America Seizes Oil Throne

Last week the U.S. became the world’s biggest crude oil producer. Not everyone agrees – Russian production figures still show them ahead. But the Energy Information Administration (EIA) is confident that we are, and that we’re going to stay there at least through next year.

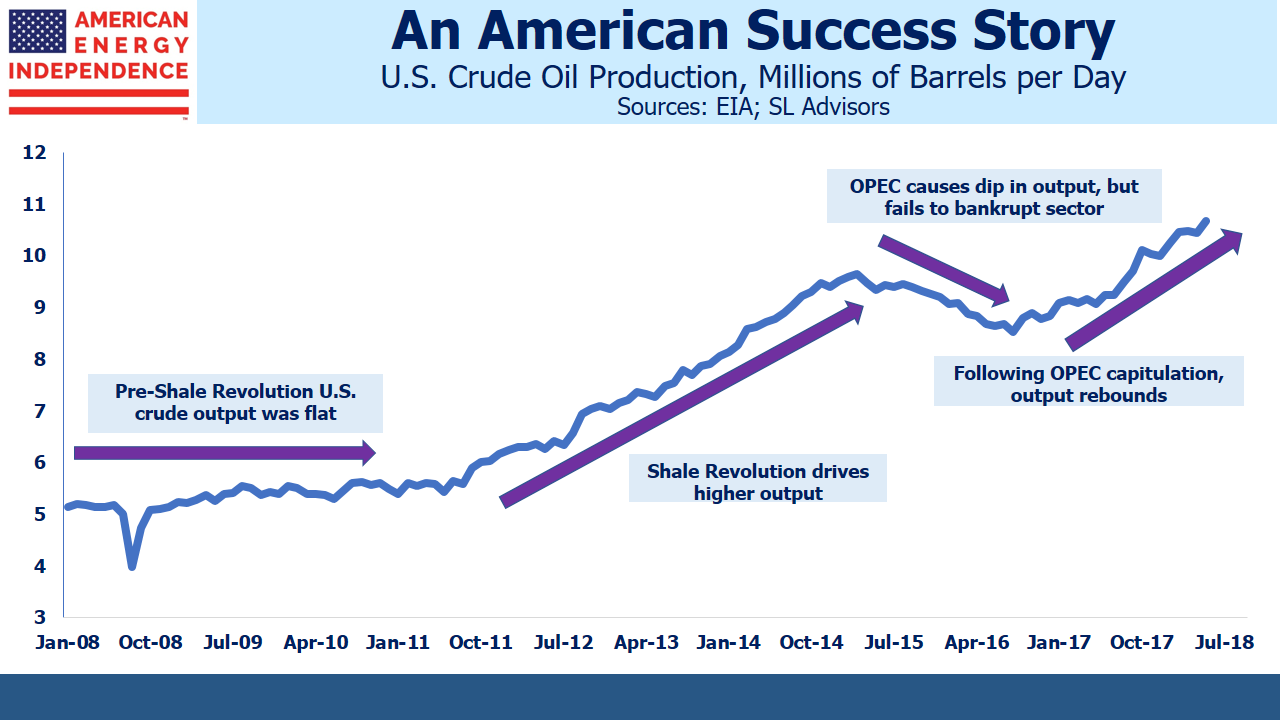

This represents a milestone in the path towards American Energy Independence. Only 10 years ago, U.S. output was 5 Million Barrels per Day (MMB/D) and was in decline. Today it’s reached 11MMB/D and is growing rapidly. Horizontal drilling and hydraulic fracturing unlocked the huge reserves in shale formations, and the decline was arrested. Over the next several years U.S. output grew sufficiently to more than meet global demand growth.

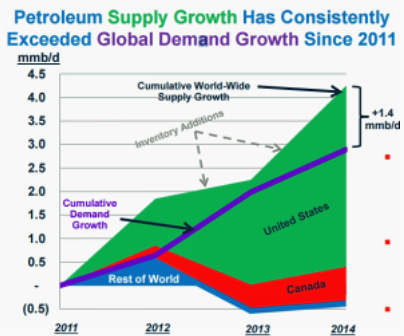

In 2014 Plains All American (PAGP) produced a powerful chart showing how North American crude was gaining market share. OPEC finally tired of their commensurate lost share which they believed was hurting their revenues. The subsequent 2014-16 energy sector collapse was OPEC’s attempt to bankrupt America’s nascent shale industry, to blunt the growth of this new oil producer. Although the financial pain was widespread, the industry didn’t break. American capitalism responded – costs were slashed, productivity enhanced and a leaner, stronger shale industry emerged.

OPEC relented (see OPEC Blinks), concluding low prices were damaging their members more than the shale upstarts. U.S. production began rising again. It passed its 2014 high last year, and last week took the world’s top oil producer spot, well ahead of many forecasts.

It’s an epic story, with significant consequences across geopolitics, trade and the environment. America’s improved energy security is underwriting a more robust approach to Iran. In the 1970s, support for Israel in its wars against Arab states led to gas lines as OPEC’s flexed its muscle and imposed an oil embargo.

American exports of Liquified Natural Gas (LNG) are creating new trade opportunities with Asia, where South Korea, China and Japan are among our biggest buyers. In spite of the escalating tariffs with China, they recently exempted U.S. crude oil imports from a list of items subject to new tariffs. Germany’s plan to buy more natural gas from Russia via Nord Stream 2 is more easily criticized when U.S. LNG is available. Trump’s tweet, “What good is NATO if Germany is paying Russia billions of dollars for gas and energy?” is hard to fault.

American Shale gas has contributed to the world’s biggest reduction in CO2 emissions (see Guess Who’s Most Effective at Combating Global Warming). It’s made possible the shift from coal to natural gas in electricity generation. The Shale Revolution has been positive in so many ways.

Although few stop to think about it, the Shale Revolution reflects the success of American capitalism. Oil and gas originate in porous rock all over the world, but it’s taken a unique combination of advantages for the U.S. to emerge as virtually the only shale player on the planet. In America Is Great! we list the many attributes whose presence was necessary, such as a skilled energy sector labor force, existing infrastructure, access to capital, advanced technology and so on. Apart from the geology, they’re all the results of America’s capitalist system. The least appreciated is privately-owned mineral rights. All over the world, an individual’s property ownership is limited to the surface, with the government owning what’s beneath. By contrast, American landowners have been able to profit from their mineral rights. This has created private sector wealth in a way that a government claiming eminent domain of a lucrative property never could.

All this means that the Shale Revolution was not luck; if it was going to happen anywhere, it was going to be in America.

The energy infrastructure sector has been lethargic over the past few weeks. 2Q18 earnings were strong, but investor positivity was fleeting. Since early August, flows have been light and buyers cautious. The Alerian MLP ETF (AMLP) has seen outflows on most days, although that may be because people are becoming aware of its flawed tax structure (see Uncle Sam Helps You Short AMLP).

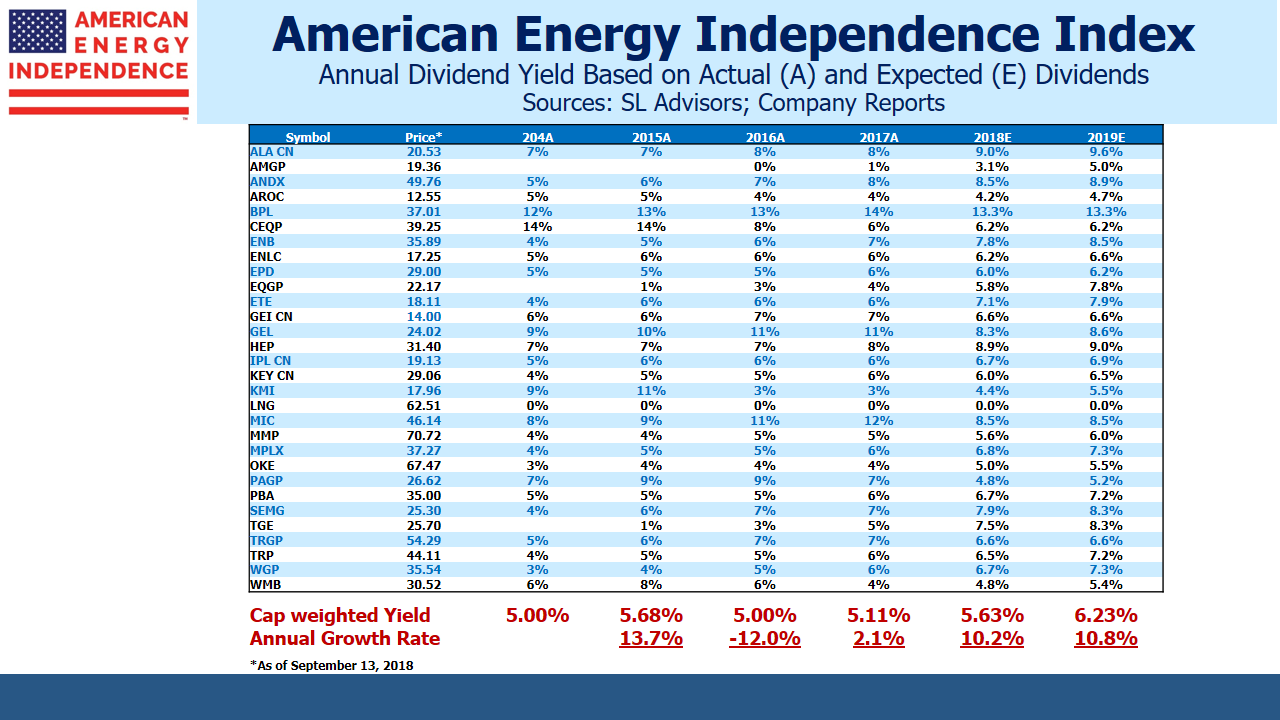

Record U.S. oil production should serve as a reminder that pipeline companies are the vital enablers of our energy success. Cash flow yields on the American Energy Independence Index are 8.75% and we expect 15-20% annual cash flow growth this year and next. The dividend yield is 5.6% and growing 10%/year. Hydrocarbons have to be processed, stored and moved; record volumes should support 3Q18 profits when they start being reported next month.

We are long PAGP.

We are short AMLP.