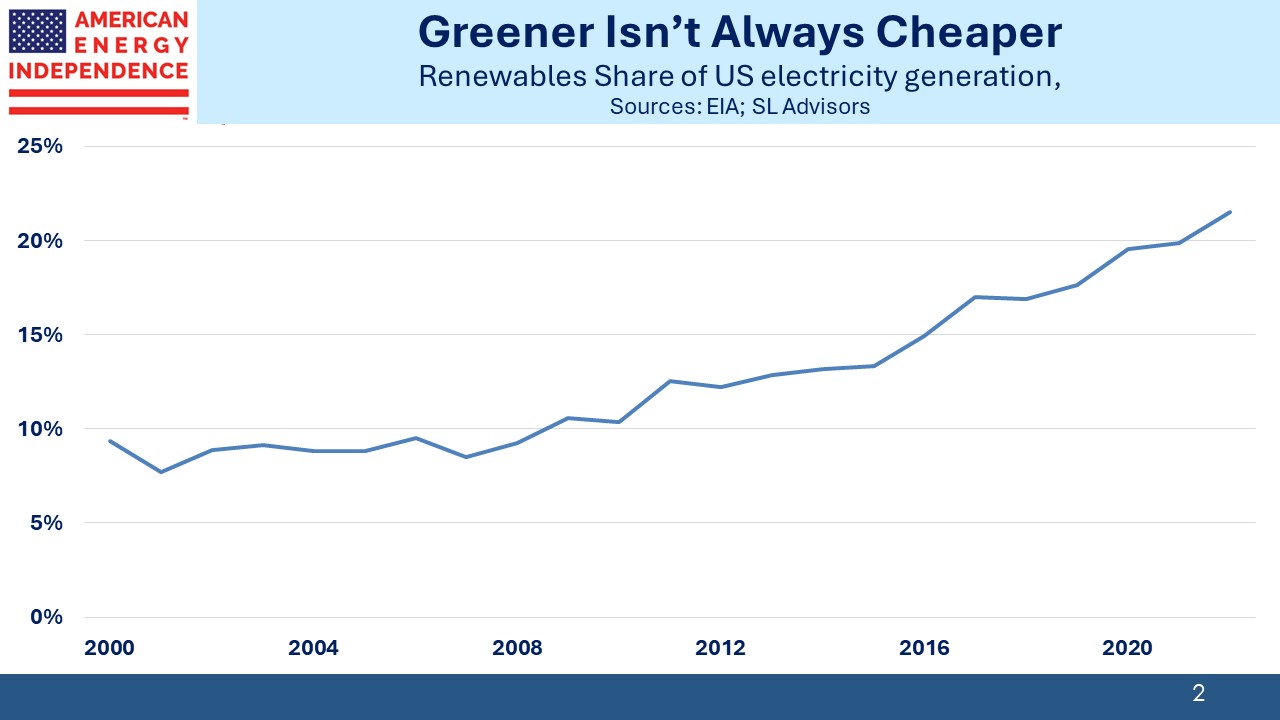

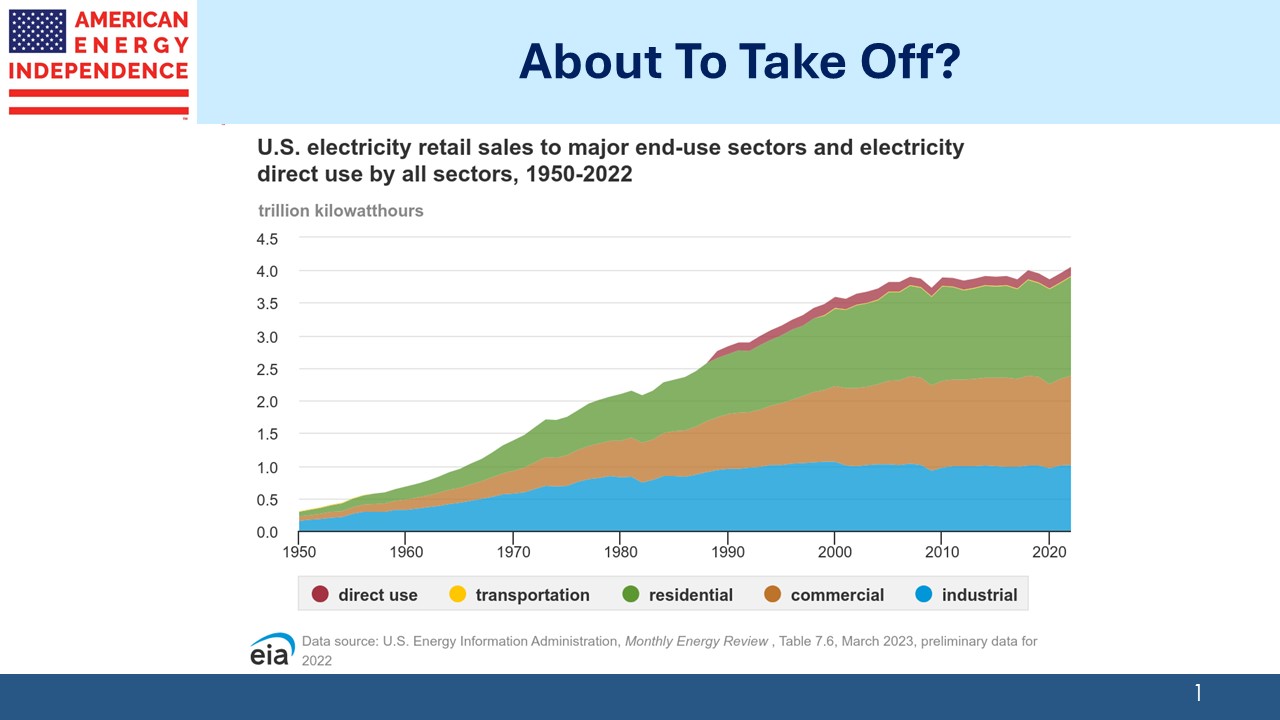

As Cembalest has noted before, renewables are gaining market share of power generation faster than electricity is growing its share of primary energy use. Around a fifth of US electricity generation comes from solar and wind. Texas is about a quarter of US windpower (see Windpower Stumbles On Unique American Mineral Rights) and Iowa relies on wind for over half of its electricity (See Offshore Wind vs Onshore). Wind’s market share doesn’t appear to correlate with electricity prices in states, but solar does.

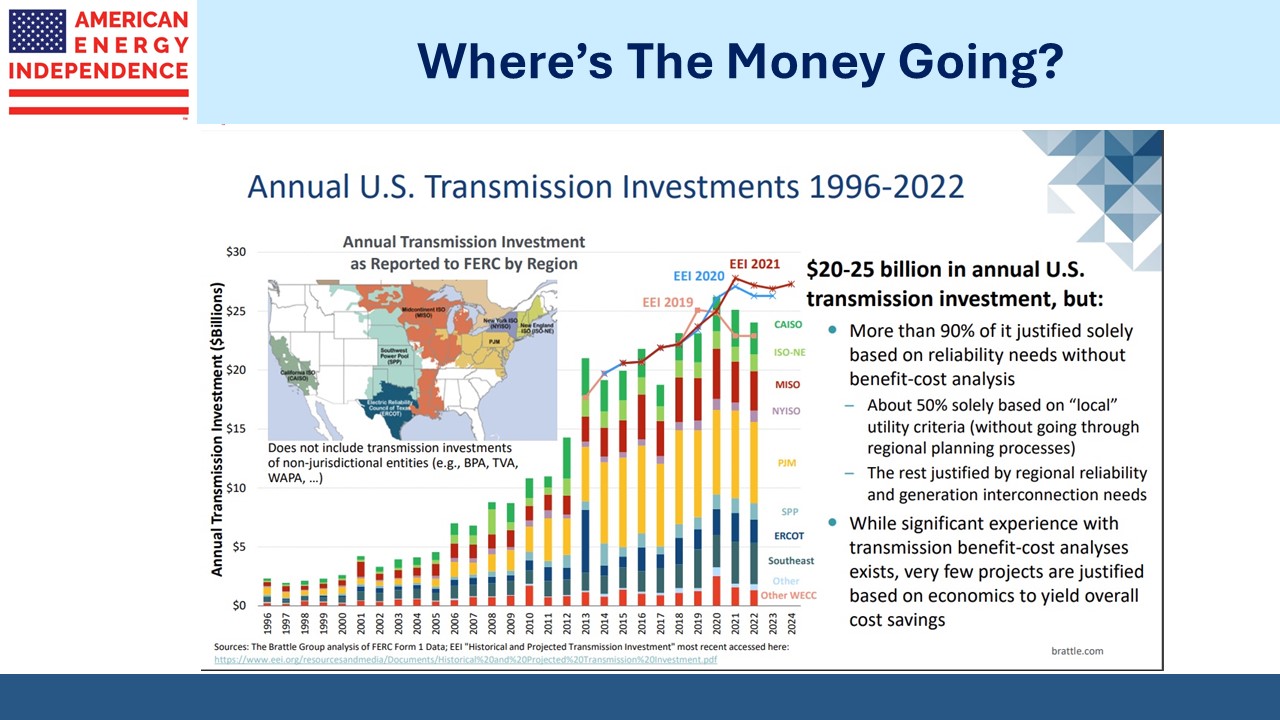

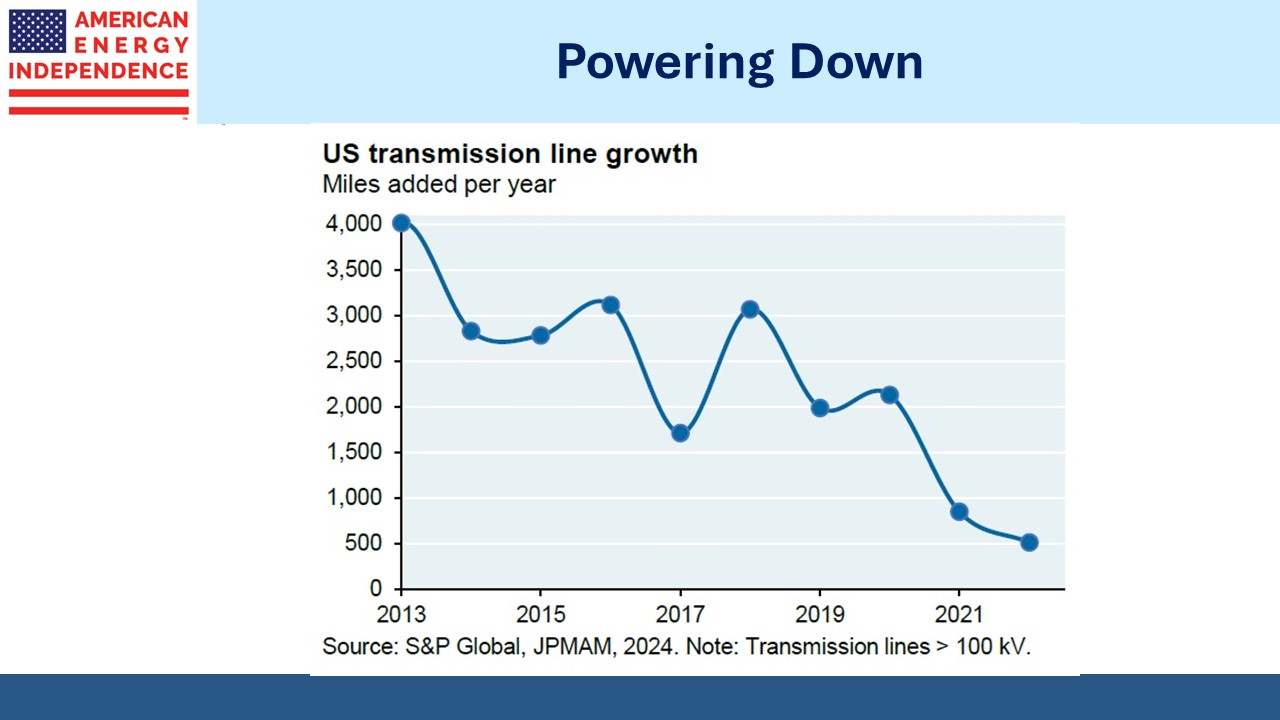

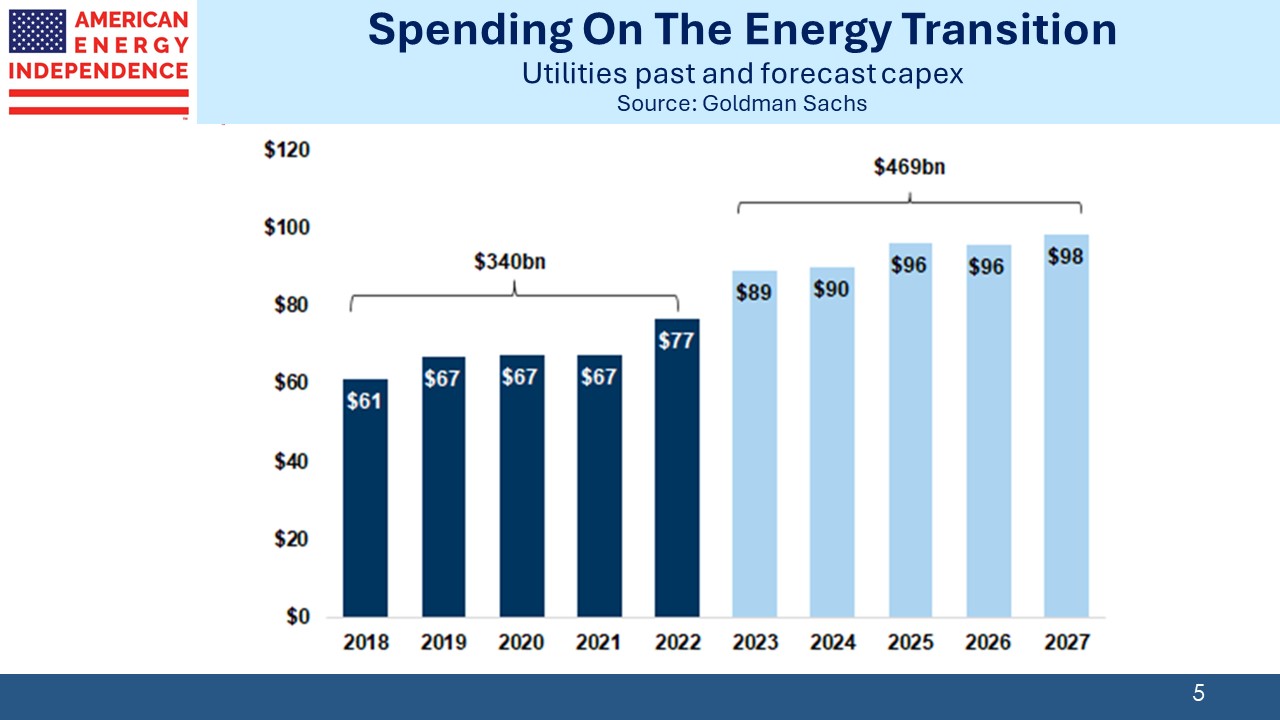

The growth in renewables is exposing more grids to intermittency, since it’s not always sunny and windy. Battery storage is expected to be the major solution, but so far it’s made few inroads. Pumped storage relies on using electricity when it’s cheap (ie midday solar) to move water uphill, releasing it to generate power when demand exceeds renewables supply (breakfast and dinner time). It’s low tech, and yet this still represents 70% of utility scale storage.

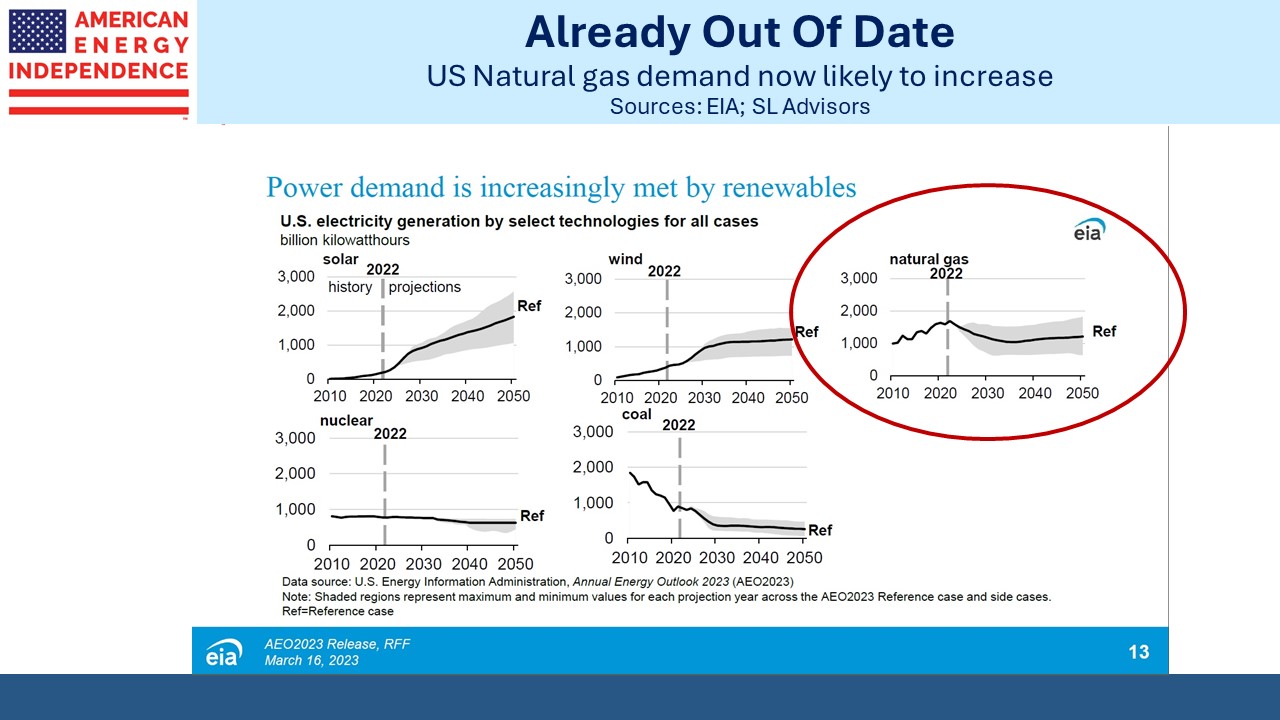

Therefore, existing dispatchable power (usually natural gas, sometimes coal) is being retained. Because renewables operate at much less capacity than natural gas plants (typically 25-35% vs >90%), adding 1MW of solar capacity does little to reduce the need for the traditional energy it’s supposed to replace.

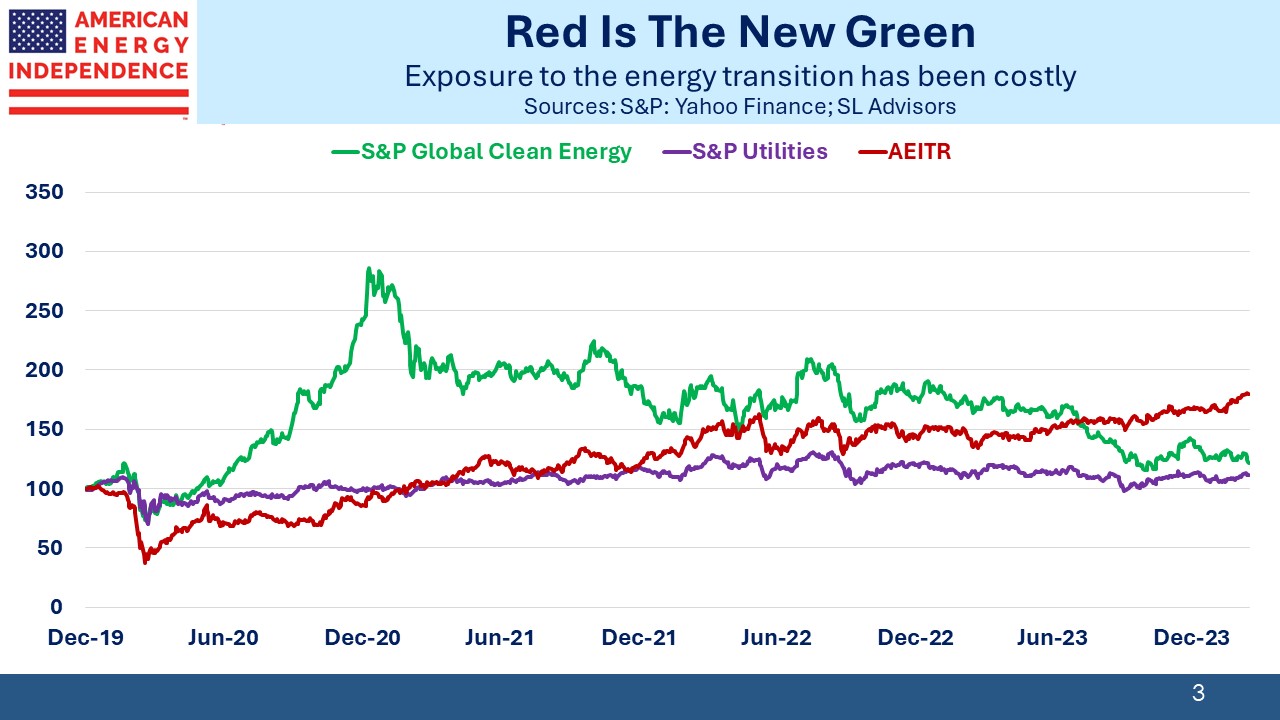

The result is adding renewables means carrying ever more redundant dispatchable capacity. Regional grid operators report that new renewables lead to only 10-20% of equivalent capacity reduction of coal or gas. It’s why solar and wind aren’t as cheap as their proponents like to think (see Renewables Are Pushing US Electricity Prices Up).

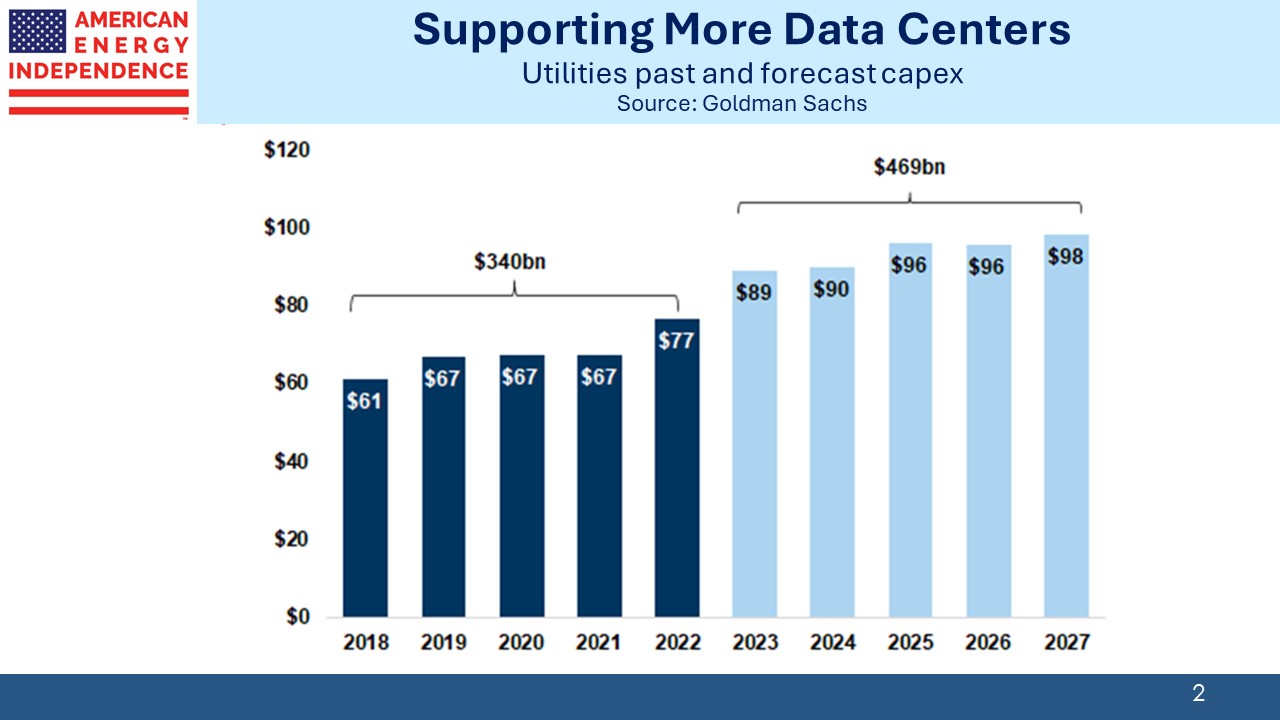

It also means capacity buffers are falling. New England expects peak summer generation capacity to drop below 10% within a decade, from over 25% currently. The recent surge in data centers to support AI is putting further pressure on power supply.

We tolerate power outages which rarely last more than a few hours. We haven’t had any natural gas outages, which would occur if, for example, very cold weather interrupted production. We’ve had some near misses, including in New York on Christmas Eve morning in 2022. If gas supply was cut, technicians would need to visit every building to ensure no residual gas had leaked while the pilot light was out. Frozen water pipes would presumably be common.

Engineers estimated that restoring service to 130,000 customers could take five to seven weeks. Let’s hope none of us ever lives through that.

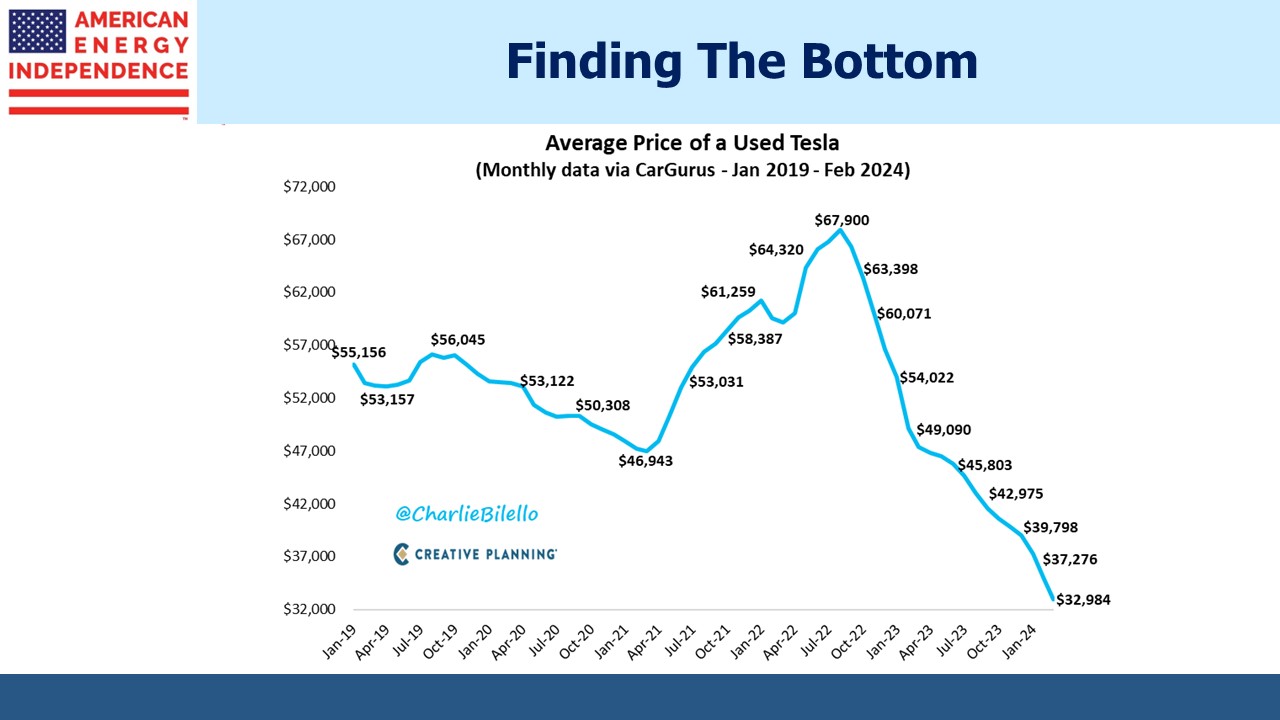

On Electric Vehicles (EVs), estimates of their carbon impact usually rely on a grid’s average emissions intensity based on its mix of power. But Cembalest argues that it’s the marginal source that is more important. For example, if most drivers charge their cars overnight, a grid’s heavy reliance on solar power won’t help. The grid may be relying on fossil fuels or even have to invest more in storage. Bad news for EVs is that marginal emission rates are 1.5X average ones, reducing the carbon benefits of EVs.

Cembalest recounts the sorry tale of the new owner of a Ford F-150 Lightning EV who encountered many non-working EV chargers on a trip north from the Bay area. Tesla owners still report very good experience with charging.

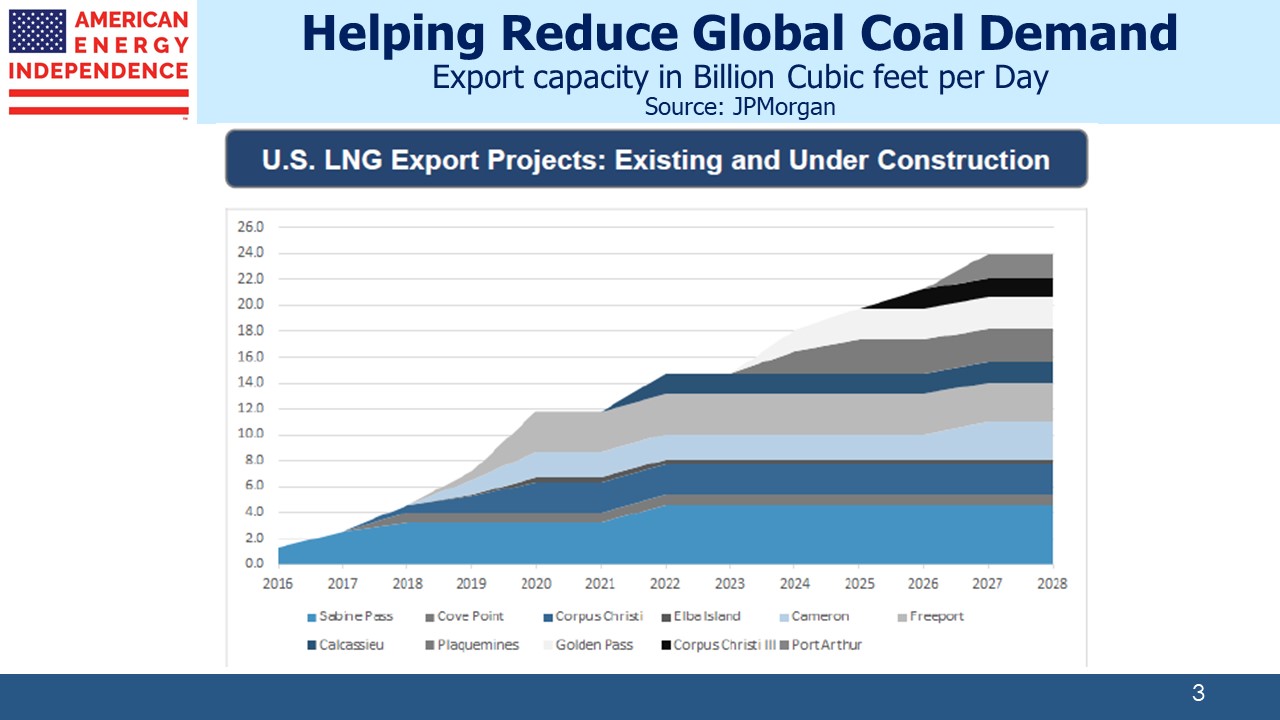

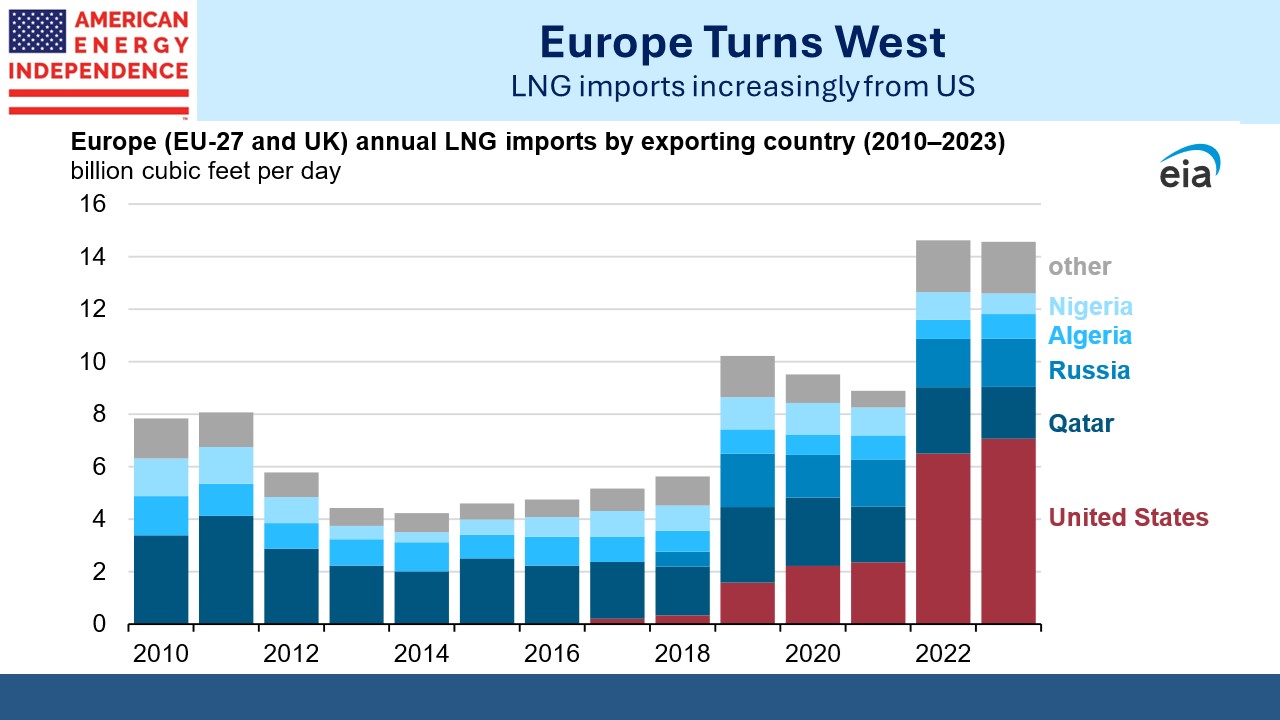

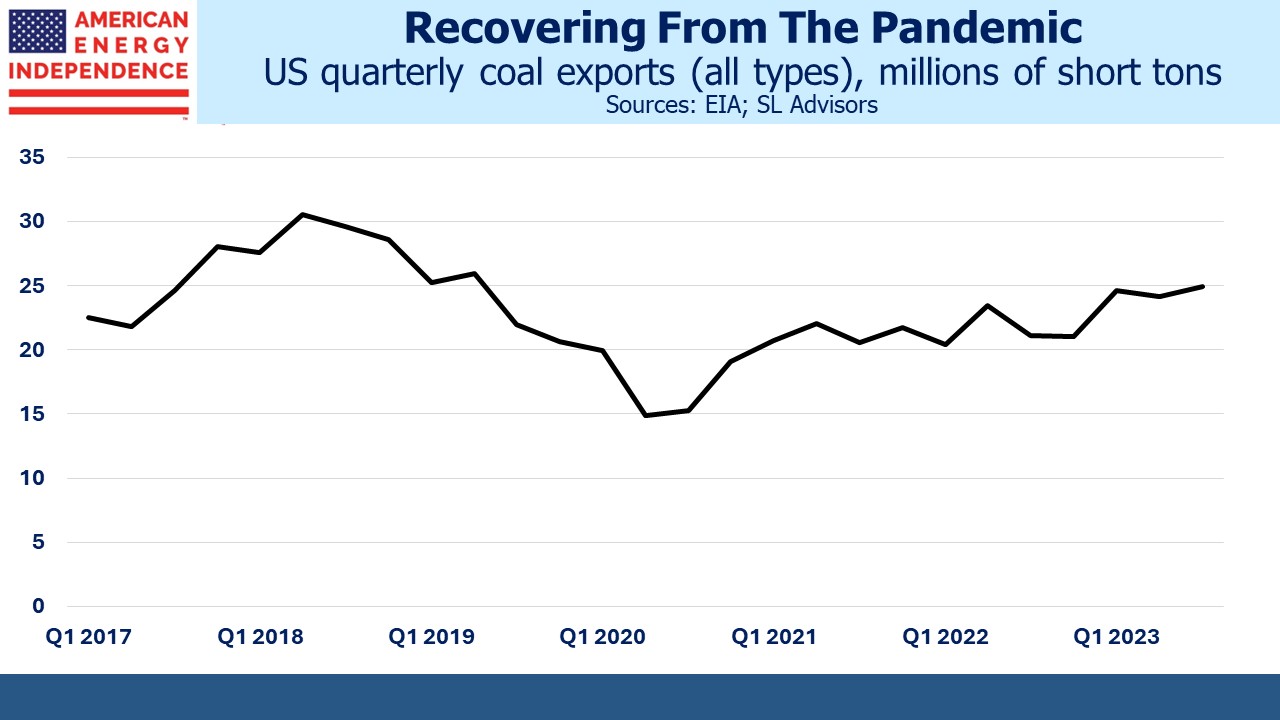

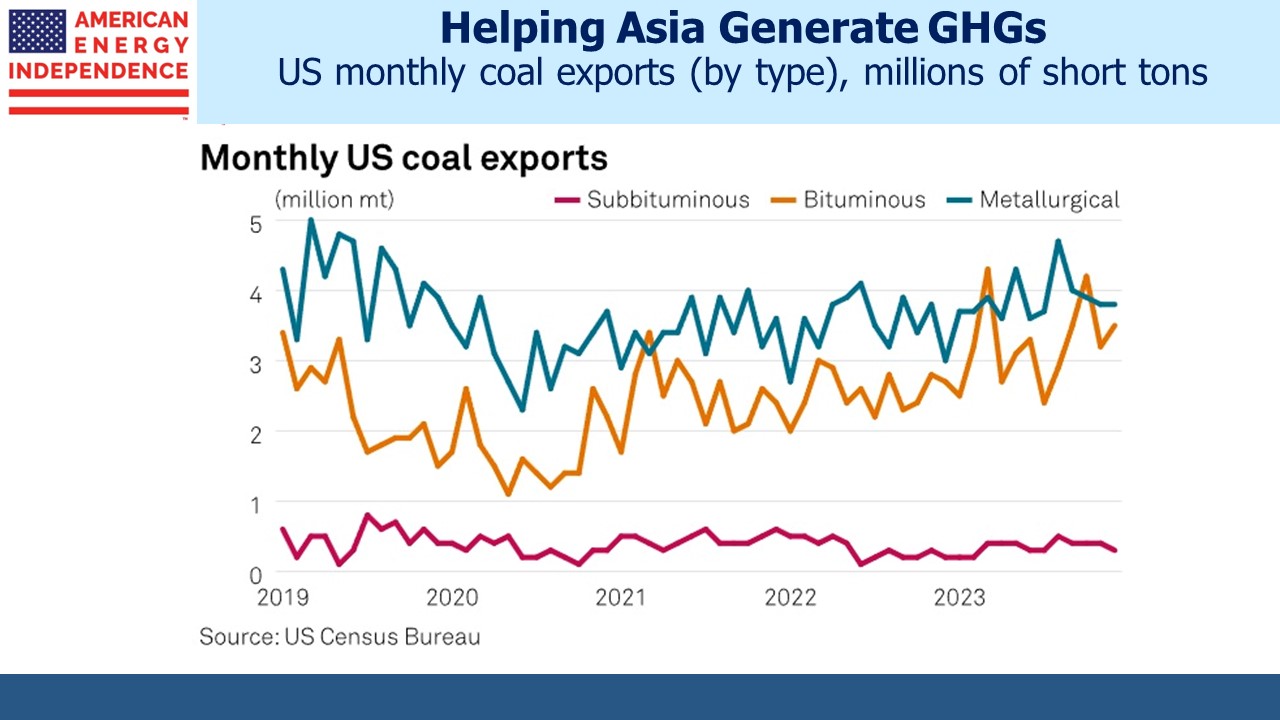

Hydraulic fracturing produces over half of America’s primary energy. This technique remains almost exclusively American although Argentina’s Vaca Muerta shale play is a rare foreign example. It’s hard to conceive how the US economy would look without fracking. We’d face higher energy prices, slower growth and continued reliance on foreign imports. The shale revolution has been an enormous benefit to Americans and our trade partners.

JPMorgan’s Annual Energy Paper is full of interesting facts. Europe is colder than the US, because it’s farther north. How much farther? The 44th parallel north runs through upstate New York and across the Atlantic, passing just north of San Marino. 92% of Americans live below this line, while 82% of Europeans live above it. This is why 10% of European households have air conditioning vs 90% in the US. The increasing use of heat pumps in new European dwellings is making a/c available, since all that’s required is to run the heat pump in reverse on warm days. This will offset some of the efficiency benefits that come with heat pumps.

Mike Cembalest is in that rare category of writers whose output informs, surprises and is always worth reading.

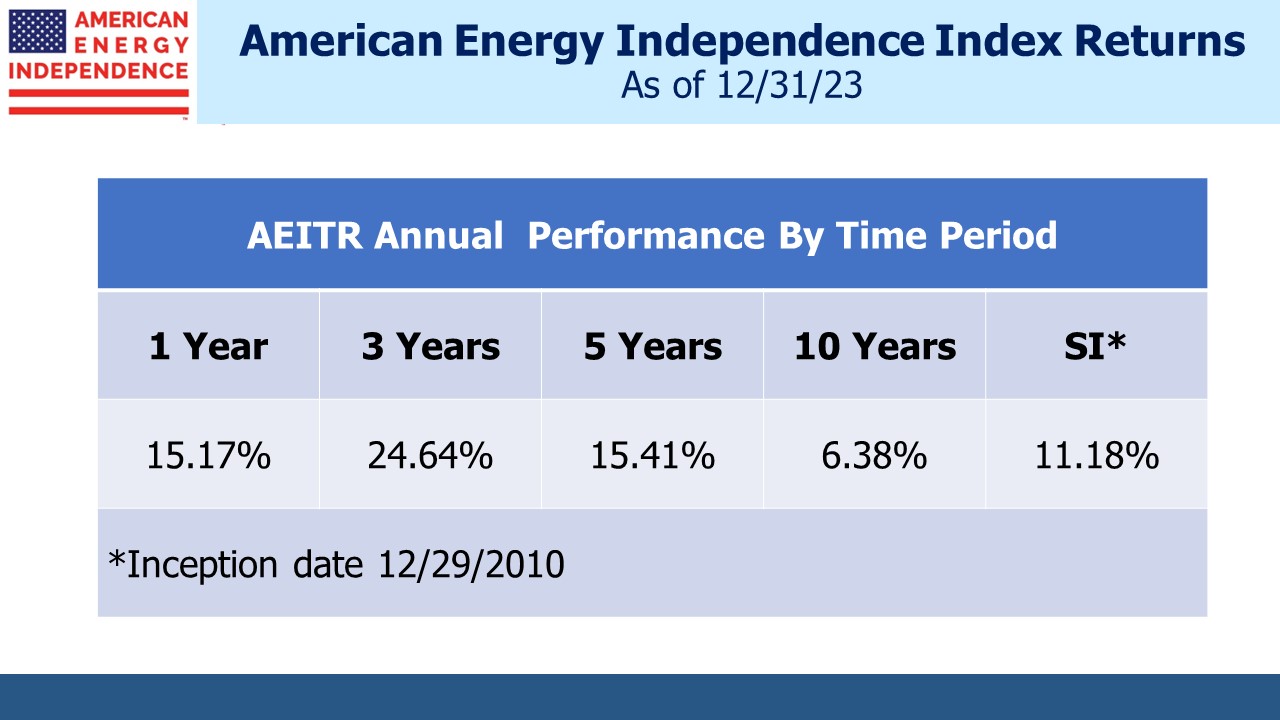

We have three have funds that seek to profit from this environment: